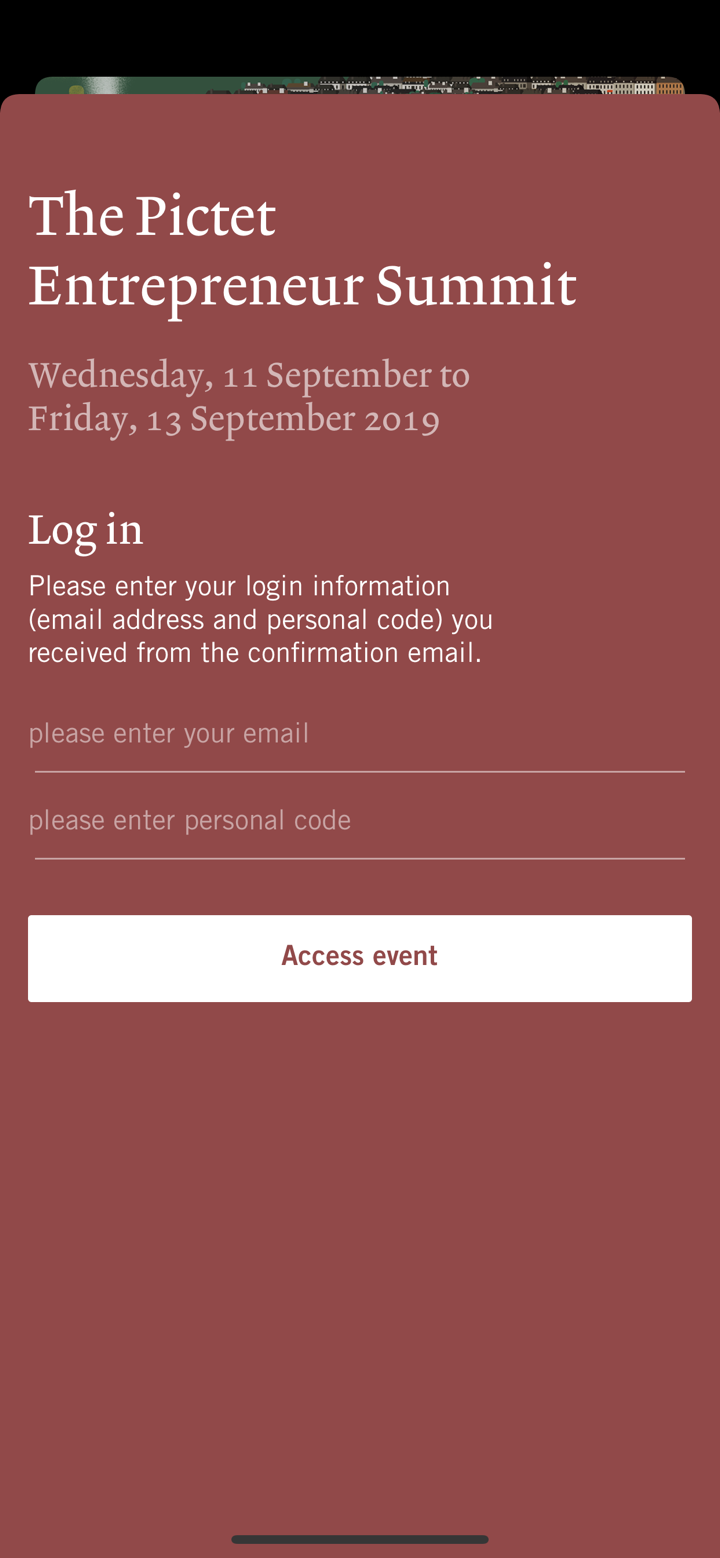

Unternehmensprofil

| Pictet Überprüfungszusammenfassung | |

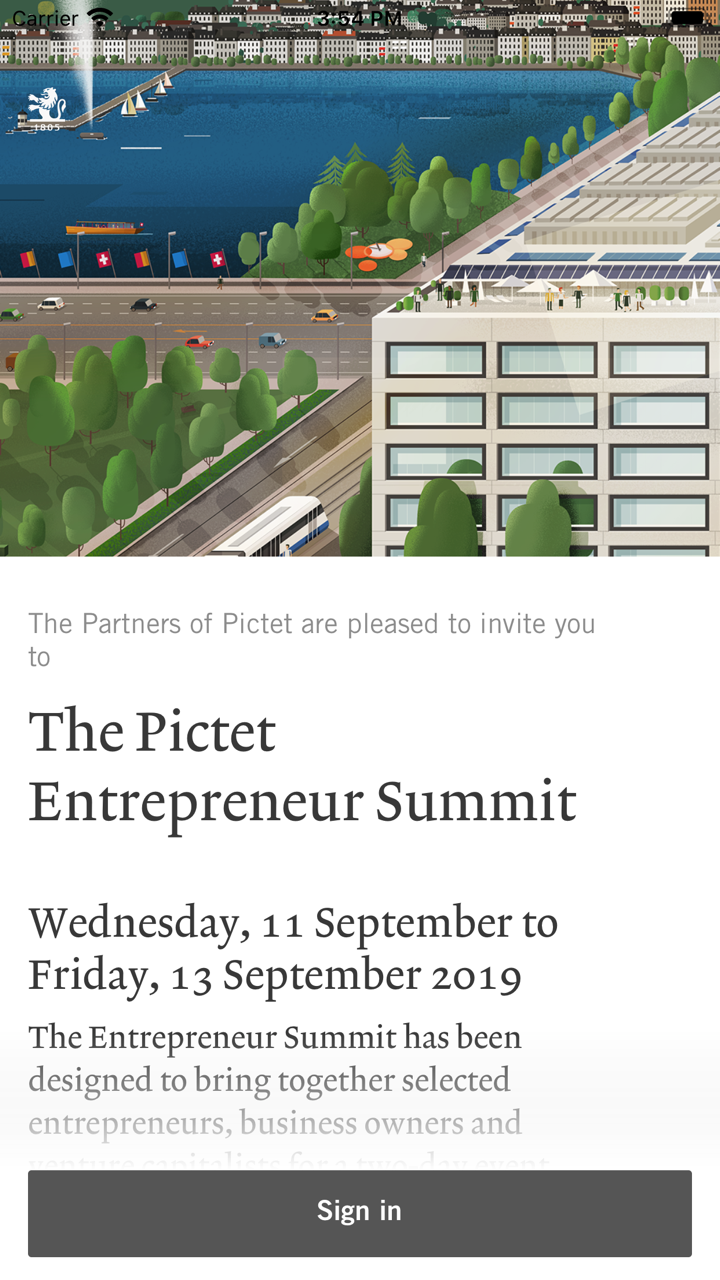

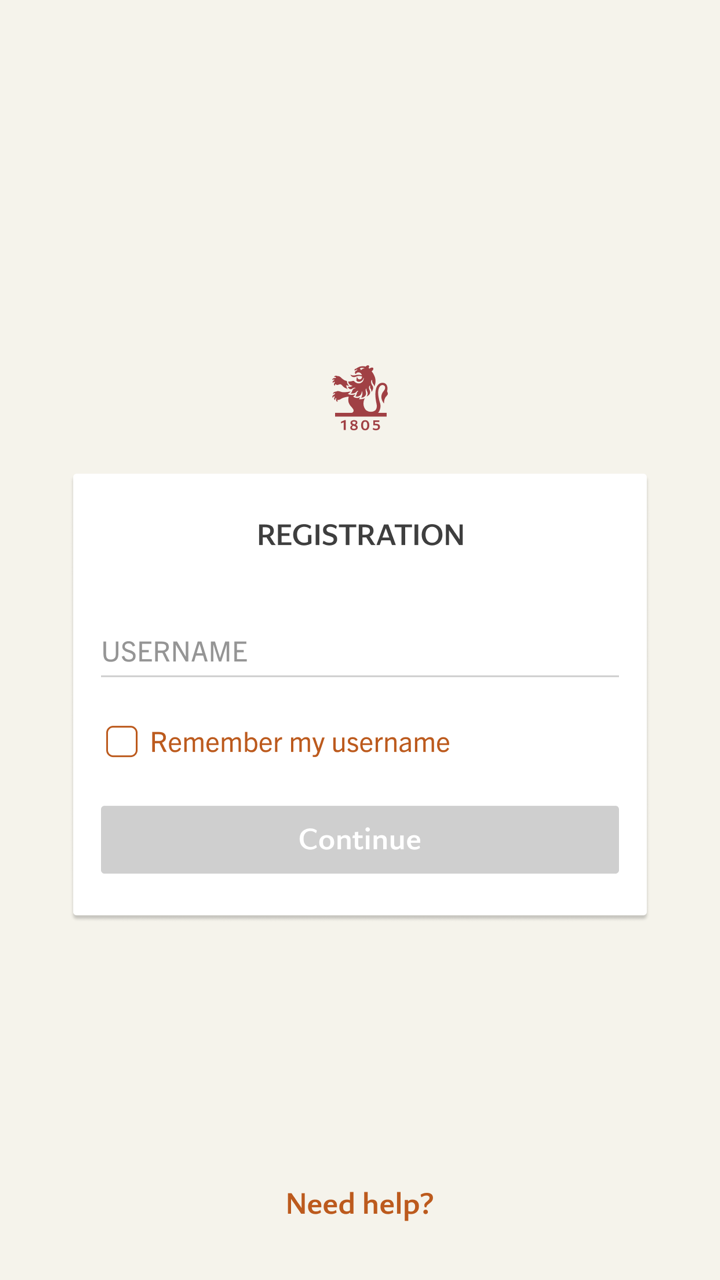

| Gegründet | 1805 |

| Registriertes Land/Region | Schweiz |

| Regulierung | SFC |

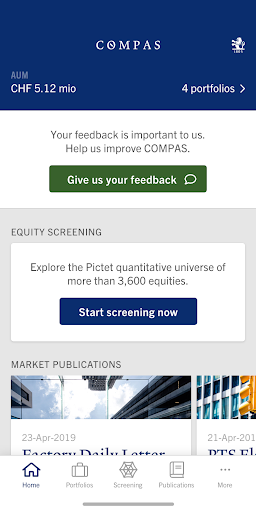

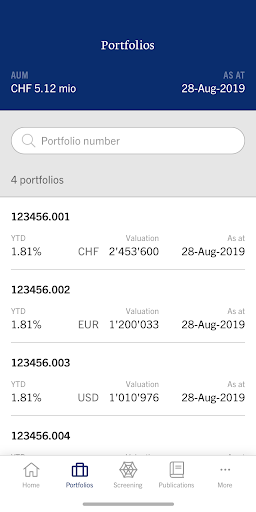

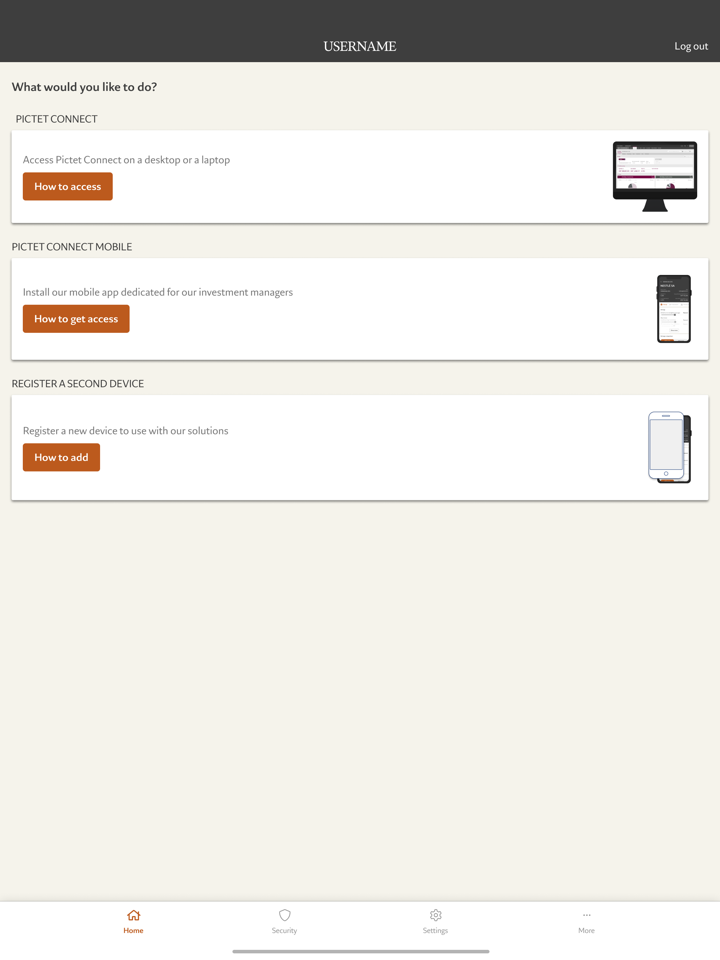

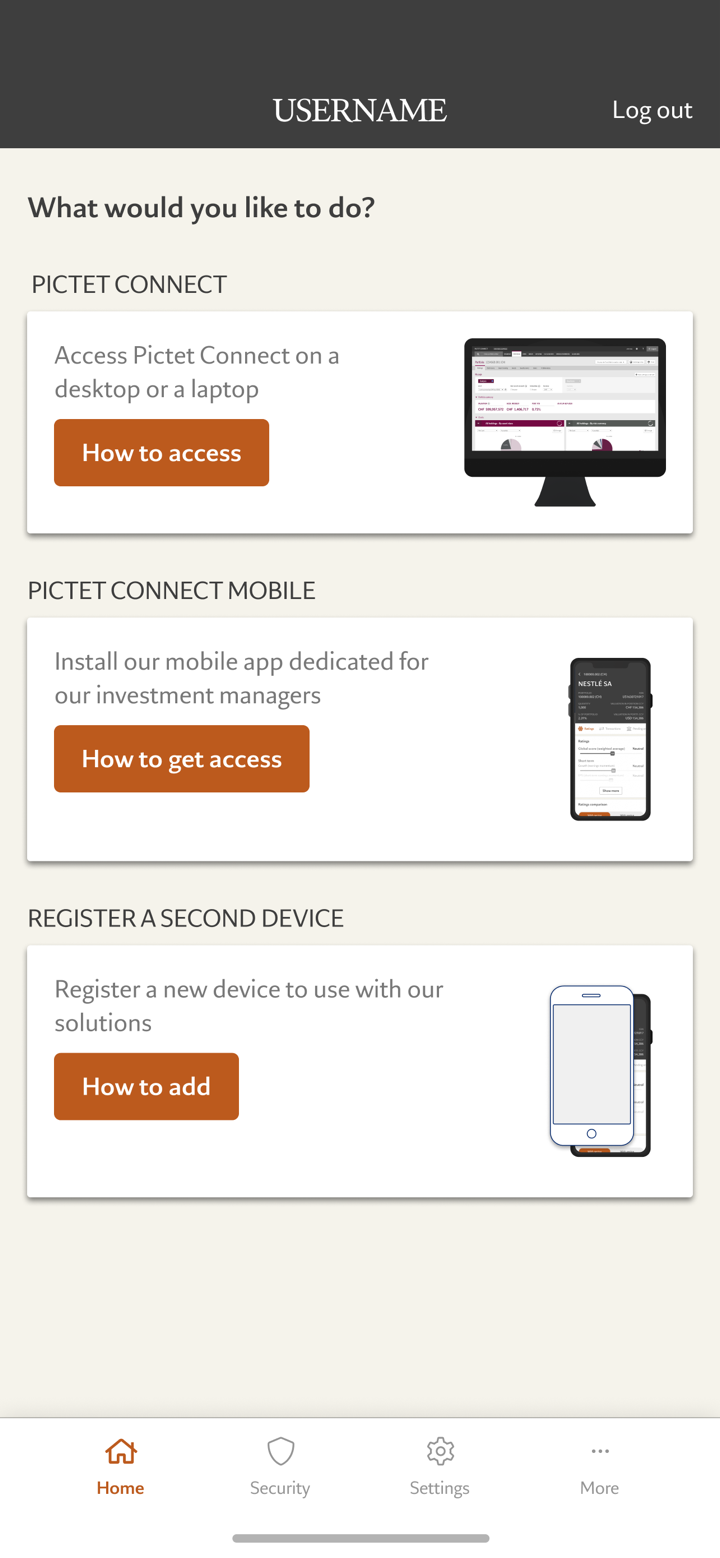

| Dienstleistungen | Vermögensverwaltung, Asset Management, alternative Investitionen, Asset-Services |

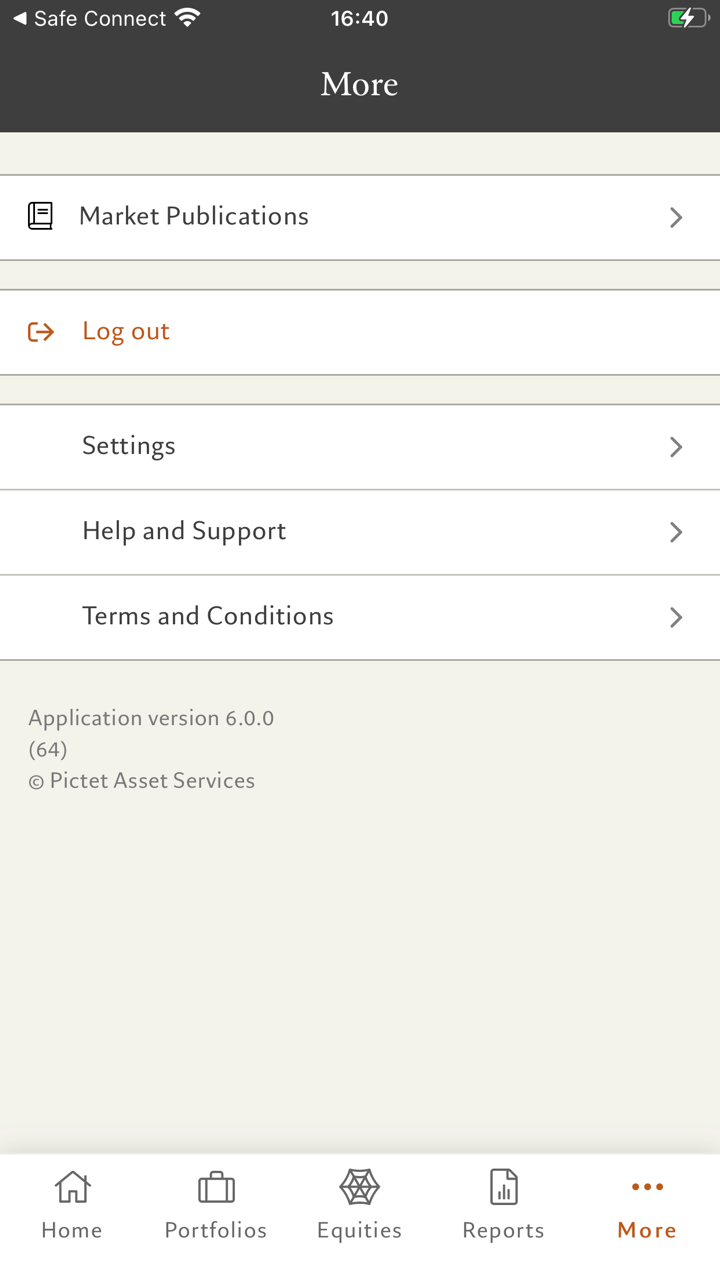

| Kundenbetreuung | Tel: +41 58 323 23 23Tel.: +852 3191 1805 |

| Fax: +852 3191 1808 | |

