Profil perusahaan

| ZHONGYANG Ringkasan Ulasan | |

| Didirikan | 2019 |

| Negara/Daerah Terdaftar | Hong Kong |

| Regulasi | SFC (Melebihi, Klone yang Mencurigakan) |

| Instrumen Pasar | Efek dan futures |

| Akun Demo | ❌ |

| Platform Perdagangan | Sistem Yisheng Polestar 9.5.7 |

| Deposit Minimum | / |

| Dukungan Pelanggan | Konsultasi online |

| Telepon: +852 31070731 | |

| Fax: (852) 2836 3825 | |

| Email: CS@zyzq.com.hk | |

| Alamat: Room 1101, 118 Connaught Road West, Hong Kong | |

ZHONGYANG menyediakan layanan pialang efek dan futures, menawarkan opsi perdagangan di berbagai pasar, termasuk Bursa Saham Hong Kong (HKEX), bursa saham Amerika (NYSE, NASDAQ), dan Shanghai dan Shenzhen Stock Connect.

Mereka menawarkan berbagai produk keuangan, termasuk kontrak efek dan futures, masing-masing dengan biaya perdagangan terkait.

Namun, lisensi regulasi mereka dari SFC melebihi dan mencurigakan klone.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Akses ke efek dan futures global | Lisensi SFC yang melebihi dan mencurigakan klone |

| Konsultasi online tersedia | Metode pendanaan terbatas |

| Tidak ada informasi tentang deposit minimum |

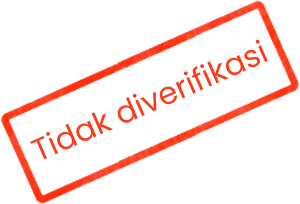

Apakah ZHONGYANG Legal?

