公司簡介

| 中阳金融集团 綜述 | |

| 成立年份 | 2019 |

| 註冊國家/地區 | 香港 |

| 監管機構 | SFC(超出,可疑副本) |

| 市場工具 | 證券和期貨 |

| 模擬帳戶 | ❌ |

| 交易平台 | Yisheng Polestar 9.5.7 系統 |

| 最低存款 | / |

| 客戶支援 | 在線諮詢 |

| 電話:+852 31070731 | |

| 傳真:(852) 2836 3825 | |

| 電郵:CS@zyzq.com.hk | |

| 地址:香港干諾道西118號1101室 | |

中阳金融集团 提供證券和期貨經紀服務,提供在不同市場的交易選項,包括香港交易所(HKEX)、美國股票交易所(NYSE、NASDAQ)以及上海和深圳股票通。

他們提供一系列金融產品,包括證券和期貨合約,每個產品都有相應的交易費用。

然而,他們的SFC監管許可證超出並存在可疑副本。

優點和缺點

| 優點 | 缺點 |

| 可接觸全球證券和期貨 | 超出並存在可疑副本的SFC許可證 |

| 提供在線諮詢 | 有限的資金存取方式 |

| 沒有最低存款資訊 |

中阳金融集团 是否合法?

中阳金融集团 持有兩種SFC牌照:證券顧問和期貨合約交易。然而,這兩個牌照被報告為超額或可疑的副本。

| 監管狀態 | 超額 |

| 監管機構 | 香港證券及期貨事務監察委員會(SFC) |

| 牌照機構 | 中陽資本有限公司 |

| 牌照類型 | 證券顧問 |

| 牌照號碼 | BLG119 |

| 監管狀態 | 可疑副本 |

| 監管機構 | 香港證券及期貨事務監察委員會(SFC) |

| 牌照機構 | 中陽資本有限公司 |

| 牌照類型 | 期貨合約交易 |

| 牌照號碼 | BGT529 |

產品和服務

中阳金融集团 的證券業務提供交易香港交易所上市公司的證券和相關衍生品,交易上海-香港股票通、全球證券、基金和債券,以及相關的保證金交易服務。

此外,他們還為客戶提供投資建議和資產管理金融服務。

中阳金融集团 費用

中阳金融集团 收取交易額費用和佣金:

| 香港股票 | 上海/深圳-香港股票通 | 美國 | |

| 費用 | 0.1% 交易額費用 | 0.1% 交易額費用 | $0.05/股(每日超過2,000股時為$0.01/股)運行費用 |

| 最低消費額 | 80港元 | 100元 | $1.99 |

| 融資利率 | 年利率8% | 年利率8% | 年利率8% |

此外,他們還對不同的期貨產品收取佣金,例如:

