webgalaxy

1-2年

Does Ata Yatırım offer fixed or variable spreads, and how are these affected during periods of high market volatility, such as major news releases?

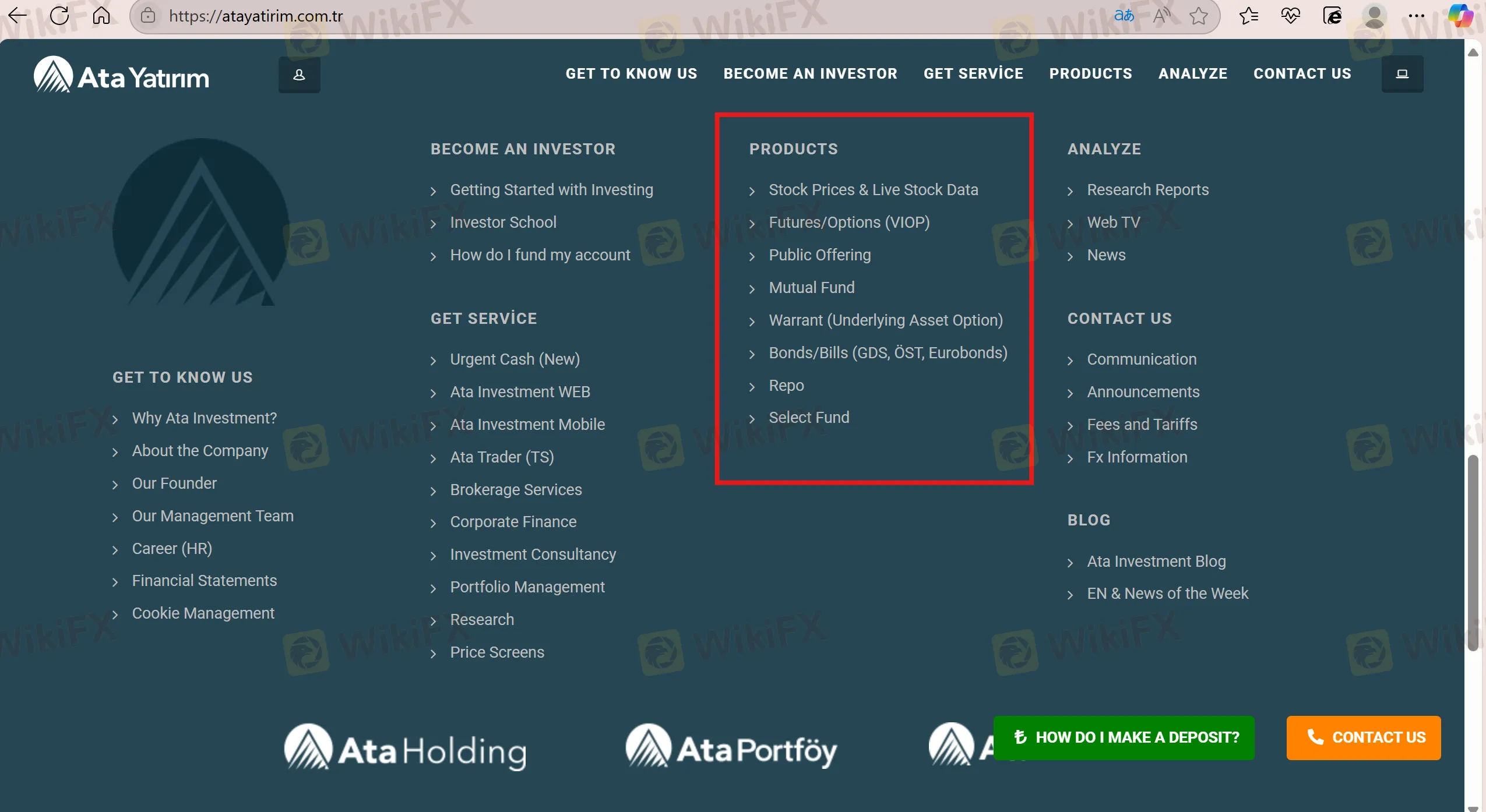

In my careful review of Ata Yatırım, I could not find any clear or published information regarding fixed or variable spreads for their trading services. This lack of transparency on such a fundamental cost factor is a significant consideration for me as a trader. I noticed that Ata Yatırım primarily offers access to products like stocks, futures, options, and funds, rather than forex or CFD instruments where spread conditions are typically outlined in detail. Furthermore, the absence of regulation and insufficient disclosure of trading conditions make it impossible for me to assess how their spreads might behave during periods of elevated market volatility caused by major news releases.