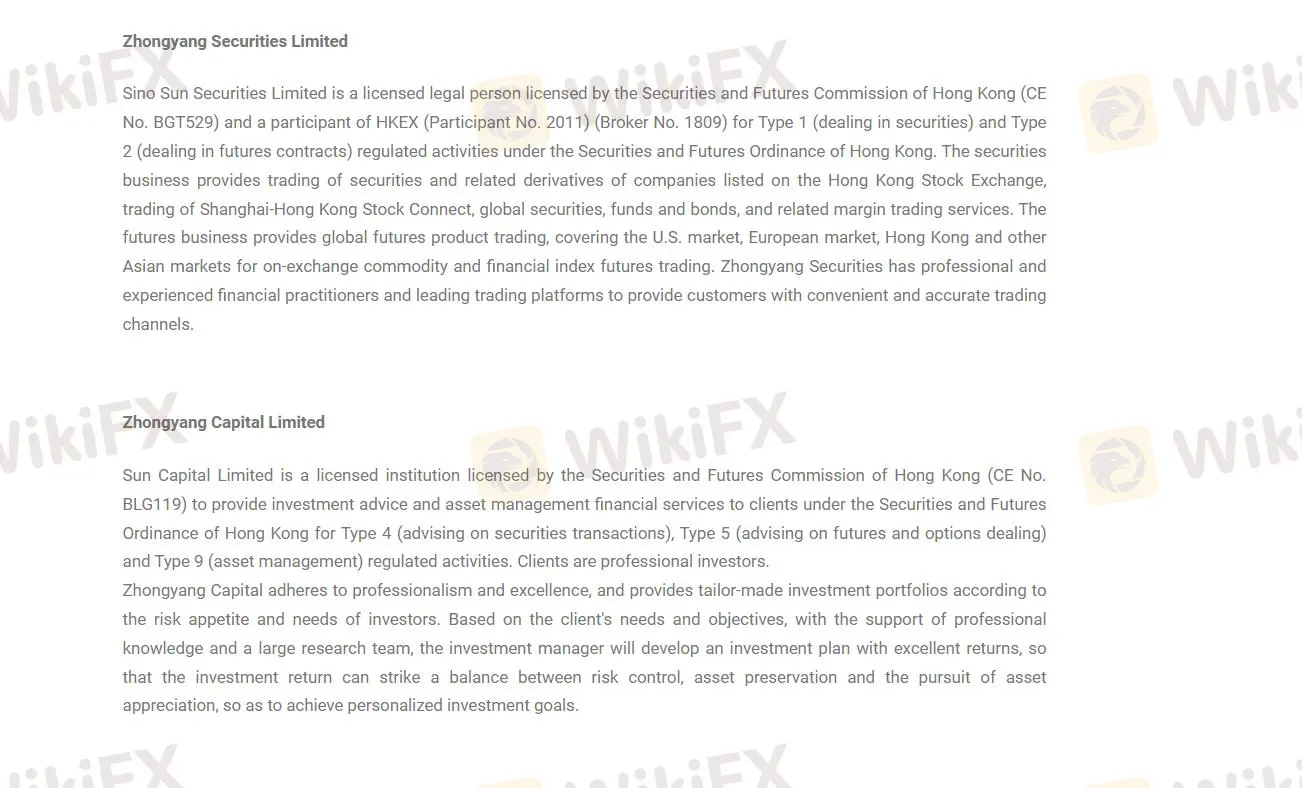

ZHONGYANG memegang dua jenis lisensi SFC: Penasehatan pada sekuritas dan Perdagangan kontrak berjangka. Namun, kedua lisensi ini dilaporkan sebagai melebihi atau mencurigakan klon.

| Status Regulasi | Melebihi |

| Diregulasi oleh | Komisi Sekuritas dan Berjangka Hong Kong (SFC) |

| Institusi Berlisensi | Zhong Yang Capital Limited |

| Jenis Lisensi | Penasehatan pada sekuritas |

| Nomor Lisensi | BLG119 |

| Status Regulasi | Klon Mencurigakan |

| Diregulasi oleh | Komisi Sekuritas dan Berjangka Hong Kong (SFC) |

| Institusi Berlisensi | Zhong Yang Capital Limited |

| Jenis Lisensi | Perdagangan kontrak berjangka |

| Nomor Lisensi | BGT529 |

Produk dan Layanan

ZHONGYANG menyediakan bisnis sekuritas perdagangan sekuritas dan derivatif terkait perusahaan yang terdaftar di Bursa Saham Hong Kong, perdagangan Shanghai-Hong Kong Stock Connect, sekuritas global, dana dan obligasi, serta layanan perdagangan marjin terkait.

Selain itu, mereka juga menyediakan layanan nasihat investasi dan pengelolaan aset keuangan kepada klien.

Biaya ZHONGYANG

ZHONGYANG mengenakan biaya omset dan komisi:

| Saham Hong Kong | Saham Shanghai/Shenzhen-Hong Kong Stock Connect | Amerika Serikat | |

| Biaya | Biaya omset 0,1% | Biaya transaksi 0,1% | Biaya berjalan $0,05/saham ($0,01/saham untuk lebih dari 2.000 saham per hari) |

| Tingkat konsumsi minimum | 80 dolar Hong Kong | 100 yuan | $1,99 |

| Tingkat bunga pembiayaan | 8% tahunan | 8% tahunan | 8% tahunan |

Selain itu, mereka juga mengenakan komisi untuk berbagai produk futures, misalnya:

| Nomor Breed | Nama Breed | Unit Kontrak | Perubahan Harga Minimum | Komisi (USD) | |

| COMEX | GC | Emas AS | 100 ons | 0.1 | 20 |

| COMEX | HG | CMX Tembaga | 25000 pound | 0.0005 | |

| COMEX | SI | Perak AS | 5000 ons | 0.005 | |

| COMEX | MGC | Kontrak Emas Mikro | 10 ons | 1 | |

| NYMEX | CL | Minyak mentah AS | 1000 barel | 0.01 |

Informasi lebih lanjut dapat dipelajari melalui klik: https://www.zyfgl.com/index.php?m=content&c=index&a=lists&catid=19

