Perfil de la compañía

| Akatsuki Resumen de la revisión | |

| Establecido | 1997 |

| País/Región Registrada | Japón |

| Regulación | FSA |

| Instrumentos de Mercado | Fideicomiso de Inversión, Acciones, Bonos |

| Cuenta Demo | / |

| Plataforma de Trading | / |

| Depósito Mínimo | / |

| Soporte al Cliente | Formulario de Contacto |

| Tel: 0120-753-960 | |

| Dirección: 17-10 Koamicho, Nihonbashi, Chuo-ku, Tokio 103-0016 Edificio Nihonbashi Koamicho Square, 5º piso | |

Información de Akatsuki

Akatsuki es un corredor con sede en Japón fundado en 1997, regulado por FSA. Ofrece servicios en Fideicomiso de Inversión, Acciones y Bonos.

Pros y Contras

| Pros | Contras |

| Regulado por FSA | Información de trading limitada |

| Oficina física comprobada | Se aplican varios honorarios |

| Larga historia operativa |

¿Es Akatsuki Legítimo?

Akatsuki está regulado por la Agencia de Servicios Financieros (FSA) en Japón. ¡Por favor, tenga en cuenta el riesgo!

| Estado Regulatorio | Regulado Por | Institución Licenciada | Tipo de Licencia | Número de Licencia |

| Regulado | Agencia de Servicios Financieros (FSA) | Akatsuki株式会社 | Licencia de Forex Minorista | 関東財務局長(金商)第67号 |

Encuesta de Campo de WikiFX

El equipo de investigación de campo de WikiFX visitó la dirección de Akatsuki en Japón y encontramos su oficina en el lugar, lo que significa que la empresa opera con una oficina física.

¿Qué puedo comerciar en Akatsuki?

