Présentation de l'entreprise

| Cathay Futures Résumé de l'examen | |

| Fondé | 1993 |

| Pays/Région enregistré | Taïwan |

| Régulation | Bourse de Taipei (TPEx) |

| Instrument de marché | Futures |

| Plateforme de trading | / |

| Support client | Tél : 02-7752-1699 |

Informations sur Cathay Futures

Cathay Futures, fondé à Taïwan en 1993 et régulé par la Bourse de Taipei, est une entreprise proposant du trading sur marge pour les matières premières nationales et étrangères. La société offre un accès au trading de contrats à terme sur les principales bourses internationales en Asie, en Europe et en Amérique.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Régulé par la Bourse de Taipei | Structure de frais peu claire |

| Accès aux principales bourses mondiales | Canaux de contact limités |

| Temps d'opération prolongé |

Cathay Futures est-il légitime ?

Cathay Futures détient une licence de "Négociation de contrats à terme et de trading sur le marché des changes à effet de levier" réglementée par la Bourse de Taipei à Taïwan.

| Autorité de Régulation | Statut Actuel | Pays Réglementé | Type de Licence | Numéro de Licence |

| Bourse de Taipei (TPEx) | Réglementée | Chine (Taïwan) | Négociation de contrats à terme et de trading sur le marché des changes à effet de levier | non publié |

Cathay Futures Activités

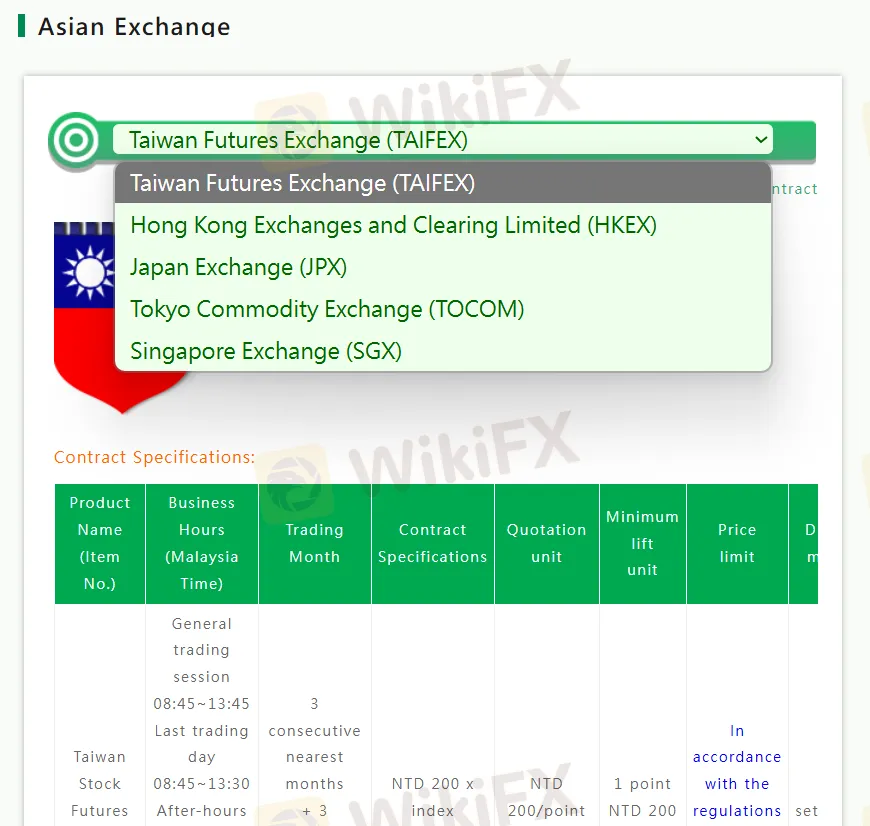

- Bourses asiatiques: Cathay Futures propose des produits de trading sur plusieurs grandes bourses asiatiques, notamment la Bourse des contrats à terme de Taïwan (TAIFEX), la Bourse de Hong Kong (HKEX), la Bourse du Japon (JPX), la Bourse des matières premières de Tokyo (TOCOM) et la Bourse de Singapour (SGX).

