公司簡介

| CGSCIMB 評論摘要 | |

| 成立年份 | 2018 |

| 註冊國家/地區 | 泰國 |

| 監管 | 無監管 |

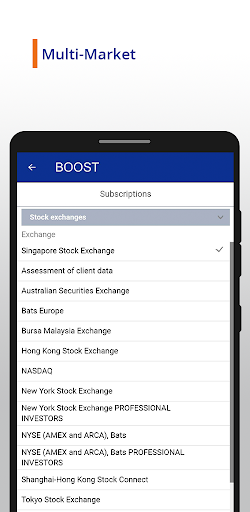

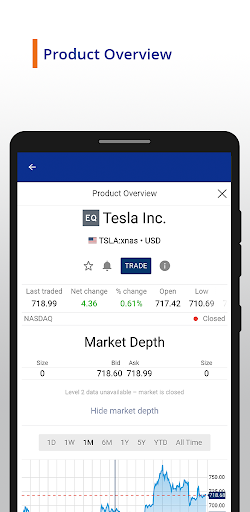

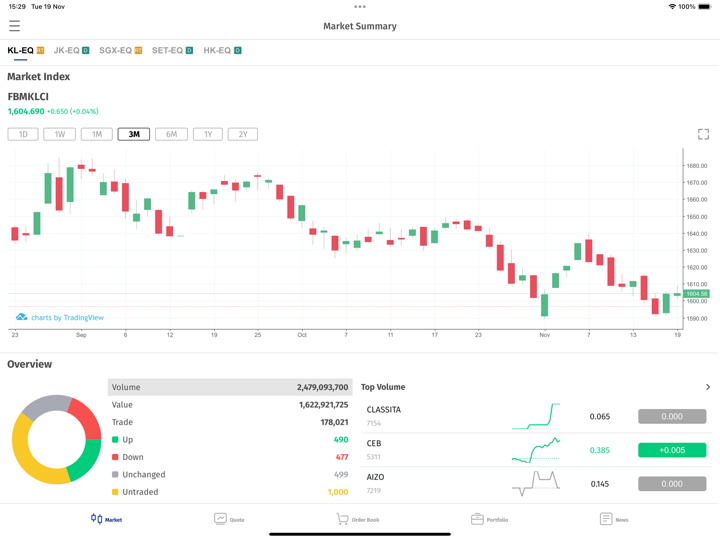

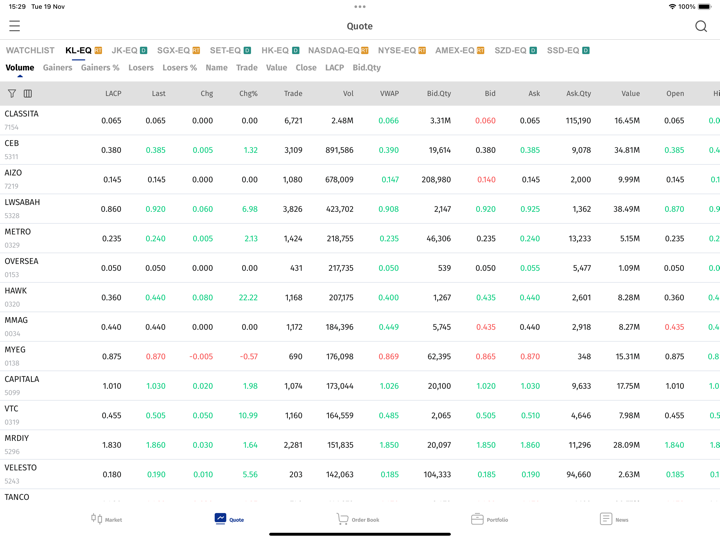

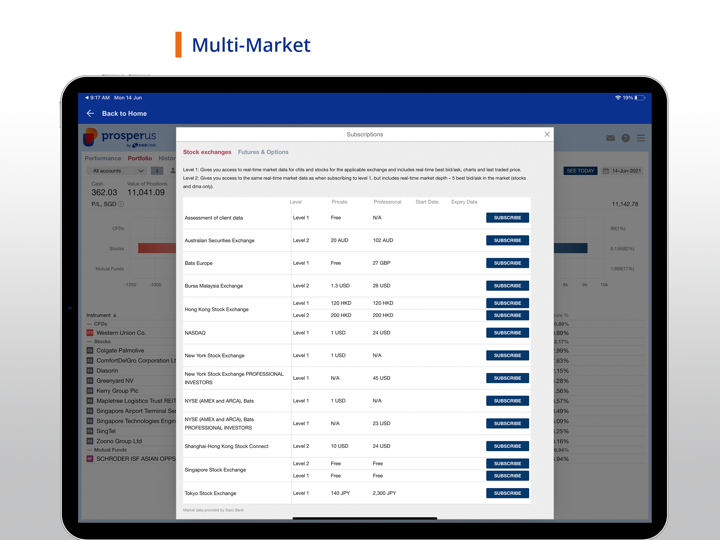

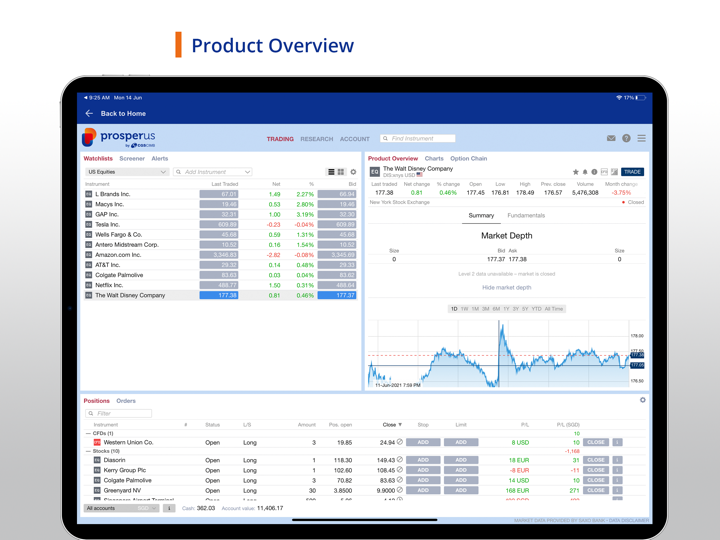

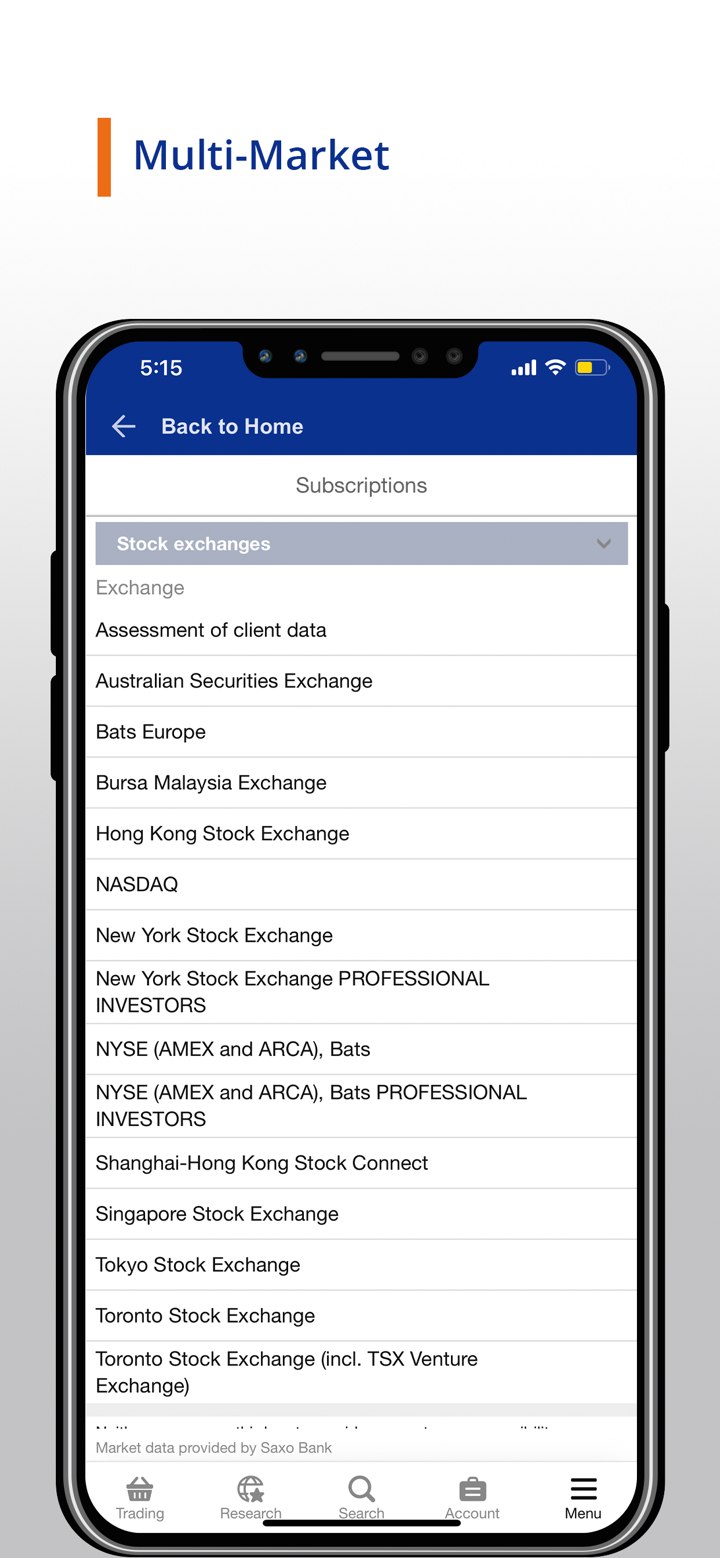

| 市場工具 | 外匯、股票、衍生品、共同基金、債券 |

| 模擬帳戶 | / |

| 槓桿 | / |

| 點差 | / |

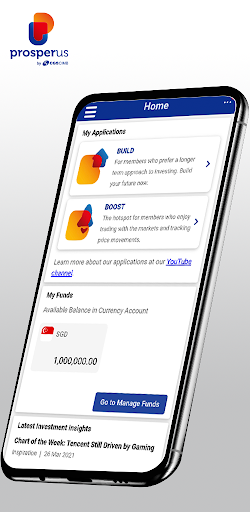

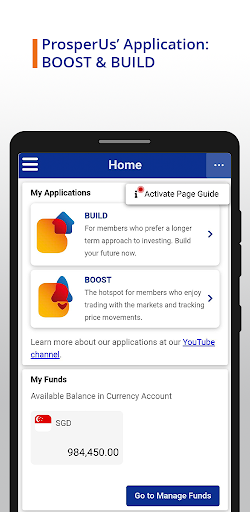

