Información básica

Tailandia

Tailandia

Calificación

Tailandia

|

De 5 a 10 años

|

Tailandia

|

De 5 a 10 años

| https://www.cgsi.co.th

Sitio web

Índice de calificación

MT4/5

Licencia completa

CGSIntlSecuritiesSG-CGSIntlSecuritiesSG

influencia

C

índice de influencia NO.1

Tailandia 5.69

Tailandia 5.69

Identificación MT4/5

Licencia completa

Reino Unido

Reino Unidoinfluencia

C

índice de influencia NO.1

Tailandia 5.69

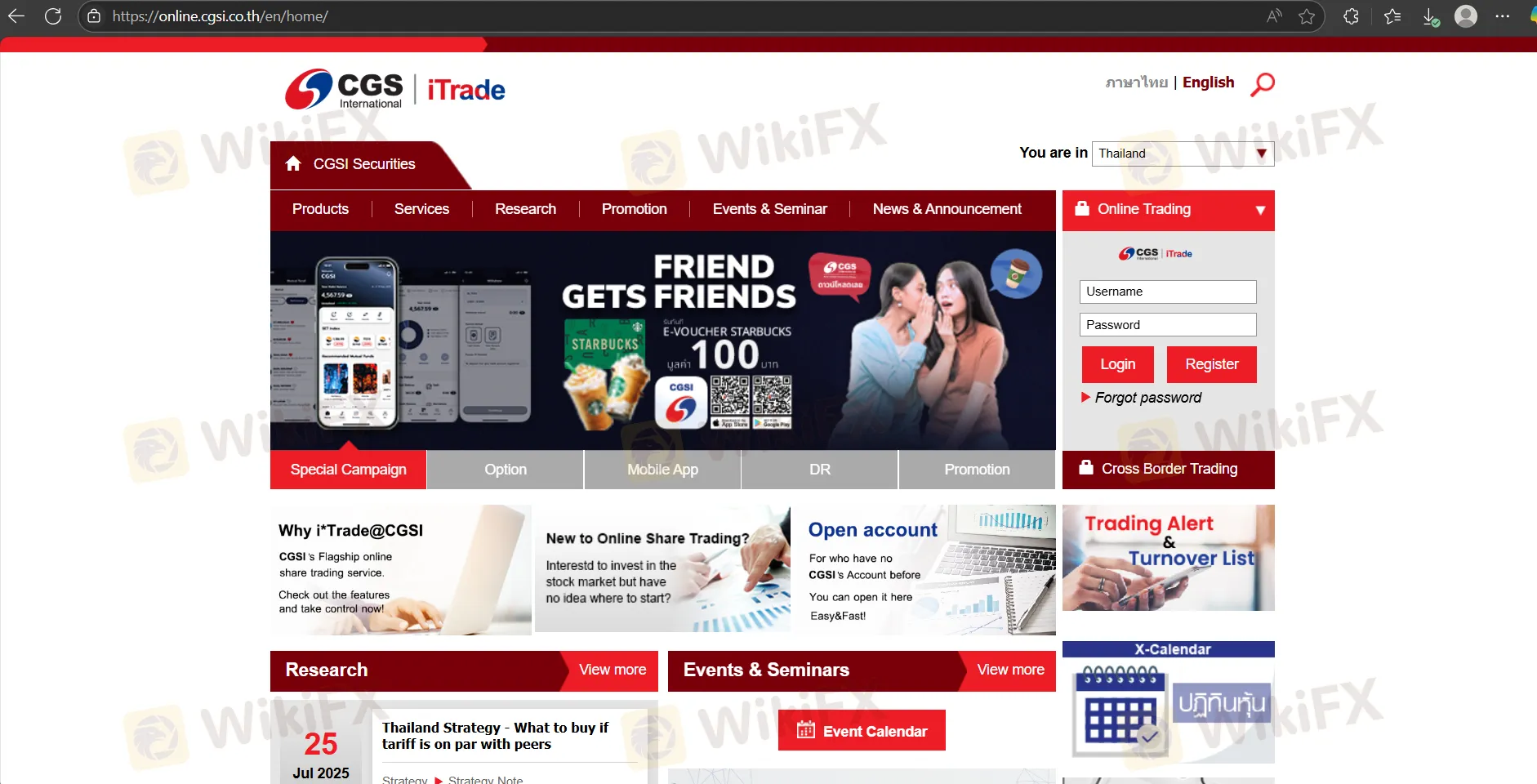

Tailandia 5.69 Licencias

LicenciasNo información reguladora válida, ¡preste atención a los riesgos!