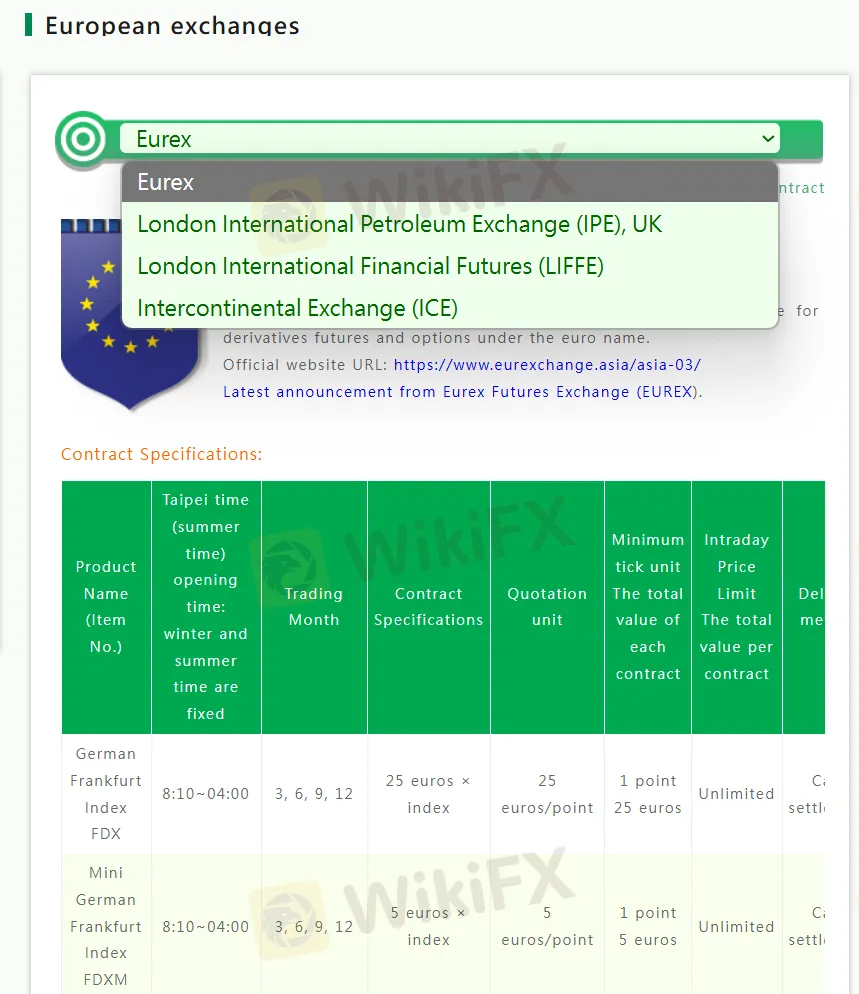

- Bourses européennes: Cathay Futures offre un accès aux bourses européennes telles que Eurex, l'International Petroleum Exchange de Londres (IPE), le London International Financial Futures (LIFFE) et l'Intercontinental Exchange (ICE) pour le trading de divers contrats à terme et options.