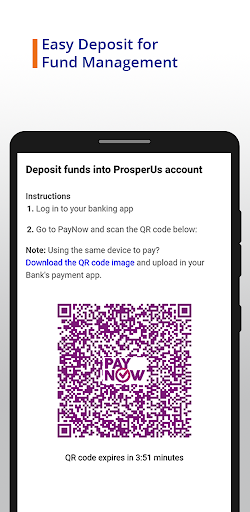

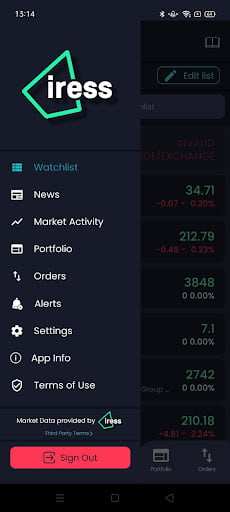

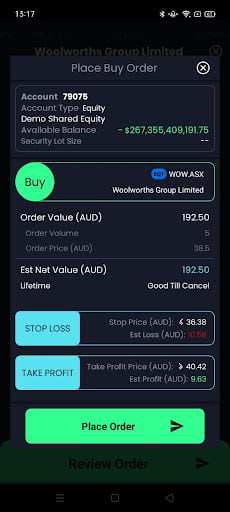

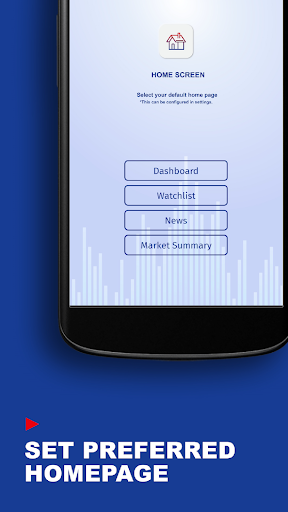

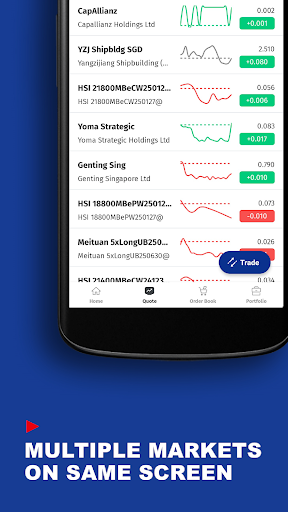

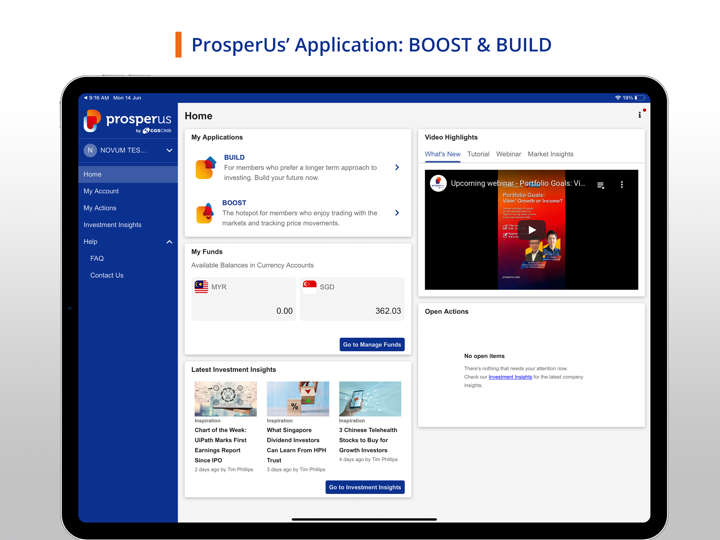

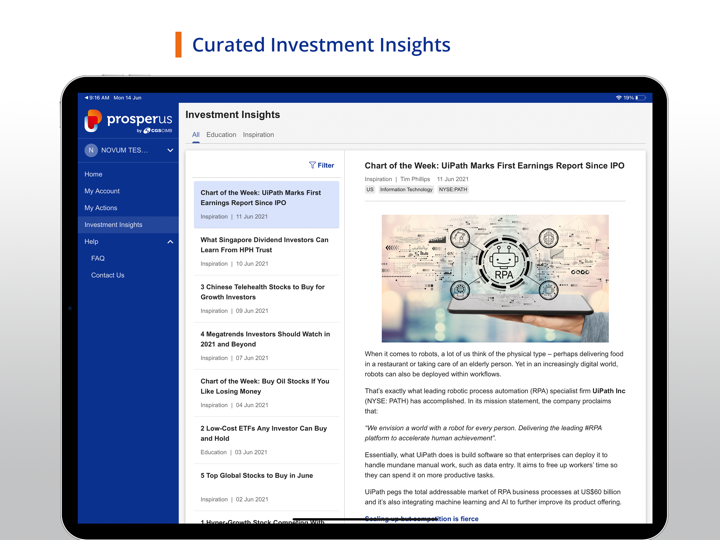

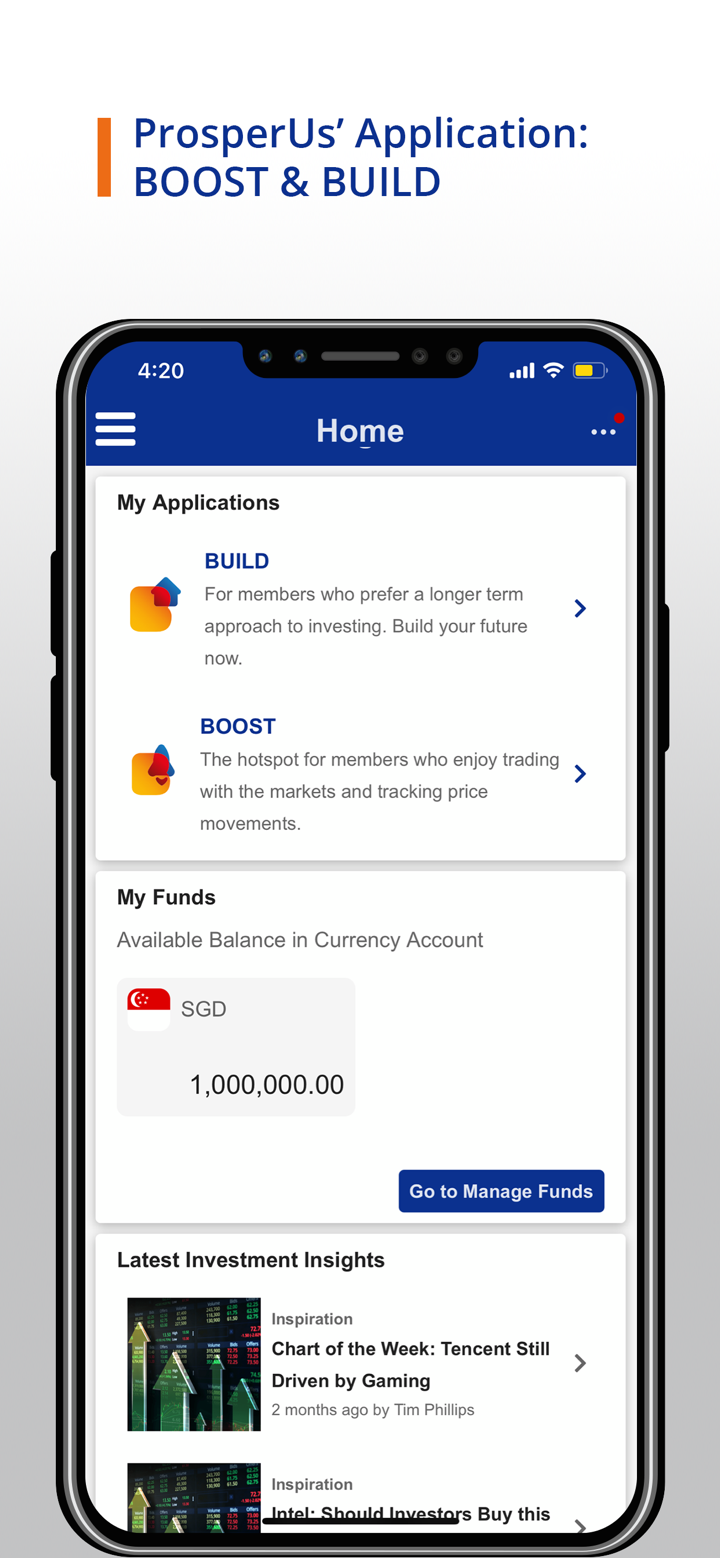

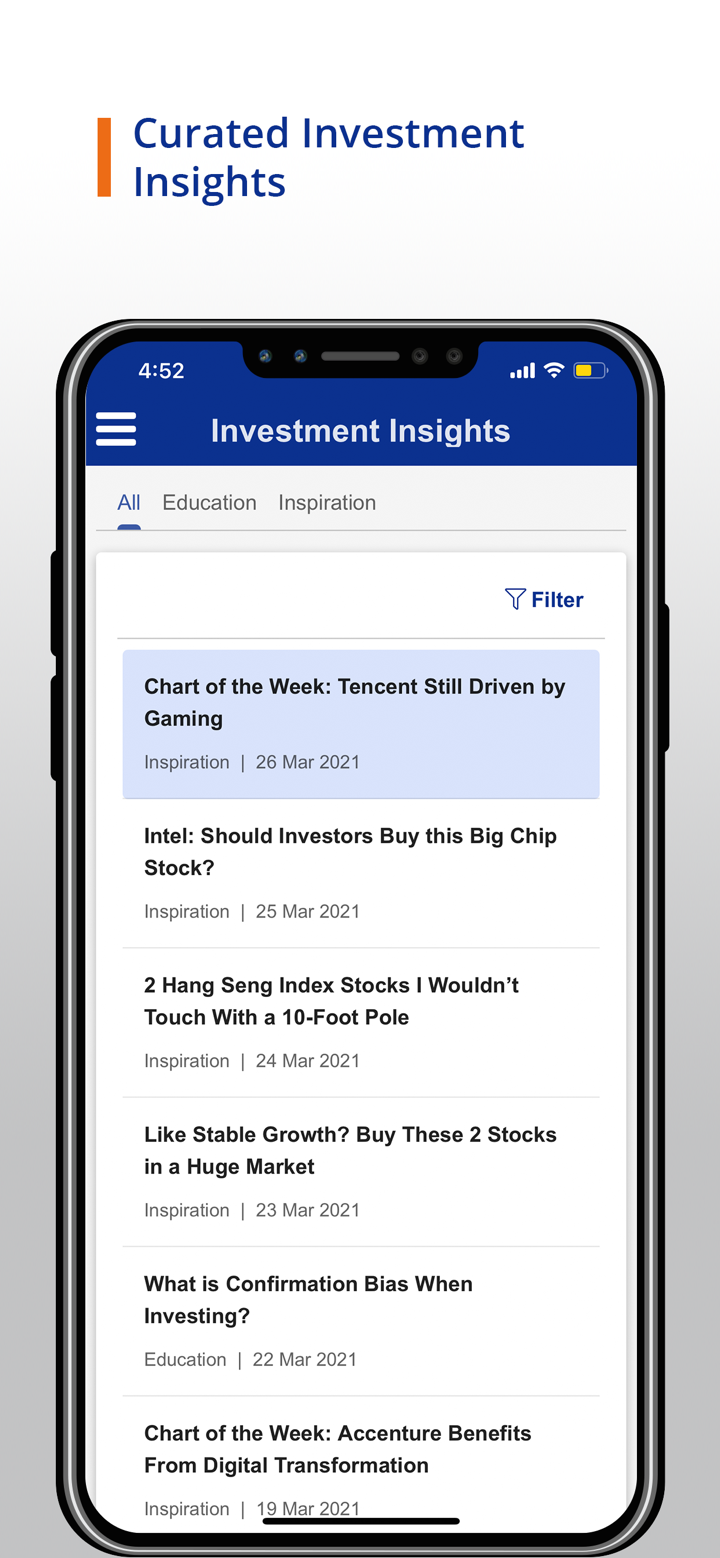

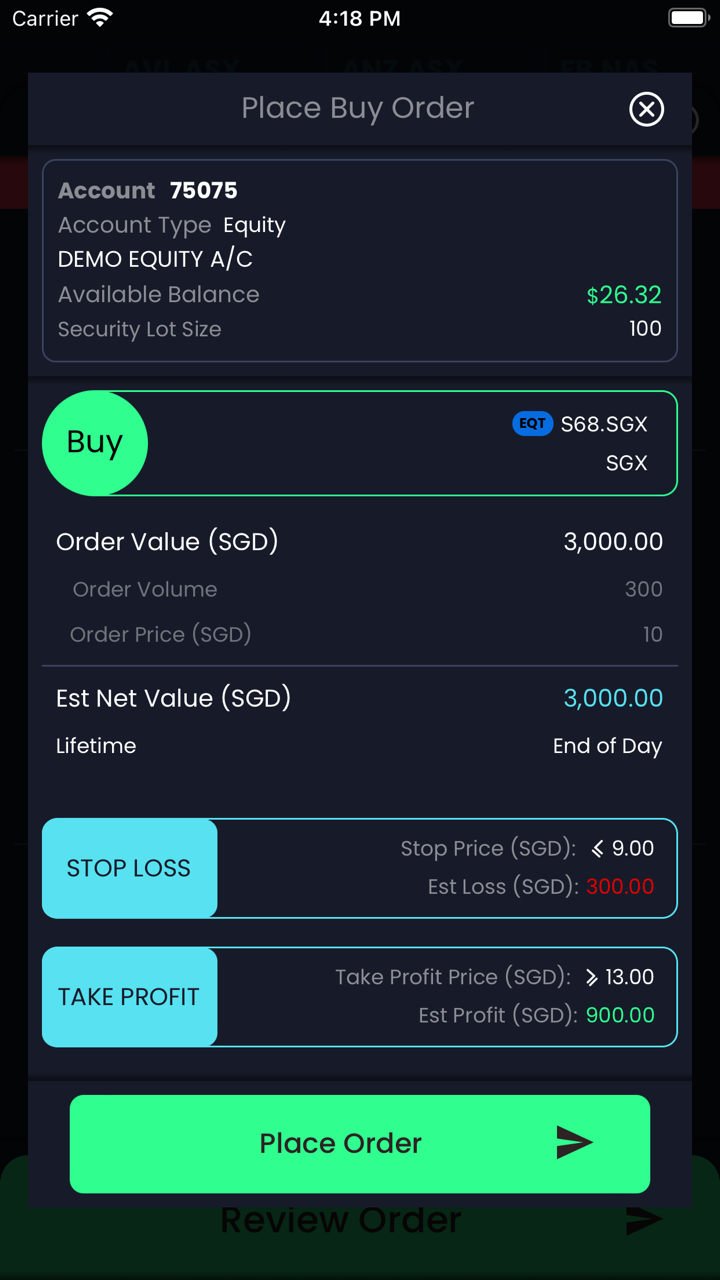

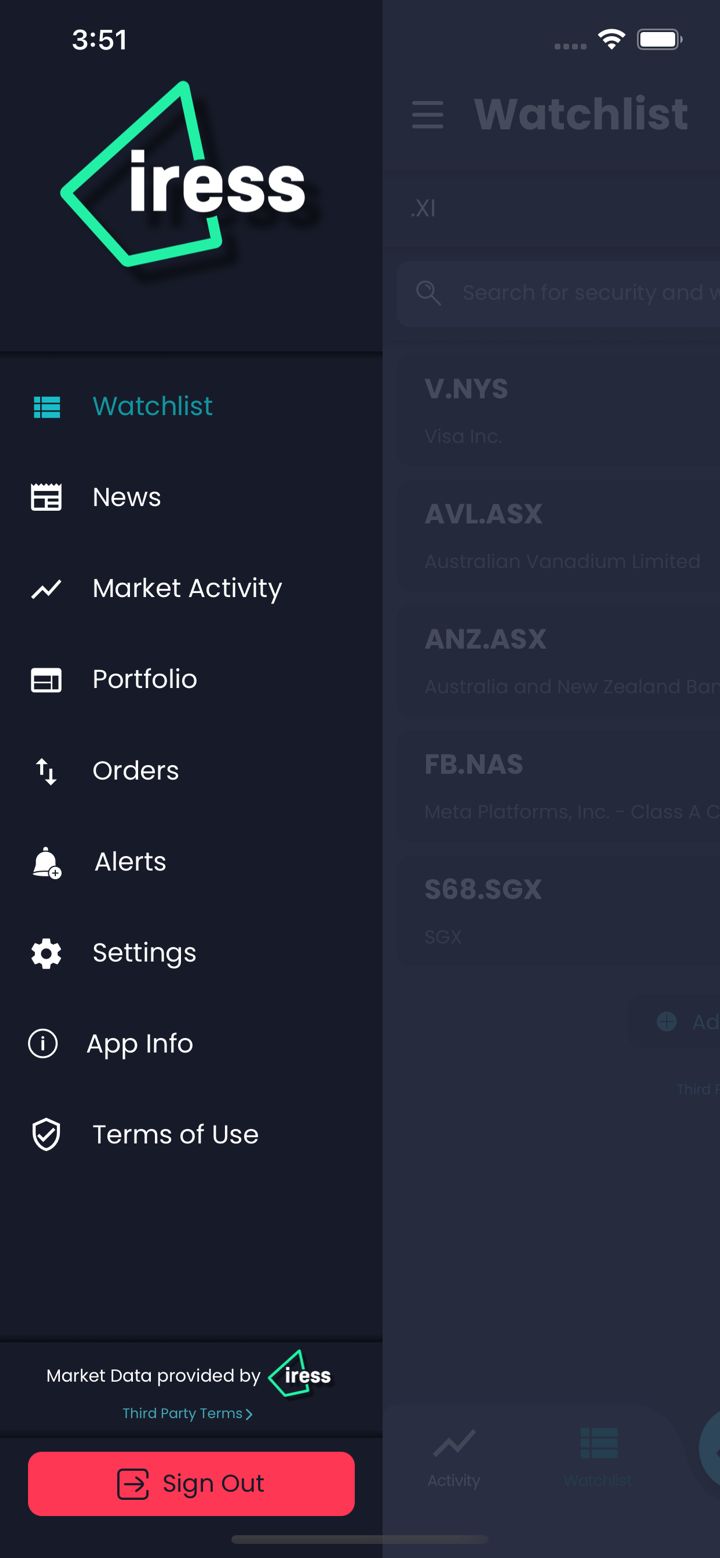

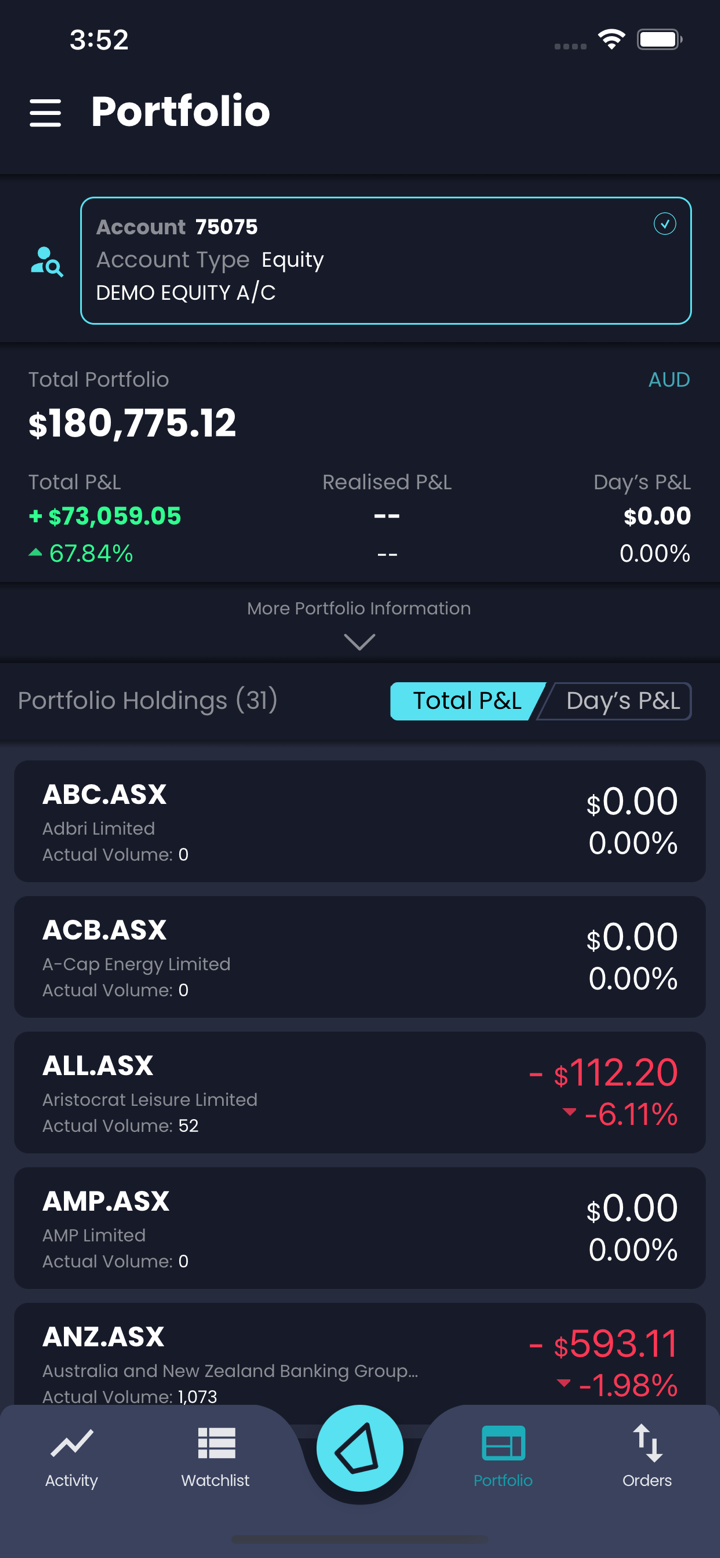

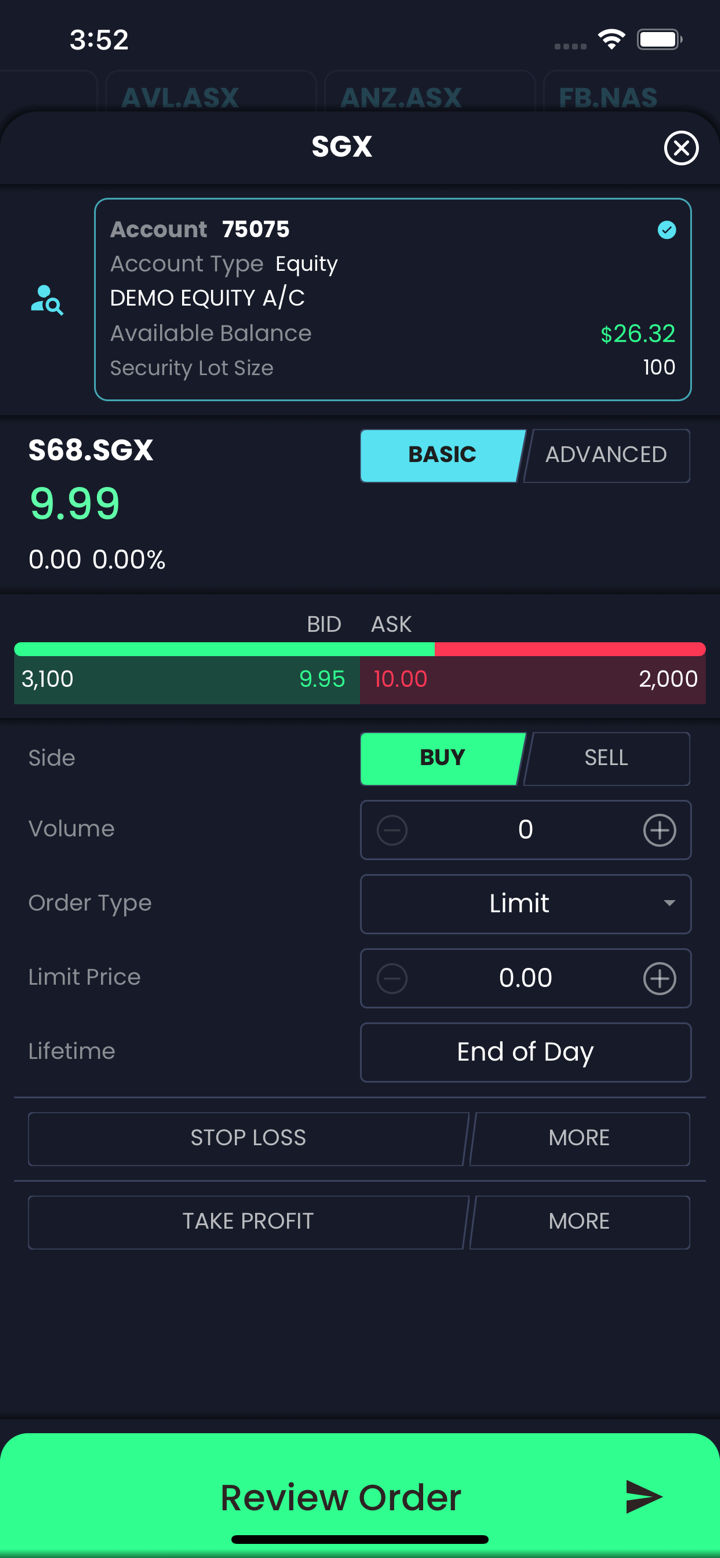

