Buod ng kumpanya

| Cathay Futures Buod ng Pagsusuri | |

| Itinatag | 1993 |

| Nakarehistrong Bansa/Rehiyon | Taiwan |

| Regulasyon | Taipei Exchange (TPEx) |

| Instrumento sa Merkado | Futures |

| Platform ng Paggagalaw | / |

| Suporta sa Customer | Tel: 02-7752-1699 |

Impormasyon Tungkol sa Cathay Futures

Cathay Futures, itinatag sa Taiwan noong 1993 at regulado ng Taipei Exchange, ay isang kumpanya na nag-aalok ng margin trading para sa lokal at dayuhang kalakal. Nagbibigay ang kumpanya ng access sa futures trading sa mga pangunahing internasyonal na palitan sa buong Asia, Europa, at Amerika.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Regulado ng Taipei Exchange | Unclear fee str |

| Access sa mga pangunahing global na palitan | Limitadong mga channel ng contact |

| Mahabang oras ng operasyon |

Tunay ba ang Cathay Futures?

Cathay Futures ay may lisensiyang "Dealing in futures contracts & Leveraged foreign exchange trading" na regulated ng Taipei Exchange sa Taiwan.

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| Taipei Exchange (TPEx) | Regulated | China (Taiwan) | Dealing in futures contracts & Leveraged foreign exchange trading | unreleased |

Cathay Futures Negosyo

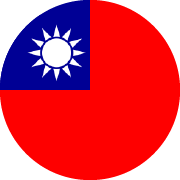

- Asian exchanges: Ang Cathay Futures ay nag-aalok ng mga produkto sa pamamagitan ng ilang pangunahing Asian Exchanges, kabilang ang Taiwan Futures Exchange (TAIFEX), Hong Kong Exchanges and Clearing Limited (HKEX), Japan Exchange (JPX), Tokyo Commodity Exchange (TOCOM), at Singapore Exchange (SGX).

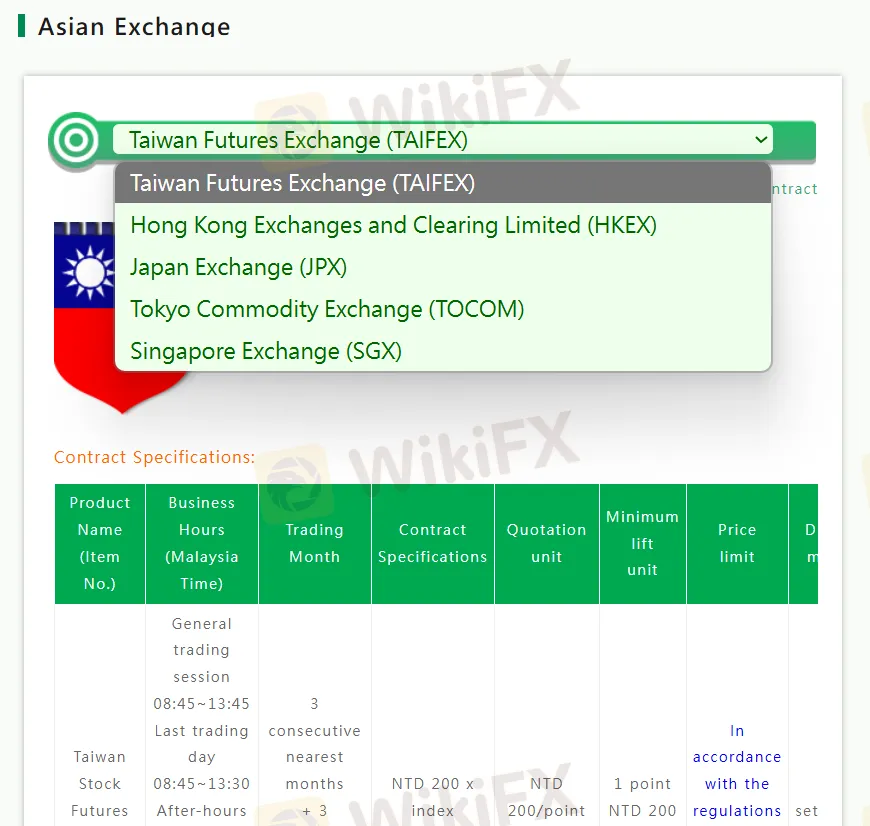

- European exchanges: Nagbibigay ng access ang Cathay Futures sa mga European exchanges tulad ng Eurex, ang London International Petroleum Exchange (IPE), ang London International Financial Futures (LIFFE), at ang Intercontinental Exchange (ICE) para sa pag-trade ng iba't ibang futures at options.

