Perfil de la compañía

| WOOD & CoResumen de la reseña | |

| Fundado | 1998 |

| País/Región registrado | República Checa |

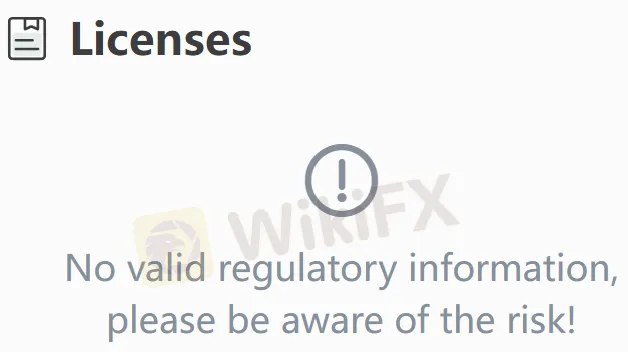

| Regulación | Sin regulación |

| Servicio | Mercados, Banca de inversión, Gestión de activos y patrimonio, Bienes raíces, Inversiones de riesgo |

| Soporte al cliente | Formulario de contacto |

| Tel: +420 222 096 111 (Praga); +48 22 222 1530 (Varsovia) | |

| Email: info@wood.com | |

| Redes sociales: LinkedIn, YouTube | |

| Dirección en Praga: WOOD & Company Financial Services, a.s. Nám. Republiky 1079/1a 110 00 Praha | |

| Dirección en Londres: WOOD & COMPANY FINANCIAL SERVICES LTD 16 Berkeley Street, London, W1J 8DZ | |

| Dirección en Varsovia: Centrum Marszałkowska ul. Marszałkowska 126/134, 00-008 Warszawa | |

WOOD & Co se registró en 1998 en la República Checa. Ofrece diferentes tipos de servicios, incluyendo mercados, banca de inversión, gestión de activos y patrimonio, bienes raíces e inversiones de riesgo. Sin embargo, esta empresa no está regulada y no se pueden ignorar los posibles riesgos.

Pros y contras

| Pros | Contras |

| Tiempo de operación prolongado | Falta de regulación |

| Se ofrecen diversos servicios | |

| Múltiples canales de soporte al cliente |

¿Es legítimo WOOD & Co?

No, WOOD & Co no está regulado por las autoridades reguladoras financieras de la República Checa, lo que significa que la empresa carece de regulación en su lugar de registro. ¡Tenga en cuenta los posibles riesgos!

Servicios de WOOD & Co

WOOD & Co ofrece una serie de servicios, incluyendo mercados, banca de inversión, gestión de activos y patrimonio, bienes raíces e inversiones de riesgo.