Buod ng kumpanya

| ZHONGYANG Buod ng Pagsusuri | |

| Itinatag | 2019 |

| Rehistradong Bansa/Rehiyon | Hong Kong |

| Regulasyon | SFC (Lumampas, Kwestyonableng clone) |

| Mga Instrumento sa Merkado | Mga Sekuridad at mga hinaharap |

| Demo Account | ❌ |

| Plataporma ng Pagkalakalan | Yisheng Polestar 9.5.7 system |

| Min Deposit | / |

| Suporta sa Customer | Online na konsultasyon |

| Telepono: +852 31070731 | |

| Fax: (852) 2836 3825 | |

| Email: CS@zyzq.com.hk | |

| Address: Room 1101, 118 Connaught Road West, Hong Kong | |

ZHONGYANG nagbibigay ng mga serbisyo sa brokerage ng mga sekuridad at hinaharap, nag-aalok ng mga pagpipilian sa pagkalakalan sa iba't ibang merkado, kasama ang Hong Kong Stock Exchange (HKEX), mga stock exchange sa Amerika (NYSE, NASDAQ), at ang Shanghai at Shenzhen Stock Connect.

Nag-aalok sila ng iba't ibang mga produkto sa pananalapi, kasama ang mga kontrata sa mga sekuridad at hinaharap, bawat isa ay may kaugnay na bayad sa pagkalakal.

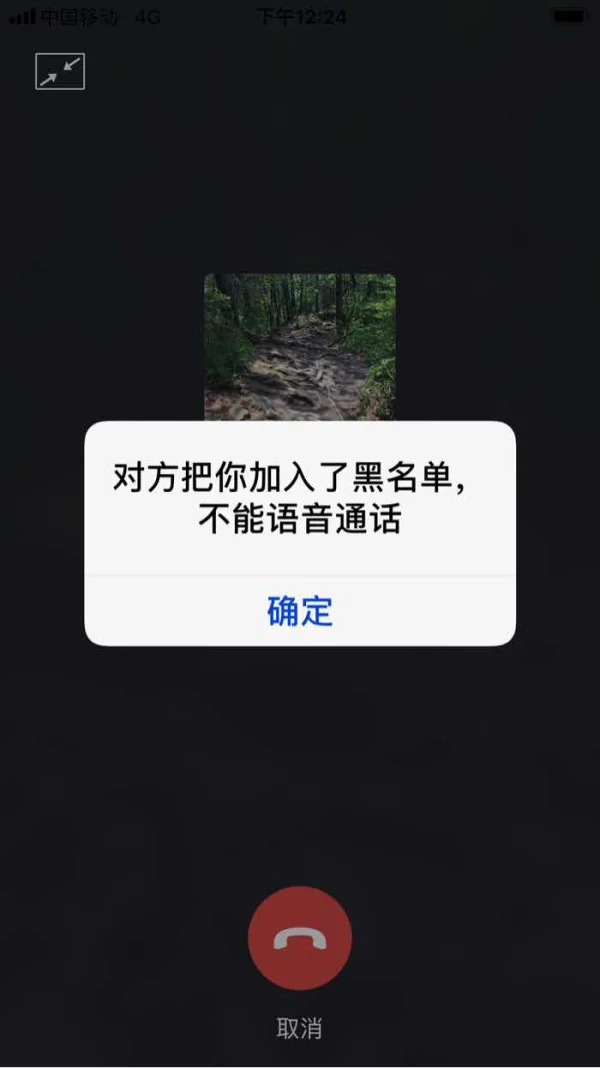

Gayunpaman, ang kanilang mga lisensya sa regulasyon ng SFC ay lumampas at kwestyonableng clone.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Access sa global na mga sekuridad at hinaharap | Lumampas at kwestyonableng clone na mga lisensya ng SFC |

| Available ang online na konsultasyon | Limitadong mga paraan ng pagpopondo |

| Walang impormasyon tungkol sa minimum na deposito |

Tunay ba ang ZHONGYANG?

