Company Summary

| Afterprime Review Summary | |

| Founded | 2018 |

| Registered Country/Region | United Kingdom |

| Regulation | CySEC (License 368/18), Seychelles FSA (License SD057), Suspicious ASIC Clone (License 404300) |

| Market Instruments | Forex, Cryptocurrencies, Commodities, Indices, Stocks |

| Demo Account | ✅ |

| Leverage | Up to 30:1 |

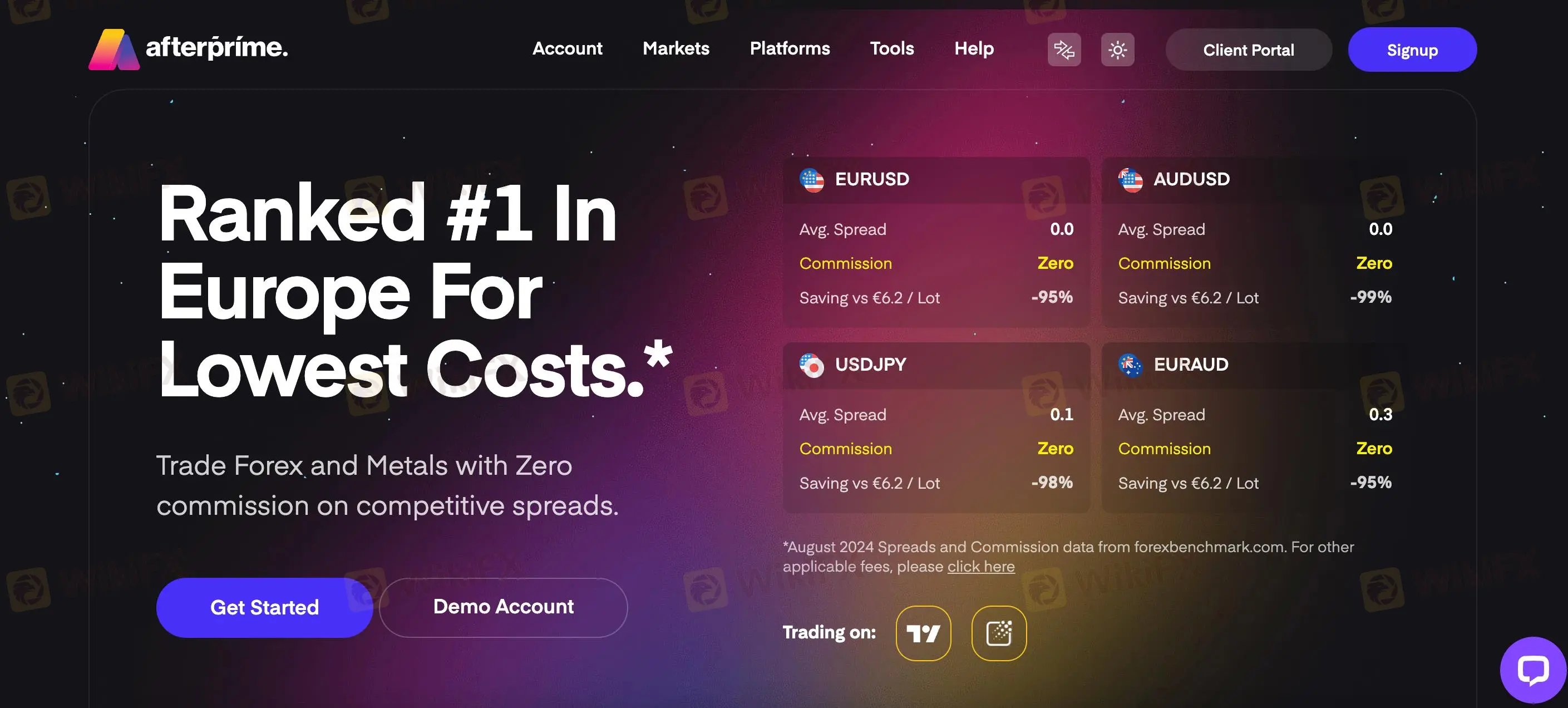

| Spread | EUR/USD: 0.7 pips |

| Trading Platform | TradingView, MetaTrader 4 (MT4), TraderEvolution, FIX API |

| Min Deposit | Recommended 200 EUR or equivalent |

| Customer Support | 24/5 Onlin chat |

Afterprime Information

Globally known broker created in 2018, Afterprime provides a range of trading assets including commodities, currency, and cryptocurrencies. For its European operations, it follows CySEC rules; likewise, the Seychelles FSA licenses it. But traders should be wary of its ASIC suspicious clone license. Afterprime serves both retail and professional traders with low fees and strong trading tools.

Pros and Cons

| Pros | Cons |

| Regulated by CySEC | Suspicious ASIC clone license |

| Low spreads and commission fees | Offshore Seychelles license less stringent |

| Advanced trading platforms with multi-device support | No Islamic account support |

| No deposit or withdrawal fees | Limited leverage for certain instruments (1:2 for Crypto Assets) |

Is Afterprime Legit?

Operations under several licenses define Afterprime. Under license 368/18, CySEC ( Cyprus) controls it and permits Afterprime Europe Limited to offer STP brokerage services since July 30, 2018, therefore guaranteeing compliance with EU criteria.

