Giới thiệu doanh nghiệp

| Akatsuki Tóm tắt Đánh giá | |

| Thành lập | 1997 |

| Quốc gia/Vùng | Nhật Bản |

| Quy định | FSA |

| Công cụ Thị trường | Quỹ Đầu tư, Cổ phiếu, Trái phiếu |

| Tài khoản Demo | / |

| Nền tảng Giao dịch | / |

| Yêu cầu Tiền gửi Tối thiểu | / |

| Hỗ trợ Khách hàng | Mẫu Liên hệ |

| Điện thoại: 0120-753-960 | |

| Địa chỉ: 17-10 Koamicho, Nihonbashi, Chuo-ku, Tokyo 103-0016 Nihonbashi Koamicho Square Building Tầng 5 | |

Thông tin về Akatsuki

Akatsuki là một nhà môi giới có trụ sở tại Nhật Bản, thành lập vào năm 1997, được quy định bởi FSA. Cung cấp dịch vụ về Quỹ Đầu tư, Cổ phiếu và Trái phiếu.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

| Được quy định bởi FSA | Thông tin giao dịch hạn chế |

| Có văn phòng vật lý | Các phí đa dạng |

| Lịch sử hoạt động lâu dài |

Akatsuki Có Uy tín không?

Akatsuki được quy định bởi Cơ quan Dịch vụ Tài chính (FSA) tại Nhật Bản. Vui lòng chú ý đến rủi ro!

| Tình trạng Quy định | Được Quy định bởi | Cơ sở Đã được Cấp phép | Loại Giấy phép | Số Giấy phép |

| Được Quy định | Cơ quan Dịch vụ Tài chính (FSA) | Akatsuki株式会社 | Giấy phép Ngoại hối Bán lẻ | 関東財務局長(金商)第67号 |

Khảo sát Thực địa WikiFX

Đội khảo sát hiện trường WikiFX đã đến thăm địa chỉ của Akatsuki tại Nhật Bản, và chúng tôi đã tìm thấy văn phòng của họ tại địa điểm, điều này có nghĩa là công ty hoạt động với một văn phòng vật lý.

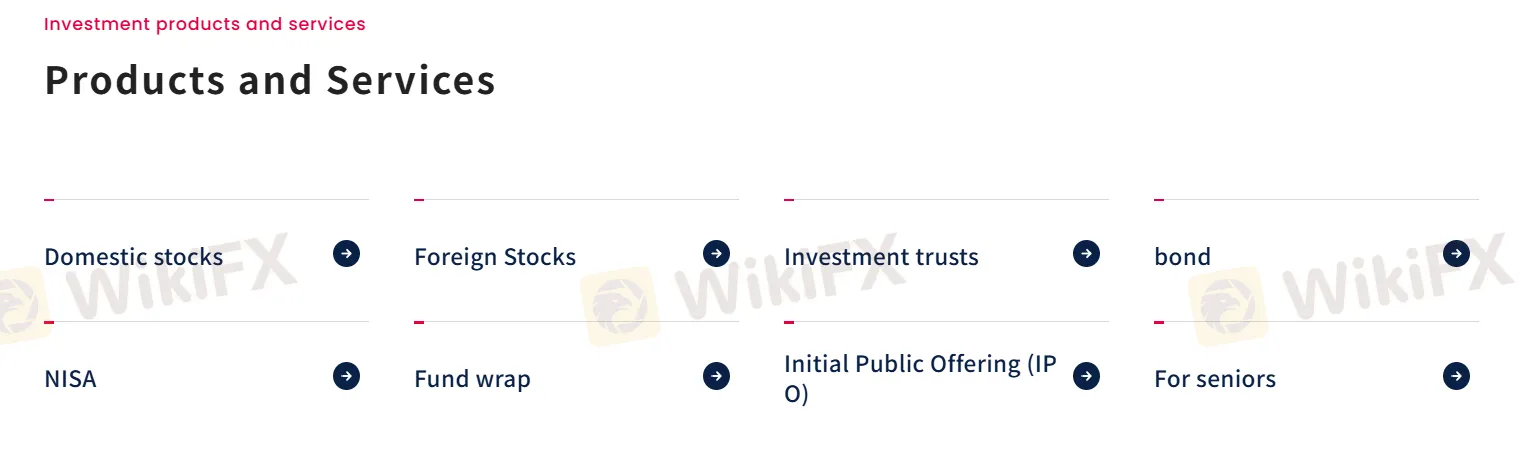

Tôi có thể giao dịch gì trên Akatsuki?

