Perfil de la compañía

| Multigain Resumen de la reseña | |

| Establecido | 2008 |

| País/Región Registrada | India |

| Regulación | Sin regulación |

| Instrumentos de Mercado | Divisas, Derivados, Materias Primas, Fondos Mutuos, Bonos, Seguros, Bienes Raíces, A.I.F. (Fondo de Inversión Alternativa) |

| Cuenta Demo | / |

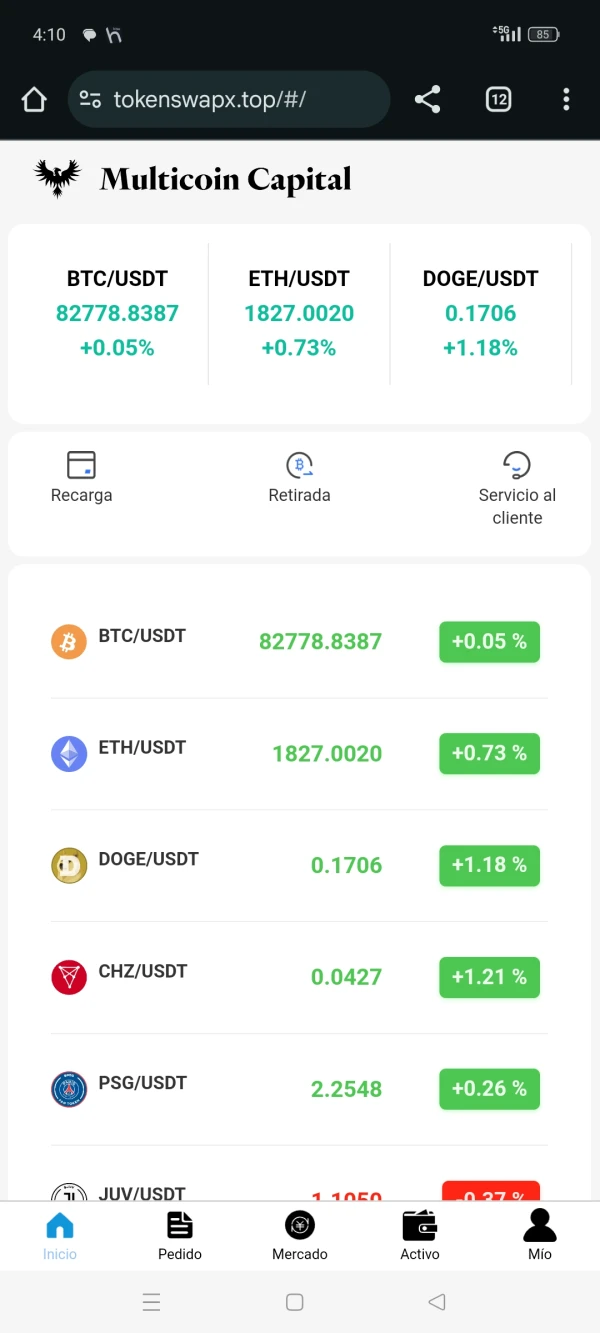

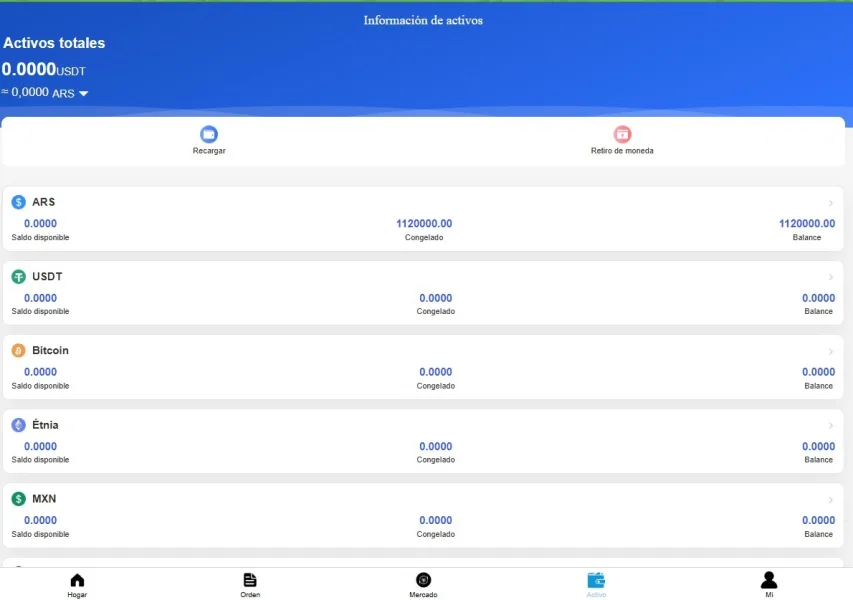

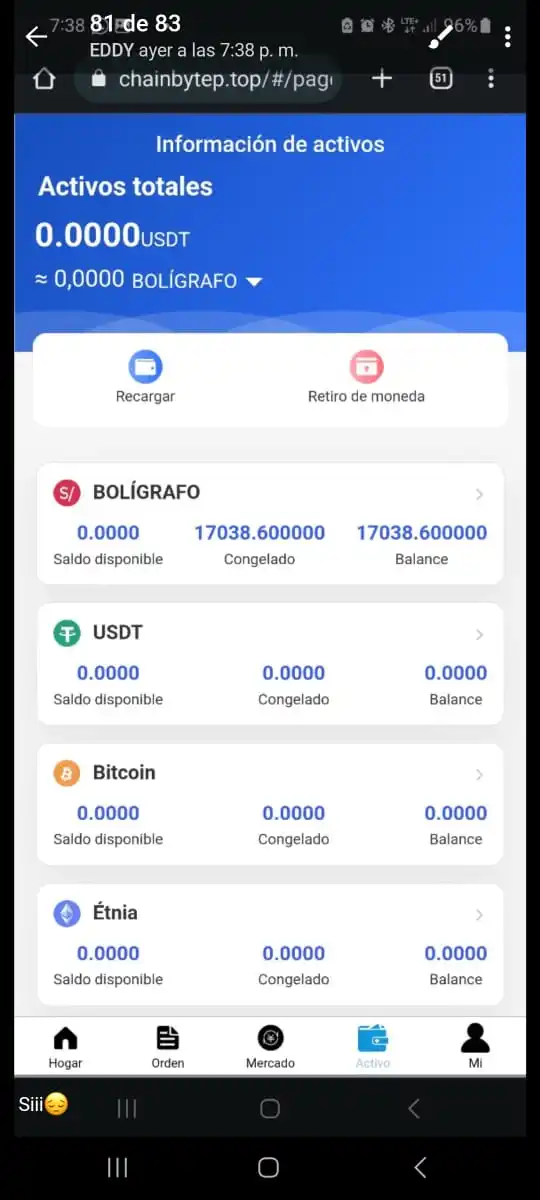

| Plataforma de Trading | Plataforma integrada en línea y móvil |

| Depósito Mínimo | / |

| Soporte al Cliente | Formulario de contacto |

| Tel: 0591-2490200/ 400 / 500 | |

| Email: info@multigain.in | |

| Fax: 0591-2490400 | |

| Dirección: H-50, Lajpat Nagar, Moradabad – 244001 (U.P.) | |