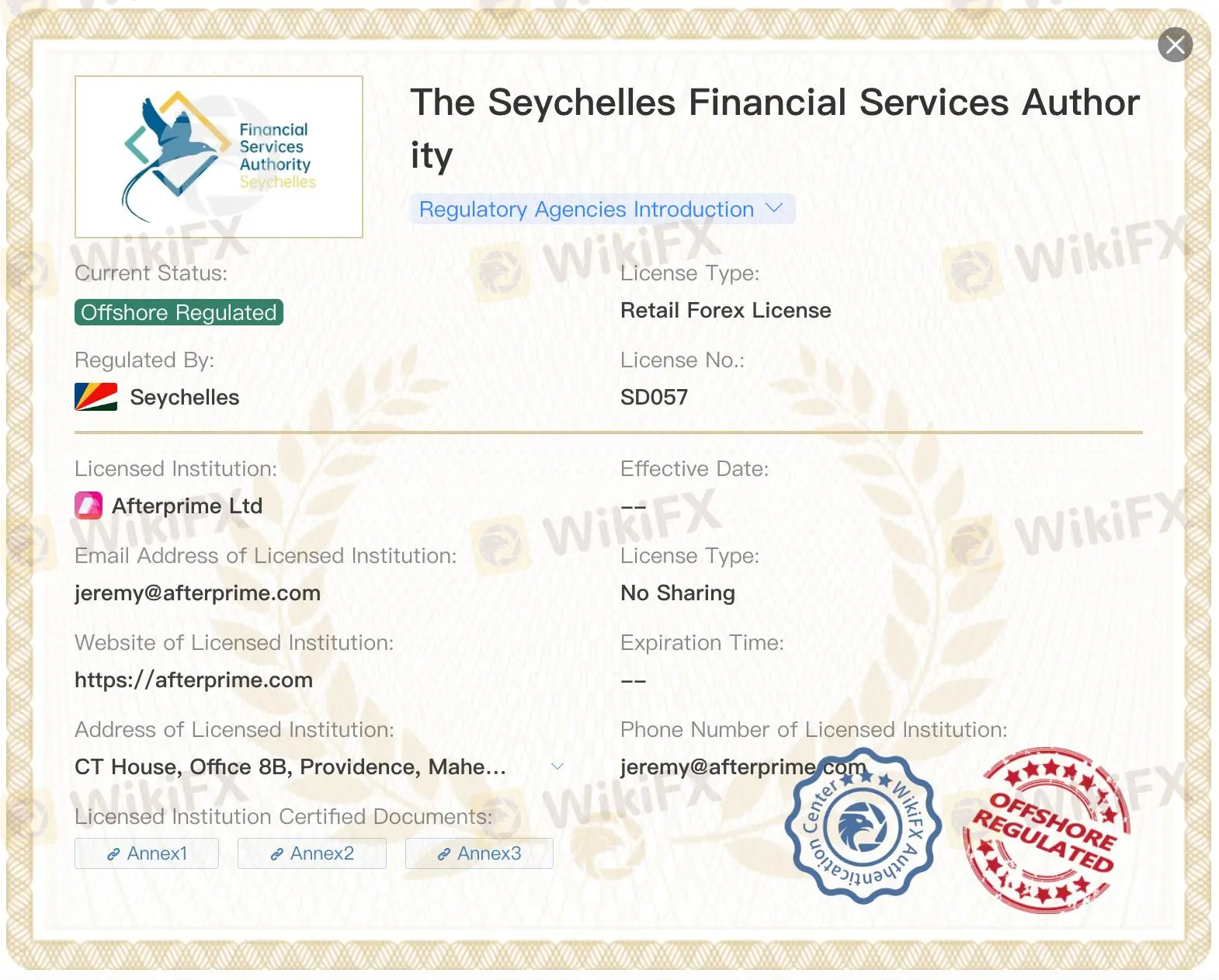

Though this rules is less strict, the Seychelles FSA also licenses it under license SD057 for retail currency services.

Nevertheless, a purported ASIC (Australia) license 404300 has been identified as a dubious clone that deceives traders. Investors should steer clear of companies associated with dubious licensing and give priority to CySEC services for dependability.

| License Authority | License Type | License Number |

| Cyprus Securities and Exchange Commission (CySEC) | EU Financial Regulation | 368/18 |

| Seychelles Financial Services Authority (FSA) | Retail Currency Services | SD057 |

| Australian Securities and Investment Commission (ASIC) | Financial Market Regulation (Clone Suspected) | 404300 |

What Can I Trade on Afterprime?

Afterprime provides a large selection of trading instruments, such as equities, indices, commodities, FX, and cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Cryptocurrencies | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

Account Types

Afterprime features live trading accounts as well as demo ones. These kind of accounts satisfy traders with different degrees of tastes and experience. There is no particular reference to Islamic viewpoints.