| Công cụ Giao dịch | Hỗ trợ |

| Trái phiếu | ✔ |

| Cổ phiếu | ✔ |

| Quỹ Đầu tư | ✔ |

| Forex | ❌ |

| Hàng hóa | ❌ |

| Chỉ số | ❌ |

| Tiền điện tử | ❌ |

| Trái phiếu | ❌ |

| Tùy chọn | ❌ |

| ETFs | ❌ |

| Hợp đồng tương lai | ❌ |

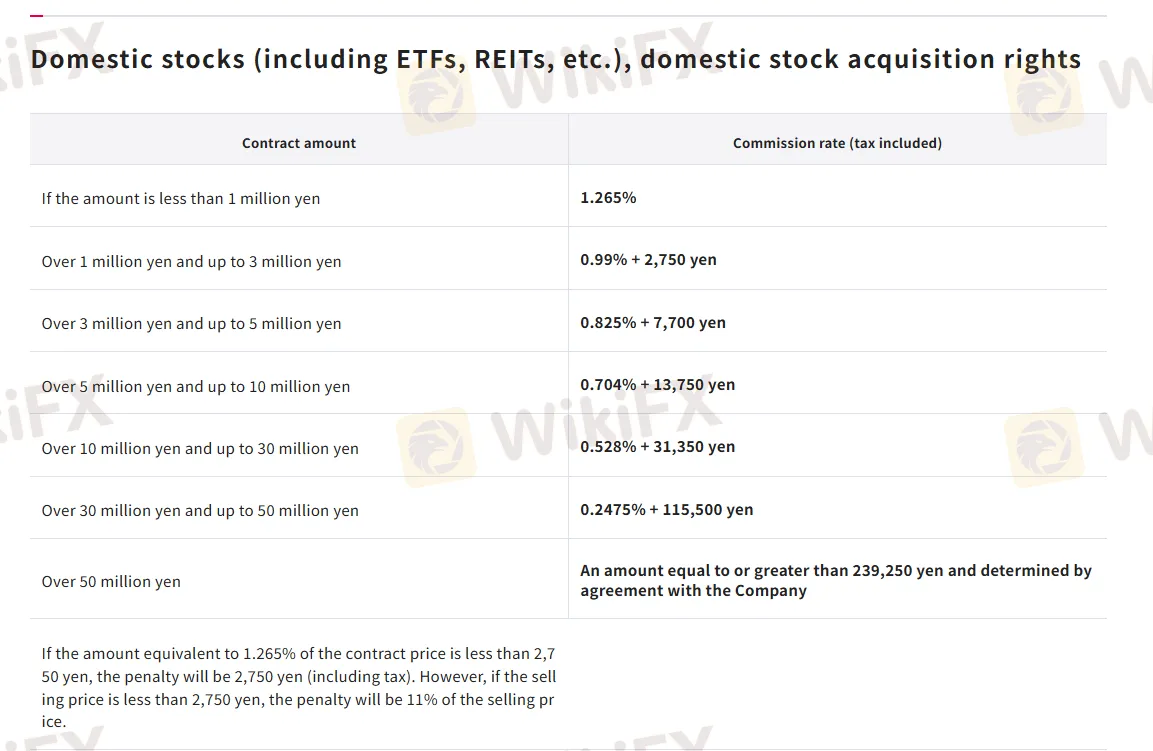

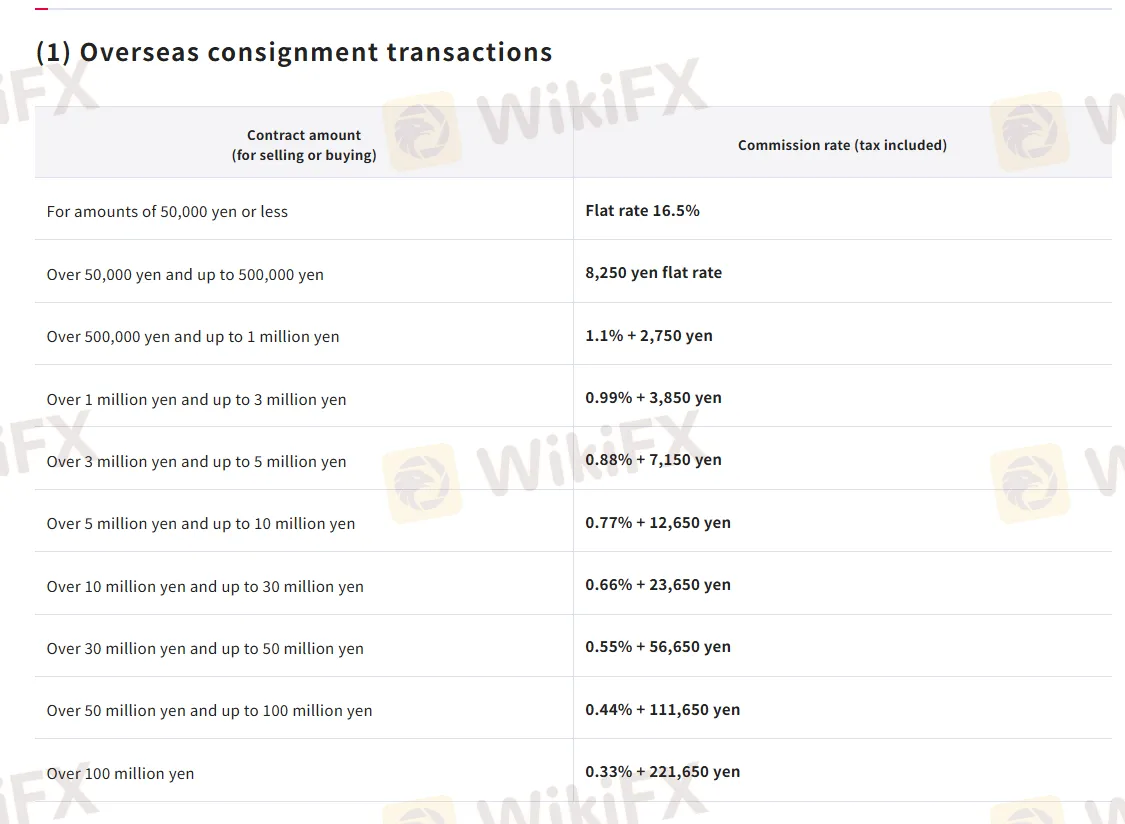

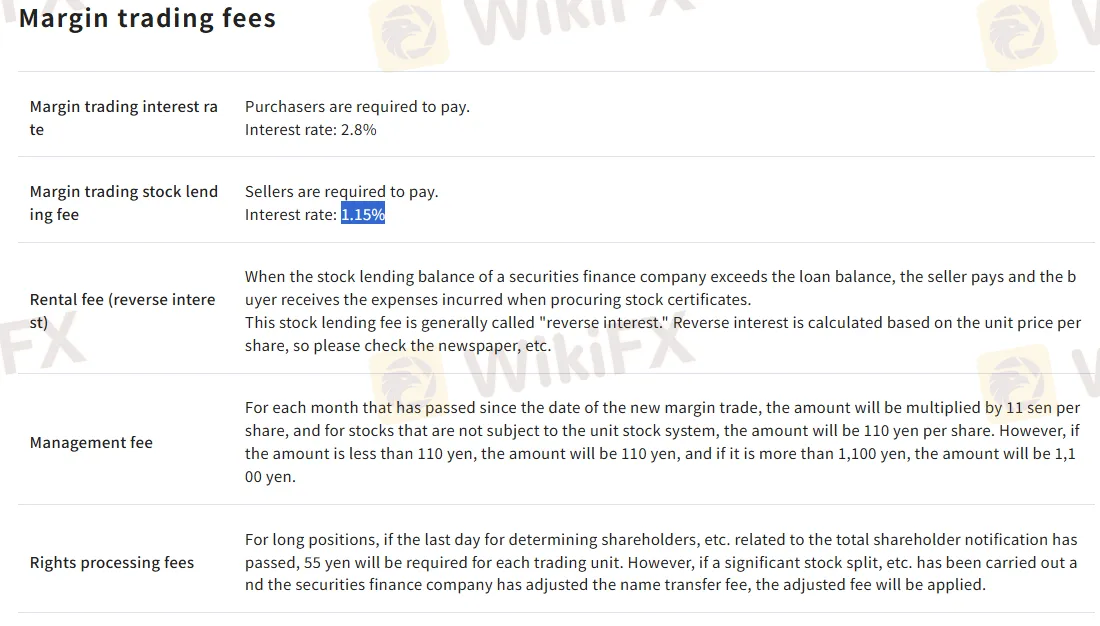

Phí của Akatsuki

| Loại Dịch vụ | Phí Cơ bản |

| Tỷ lệ Hoa hồng Cổ phiếu Trong nước | 0.2475% - 1.265% |

| Tỷ lệ Hoa hồng Cổ phiếu Nước ngoài | 0.33% - 16.5% |

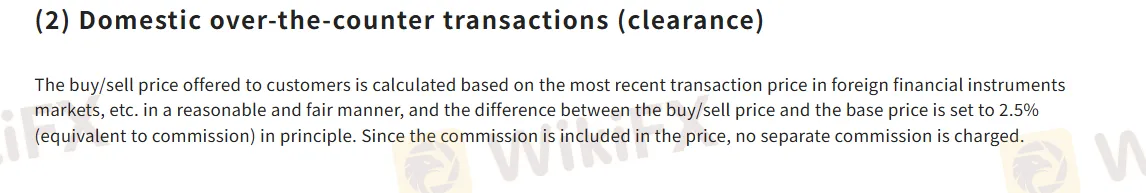

| Giao dịch ngoại tệ Trong nước | 2.5% |

| Phí Mua vào và Bán ra | 1,100 yen |

| Phí Giao dịch Đòn bẩy | 1.15% - 2.8% |