Buod ng kumpanya

| KOSEI SECURITIES Buod ng Pagsusuri | |

| Itinatag | 1997 |

| Nakarehistrong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Produkto sa Paghahalal | Mga Stock, Bonds, Investment Trusts, ETFs/REITs, Futures, Options, at Insurance/iDeco |

| Platform ng Paghahalal | / |

| Minimum na Deposito | / |

| Suporta sa Customer | Tel: 0120-06-8617 |

| Address: 2-1-10 Kitahama, Chuo-ku, Osaka | |

Impormasyon Tungkol sa KOSEI SECURITIES

Matatagpuan ang punong tanggapan ng Kosei Securities sa Kitahama, Chuo-ku, Lungsod ng Osaka. Saklaw ng kanilang negosyo ang pagtitingi ng securities, investment trusts, futures at options, life insurance agency, at iba pa, habang nagbibigay din ng espesyal na mga serbisyo tulad ng mga partikular na account (pinadaling pagsusumite ng buwis) at mga NISA account (exemption sa buwis para sa maliit na pamumuhunan).

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Regulado ng FSA | Komplikadong istraktura ng komisyon |

| Garantiya sa kaligtasan ng pondo | Kulang sa suporta sa Ingles (higit sa lahat sa Hapon) |

| Kombinasyon ng online at offline | |

| Mahabang kasaysayan ng operasyon | |

| Iba't ibang mga produkto sa pagtitingi | |

| Transparent na impormasyon sa bayad |

Tunay ba ang KOSEI SECURITIES?

Ang Kosei Securities ay nakalista sa Tokyo Stock Exchange at regulatedng Financial Services Agency (FSA) ng Japan. Na may license number na 近畿財務局長(金商)第14号, ito ay isang legal na rehistradong kumpanya ng securities.

| Regulated Authority | Current Status | Regulated Country | Licensed Entity | License Type | License No. |

| Financial Services Agency (FSA) | Regulated | Japan | KOSEI SECURITIES株式会社 | Retail Forex License | 近畿財務局長(金商)第14号 |

