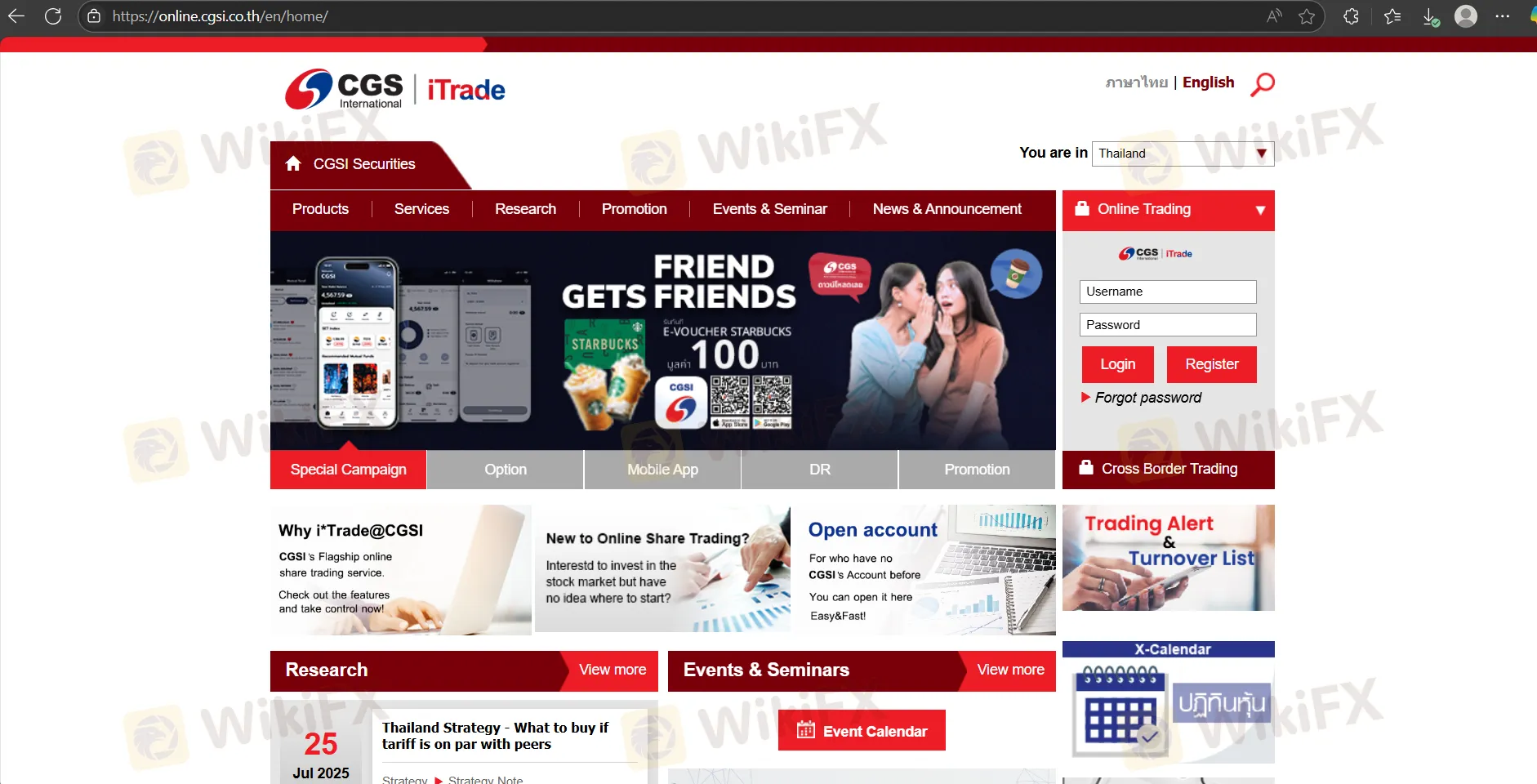

Profil perusahaan

| CGSCIMB Ringkasan Ulasan | |

| Didirikan | 2018 |

| Negara/Daerah Terdaftar | Thailand |

| Regulasi | Tidak diatur |

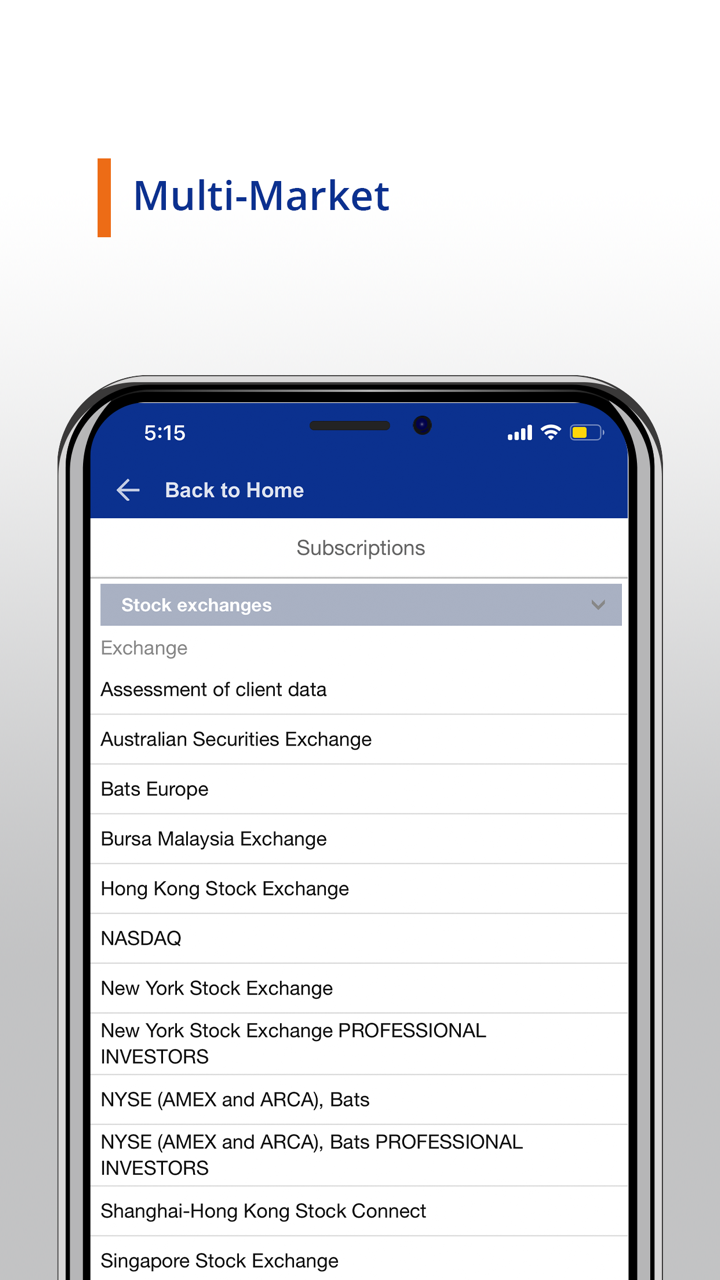

| Instrumen Pasar | Forex, Saham, Derivatif, Reksa Dana, Obligasi |

| Akun Demo | / |

| Leverage | / |

| Spread | / |

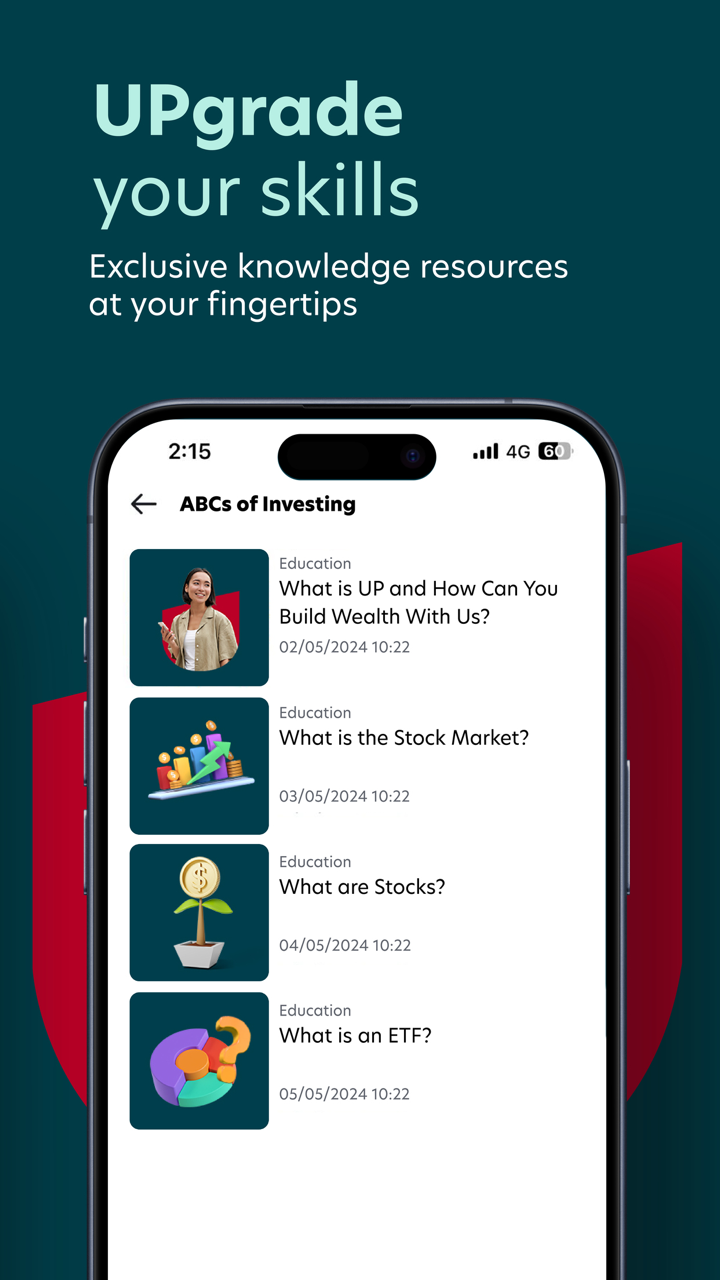

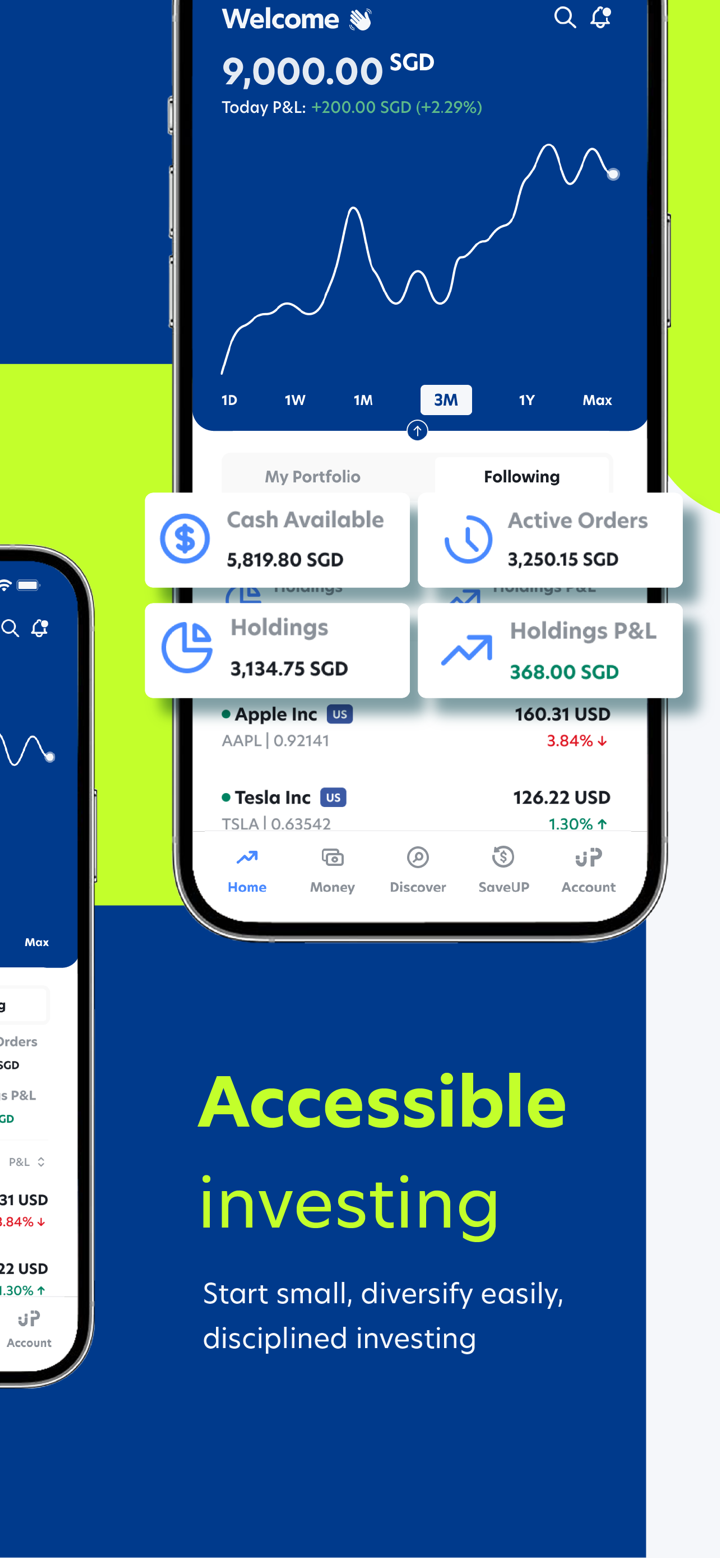

| Platform Perdagangan | WebTrader, Aplikasi Seluler |

| Deposit Minimum | / |

| Dukungan Pelanggan | Tel: 02-846-8689 |

| Email: bk.etrade@cgsi.com | |

| Media sosial: Line, YouTube, Facebook | |

| Alamat: 130-132 Sindhorn Tower 2, Lantai 2, 3 dan Sindhorn Tower 3, Lantai 12 Wireless Road, Lumpini, Pathumwan, Bangkok 10330 | |

Informasi CGSCIMB

CGSCIMB adalah broker berbasis Thailand yang didirikan pada tahun 2018, yang tidak diatur. Broker ini menawarkan beragam instrumen pasar, termasuk Forex, Saham, Derivatif, Reksa Dana, dan Obligasi.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Berbagai aset perdagangan | Status tidak diatur |

| Promosi yang ditawarkan | Informasi terbatas tentang kondisi perdagangan |

| Tidak ada MT4/MT5 | |

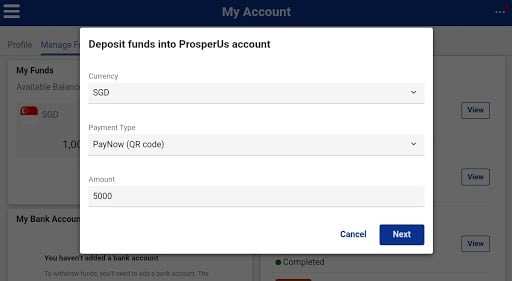

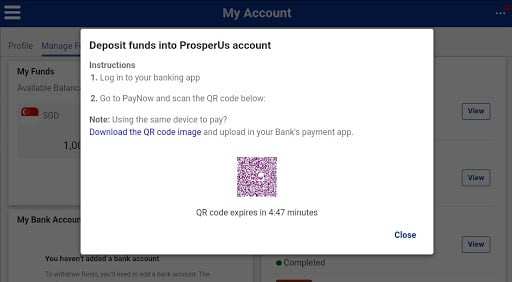

| Tidak ada informasi tentang deposit dan penarikan |

Apakah CGSCIMB Legal?

CGSCIMB saat ini tidak memiliki regulasi yang valid. Harap waspada terhadap risiko!