Pictet Informationen

Pictet, gegründet im Jahr 1805 und mit Sitz in der Schweiz, wird von der SFC reguliert. Sie bieten Vermögensverwaltung, Asset Management, alternative Investitionen und Asset-Services an, wobei der Kundensupport telefonisch und per Fax erreichbar ist.

Vor- und Nachteile

| Vorteile | Nachteile |

|

|

|

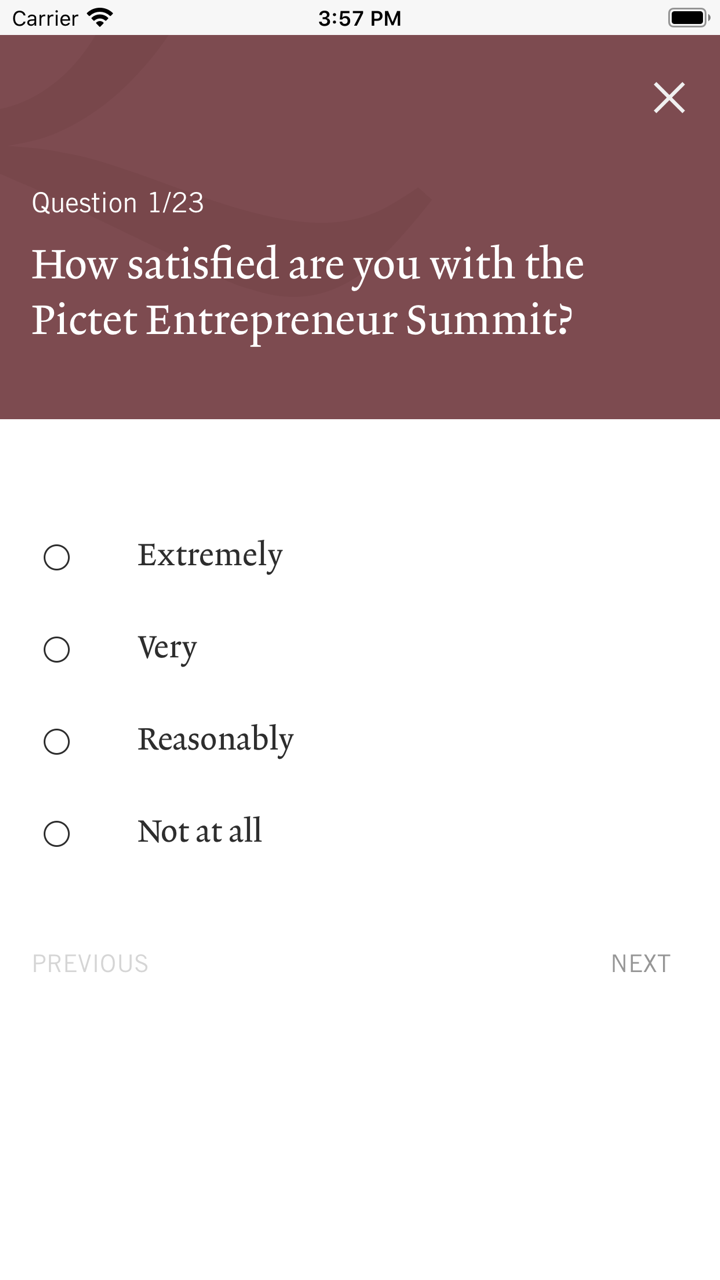

Ist Pictet legitim?

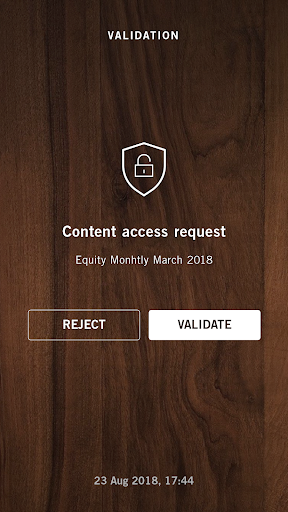

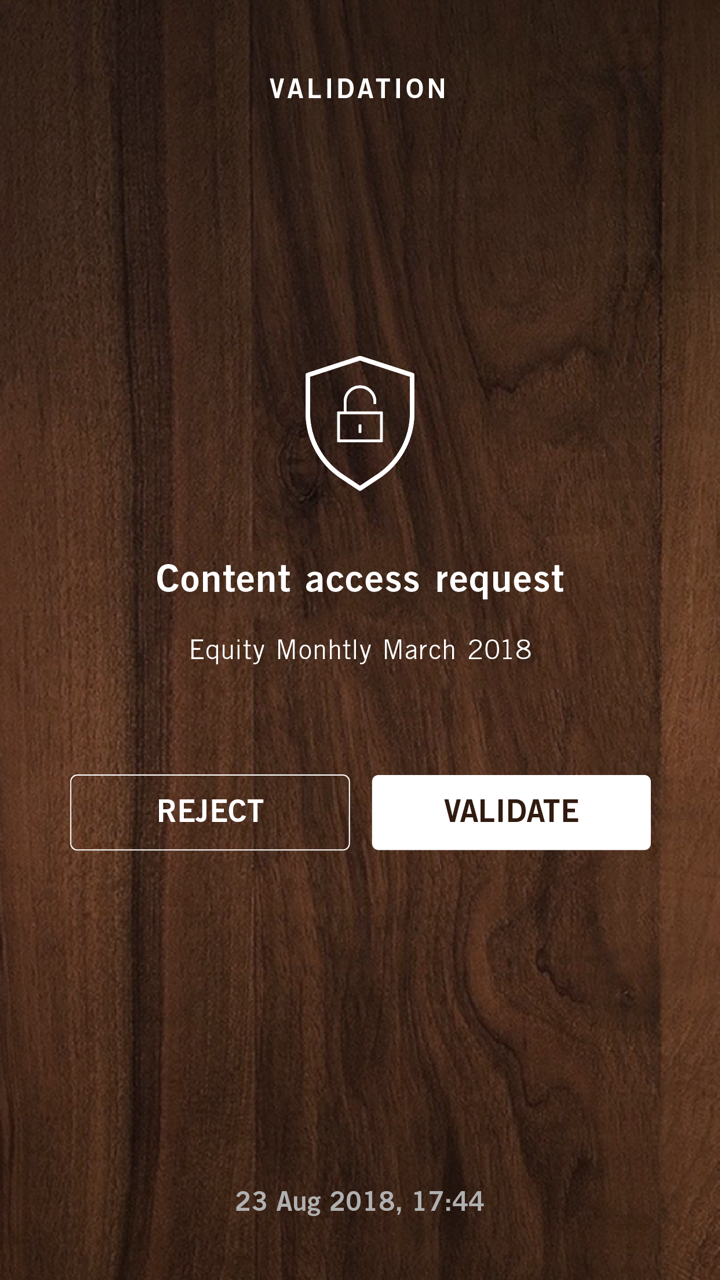

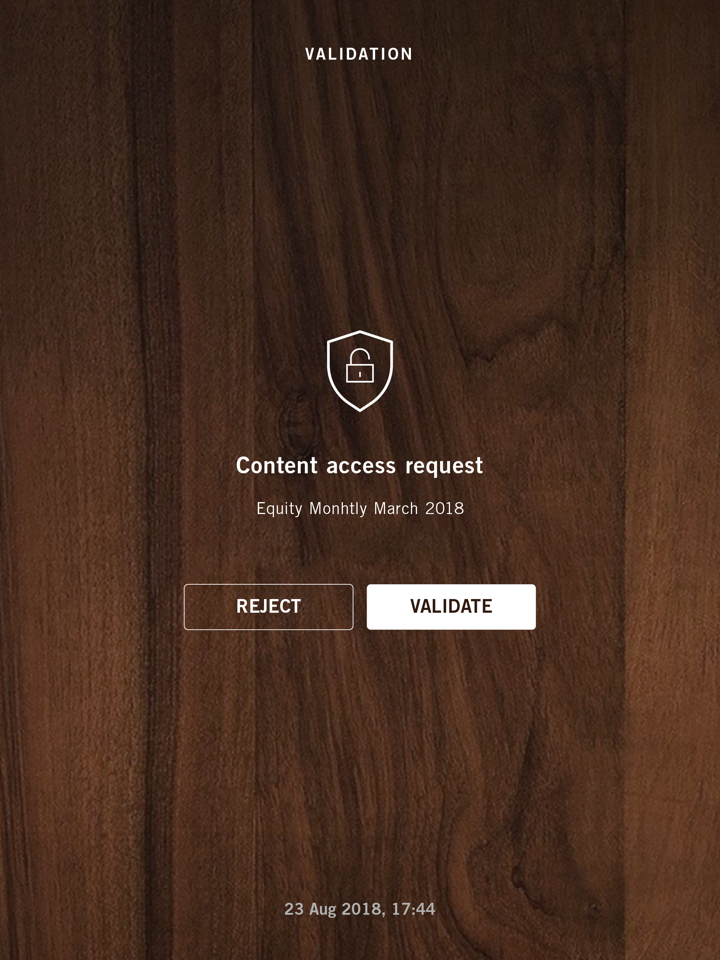

Pictet verfügt über eine „Dealing in Futures-Kontrakten“-Lizenz, die von der Securities and Futures Commission (SFC) in Hongkong reguliert wird und eine Lizenznummer von AAG715 hat.