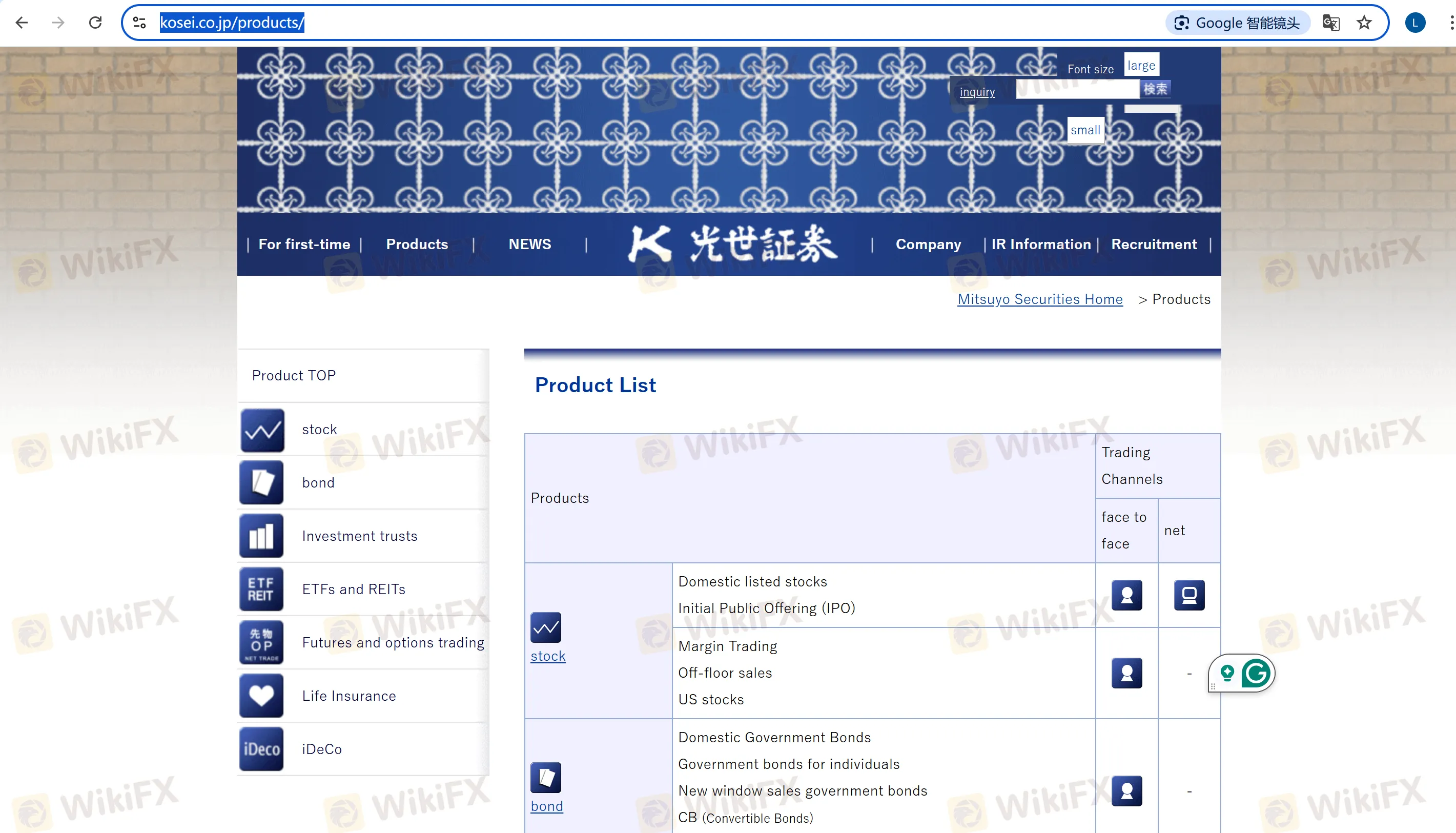

Ano ang Maaari Kong I-trade sa KOSEI SECURITIES?

| Trading Products | Supported | Details |

| Stocks | ✔ | Domestic listed stocks, U.S. stocks, initial public offerings (IPOs), at margin trading |

| Bonds | ✔ | Individual government bonds, corporate bonds, foreign currency-denominated bonds, at convertible bonds |

| Investment Trusts | ✔ | Equity investment trusts, corporate bond investment trusts, at hedge fund-type funds |

| ETFs/REITs | ✔ | Listed investment trusts, real estate investment trusts (e.g., TOPIX REIT Index) |

| Futures and Options | ✔ | Nikkei 225 futures, TOPIX options, precious metal futures (gold standard), at commodity index futures (CME crude oil) |

| Insurance/iDeco | ✔ | Life insurance agency services, Nomura iDeco (pension accounts) |

Uri ng Account

Specific Account: Kumokalkula ng kita at pagkawala para sa mga kliyente, namamahala ng pagbabayad ng buwis, at pinaaangat ang taunang pag-file ng buwis.

NISA Account: Isang account na hindi kinakaltasan ng buwis para sa maliit na pamumuhunan, may taunang limitasyon sa pamumuhunan na ¥1,000,000. Ang mga dividend at kita sa benta ay hindi kinakaltasan ng buwis sa loob ng 5 taon.