Platform Perdagangan

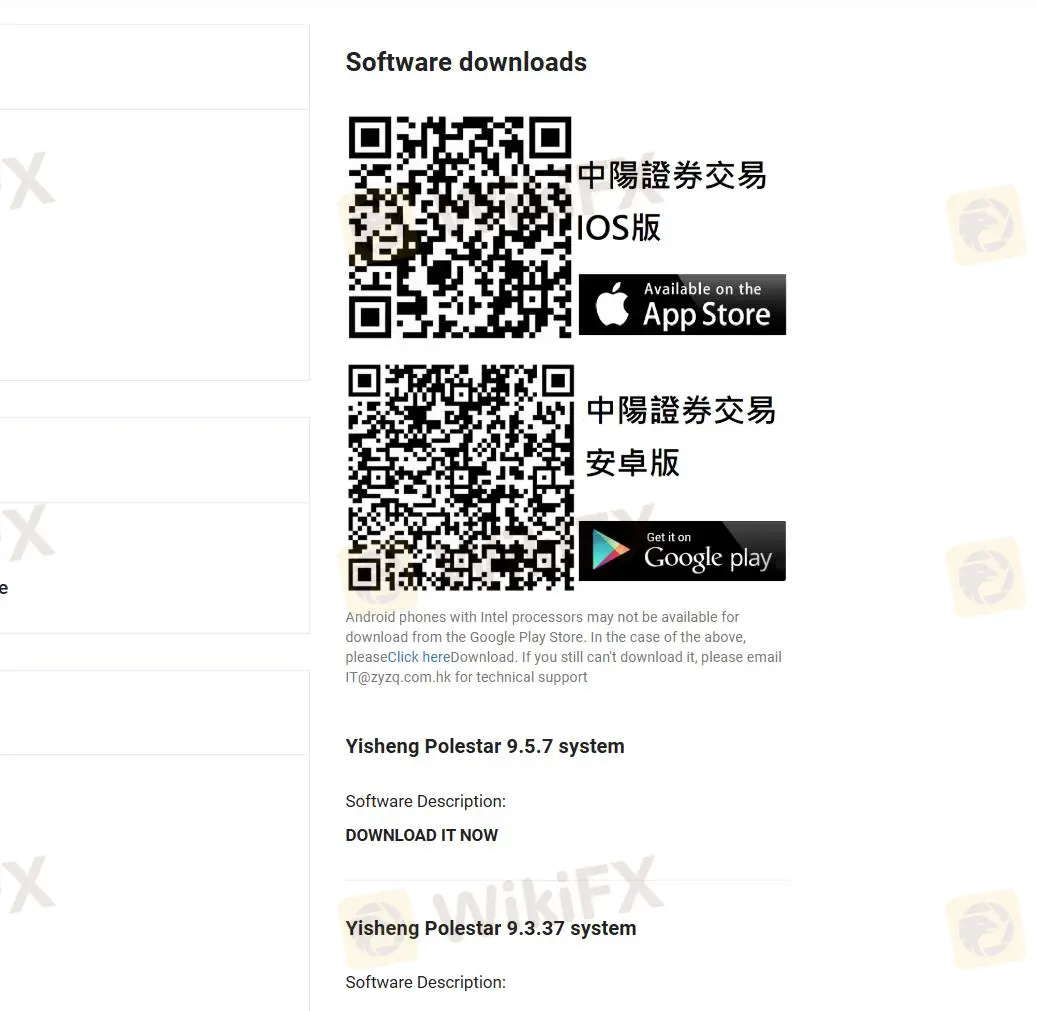

ZHONGYANG menawarkan sistem Yisheng Polestar 9.5.7, yang dapat diunduh melalui App Store dan Google Play.