Tailandia

Tailandia

Los traders principales formales de MT4/5 tendrán servicios de sistema de sonido y soporte técnico de seguimiento. En general, su negocio y tecnología son relativamente maduros y sus capacidades de control de riesgos son sólidas.

cgsi.co.th

cgsi.co.th cimbsecurities.co.th

cimbsecurities.co.th VIP no activado

VIP no activado

นายกิตติศักดิ์ อมรชัยโรจน์กุล

pareja

Fecha de inicio

Estado

Empleado

หลักทรัพย์ ซีจีเอส-ซีไอเอ็มบี (ประเทศไทย) จำกัด(Thailand)

นางจาง หยวน เมย์

pareja

Fecha de inicio

Estado

Empleado

หลักทรัพย์ ซีจีเอส-ซีไอเอ็มบี (ประเทศไทย) จำกัด(Thailand)

นายสุธีร์ โล้วโสภณกุล

pareja

Fecha de inicio

Estado

Empleado

หลักทรัพย์ ซีจีเอส-ซีไอเอ็มบี (ประเทศไทย) จำกัด(Thailand)

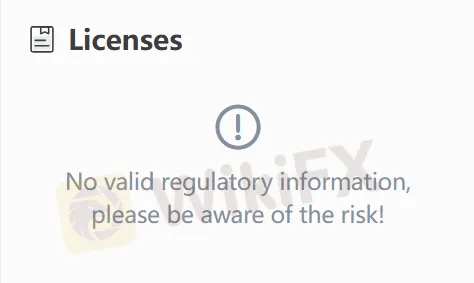

| CGSCIMB Resumen de la reseña | |

| Establecido | 2018 |

| País/Región Registrada | Tailandia |

| Regulación | Sin regulación |

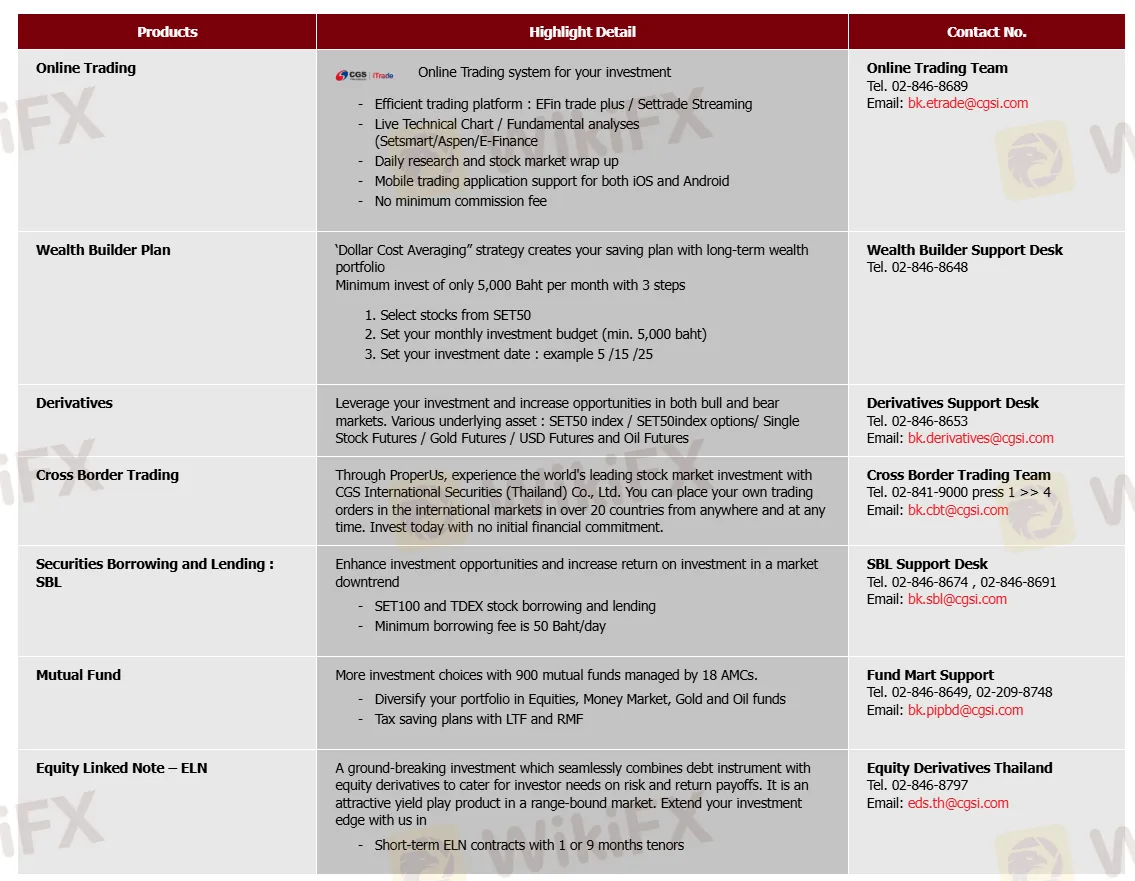

| Instrumentos de Mercado | Forex, Acciones, Derivados, Fondos Mutuos, Bonos |

| Cuenta Demo | / |

| Apalancamiento | / |

| Spread | / |

| Plataforma de Trading | WebTrader, Aplicación Móvil |

| Depósito Mínimo | / |

| Soporte al Cliente | Tel: 02-846-8689 |

| Email: bk.etrade@cgsi.com | |

| Redes Sociales: Line, YouTube, Facebook | |