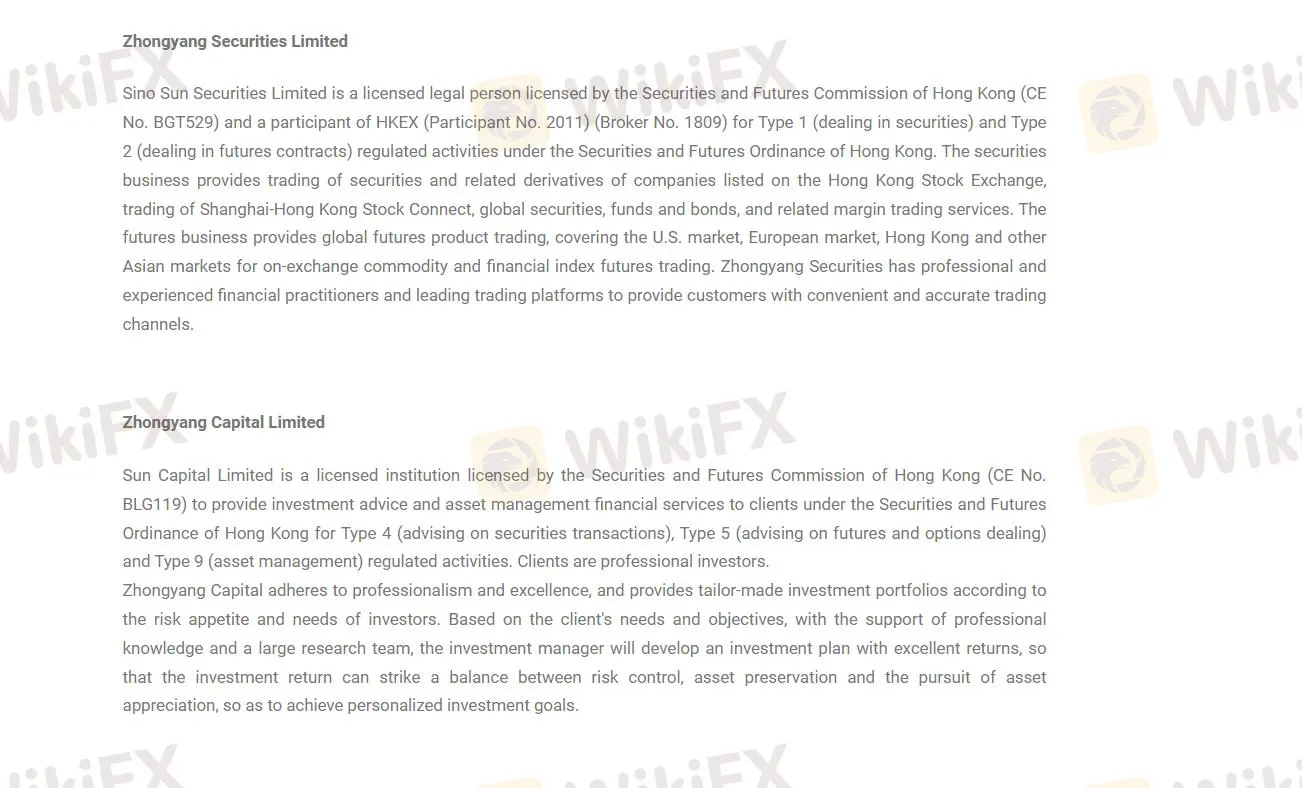

ZHONGYANG may dalawang uri ng lisensya mula sa SFC: Pagpayo sa mga seguridad at Pakikipagkalakalan sa mga kontrata ng mga hinaharap. Gayunpaman, ang dalawang lisensyang ito ay iniulat bilang nalampasan o kaduda-dudang mga kopya.

| Kalagayan sa Pagsasaklaw | Nalampasan |

| Regulado ng | Securities and Futures Commission ng Hong Kong (SFC) |

| Lisensyadong Institusyon | Zhong Yang Capital Limited |

| Uri ng Lisensya | Pagpayo sa mga seguridad |

| Numero ng Lisensya | BLG119 |

| Kalagayan sa Pagsasaklaw | Kaduda-dudang Kopya |

| Regulado ng | Securities and Futures Commission ng Hong Kong (SFC) |

| Lisensyadong Institusyon | Zhong Yang Capital Limited |

| Uri ng Lisensya | Pakikipagkalakalan sa mga kontrata ng mga hinaharap |

| Numero ng Lisensya | BGT529 |

Mga Produkto at Serbisyo

Ang negosyo sa mga seguridad ni ZHONGYANG ay nagbibigay ng pamamalakad ng mga seguridad at kaugnay na mga derivatibo ng mga kumpanya na nakalista sa Hong Kong Stock Exchange, pamamalakad ng Shanghai-Hong Kong Stock Connect, pandaigdigang mga seguridad, pondo at mga bond, at kaugnay na mga serbisyong pang-margin trading.