Deposit dan Penarikan

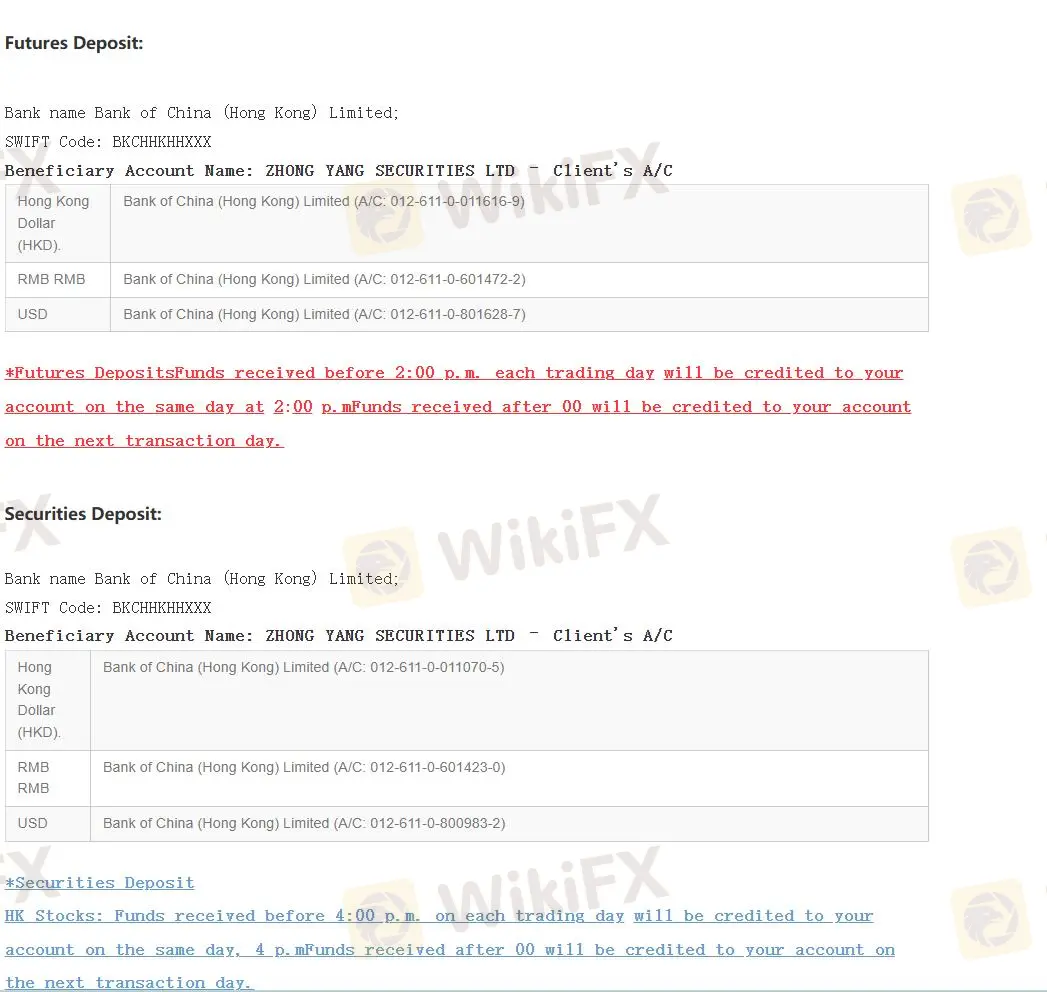

Deposit:

ZHONGYANG menawarkan transfer bank untuk melakukan deposit. Setelah transfer akun selesai, pelanggan perlu menyediakan Zhong Yang Securities dengan sertifikat deposit lengkap. Perusahaan kemudian akan menghubungi pelanggan untuk memverifikasi dan mengkonfirmasi operasi deposit dana.