| Dirección: 130-132 Sindhorn Tower 2, 2nd, 3rd Floor y Sindhorn Tower 3, 12th Floor Wireless Road, Lumpini, Pathumwan, Bangkok 10330 | |

CGSCIMB es un corredor con sede en Tailandia fundado en 2018, el cual no está regulado. Ofrece una amplia gama de instrumentos de mercado, incluyendo Forex, Acciones, Derivados, Fondos Mutuos y Bonos.

| Pros | Contras |

| Varios activos de trading | Estado no regulado |

| Ofertas de promoción | Información limitada sobre condiciones de trading |

| Sin MT4/MT5 | |

| Sin información sobre depósitos y retiros |

CGSCIMB actualmente no tiene regulaciones válidas. ¡Por favor, tenga en cuenta el riesgo!

| Instrumentos negociables | Soportado |

| Forex | ✔ |

| Acciones | ✔ |

| Derivados | ✔ |

| Fondos Mutuos | ✔ |

| Bonos | ✔ |

| Productos Básicos | ❌ |

| Índices | ❌ |

| Criptomonedas | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

| Plataforma de Trading | Soportado | Dispositivos Disponibles | Adecuado para |

| WebTrader | ✔ | Navegador Web, MacOS, Windows | / |

| Aplicación Móvil | ✔ | iOS, Android | / |

| MT4 | ❌ | / | Principiantes |

| MT5 | ❌ | / | Traders experimentados |

CGSCIMB ofrece diferentes actividades promocionales para que los clientes elijan. Por ahora, los clientes pueden obtener un vale electrónico de Starbucks si abren una cuenta.