Bukod dito, nagbibigay rin sila ng sa mga kliyente.

Mga Bayarin ni ZHONGYANG

Nagpapataw si ZHONGYANG ng mga bayarin sa paglikom at komisyon:

| Hong Kong Stock | Shanghai/Shenzhen-Hong Kong Stock Connect | U.S. | |

| Bayad | 0.1% bayad sa paglikom | 0.1% bayad sa paghawak | $0.05/bahagi ($0.01/bahagi para sa higit sa 2,000 bahagi kada araw) bayad sa pagpatakbo |

| Minimum na halaga ng pagkonsumo | 80 dolyar ng Hong Kong | 100 yuan | $1.99 |

| Antas ng interes sa pondo | 8% taun-taon | 8% taun-taon | 8% taun-taon |

Bukod dito, nagpapataw rin sila ng mga komisyon para sa iba't ibang mga produkto ng futures, halimbawa:

| Numero ng Breed | Pangalan ng Breed | Contract Units | Minimum na Pagbabago ng Presyo | Komisyon (USD) | |

| COMEX | GC | U.S. Gold | 100 onsa | 0.1 | 20 |

| COMEX | HG | CMX Copper | 25000 pounds | 0.0005 | |

| COMEX | SI | U.S. Silver | 5000 onsa | 0.005 | |

| COMEX | MGC | Micro Gold Futures | 10 onsa | 1 | |

| NYMEX | CL | U.S. crude oil | 1000 barrels | 0.01 |

Maaaring malaman ang mga karagdagang detalye sa pamamagitan ng pag-click dito: https://www.zyfgl.com/index.php?m=content&c=index&a=lists&catid=19