| Redes sociales: Facebook, X, digg, linkedin, myspace | |

Información de Multigain

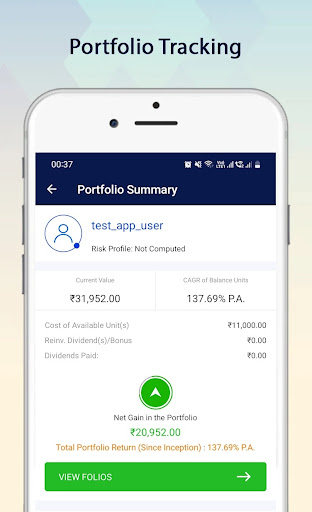

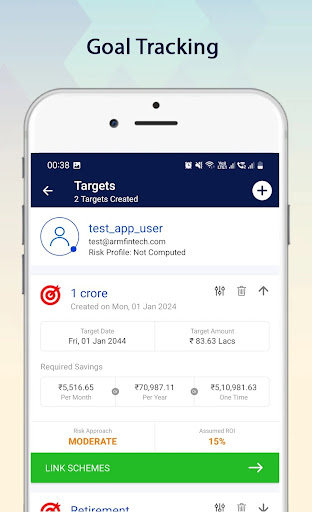

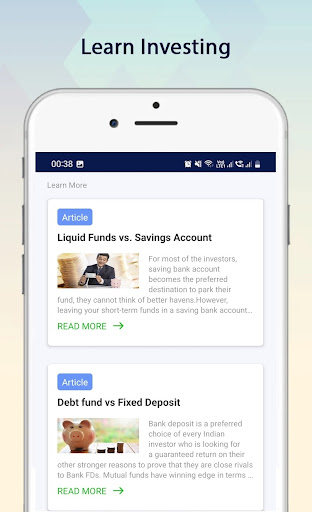

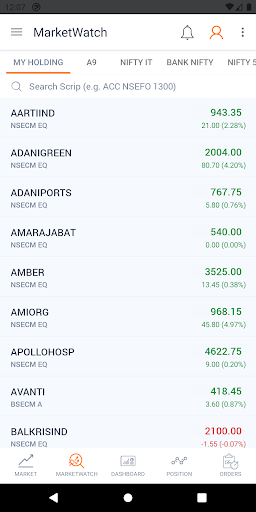

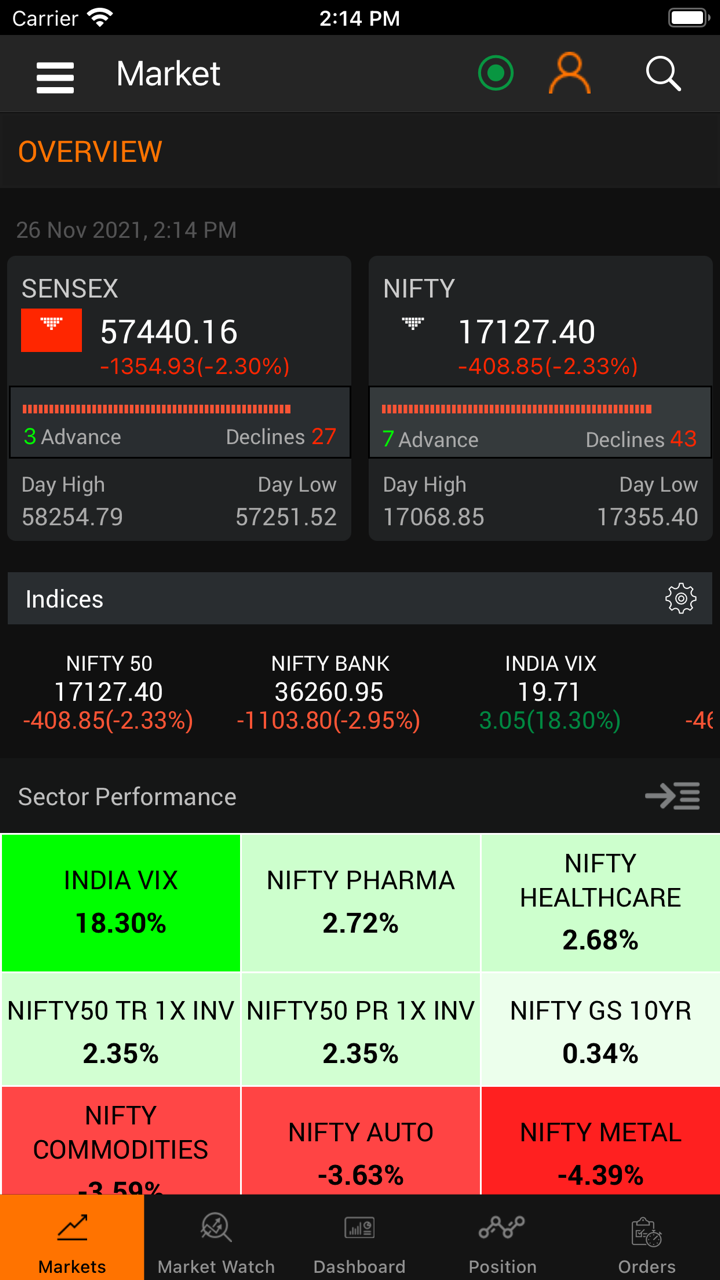

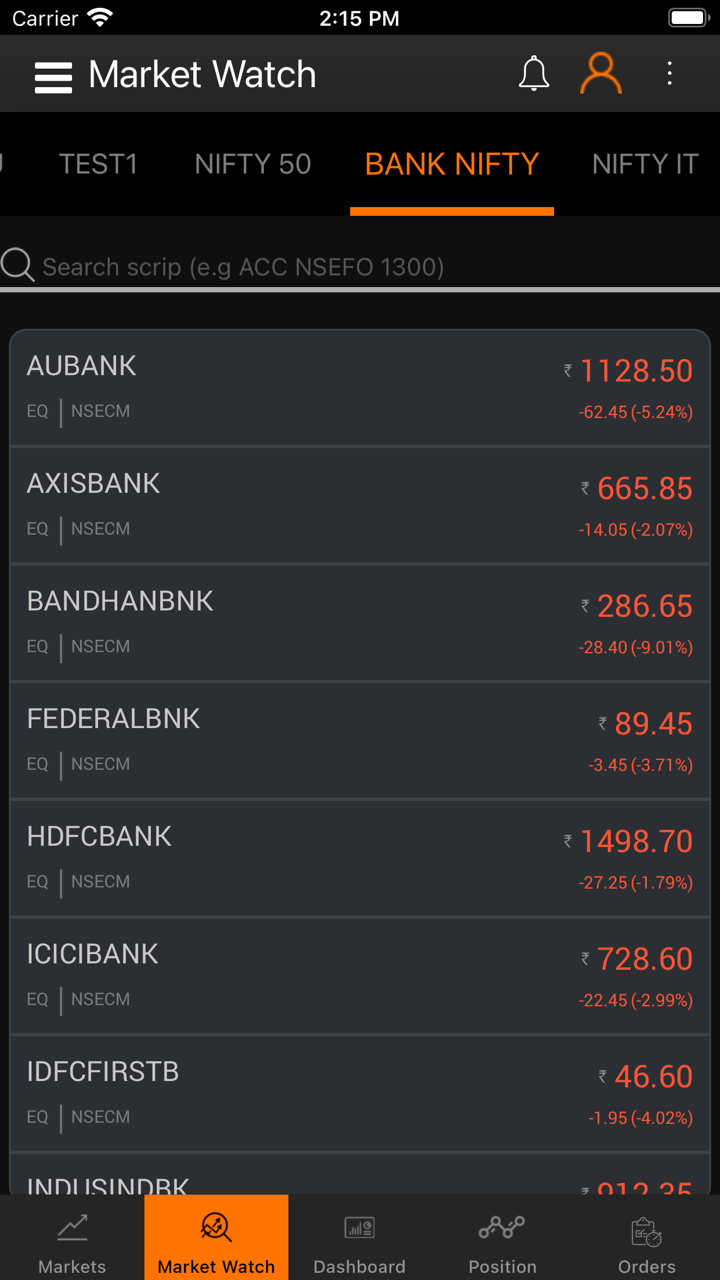

Multigain es un proveedor de servicios no regulado de corretaje y servicios financieros de primera categoría en la Bolsa de Valores de la India. Ofrece productos y servicios en Soluciones del Mercado Secundario: Efectivo y Derivados, Divisas, Derivados, Materias Primas: Spot y Derivados, Servicios de Depósito, Servicios de Repositorio de Seguros, Fondos Mutuos, Servicios de Gestión de