Based on my personal experience, I consider clearly disclosed spread structures to be essential for risk management and cost calculation—particularly during turbulent markets, where variable spreads can widen suddenly and fixed spreads may offer limited but potentially illusory protection. Because Ata Yatırım does not provide these critical details, I would exercise extreme caution, and I cannot make any assumptions about their cost competitiveness or reliability during volatile conditions. Trading in such an environment, where critical trading conditions are not specified, simply does not align with the standards of transparency and safety that I require.

Broker Issues

Fees and Spreads

Bhavani Durga K

1-2年

Could you give a comprehensive overview of Ata Yatırım's fees, such as their commission rates and spread charges?

As a trader who relies on transparency and strong risk controls, I find Ata Yatırım’s lack of publicly disclosed fee information immediately concerning. From my review of the available data, there is no clear documentation regarding commission rates, spread charges, or other transaction costs for their platforms or instruments. This absence of clarity puts me on guard since understanding fees is fundamental to assessing real trading costs and potential profitability.

In my experience, legitimate firms recognize how crucial fee structures are to traders, particularly regarding spreads and commissions that directly impact trade outcomes. Brokers with a high standard of client care usually provide this information up front—even different rates for stocks, futures, bonds, or managed portfolios—so that clients can make informed choices and accurately estimate overall trading expenses.

With Ata Yatırım, the only concrete offerings described are their range of products (stocks, futures, options, funds, and bonds) and platforms, but there’s a notable gap regarding precise financial terms. This deficiency may signal limited transparency or a currently underdeveloped disclosure policy. For me, any decision to consider a broker requires that all fees—whether fixed commissions, spread markups, custody, or withdrawal fees—are detailed and verifiable before I would ever commit capital. Until such information is made available and easily accessible, I would exercise maximum caution and recommend that fellow traders do the same.

Broker Issues

Fees and Spreads

Aman A

1-2年

How much is the least amount you need to deposit to start a live trading account with Ata Yatırım?

Speaking from my own experience researching and evaluating brokers, I could not determine a clearly stated minimum deposit requirement for Ata Yatırım. The information available to me did not specify the lowest amount needed to open a live trading account, which for me raises immediate caution about transparency. In my approach to brokerage selection, knowing the minimum deposit is critical before considering funding an account, particularly with a firm that does not hold any recognized regulatory license and has been flagged for high potential risk.

Given these factors—the lack of clear funding details and the absence of regulation—I would personally be hesitant to proceed without direct and specific confirmation from the broker itself. In such situations, my practice is to reach out to their support contacts to request clear, written documentation regarding the minimum deposit and all related terms before taking any action. For me, the safety of my funds and clarity about the trading terms always come first, especially when information is limited or ambiguous.

Broker Issues

Deposit

Withdrawal

Tom Nalichowski

1-2年

Have you encountered any drawbacks with Ata Yatırım’s customer service or the reliability of their platform?

Reflecting on my experience and the available information, there are several critical considerations regarding Ata Yatırım’s customer service and platform reliability. One of the immediate points of concern for me is the firm’s lack of regulatory oversight. From a cautious trader’s standpoint, operating with an unregulated broker inherently introduces risk—there is simply no third-party authority holding them accountable, which can ultimately impact both service transparency and client protection in case of disputes.

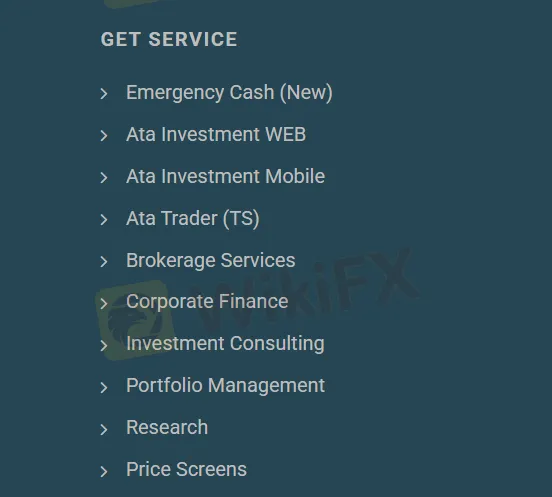

In terms of customer service, while Ata Yatırım provides various support channels, including phone, email, and social media, I have found that having more options does not always guarantee efficient or reliable support. In the absence of client reviews or verifiable metrics detailing issue resolution times, I remain conservative about trusting the effectiveness of their service, especially when problems might arise in fast-moving market conditions.

