Unternehmensprofil

| Cathay Futures Überprüfungszusammenfassung | |

| Gegründet | 1993 |

| Registriertes Land/Region | Taiwan |

| Regulierung | Taipei Exchange (TPEx) |

| Marktinstrument | Futures |

| Handelsplattform | / |

| Kundenbetreuung | Tel: 02-7752-1699 |

Cathay Futures Informationen

Cathay Futures, gegründet in Taiwan im Jahr 1993 und reguliert von der Taipei Exchange, ist ein Unternehmen, das den Handel mit Margen für inländische und ausländische Waren anbietet. Das Unternehmen ermöglicht den Zugang zum Futures-Handel an wichtigen internationalen Börsen in Asien, Europa und Amerika.

Vor- und Nachteile

| Vorteile | Nachteile |

| Reguliert von der Taipei Exchange | Unklare Gebührenstruktur |

| Zugang zu wichtigen globalen Börsen | Begrenzte Kontaktmöglichkeiten |

| Lange Betriebszeiten |

Ist Cathay Futures legitim?

Cathay Futures besitzt eine Lizenz für "Handel mit Futures-Kontrakten & Gehebelten Devisenhandel", die von der Taipei Exchange in Taiwan reguliert wird.

| Regulierungsbehörde | Aktueller Status | Reguliertes Land | Lizenztyp | Lizenznummer |

| Taipei Exchange (TPEx) | Reguliert | China (Taiwan) | Handel mit Futures-Kontrakten & Gehebelten Devisenhandel | unveröffentlicht |

Cathay Futures Geschäft

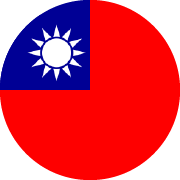

- Asiatische Börsen: Cathay Futures bietet Handelsprodukte an mehreren wichtigen asiatischen Börsen an, darunter die Taiwan Futures Exchange (TAIFEX), Hong Kong Exchanges and Clearing Limited (HKEX), Japan Exchange (JPX), Tokyo Commodity Exchange (TOCOM) und Singapore Exchange (SGX).

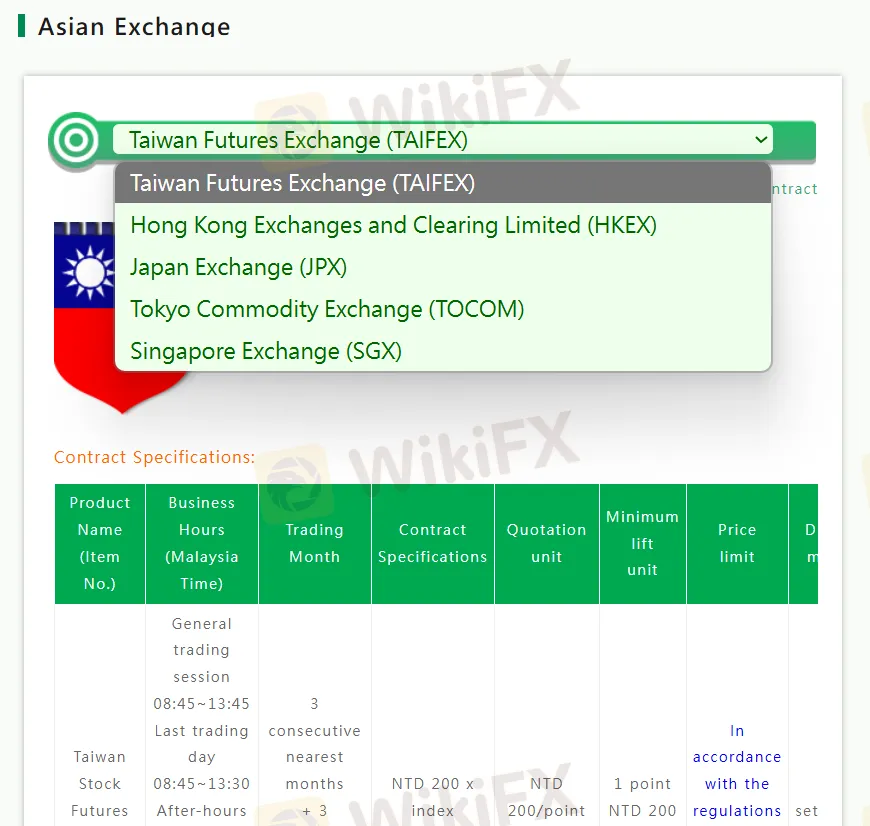

- Europäische Börsen: Cathay Futures bietet Zugang zu europäischen Börsen wie Eurex, der London International Petroleum Exchange (IPE), der London International Financial Futures (LIFFE) und der Intercontinental Exchange (ICE) für den Handel mit verschiedenen Futures und Optionen.