| 品種編號 | 品種名稱 | 合約單位 | 最小價格變動 | 佣金(美元) | |

| COMEX | GC | 美國黃金 | 100 盎司 | 0.1 | 20 |

| COMEX | HG | CMX 銅 | 25000 磅 | 0.0005 | |

| COMEX | SI | 美國白銀 | 5000 盎司 | 0.005 | |

| COMEX | MGC | 微型黃金期貨 | 10 盎司 | 1 | |

| NYMEX | CL | 美國原油 | 1000 桶 | 0.01 |

更多詳情可點擊:https://www.zyfgl.com/index.php?m=content&c=index&a=lists&catid=19

交易平台

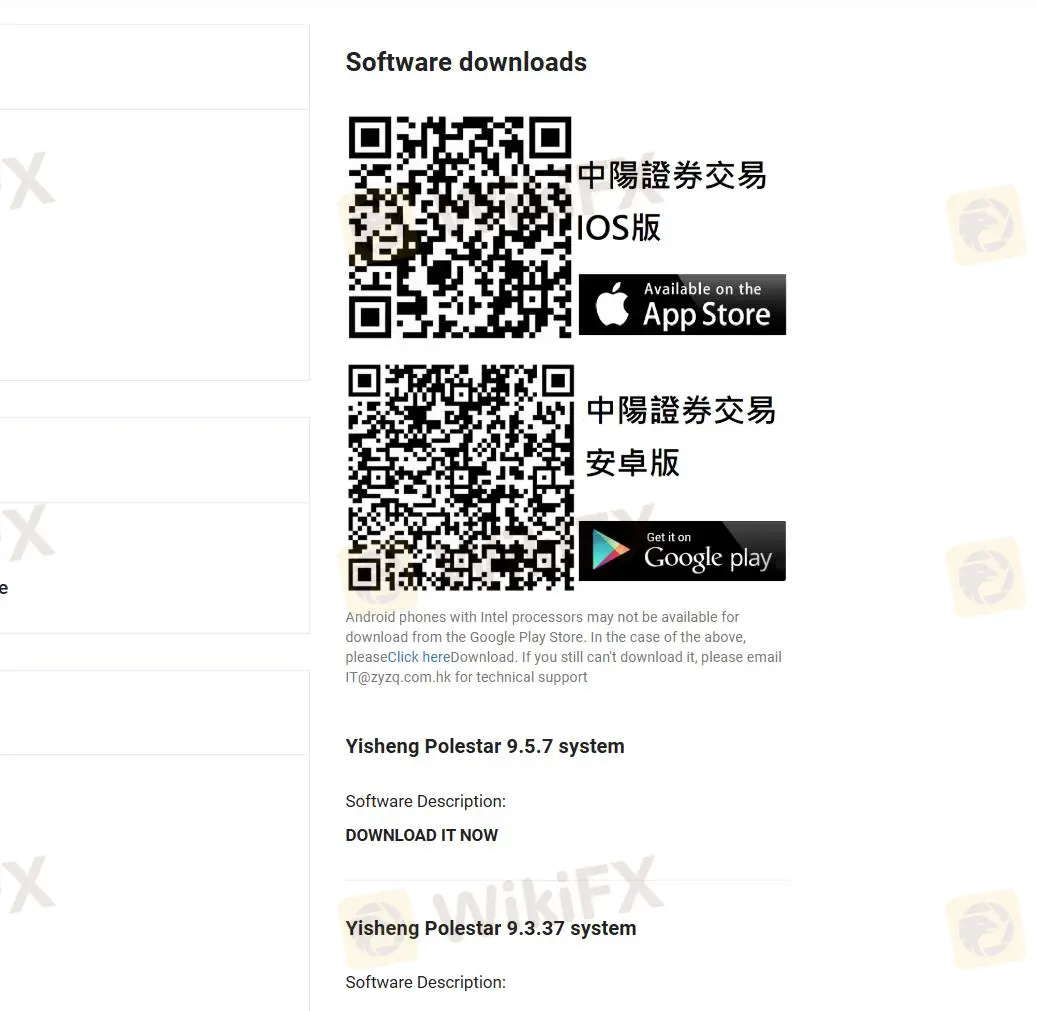

中阳金融集团 提供易勝極星9.5.7系統,可通過App Store和Google Play下載。

存款和提款

存款:

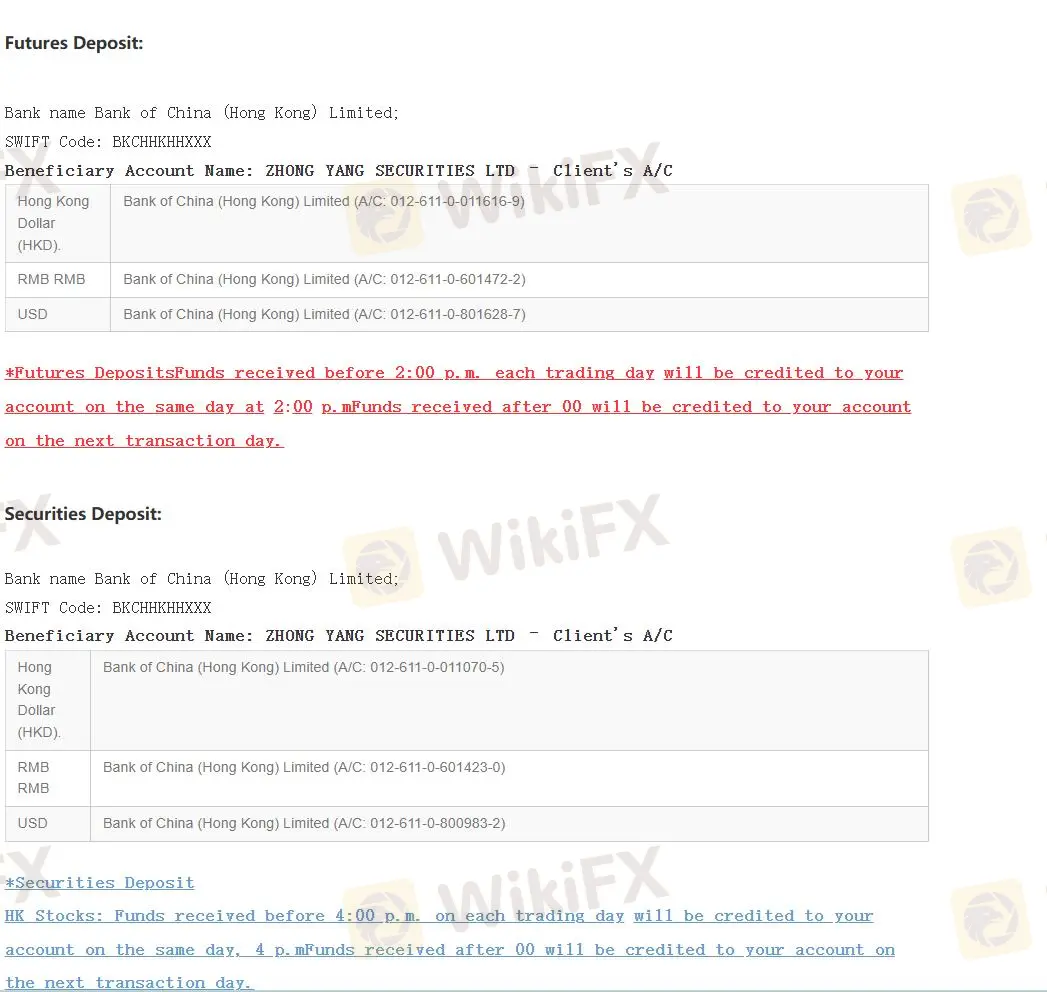

中阳金融集团 提供銀行轉帳進行存款。賬戶轉帳完成後,客戶需向中陽證券提供完整的存款證明。公司將致電客戶進行驗證和確認資金存入操作。

銀行名稱:中國銀行(香港)有限公司

SWIFT代碼:BKCHHKHHXXX

受益人賬戶名稱:中陽證券有限公司 - 客戶賬戶

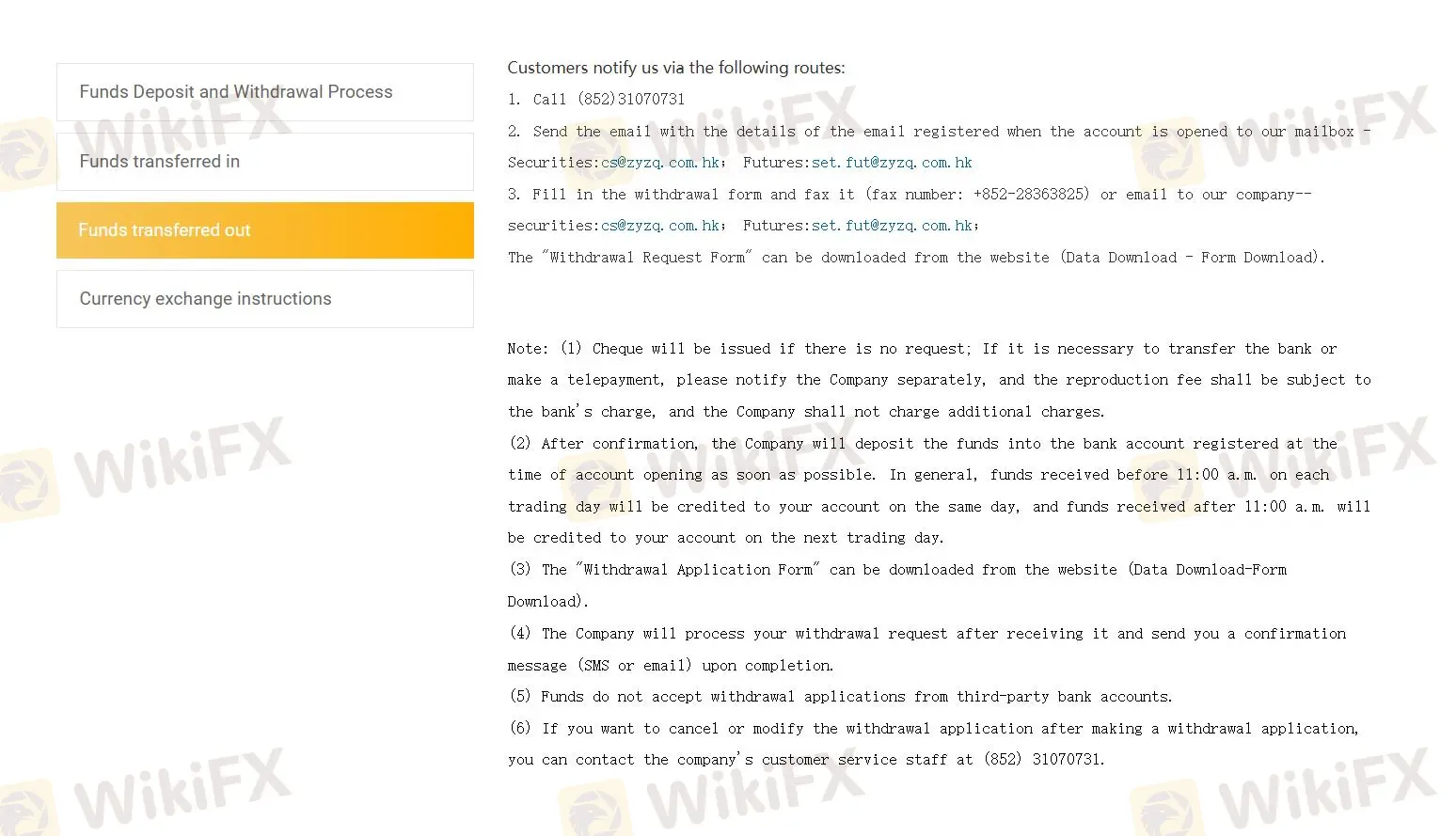

提款:

客戶可通過以下途徑通知中陽證券進行提款:

電話:撥打 (852) 31070731

電郵:將詳細信息發送至 cs@zyzq.com.hk(證券)和 set.fut@zyzq.com.hk(期貨),使用開戶時註冊的電郵地址。

傳真或電郵:填寫提款表格,傳真至 +852-28363825 或電郵至 cs@zyzq.com.hk(證券)和 set.fut@zyzq.com.hk(期貨)。

注意事項:

- 如未提出要求,將發出支票。如需銀行轉帳或電匯支付,請另行通知公司。 任何手續費均由銀行收取。

- 在交易日上午11:00之前收到的資金將於同日入賬,上午11:00之後收到的資金將於下一個交易日入賬。

- 公司不處理從第三方銀行賬戶提出的提款請求。