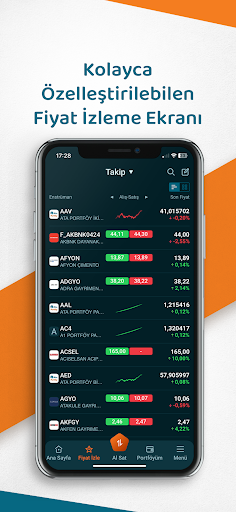

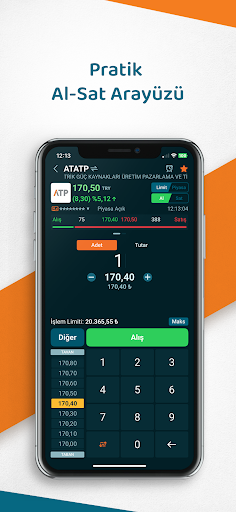

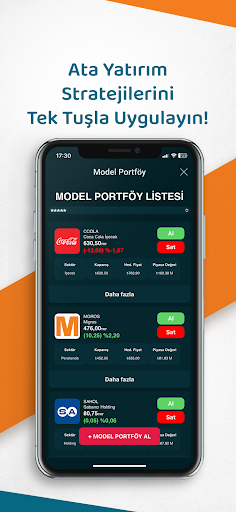

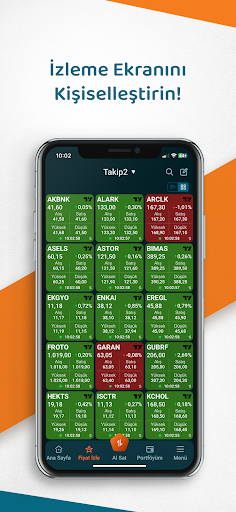

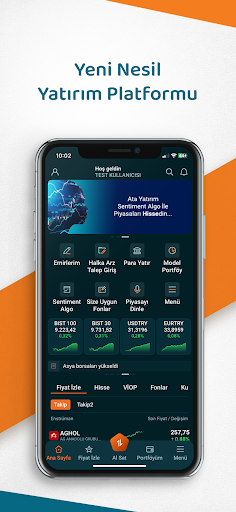

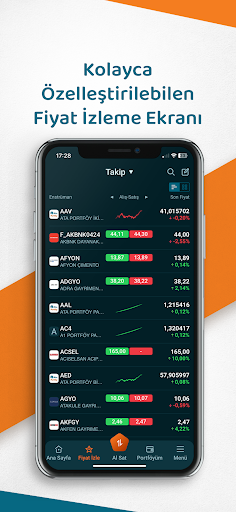

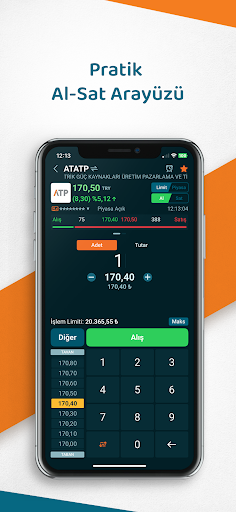

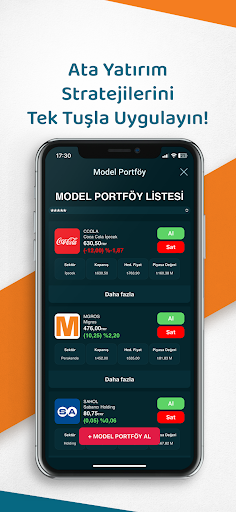

Regarding the reliability of their platform, my research shows that Ata Yatırım offers trading primarily through mobile and web applications. However, with no detailed information available about the technology stack, historical uptime, security protocols, or support for platforms common among forex traders like MetaTrader, I’m hesitant to assume the platform’s robustness. As someone who has learned to prioritize not just execution speed but also platform stability, I find these information gaps to be a significant drawback. For me, if I cannot verify these basics, I prefer not to risk my capital, regardless of the broker’s service offerings or long operating history.