Company Summary

| AM Broker | Basic Information |

| Company Name | AM Broker |

| Founded | 2018 |

| Headquarters | Saint Vincent and the Grenadines |

| Regulations | Not regulated |

| Tradable Assets | Currency pairs, CFDs on indices, shares, ETFs, commodities, cryptocurrencies |

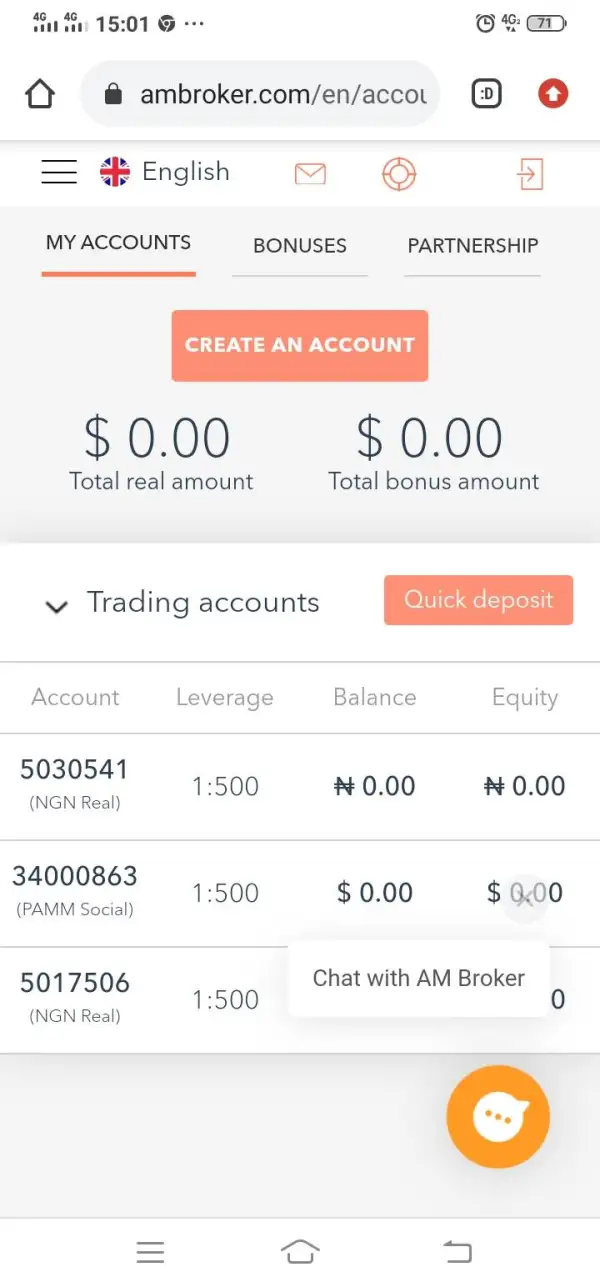

| Account Types | Demo, Retail, Professional, Institutional Account |

| Minimum Deposit | $1000 |

| Maximum Leverage | 1:500 |

| Spreads | Variable |

| Commission | Variable |

| Payment Methods | VISA and MasterCard or electronic payment methods such as Neteller, FastPay, and Skrill |

| Trading Platforms | MetaTrader 5, Web Trading, iOS/Android apps |

| Trading Tools | Economic calendar, technical analysis signals, research reports |

| Customer Support | Email (info@ambroker.com, vietnam@ambroker.com, indonesia@ambroker.com)Phone (+44 20 36 704 699 or +44 2036704699) |

| Education Resources | Online courses and video seminars |

| Bonus Offerings | Sign-up bonus |

Overview of AM Broker

AM Broker, established in 2018 and based in Saint Vincent and the Grenadines, is an online trading platform that offers a wide range of financial instruments. Traders can access currency pairs, CFDs on indices, shares, ETFs, commodities, and cryptocurrencies through AM Broker. The platform provides various account types, including Demo, Retail, Professional, and Institutional Accounts, to suit different levels of trading experience and preferences. Available trading platforms include MetaTrader 5, Web Trading, and iOS/Android apps. However, it is important to note that AM Broker operates without regulatory oversight, which introduces potential risks associated with unregulated trading.

Is AM Broker Legit?