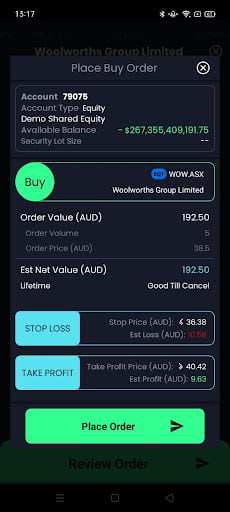

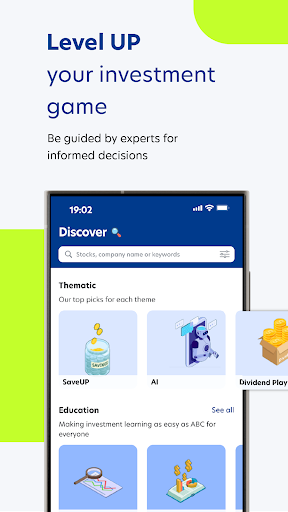

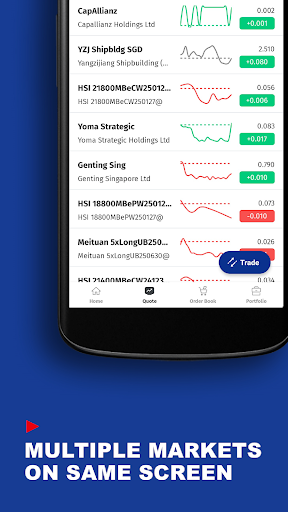

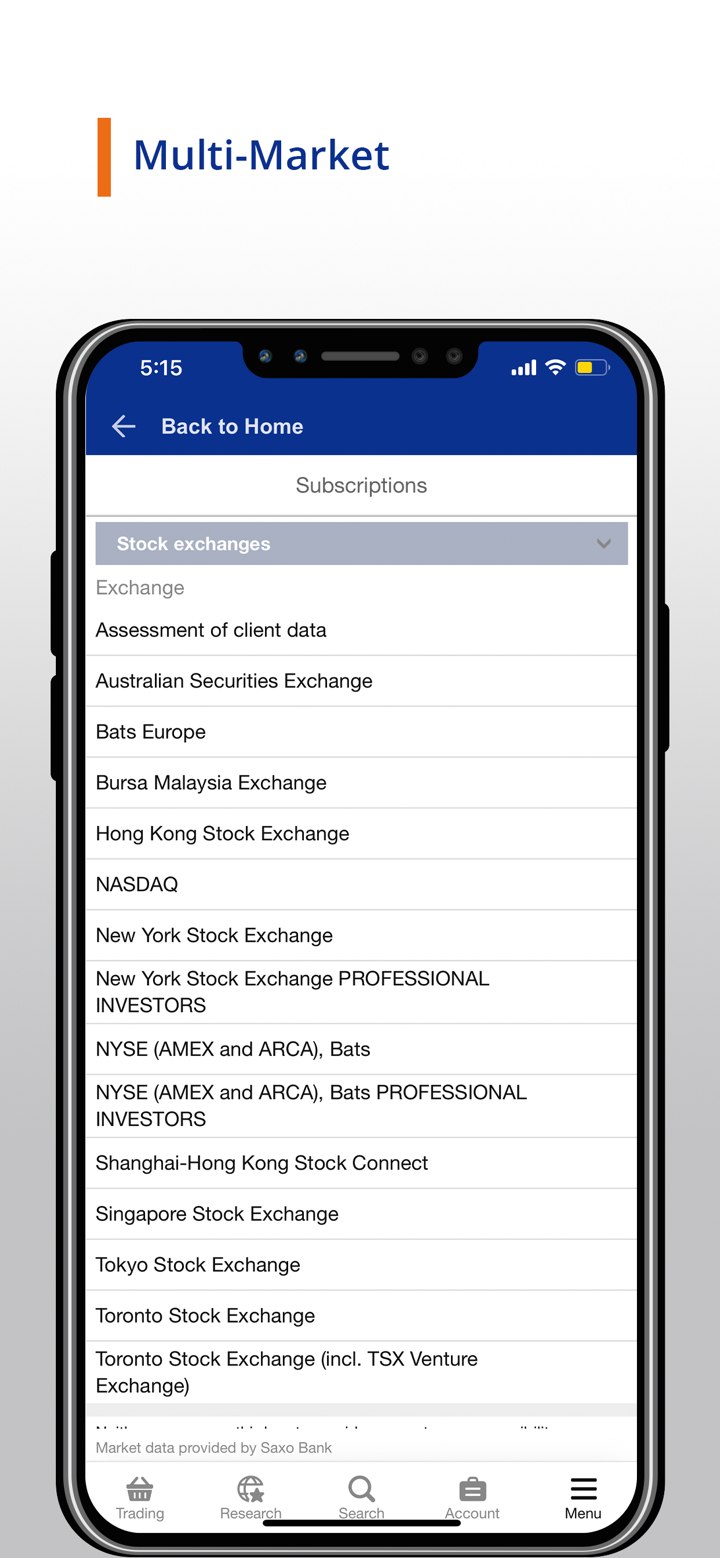

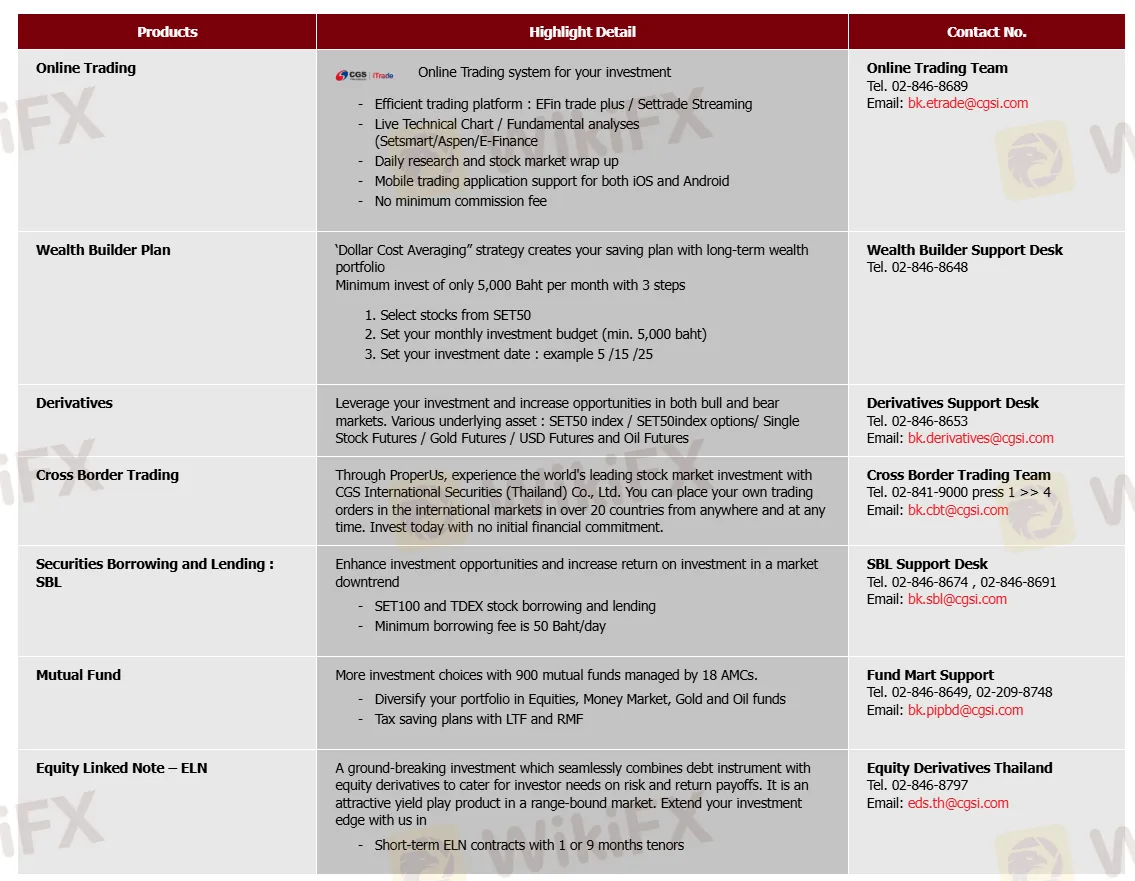

Apa yang Dapat Saya Perdagangkan di CGSCIMB?

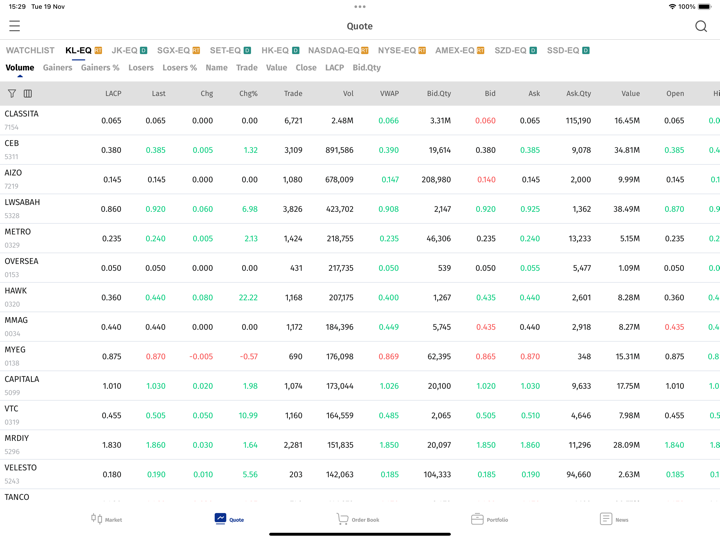

| Instrumen yang Dapat Diperdagangkan | Didukung |

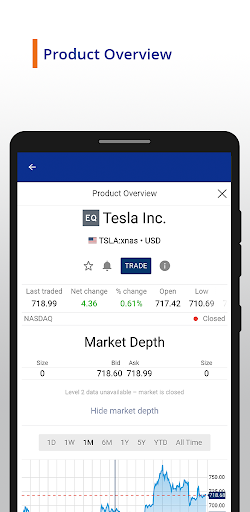

| Forex | ✔ |

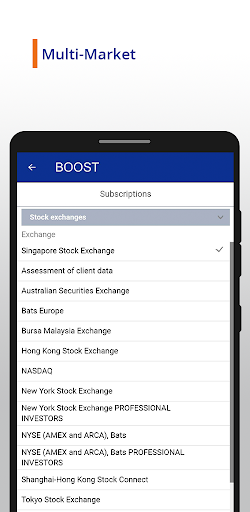

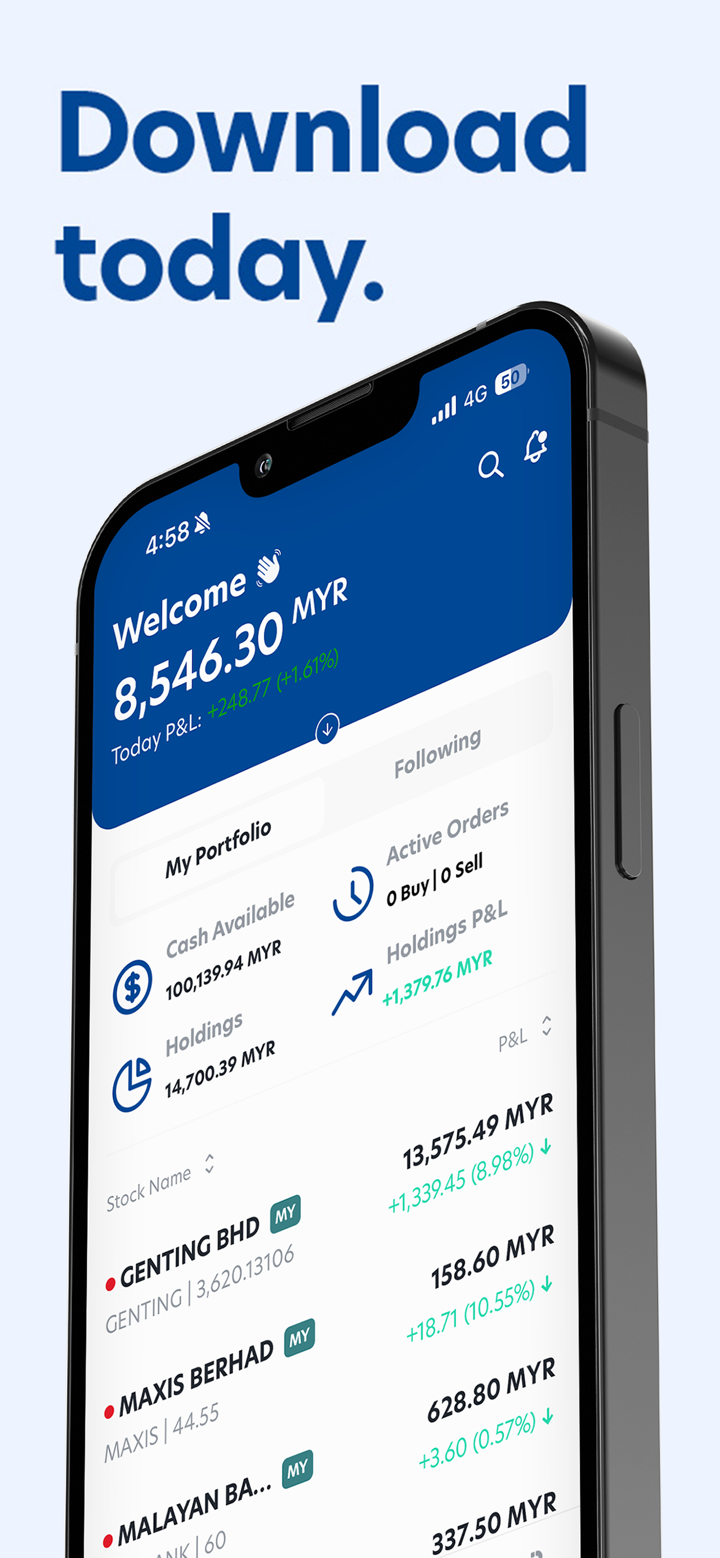

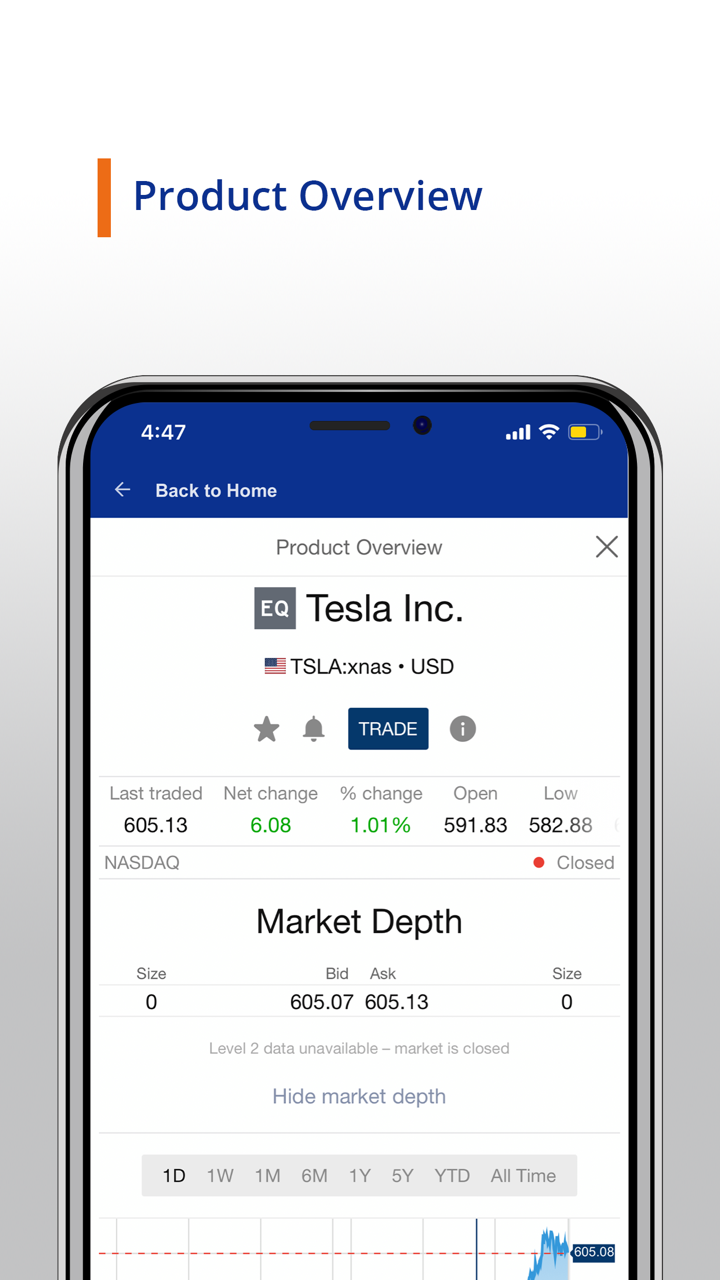

| Saham | ✔ |

| Derivatif | ✔ |

| Reksa Dana | ✔ |

| Obligasi | ✔ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Kriptokurensi | ❌ |

