Perfil de la compañía

| Shenwan Hongyuan Resumen de la reseña | |

| Fecha de fundación | 2015 |

| País/Región registrado | China |

| Regulación | Licencia de negociación de contratos de futuros de SFC (regulado), Licencia de negociación de valores de SFC (Excedida) |

| Instrumentos de mercado | Acciones, Futuros |

| Plataforma de negociación | e-service |

| Soporte al cliente | Formulario de contacto |

| Tel: (852) 2509-8395 | |

| Correo electrónico: ir@swhyhk.com | |

Información de Shenwan Hongyuan

Shenwan Hongyuan (H.K.) Limited es un proveedor de servicios financieros con sede en Hong Kong y una subsidiaria de Shenwan Hongyuan Group Co., Ltd., una firma de valores china. La empresa ofrece una amplia gama de servicios, que incluyen negociación de acciones y futuros, gestión de activos, finanzas corporativas y valores institucionales.

Pros y contras

| Pros | Contras |

| Regulado con una licencia de negociación de contratos de futuros | Licencia de negociación de valores excedida |

| Múltiples canales de contacto | Productos negociables limitados |

| Estructura de tarifas transparente |

¿Es Shenwan Hongyuan Legítimo?

Shenwan Hongyuan está regulado por la Comisión de Valores y Futuros de Hong Kong (SFC), con una Licencia de negociación de contratos de futuros (No AAF420). Mientras tanto, su Licencia de negociación de valores (No AAC927) ha sido excedida, lo que significa que las actividades asociadas con valores podrían implicar riesgos.

| Regulado por | Autoridad Reguladora | Estado Regulatorio | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| Comisión de Valores y Futuros de Hong Kong (SFC) | Regulado | Shenwan Hongyuan Futures (H.K.) Limited | Negociación de contratos de futuros | AAF420 |

| Comisión de Valores y Futuros de Hong Kong (SFC) | Excedido | Shenwan Hongyuan Securities (H.K.) Limited | Negociación de valores | AAC927 |

¿Qué puedo negociar en Shenwan Hongyuan?

Los traders pueden operar acciones y futuros en esta plataforma.