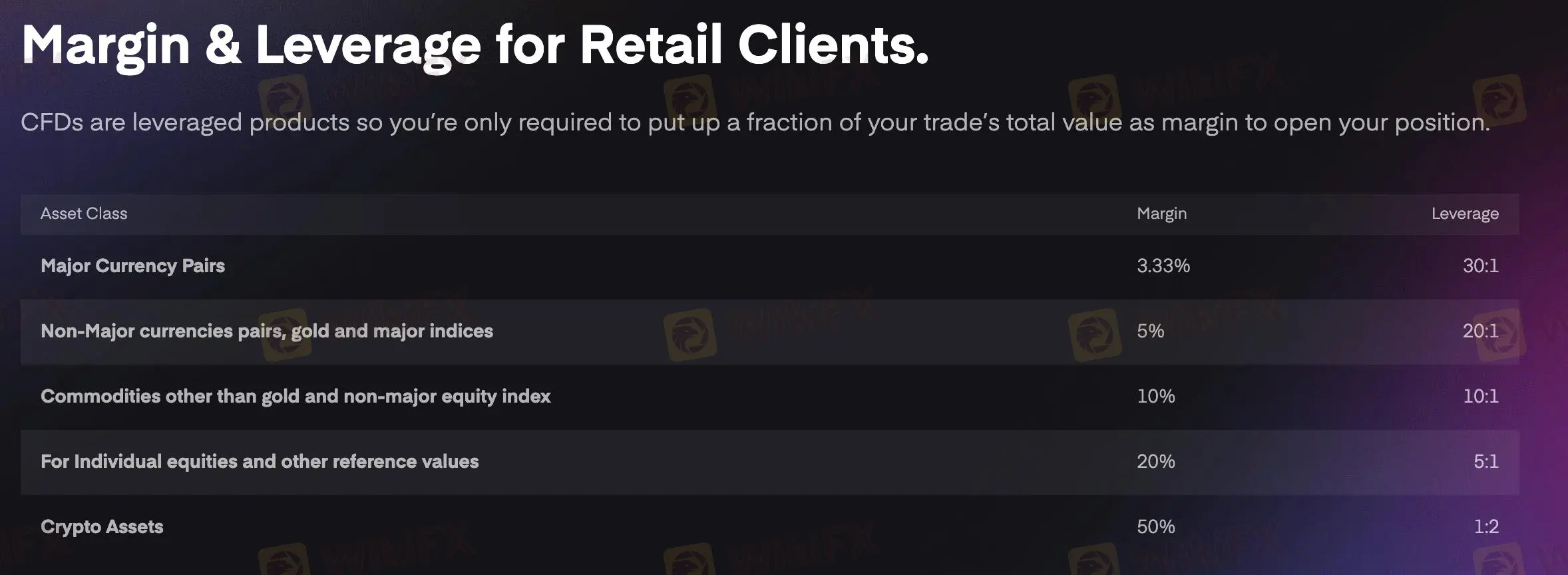

Leverage

Based on the asset type, Afterprime offers graded leverage; maximum leverage ranges from 30:1 for major currency pairs to 2:1 for cryptocurrencies.

| Asset Class | Margin Requirement | Maximum Leverage |

| Major Currency Pairs | 3.33% | 30:1 |

| Non-Major Currencies, Gold, and Major Indices | 5% | 20:1 |

| Commodities (excluding gold) and Non-Major Equity Indices | 10% | 10:1 |

| Individual Equities and Other Reference Values | 20% | 5:1 |

| Crypto Assets | 50% | 2:1 |

Afterprime Fees

With spreads starting from 0.01 pips and costs from $7 per lot round trip for FX and metals, Afterprime's fees are affordable relative to industry norms. Swap rates apply for overnight positions.