| Opsi | ❌ |

| ETF | ❌ |

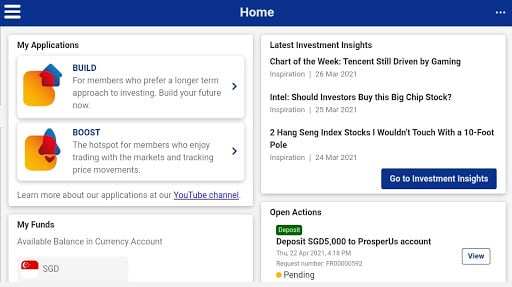

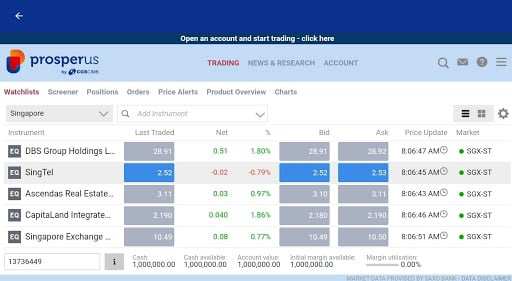

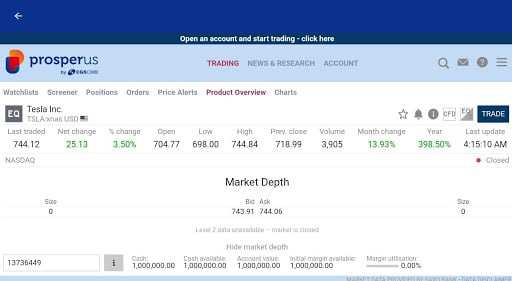

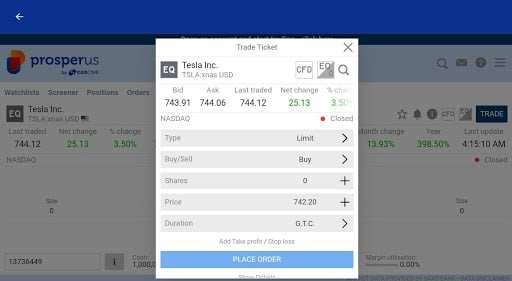

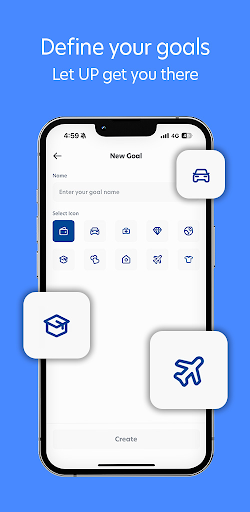

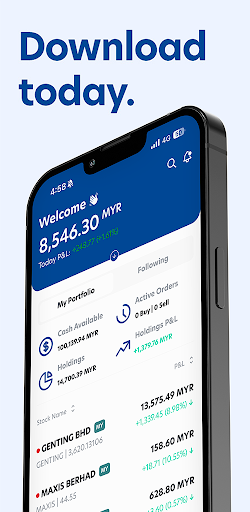

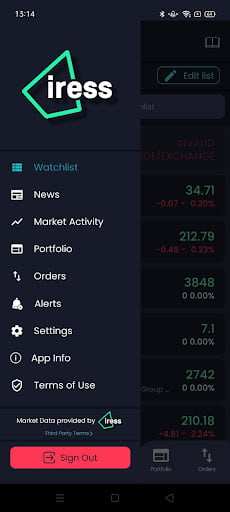

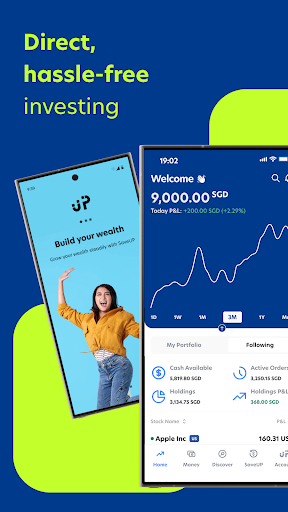

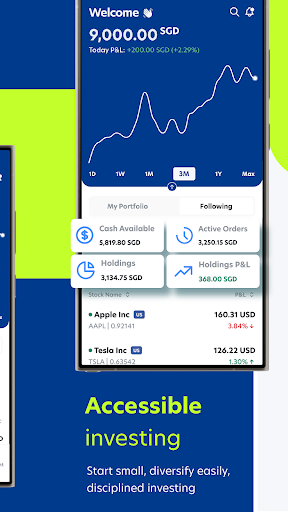

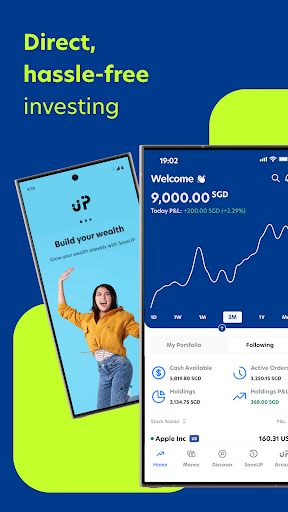

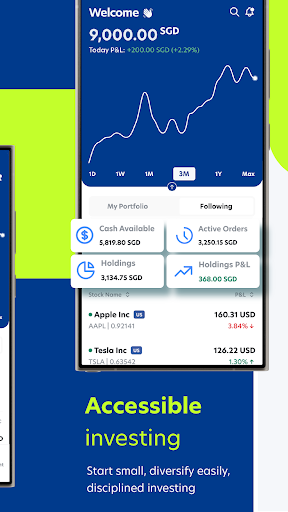

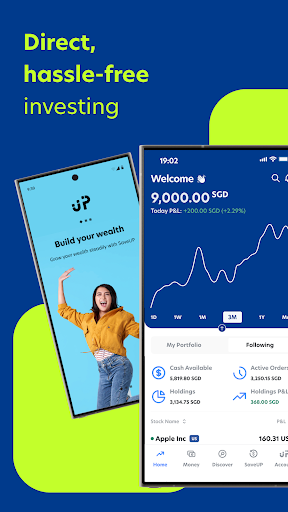