Für wen ist Pictet tätig?

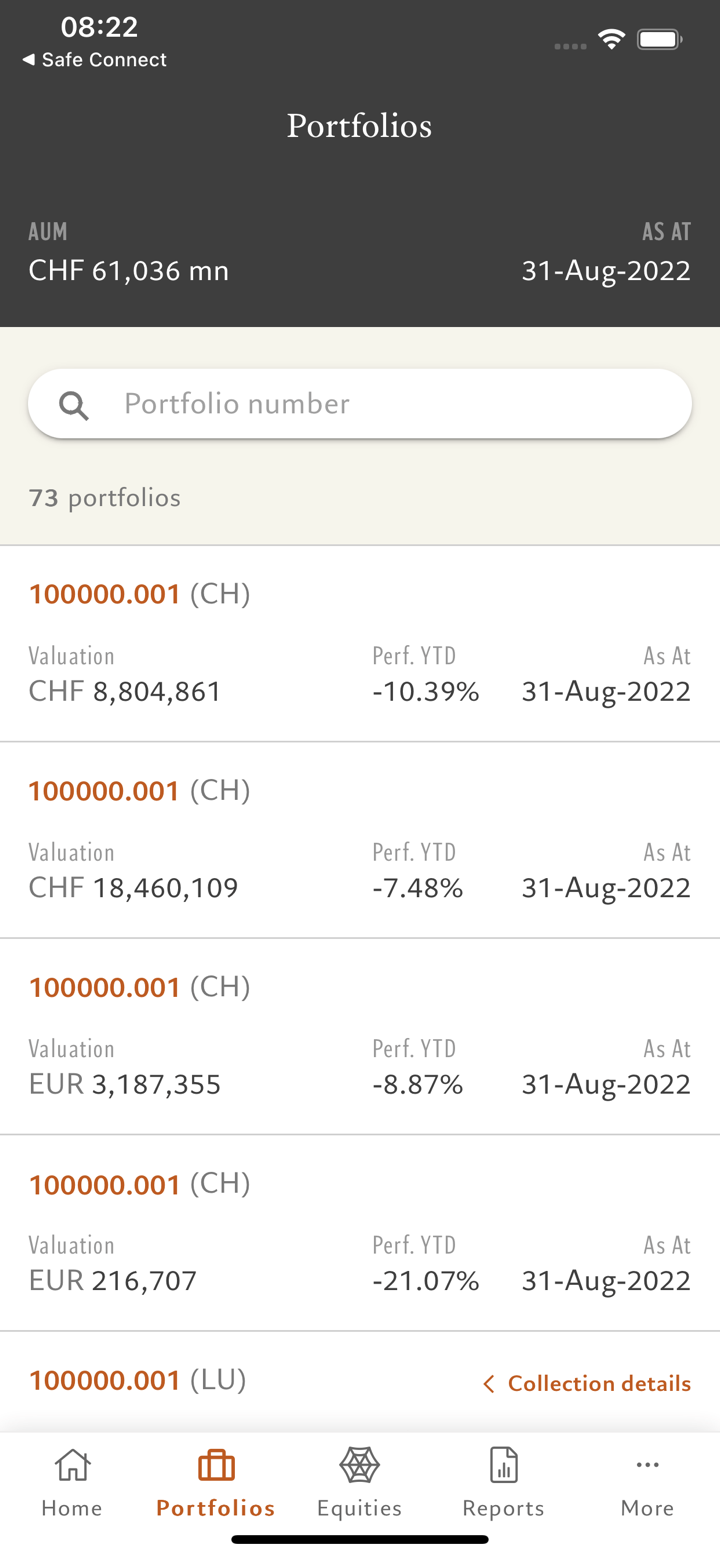

- Einzelpersonen und Familien: Pictet bietet Finanzmittel an, um Finanzinstituten und Vermittlern dabei zu helfen, die Anlageziele ihrer Kunden zu erreichen, und bietet gleichzeitig Servicelösungen zur Vereinfachung von Verwaltung, Handel und Berichterstattung.

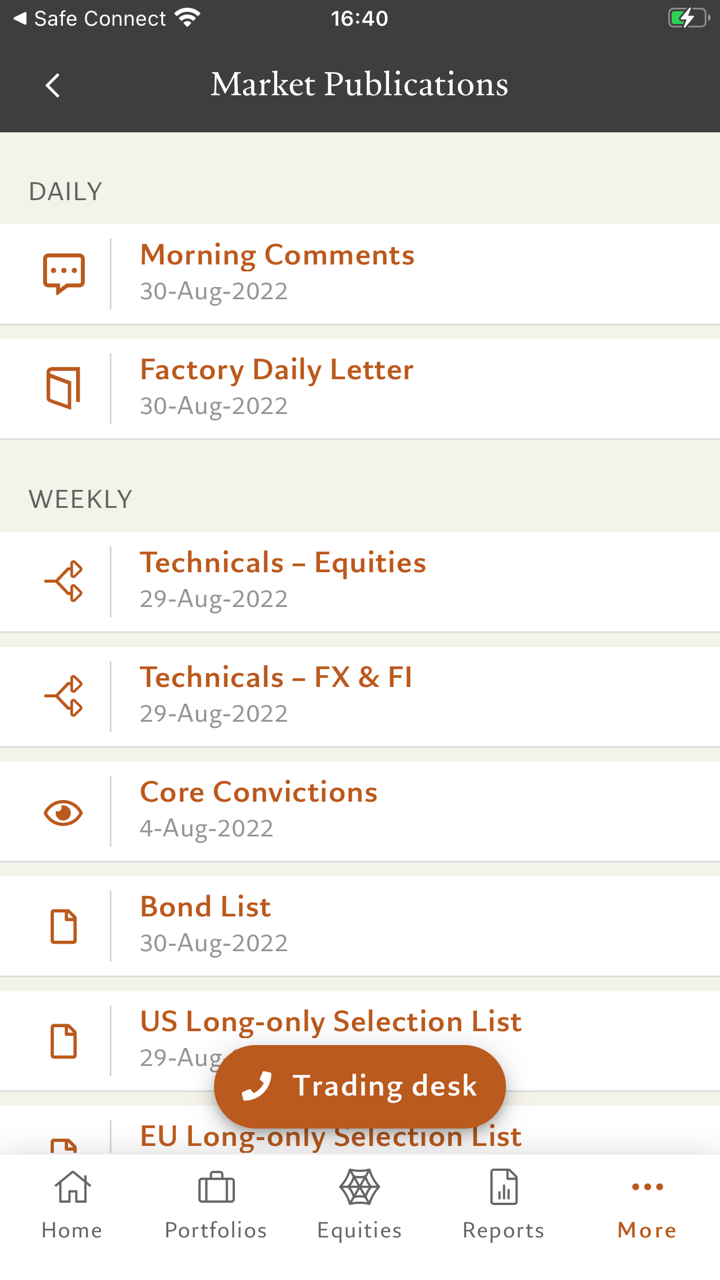

- Finanzinstitute und Vermittler: Pictet bietet Finanzmittel an, um Finanzinstituten und Vermittlern dabei zu helfen, die Anlageziele ihrer Kunden zu erreichen. Sie bieten auch Servicelösungen zur Vereinfachung von Verwaltung, Handel und Berichterstattungsprozessen.

- Institutionelle Investoren: Pictet bietet weltweit institutionellen Großinvestoren, einschließlich Pensionsfonds, Stiftungen und Staatsfonds, Anlagestrategien und Servicelösungen.

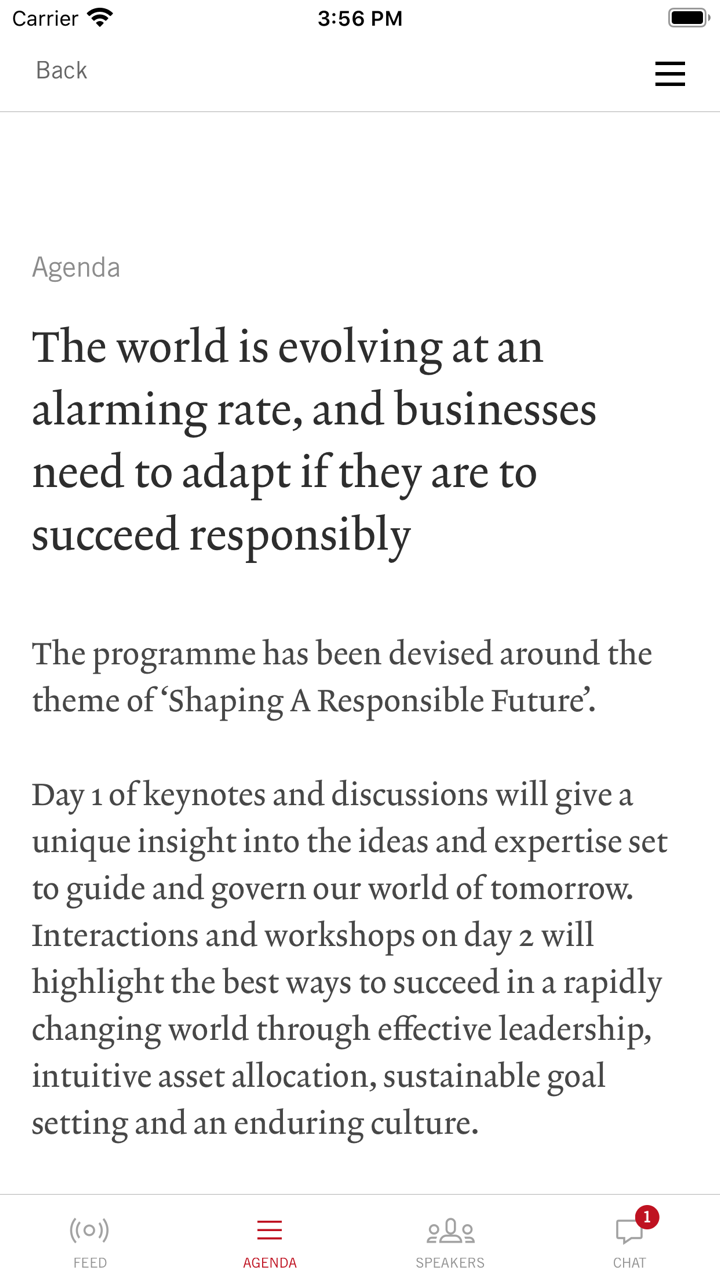

Was macht Pictet?