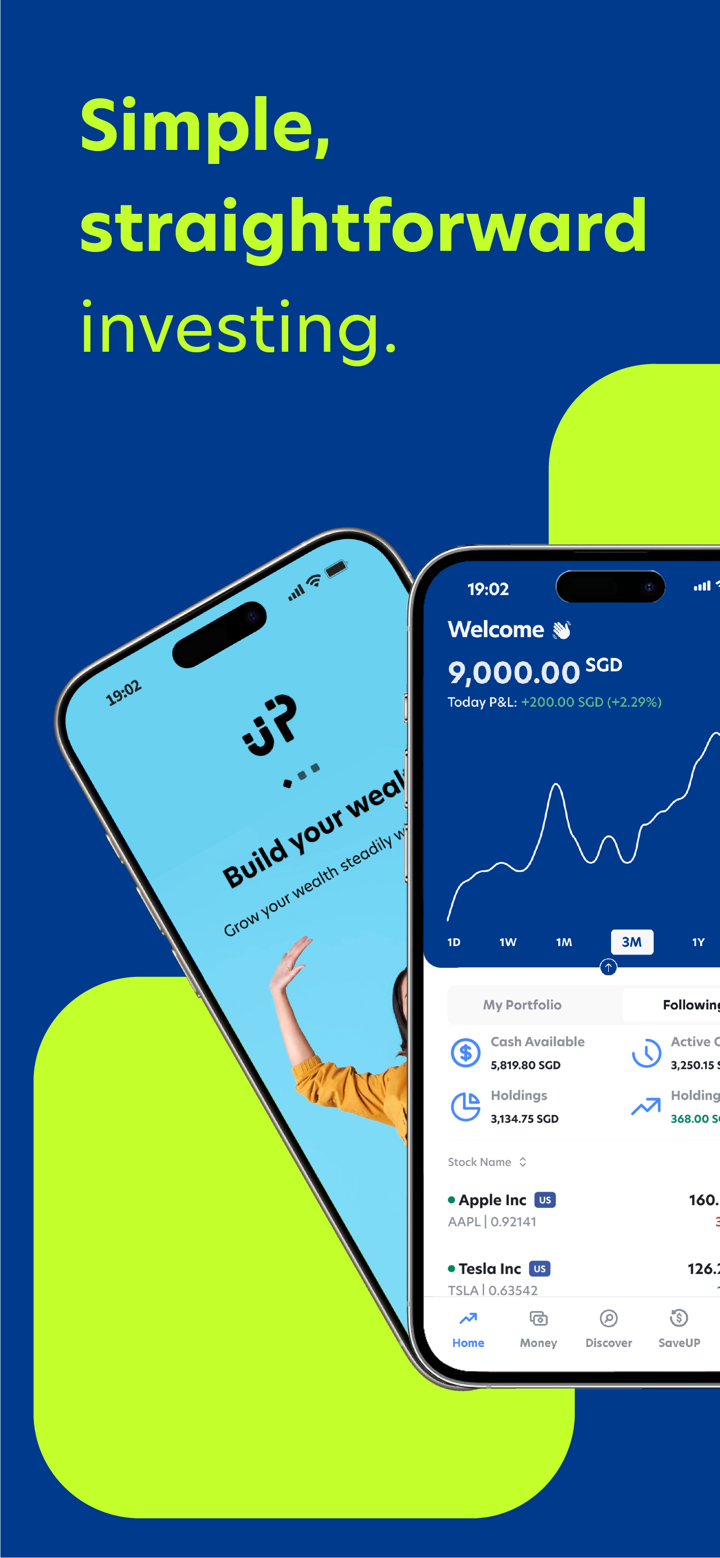

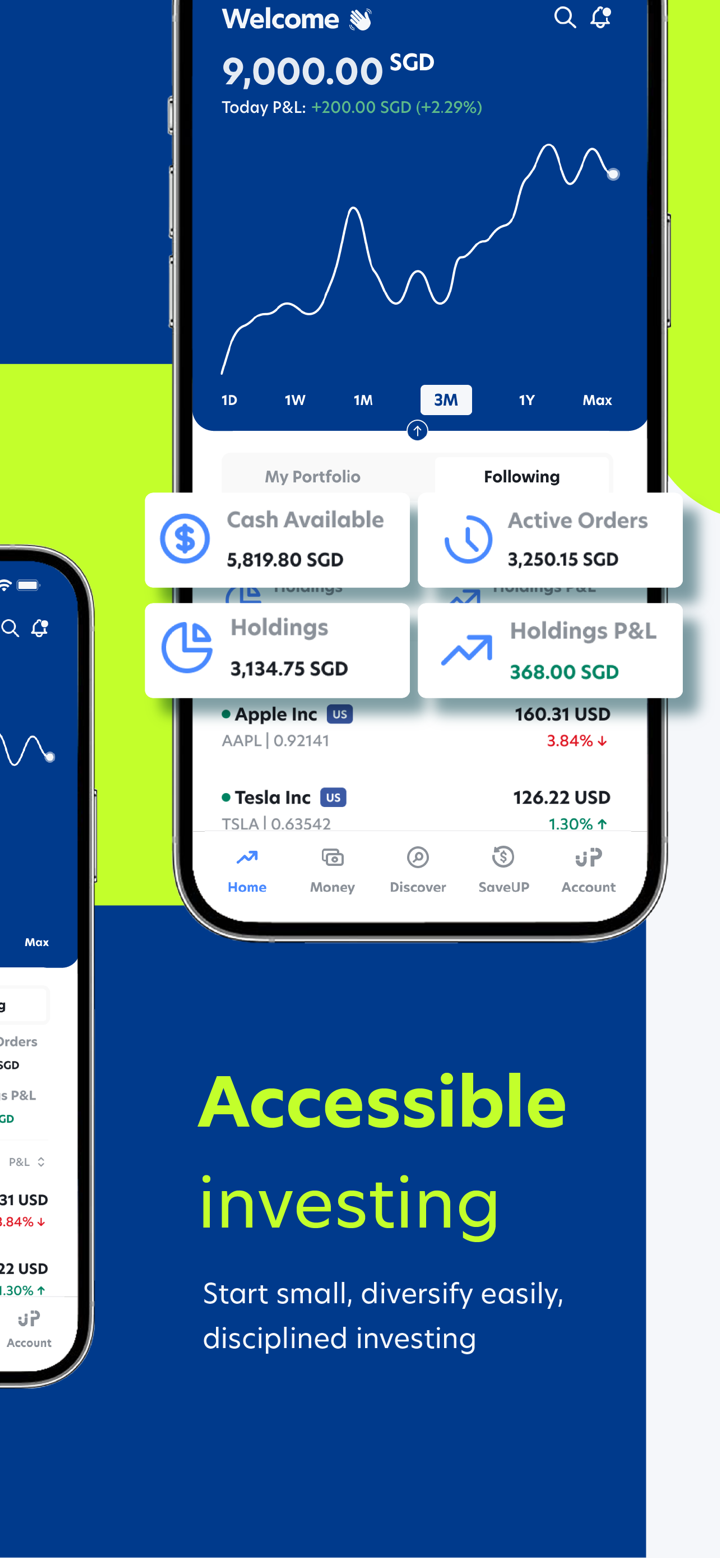

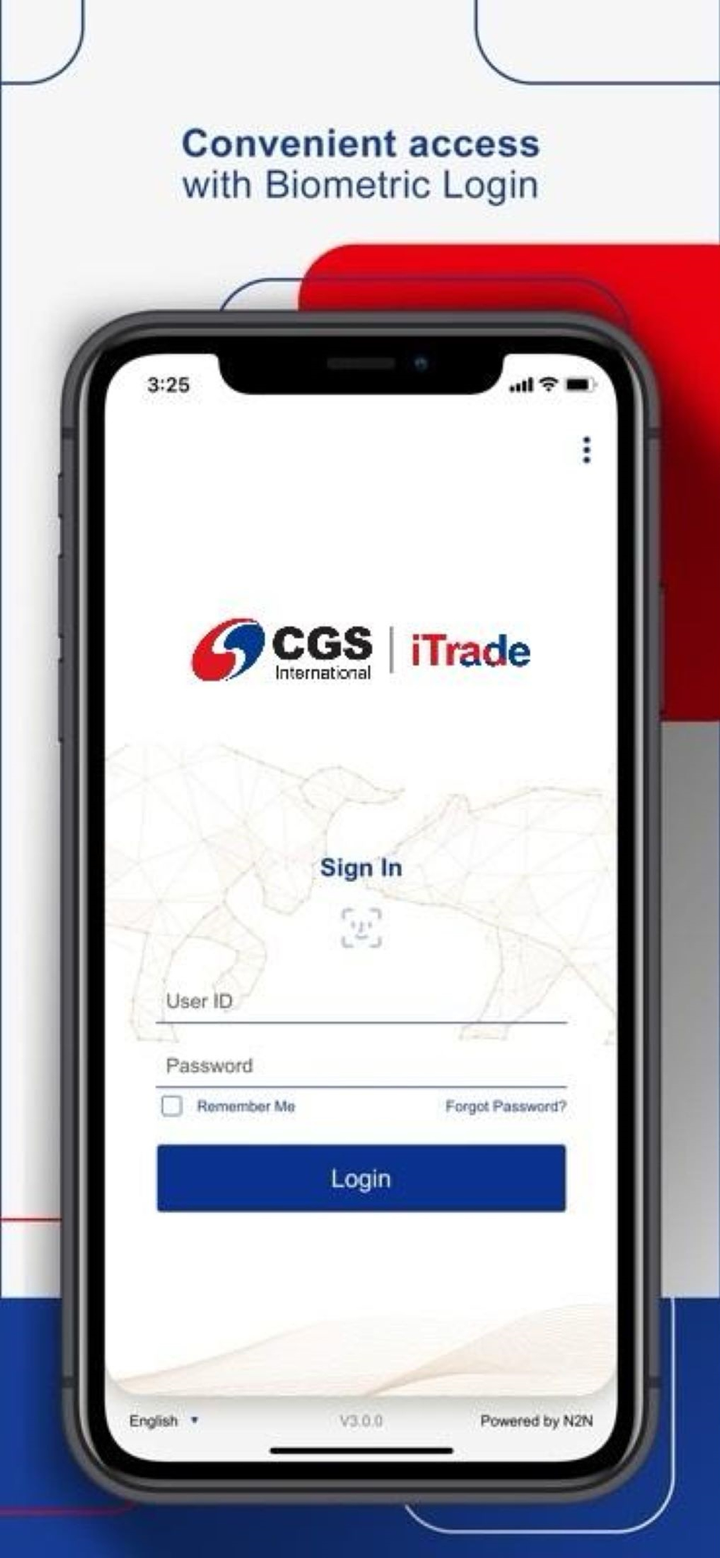

| 交易平台 | WebTrader、手機應用程式 |

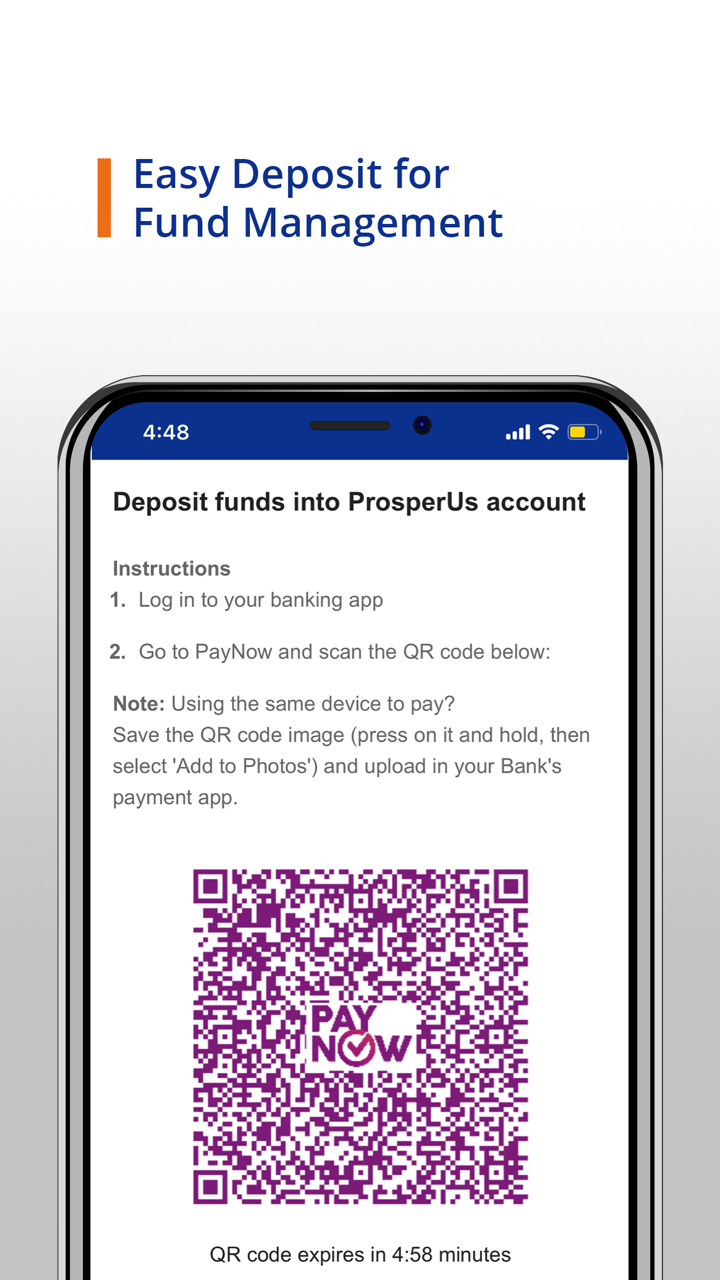

| 最低存款 | / |

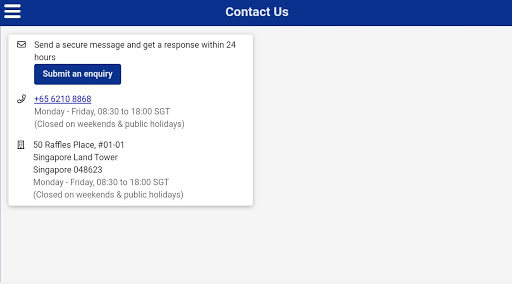

| 客戶支援 | 電話:02-846-8689 |

| 電郵:bk.etrade@cgsi.com | |

| 社交媒體:Line、YouTube、Facebook | |

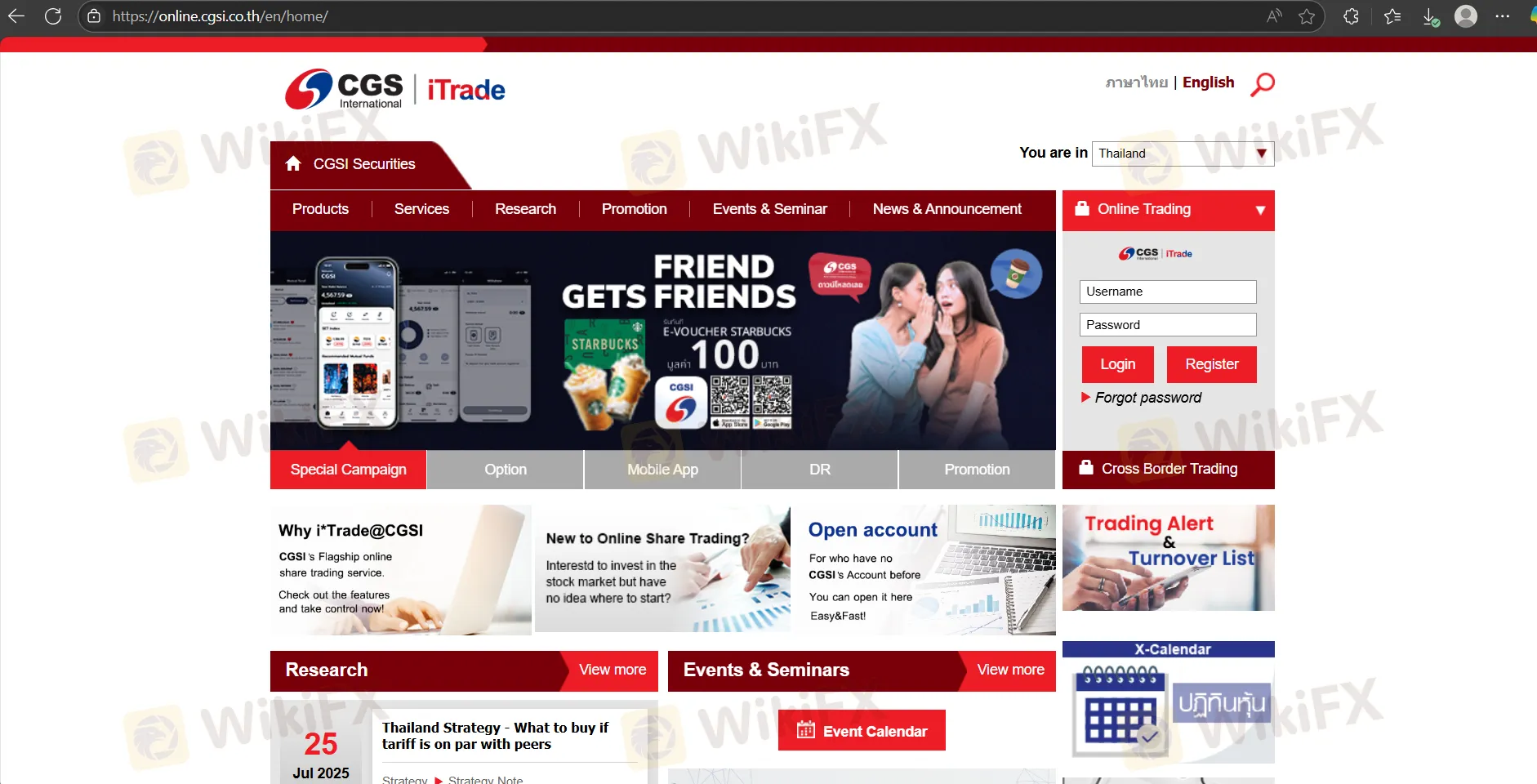

| 地址:130-132 Sindhorn Tower 2, 2nd, 3rd Floor and Sindhorn Tower 3, 12th Floor Wireless Road, Lumpini, Pathumwan, Bangkok 10330 | |