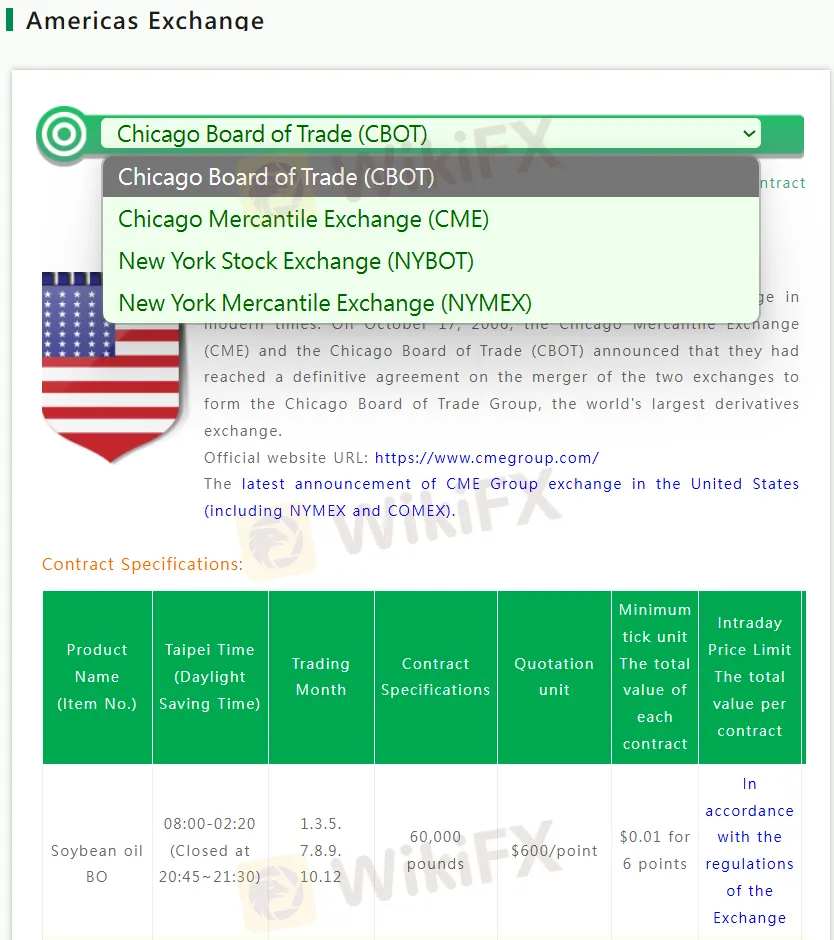

- Bourses américaines: Cathay Futures propose des produits de trading sur les principales bourses américaines, notamment le Chicago Board of Trade (CBOT), le Chicago Mercantile Exchange (CME), le New York Stock Exchange (NYBOT) et le New York Mercantile Exchange (NYMEX).

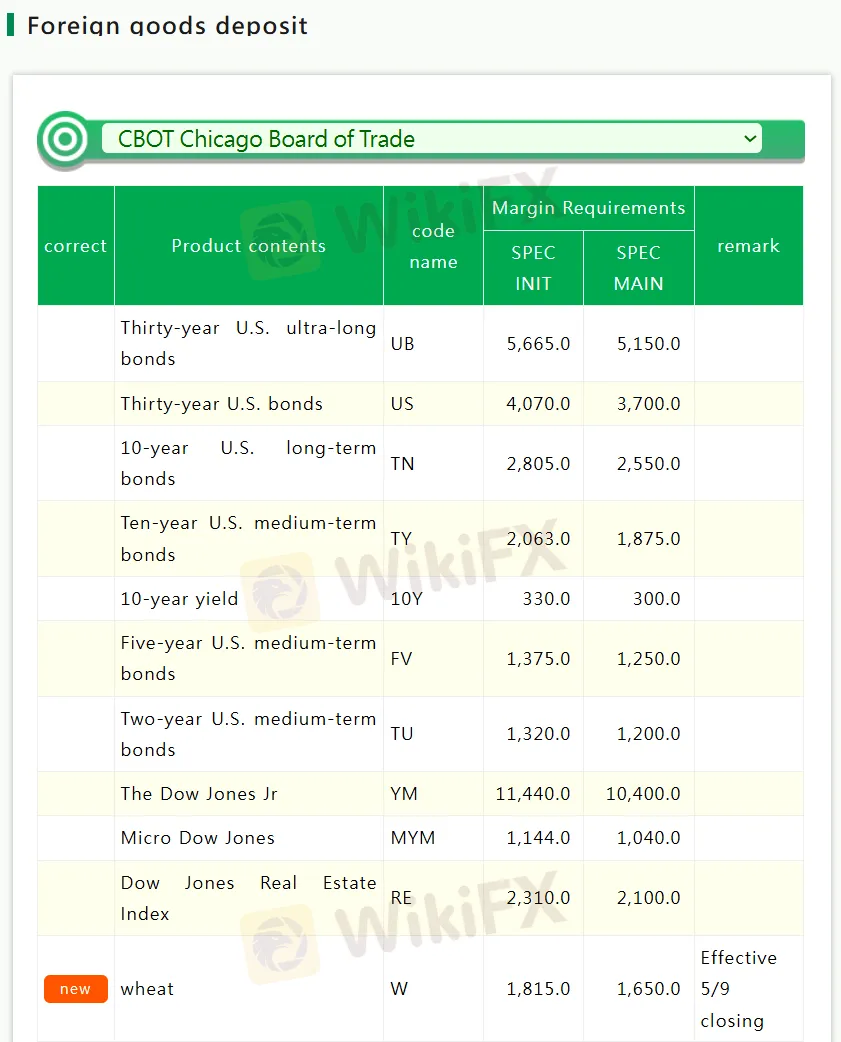

Marge

- Marge des matières premières domestiques: Cathay Futures propose du trading sur marge pour divers contrats à terme taïwanais, avec des marges initiales variant selon le produit financier ; par exemple, l'indice boursier de Taïwan (TX) nécessite une marge initiale de NT$356,000.

- Dépôt de marchandises étrangères: Cathay Futures propose des dépôts de marchandises étrangères pour les produits de trading sur le CBOT, la Bourse de Chicago, avec des exigences de marge variant selon le produit financier ; par exemple, la marge initiale pour les obligations ultra-longues américaines de trente ans (UB) est SPEC INIT 5,665.0.