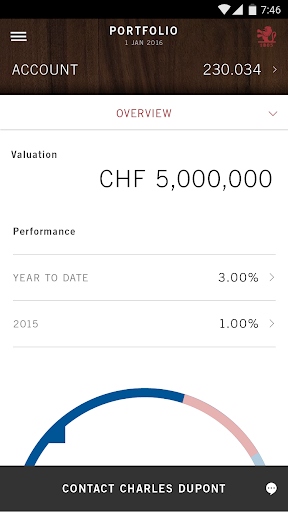

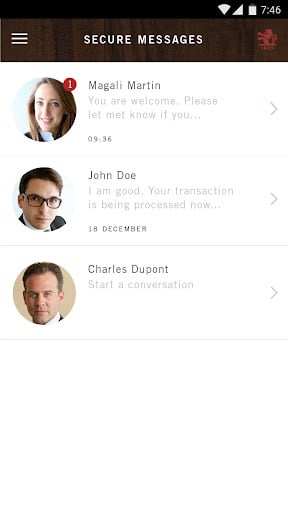

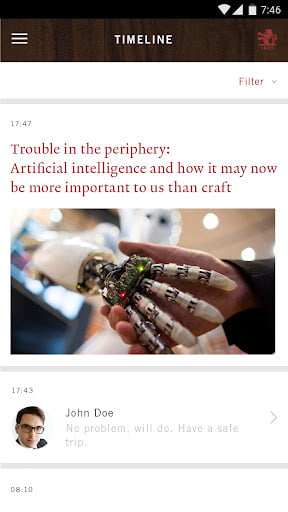

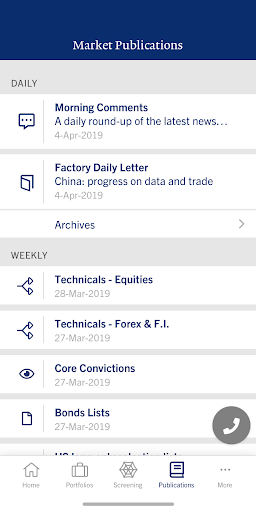

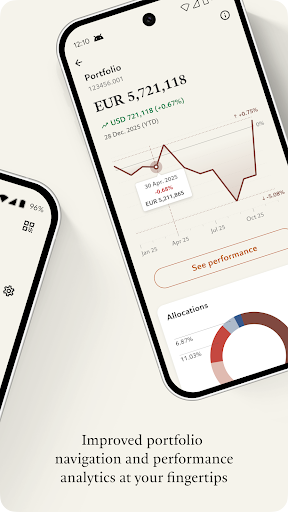

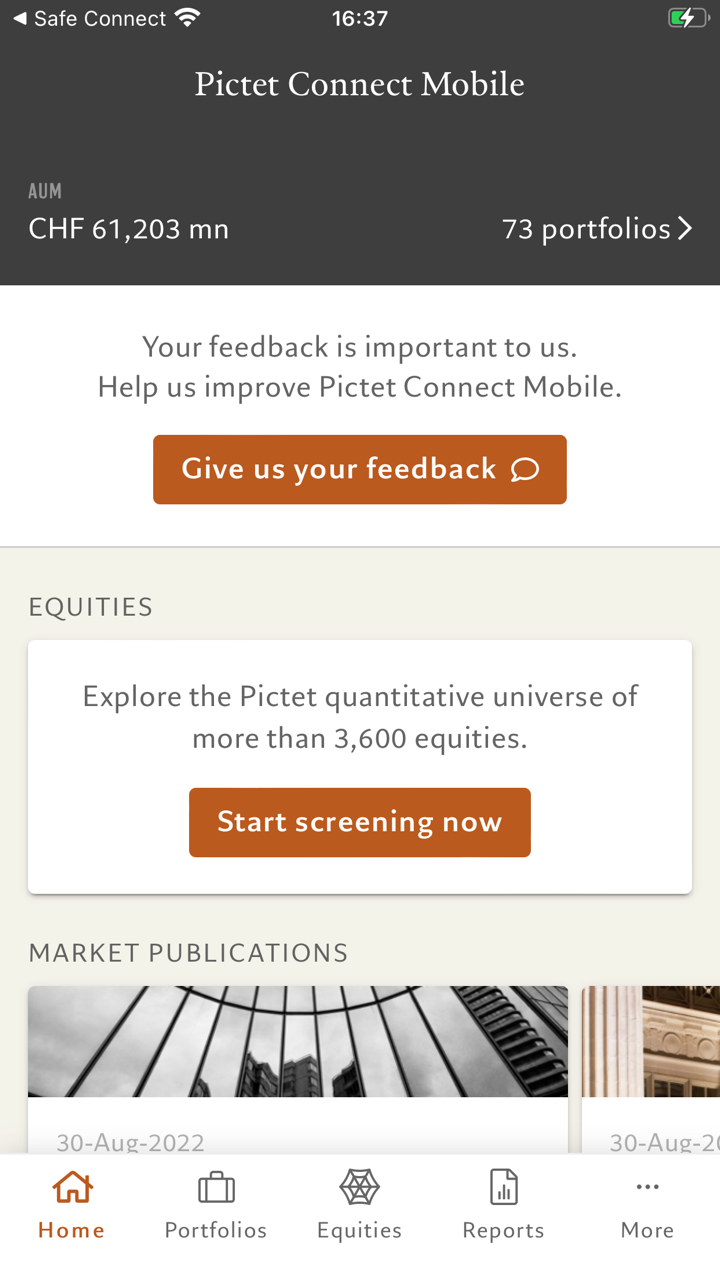

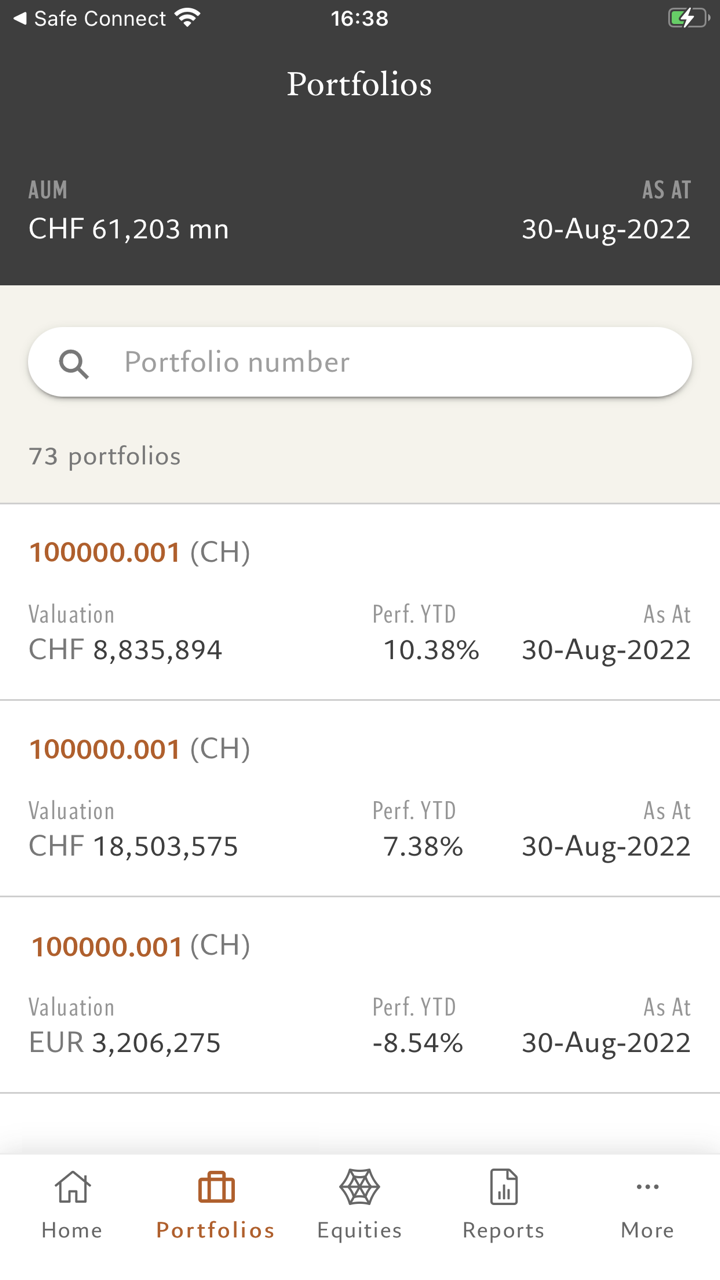

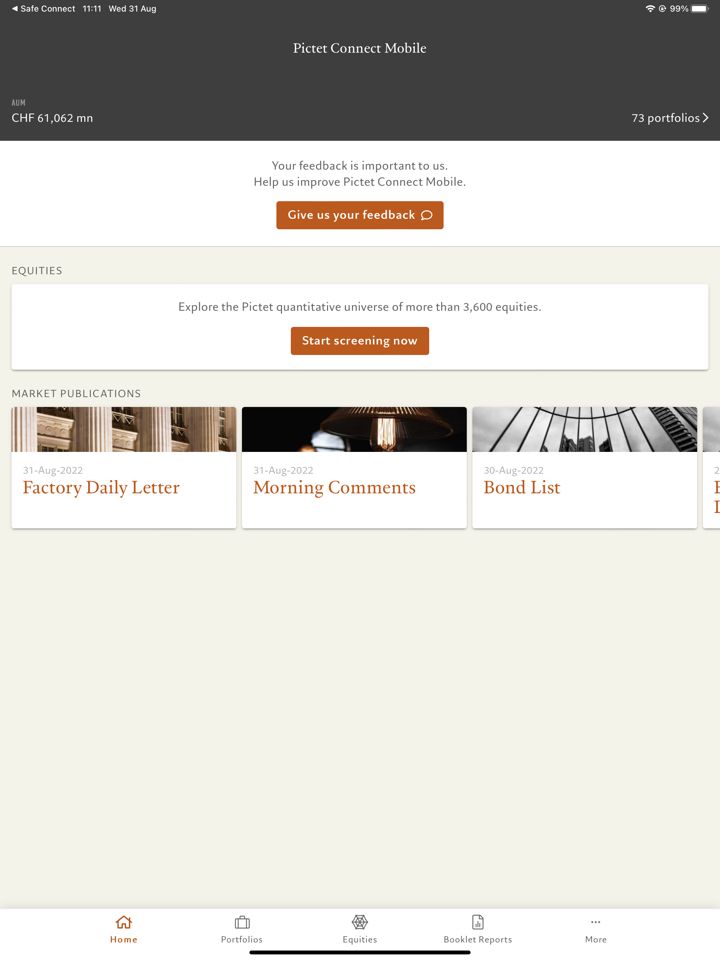

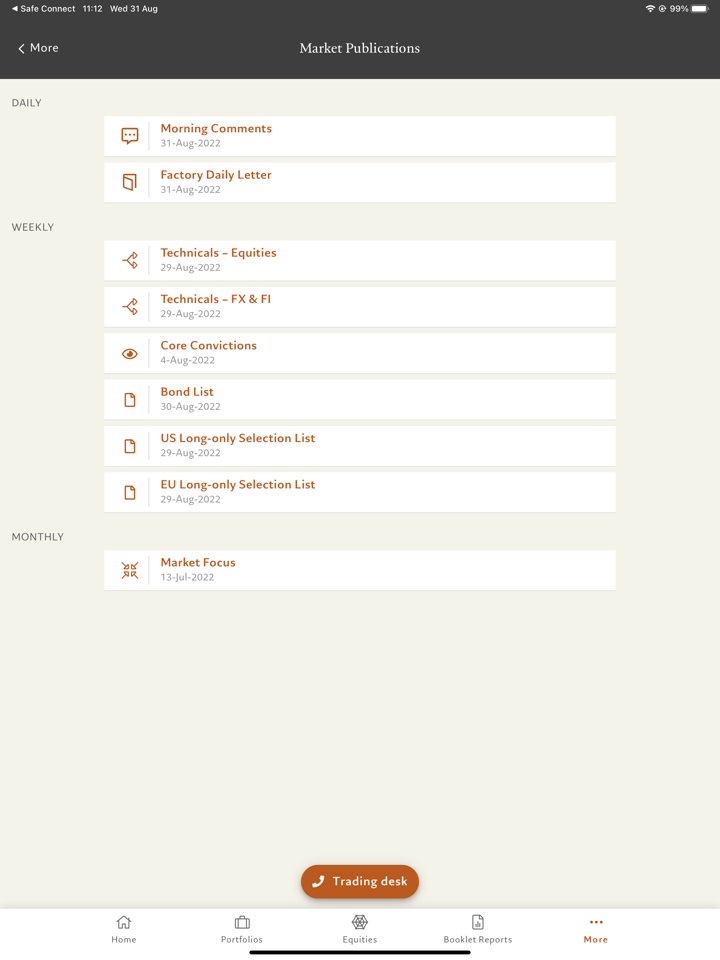