CGSCIMB 資訊

CGSCIMB 是一家成立於2018年的泰國經紀商,並未受到監管。其提供多元化的市場工具,包括外匯、股票、衍生品、共同基金和債券。

優缺點

| 優點 | 缺點 |

| 多樣化的交易資產 | 無監管地位 |

| 提供促銷活動 | 有限的交易條件資訊 |

| 沒有MT4/MT5 | |

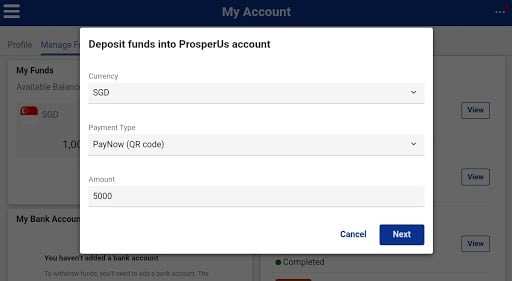

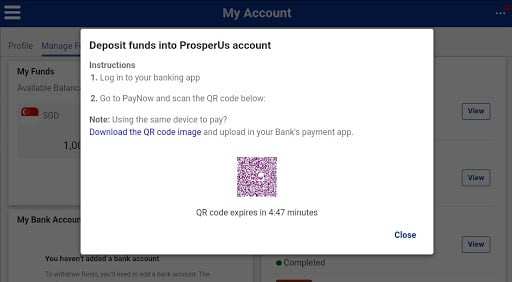

| 沒有存款和提款資訊 |

CGSCIMB 是否合法?

CGSCIMB 目前沒有有效的監管。請注意風險!

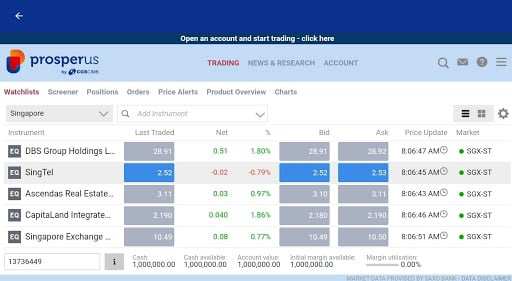

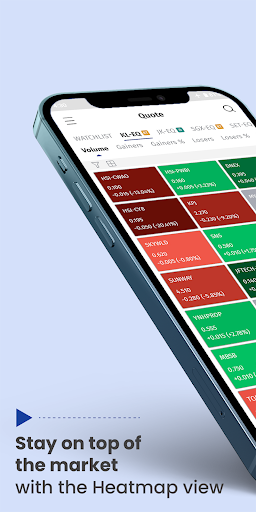

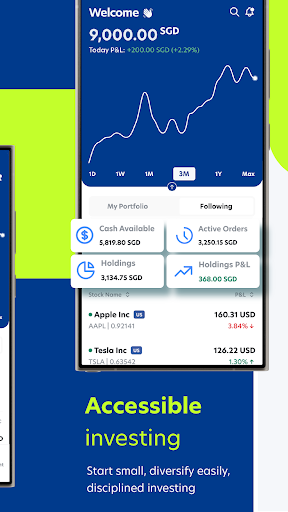

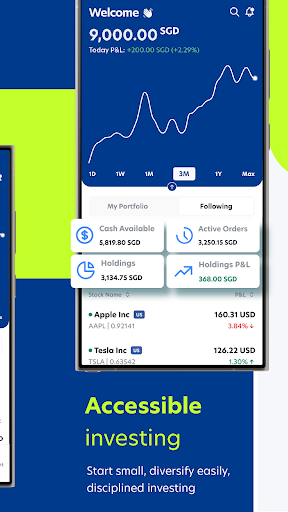

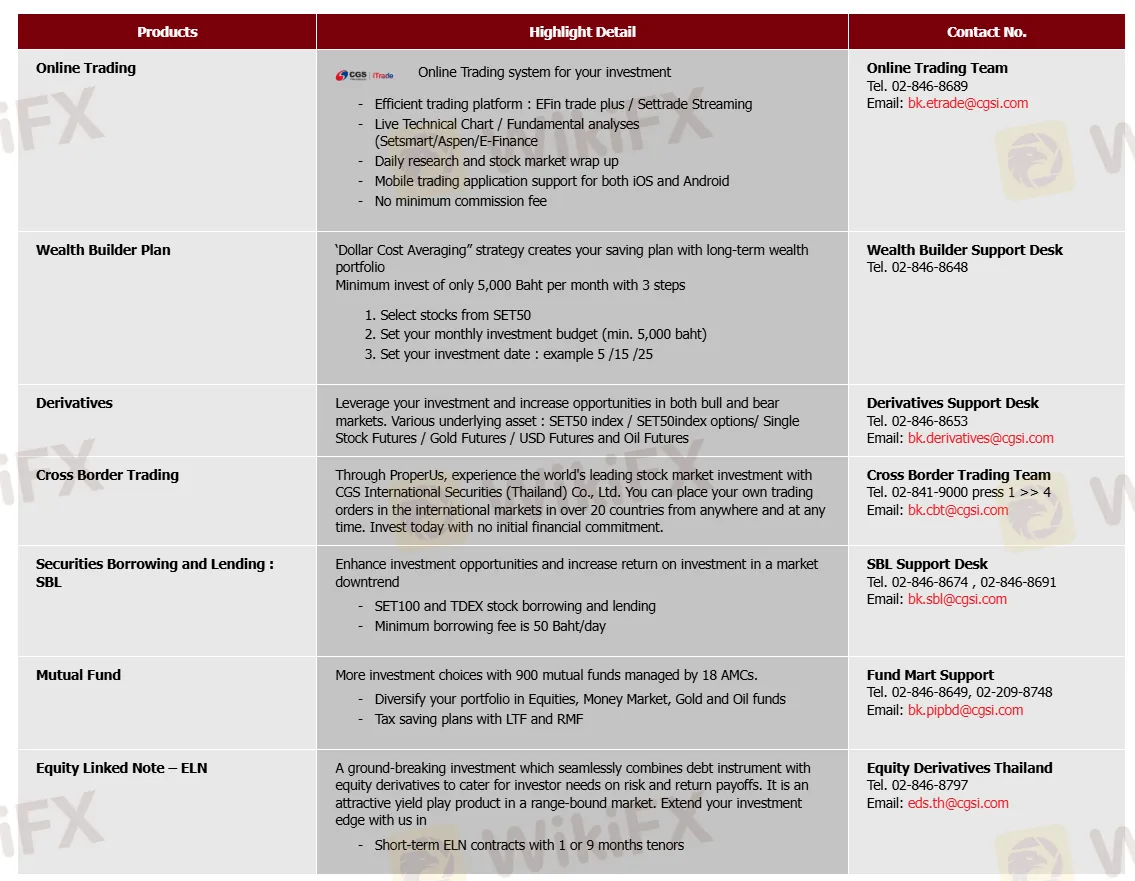

我可以在CGSCIMB上交易什麼?