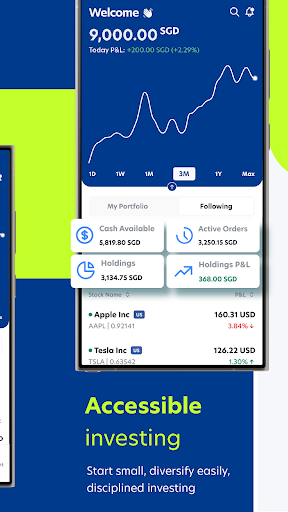

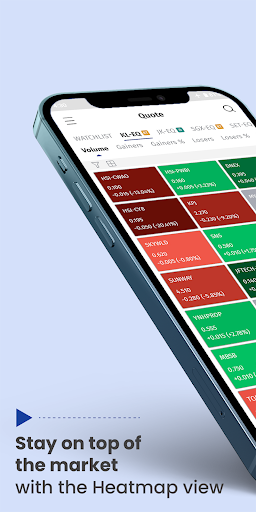

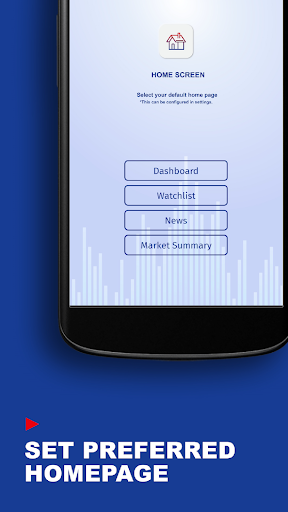

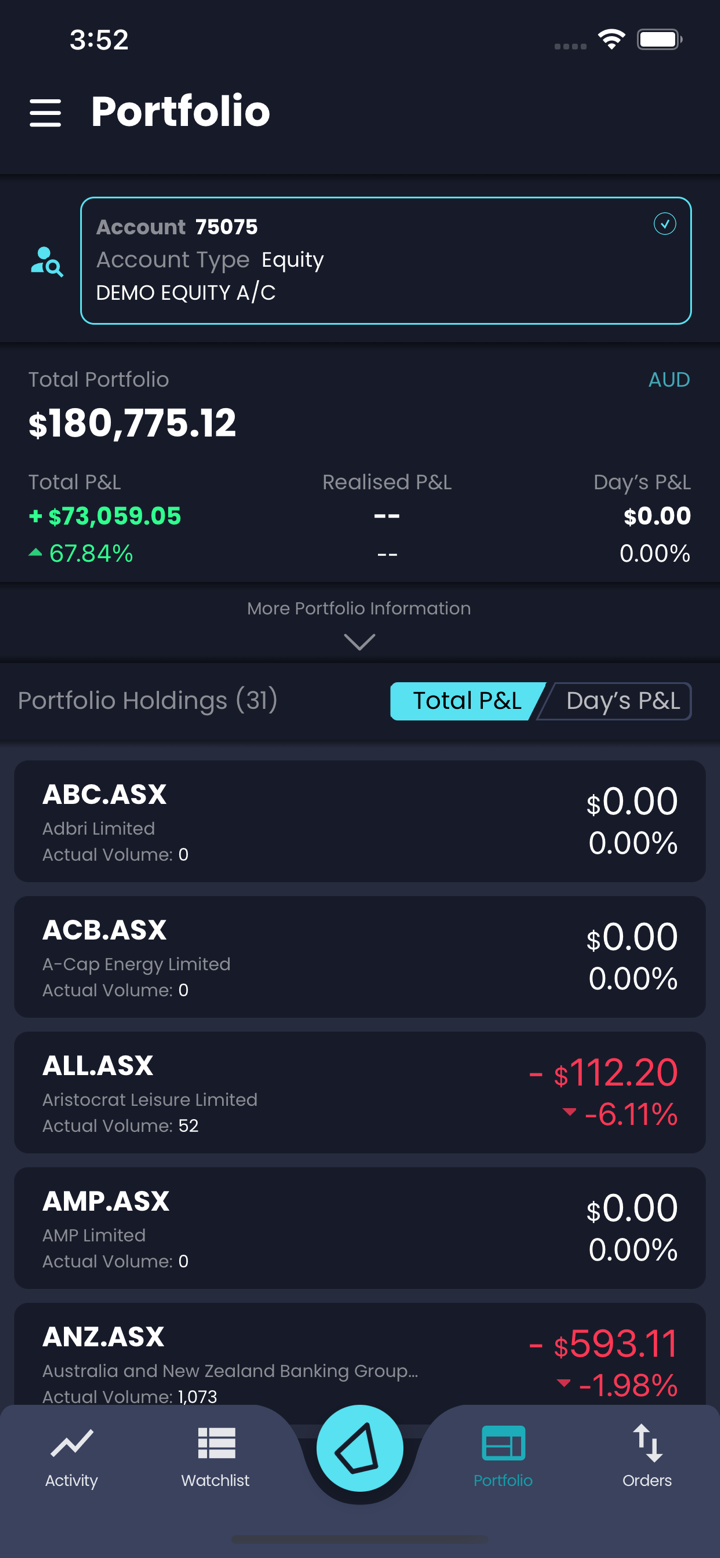

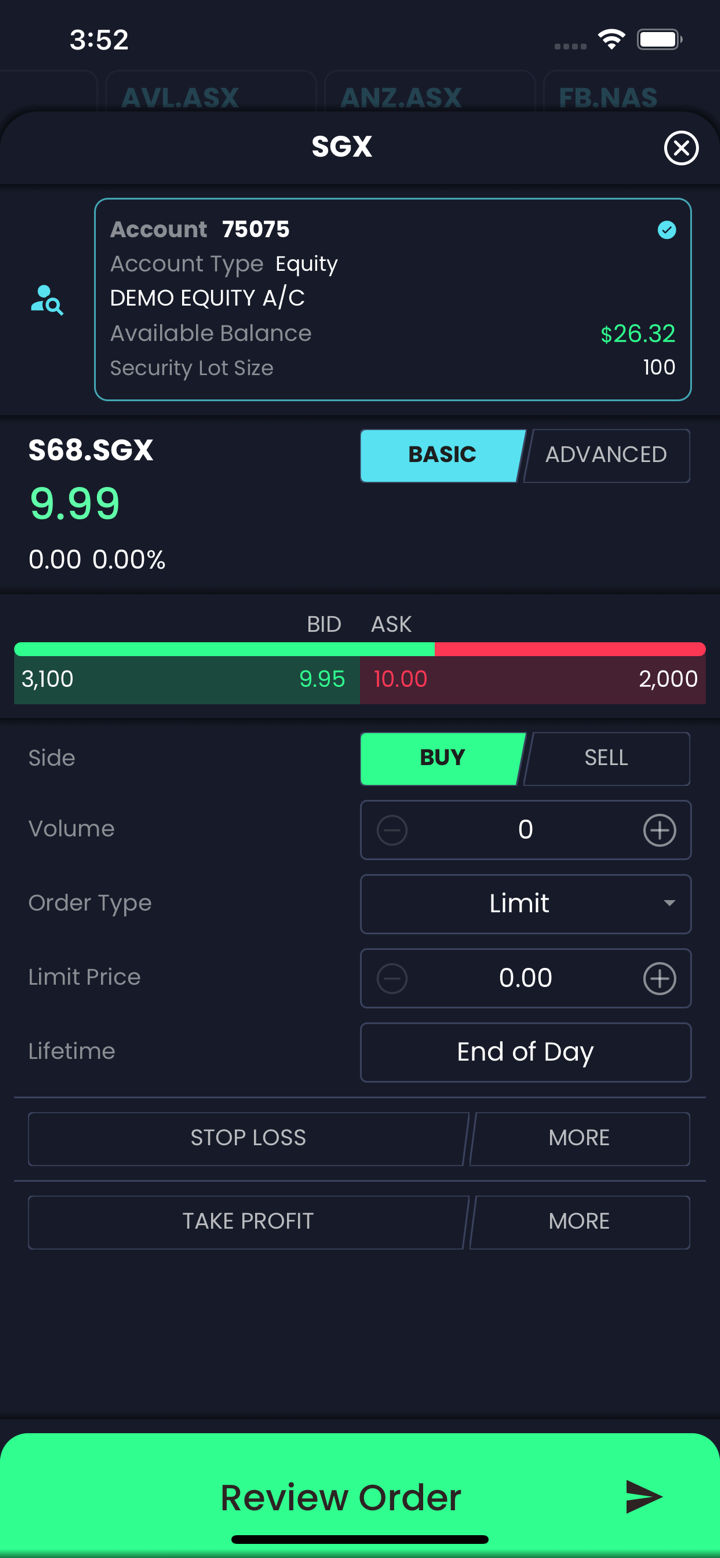

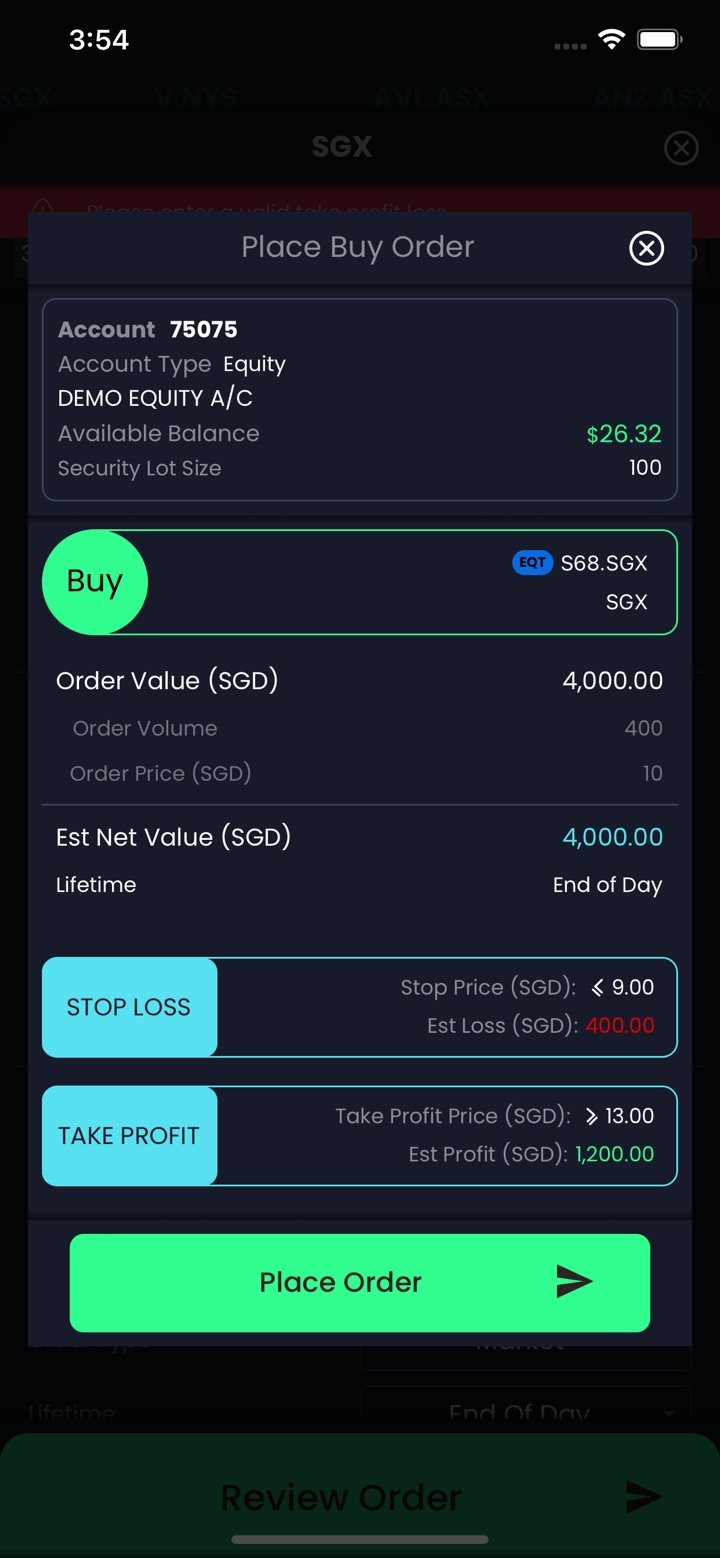

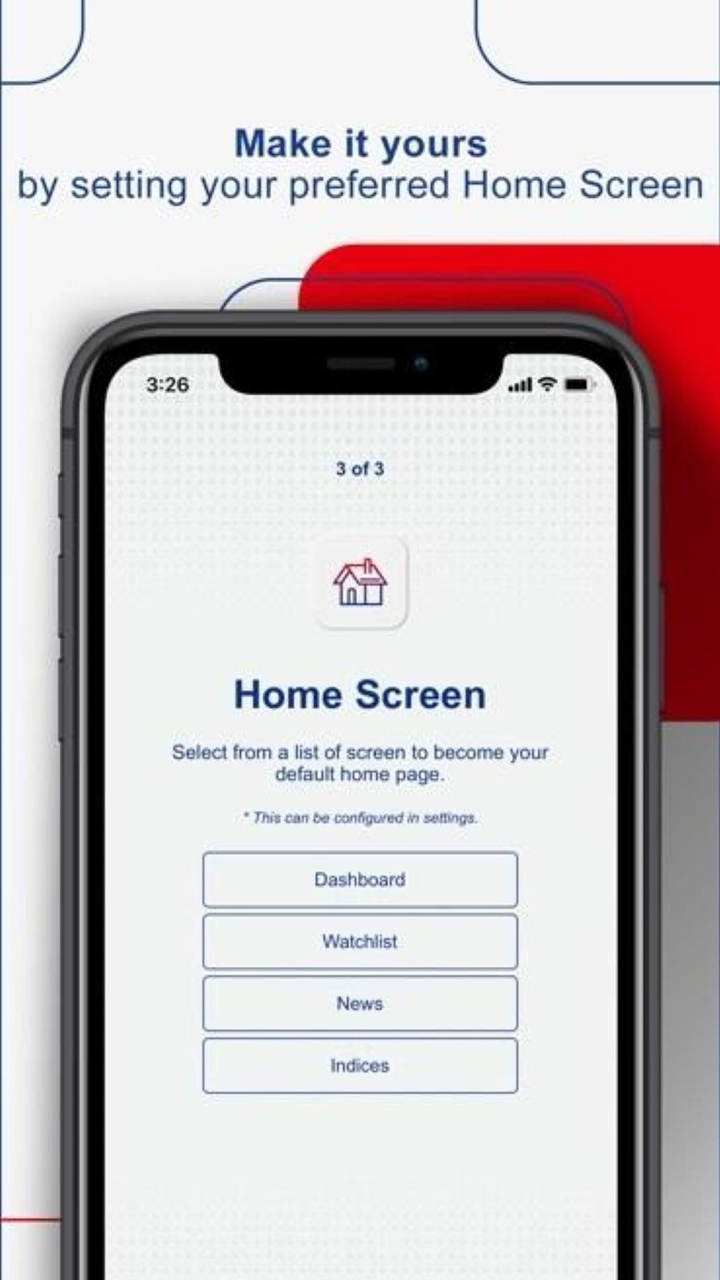

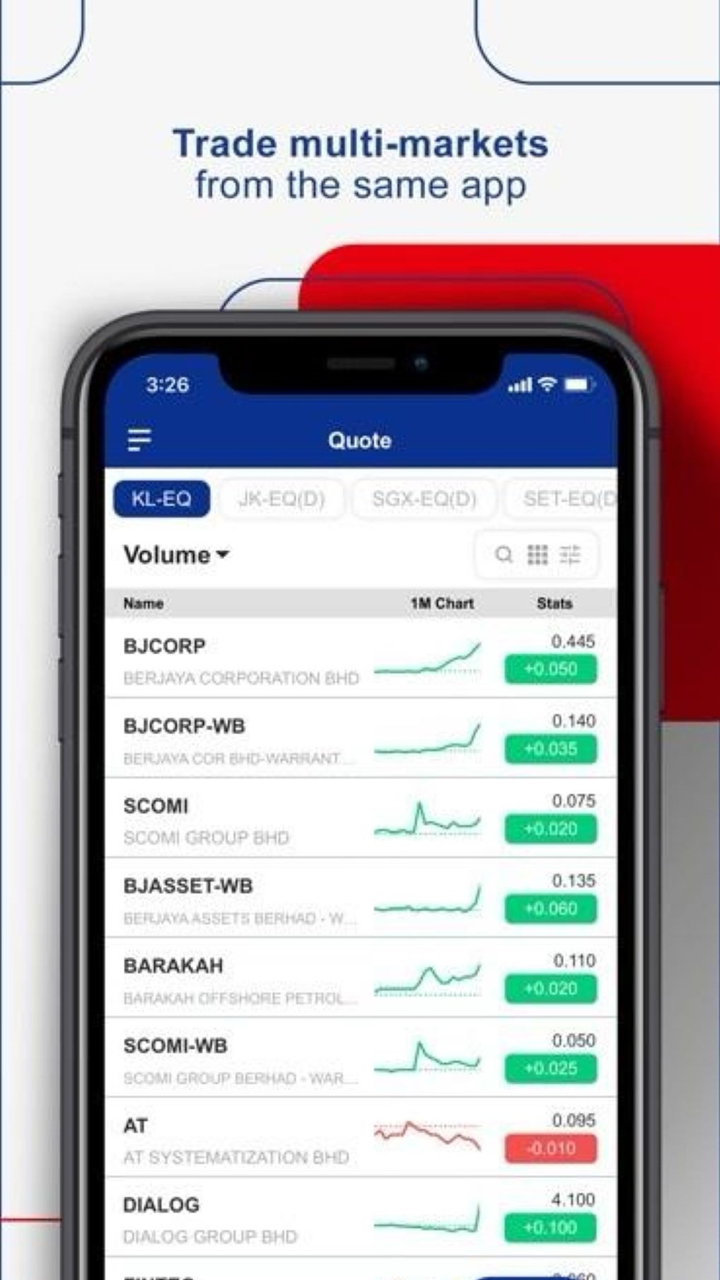

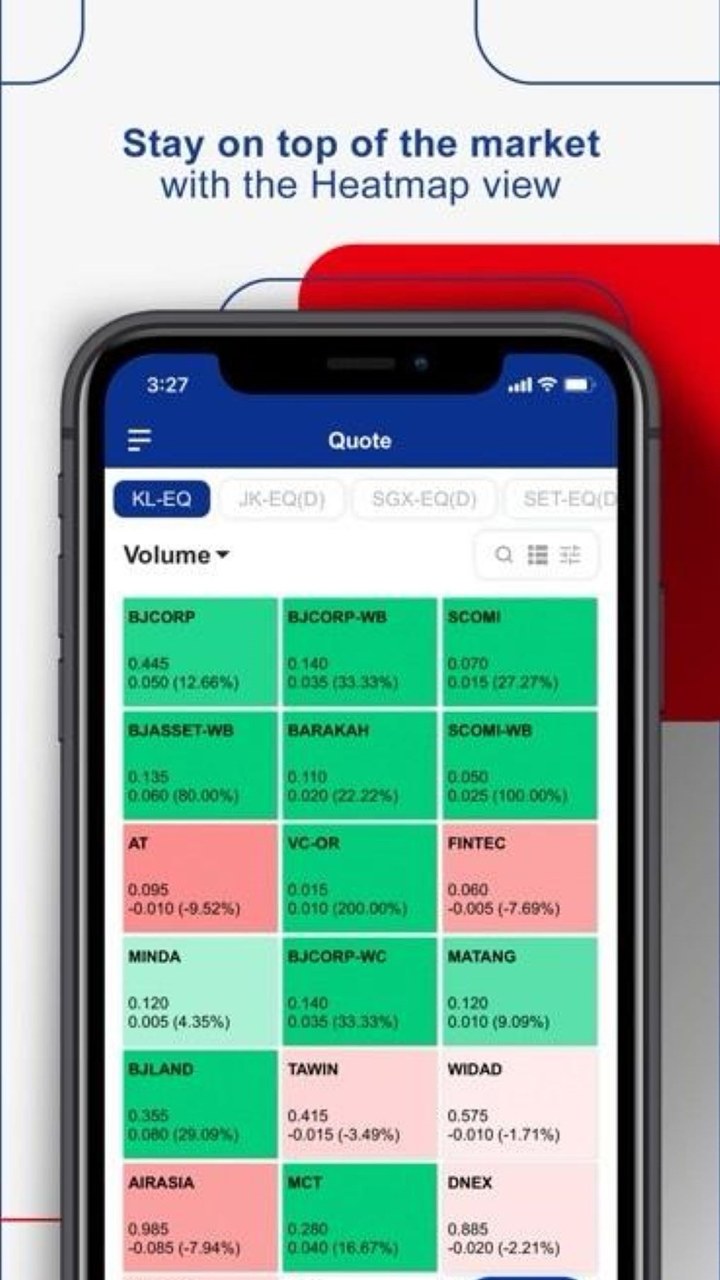

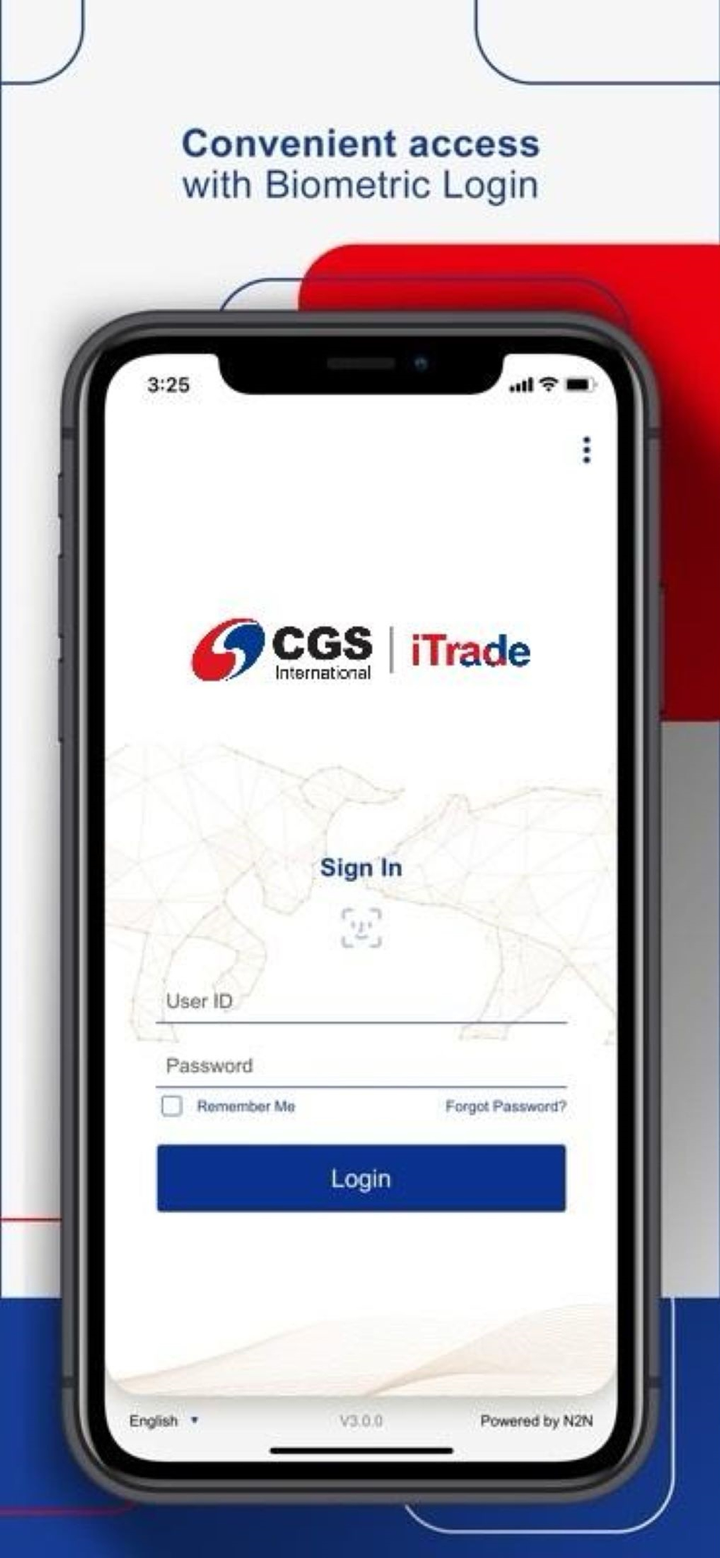

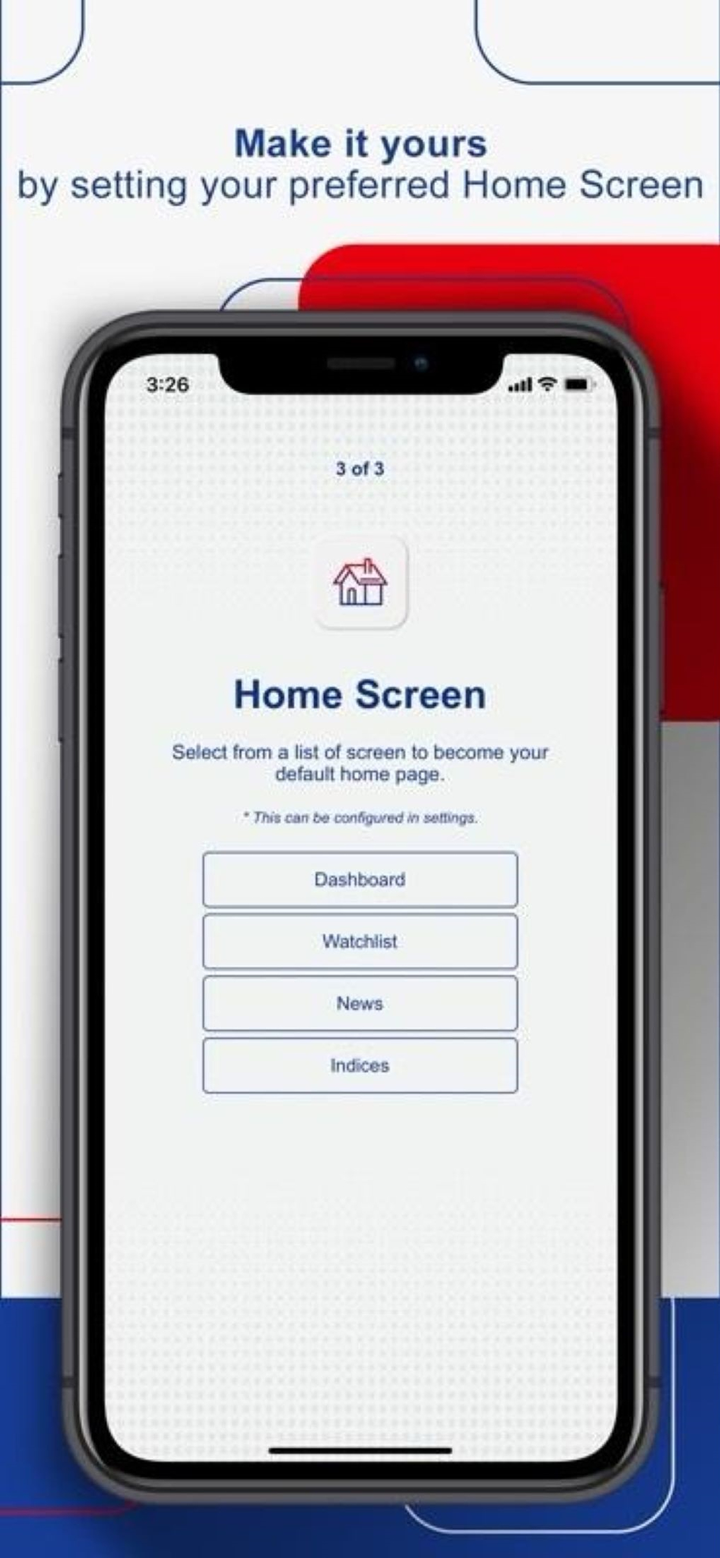

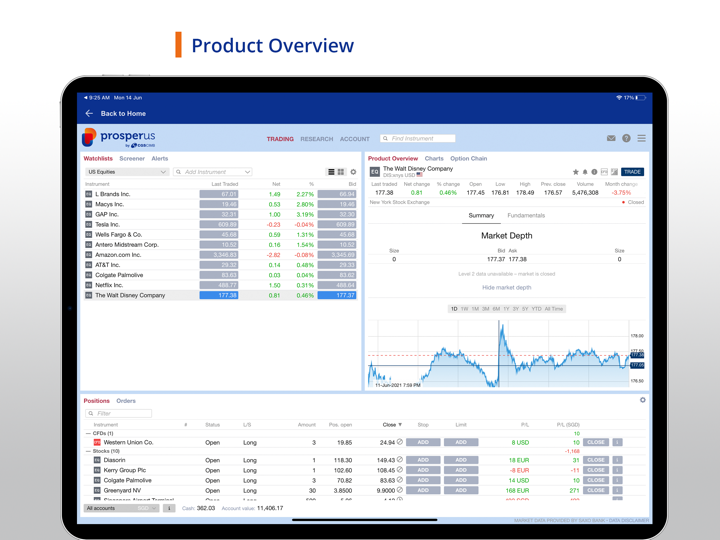