| Instrument | Description | Spread |

| EURUSD | Euro / US Dollar | 0.7 |

| GBPJPY | British Pounds / Japanese Yen | 0.03 |

| BTCUSD | Bitcoin | 0.1 |

| ETHUSD | Ethereum | 0.01 |

| XAUUSD | Gold vs United States Dollar | 0.32 |

| XTIUSD | WTI Crude Oil | 0.02 |

| GER30 | DAX 30 Cash CFD | 8.16 |

| NAS100 | Nasdaq 100 Cash CFD | 0.89 |

| Asset Class | Commission |

| Forex | No Commission |

| Metals | No Commission |

| Indices | No Commission |

| Commodities | No Commission |

| Cryptocurrencies | 0.05% per notional USD traded per side |

| Stocks | 0.02 USD per share per side |

| Bonds | No Commission |

| Instrument | Swap Short | Swap Long |

| AUD/USD | 0.79 | -2.562 |

| EUR/USD | 2.48 | -6.24 |

| GBP/USD | -1.36 | -1.98 |

| USD/CAD | -5.35 | 1.91 |

| USD/CHF | -13.683 | 8.75 |

| USD/JPY | -25.91 | 14.25 |

Non-Trading Fees

| Non-trading Fees | |

| Deposit Fee | Free (Bank fees may apply) |

| Withdrawal Fee | Free (Bank fees or currency conversion charges may apply) |

| Inactivity Fee | None |

Trading Platform

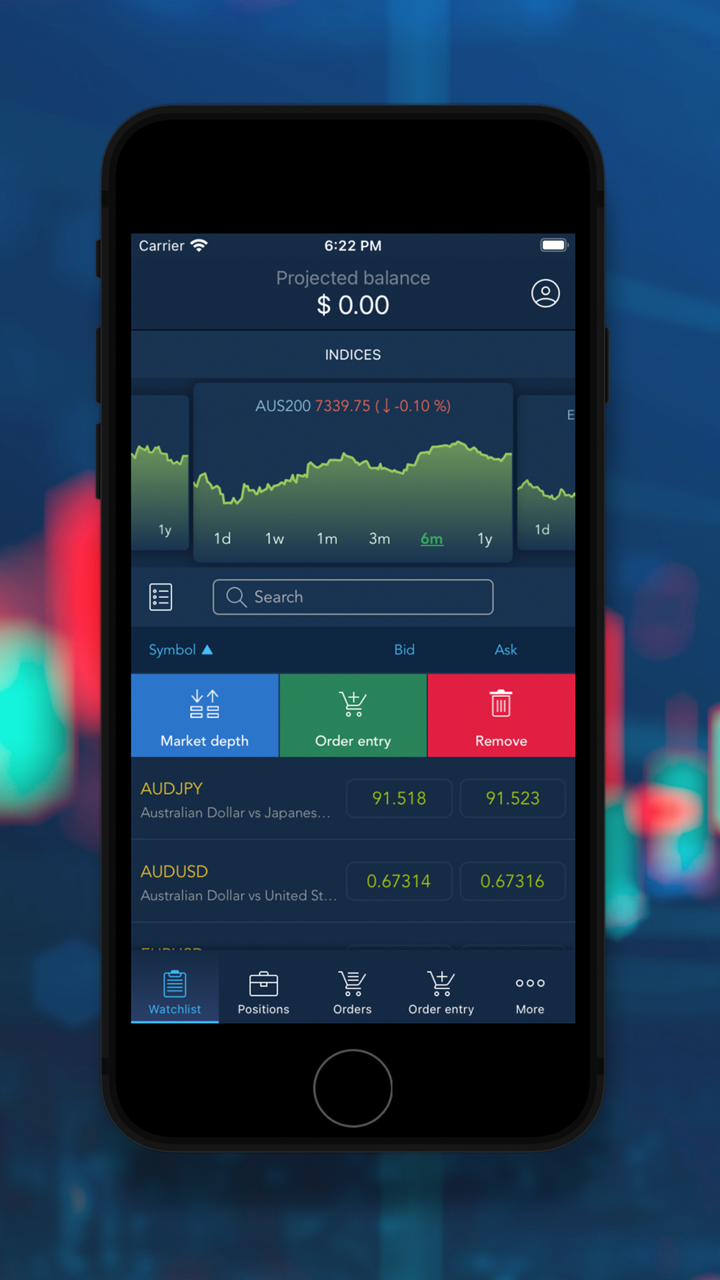

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| TradingView | ✔ | Web, iPhone, Android, Windows, Mac | Traders seeking advanced charting and community-driven analysis |

| MetaTrader 4 (MT4) | ✔ | Web, iPhone, Android, Windows, Mac | Traders requiring robust technical analysis and algorithmic trading tools |