| 可交易工具 | 支援 |

| 外匯 | ✔ |

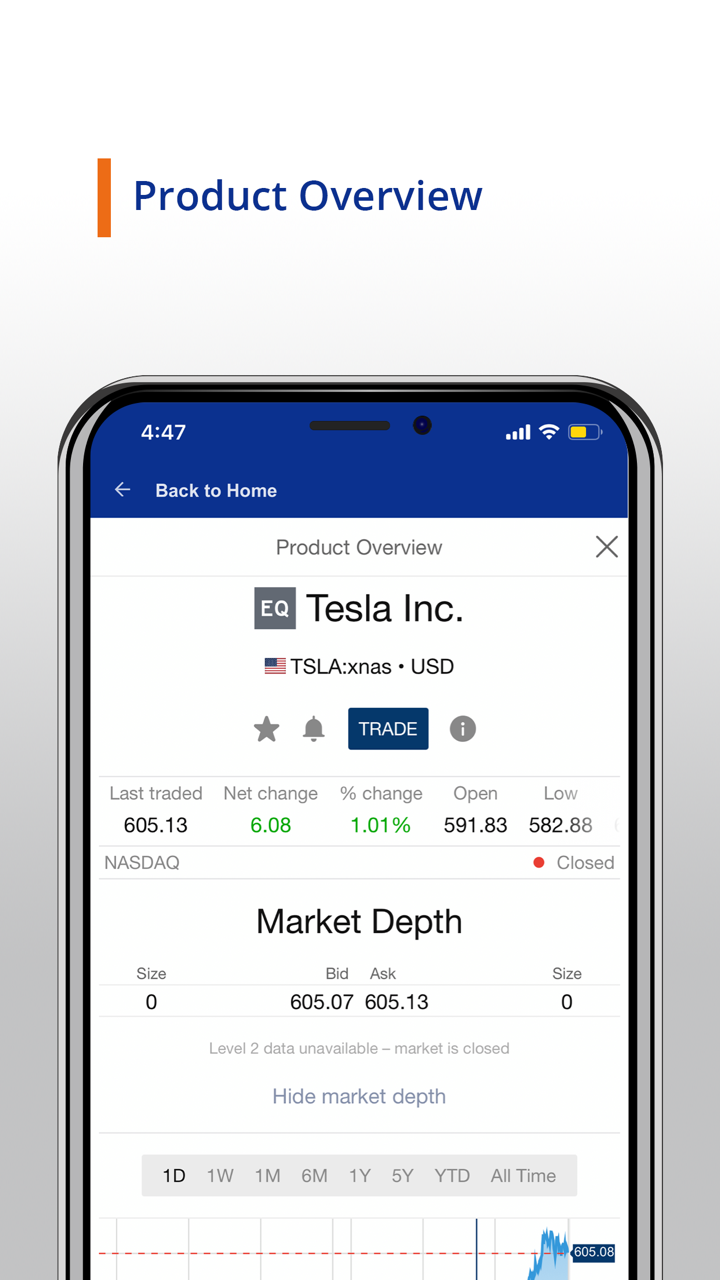

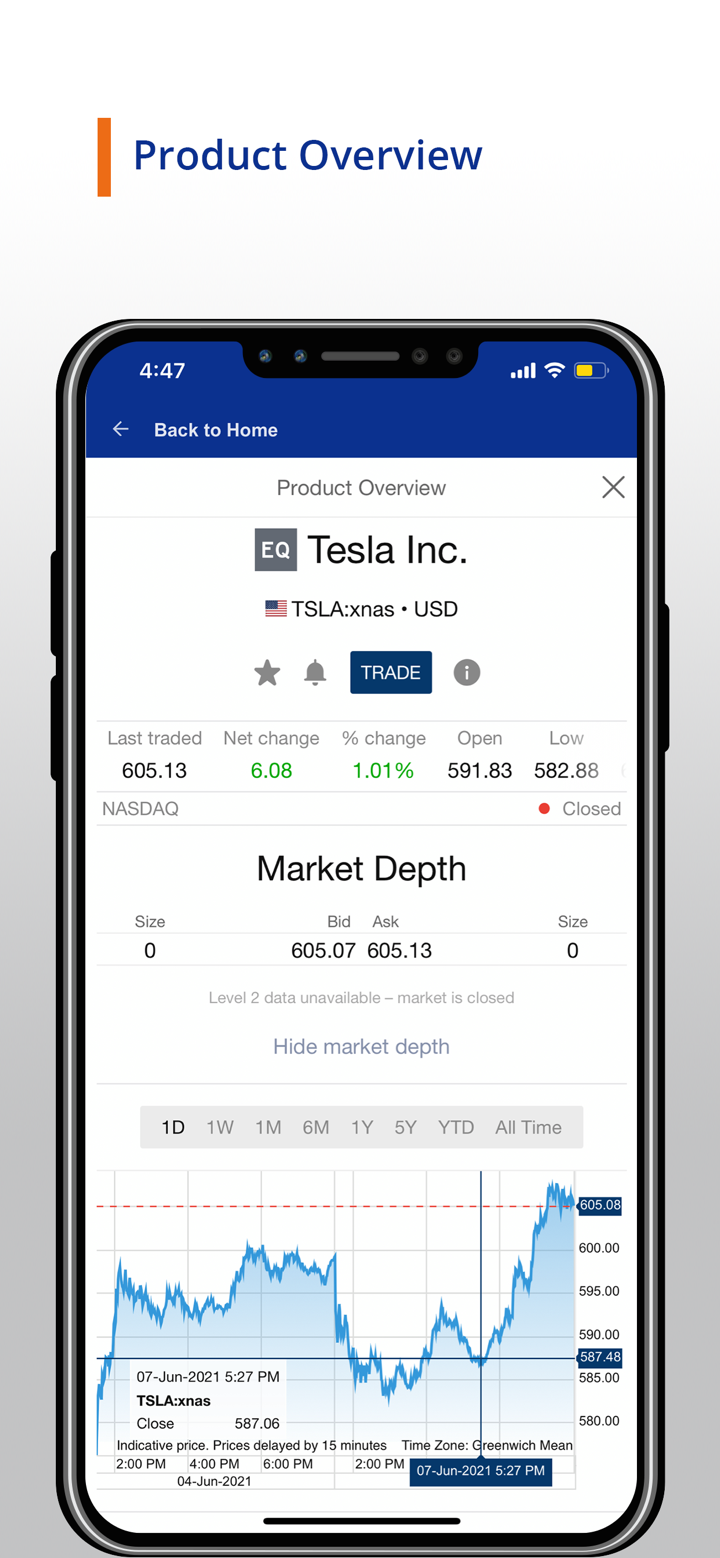

| 股票 | ✔ |

| 衍生品 | ✔ |

| 共同基金 | ✔ |

| 債券 | ✔ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

| 交易所交易基金 | ❌ |

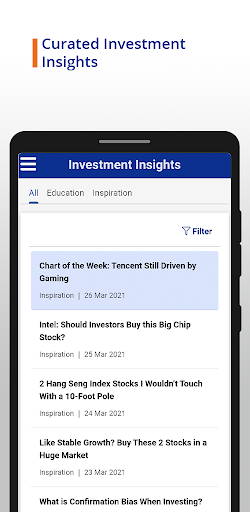

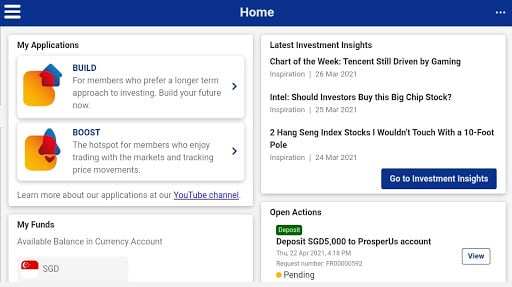

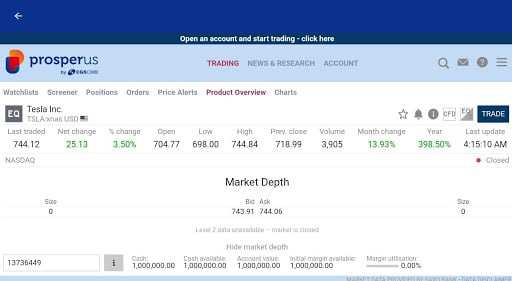

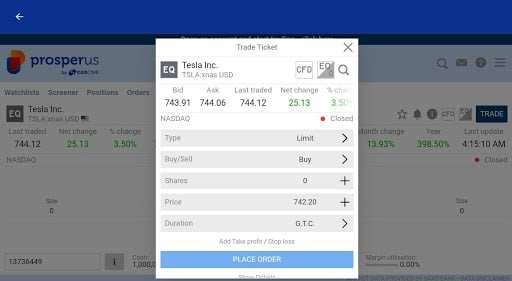

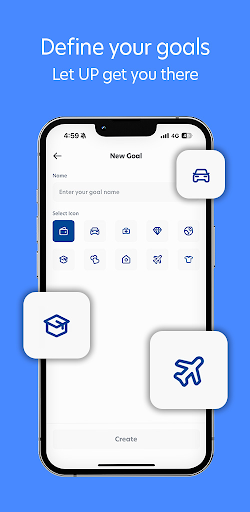