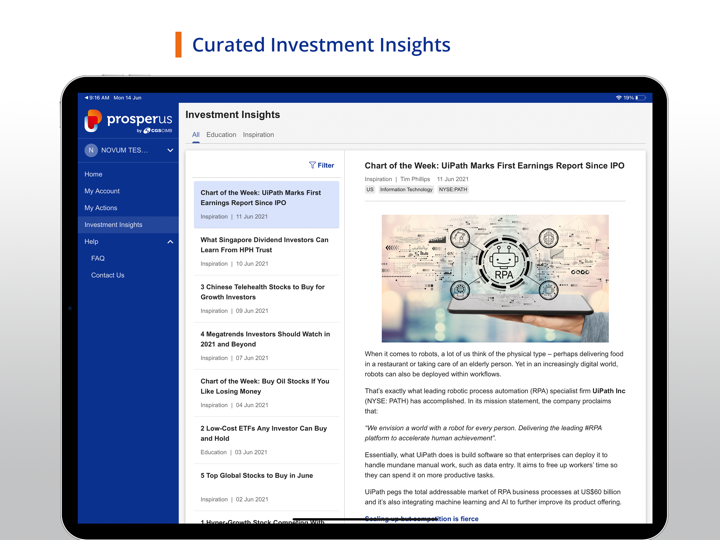

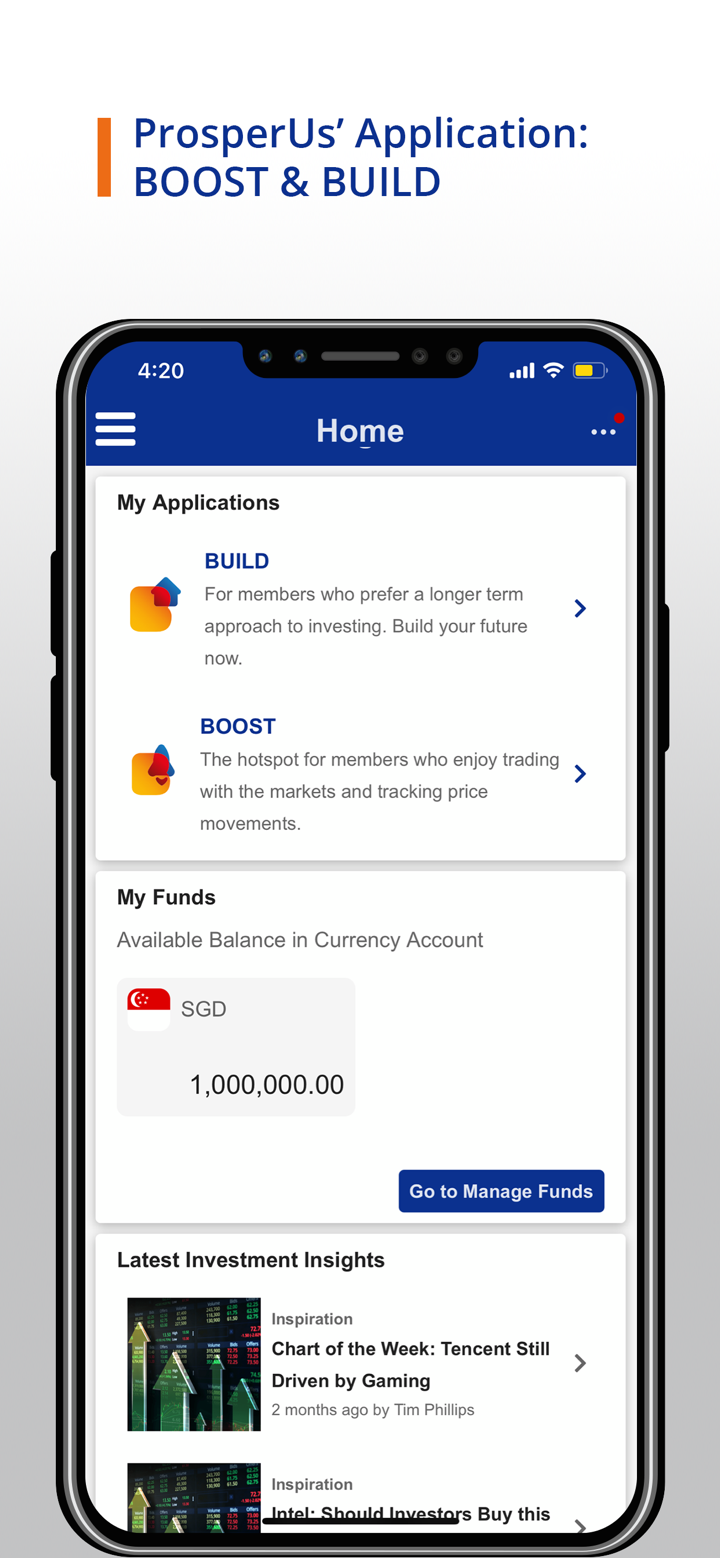

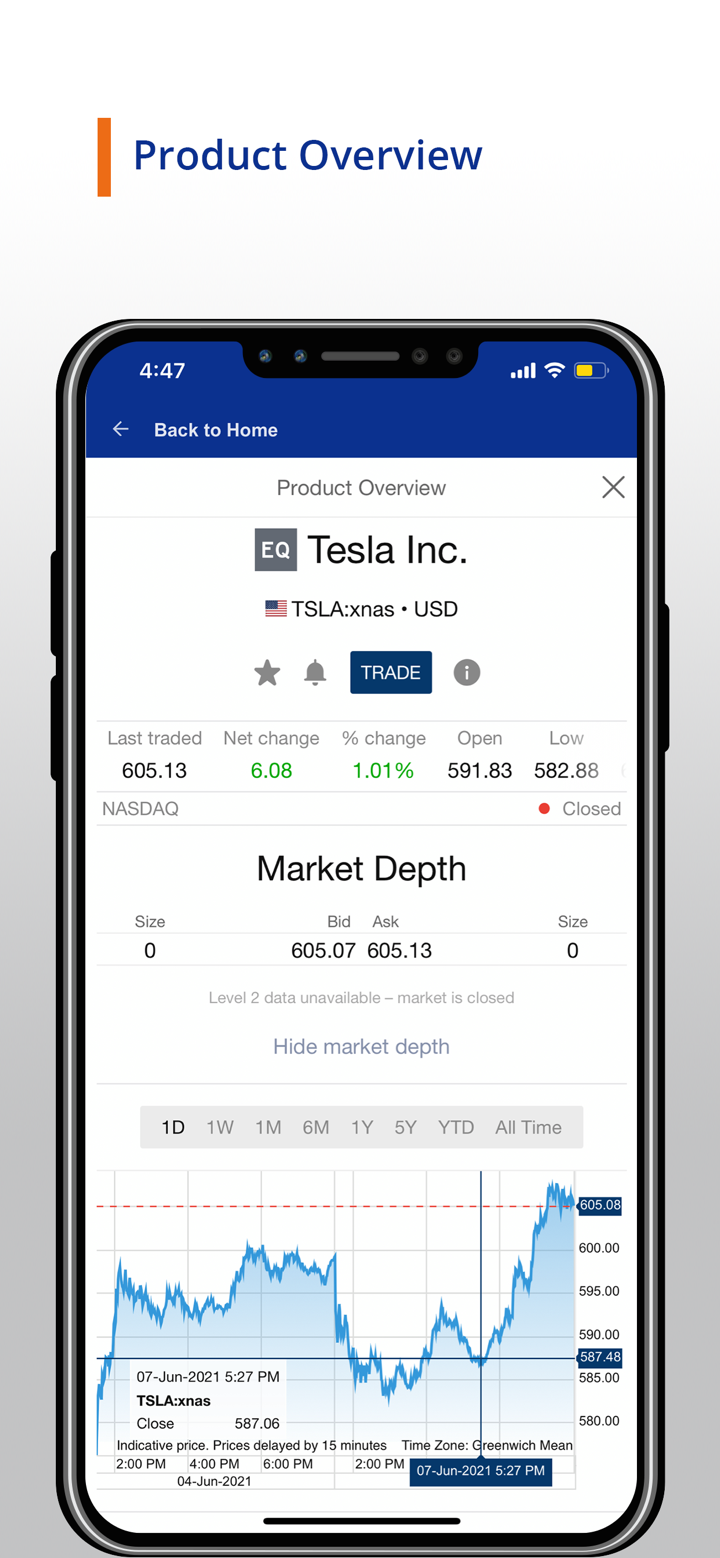

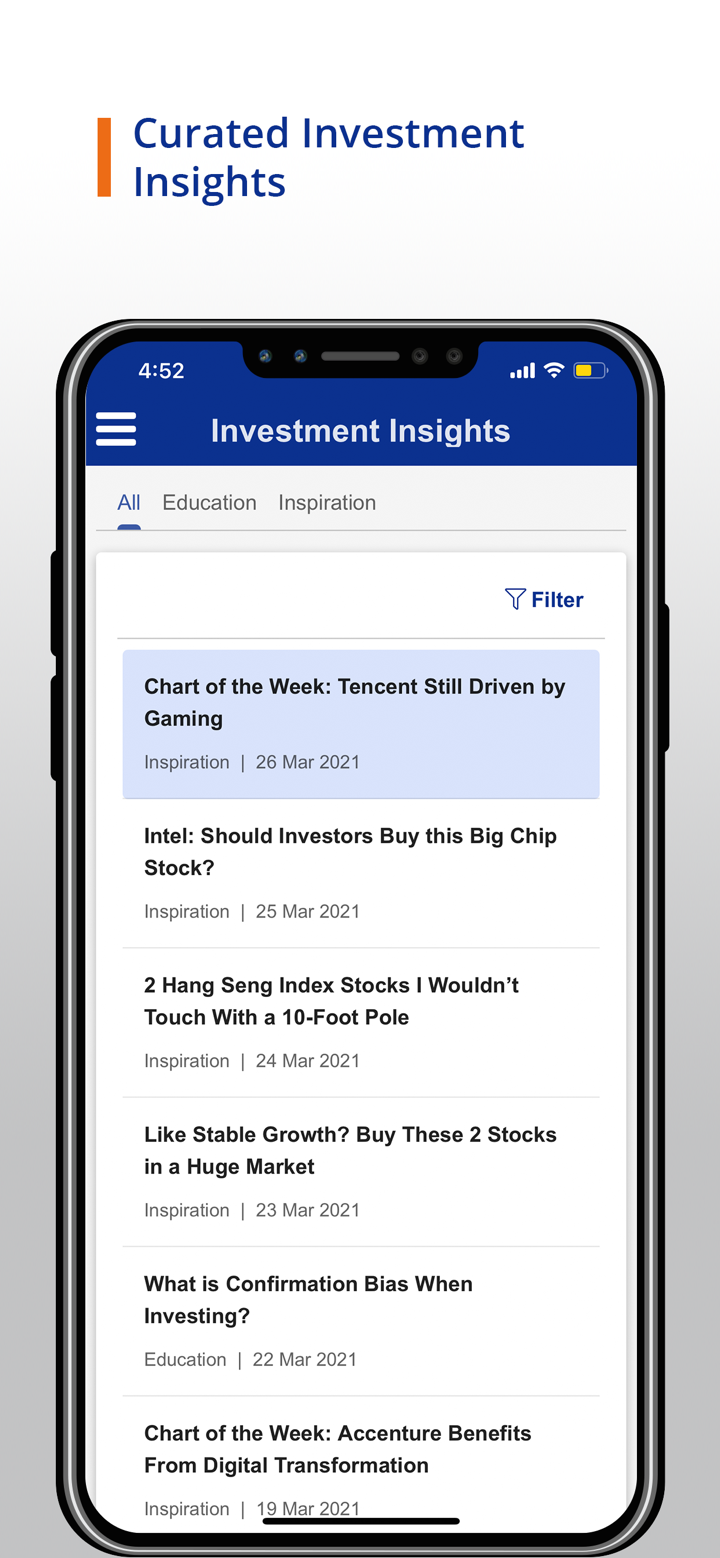

Platform Perdagangan

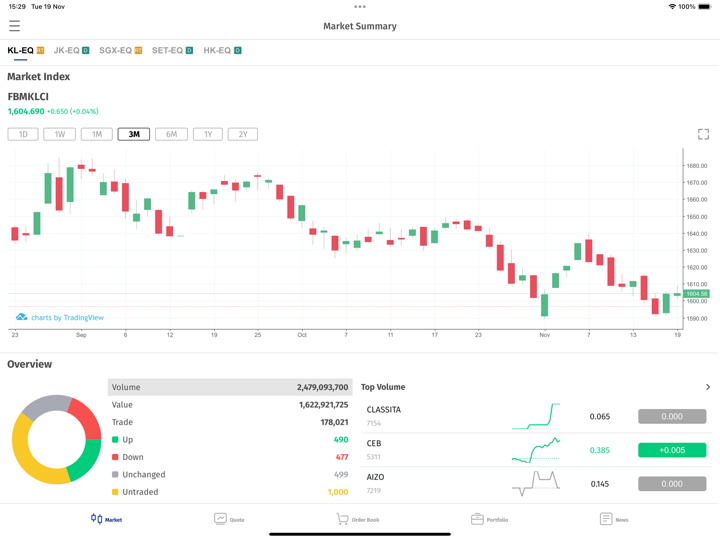

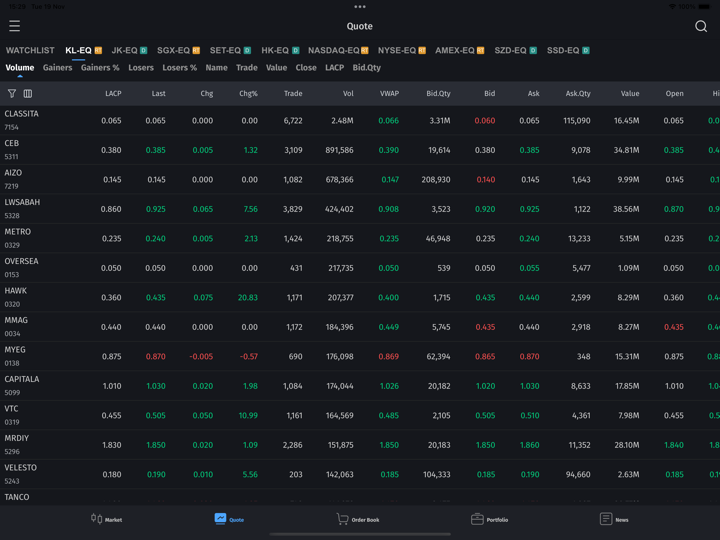

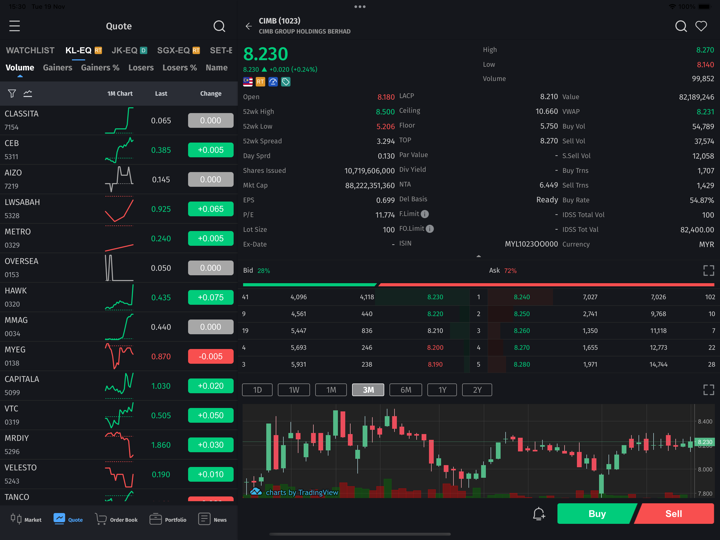

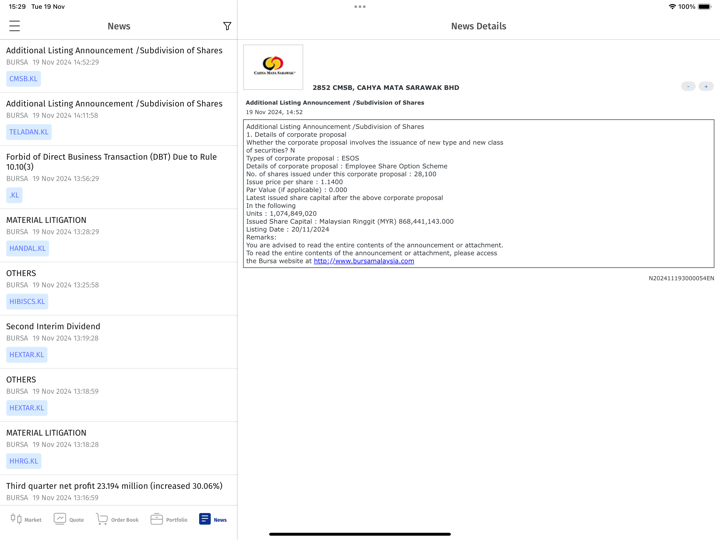

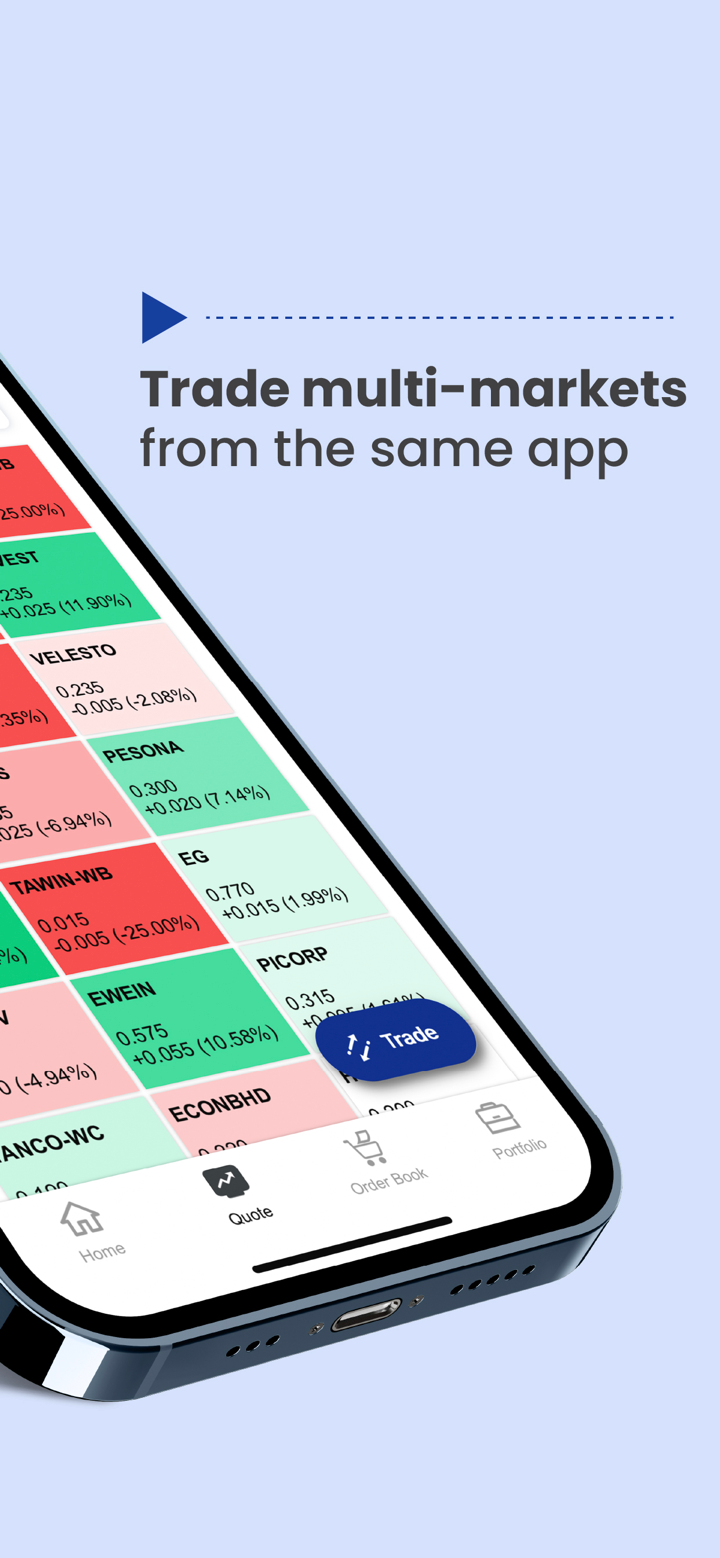

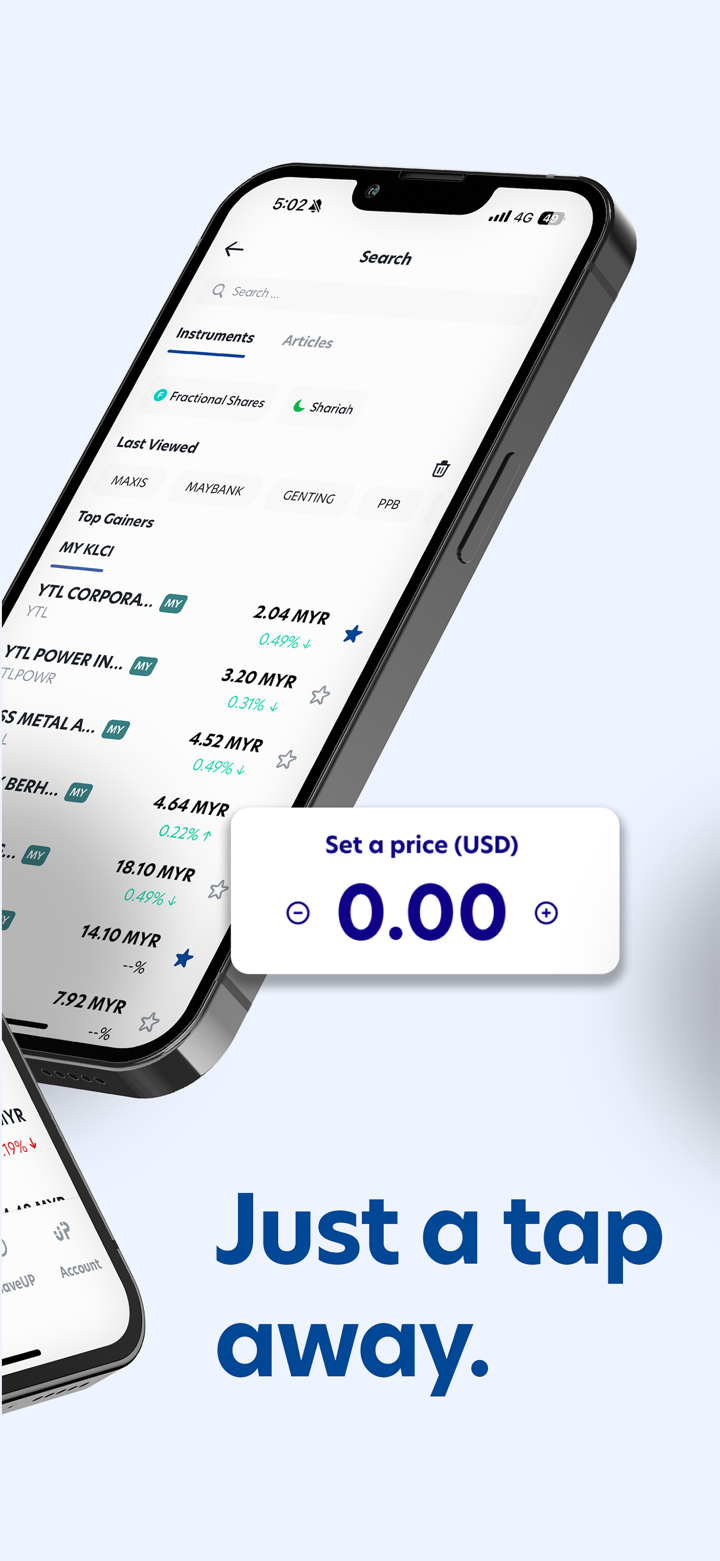

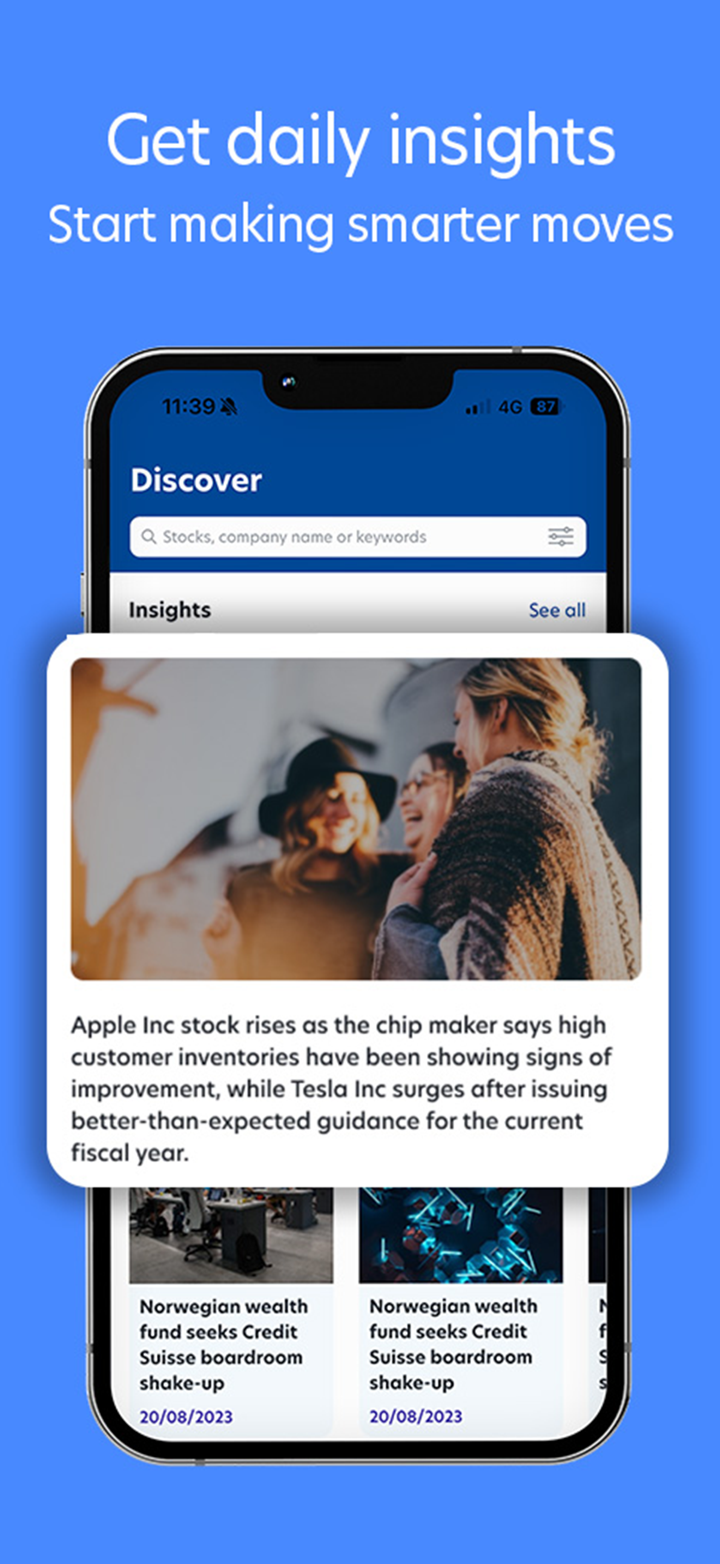

