公司簡介

| 尚乘 檢討摘要 | |

| 成立年份 | 1997 |

| 註冊地區/國家 | 香港 |

| 監管 | SFC(未經證實) |

| 服務 | 數碼解決方案、媒體與文化、教育培訓、高端資產 |

| 平台/應用程式 | airstar APP |

| 客戶支援 | 電郵:enquiry@amtdinc.com |

| 社交媒體:Facebook、LinkedIn、YouTube、X | |

尚乘 資訊

尚乘 成立於1997年,註冊地點為香港,受香港證券及期貨事務監察委員會(SFC)監管。提供多種服務,包括數碼解決方案、一站式商務服務、媒體娛樂、教育培訓等。然而,其監管狀態目前未經證實。

優缺點

| 優點 | 缺點 |

| 歷史悠久 | 未經證實的SFC監管 |

| 提供多種服務 | 收費結構不清晰 |

| 沒有直接聯絡渠道 | |

| 沒有實際地址 |

尚乘 是否合法?

尚乘 受香港證券及期貨事務監察委員會(SFC)監管,但其當前監管狀態未經證實。持牌實體為oOo Securities(HK)Group Limited,持有證券交易牌照,牌照號碼為AJH488。

WikiFX 實地調查

WikiFX 實地調查團隊訪問了 尚乘 的香港地址,發現 尚乘 並未在上述地址保留實體存在。

服務

尚乘 提供四項服務,包括數碼解決方案服務、一站式商務服務、媒體與娛樂、教育培訓、高端資產和款待。

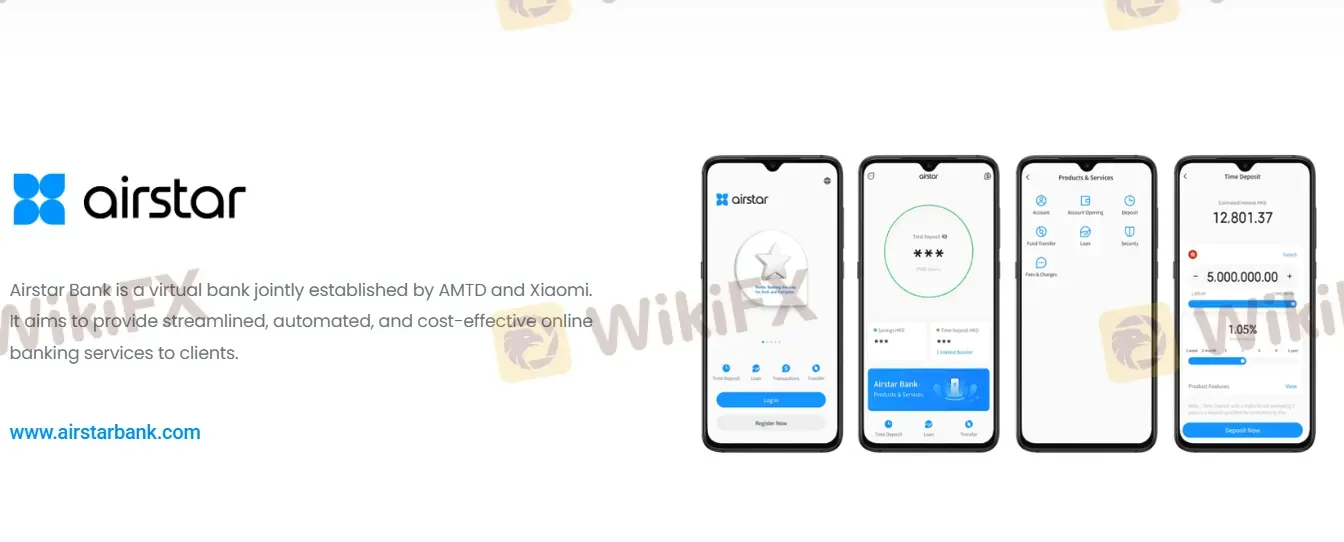

平台/應用程式

| 平台/應用程式 | 支援 | 可用設備 |

| airstar App | ✔ | iOS、Android |