AM Broker is not regulated. It is crucial to understand that this broker operates without any valid regulation, lacking oversight from recognized financial regulatory authorities. Traders should exercise caution and be aware of the associated risks when considering trading with an unregulated broker like AM Broker. This absence of regulation may result in limited options for dispute resolution, potential safety and security issues regarding funds, and a lack of transparency in the broker's business practices. Therefore, traders are advised to thoroughly research and consider the regulatory status of a broker before engaging in trading activities to ensure a safer and more secure trading experience.

Pros and Cons

AM Broker offers a wide selection of trading instruments, providing traders with diverse investment opportunities. The platform employs the widely used MetaTrader 5, known for its advanced features and user-friendly interface. However, it operates without regulatory oversight, which may expose traders to potential risks associated with unregulated environments. Additionally, there is a lack of transparency regarding the company's policies and procedures, which could undermine trader confidence. Furthermore, the inability to access the website presents a significant challenge for users seeking information or support.

| Pros | Cons |

|

|

|

|

|

Trading Instruments

AM BROKER provides a diverse range of trading instruments across 6 asset classes, catering to the varying needs and preferences of traders.

In the Forex market, traders can access a comprehensive selection of 100 currency pairs, encompassing major, minor, and exotic pairs, with floating spreads starting at 0.6 pips. With a maximum leverage of 1:500, traders have ample flexibility to execute their trading strategies effectively.

For CFDs on commodities, AM BROKER offers leverage of up to 1:500, featuring popular commodities such as gold, silver, gas, oil, and Brent.

Traders interested in indices can choose from a total of 20 indices, also with leverage up to 1:500.

Furthermore, AM BROKER provides access to over 3,000 stocks for CFD trading, with a maximum leverage of 1:20, offering ample opportunities for diversified trading.

Additionally, traders can explore CFDs on ETFs, with up to 300 ETFs available from 25 stock exchanges, and leverage of up to 1:20.

Finally, for cryptocurrency enthusiasts, AM BROKER offers CFDs on top cryptocurrencies like Bitcoin, Bitcoin Cash, Ripple, Ethereum, and Litecoin, with leverage of up to 1:5.

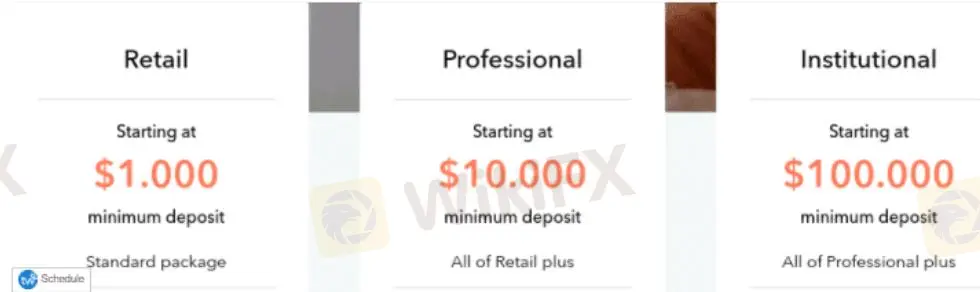

Account Types

AM Broker offers a range of account types tailored to suit the diverse needs of traders: Demo, Retail, Professional, and Institutional Accounts.

The demo account replicates the conditions of live trading, providing traders with access to all functions and features available on a live account, but with virtual funds, ensuring a risk-free environment for practice. However, profits earned on the demo account cannot be withdrawn.

The Retail Account requires a minimum deposit of $1,000 and is suitable for individual traders.

The Professional Account, requiring a minimum deposit of $10,000, caters to experienced traders seeking enhanced trading features and benefits.

The Institutional Account, with a minimum deposit of $100,000, is designed for institutional investors and provides specialized services tailored to their needs.

| Account Type | Minimum Deposit | Maximum Leverage | Commission | Spread Type |

| Retail Account | $1 000 | 1:500 | No | From 0.6 pips |

| Professional Account | $10 000 | 1:500 | Commission 3 USD per lot per deal for Indices, 7 USD per lot per deal for Commodities, from 7 USD per lot per deal for Forex | From 0.0 pip |

| Institutional Account | $100 000 | Competitive Spreads |

Leverage

The maximum leverage offered by AM Broker for both Retail and Professional accounts is 1:500.

Spreads and Commissions

In the Retail Account offered by AM Broker, traders benefit from competitive spreads, starting from as low as 0.6 pips. Unlike some brokers, there are no commissions charged on trades within this account type, allowing traders to keep more of their profits.