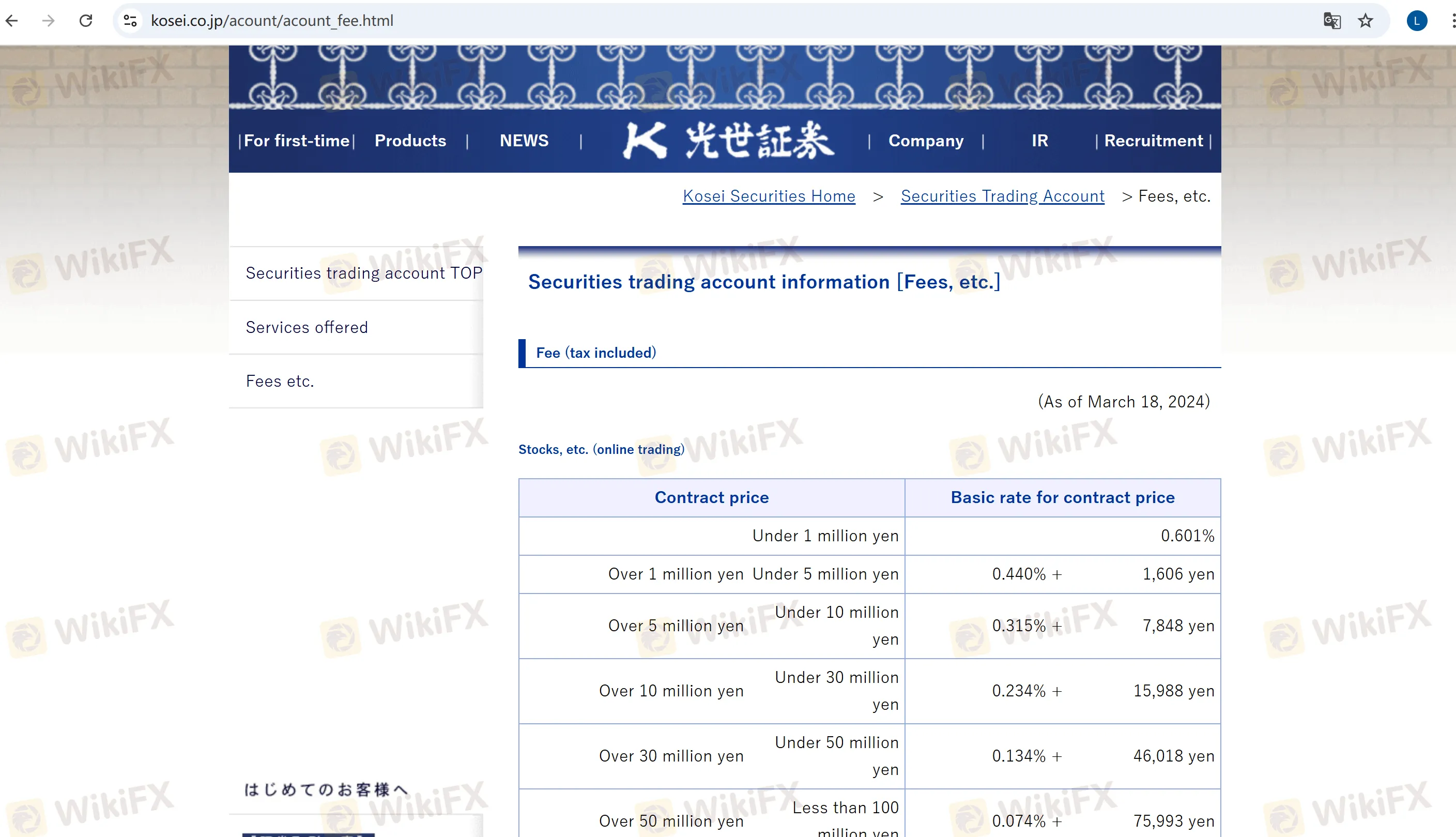

Mga Bayad sa KOSEI SECURITIES

Main Commission Fees:

Stocks (Online): 0.601% para sa mga transaksyon na hindi hihigit sa ¥1,000,000 (minimum ¥1,100). Para sa halagang higit sa ¥1,000,000,000, ang mga bayad ay saklaw ng indibidwal na negosasyon.

U.S. Stocks: Isang flat na 0.495% (minimum ¥550). Ang mga bayad ng SEC ay pansamantalang itinigil simula Mayo 13, 2025.

Futures & Options (Online): 0.022% para sa index futures, 0.0044% para sa government bond futures, na may minimum na bayad na ¥440.

Account Maintenance Fee: ¥2,200 taun-taon (walang bayad para sa mga kliyenteng may hawak na 100+ shares ng stocks ng kumpanya).

Other Fees:

Margin Loan Rates (Buy Side): Institutional margin: 1.64%–1.92% (annual interest); General margin: 2.14%–2.42%.

Para sa mas detalyadong impormasyon sa bayad ng account, mangyaring bisitahin ang opisyal na website.