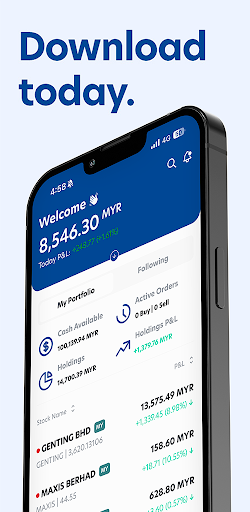

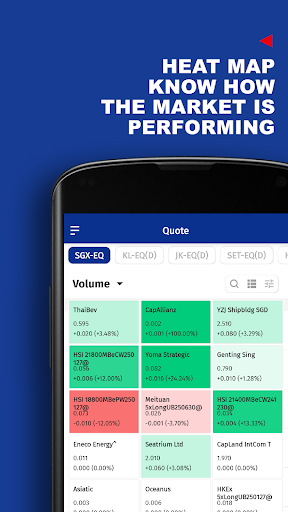

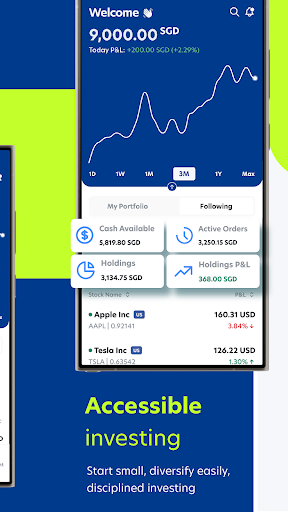

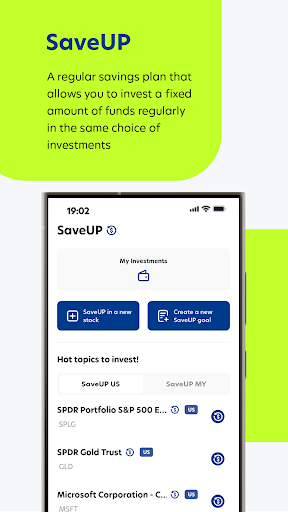

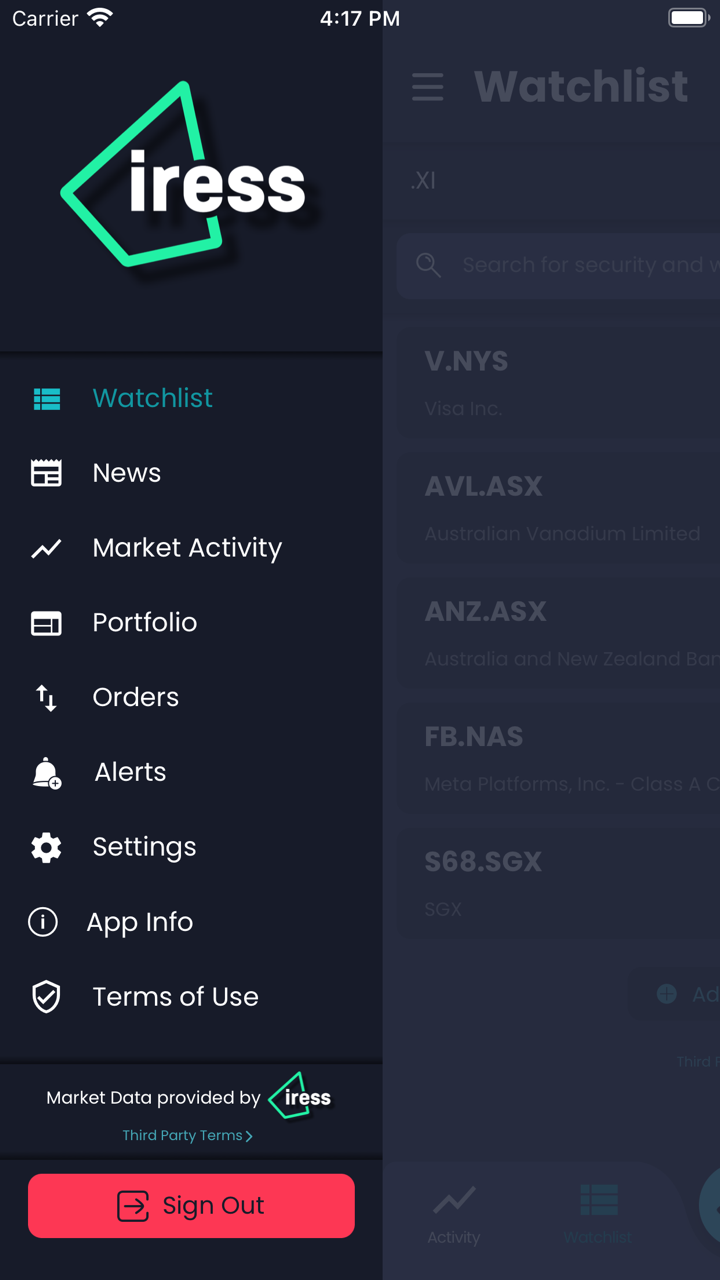

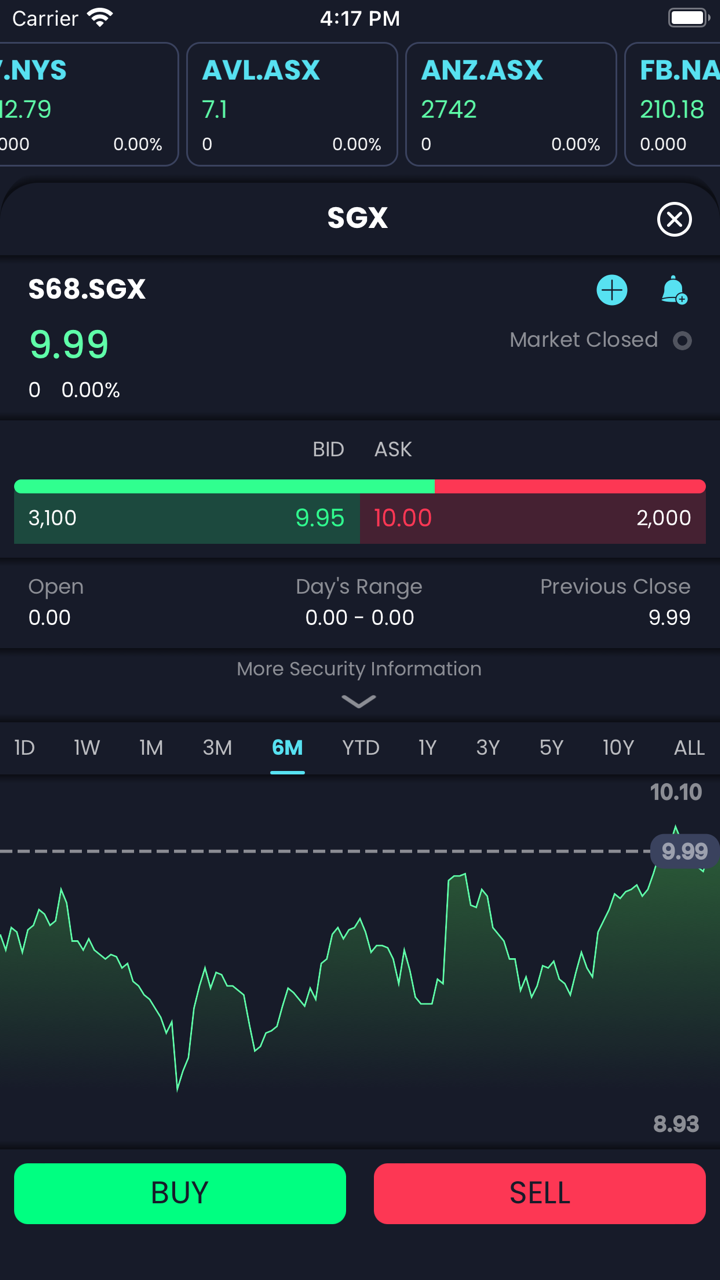

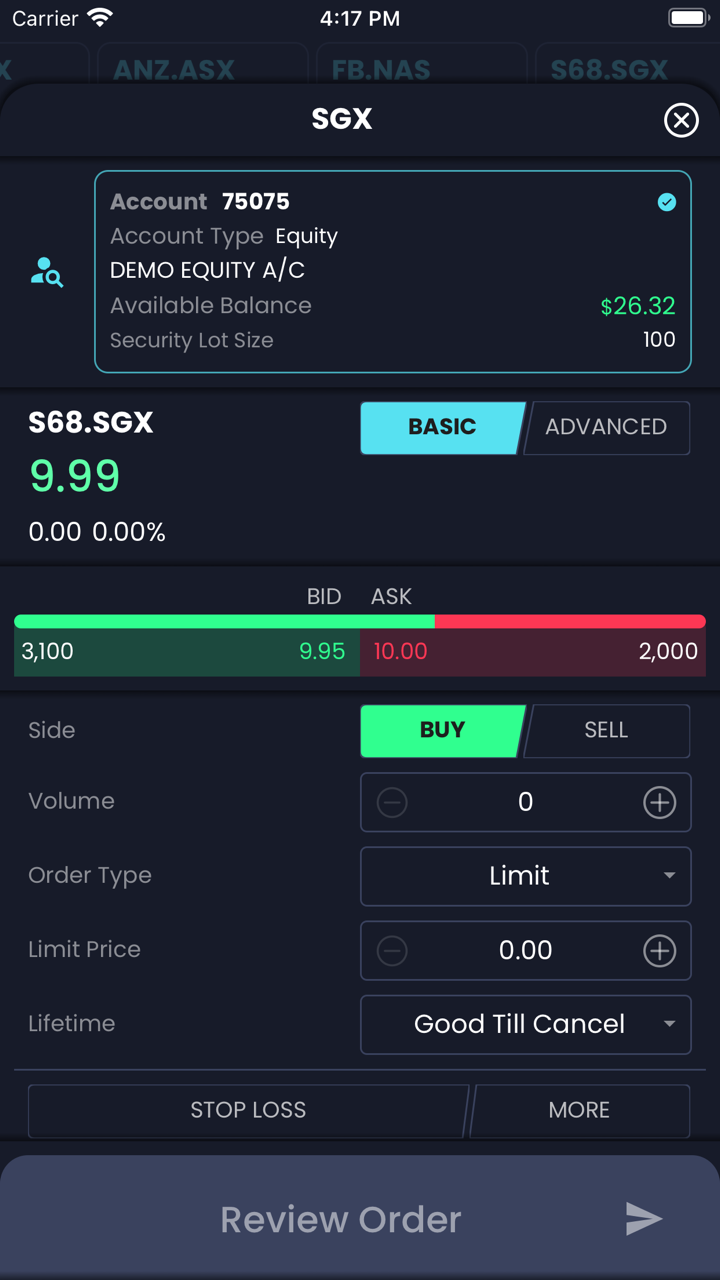

交易平台

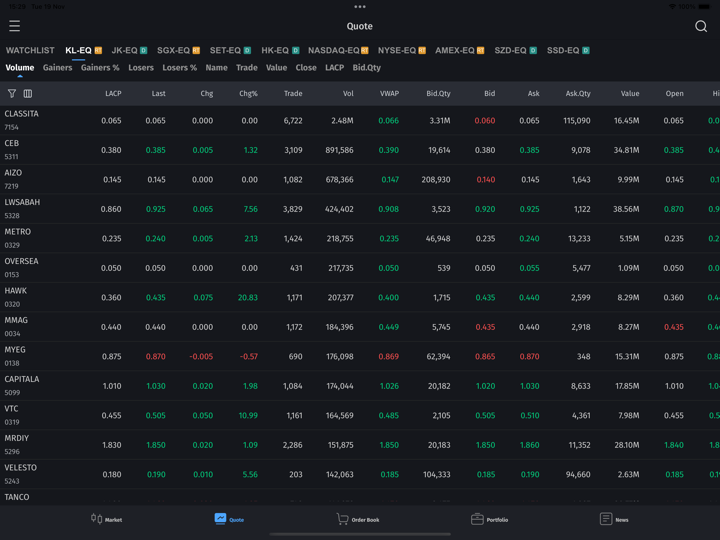

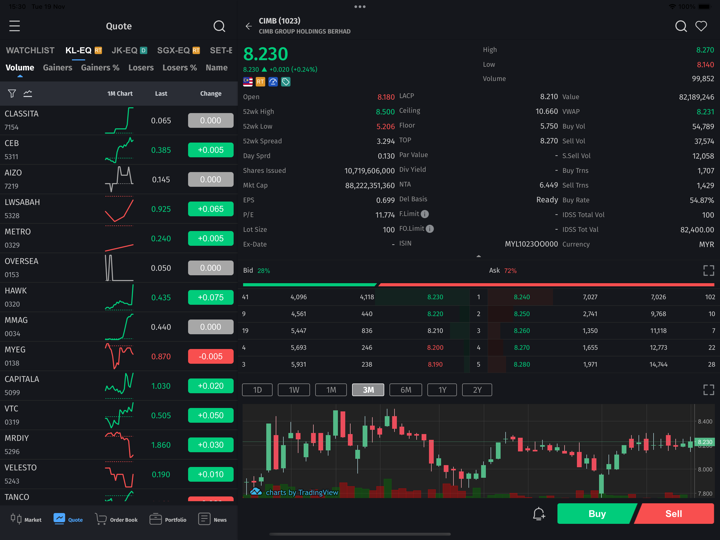

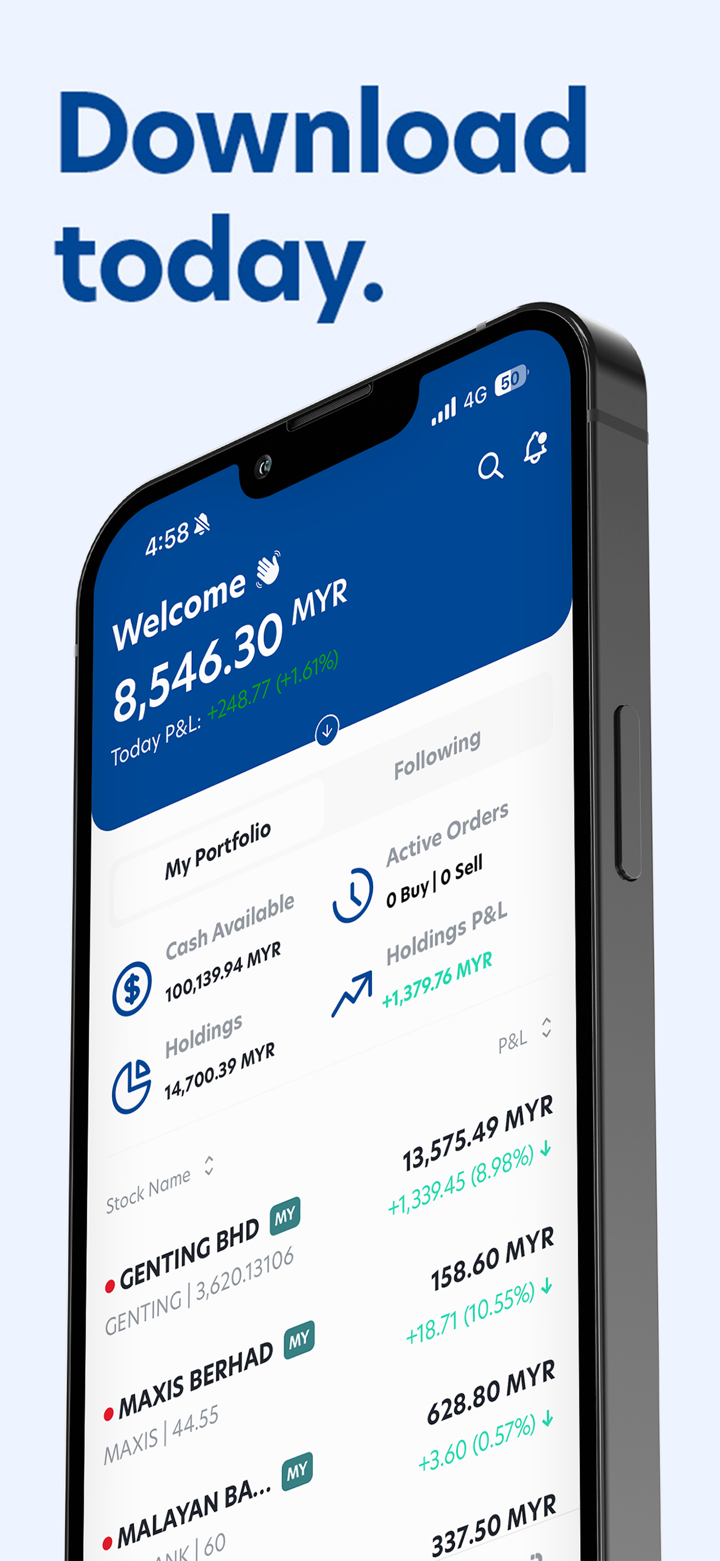

| 交易平台 | 支援 | 可用設備 | 適合對象 |