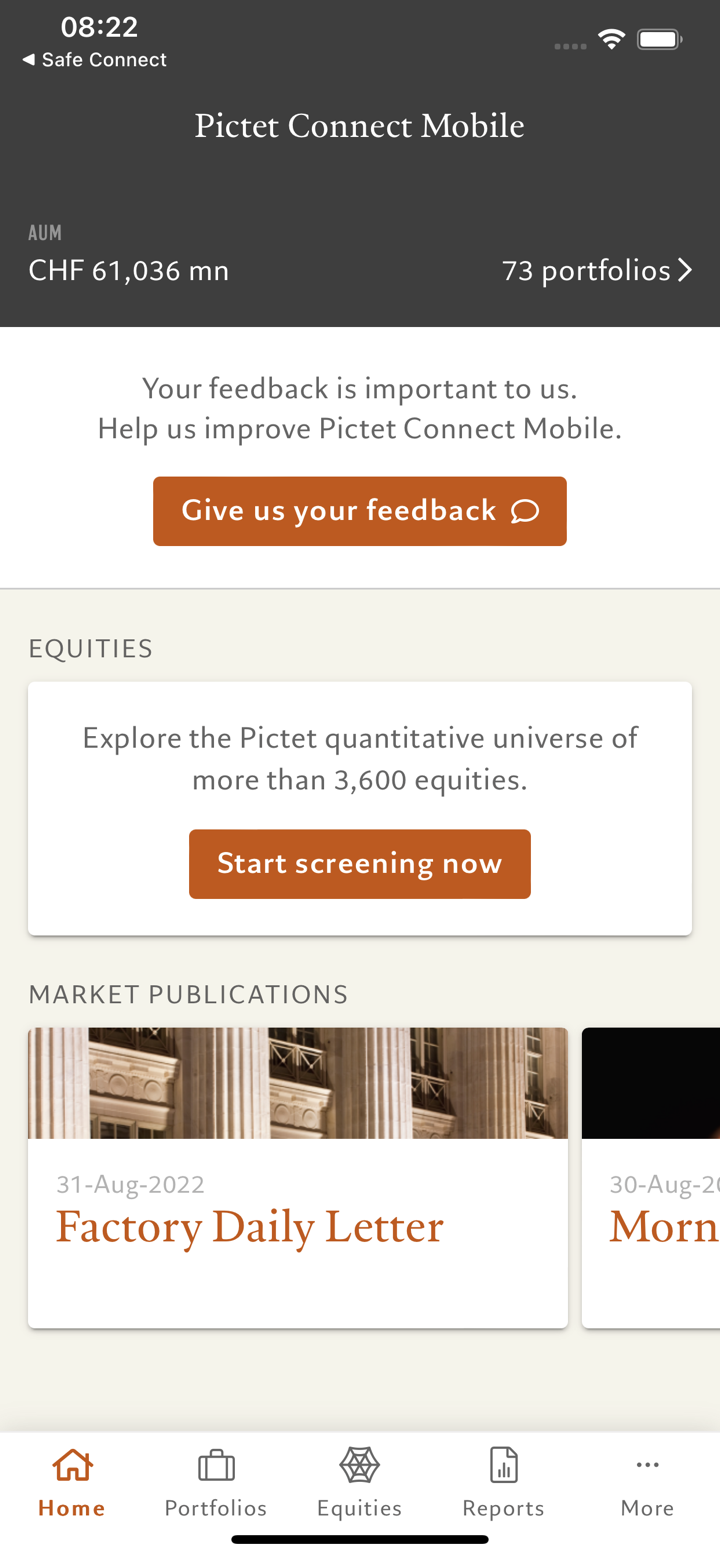

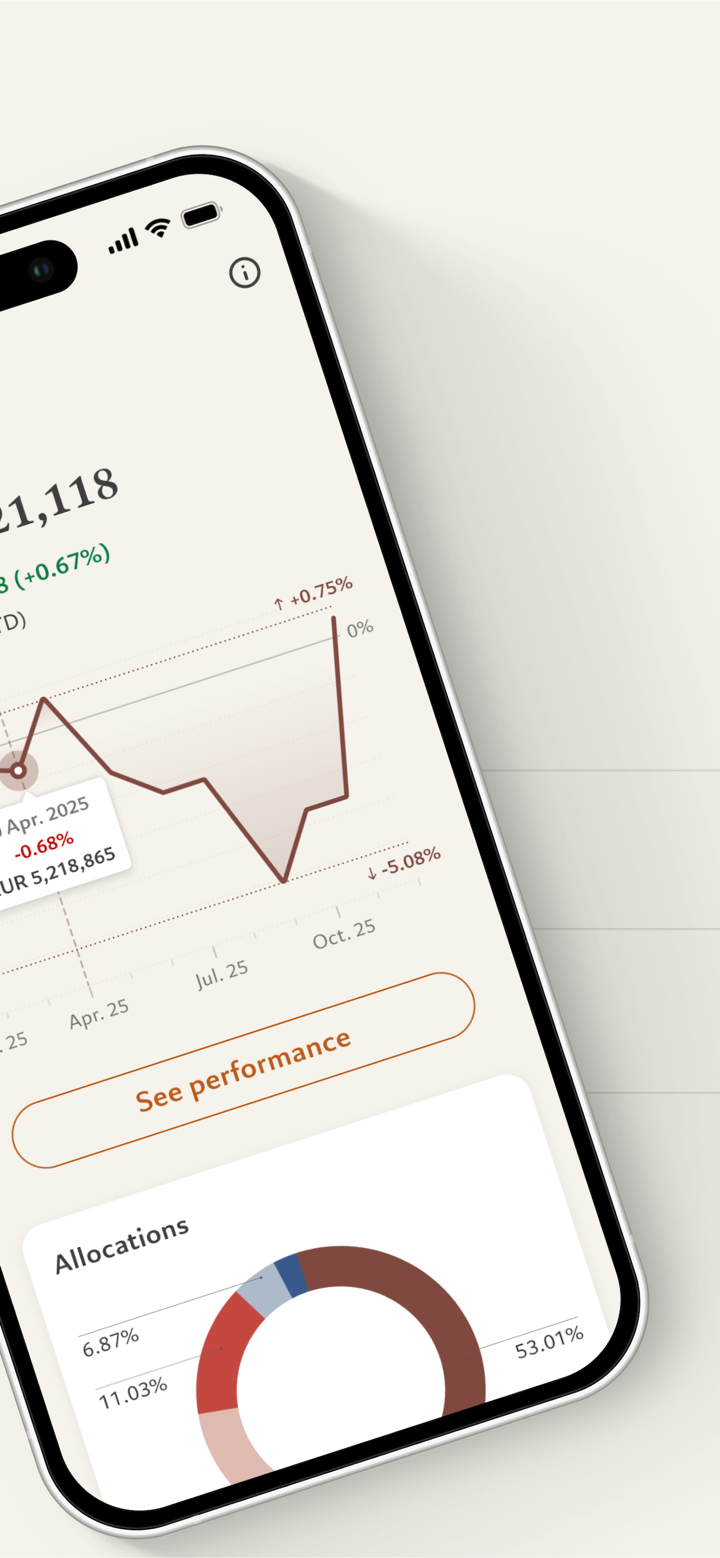

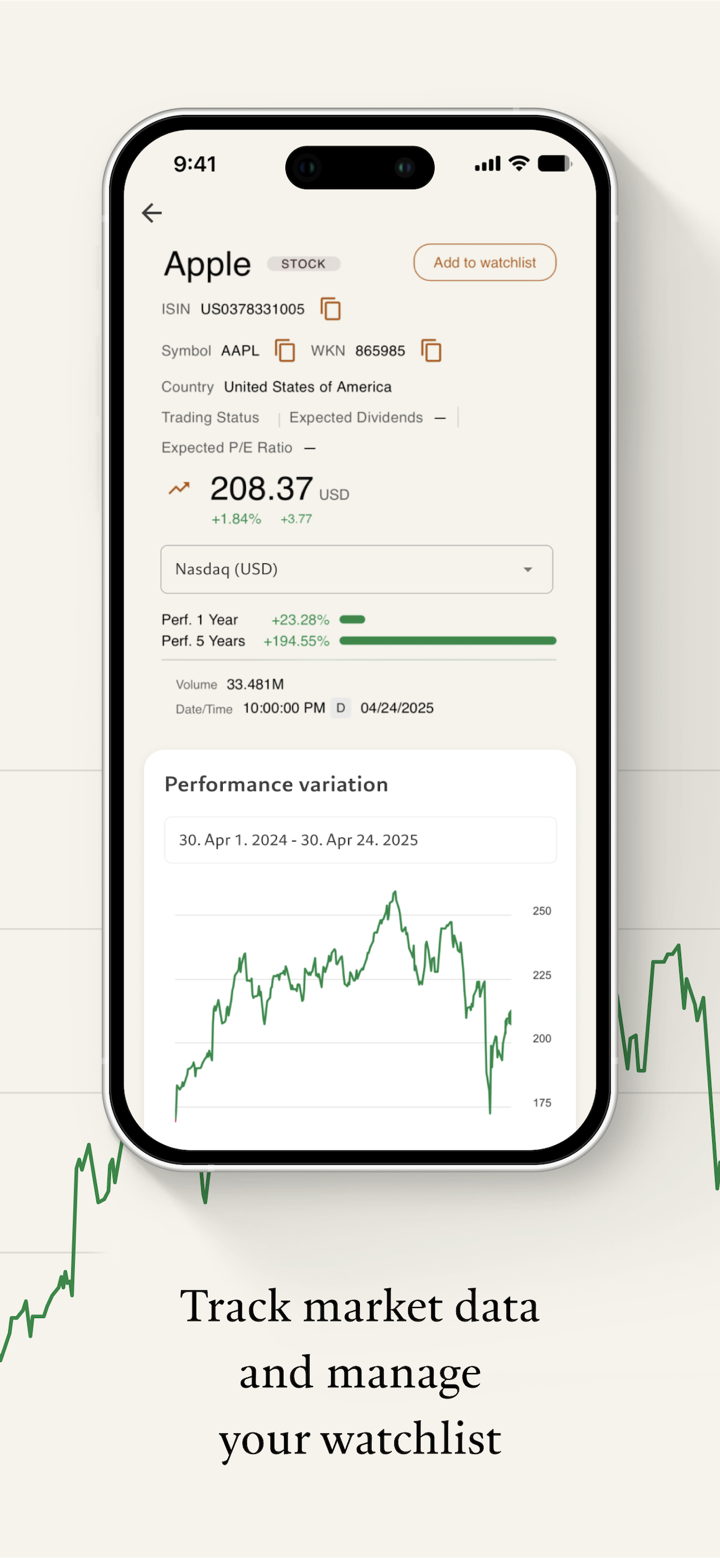

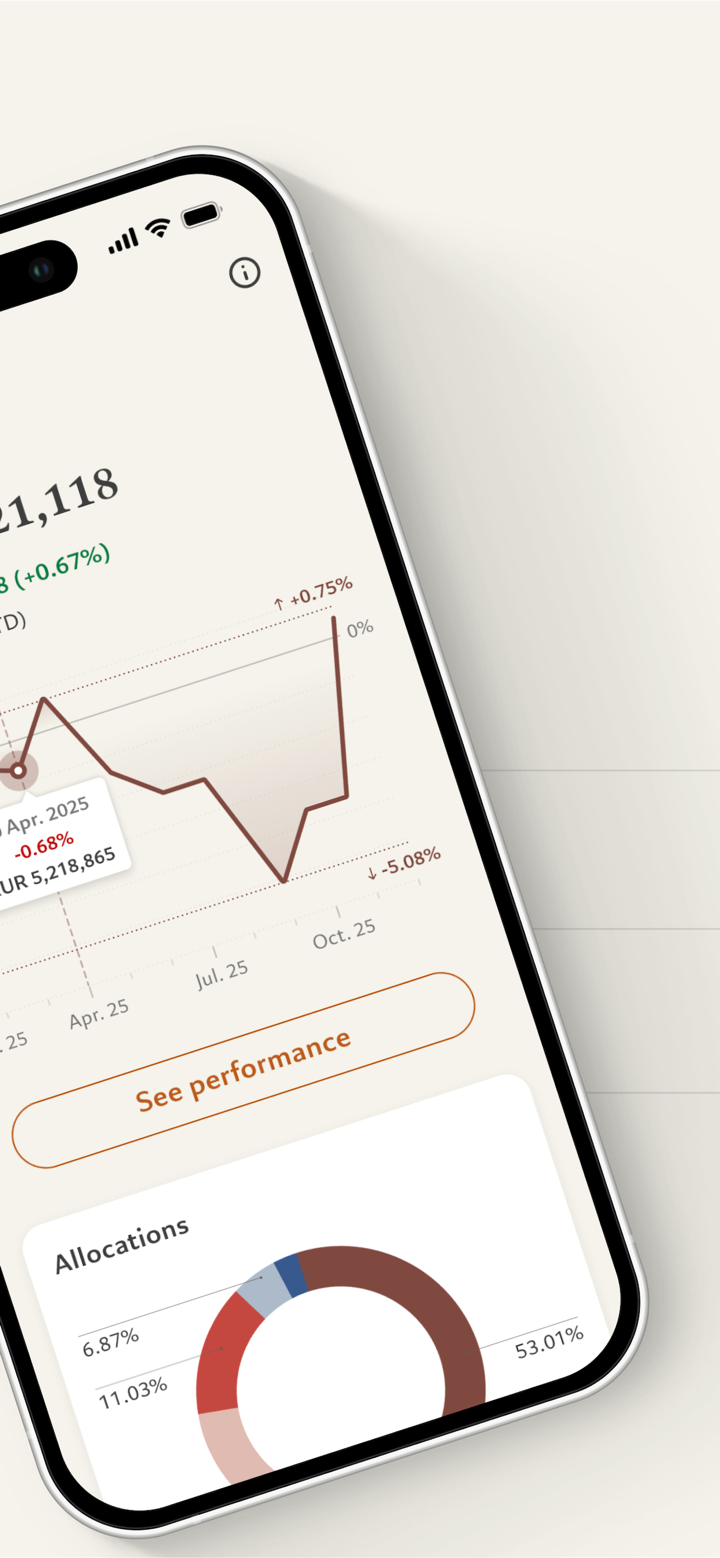

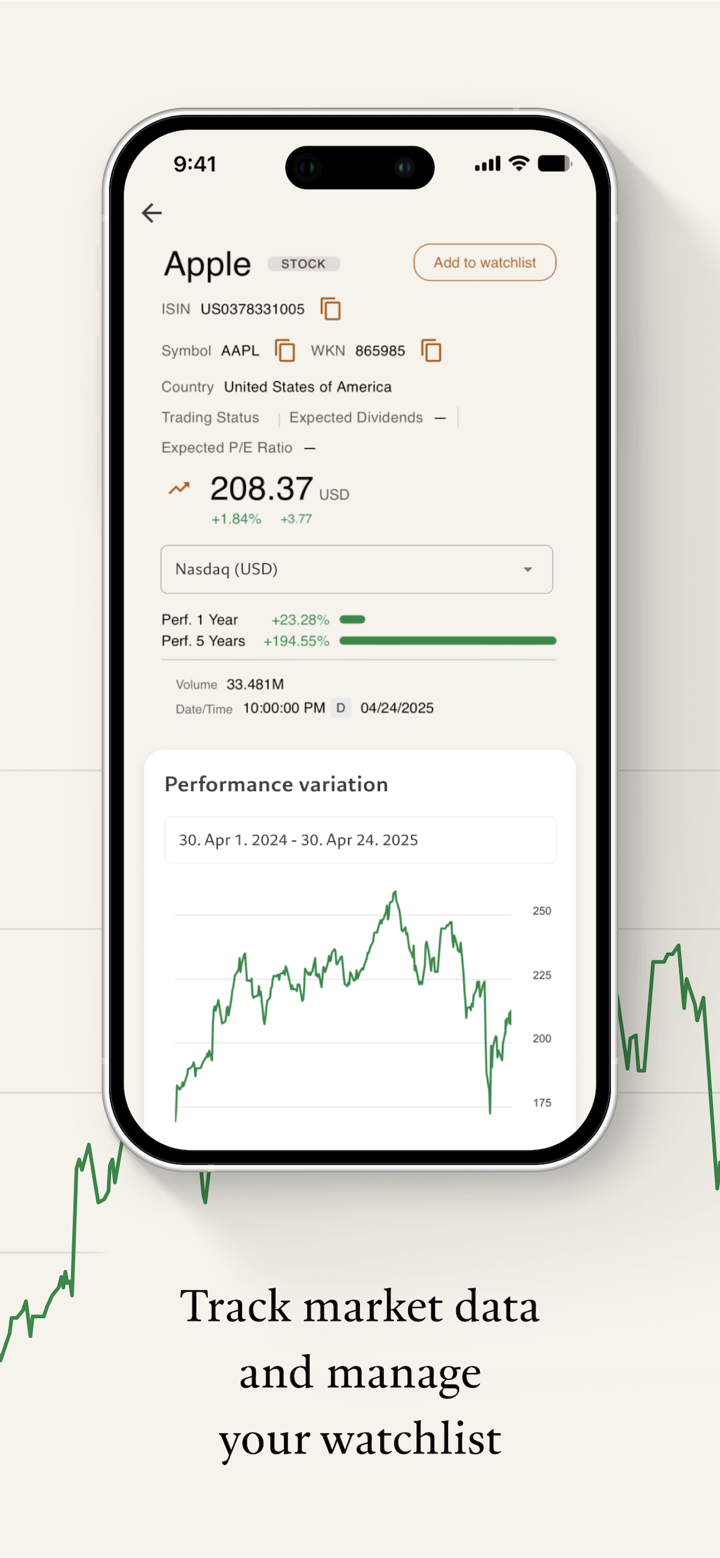

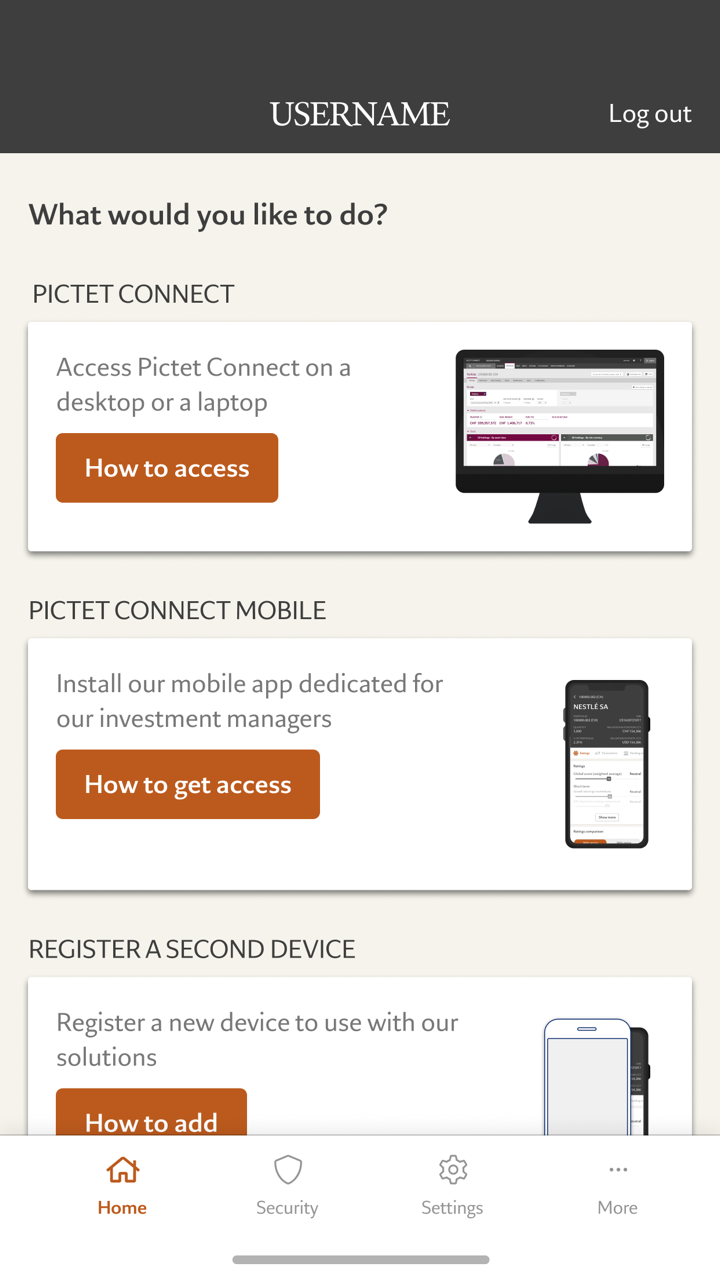

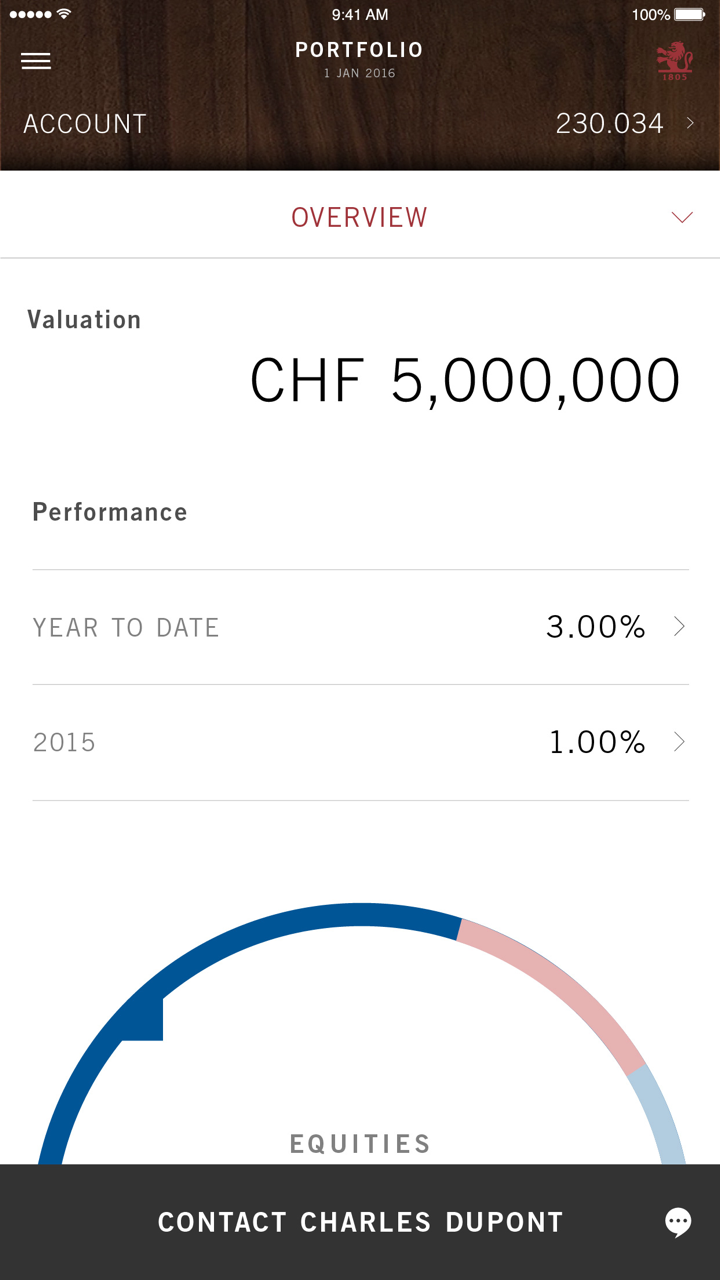

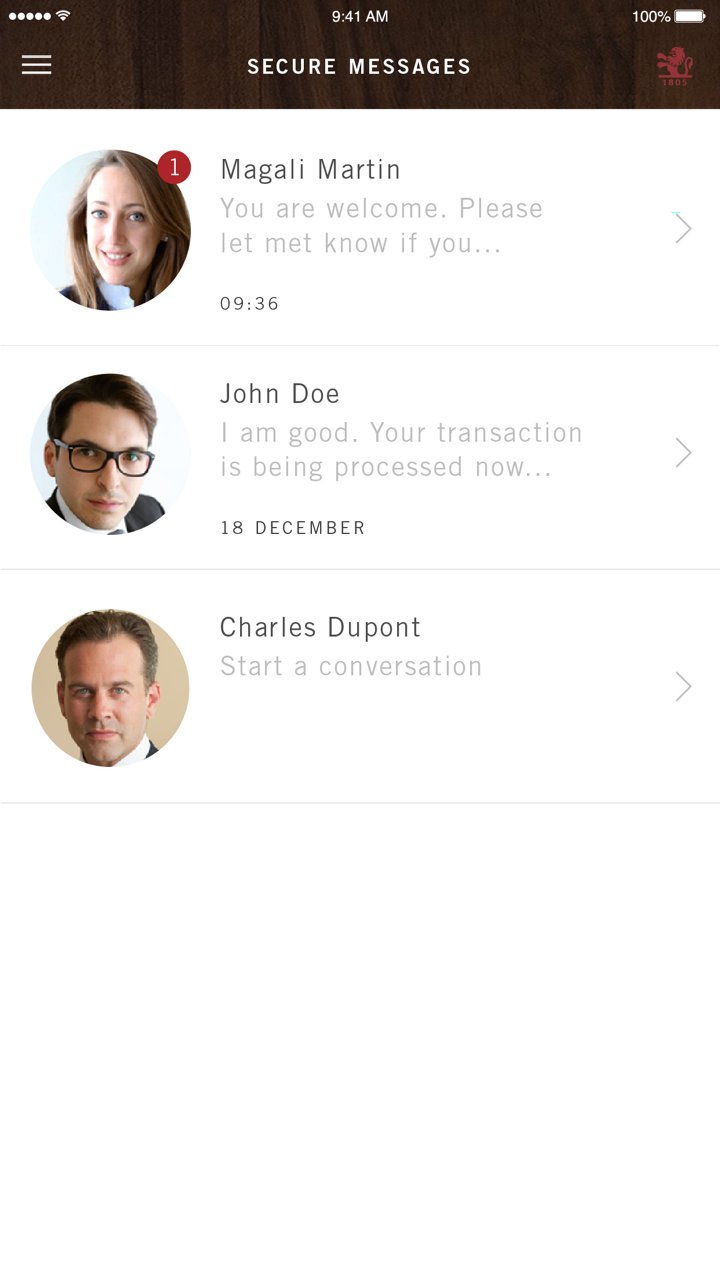

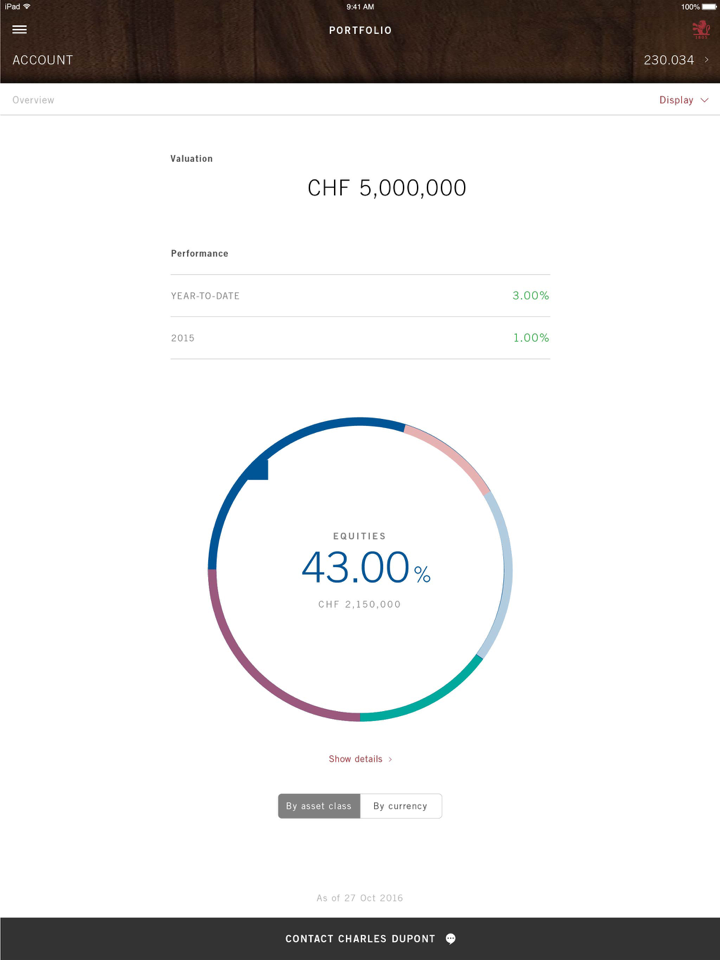

- Vermögensverwaltung: Seit über 200 Jahren konzentriert sich Pictet Wealth Management darauf, private Kunden und Family Offices bei der Verwaltung, dem Wachstum und der Sicherung ihres Vermögens auf lange Sicht zu unterstützen. Ihre Dienstleistungen zielen darauf ab, Kunden beim Aufbau von Unternehmen, beim Schutz von Vermögenswerten und bei der Sicherung für zukünftige Generationen zu helfen.