Nama Bank: Bank of China (Hong Kong) Limited

Kode SWIFT: BKCHHKHHXXX

Nama Rekening Penerima: ZHONG YANG SECURITIES LTD – Clients A/C

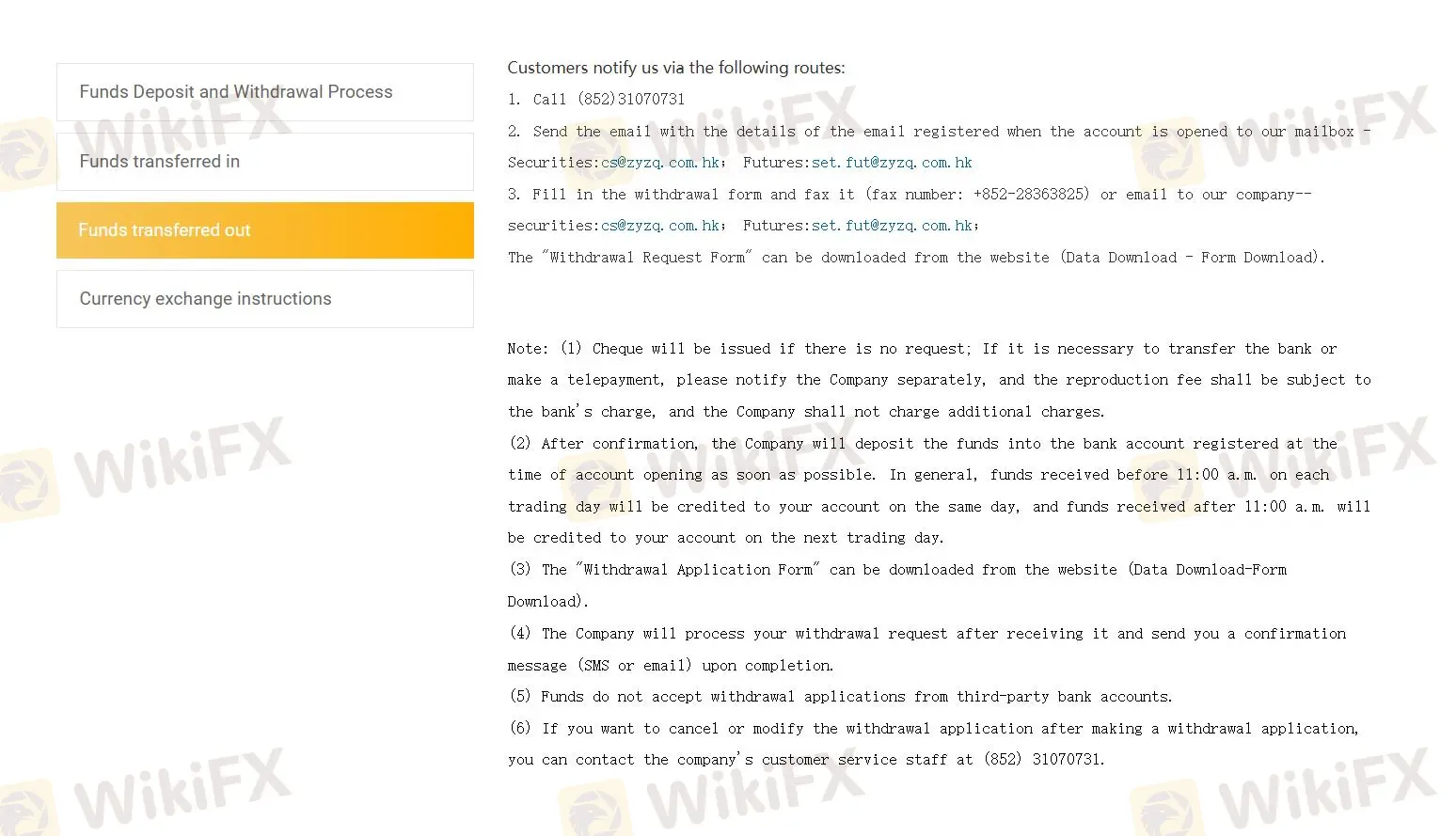

Penarikan:

Pelanggan dapat memberi tahu Zhong Yang Securities untuk penarikan melalui rute berikut:

Telepon: Hubungi (852) 31070731

Email: Kirim email dengan rincian ke cs@zyzq.com.hk untuk sekuritas dan set.fut@zyzq.com.hk untuk futures, menggunakan email yang terdaftar saat membuka akun.

Fax atau Email: Isi formulir penarikan dan faks ke +852-28363825 atau kirim email ke cs@zyzq.com.hk untuk sekuritas dan set.fut@zyzq.com.hk untuk futures.

Catatan:

- Jika tidak ada permintaan, cek akan diterbitkan. Untuk transfer bank atau pembayaran telegrafik, beri tahu perusahaan secara terpisah. Biaya penanganan akan dikenakan biaya oleh bank.

- Dana yang diterima sebelum pukul 11:00 pagi pada hari perdagangan akan dikreditkan pada hari yang sama, dan dana yang diterima setelah pukul 11:00 pagi akan dikreditkan pada hari perdagangan berikutnya.

- Perusahaan tidak memproses permintaan penarikan dari rekening bank pihak ketiga.