On the other hand, the Professional Account provides traders with even tighter spreads, starting from 0.0 pips, offering enhanced trading conditions. However, there are commissions applicable to certain instruments traded within this account type. For instance, traders are charged a commission of 3 USD per lot per deal for Indices, 7 USD per lot per deal for Commodities, and a variable commission starting from 7 USD per lot per deal for Forex trades.

Lastly, the Institutional Account offers competitive spreads.

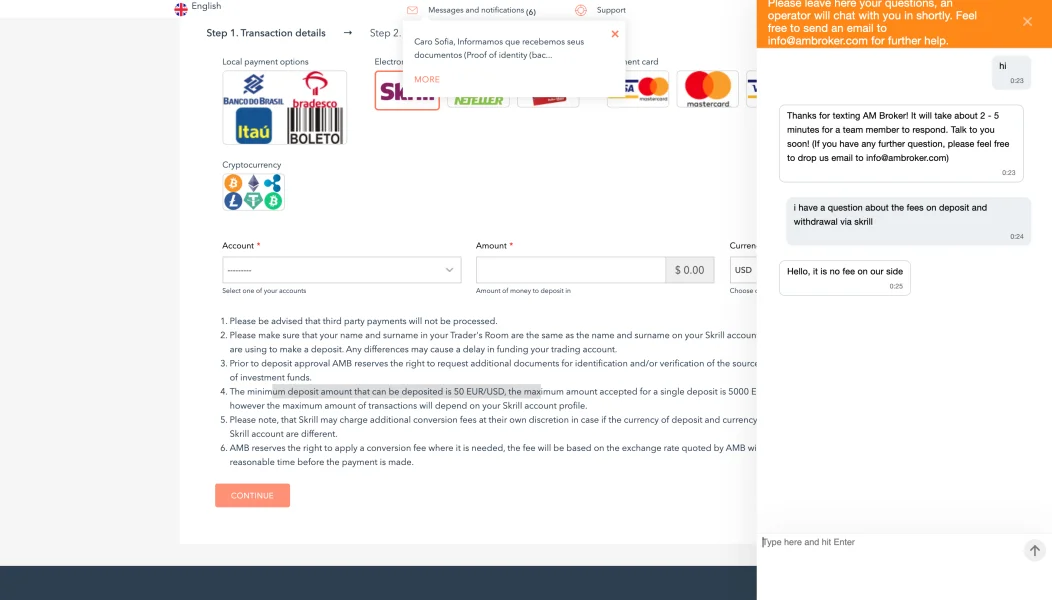

Deposit & Withdraw Methods

AM BROKER offers multiple convenient payment methods for funding accounts and processing withdrawals. Traders can fund their accounts with a minimum of $1,000 for Retail, $10,000 for Professional, and $100,000 for Institutional accounts, without any specified maximum deposit limit.

Payment methods include credit/debit card payments using VISA and MasterCard, as well as electronic payment options such as Neteller, FastPay, and Skrill.

However, it's important to note that money withdrawals can only be made via Visa or MasterCard, which may be perceived as a disadvantage due to the longer processing time, taking almost a whole week for funds to be withdrawn using these platforms.

Additionally, transfers may experience delays of up to 5 days in cases where documents about the account holder are missing or remain unverified, highlighting the importance of ensuring all required documentation is provided promptly to avoid any delays in processing withdrawals.

Trading Platforms

AM BROKER provides traders with three main trading platforms: MetaTrader 5 (MT5), a robust platform known for its advanced features and automated trading capabilities; a Web platform accessible via web browsers for convenient trading; and a Mobile platform, allowing traders to stay connected to the markets on the go.

Trading Tools

AM BROKER offers traders access to a range of trading tools, including an economic calendar, technical analysis signals, research reports, and a blog. Additionally, they provide a competitive robot-trading tool for automated trading.

Educational Resources

AM BROKER provides educational resources to support traders in enhancing their knowledge and skills in trading. These resources include online courses and video seminars. Additionally, traders with a professional account benefit from access to a portfolio managed by a dedicated account manager who offers personalized one-on-one training sessions.

Customer Support

Their support team is available 24 hours a day, five days a week, ensuring assistance is accessible whenever needed. Traders can reach out to the support team via email atinfo@ambroker.com, or through dedicated email addresses for specific regions such as Vietnam (vietnam@ambroker.com) and Indonesia (indonesia@ambroker.com). Additionally, traders can seek assistance via phone, with English support available at +44 20 36 704 699 and Chinese (Simplified) support also accessible at +44 2036704699.