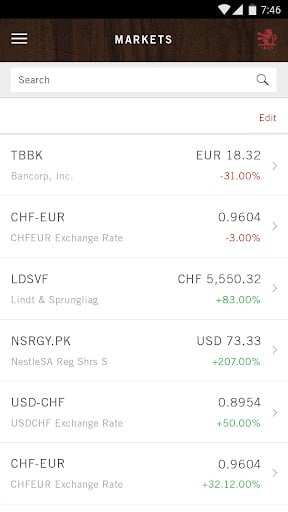

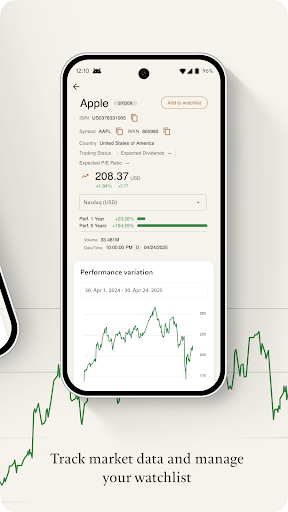

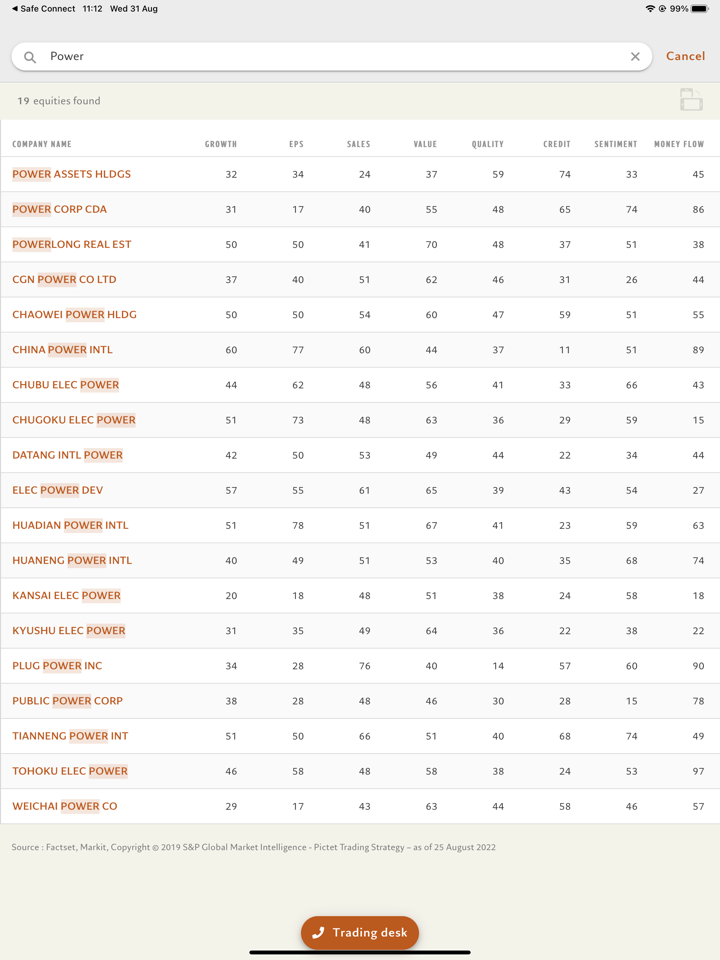

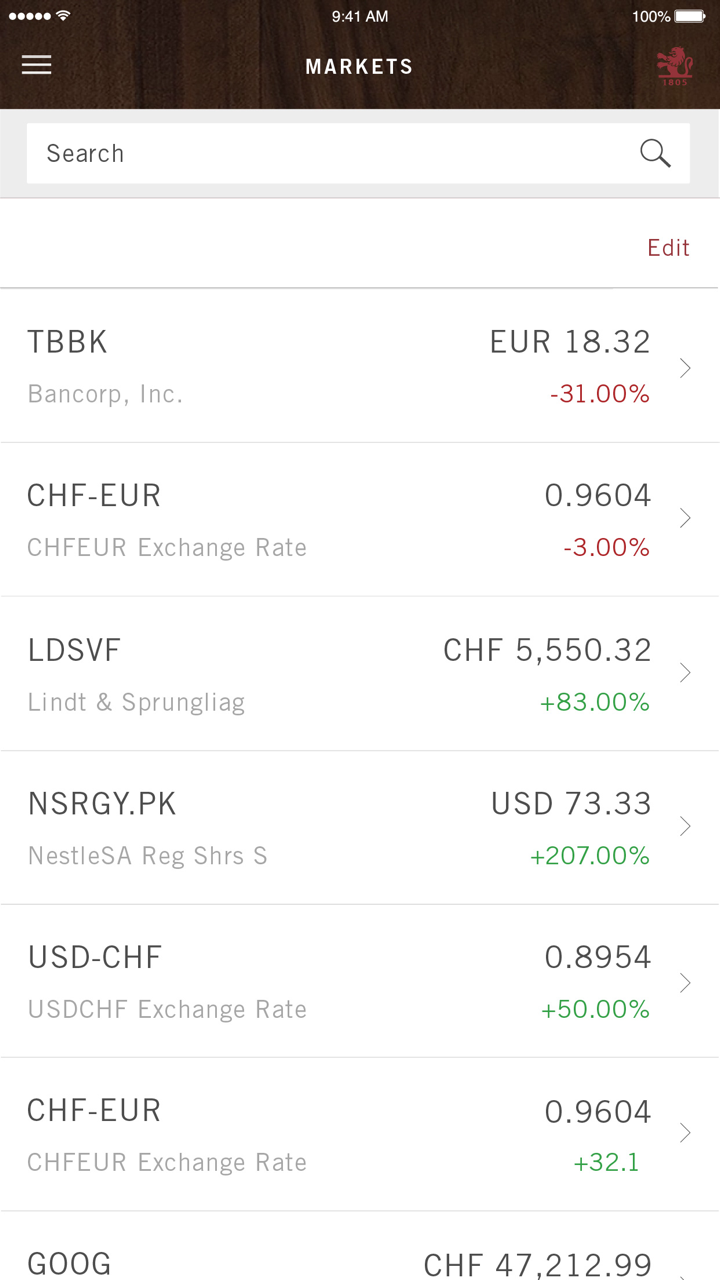

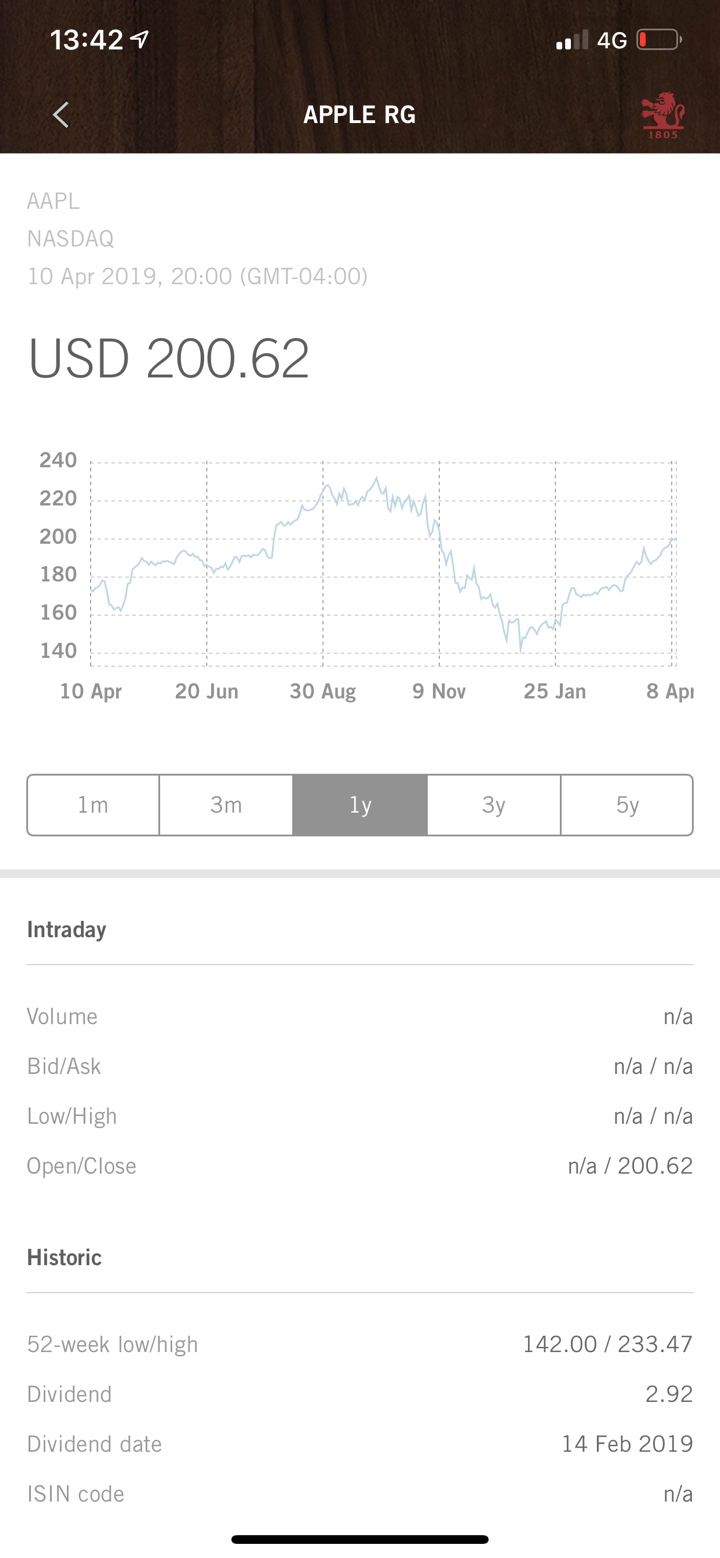

- Vermögensverwaltung: Pictet Asset Management ist ein unabhängiges Unternehmen, das im Auftrag seiner Kunden Investitionen in verschiedenen Anlageklassen wie Aktien, festverzinsliche Wertpapiere und Alternativen verwaltet.

- Alternative Investitionen: Pictet Alternative Investments bietet anspruchsvollen Investoren Zugang zu einzigartigen Möglichkeiten und setzt seit Jahrzehnten alternative Strategien ein, um starke Ergebnisse anzustreben.