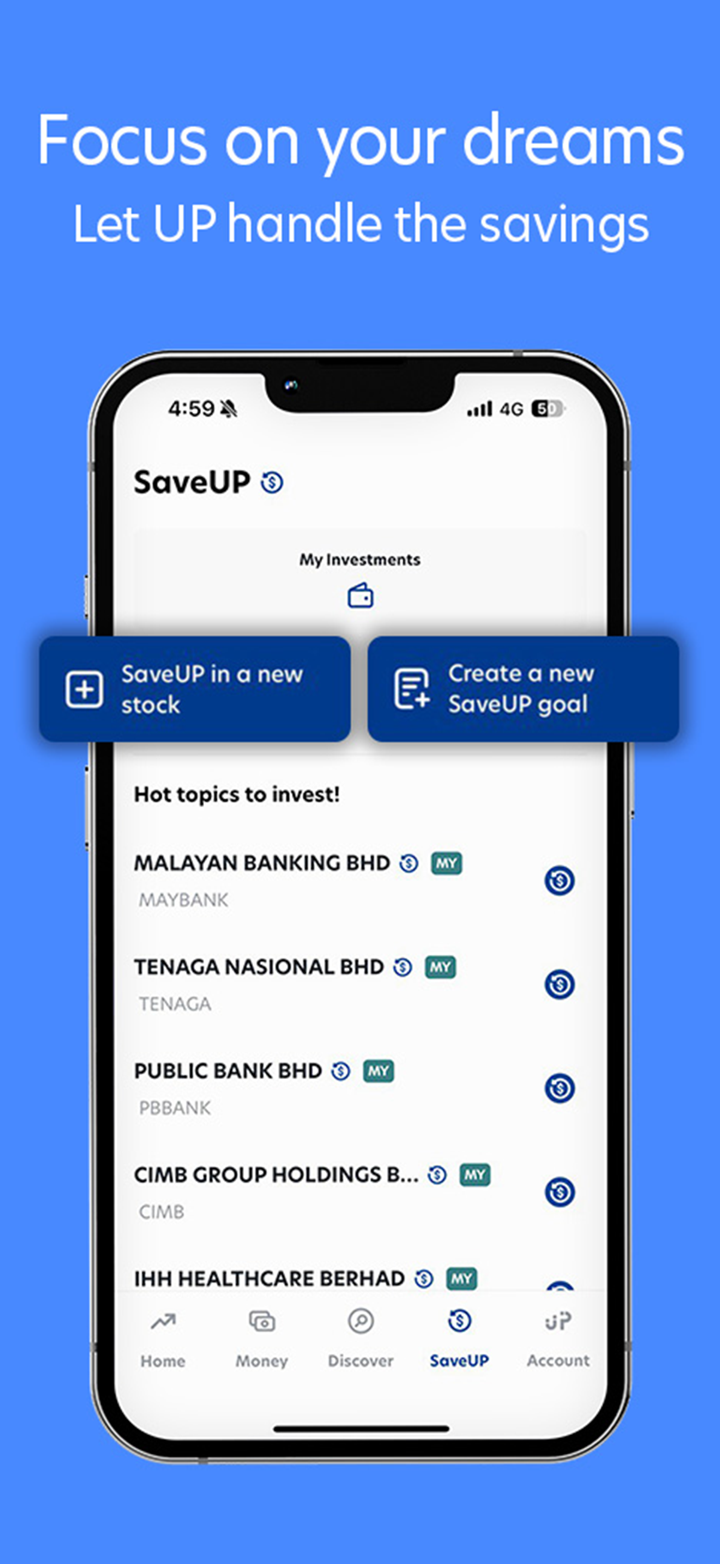

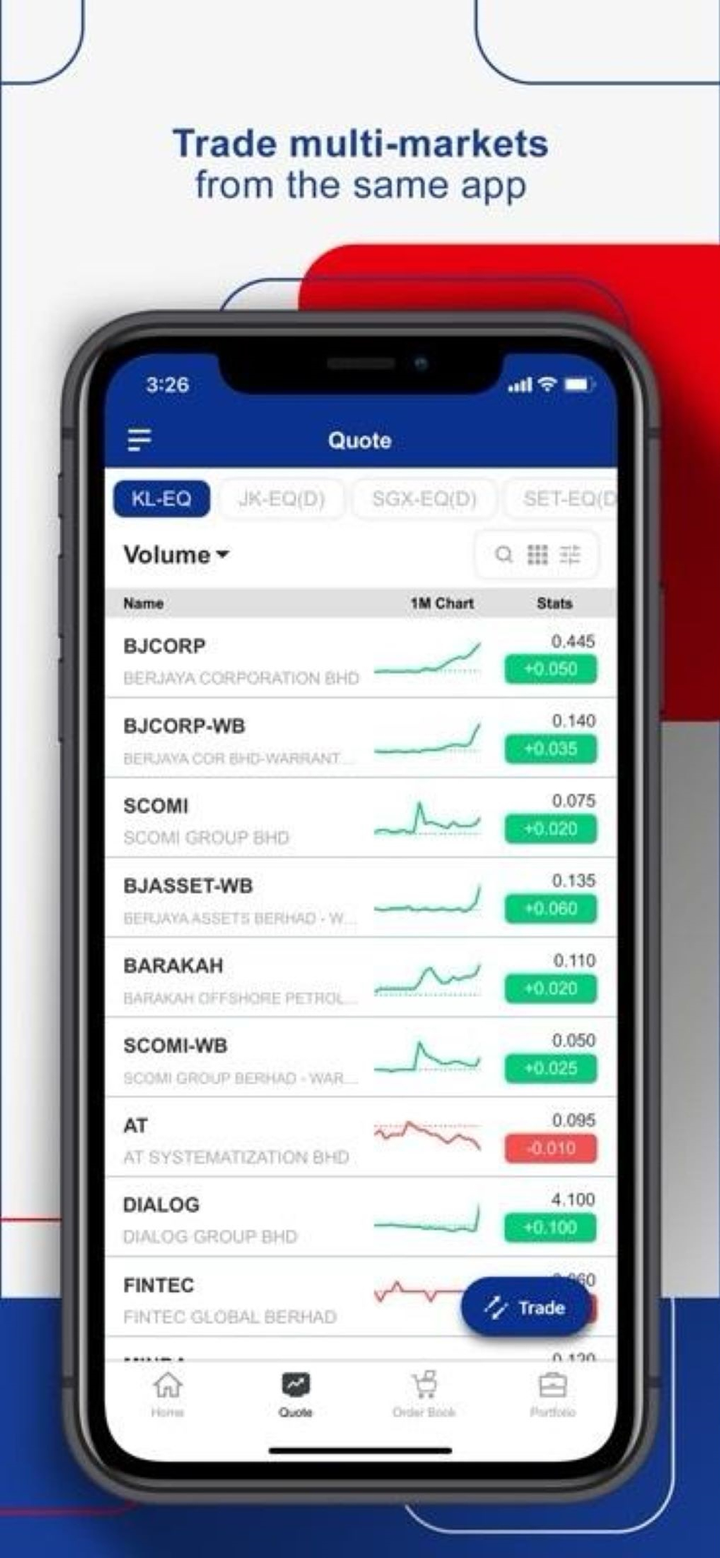

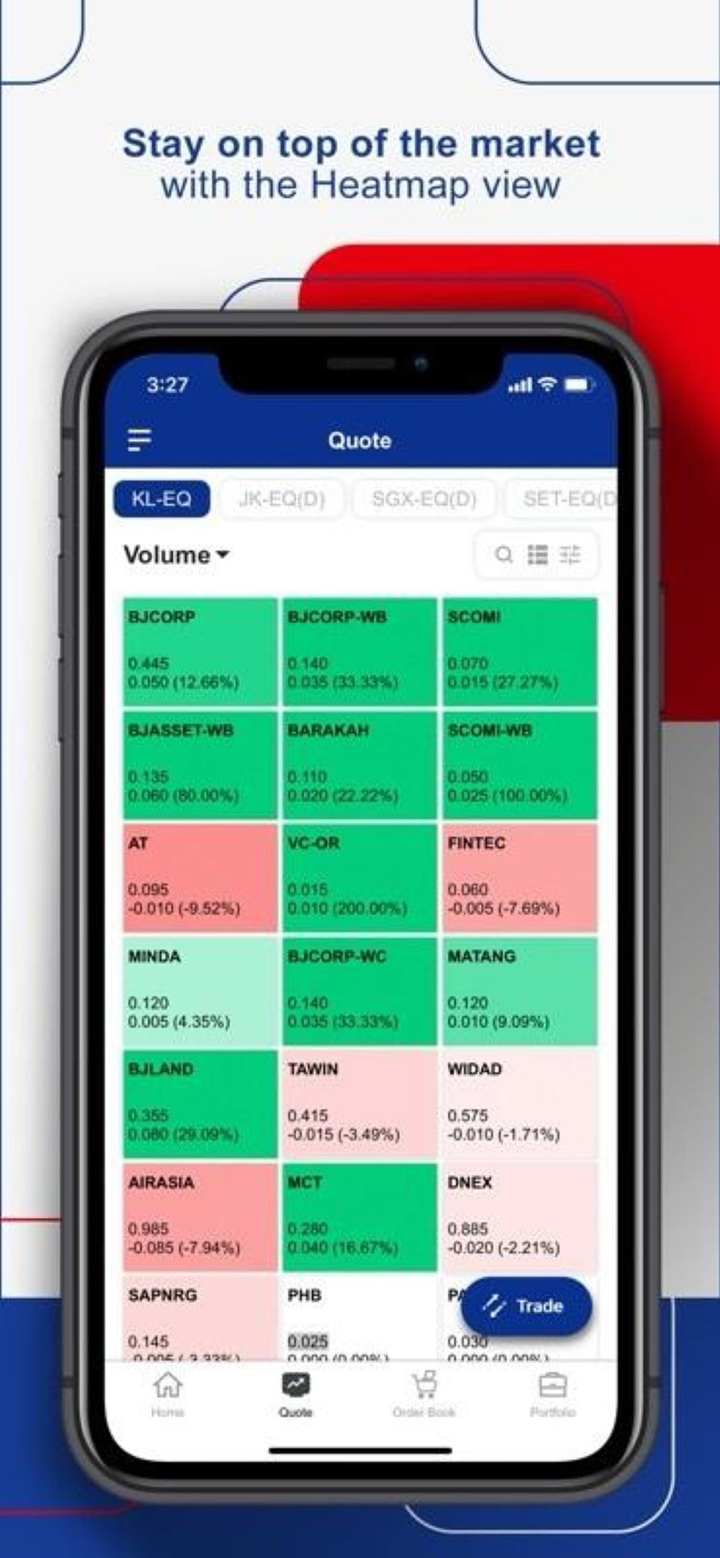

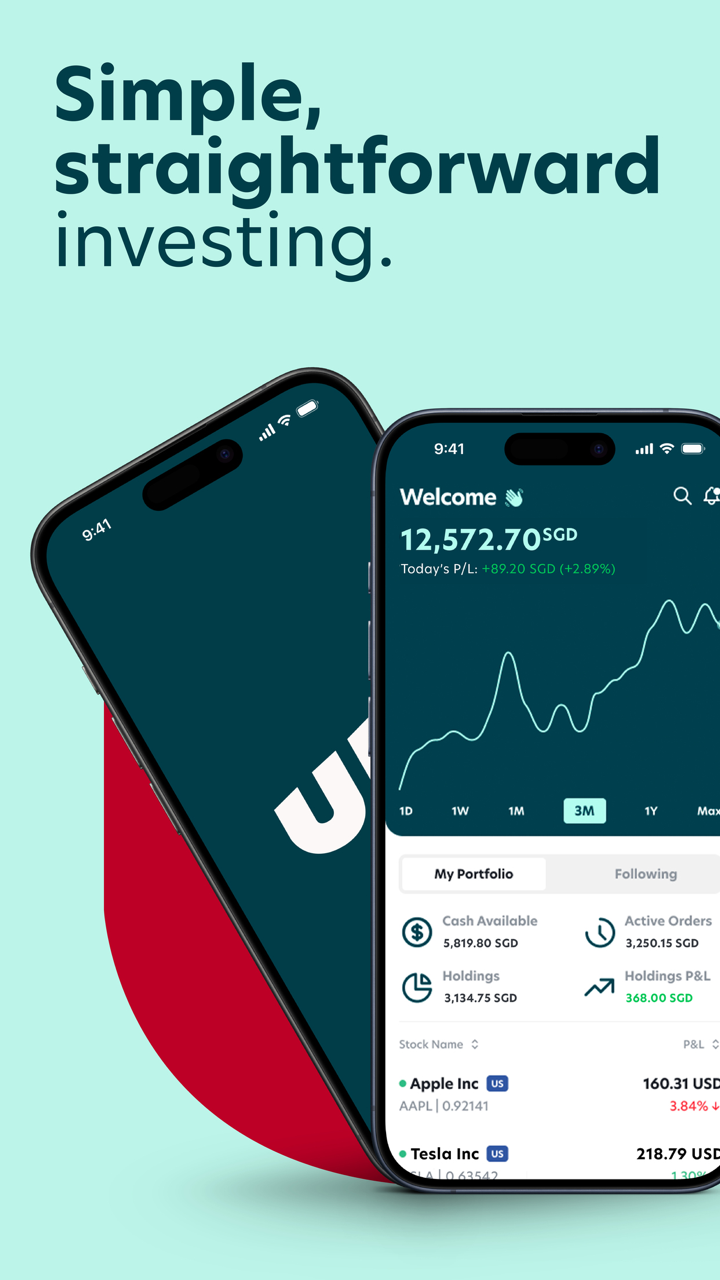

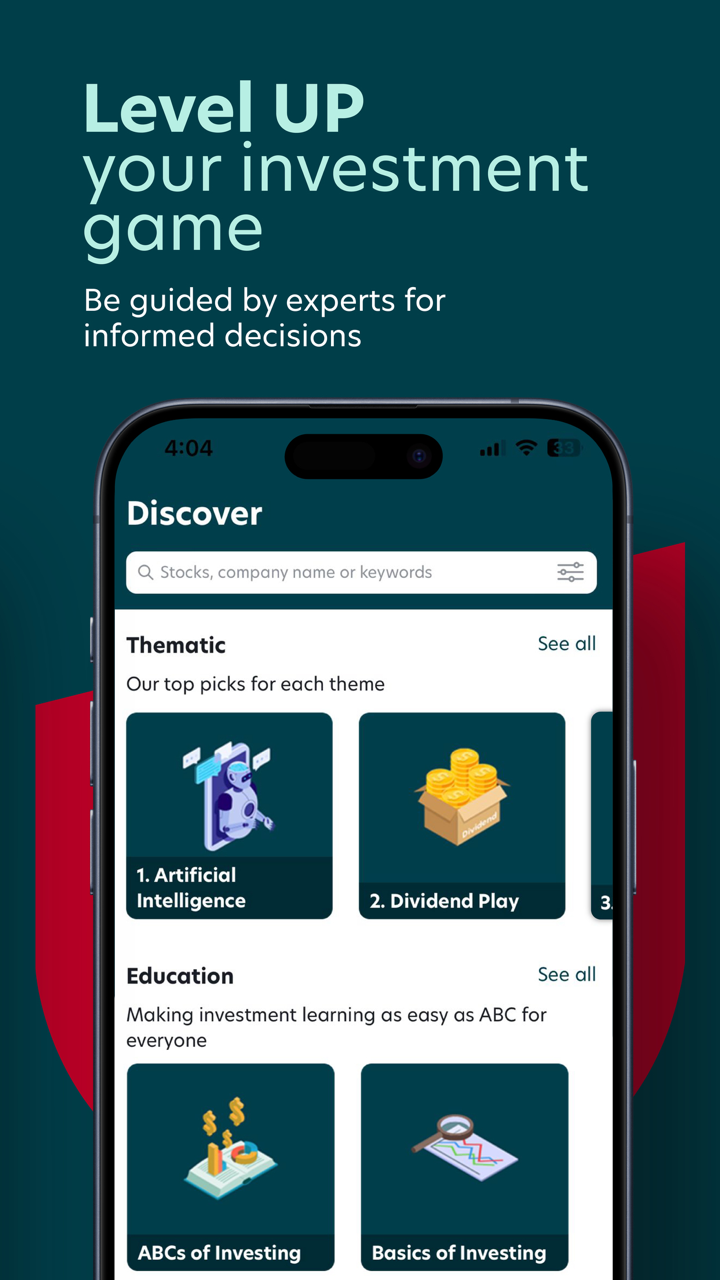

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

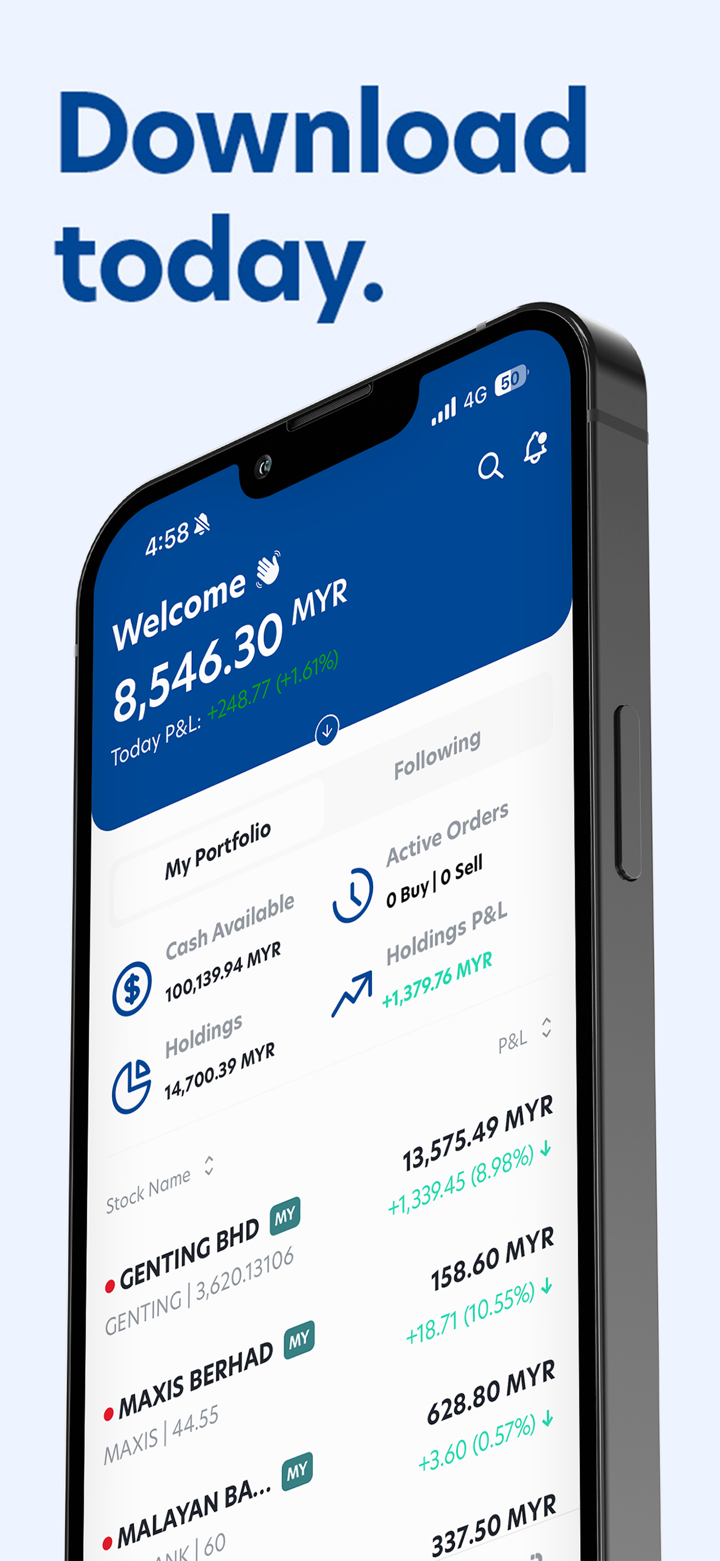

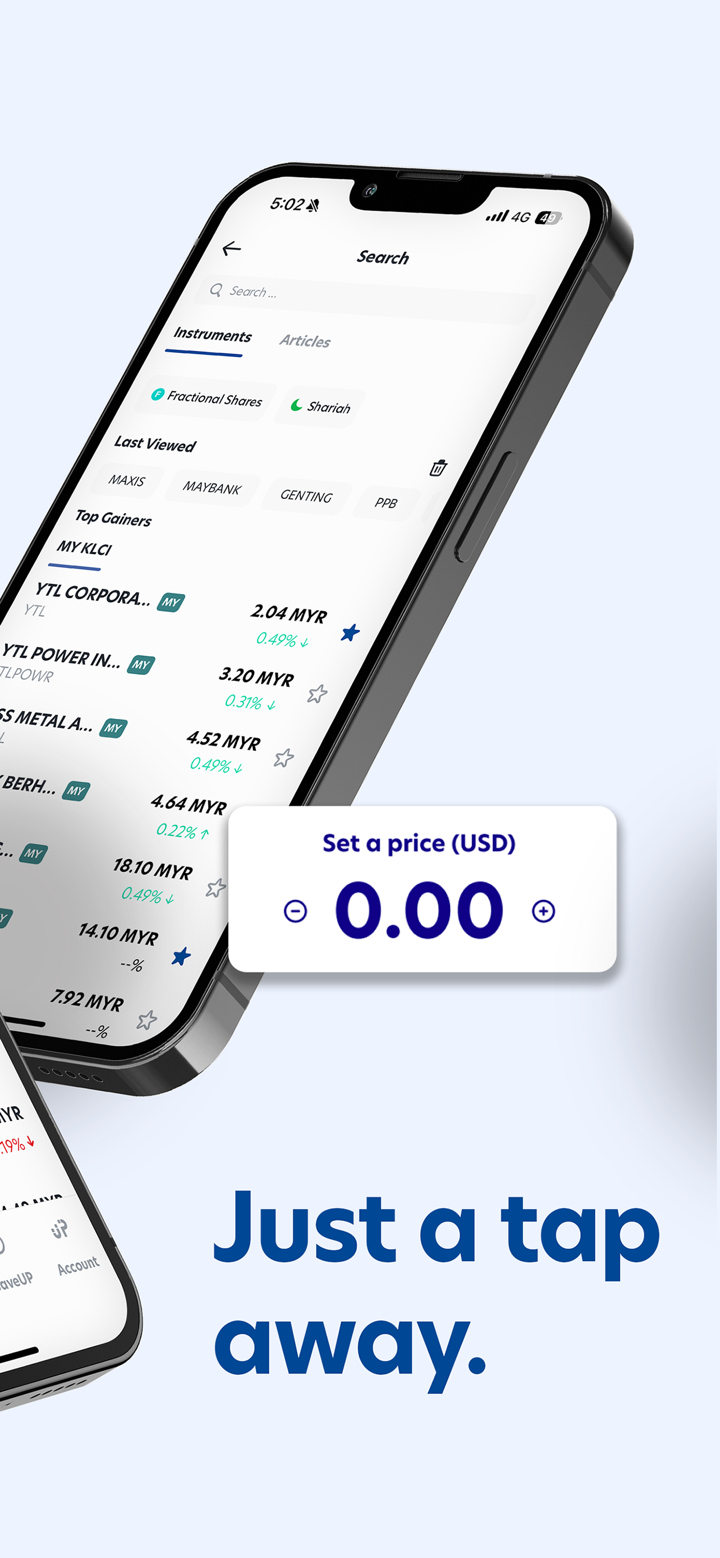

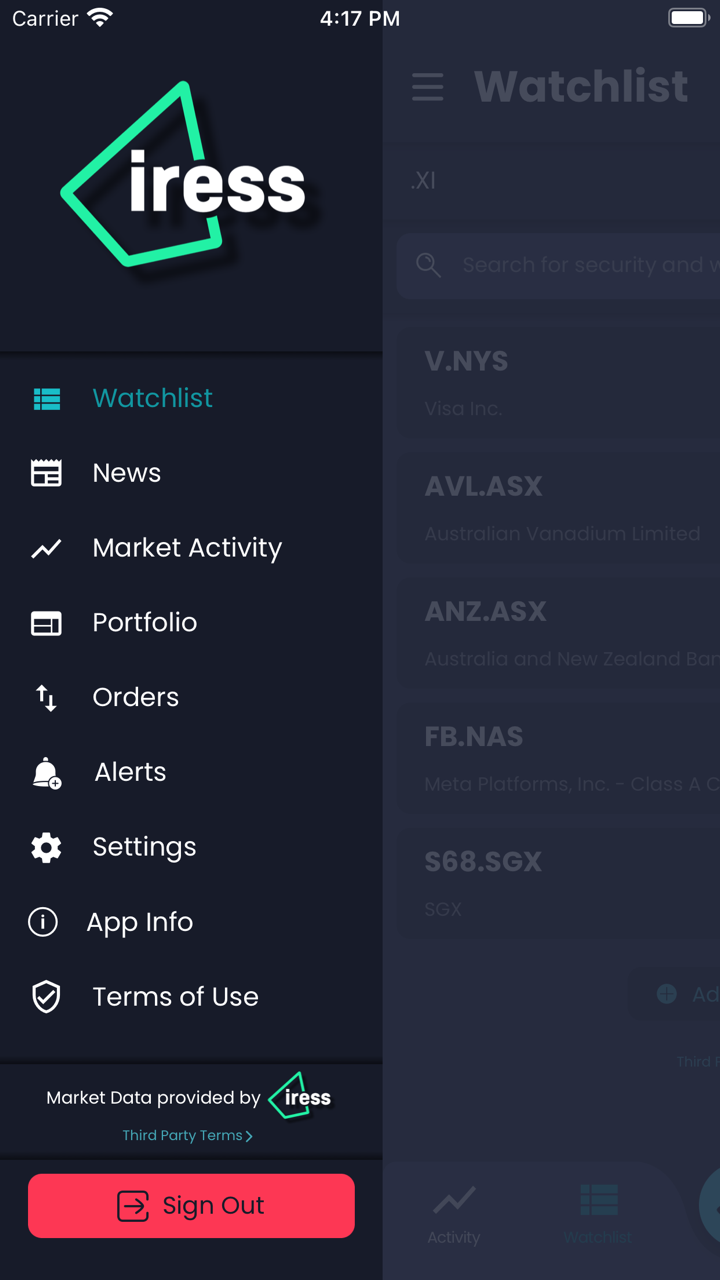

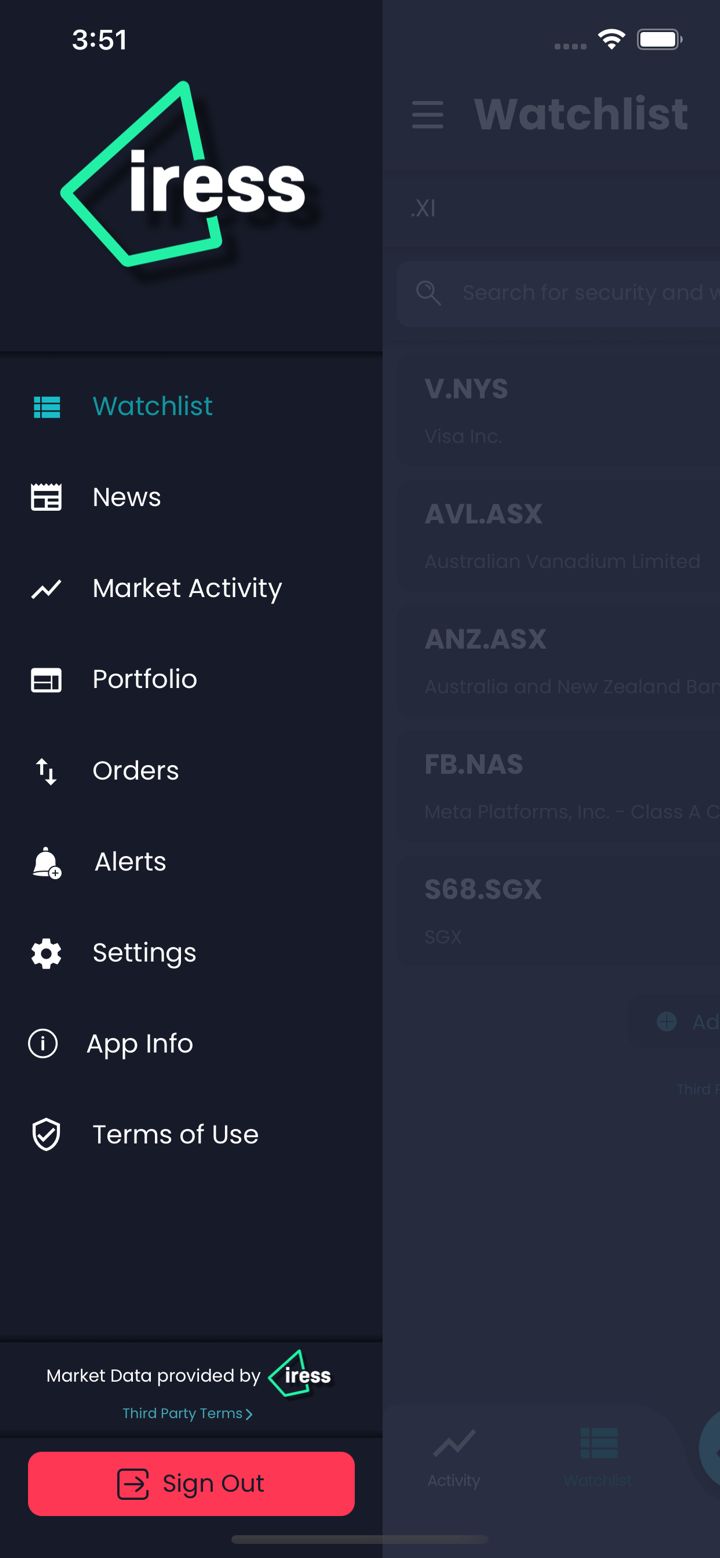

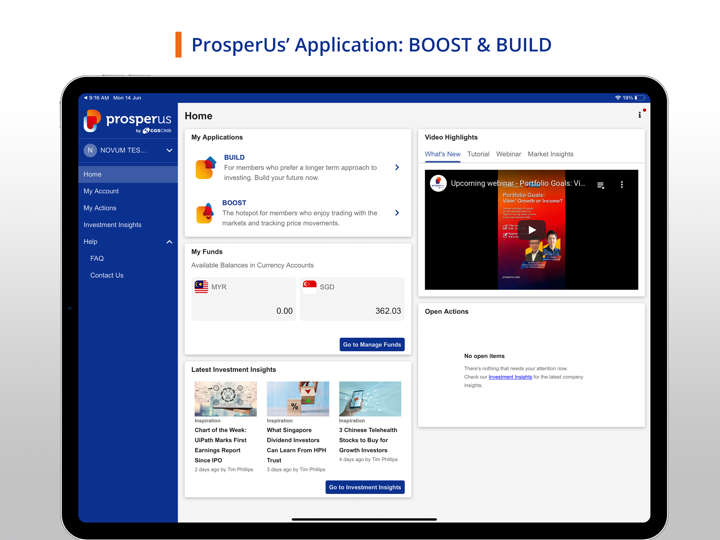

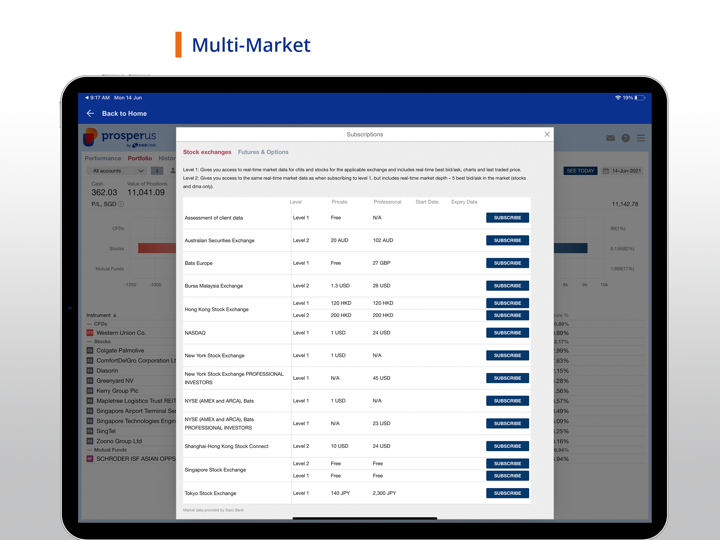

