公司簡介

| Currency Solutions 檢討摘要 | |

| 成立年份 | 2003 |

| 註冊國家/地區 | 英國 |

| 監管 | FCA: 直通處理(STP)(受監管),支付牌照(已超額) |

| 服務 | 外匯(FX)和國際支付服務 |

| 模擬帳戶 | ❌ |

| 槓桿 | / |

| 點差 | / |

| 交易平台 | / |

| 最低存款 | / |

| 客戶支援 | 電話:+44 2077400000 |

| X,Linkedin,Instagram | |

| 地址:倫敦Jacob Street 2號Hobbs Court 4樓,郵編SE1 2BG | |

Currency Solutions 成立於2003年,總部位於英國,提供外匯(FX)和國際支付服務,可提供超過170種貨幣對的交易。該公司獲得了英國金融行為監管局(FCA)的授權和監管,用於直通處理(STP)。然而,他們的支付牌照(編號512130)已超額。此外,有關交易平台、點差、槓桿和最低存款的信息並不容易獲得,他們目前也不提供模擬帳戶。

優點和缺點

| 優點 | 缺點 |

| 受FCA監管 | 超額牌照 |

| 有限的交易費用信息 | |

| 沒有模擬帳戶 | |

| 缺乏交易平台信息 |

Currency Solutions 是否合法?

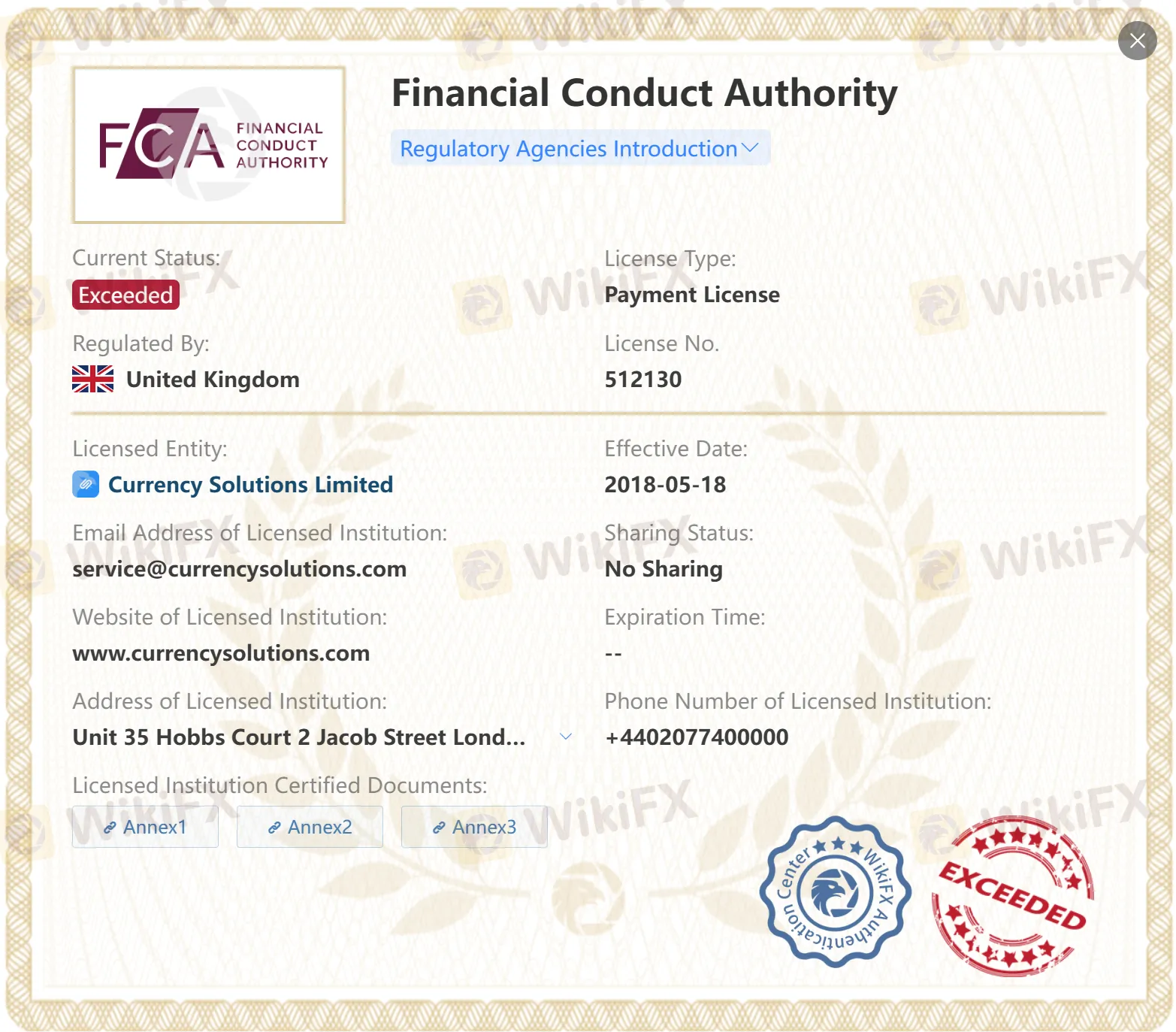

Currency Solutions目前持有兩張FCA牌照。其中一張是直通處理(STP)牌照,受到監管。另一張是支付牌照,已超出。

| 受監管國家 | 監管機構 | 受監管實體 | 當前狀態 | 牌照類型 | 牌照號碼 |

| 金融行為監管局(FCA) | Currency Solutions有限公司 | 受監管 | 直通處理(STP) | 602082 |

| 金融行為監管局(FCA) | Currency Solutions有限公司 | 超出 | 支付牌照 | 512130 |

服務

Currency Solutions提供超過170種貨幣對、外匯(FX)和國際支付服務。

存款和提款

Currency Solutions支持通過Visa和Mastercard借記卡以及銀行轉帳的支付方式。