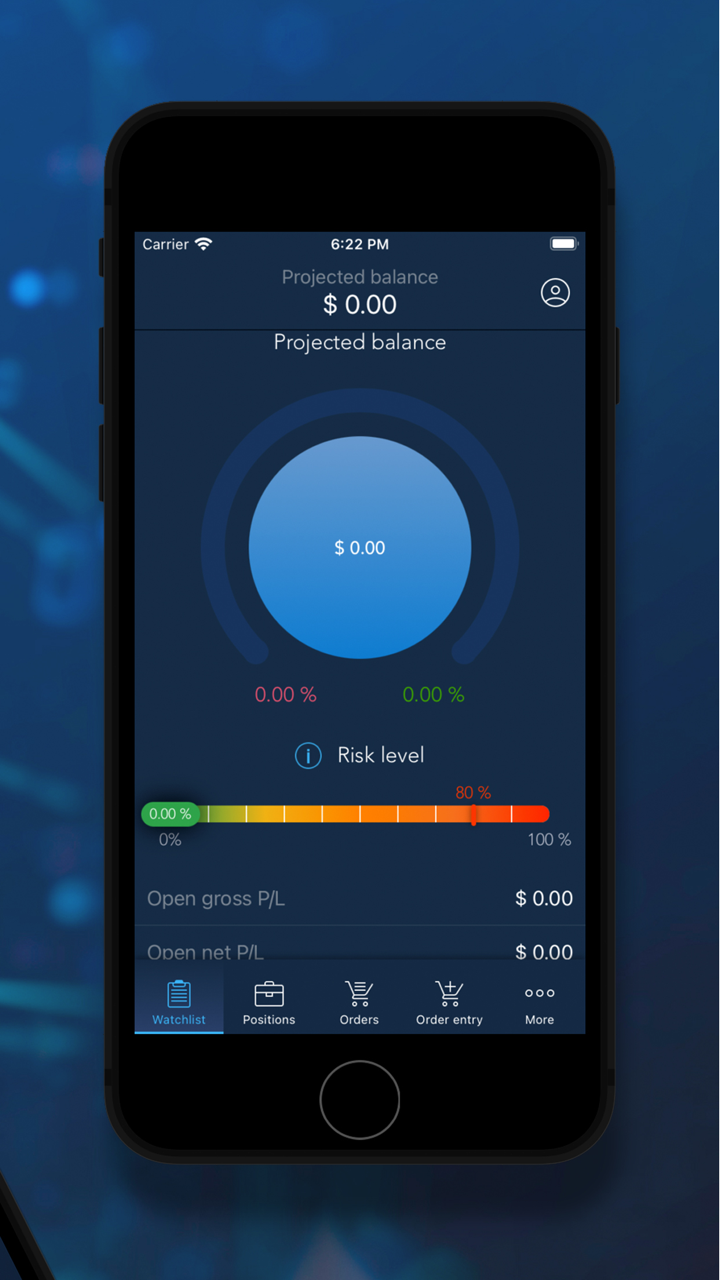

| TraderEvolution | ✔ | Web, iPhone, Android, Windows, Mac | Professional traders preferring an intuitive interface with deep insights |

| FIX API | ✔ | Web, iPhone, Android, Windows, Mac | Institutional traders needing fast and direct market access |

Deposit and Withdrawal

Not charging any fees for withdrawals or deposits, Afterprime guarantees affordable transactions for its consumers. Though there is no set minimum beginning amount, advice is given for at least 200 EUR or the equivalent in other currencies.

| Payment Method | Min. Deposit/Withdrawal | Fees | Processing Time |

| VISA | 200 EUR (recommended) | Free | Instant (Deposit) |

| Neteller | 200 EUR (recommended) | Free | Instant (Deposit) |

| Skrill | 200 EUR (recommended) | Free | Instant (Deposit) |

| Bank Transfer | 200 EUR (recommended) | Free | 1-3 Business Days |

刘建39723

Taiwan

Been on AfterPrime for a bit now. Smooth sailing with the trades and when I hit a snag, support was on it—quick and sharp. Withdrawals? No drama there, which honestly, is refreshing. Solid broker, hands down.

Positive

zhao juan

Malaysia

It's User friendly, trade in vast number of currencies, 24/7 customers support, MT4/5 support. The Deposit and Withdrawal process needs to fast because withdrawal takes more than 3 days and it needs to better.

Neutral

Yoba94

Uruguay

to the truth that it is a divine broker and its support is excellent

Positive

FX4265118843

Chile

The best spreads, the best support, the best execution, and the model is real ECN, which can be demonstrated with trade receipts.

Positive