Présentation de l'entreprise

| BaringsRésumé de l'examen | |

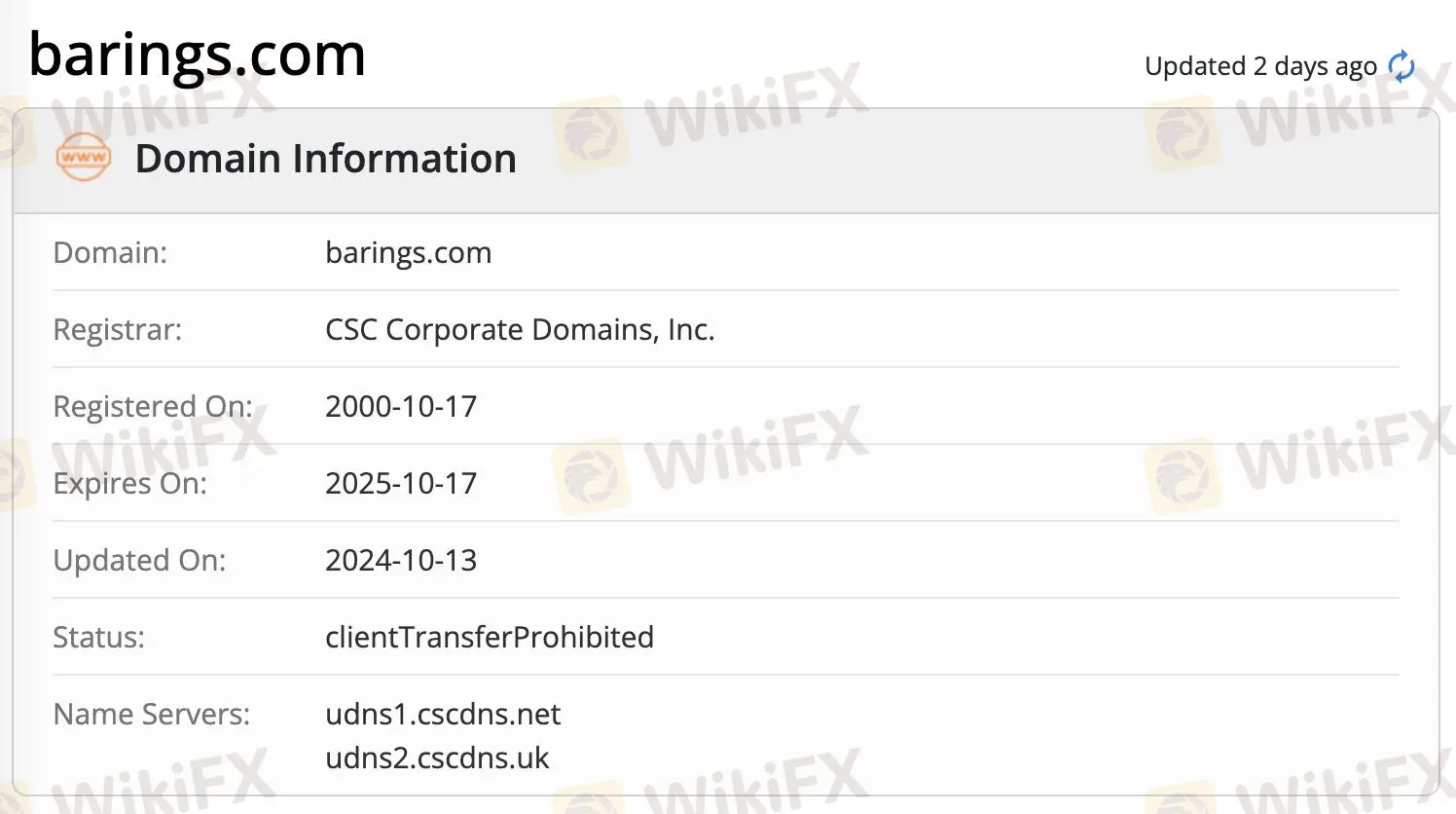

| Fondé | 2000 |

| Pays/Région enregistré | Hong Kong |

| Réglementation | SFC |

| Services | Finance privée mondiale, Immobilier, Solutions de capital, Actions alternatives diversifiées |

| Assistance clientèle | Formulaire de contact |

| Téléphone: +852 2841 1411 (Développement commercial mondial); +852 2973 3440 (Équipe des ventes institutionnelles) | |

| Email: HongKong.Sales@barings.com; BDG.HK.Institutional@barings.com | |

| Twitter, YouTube et LinkedIn | |

| Adresse: 32/F, Two Pacific Place,88 Queensway, Admiralty, Hong Kong | |

Barings Information

Barings est une société de services d'investissement financier enregistrée à Hong Kong tout en ayant une portée mondiale. La société propose à ses traders une variété de services d'investissement en Finance privée mondiale, Immobilier, Solutions de capital, Actions alternatives diversifiées. La société est actuellement réglementée par la SFC (Securities and Futures Commission de Hong Kong) avec le numéro de licence AAJ177.

Avantages et inconvénients

| Avantages | Inconvénients |

| Réglementé par la SFC | Manque de transparence |

| Gamme diversifiée de services financiers | |

| Portée mondiale |

Barings est-il légitime ?

Oui. Barings est réglementé par la Securities and Futures Commission (SFC).

| Pays réglementé | Régulateur | Statut actuel | Entité réglementée | Type de licence | Numéro de licence |

| Securities and Futures Commission de Hong Kong (SFC) | Réglementé | Baring Asset Management (Asia) Limited | Opérations sur contrats à terme | AAJ177 |

Services

Barings propose des services en Finance privée mondiale, Immobilier, Solutions de capital et Actions alternatives diversifiées.