Carteras, Bonos, Solución de Seguros: Vida y General, Servicios Inmobiliarios, Servicios de Gestión Patrimonial, A.I.F. (Fondo de Inversión Alternativa), Préstamos Hipotecarios, OPI, Trading en Línea, Trading Móvil e Investigación.

Pros y Contras

| Pros | Contras |

| Tiempo de operación prolongado | Sitio web inaccesible (parcial) |

| Varios canales de contacto | Falta de regulación |

| Varios productos de trading | Sin cuentas demo |

| Sin plataforma MT4/MT5 | |

| Falta de transparencia | |

| Opciones limitadas de pago |

¿Es Multigain Legítimo?

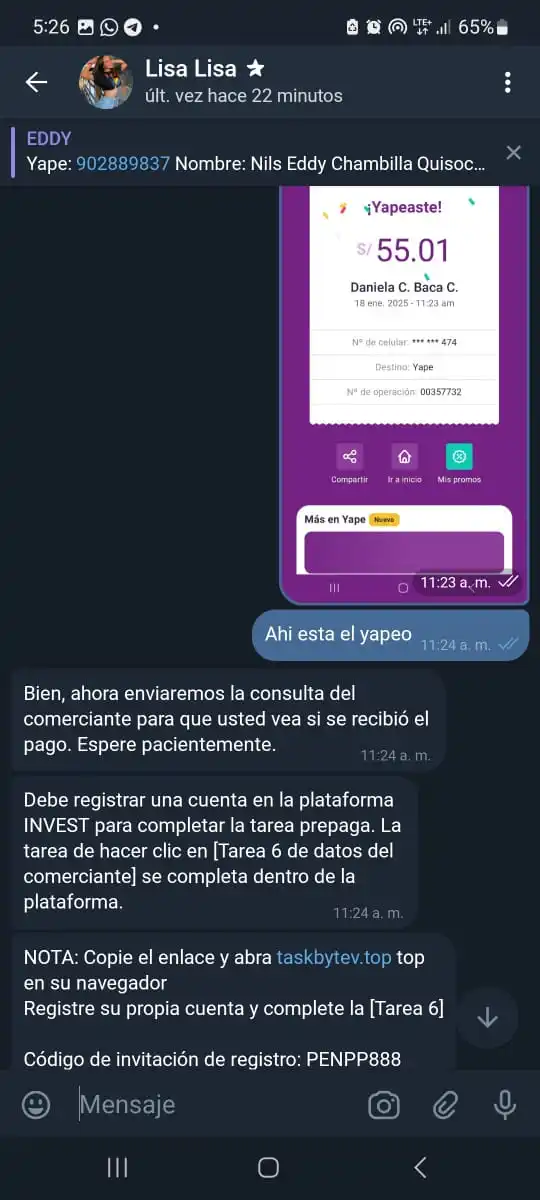

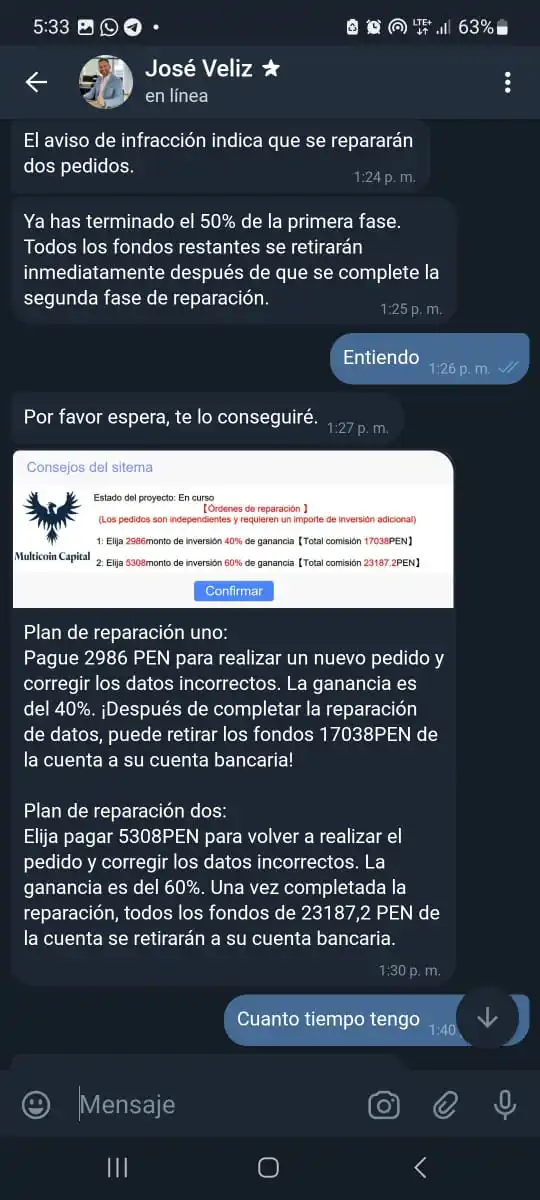

El No. Multigain actualmente no tiene regulaciones válidas. ¡Por favor, tenga en cuenta el riesgo!