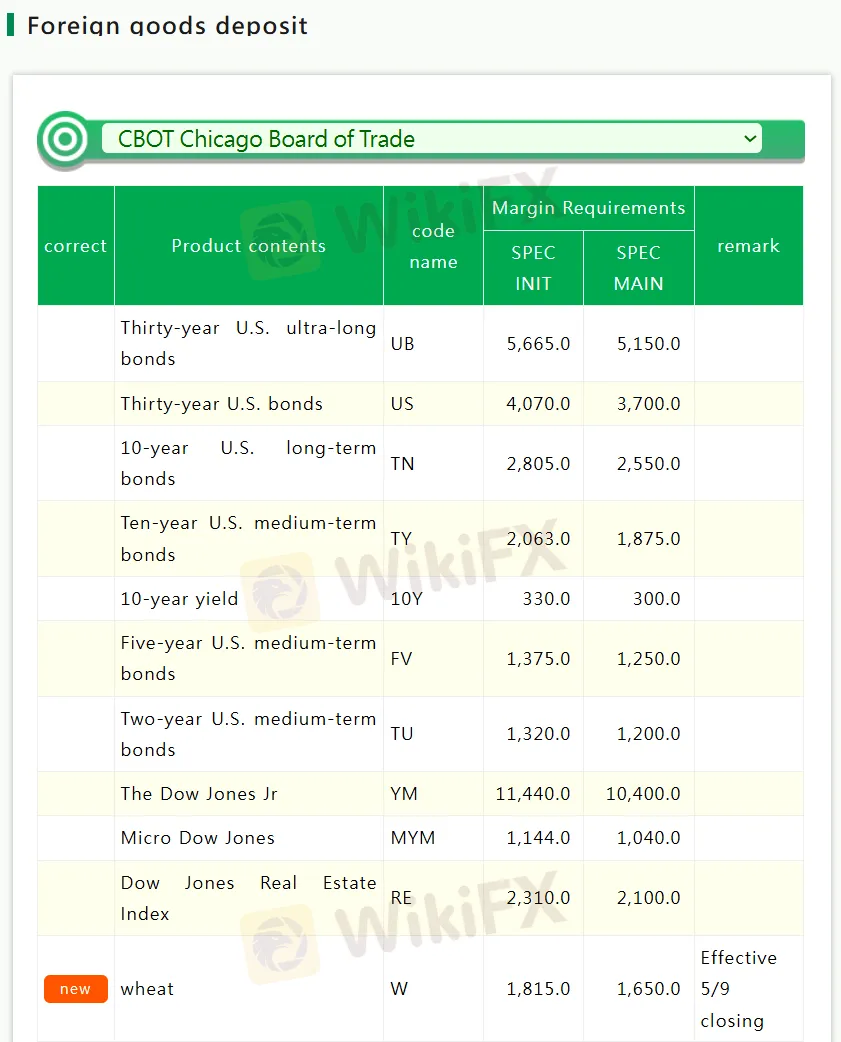

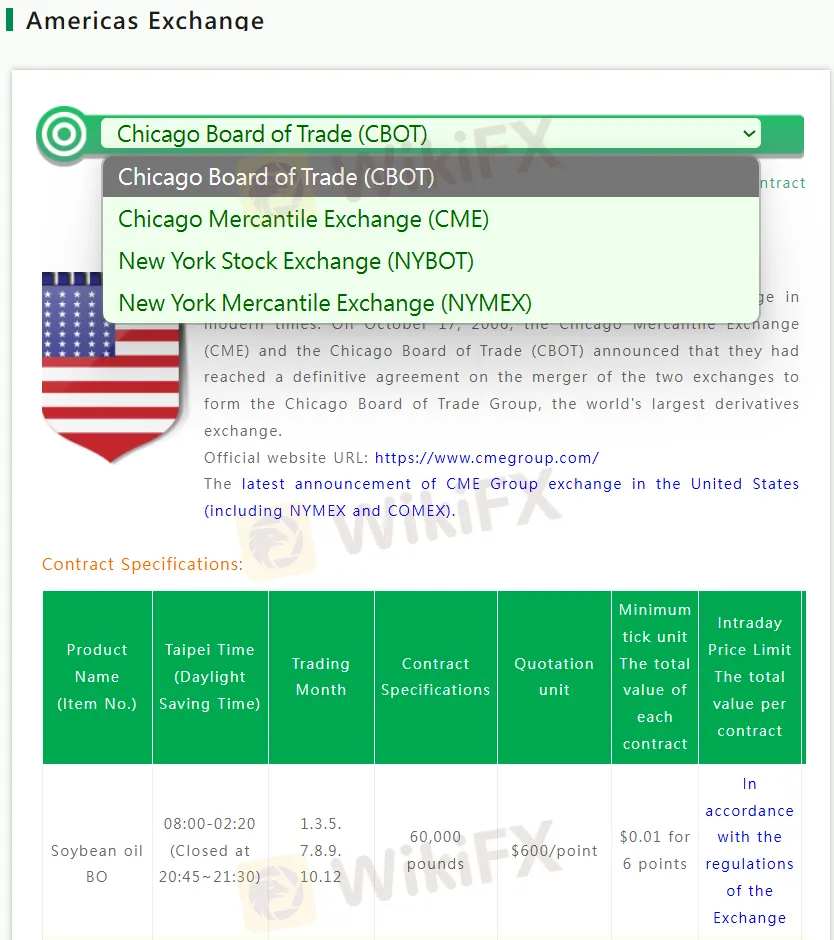

- Americas Exchanges: Nag-aalok ang Cathay Futures ng mga produkto sa pangunahing Americas exchanges, kabilang ang Chicago Board of Trade (CBOT), Chicago Mercantile Exchange (CME), New York Stock Exchange (NYBOT), at New York Mercantile Exchange (NYMEX).

Margin

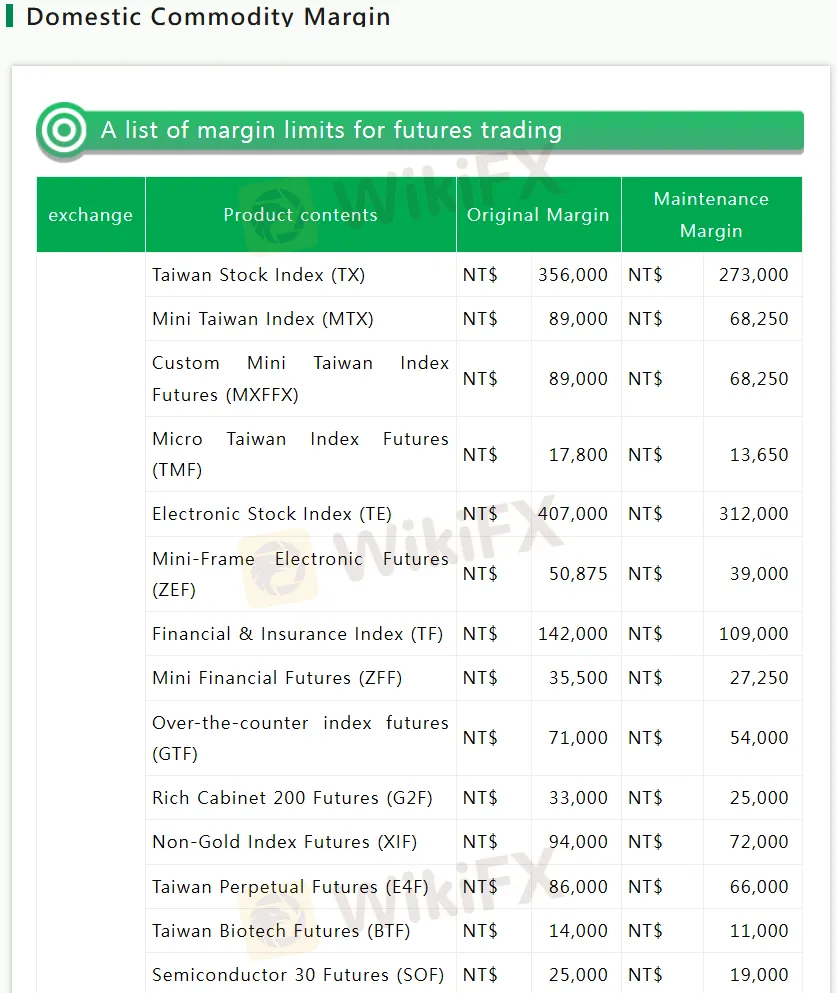

- Domestic Commodity Margin: Nagbibigay ng margin trading ang Cathay Futures para sa iba't ibang domestic Taiwanese futures, kung saan nag-iiba ang mga orihinal na margin ayon sa financial product; halimbawa, ang Taiwan Stock Index (TX) ay nangangailangan ng orihinal na margin na NT$356,000.

- Foreign Goods Deposit: Nag-aalok ang Cathay Futures ng foreign goods deposits para sa pag-trade ng mga produkto sa CBOT, Chicago Board of Trade, kung saan nag-iiba ang mga kinakailangang margin ayon sa financial product; halimbawa, ang initial margin para sa Thirty-year U.S. ultra-long bonds (UB) ay SPEC INIT 5,665.0.