| Activo de Trading | Disponible |

| acciones | ✔ |

| futuros | ✔ |

| forex | ❌ |

| productos básicos | ❌ |

| índices | ❌ |

| acciones | ❌ |

| criptomonedas | ❌ |

| bonos | ❌ |

| opciones | ❌ |

| fondos | ❌ |

| ETFs | ❌ |

Tarifas

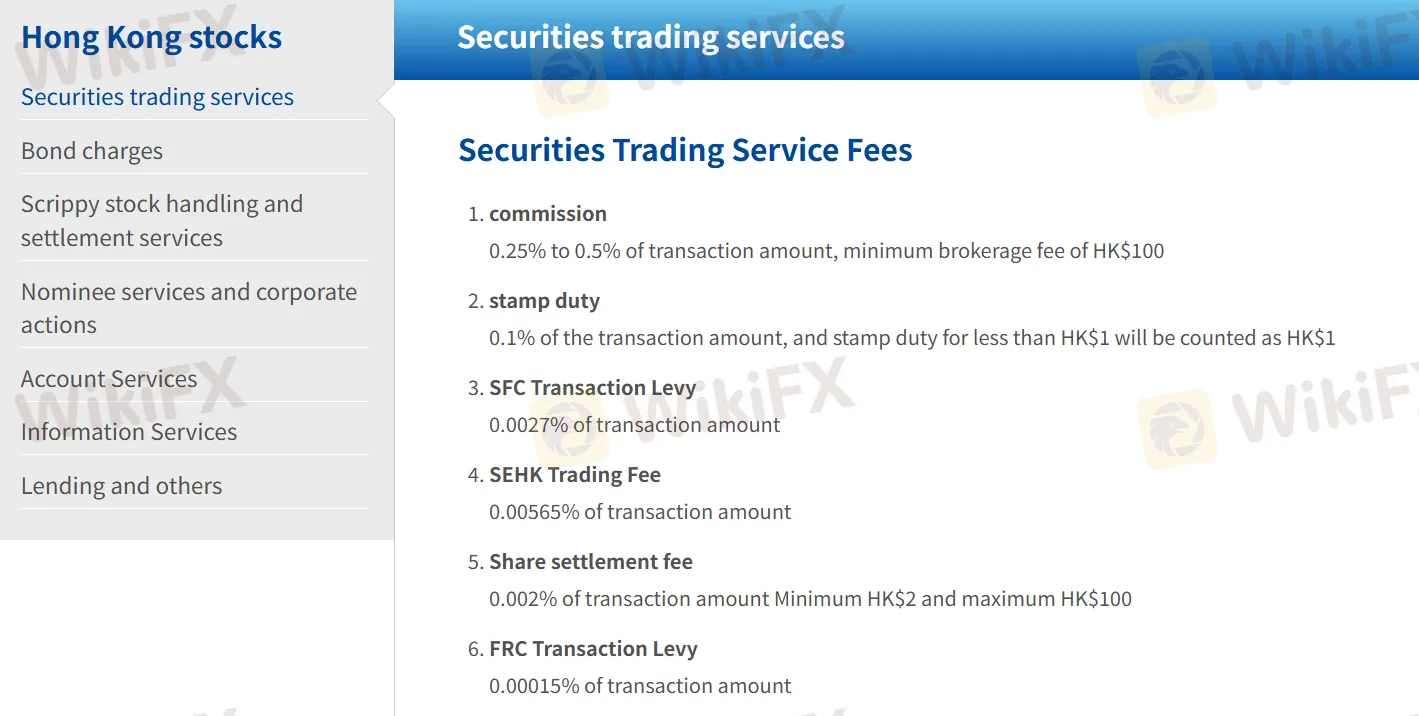

Shenwan Hongyuan proporciona una descripción clara de la estructura de tarifas en su sitio web.

A continuación se presentan varias tarifas de servicios de trading de valores, incluidos sus métodos de cálculo y los montos mínimos o máximos aplicables.

Para obtener más información sobre tarifas y cargos en esta plataforma, visite https://www.swhyhk.com/tc/wealth-management_hong-kong-equities/#trading-methods

| Servicio de Trading de Valores | Cargos |

| Comisión | 0.25% a 0.5% del monto de la transacción, tarifa mínima de corretaje de HK$100 |

| Impuesto de Timbre | 0.1% del monto de la transacción; el impuesto de timbre para menos de HK$1 se contará como HK$1 |

| Impuesto de Transacción de la SFC | 0.0027% del monto de la transacción |

| Comisión de Trading de la SEHK | 0.00565% del monto de la transacción |

| Comisión de Liquidación de Acciones | 0.002% del monto de la transacción, mínimo HK$2 y máximo HK$100 |

| Impuesto de Transacción de la FRC | 0.00015% del monto de la transacción |

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles |

| servicio electrónico | ✔ | Escritorio, Móvil, Web |

Depósito y Retiro

Procedimientos de Depósito

- Métodos Aceptados: Transferencias bancarias, cheques, giros bancarios y depósitos a través de sucursales designadas o centros express.

- Detalles de la Cuenta: Los depósitos deben hacerse a nombre de “Shenwan Hongyuan Securities (HK) Ltd”.

- Confirmación: Los clientes deben enviar por correo electrónico o fax el comprobante de depósito a funddeposit@swhyhk.com o fax al (852)-35258455.

Procedimientos de Retiro son los mismos tanto para acciones como para futuros.

- Complete y envíe por fax el formulario de retiro al (852)-35258455.

- Las instrucciones recibidas antes de las 12:00 PM se procesan el mismo día.

- Para transferencias telegráficas, se aplican tarifas de servicio.

Notas: El nombre del depositante debe coincidir con el nombre de la cuenta del cliente. No se aceptan depósitos de terceros ni depósitos en efectivo. Los depósitos deben cumplir con las regulaciones locales.