Profil perusahaan

| BaringsRingkasan Ulasan | |

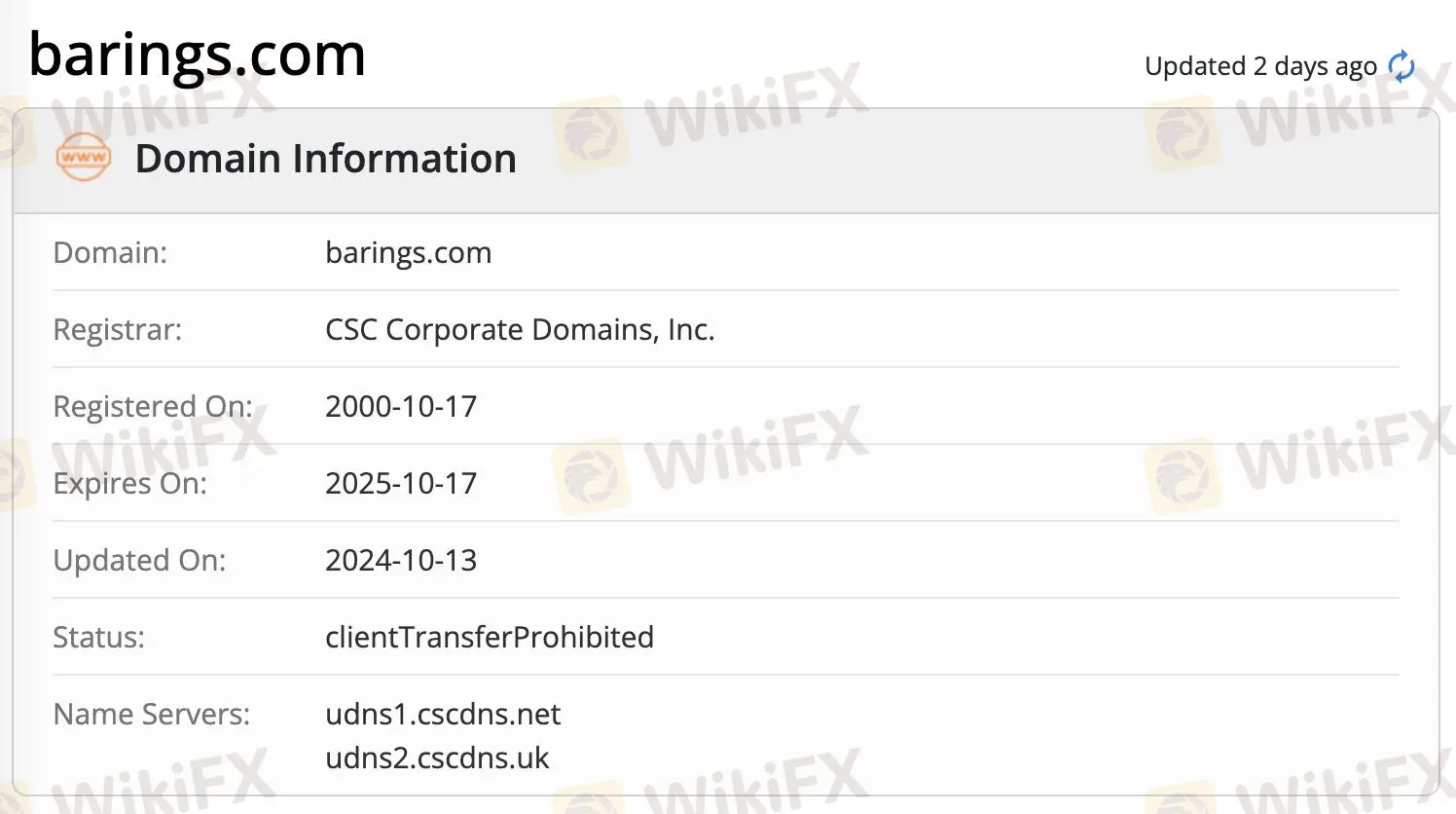

| Dibentuk | 2000 |

| Negara/Daerah Terdaftar | Hong Kong |

| Regulasi | SFC |

| Layanan | Keuangan Pribadi Global, Real Estate, Solusi Modal, Ekuitas Alternatif Diversifikasi |

| Dukungan Pelanggan | Formulir Kontak |

| Telepon: +852 2841 1411 (Pengembangan Bisnis Global); +852 2973 3440 (Tim Penjualan Institusional) | |

| Email: HongKong.Sales@barings.com; BDG.HK.Institutional@barings.com | |

| Twitter, YouTube dan LinkedIn | |

| Alamat: 32/F, Two Pacific Place,88 Queensway, Admiralty, Hong Kong | |

Informasi Barings

Barings adalah perusahaan layanan investasi keuangan yang terdaftar di Hong Kong sambil memiliki jangkauan global di seluruh dunia. Perusahaan ini menawarkan berbagai layanan investasi kepada para trader dalam Keuangan Pribadi Global, Real Estate, Solusi Modal, Ekuitas Alternatif Diversifikasi. Perusahaan ini sekarang berada di bawah regulasi SFC (Securities and Futures Commission of Hong Kong) dengan nomor lisensi AAJ177.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh SFC | Kurangnya transparansi |

| Rentang layanan keuangan yang beragam | |

| Jangkauan global |

Apakah Barings Legal?

Ya. Barings diatur oleh Securities and Futures Commission (SFC).

| Negara yang Diatur | Regulator | Status Saat Ini | Entitas yang Diatur | Jenis Lisensi | Nomor Lisensi |

| Securities and Futures Commission of Hong Kong (SFC) | Diatur | Baring Asset Management (Asia) Limited | Berurusan dengan kontrak berjangka | AAJ177 |

Layanan

Barings menawarkan layanan dalam Keuangan Pribadi Global, Real Estate, Solusi Modal, dan Ekuitas Alternatif Diversifikasi.