회사 소개

| AMTD 리뷰 요약 | |

| 설립 연도 | 1997 |

| 등록 국가/지역 | 홍콩 |

| 규제 | SFC (미확인) |

| 서비스 | 디지털 솔루션, 미디어 및 문화, 교육 및 훈련, 프리미엄 자산 |

| 플랫폼/앱 | airstar APP |

| 고객 지원 | 이메일: enquiry@amtdinc.com |

| 소셜 미디어: Facebook, LinkedIn, YouTube, X | |

AMTD 정보

AMTD는 1997년에 설립되었으며 홍콩에 등록되어 있으며 홍콩 증권 거래위원회(SFC)의 규제를 받고 있습니다. 디지털 솔루션, 원스톱 비즈니스 서비스, 미디어 및 엔터테인먼트, 교육 및 훈련을 포함한 다양한 서비스를 제공합니다. 그러나 현재 규제 상태는 확인되지 않았습니다.

장단점

| 장점 | 단점 |

| 긴 역사 | 미확인된 SFC 규제 |

| 다양한 서비스 제공 | 명확하지 않은 수수료 구조 |

| 직접 연락 채널 없음 | |

| 실제 주소 없음 |

AMTD 합법성

AMTD은 홍콩 증권 거래위원회(SFC)의 규제를 받고 있지만 현재 규제 상태는 확인되지 않았습니다. 라이선스를 보유한 기관은 AJH488 라이센스 번호를 가진 oOo Securities (HK) Group Limited입니다.

WikiFX 현장 조사

WikiFX 현장 조사팀이 AMTD 주소를 방문한 결과, AMTD이 상기 주소에 물리적인 존재를 유지하지 않는 것을 발견했습니다.

서비스

AMTD은 디지털 솔루션 서비스, 원스톱 비즈니스 서비스, 미디어 및 엔터테인먼트, 교육, 훈련, 프리미엄 자산 및 호스피탈리티를 포함한 네 가지 서비스를 제공합니다.

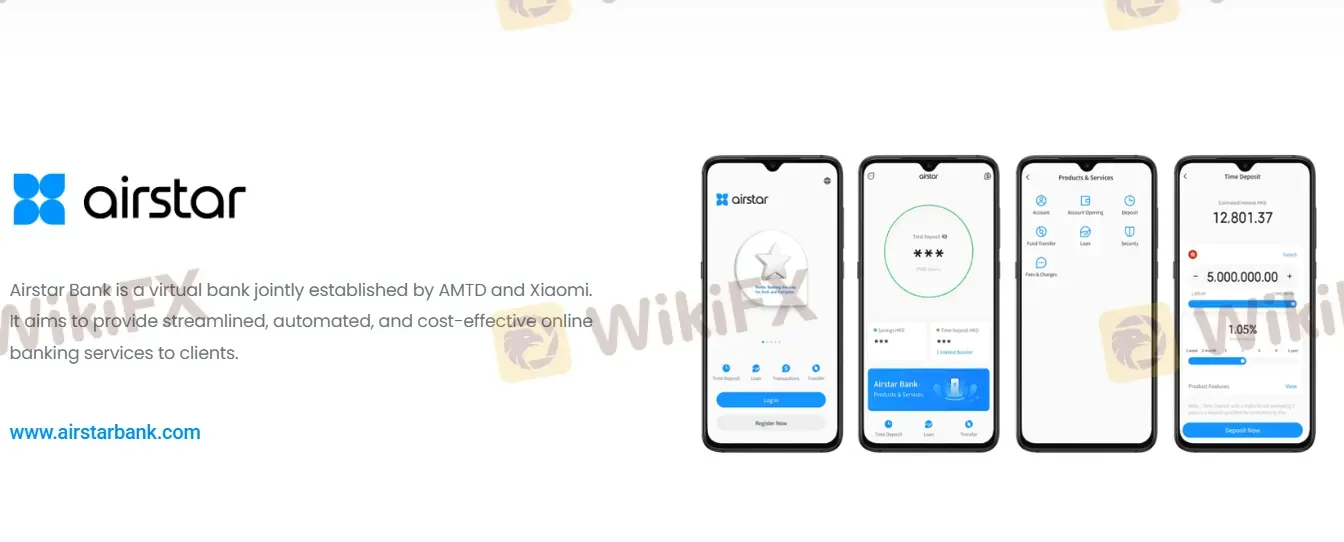

플랫폼/앱

| 플랫폼/앱 | 지원 | 사용 가능한 장치 |

| airstar App | ✔ | iOS, Android |