Unternehmensprofil

| UP TREND Überprüfungszusammenfassung | |

| Gegründet | 1997 |

| Registriertes Land/Region | Bulgarien |

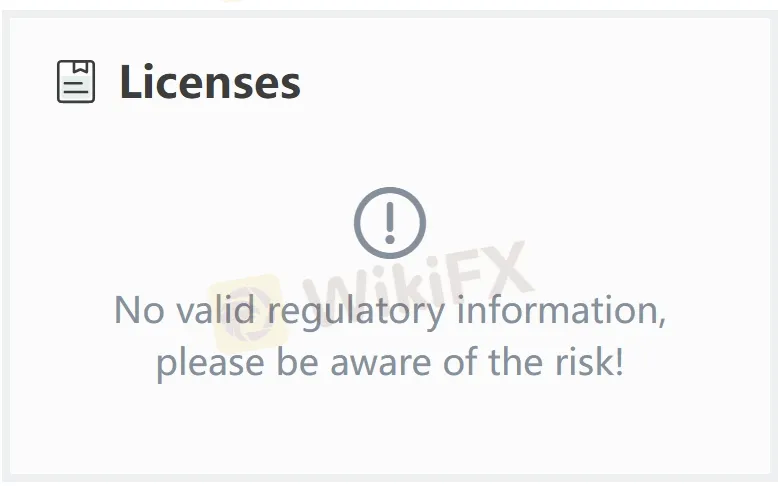

| Regulierung | Keine Regulierung |

| Finanzdienstleistungen | Vermögensverwaltung, Anlageberatung, Brokerage-Services, IPO/SPO-Unterstützung, Verwahrung von Finanzinstrumenten usw. |

| Kundenbetreuung | Tel: +359 2 815 56 60 |

| Email: uptrend@uptrend.bg | |

| Adresse: Sofia 1407, Blvd. Nikola Y. Vaptsarov Nr. 51A, Etage 1 | |

UP TREND Informationen

Up Trend ist einer der ersten lizenzierten Anlagevermittler in Bulgarien, gegründet im Jahr 1997. Seit 1998 ist das Unternehmen Mitglied der Bulgarischen Börse und der Zentralverwahrstelle. Die Firma besitzt eine EU-weite Lizenz und bietet eine breite Palette von Finanzdienstleistungen für Einzel- und Institutionelle Kunden an, einschließlich Vermögensverwaltung, Anlageberatung, Brokerage, IPO/SPO-Unterstützung und Verwahrung von Finanzinstrumenten. Sie arbeitet mit Plattformen wie Thomson Reuters, Capital IQ, Bloomberg und FactSet zusammen, um ihre Marktanalysen zu veröffentlichen. Der Hauptsitz befindet sich in Sofia, Bulgarien.

Allerdings wird der Broker derzeit nicht von offiziellen Behörden gut reguliert, was auf mögliche geringere Glaubwürdigkeit und Vertrauenswürdigkeit hinweisen sollte.

Vor- und Nachteile

| Vorteile | Nachteile |

| Breites Spektrum von Finanzdienstleistungen | Keine Regulierung |

| Viele Jahre Branchenerfahrung |

Ist UP TREND Seriös?

Der wichtigste Faktor zur Messung der Sicherheit einer Brokerplattform ist, ob sie formell reguliert ist. UP TREND ist ein unregulierter Broker, was bedeutet, dass die Sicherheit der Gelder der Benutzer und ihrer Handelsaktivitäten nicht effektiv geschützt ist. Anleger sollten UP TREND mit Vorsicht wählen.

Was kann ich bei UP TREND handeln?

Up Trend Ltd. bietet eine breite Palette von Anlage-Dienstleistungen für Einzel- und Institutionelle Kunden an, einschließlich:

- Brokerage-Services: Kauf-/Verkaufsaufträge auf bulgarischen und internationalen Märkten.

- Vermögensverwaltung: Individuelles Portfoliomanagement unter einem Ermessensmandat.

- Anlageberatung: Persönliche Finanzberatung basierend auf den Zielen und Risikoprofil des Kunden.

- Verwahrungsdienste: Verwahrung und Verwaltung von Finanzinstrumenten.

- IPO/SPO-Unterstützung: Dienstleistungen im Zusammenhang mit erstmaligen und sekundären öffentlichen Angeboten.

Sie bieten Brokerage-Services mit Zugang zu:

- Aktien

- ETFs

- Anleihen

- Devisen

- Waren

- CFDs (Differenzkontrakte)

- Indizes und Derivate

| Handelsinstrumente | Unterstützt |

| Aktien | ✔ |

| ETFs | ✔ |

| Anleihen | ✔ |

| Devisen | ✔ |

| Waren | ✔ |

| CFDs | ✔ |

| Indizes | ✔ |

| Derivate | ✔ |

| Kryptowährungen | ❌ |

| Optionen | ❌ |