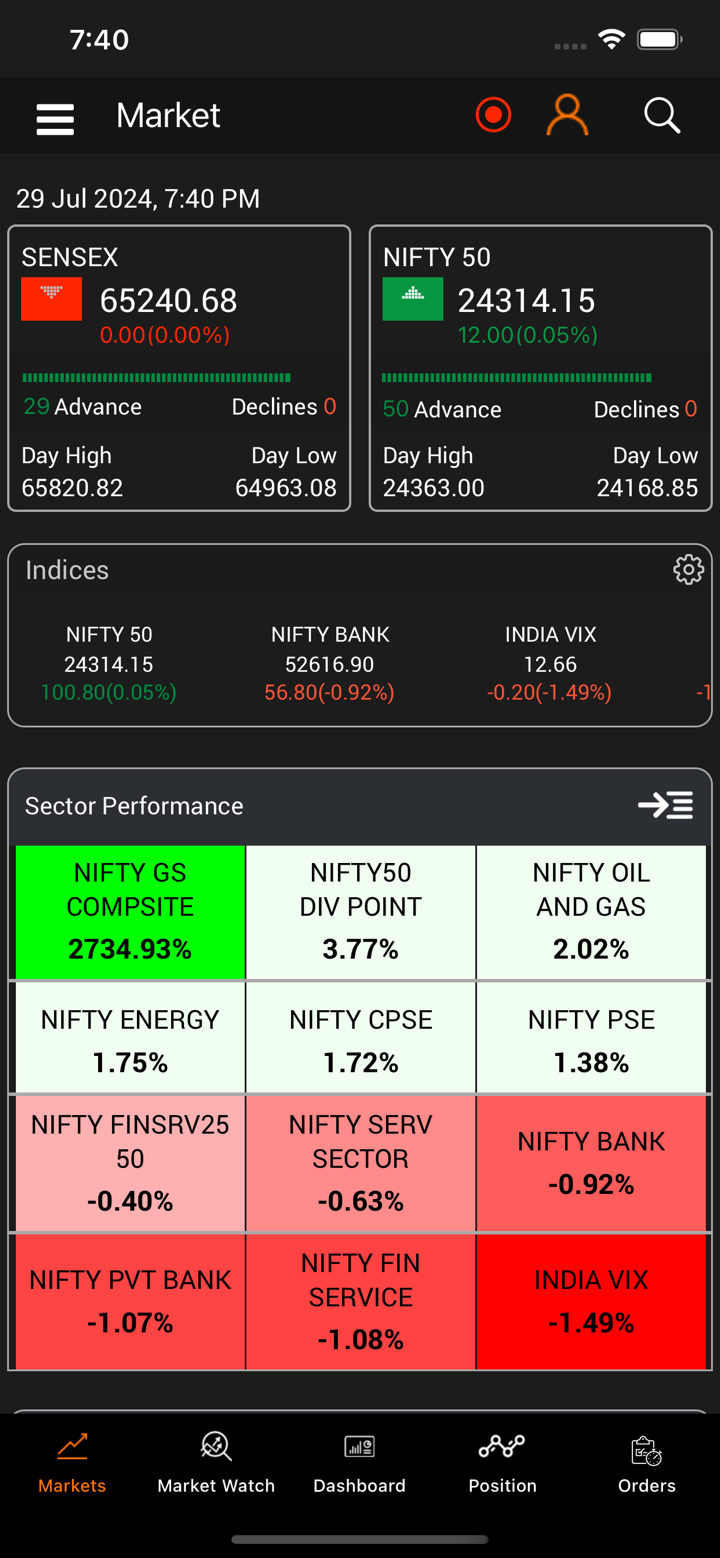

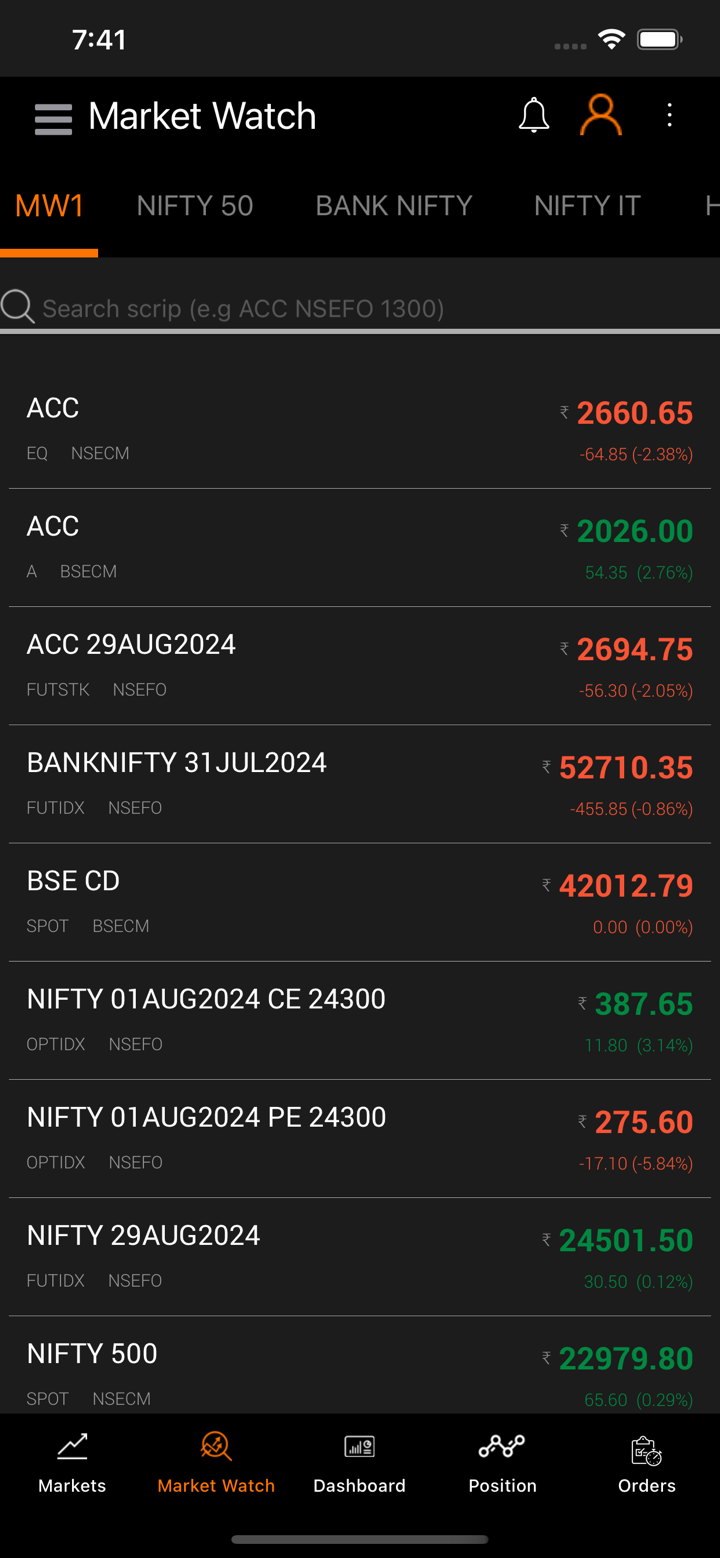

¿Qué puedo comerciar en Multigain?