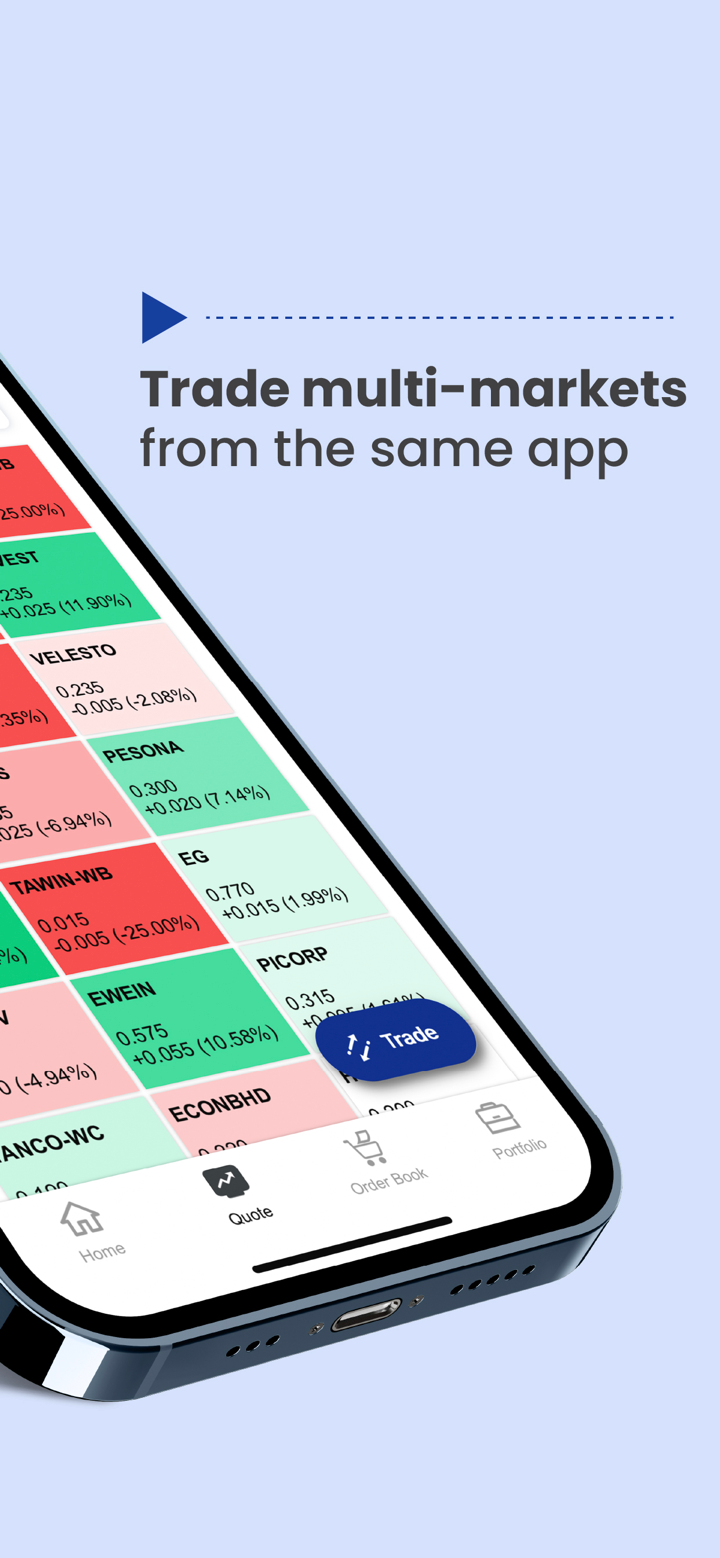

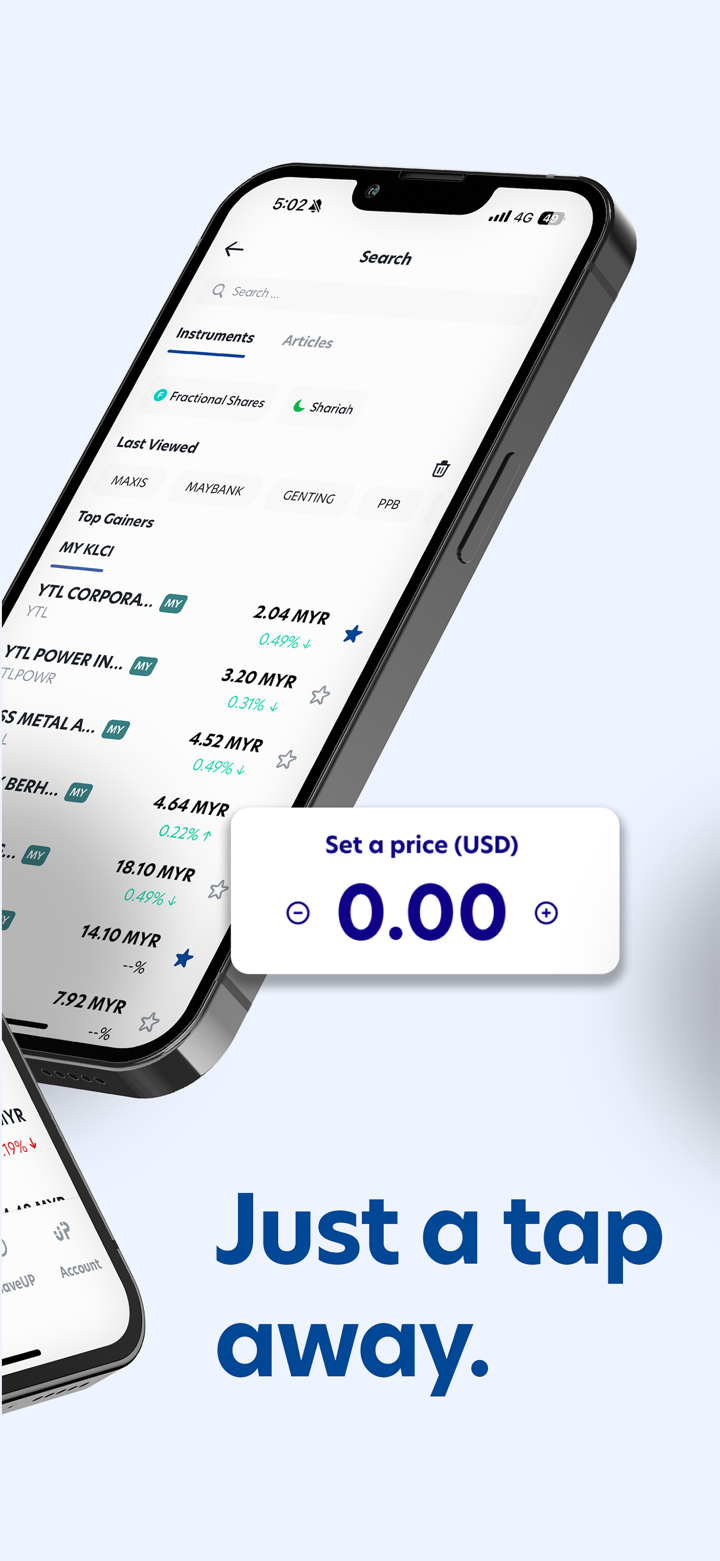

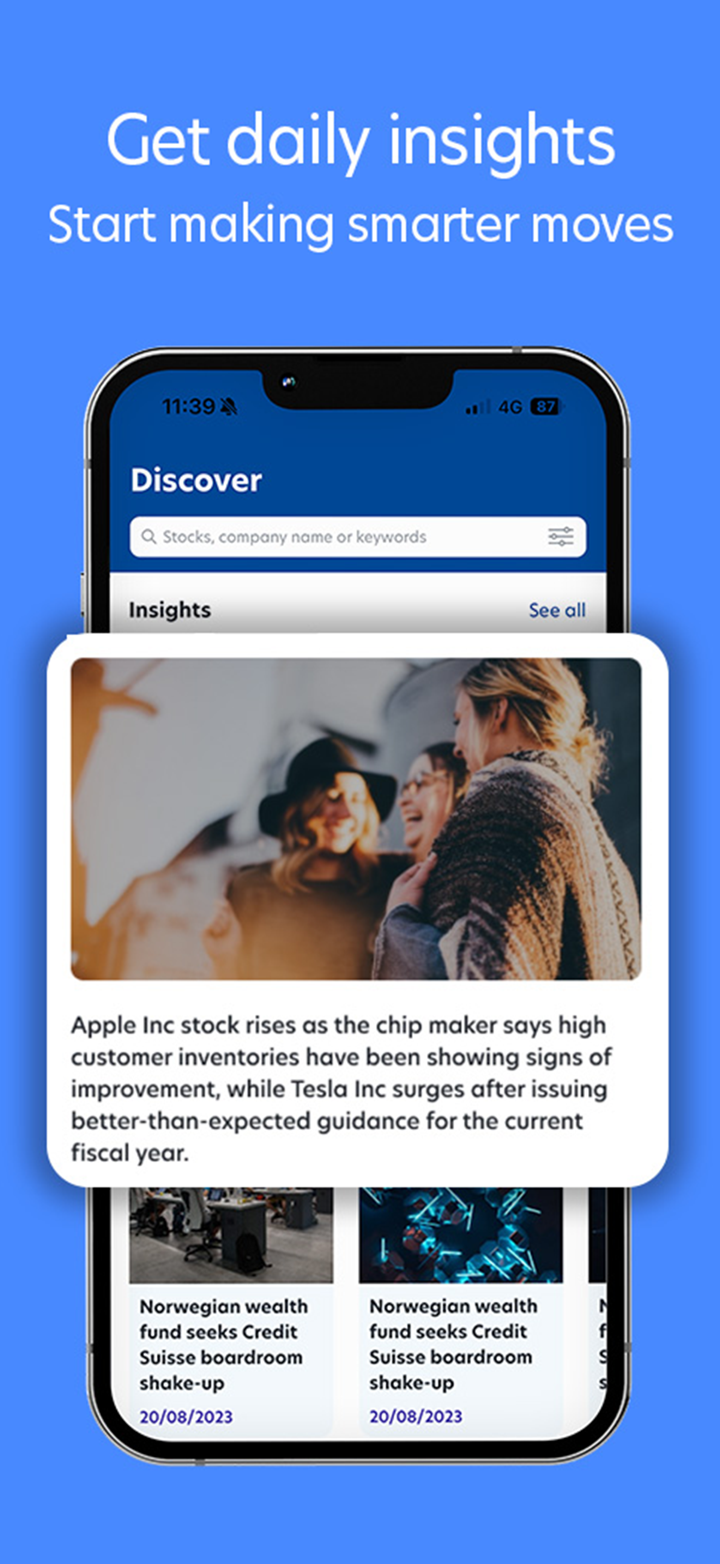

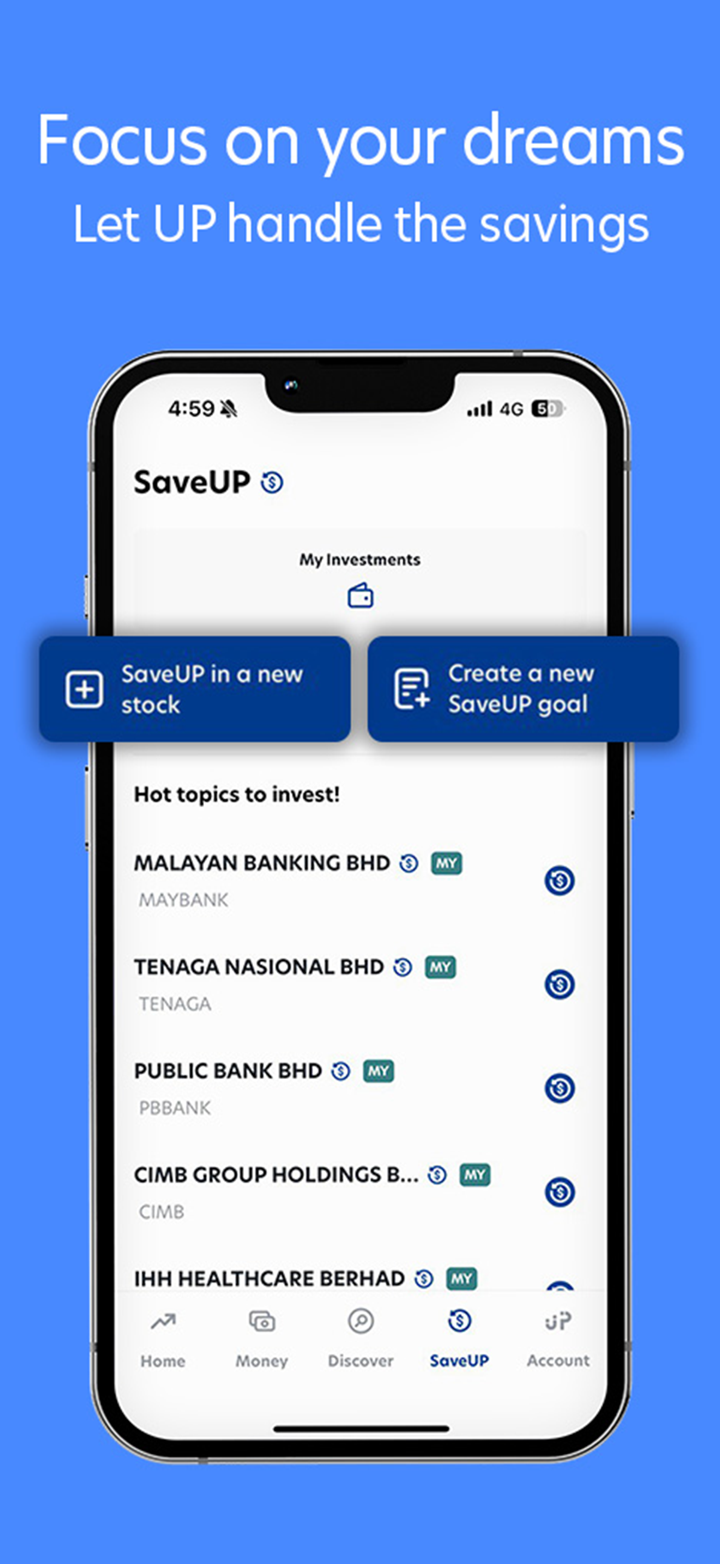

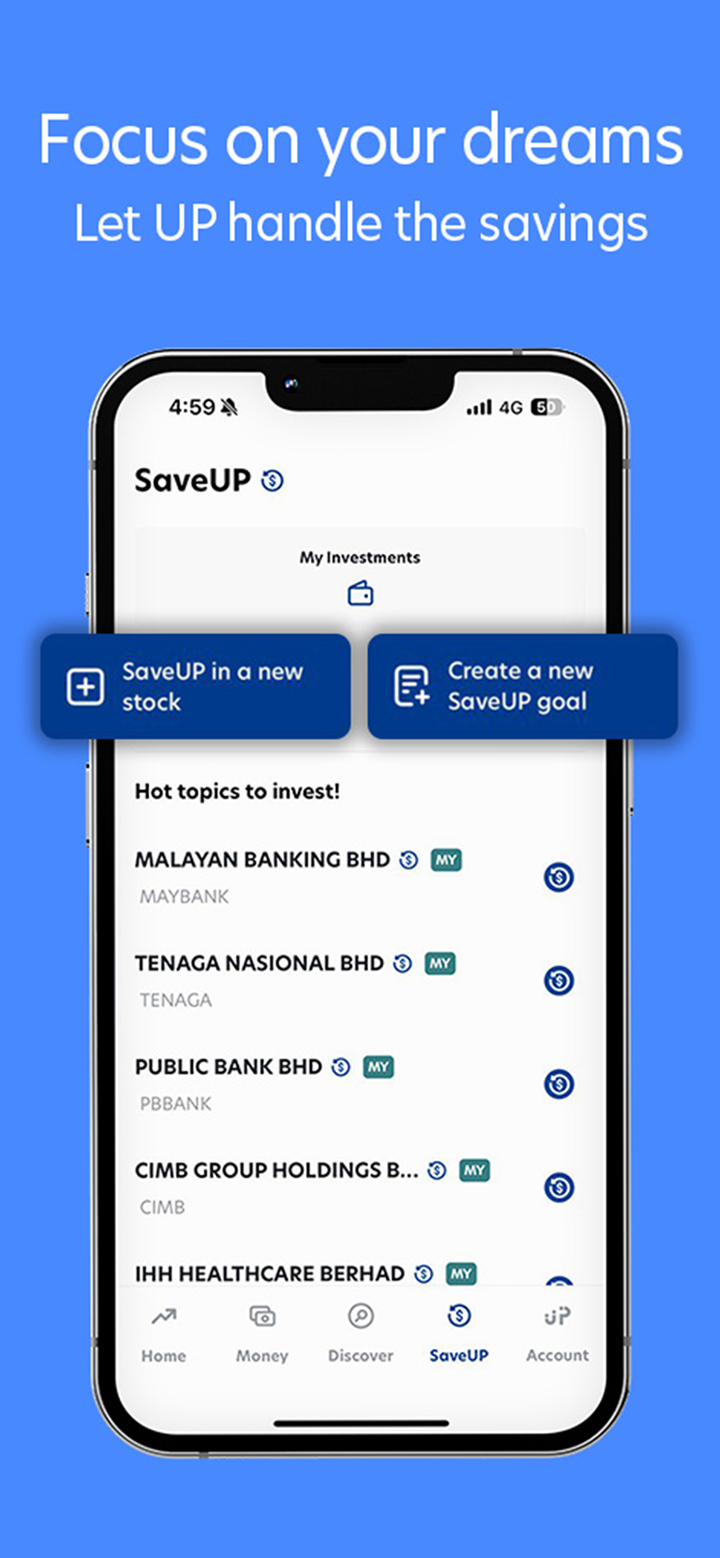

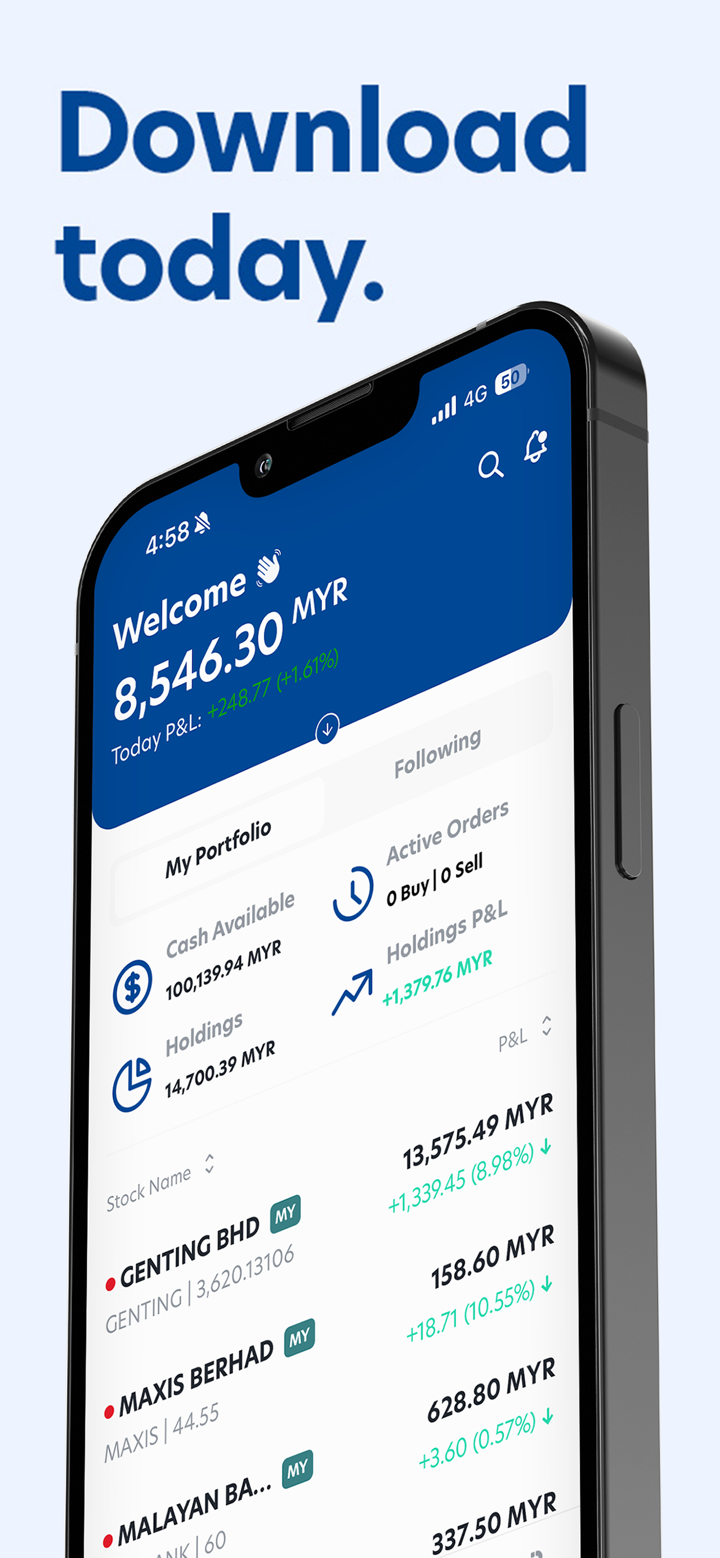

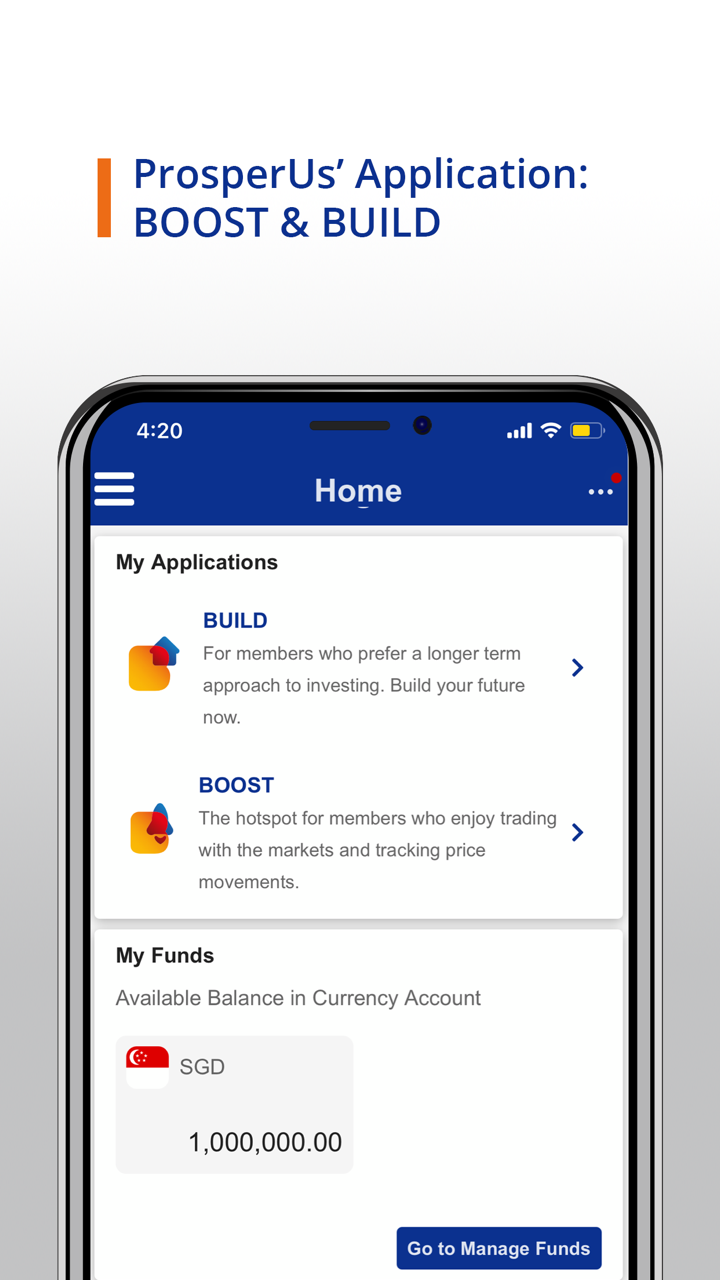

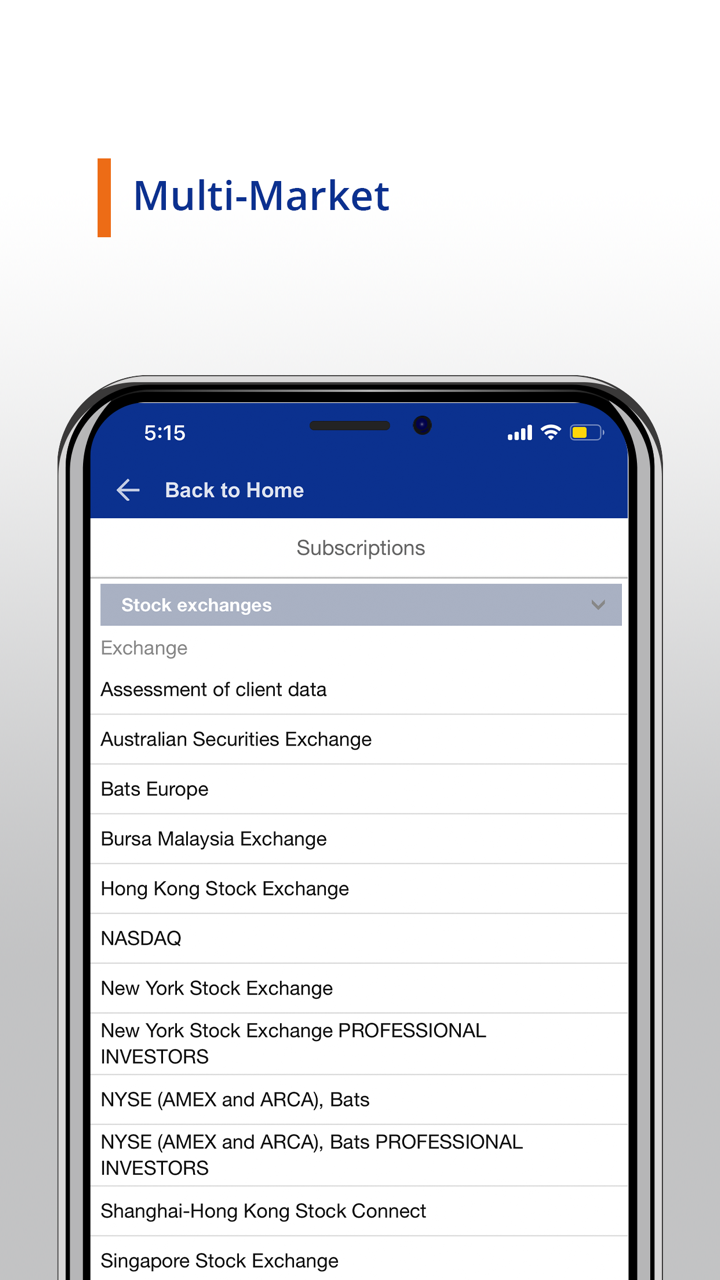

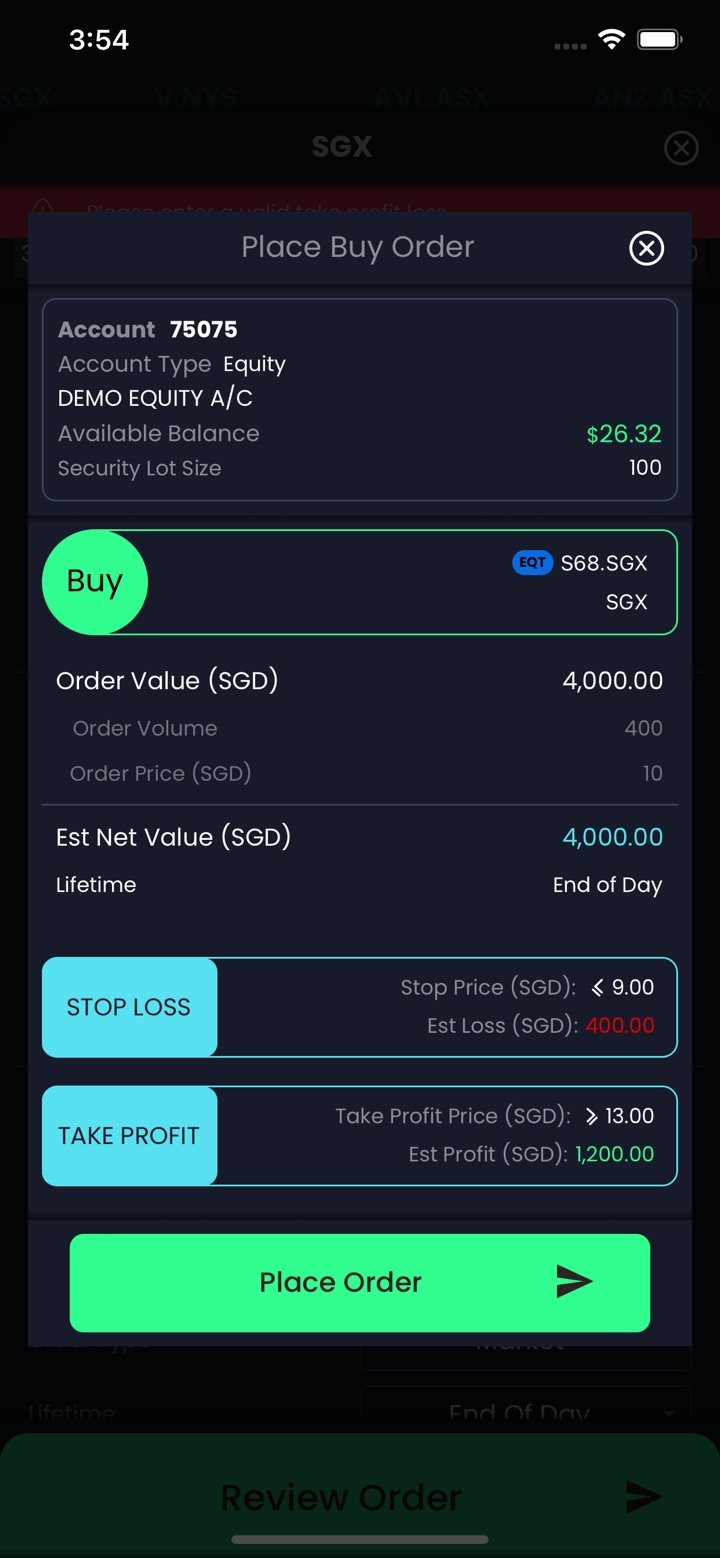

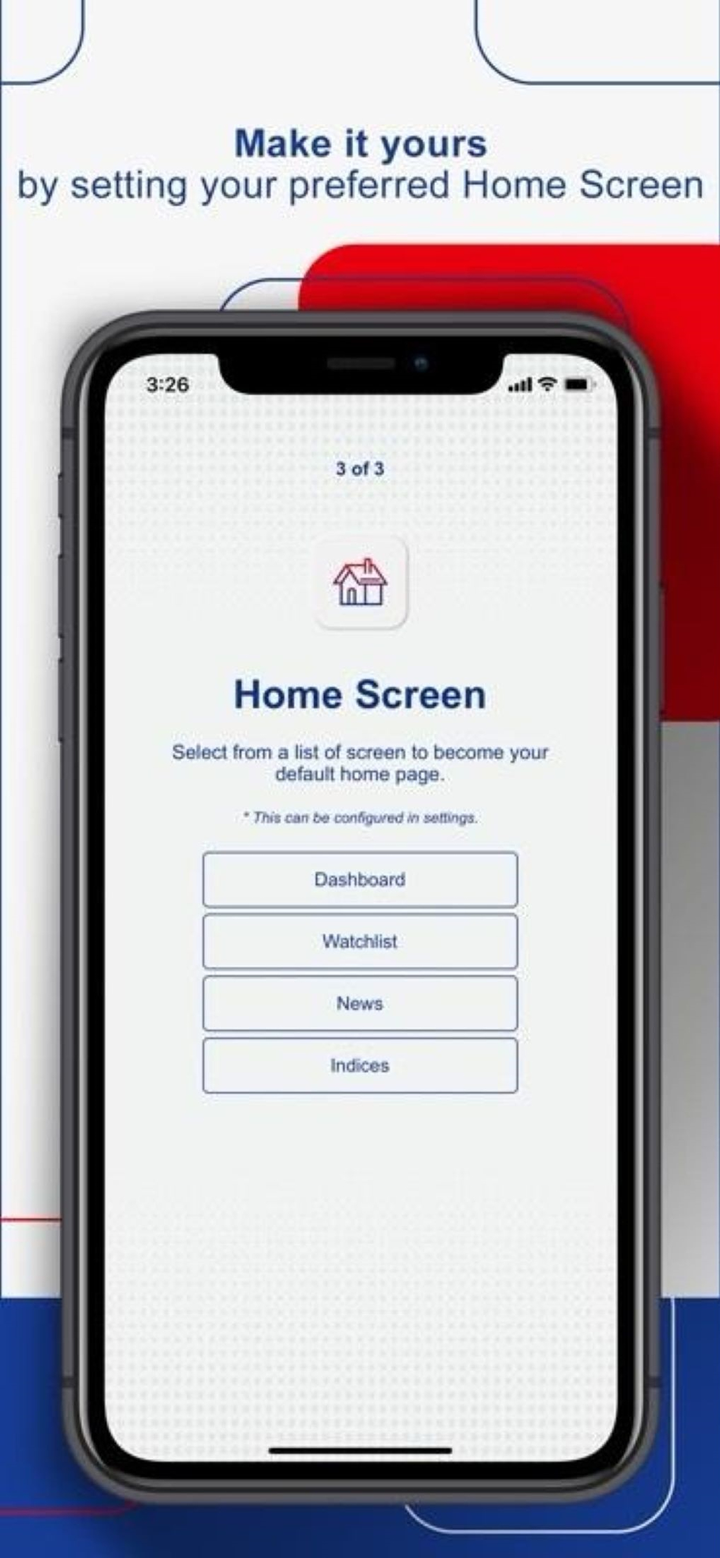

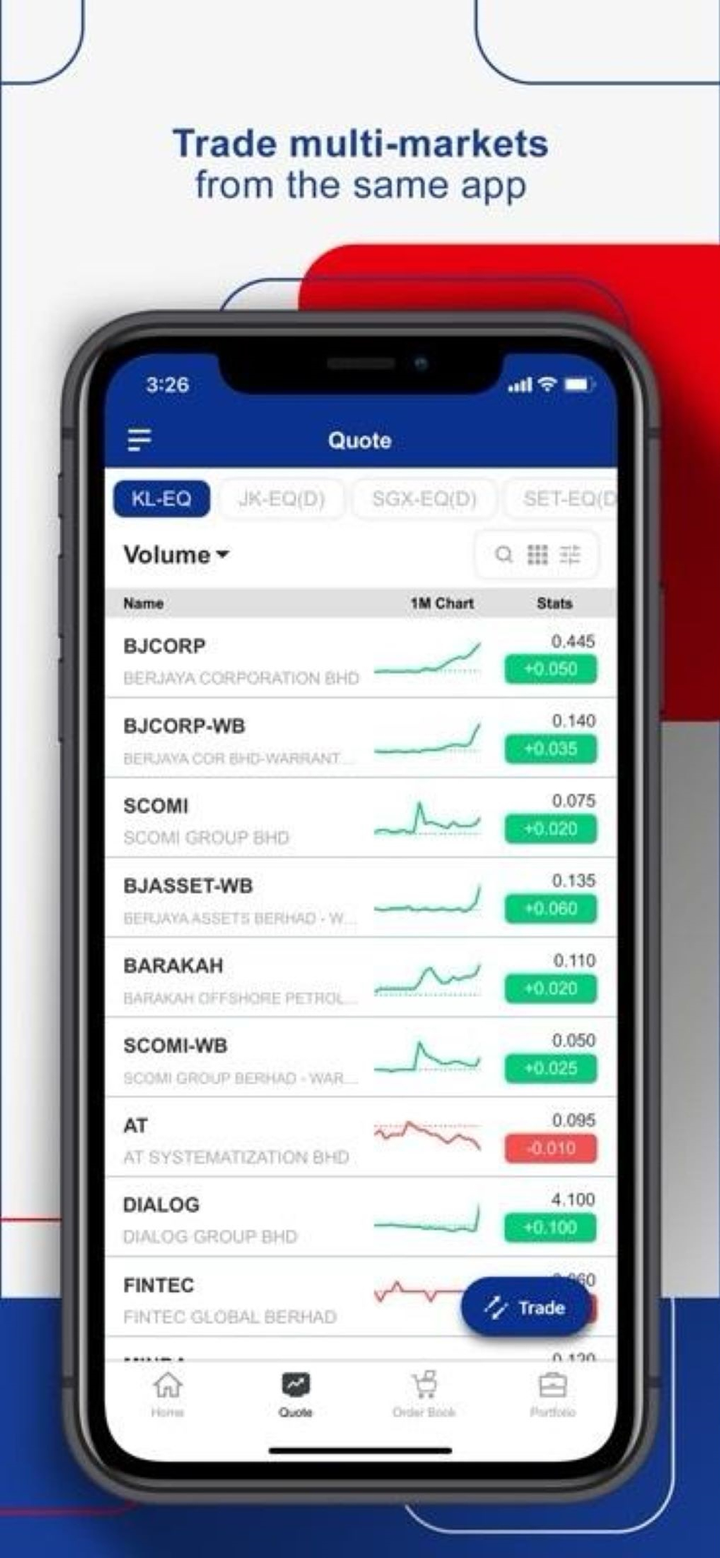