Conclusion

In conclusion, AM Broker provides traders with a wide array of trading instruments, offering diverse investment opportunities to suit various trading preferences. The platform utilizes the widely acclaimed MetaTrader 5, renowned for its advanced features and intuitive interface, enhancing the trading experience for users. However, the absence of regulatory oversight raises concerns about potential risks in an unregulated environment. Furthermore, the lack of transparency regarding the company's policies and procedures may undermine trader confidence. Additionally, the inability to access the website poses a significant challenge for users seeking information or support.

FAQs

Q: Is AM Broker regulated?

A: No, AM Broker operates without regulation, which means it lacks oversight from recognized financial regulatory authorities.

Q: What trading instruments are available on AM Broker?

A: AM Broker offers a range of trading instruments, including currency pairs, CFDs on indices, shares, ETFs, commodities, and cryptocurrencies.

Q: What account types does AM Broker offer?

A: AM Broker provides various account types, including Demo, Retail, Professional, and Institutional Accounts, catering to different trading preferences and experience levels.

Q: How can I contact AM Broker's customer support?

A: You can reach AM Broker's customer support via email at info@ambroker.com. Additionally, traders can use dedicated email addresses for specific regions such as Vietnam (vietnam@ambroker.com) and Indonesia (indonesia@ambroker.com). Phone support is also available with English support at +44 20 36 704 699 and Chinese (Simplified) support at +44 2036704699.

Risk Warning

Trading online comes with inherent risks, and there's a possibility of losing your entire investment. It's crucial to understand these risks and recognize that not all traders or investors may be suited for online trading. Please keep in mind that the information provided in this review could change due to updates in the company's services and policies. The date of this review is also essential, as information might have changed since it was generated. Therefore, it's recommended to verify any updated information directly with the company before making any decisions or taking action. Ultimately, the responsibility for using the information provided in this review lies with the reader.

FX4565780092

Vietnam

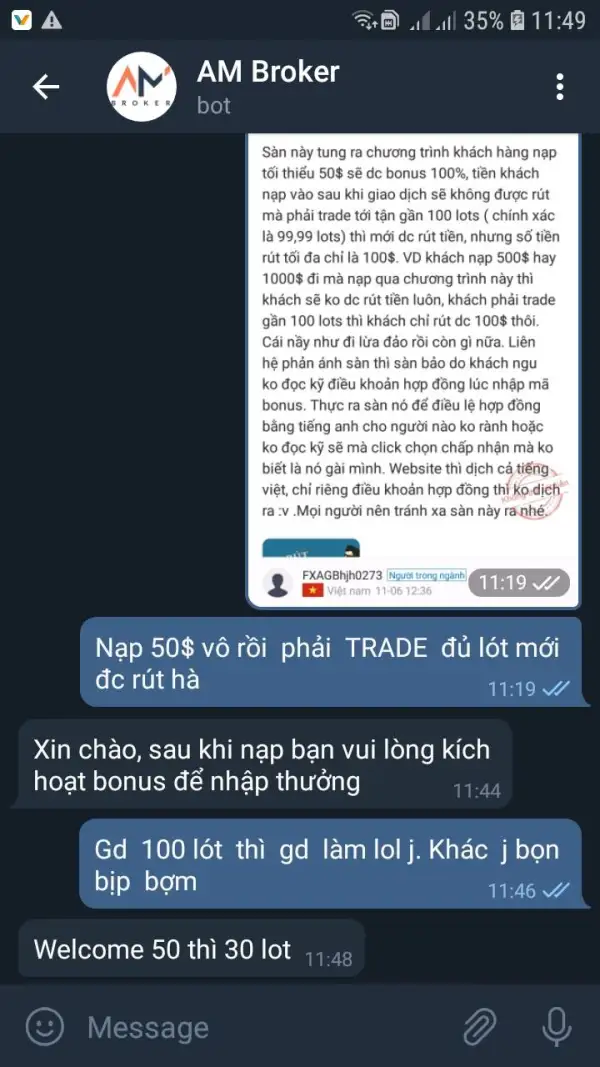

The broker carried out an activity, you should deposit at least $50 to get the 100% bonus. You can't withdraw your funds untill trading 100 lots (Actually, it's 99.99 lots) But the maximum amount is $100. It's a scam. I contacted the customer service while they said this was according to the contrct terms。 But in act, the contract terms are written in English. Please stay away from this broker.

Exposure

FX3949609030

Vietnam

Scam.