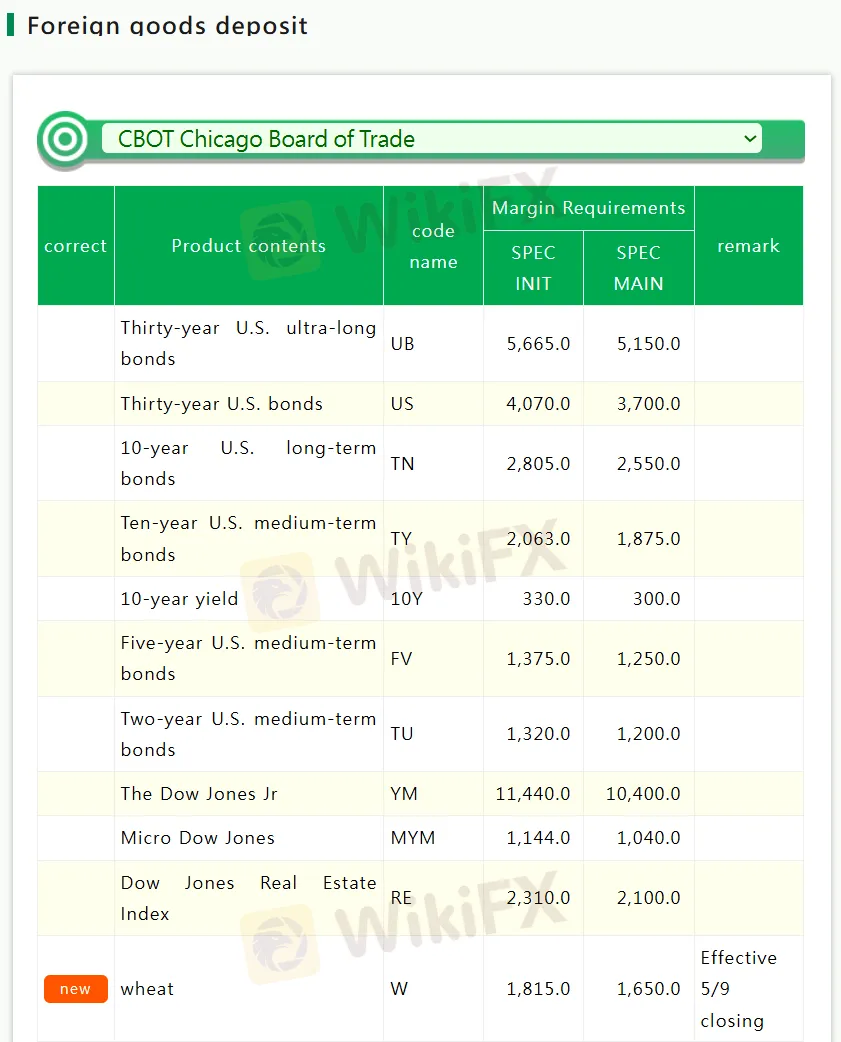

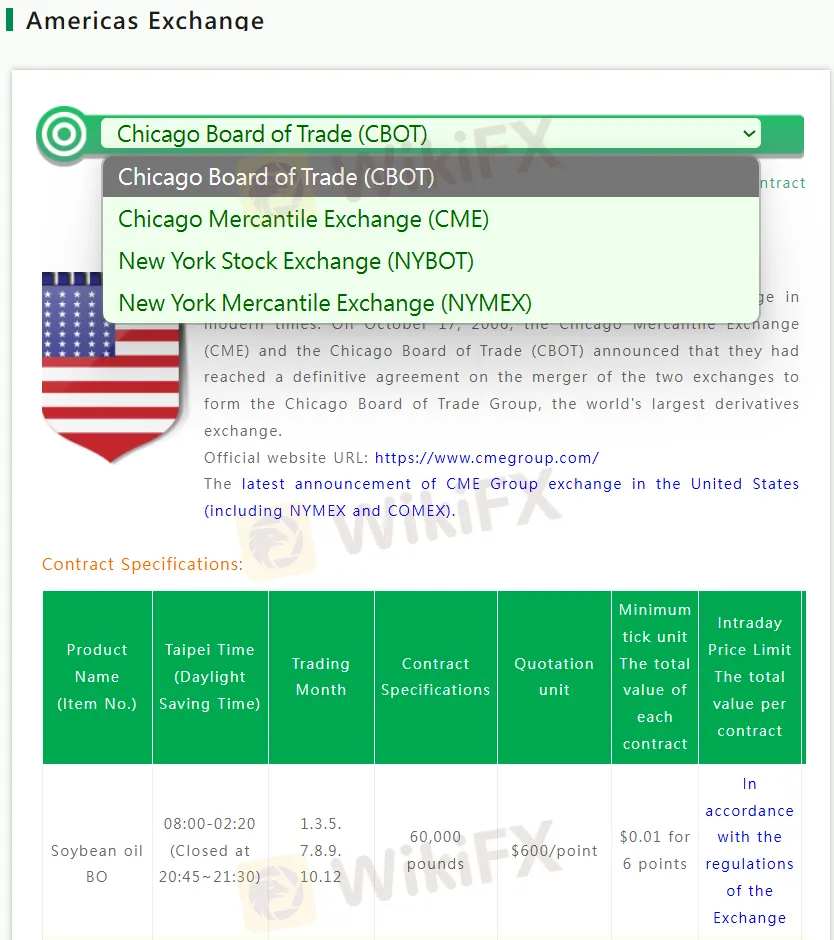

- Amerikanische Börsen: Cathay Futures bietet Handelsprodukte an wichtigen amerikanischen Börsen an, darunter die Chicago Board of Trade (CBOT), Chicago Mercantile Exchange (CME), New York Stock Exchange (NYBOT) und New York Mercantile Exchange (NYMEX).

Margin

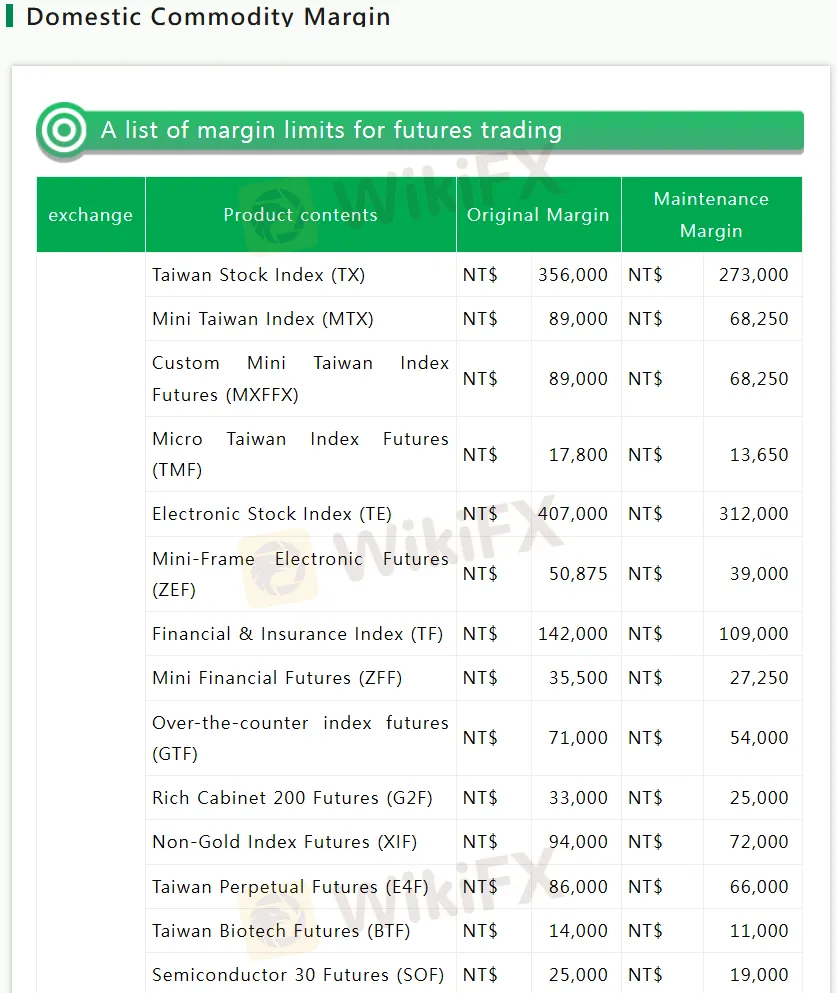

- Inländische Warenmarge: Cathay Futures bietet Margenhandel für verschiedene inländische taiwanesische Futures an, wobei die ursprünglichen Margen je nach Finanzprodukt variieren; beispielsweise erfordert der Taiwan Stock Index (TX) eine ursprüngliche Marge von NT$356.000.

- Ausländische Warenanlage: Cathay Futures bietet ausländische Warenanlagen für Handelsprodukte an der CBOT, Chicago Board of Trade, mit variierenden Margenanforderungen je nach Finanzprodukt an; beispielsweise beträgt die anfängliche Marge für Dreißigjährige US-Ultralangfristanleihen (UB) SPEC INIT 5.665,0.