| Activos de Trading | Soportado |

| Monedas | ✔ |

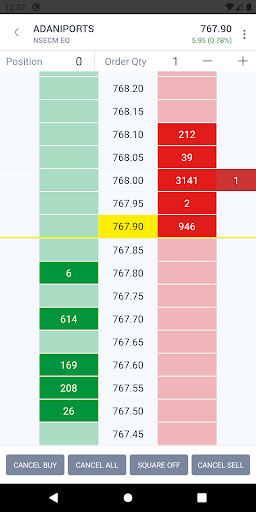

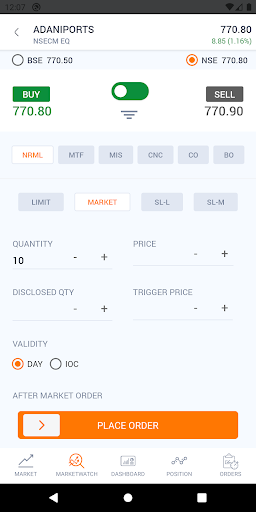

| Derivados | ✔ |

| Productos Básicos | ✔ |

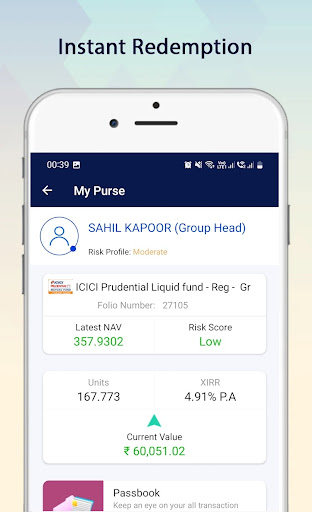

| Fondos Mutuos | ✔ |

| Bonos | ✔ |

| Seguros | ✔ |

| Bienes Raíces | ✔ |