| WebTrader | ✔ | Browser Web, MacOS, Windows | / |

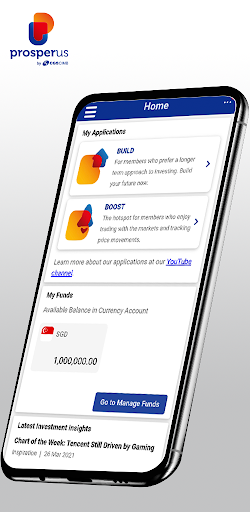

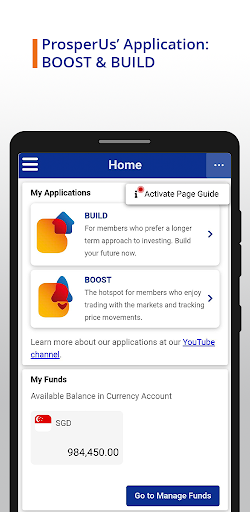

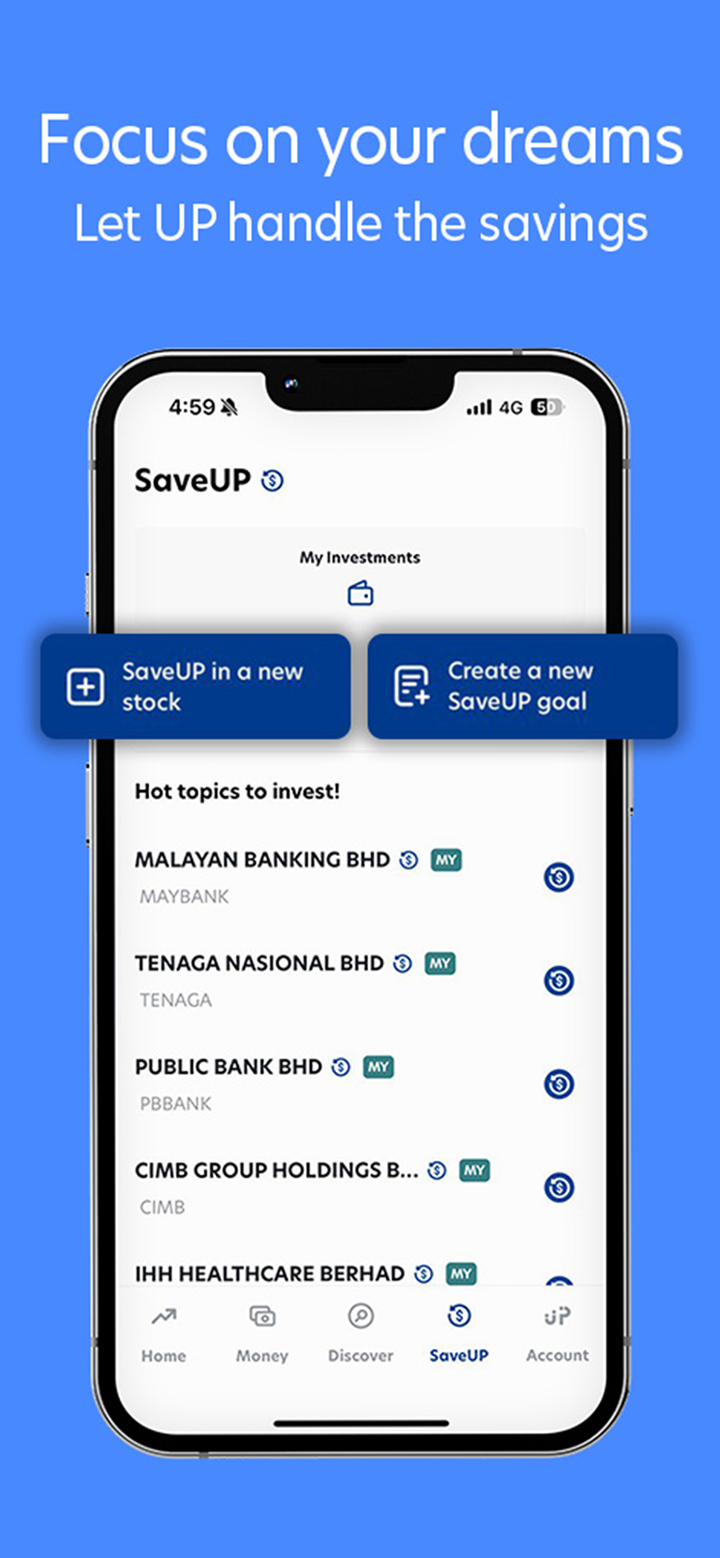

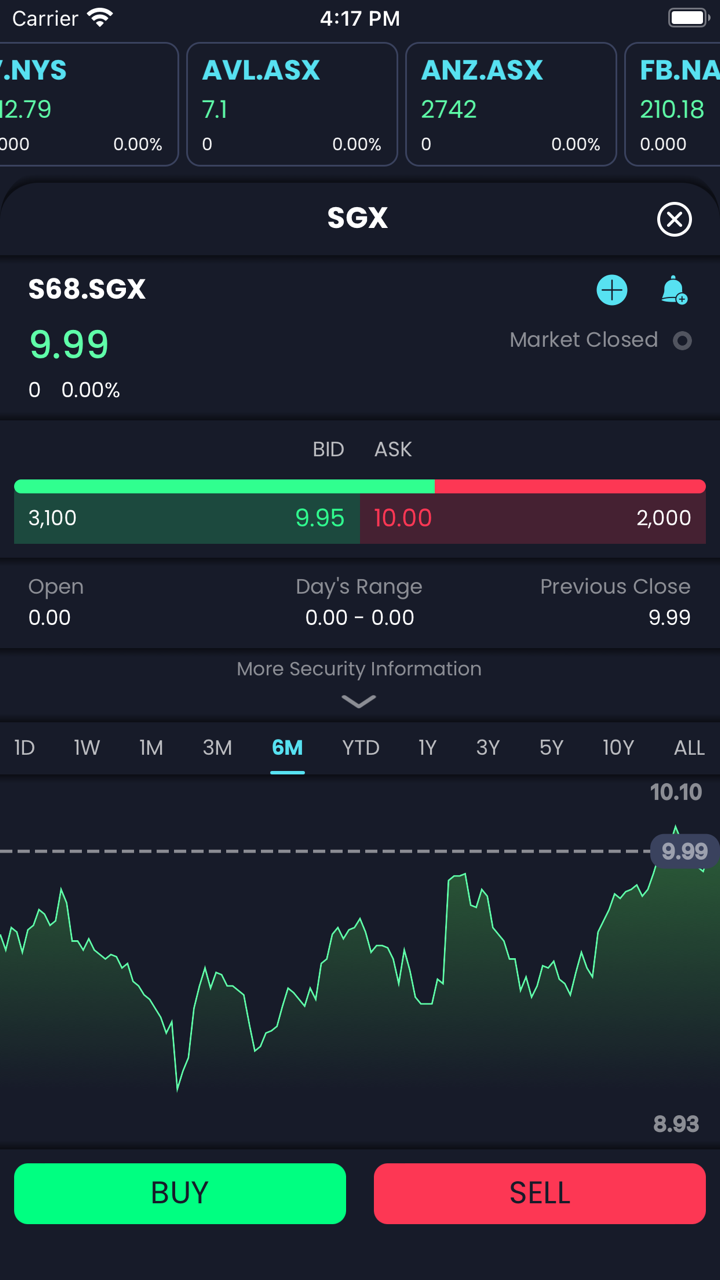

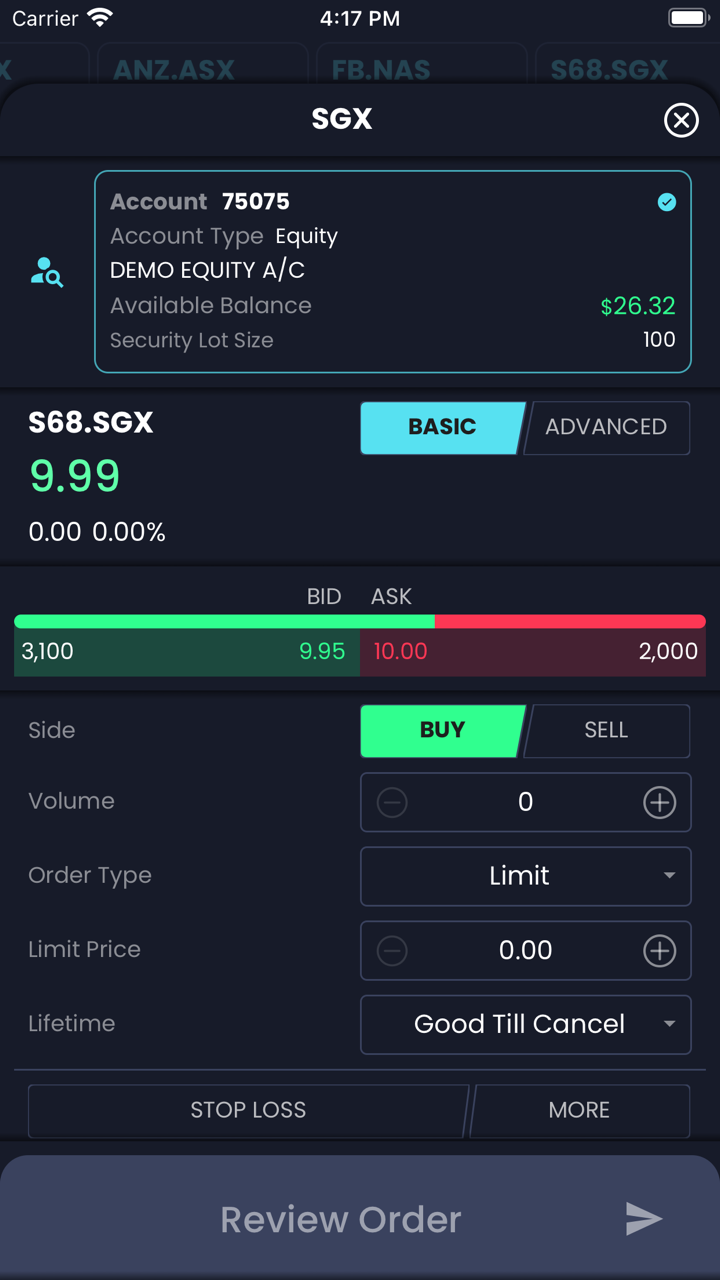

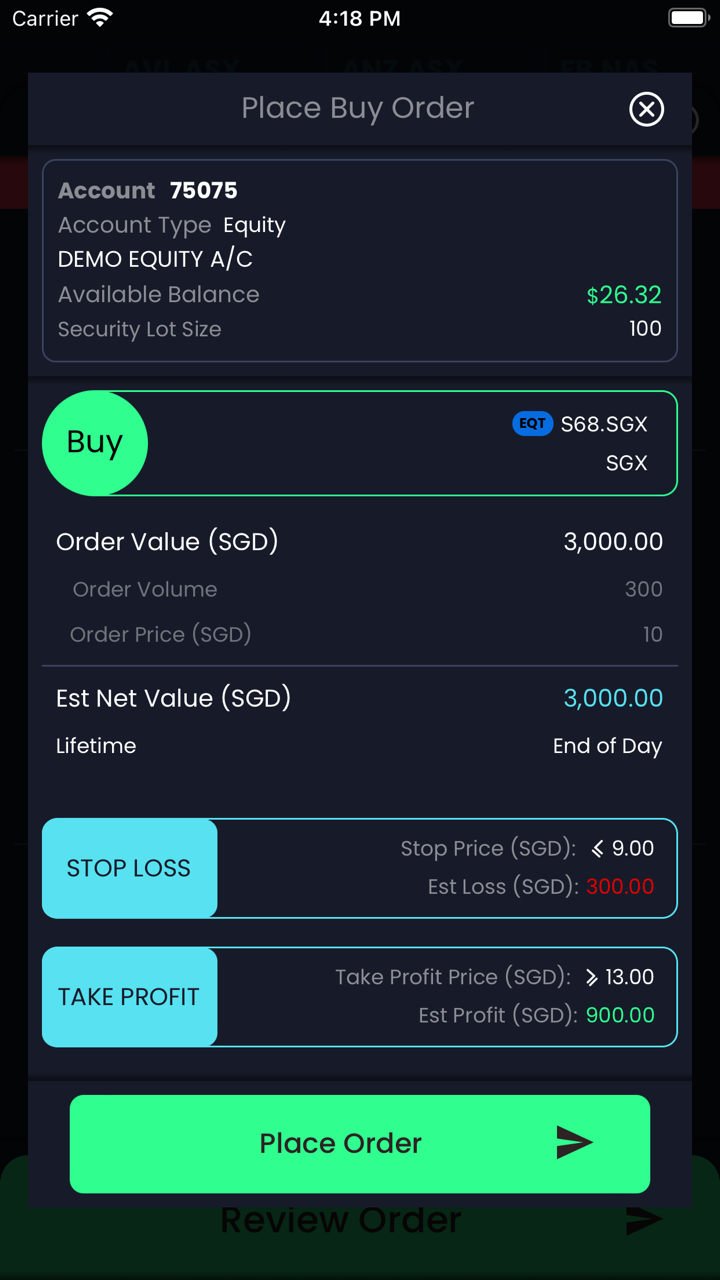

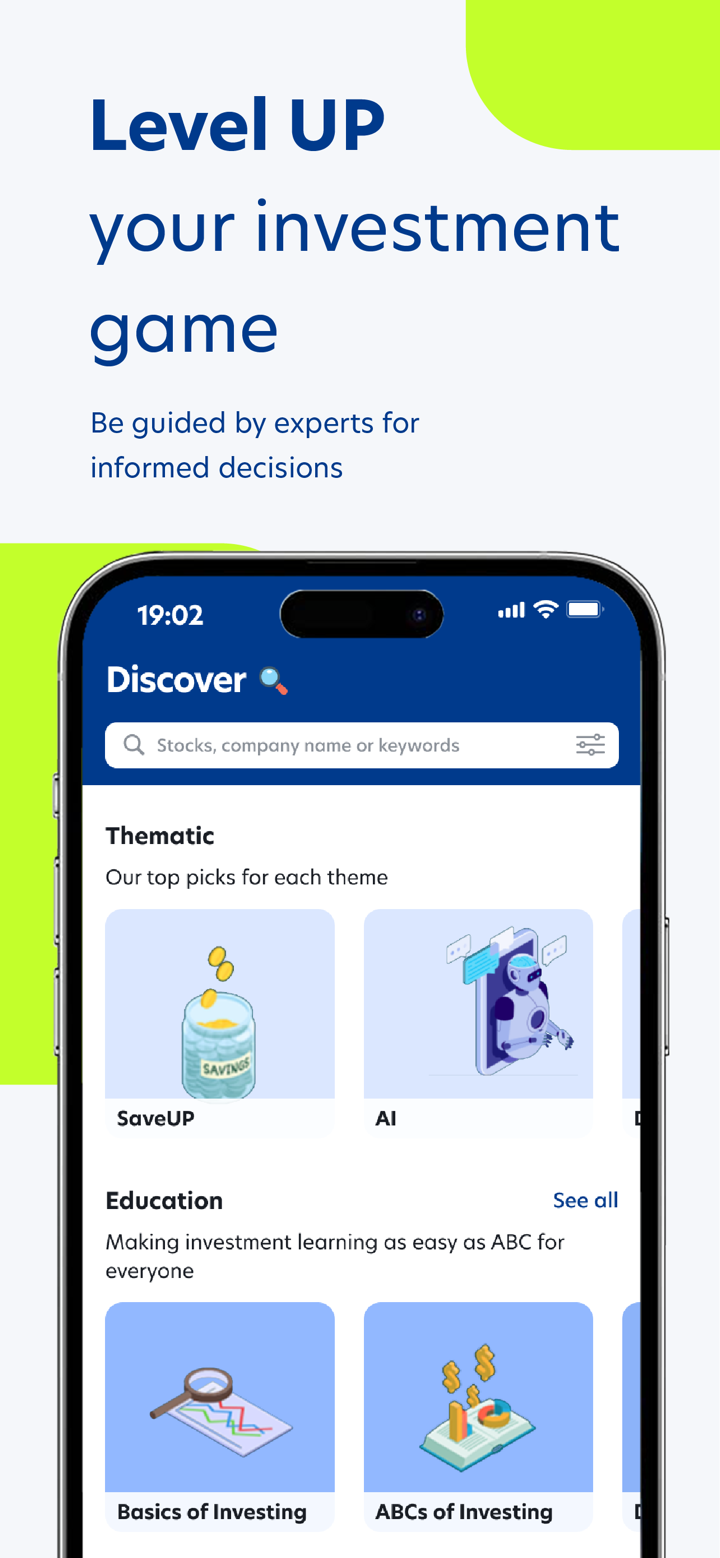

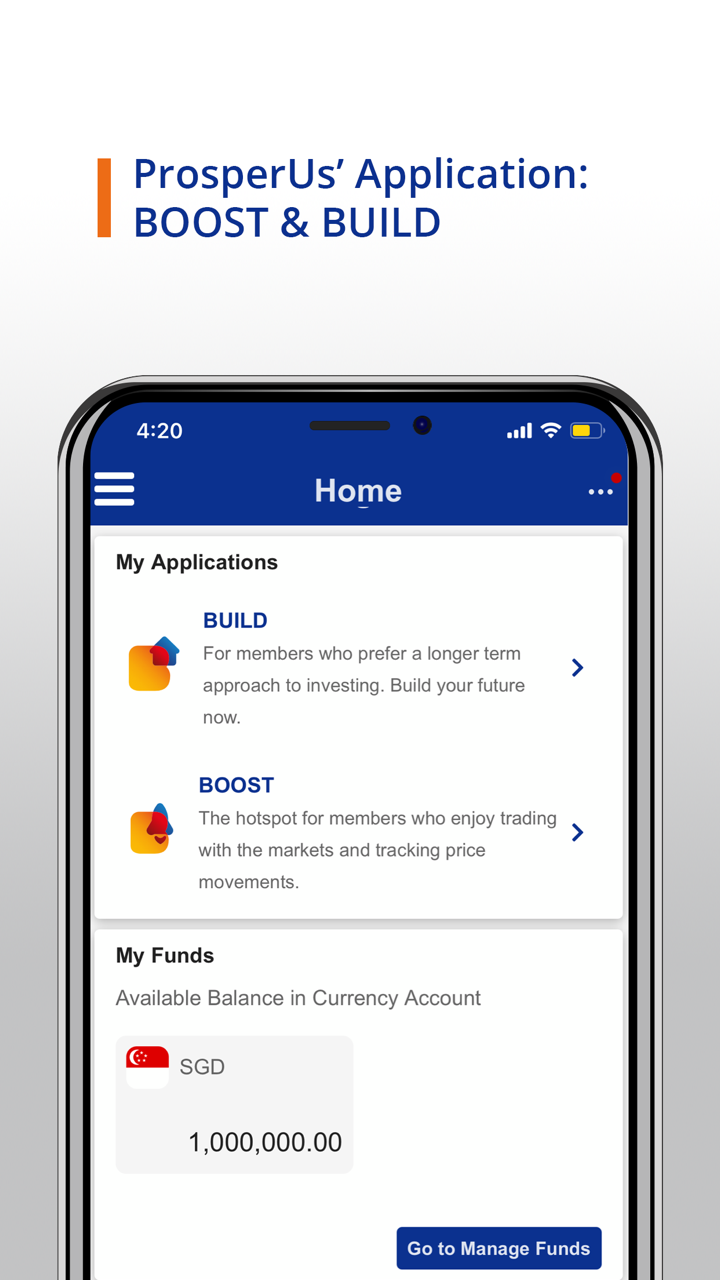

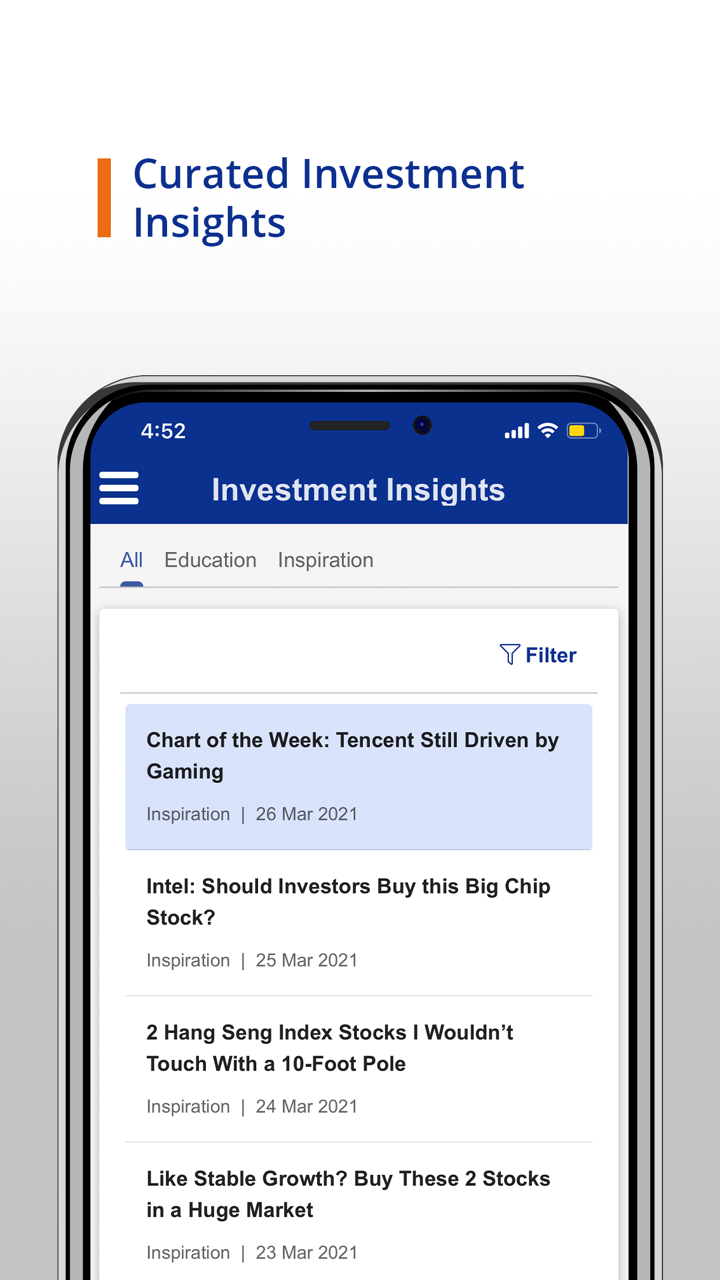

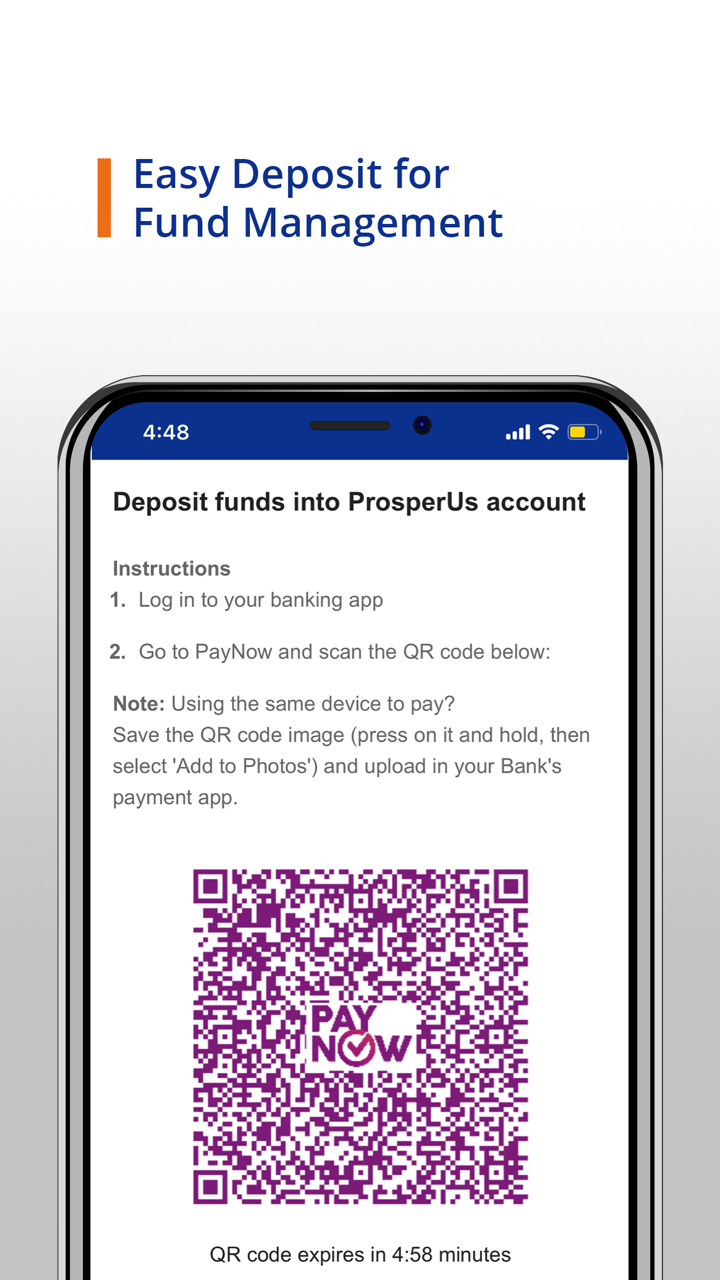

| Aplikasi Seluler | ✔ | iOS, Android | / |