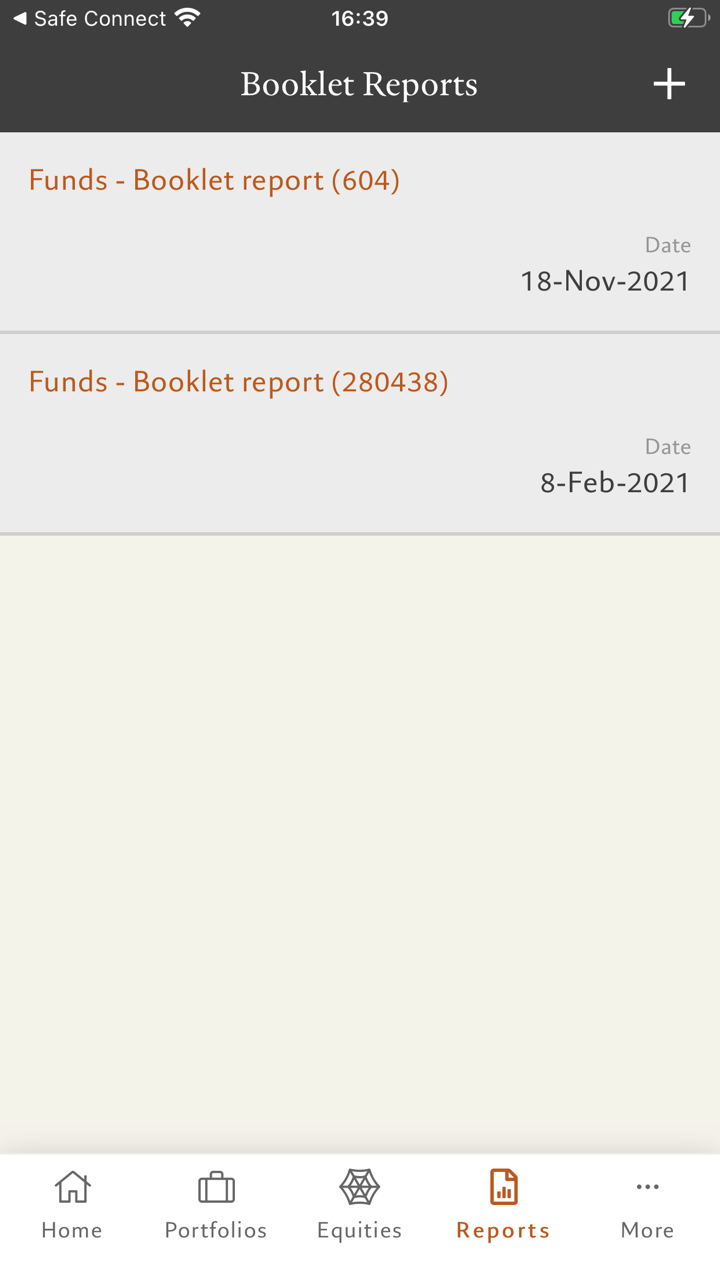

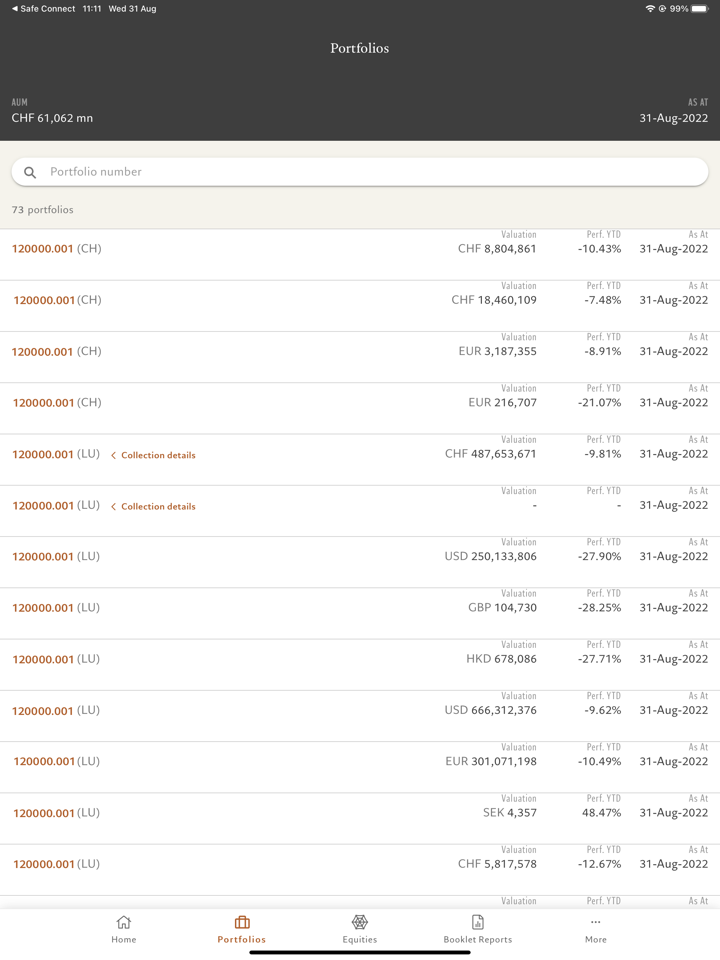

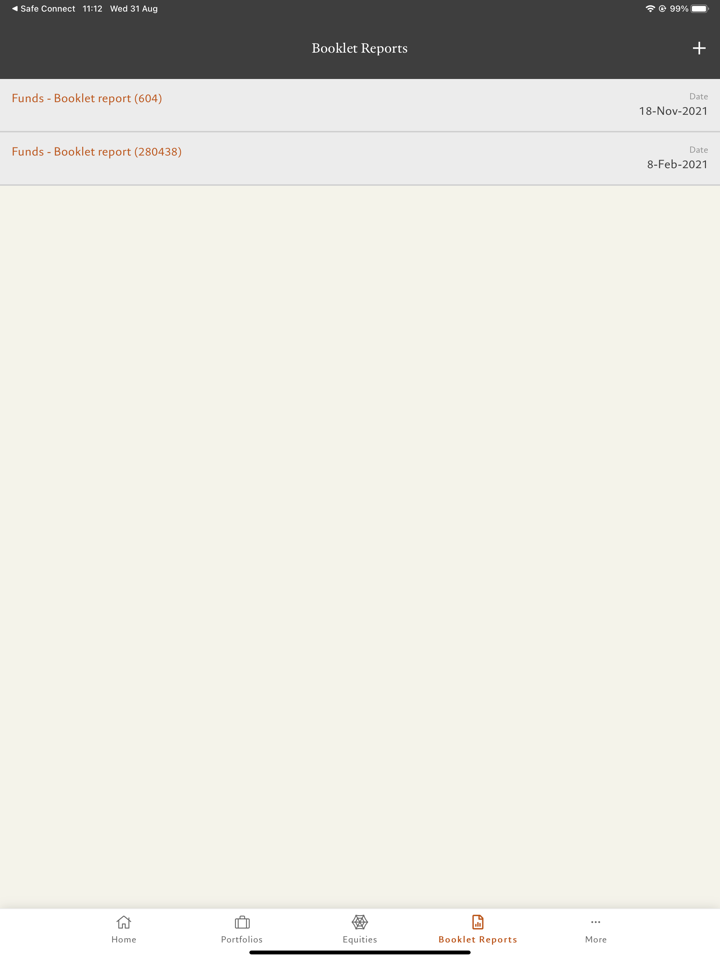

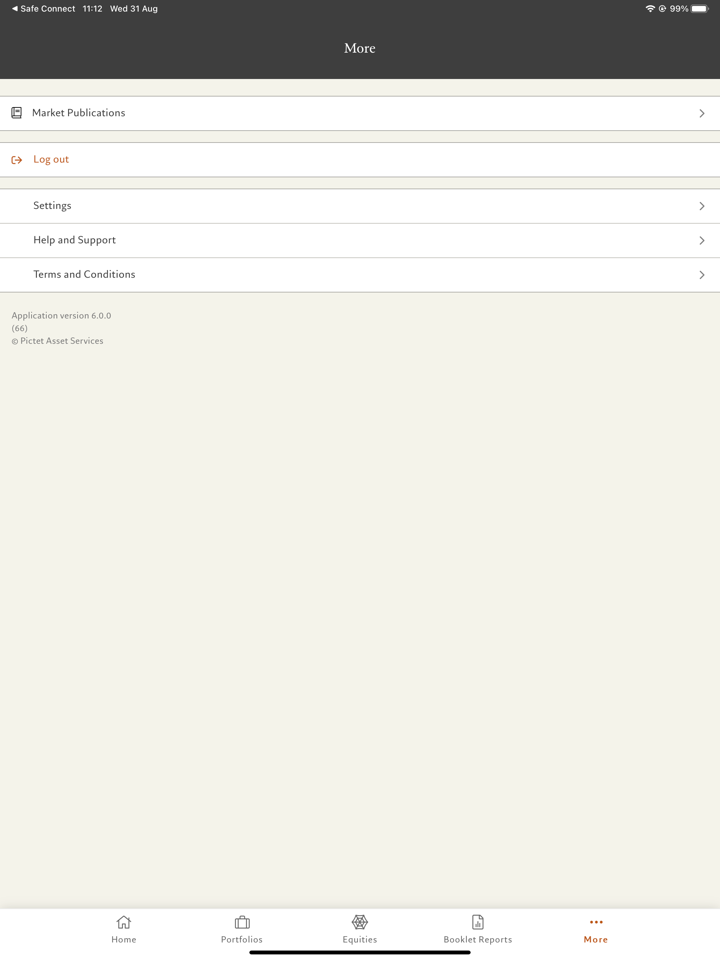

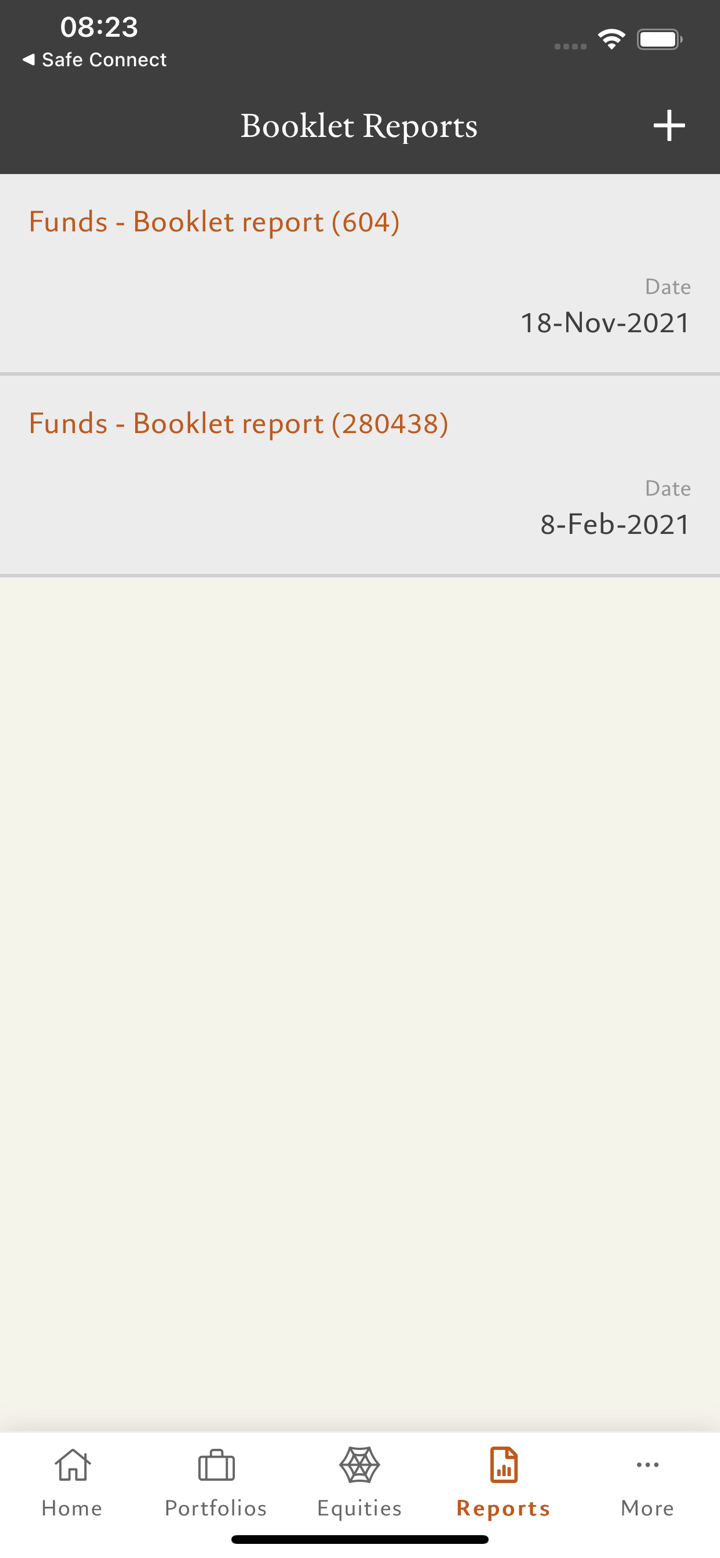

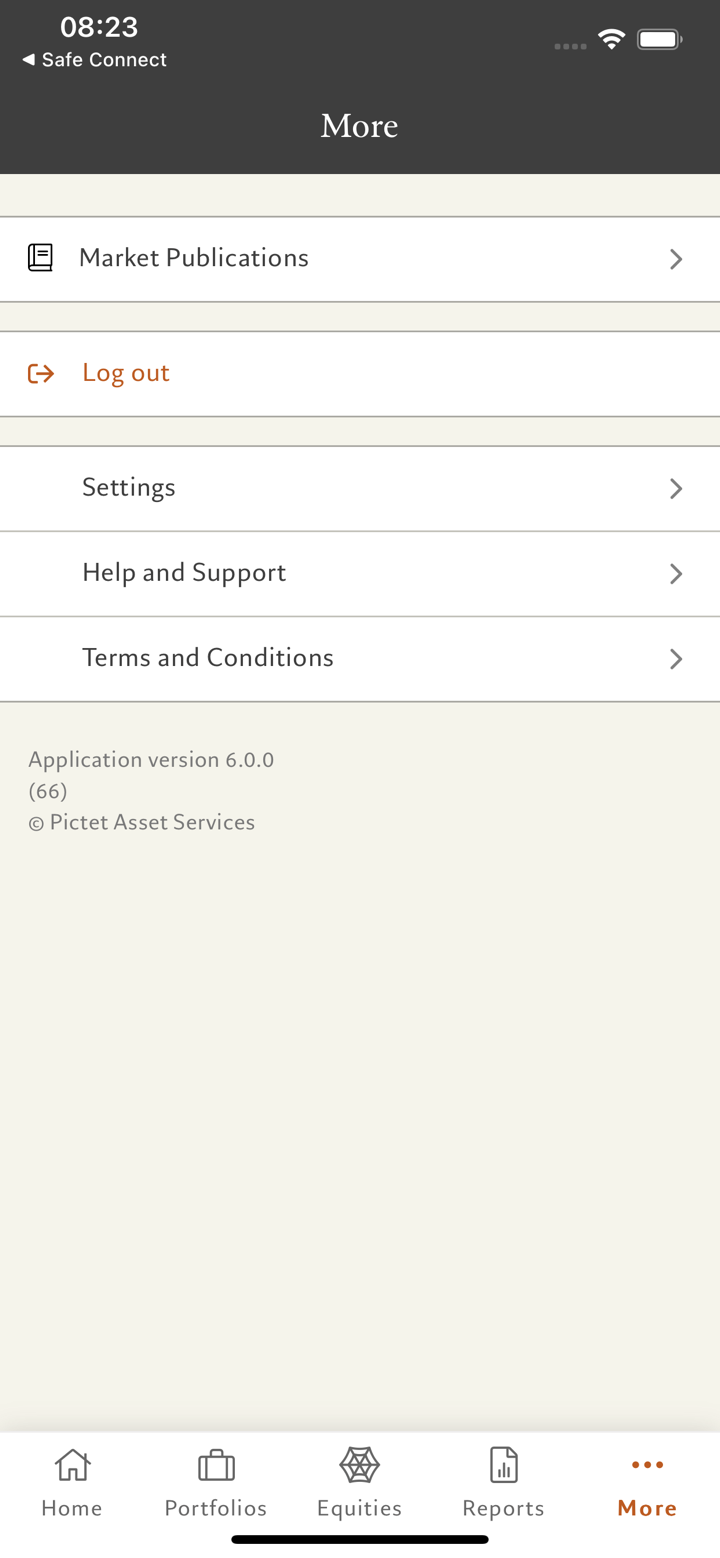

- Vermögensdienstleistungen: Pictet Asset Services verwaltet alle Aspekte des Vermögensverwaltungsprozesses, sodass sich Kunden auf die Distribution und die Erzielung von Portfolioerträgen konzentrieren können.