| A.I.F. (Fondo de Inversión Alternativa) | ✔ |

| Índices | ❌ |

| Acciones | ❌ |

| Criptomonedas | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

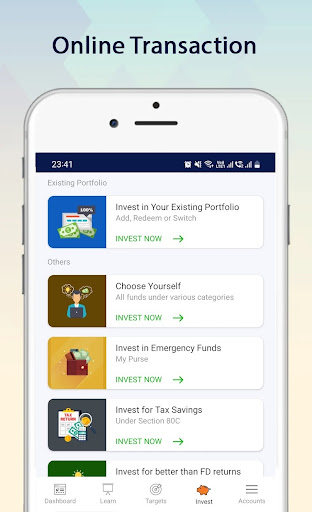

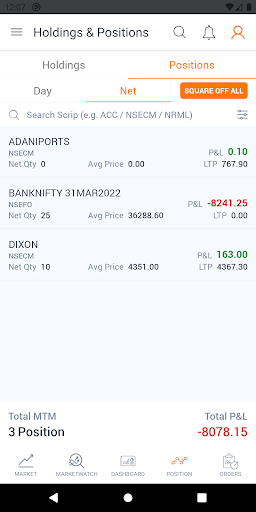

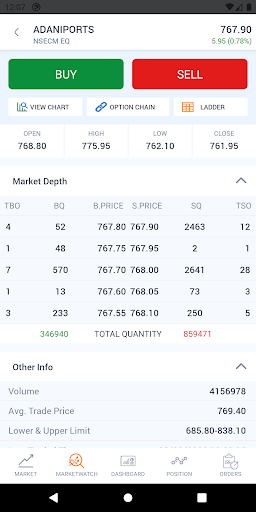

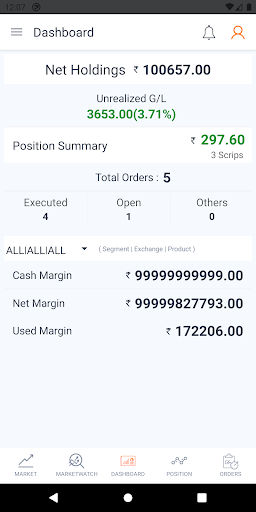