Exposure

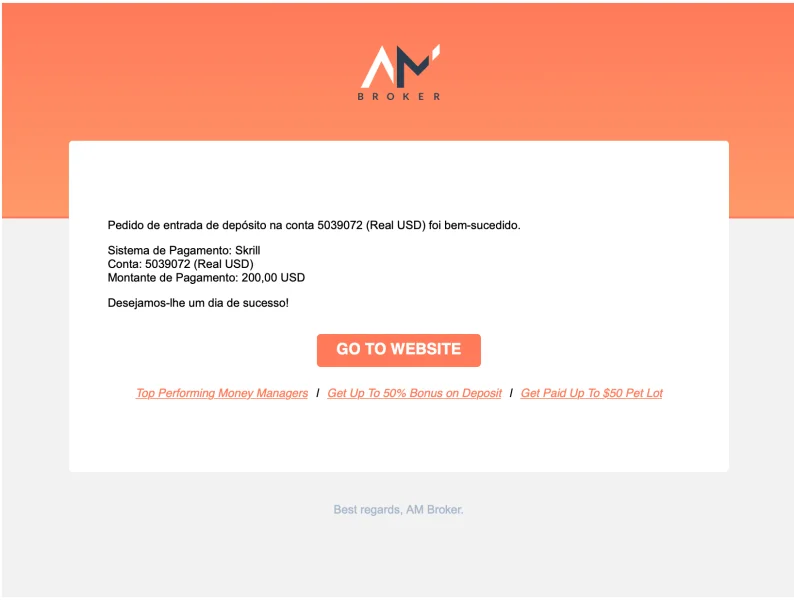

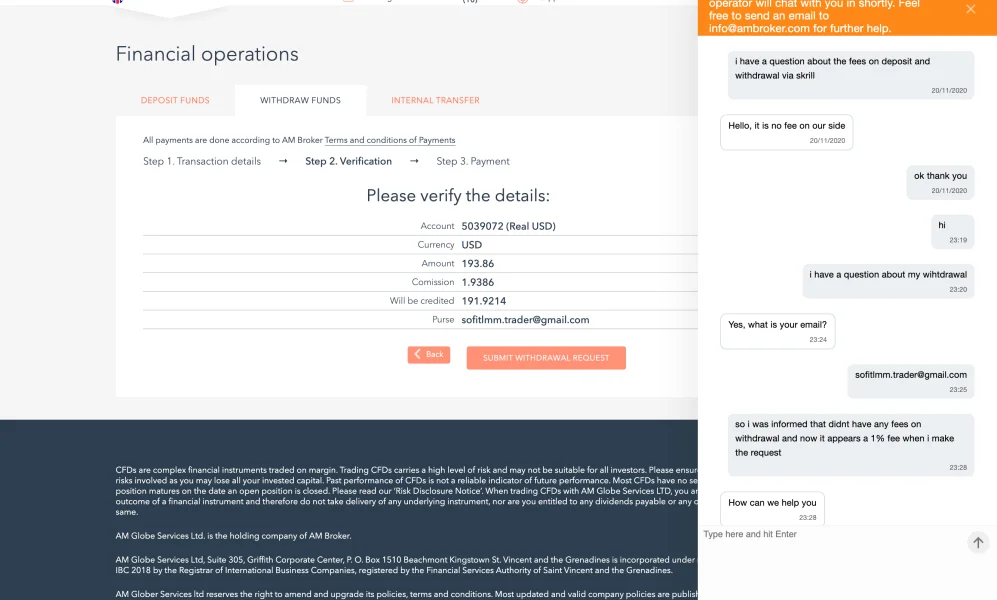

MrTrader

Brazil

I asked before i deposit if there was any fees and the support team answer me NO. after i deposit, i start my trades and there was a BIG SLIPPAGE AND EXECUTION TIME for each and every trade i took. Clearly they use plugins. Fine, i went to withdrawal my money and surprise 1% fee of NOWERE. I have deposit via skrill USD and when i went to withdrawal there was the only option i had ( of course) and there is a 1%fee of different currency from the one i withdrawal. I went to live chat to clarify and completely LOST OF TIME. RIDICULOUS live chat. they dont know their job nether help an issue from their side. NEVER AGAIN. DONT DEPOSIT ON THIS COMPANY. SCAM!!!!!

Exposure

FX2177465712

Nigeria

am broker is a big scam they control their server 4time for me to lose the trades and at the end they remove all my money because of inactive of 2month without notifying me.

Exposure