As an experienced trader, when I consider a broker like CGSCIMB, I insist on having transparent and detailed information about their fee structure, especially regarding commissions and spreads. Unfortunately, when researching CGSCIMB, I encountered a critical barrier: the available information about their fees was inaccessible due to persistent server errors. This lack of transparency is a concern for me, as understanding the exact costs of trading—both spreads and commissions—is fundamental for assessing a broker’s overall competitiveness and suitability for my trading strategies. From my perspective, being unable to verify up-to-date details on how spreads are structured—whether they are fixed or variable, typical ranges for major pairs, and how commission charges are applied—makes it impossible to evaluate the total cost of trading with CGSCIMB. Experience has taught me that even small differences in spreads or unexpected commission policies can significantly impact profitability over time. Reliable brokers usually present this information clearly, enabling informed decision-making and proper risk management. Given my commitment to capital preservation and best execution practices, I would urge anyone, including myself, to proceed cautiously and seek direct clarification from the broker before opening an account or placing funds. For me, avoiding uncertainty and ensuring transparency around all trading costs is non-negotiable for engaging with any broker.

Based on my experience navigating broker assessments, transparency around account types is essential for any trader—especially when considering crucial aspects like swap-free Islamic account options. Unfortunately, after checking the available information, I wasn't able to access any definitive details about whether CGSCIMB provides a swap-free, or Islamic, account. When such key information is missing or unclear, I personally view it as a signal to proceed with caution. In my trading journey, I have learned that not all brokers are equally forthcoming, and this lack of clarity on an important topic like Islamic account availability makes me hesitant. The presence or absence of swap-free accounts can directly affect compliance for traders observing religious guidelines. For me, it's important that a broker explicitly states not just its available account types, but also the conditions attached—such as fee structures, eligibility, and the precise mechanism for maintaining Shariah-compliance. When this information is ambiguous or simply unavailable, I find it prudent to reach out directly to the broker for clarification or, as a safeguard, to consider brokers that clearly disclose such options. Ultimately, I believe the safest approach is to verify directly with CGSCIMB's official support or documentation before opening an account, particularly if a swap-free option is essential for your trading needs. I always err on the side of caution when the details are incomplete or uncertain, as transparency remains a top priority in broker selection.

Having looked for information regarding inactivity fees with CGSCIMB, I wasn't able to confirm the presence or absence of such charges based on the available background. This lack of transparency itself raises some caution for me as a forex trader. In my experience, reputable brokers typically provide clear, specific details on inactivity fees, including the exact conditions under which they might apply, such as account dormancy periods or thresholds for account activity. Since I don't have any directly verifiable details on whether CGSCIMB imposes these fees or the circumstances involved, I would be particularly careful before opening or leaving an account dormant. I always prioritize clarity on all brokerage fees to avoid unexpected deductions, because inactivity charges—if undisclosed—could directly affect trading capital over time. For anyone considering using CGSCIMB, I strongly recommend reaching out directly to their support or referencing official documentation to get written confirmation regarding any and all inactivity policies. This approach helps manage risk and ensure there are no unpleasant surprises related to account charges.

As an experienced forex trader, when I attempt to verify the regulatory status of CGSCIMB, the first step I take is always to rely on authoritative sources and ensure that any financial services provider I consider is properly licensed. However, during my recent review process, I encountered a technical issue: the page displaying regulatory information for CGSCIMB failed to load due to a server error. This meant that I was unable to confirm whether CGSCIMB is currently overseen by any recognized financial authorities. In situations like this, I exercise extra caution. The presence or absence of proper regulation has a direct impact on trader protection, as regulatory oversight can help ensure fair dealing and recourse in case of disputes. Personally, I would not proceed with opening an account or depositing funds until I can independently verify the broker’s regulatory status through a reliable channel, such as an official regulator’s website. In my experience, it's best to avoid making any assumptions and never rely on unconfirmed information when it comes to financial safety. If I cannot independently confirm regulatory details, I consider this a significant red flag and prefer to look for alternatives where regulatory credentials are transparently verifiable.

Ingrese...

TOP

TOP

Chrome

Extensión de Chrome

Consulta regulatoria de bróker de Forex global

Navegue por los sitios web de los brokers de divisas e identifique con precisión los brokers legítimos y los fraudulentos.

Instalar ahora