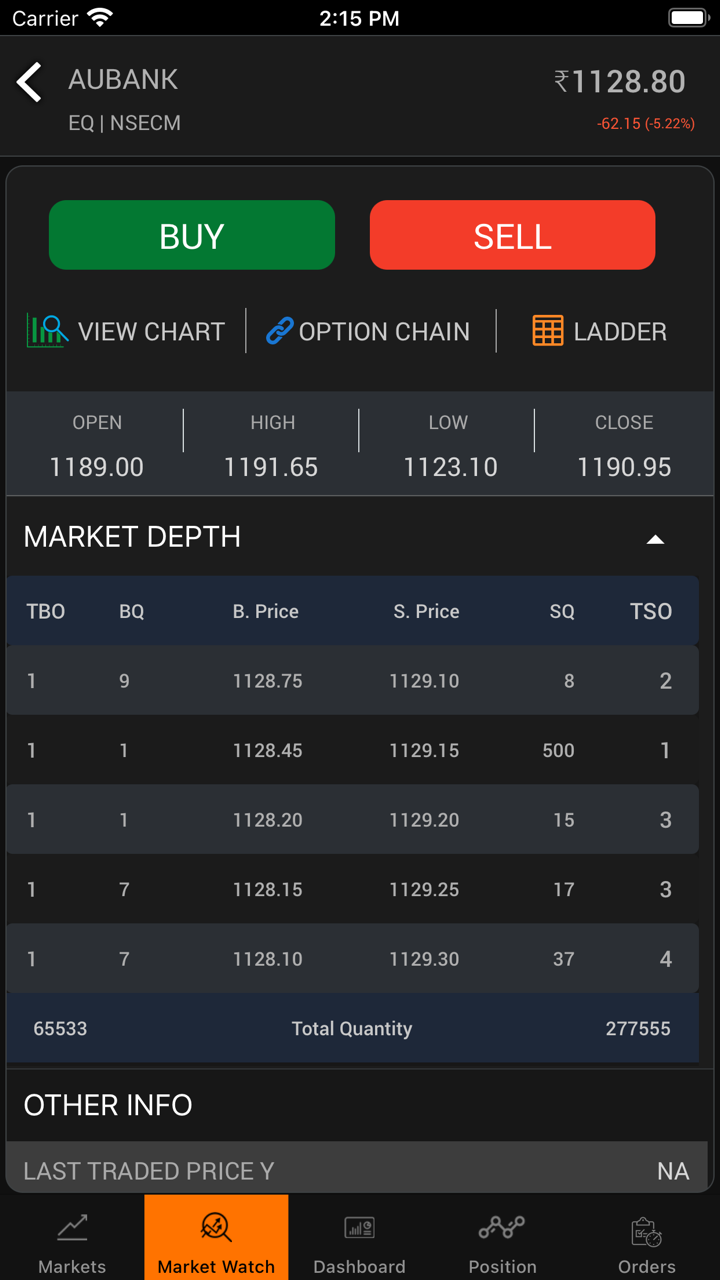

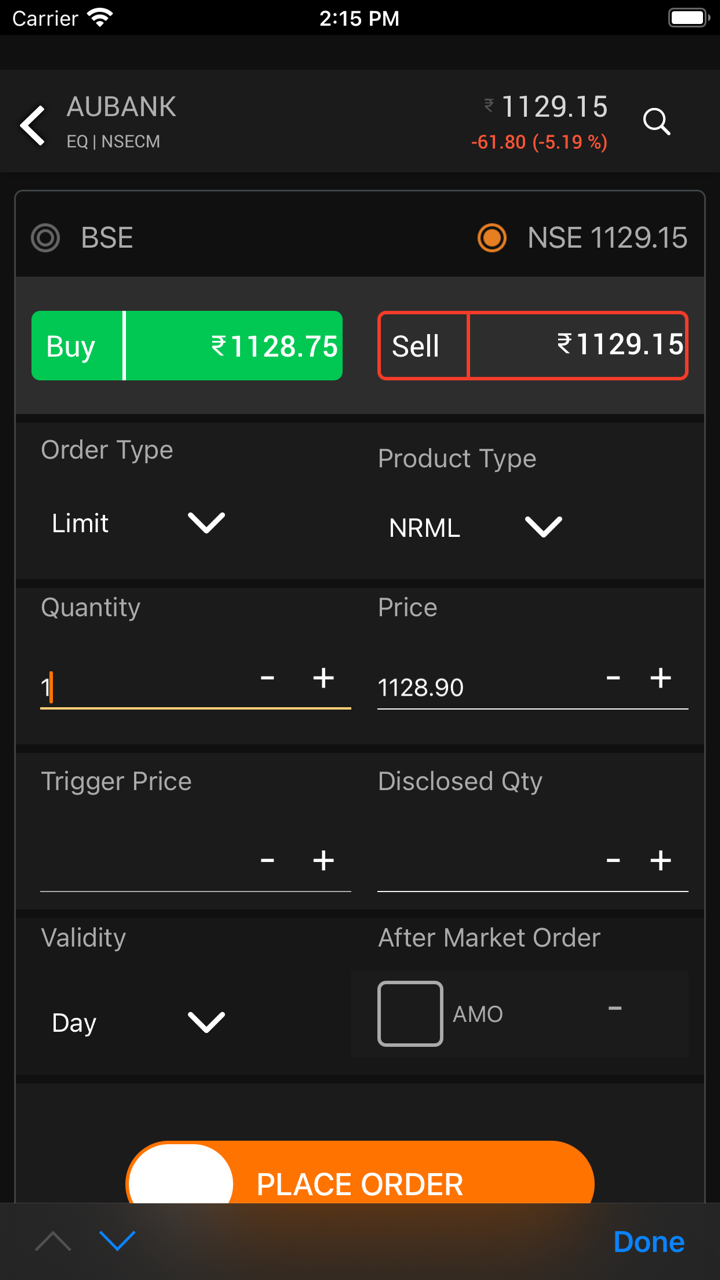

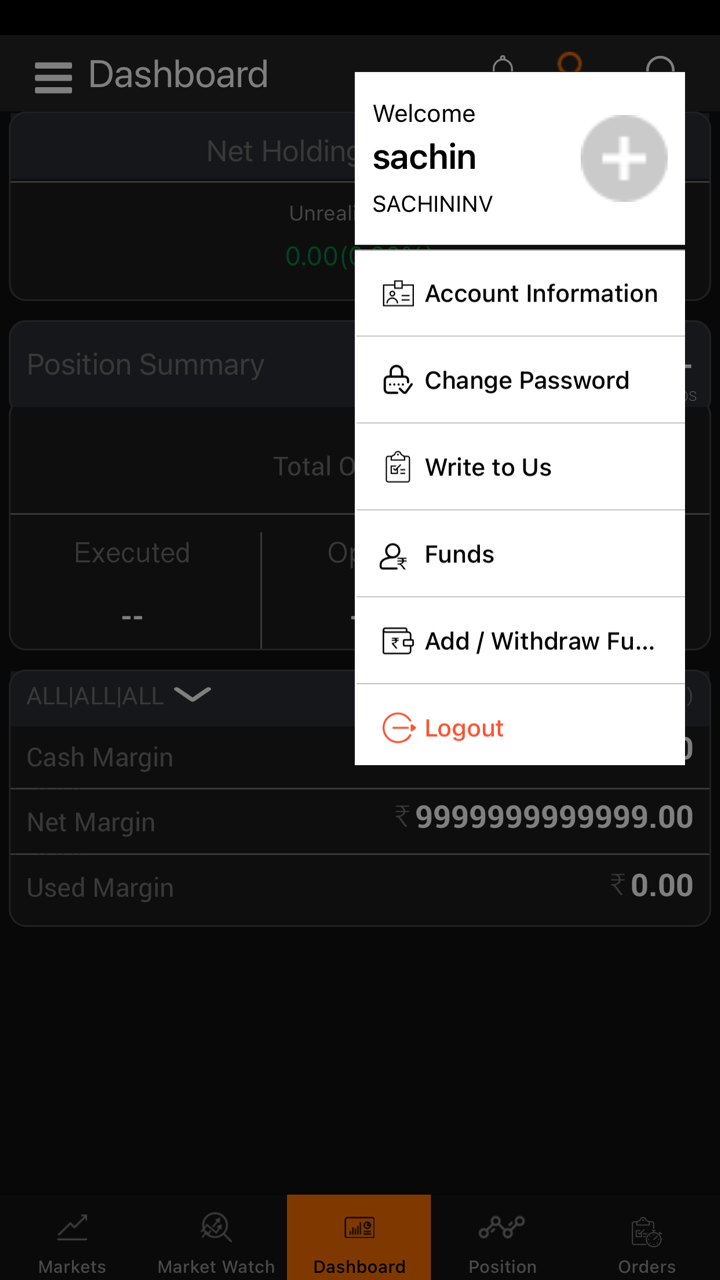

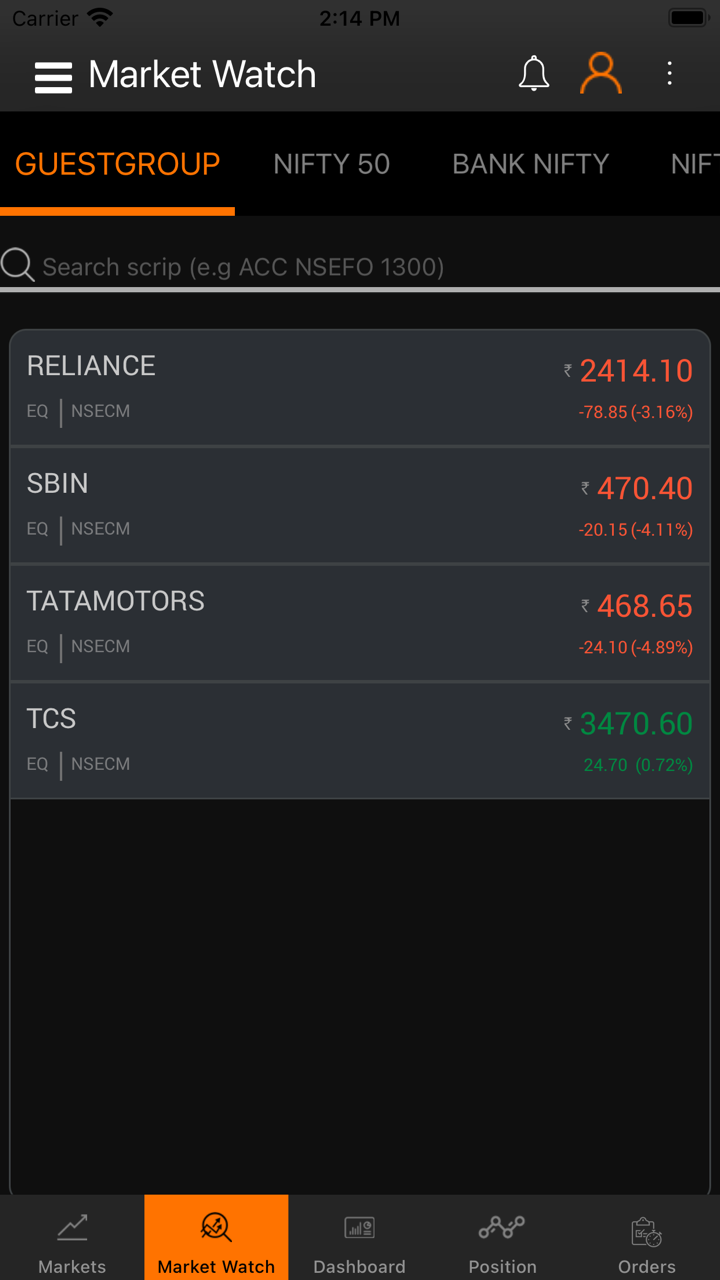

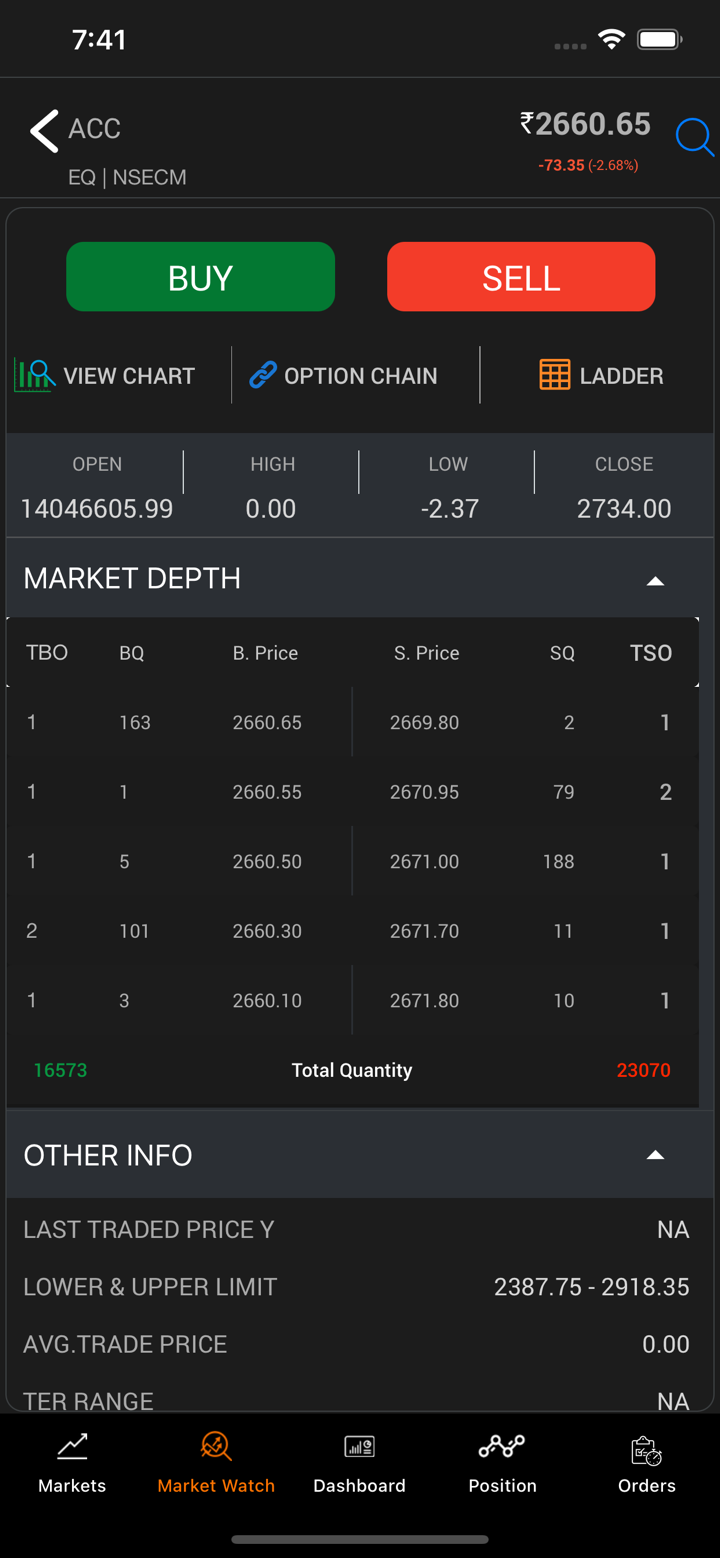

Plataforma de Trading

| Plataforma de Trading | Soportado | Dispositivos Disponibles | Adecuado para |

