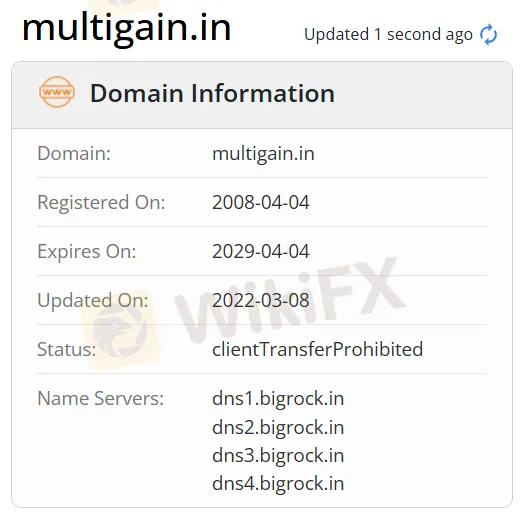

基础信息

印度

印度

天眼评分

印度

|

5-10年

|

印度

|

5-10年

| https://www.multigain.in

官方网址

评分指数

影响力

D

影响力指数 NO.1

印度 2.66

印度 2.66 监管信息

监管信息暂未查证到有效监管信息,请注意风险!

印度

印度 multigain.in

multigain.in 印度

印度

| Multigain 评论摘要 | |

| 成立时间 | 2008 |

| 注册国家/地区 | 印度 |

| 监管 | 无监管 |

| 市场工具 | 货币、衍生品、大宗商品、共同基金、债券、保险、房地产、A.I.F.(备选投资基金) |

| 模拟账户 | / |

| 交易平台 | 在线和移动一体化平台 |

| 最低存款 | / |

| 客户支持 | 联系表单 |

| 电话:0591-2490200/400/500 | |

| 电子邮件:info@multigain.in | |

| 传真:0591-2490400 | |

| 地址:H-50,Lajpat Nagar,Moradabad – 244001(U.P.) | |

| 社交媒体:Facebook、X、digg、linkedin、myspace | |

Multigain 是印度证券交易所中一家未受监管的高级经纪和金融服务提供商。它在二级市场解决方案上提供产品和服务:现金与衍生品、货币、衍生品、大宗商品:现货与衍生品、存托服务、保险库服务、共同基金、投资组合管理服务、债券、保险解决方案:人寿保险与综合保险、房地产服务、财富管理服务、A.I.F.(备选投资基金)、住房贷款、首次公开募股、在线交易、移动交易和研究。

| 优点 | 缺点 |

| 运营时间长 | 网站不可访问(部分) |

| 多种联系渠道 | 缺乏监管 |

| 多样的交易产品 | 无演示账户 |

| 无MT4/MT5平台 | |

| 缺乏透明度 | |

| 支付选择有限 |

编号 Multigain 目前没有有效的监管。请注意风险!

| 交易资产 | 支持 |

| 货币 | ✔ |

| 衍生品 | ✔ |

| 大宗商品 | ✔ |

| 共同基金 | ✔ |

| 债券 | ✔ |

| 保险 | ✔ |

| 房地产 | ✔ |

| A.I.F.(备选投资基金) | ✔ |

| 指数 | ❌ |

| 股票 | ❌ |

| 加密货币 | ❌ |

| 期权 | ❌ |

| 交易所交易基金 | ❌ |

| 交易平台 | 支持 | 可用设备 | 适用于 |

| 在线和移动集成平台 | ✔ | 移动,网络 | / |

| MT4 | ❌ | / | / |

| MT5 | ❌ | / | / |

Multigain 接受通过在线/离线银行、手机银行和IVR银行进行的支付。

Based on my careful review of the available information about Multigain, I was not able to find any explicit mention of inactivity fees or clear policies regarding their application. As someone who has navigated various brokerage environments, I recognize that the lack of transparency around crucial fees is a significant red flag, particularly when combined with Multigain’s unregulated status and the absence of robust regulatory oversight. In my experience, reputable brokers usually disclose all account-related charges, including inactivity fees, on their website or in client agreements to ensure clients can make fully informed decisions and manage their accounts responsibly. With Multigain, important details—including inactivity fees, funding and withdrawal costs, and other account maintenance charges—seem to be missing or inaccessible. This absence makes it difficult for me to confidently understand the full cost structure associated with holding an account, especially over the long term. In my view, traders should exercise considerable caution before funding or maintaining an account with any broker where fee transparency is lacking, as undisclosed charges can erode returns or introduce unexpected obstacles. For me, this lack of clear, accessible information is a serious drawback and does not inspire confidence in Multigain as a trustworthy service provider.

As a seasoned trader, I prioritize broker transparency and regulatory oversight above all, especially when it comes to crucial details like leverage. With Multigain, I found several significant gaps that made me uncomfortable. The core issue is that there is no clear disclosure of leverage levels for primary forex pairs—or indeed, for any asset class—anywhere in the readily available documentation. In my experience, this kind of opacity presents a substantial risk, as responsible brokers normally state exact leverage ratios for currencies and detail if these change for commodities, indices, or other instruments. Furthermore, Multigain operates without any recognized regulatory license and their business practices are flagged as high risk—deeply concerning from a risk management standpoint. The absence of basic, public leverage information compounds this concern for me as a trader. Not only does it prevent effective strategy planning, but it also signals either a lack of robust risk controls or a reluctance to be transparent with clients. Based on my extensive trading background, I strongly advise caution when a broker cannot clearly state leverage terms up front, as it undermines informed decision-making and can expose clients to unknown risks. For me, this lack of clarity is a major red flag, and I would not proceed without full, written confirmation of all trading conditions.

In my experience evaluating Multigain, I found that the platforms available are quite limited compared to more established global brokers. Multigain only supports its own self-developed online and mobile integrated trading platform. They do not offer access to standard industry platforms such as MT4, MT5, or cTrader. For me, this is a significant consideration, as the absence of MT4 or MT5 means I cannot rely on familiar charting tools, automated trading systems, or third-party integrations that I usually depend on for strategy analysis and risk management. I also noticed that there are concerns around operational transparency and regulatory oversight, which heightens the importance of having tried-and-tested technology like MT4/MT5—platforms that are renowned for their stability and compliance features. The proprietary platform Multigain provides may suit some basic needs, but as someone who values robust technical analysis capabilities, custom indicators, and EAs, I find this quite limiting. Ultimately, the lack of these industry-standard platforms is a red flag for me, especially when combined with the broker's overall risk profile and absence of formal regulation. For my own trading, this combination does not inspire confidence or meet my requirements for security and trading flexibility.

In my own assessment as a trader, I found that Multigain is not overseen by any recognized financial regulatory authority. This lack of regulation was a significant concern for me, as regulation serves to protect traders by ensuring brokers adhere to established standards regarding transparency, client fund protection, and fair dealing. For me, regulatory oversight means added peace of mind should any disputes arise or if I need recourse—for example, if there are withdrawal issues or questions regarding trade execution. During my research, I uncovered that Multigain currently operates without any valid regulatory license. This status, combined with repeated warnings about high potential risk and its classification as “unregulated,” made me especially wary. In comparison, other brokers with long-standing, robust regulation from reputable authorities—such as those in the UK or Australia—offer a higher level of trust and accountability. In the case of Multigain, the absence of supervision leaves traders without the essential protection and reassurances provided by reputable regulators. Based on this experience and knowledge, I would emphasize that relying on an unregulated broker like Multigain introduces serious risks. For me, regulation is non-negotiable, and its absence is a compelling reason to be extremely cautious.

请输入...