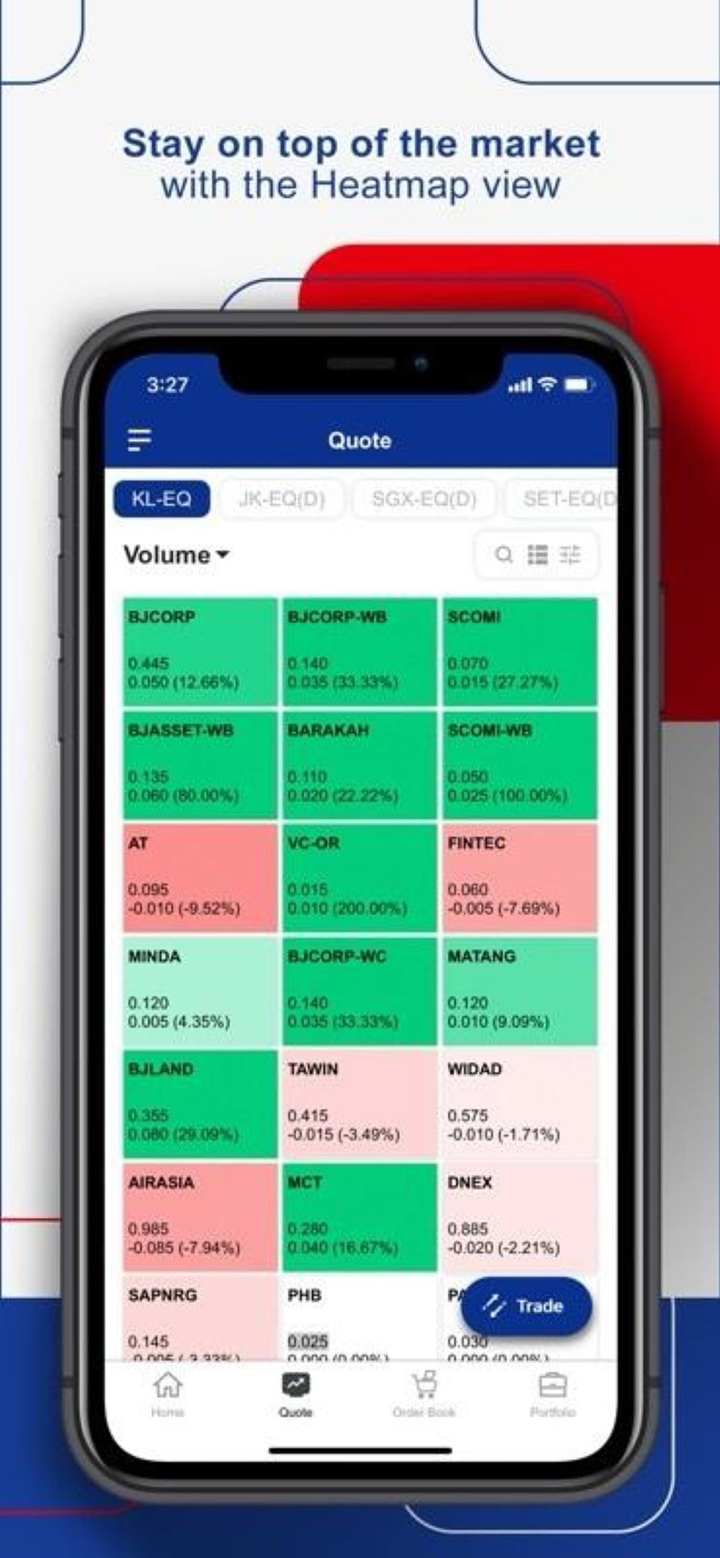

| WebTrader | ✔ | 網頁瀏覽器、MacOS、Windows | / |

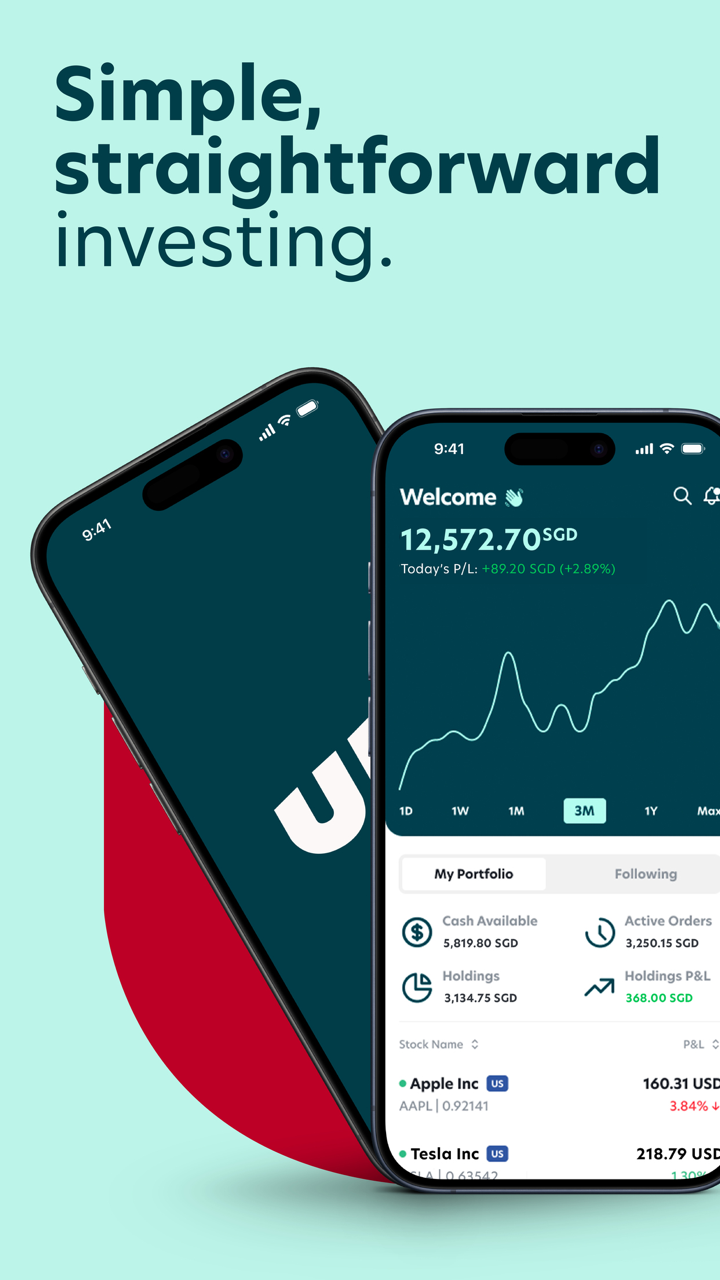

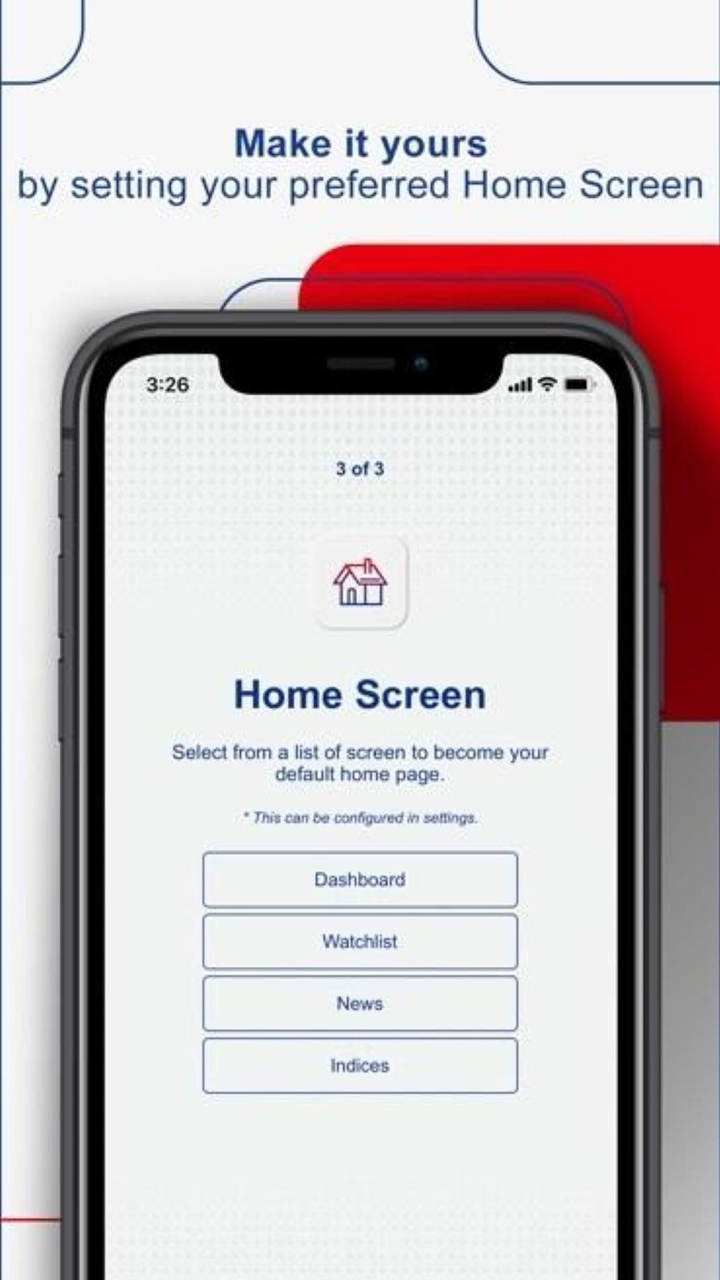

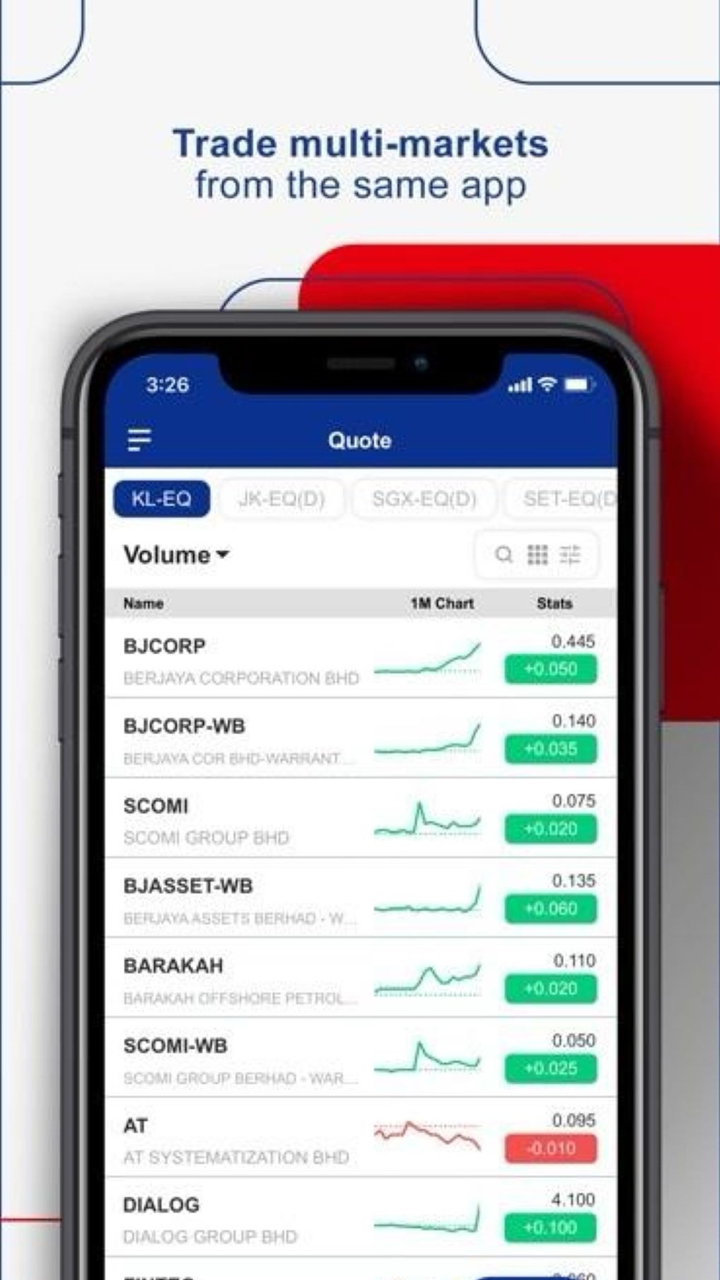

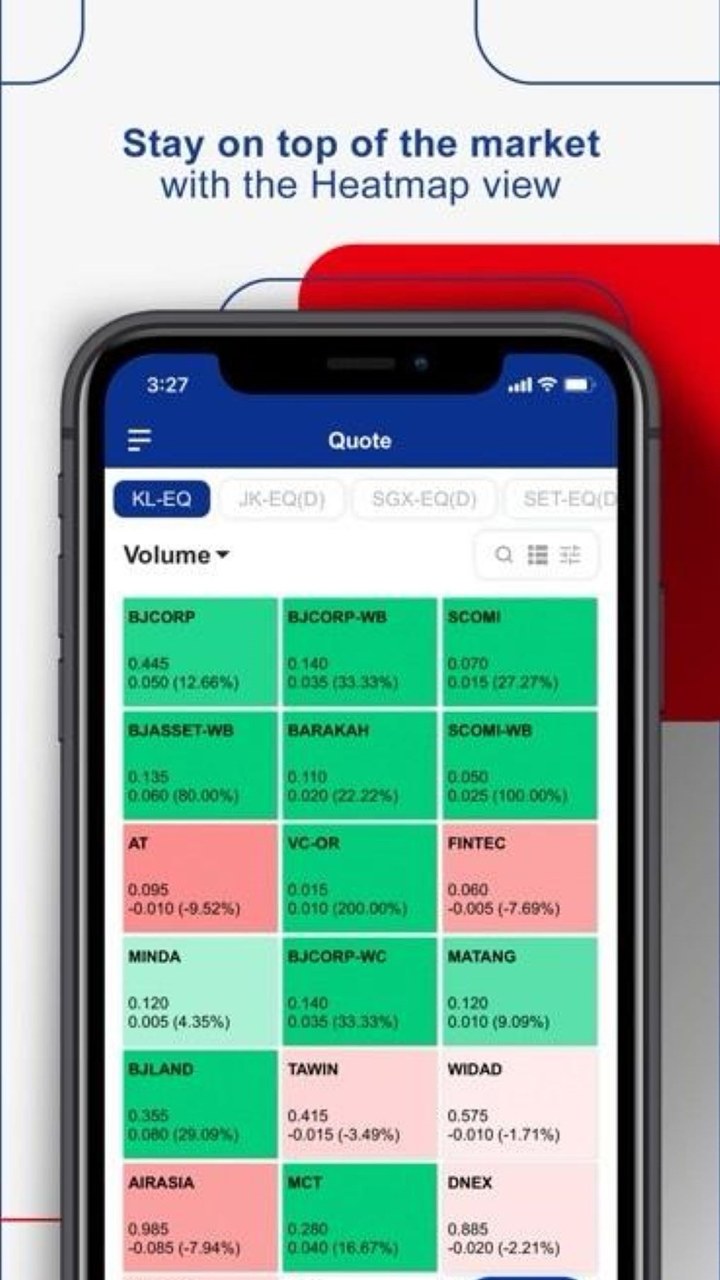

| 手機應用程式 | ✔ | iOS、Android | / |

| MT4 | ❌ | / | 初學者 |

| MT5 | ❌ | / | 經驗豐富的交易者 |

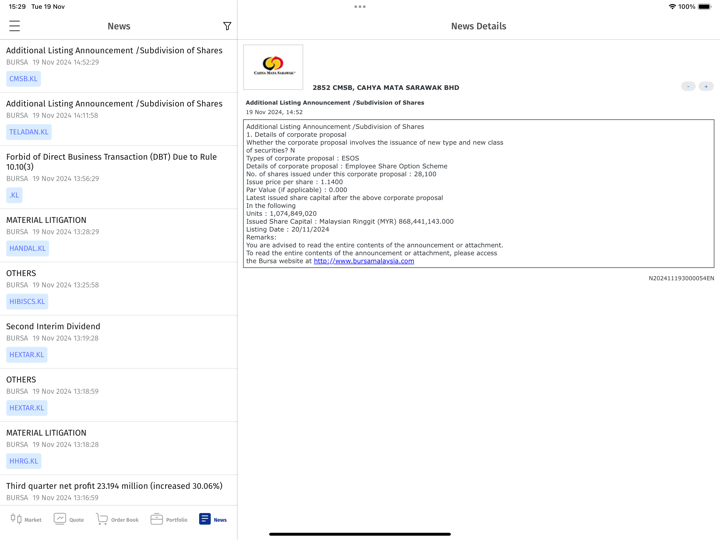

促銷活動

CGSCIMB 為客戶提供不同的促銷活動可供選擇。目前,客戶可以在開戶時獲得星巴克電子禮券。