| Plataforma integrada en línea y móvil | ✔ | Móvil, web | / |

| MT4 | ❌ | / | / |

| MT5 | ❌ | / | / |

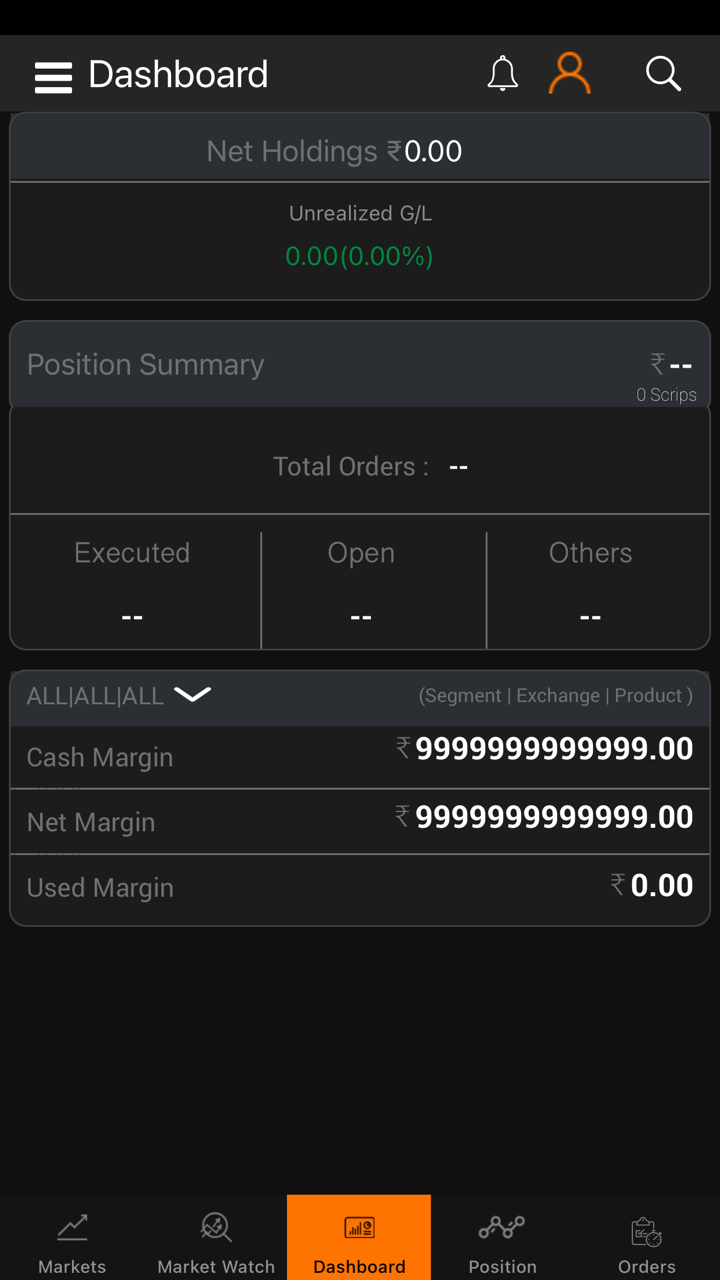

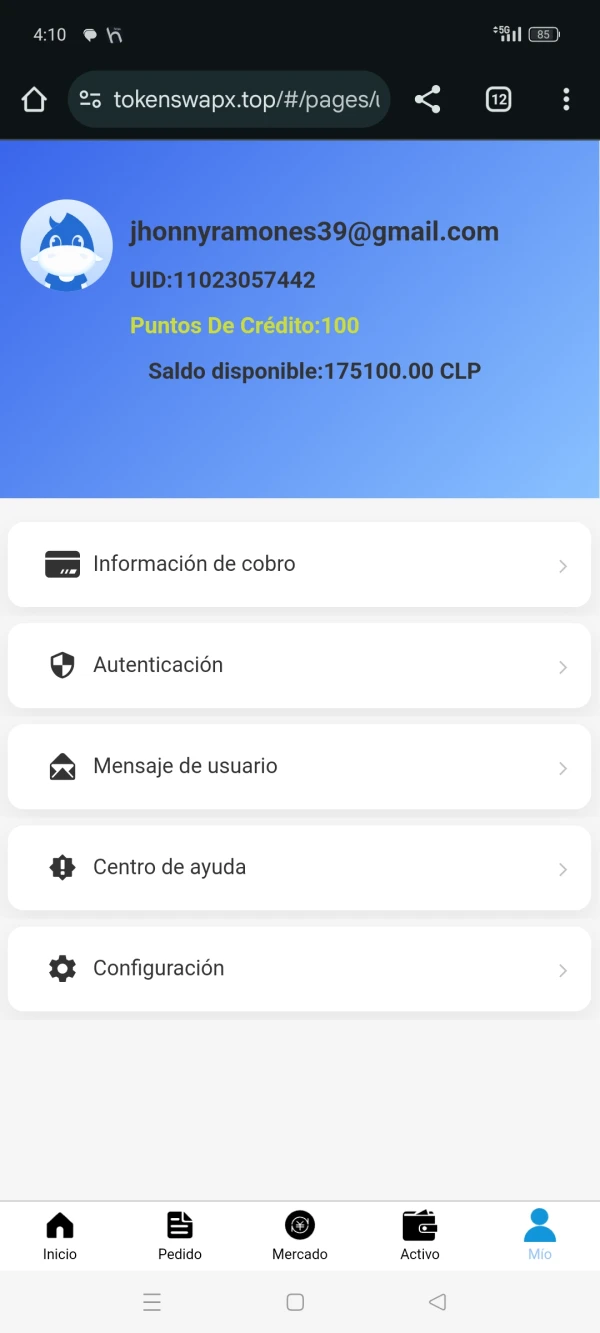

Depósito y Retiro

Multigain acepta pagos realizados a través de Banca en línea y móvil, Banca Móvil y Banca IVR.