| MT4 | ❌ | / | Pemula |

| MT5 | ❌ | / | Trader Berpengalaman |

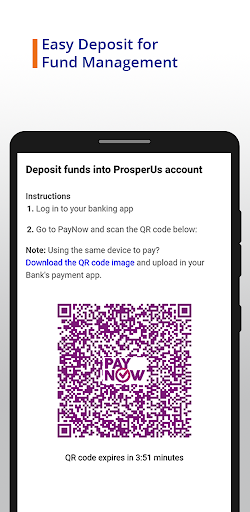

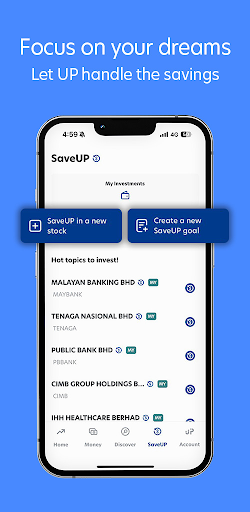

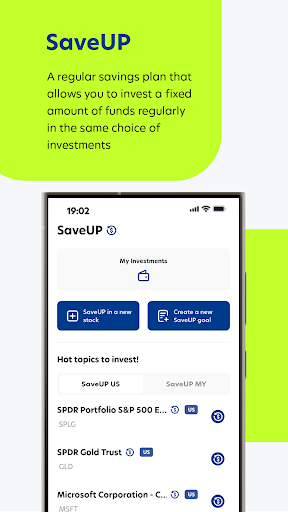

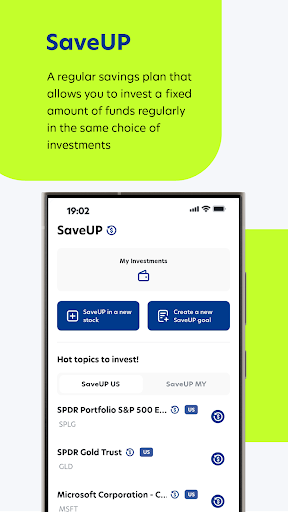

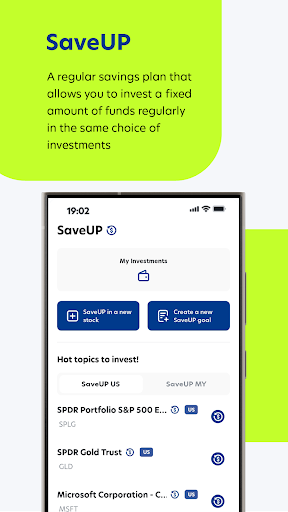

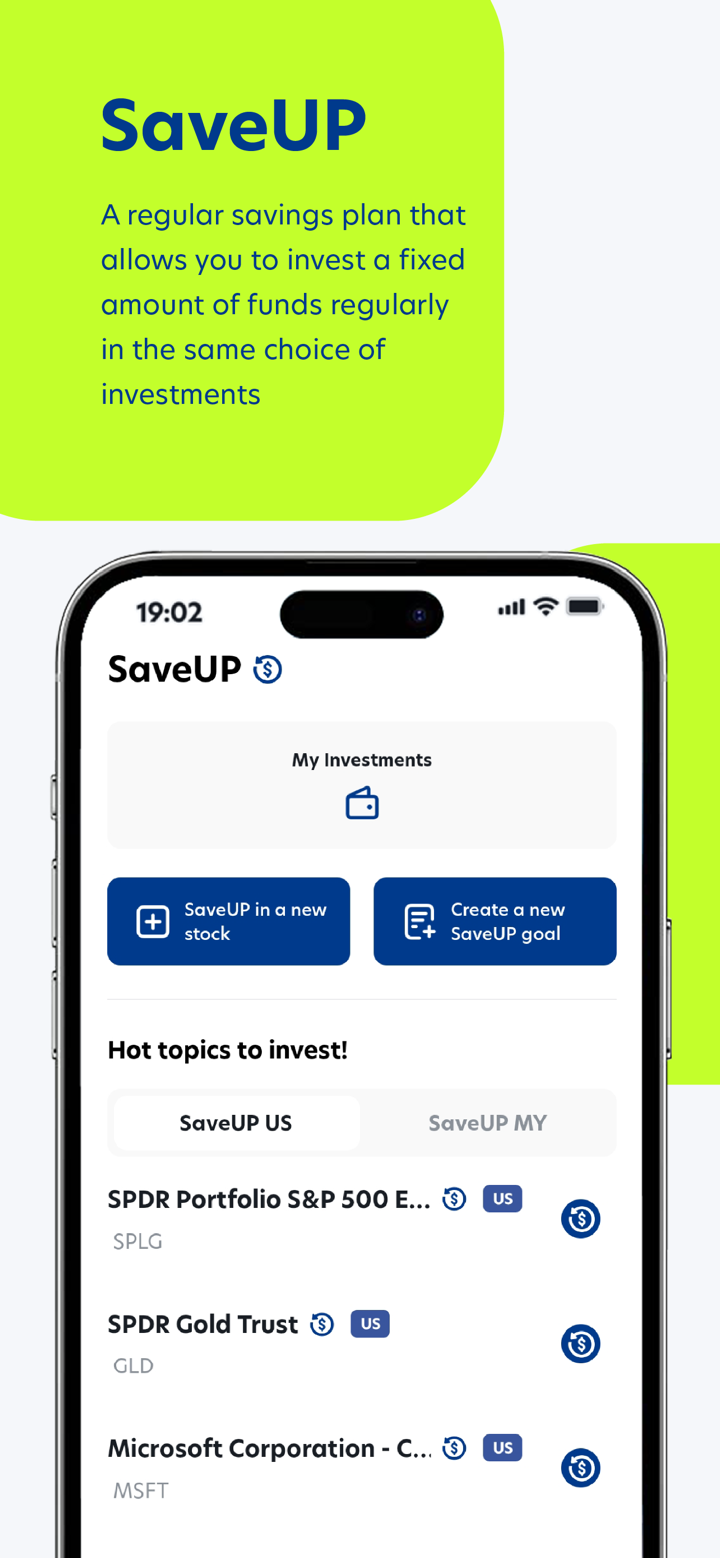

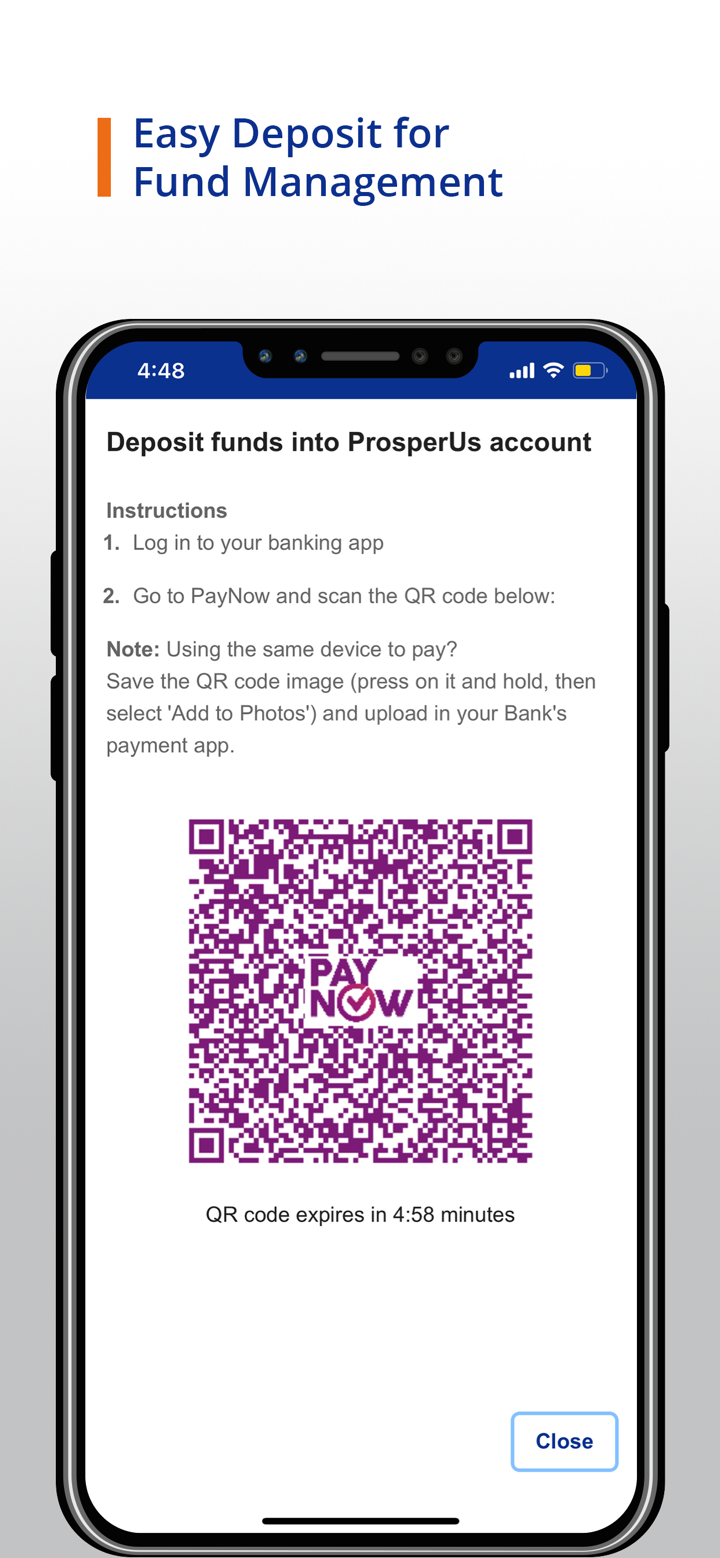

Promosi

CGSCIMB menawarkan berbagai kegiatan promosi untuk pelanggan memilih. Saat ini, pelanggan dapat mendapatkan voucher e-Starbucks jika membuka rekening.