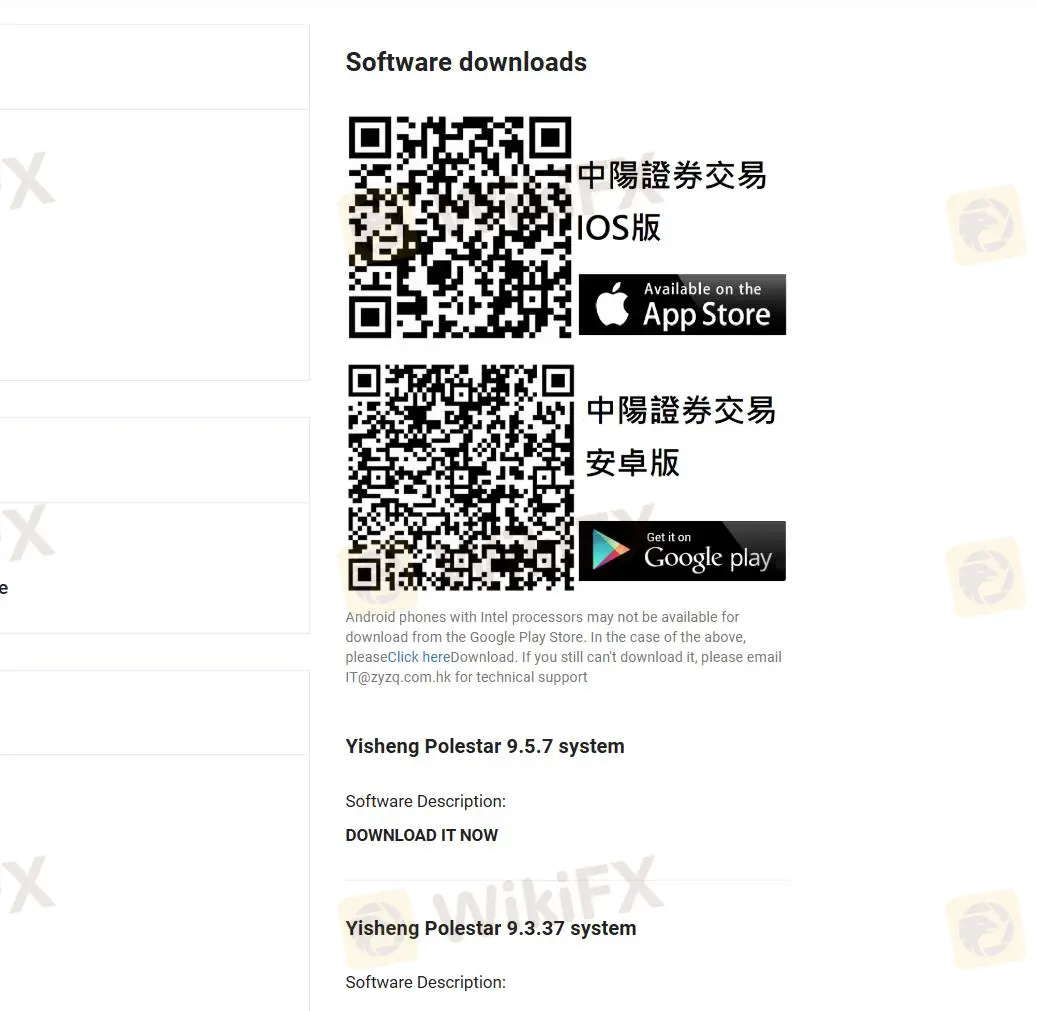

Plataforma ng Pagkalakalan

ZHONGYANG ay nag-aalok ng Yisheng Polestar 9.5.7 system, na maaaring i-download sa pamamagitan ng App Store at Google Play.

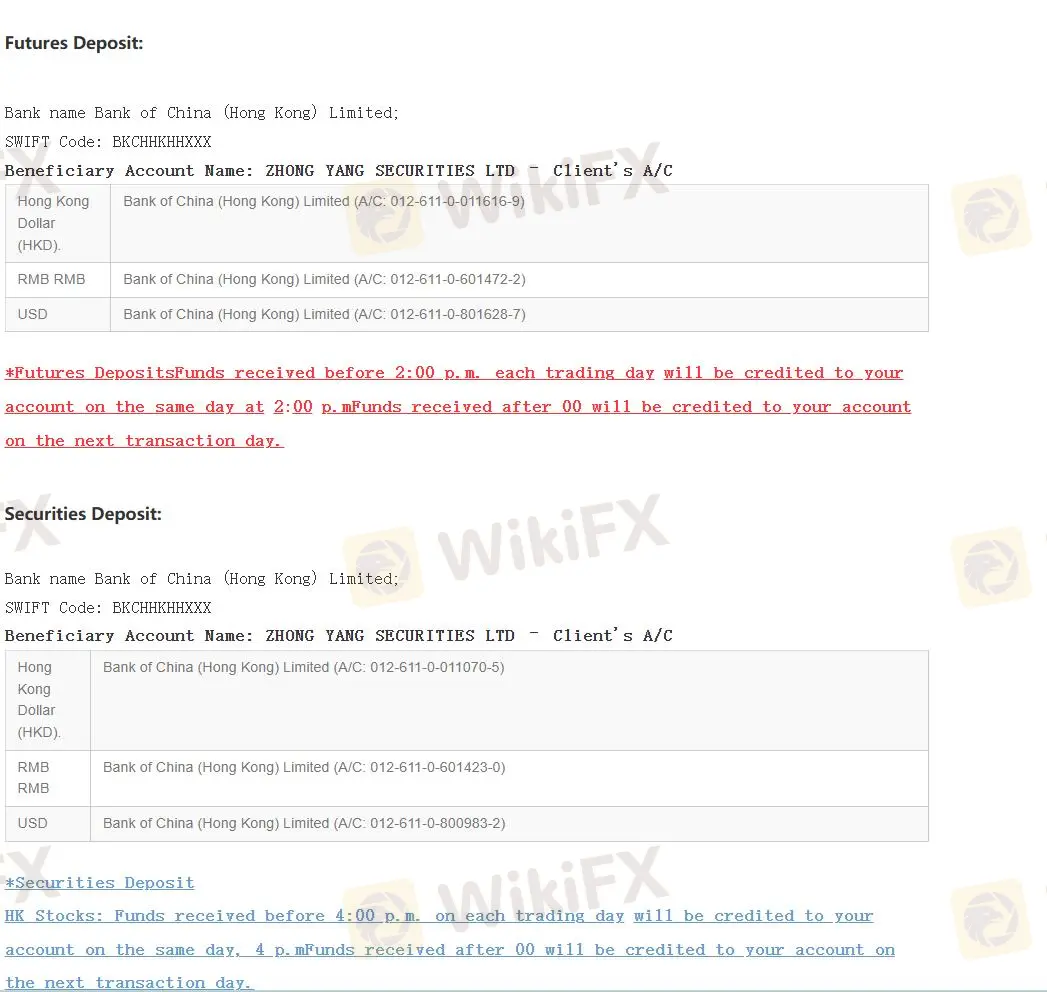

Pag-iimpok at Pagwiwithdraw

Pag-iimpok:

ZHONGYANG ay nag-aalok ng bank transfer para mag-iimpok. Matapos matapos ang paglipat ng account, kailangan ng customer na magbigay ng kumpletong sertipiko ng deposito sa Zhong Yang Securities. Tapos tatawagan ng kumpanya ang customer upang patunayan at kumpirmahin ang operasyon ng pag-iimpok ng pondo.

Pangalan ng Bangko: Bank of China (Hong Kong) Limited

SWIFT Code: BKCHHKHHXXX

Beneficiary Account Name: ZHONG YANG SECURITIES LTD – Clients A/C

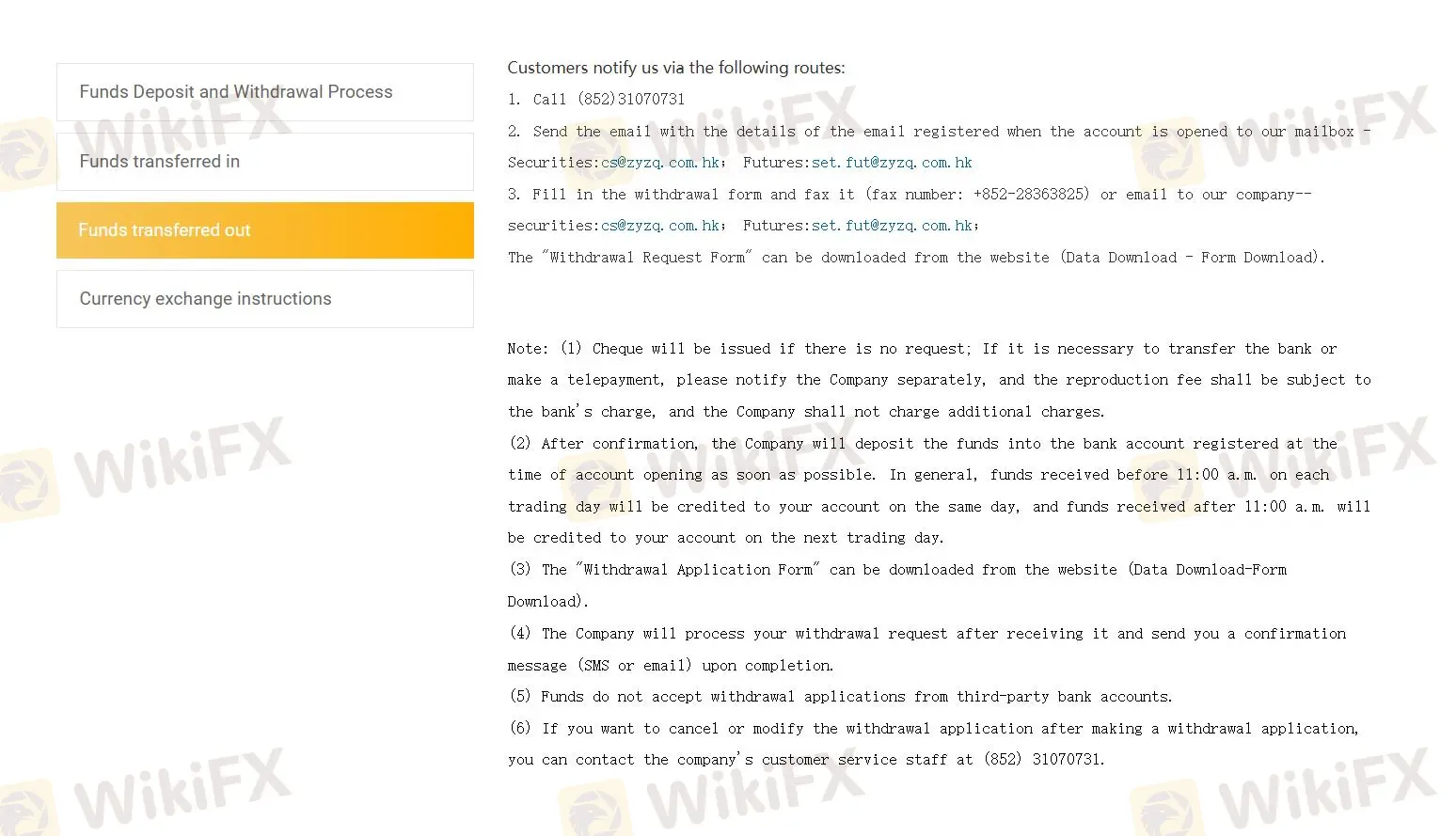

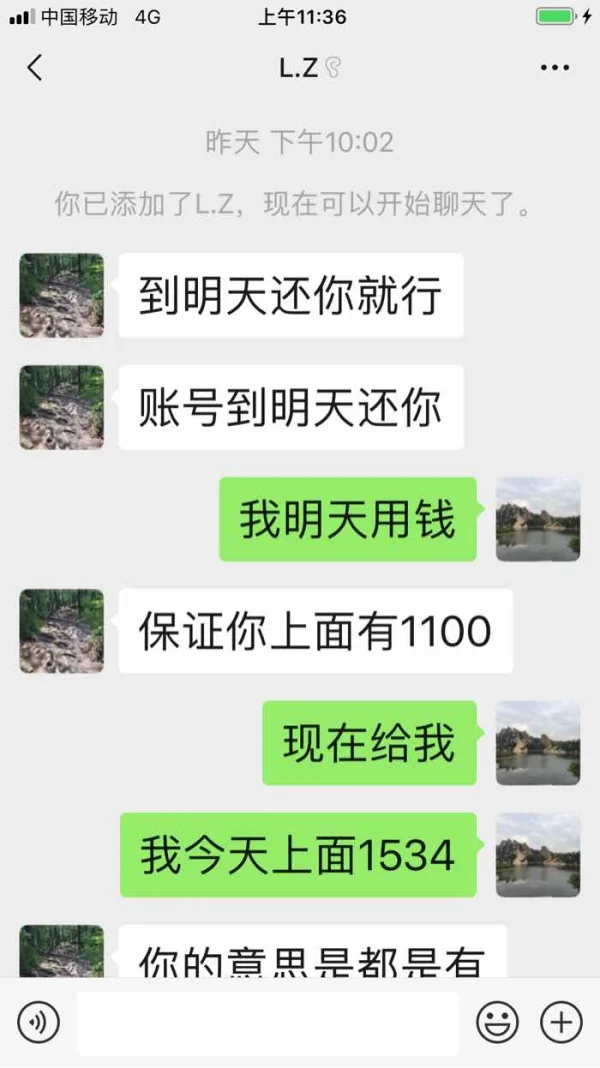

Pagwiwithdraw:

Maaaring ipaalam ng mga customer sa Zhong Yang Securities ang kanilang mga pagwiwithdraw sa pamamagitan ng mga sumusunod na paraan:

Tawag: Tumawag sa (852) 31070731

Email: Magpadala ng email na may mga detalye sa cs@zyzq.com.hk para sa securities at set.fut@zyzq.com.hk para sa futures, gamit ang email na rehistrado noong binuksan ang account.

Fax o Email: Punan ang withdrawal form at i-fax sa +852-28363825 o i-email sa cs@zyzq.com.hk para sa securities at set.fut@zyzq.com.hk para sa futures.

Mga Tala:

- Kung walang kahilingan, mag-iisyu ng tseke. Para sa mga bank transfer o telegraphic payments, ipaalam ito sa kumpanya nang hiwalay. Anumang bayad sa pagproseso ay nasasailalim sa mga bayarin ng mga bangko.

- Ang mga pondo na natanggap bago mag 11:00 a.m. sa isang araw ng pagkalakalan ay magkakaroon ng kredito sa parehong araw, at ang mga pondo na natanggap pagkatapos ng 11:00 a.m. ay magkakaroon ng kredito sa susunod na araw ng pagkalakalan.

- Ang kumpanya ay hindi nagproseso ng mga kahilingan sa pagwiwithdraw mula sa mga bank account ng third-party.