基礎資訊

印度

印度

天眼評分

印度

|

5-10年

|

印度

|

5-10年

| https://www.multigain.in

官方網址

評分指數

影響力

D

影響力指數 NO.1

印度 2.66

印度 2.66 監管資訊

監管資訊暫未查證到有效監管資訊,請注意風險!

印度

印度 multigain.in

multigain.in 印度

印度

| Multigain 檢討摘要 | |

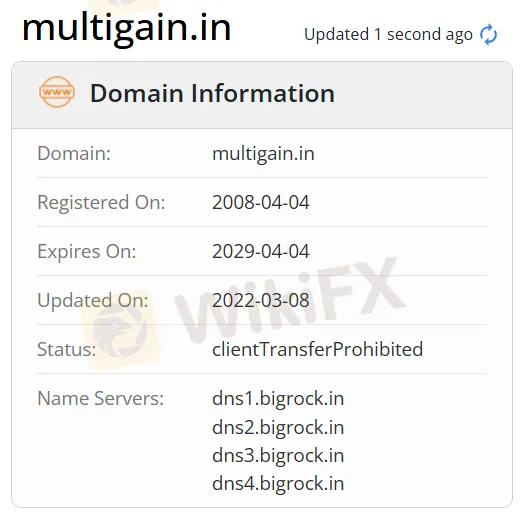

| 成立年份 | 2008 |

| 註冊國家/地區 | 印度 |

| 監管 | 無監管 |

| 市場工具 | 貨幣、衍生品、商品、共同基金、債券、保險、房地產、A.I.F.(替代投資基金) |

| 模擬帳戶 | / |

| 交易平台 | 在線和移動一體化平台 |

| 最低存款 | / |

| 客戶支援 | 聯絡表格 |

| 電話:0591-2490200/ 400 / 500 | |

| 電郵:info@multigain.in | |

| 傳真:0591-2490400 | |

| 地址:H-50, Lajpat Nagar, Moradabad – 244001 (U.P.) | |

| 社交媒體:Facebook、X、digg、linkedin、myspace | |

Multigain 是印度證券交易所的一家未受監管的頂級經紀和金融服務提供商。它在二級市場解決方案上提供產品和服務:現金和衍生品、貨幣、衍生品、商品:現貨和衍生品、存管服務、保險庫服務、共同基金、投資組合管理服務、債券、保險解決方案:人壽保險和綜合保險、房地產服務、財富管理服務、A.I.F.(替代投資基金)、房屋貸款、首次公開募股、網上交易、手機交易和研究。

| 優點 | 缺點 |

| 營運時間長 | 網站不易訪問(部分) |

| 多元的聯絡途徑 | 缺乏監管 |

| 多樣的交易產品 | 沒有模擬帳戶 |

| 沒有 MT4/MT5 平台 | |

| 缺乏透明度 | |

| 付款選擇有限 |

No. Multigain 目前沒有有效的監管。請注意風險!

| 交易資產 | 支援 |

| 貨幣 | ✔ |

| 衍生品 | ✔ |

| 大宗商品 | ✔ |

| 共同基金 | ✔ |

| 債券 | ✔ |

| 保險 | ✔ |

| 房地產 | ✔ |

| A.I.F. (替代投資基金) | ✔ |

| 指數 | ❌ |

| 股票 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

| ETFs | ❌ |

| 交易平台 | 支援 | 可用設備 | 適合 |

| 線上和移動一體化平台 | ✔ | 移動,網頁 | / |

| MT4 | ❌ | / | / |

| MT5 | ❌ | / | / |

Multigain 接受透過線上/離線銀行,手機銀行和IVR銀行進行的付款。

Based on my careful review of the available information about Multigain, I was not able to find any explicit mention of inactivity fees or clear policies regarding their application. As someone who has navigated various brokerage environments, I recognize that the lack of transparency around crucial fees is a significant red flag, particularly when combined with Multigain’s unregulated status and the absence of robust regulatory oversight. In my experience, reputable brokers usually disclose all account-related charges, including inactivity fees, on their website or in client agreements to ensure clients can make fully informed decisions and manage their accounts responsibly. With Multigain, important details—including inactivity fees, funding and withdrawal costs, and other account maintenance charges—seem to be missing or inaccessible. This absence makes it difficult for me to confidently understand the full cost structure associated with holding an account, especially over the long term. In my view, traders should exercise considerable caution before funding or maintaining an account with any broker where fee transparency is lacking, as undisclosed charges can erode returns or introduce unexpected obstacles. For me, this lack of clear, accessible information is a serious drawback and does not inspire confidence in Multigain as a trustworthy service provider.

As a seasoned trader, I prioritize broker transparency and regulatory oversight above all, especially when it comes to crucial details like leverage. With Multigain, I found several significant gaps that made me uncomfortable. The core issue is that there is no clear disclosure of leverage levels for primary forex pairs—or indeed, for any asset class—anywhere in the readily available documentation. In my experience, this kind of opacity presents a substantial risk, as responsible brokers normally state exact leverage ratios for currencies and detail if these change for commodities, indices, or other instruments. Furthermore, Multigain operates without any recognized regulatory license and their business practices are flagged as high risk—deeply concerning from a risk management standpoint. The absence of basic, public leverage information compounds this concern for me as a trader. Not only does it prevent effective strategy planning, but it also signals either a lack of robust risk controls or a reluctance to be transparent with clients. Based on my extensive trading background, I strongly advise caution when a broker cannot clearly state leverage terms up front, as it undermines informed decision-making and can expose clients to unknown risks. For me, this lack of clarity is a major red flag, and I would not proceed without full, written confirmation of all trading conditions.

In my experience evaluating Multigain, I found that the platforms available are quite limited compared to more established global brokers. Multigain only supports its own self-developed online and mobile integrated trading platform. They do not offer access to standard industry platforms such as MT4, MT5, or cTrader. For me, this is a significant consideration, as the absence of MT4 or MT5 means I cannot rely on familiar charting tools, automated trading systems, or third-party integrations that I usually depend on for strategy analysis and risk management. I also noticed that there are concerns around operational transparency and regulatory oversight, which heightens the importance of having tried-and-tested technology like MT4/MT5—platforms that are renowned for their stability and compliance features. The proprietary platform Multigain provides may suit some basic needs, but as someone who values robust technical analysis capabilities, custom indicators, and EAs, I find this quite limiting. Ultimately, the lack of these industry-standard platforms is a red flag for me, especially when combined with the broker's overall risk profile and absence of formal regulation. For my own trading, this combination does not inspire confidence or meet my requirements for security and trading flexibility.

In my own assessment as a trader, I found that Multigain is not overseen by any recognized financial regulatory authority. This lack of regulation was a significant concern for me, as regulation serves to protect traders by ensuring brokers adhere to established standards regarding transparency, client fund protection, and fair dealing. For me, regulatory oversight means added peace of mind should any disputes arise or if I need recourse—for example, if there are withdrawal issues or questions regarding trade execution. During my research, I uncovered that Multigain currently operates without any valid regulatory license. This status, combined with repeated warnings about high potential risk and its classification as “unregulated,” made me especially wary. In comparison, other brokers with long-standing, robust regulation from reputable authorities—such as those in the UK or Australia—offer a higher level of trust and accountability. In the case of Multigain, the absence of supervision leaves traders without the essential protection and reassurances provided by reputable regulators. Based on this experience and knowledge, I would emphasize that relying on an unregulated broker like Multigain introduces serious risks. For me, regulation is non-negotiable, and its absence is a compelling reason to be extremely cautious.

請輸入...