Présentation de l'entreprise

| Currency Solutions Résumé de l'examen | |

| Fondé | 2003 |

| Pays/Région Enregistré(e) | Royaume-Uni |

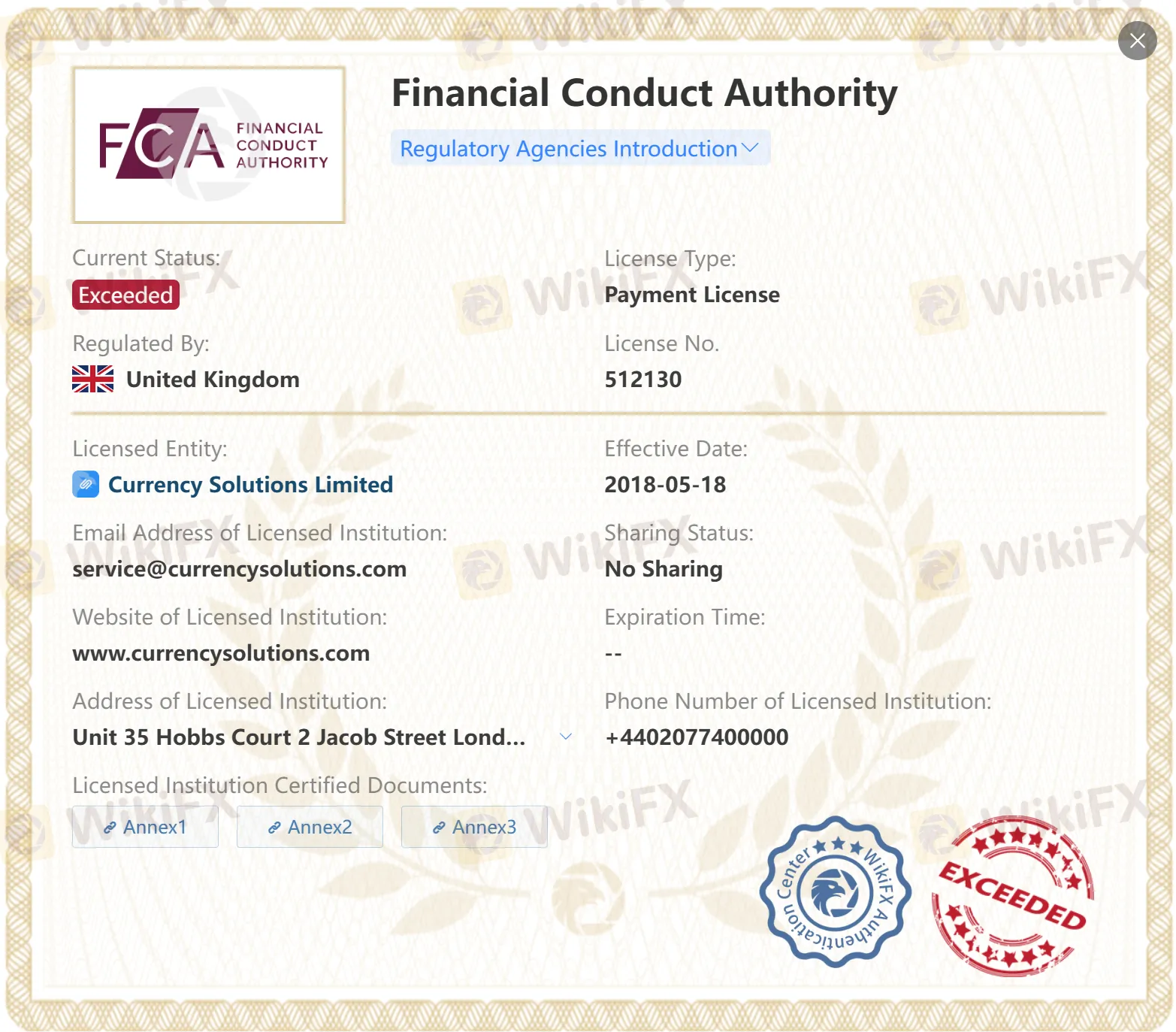

| Régulation | FCA: Traitement Direct (STP) (réglementé), Licence de Paiement (dépassée) |

| Services | Services de change (FX) et de paiement international |

| Compte de Démo | ❌ |

| Effet de Levier | / |

| Spread | / |

| Plateforme de Trading | / |

| Dépôt Minimum | / |

| Support Client | Téléphone : +44 2077400000 |

| X, Linkedin, Instagram | |

| Adresse : 4th Floor Hobbs Court, 2 Jacob Street, London, SE1 2BG | |

Fondée au Royaume-Uni en 2003, Currency Solutions propose des services de change (FX) et de paiement international, offrant l'accès à plus de 170 paires de devises. La société est autorisée et réglementée par l'Autorité de Conduite Financière (FCA) pour le Traitement Direct (STP). Cependant, leur Licence de Paiement (numéro 512130) a été dépassée. De plus, les informations concernant les plateformes de trading, les spreads, l'effet de levier et le dépôt minimum ne sont pas facilement disponibles, et ils n'offrent actuellement pas de comptes de démonstration.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé par la FCA | Licence dépassée |

| Informations limitées sur les frais de trading | |

| Pas de comptes de démonstration | |

| Manque d'informations sur les plateformes de trading |

Currency Solutions Est-il Légitime ?

Currency Solutions détient actuellement deux licences sous la FCA. L'une est une licence de Passage d'Ordres Direct (STP), qui est réglementée. L'autre est une Licence de Paiement, qui a été dépassée.

| Pays Réglementé | Autorité de Régulation | Entité Réglementée | Statut Actuel | Type de Licence | Numéro de Licence |

| Financial Conduct Authority (FCA) | Currency Solutions Limited | Réglementée | Passage d'Ordres Direct (STP) | 602082 |

| Financial Conduct Authority (FCA) | Currency Solutions Limited | Dépassée | Licence de Paiement | 512130 |

Services

Currency Solutions propose plus de 170 paires de devises, des services de change (FX) et de paiement international.

Dépôt et Retrait

Currency Solutions prend en charge les méthodes de paiement par cartes de débit Visa et Mastercard, ainsi que par virement bancaire.