| Instrumentos Comerciables | Soportado |

| Bonos | ✔ |

| Acciones | ✔ |

| Fondos de Inversión | ✔ |

| Forex | ❌ |

| Productos Básicos | ❌ |

| Índices | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

| Futuros | ❌ |

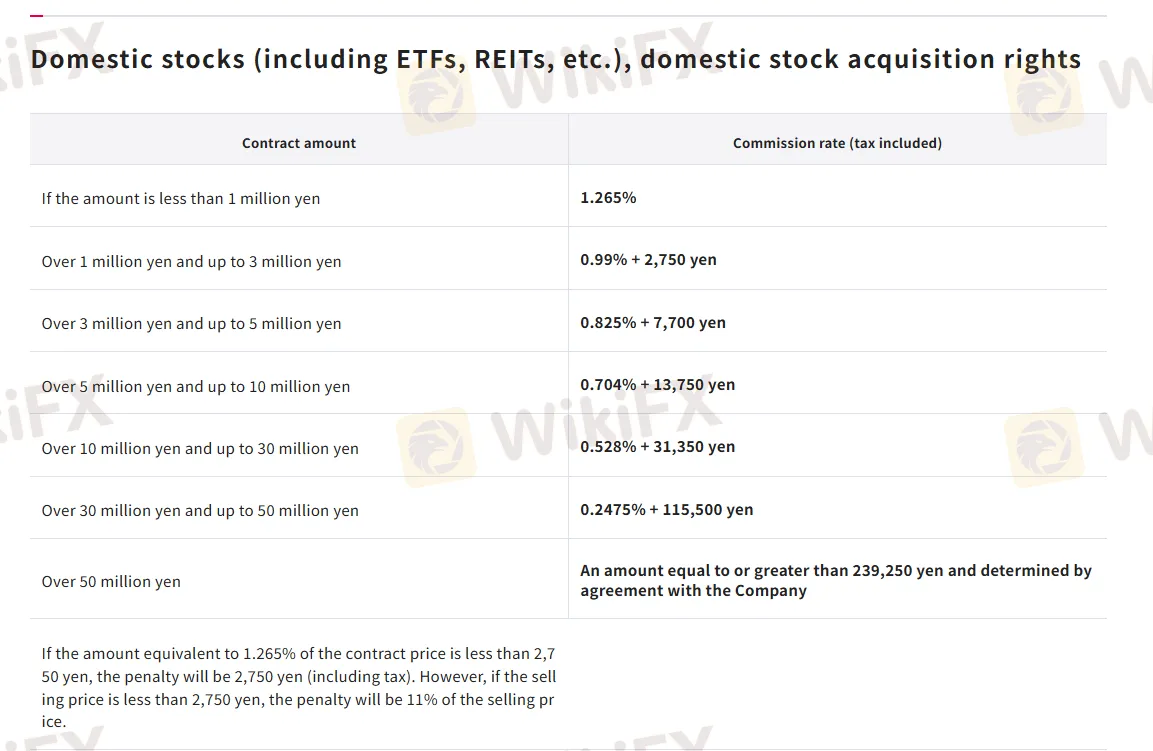

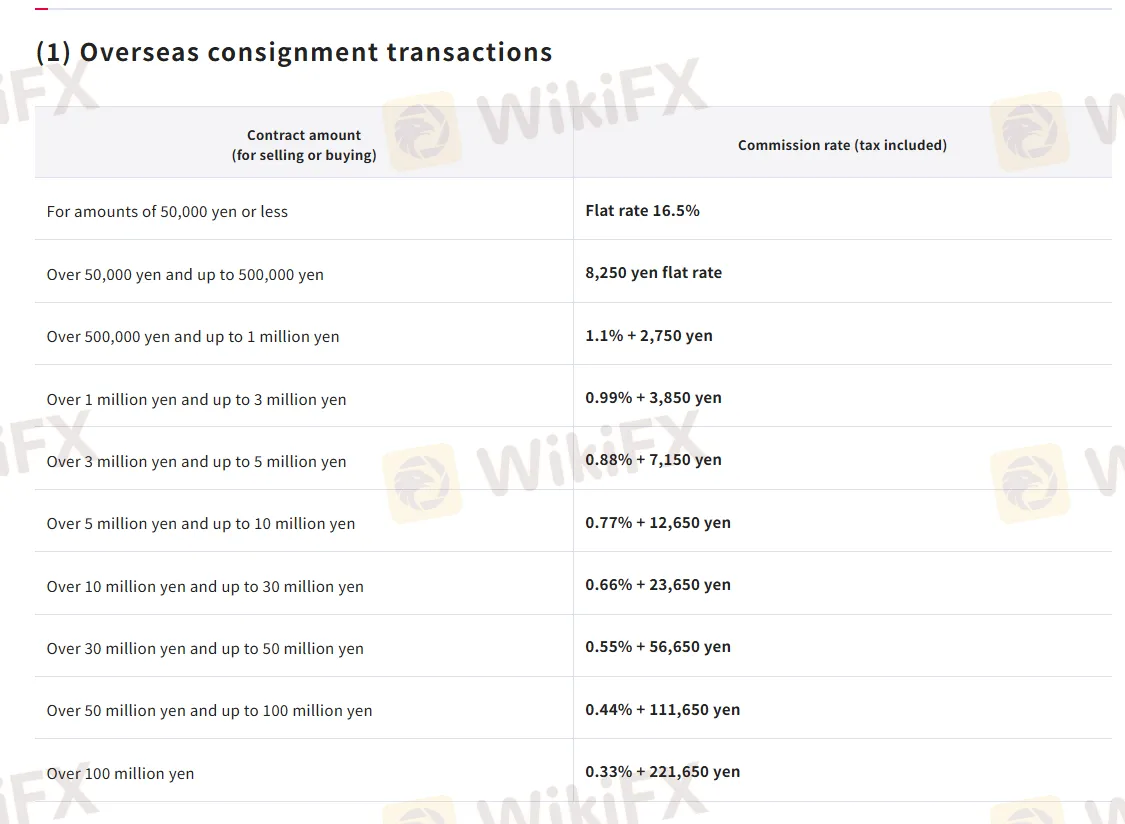

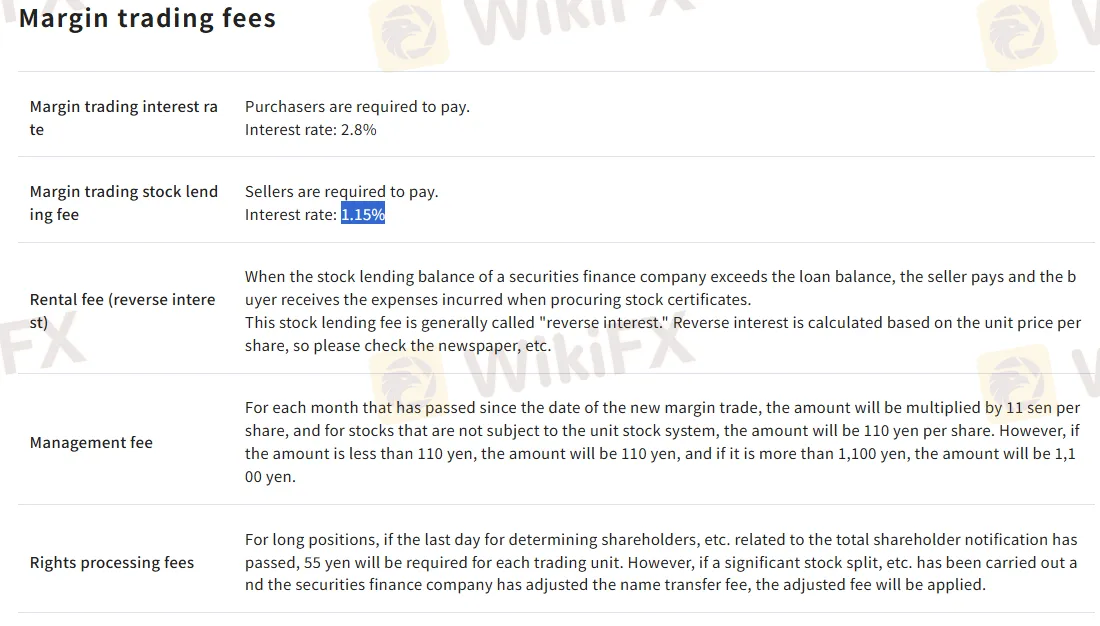

Tarifas de Akatsuki

| Tipo de Servicio | Tarifa Básica |

| Tasa de Comisión de Acciones Nacionales | 0.2475% - 1.265% |

| Tasa de Comisión de Acciones Extranjeras | 0.33% - 16.5% |

| Transacciones Nacionales de Venta Libre | 2.5% |

| Entrada y Salida | 1,100 yenes |

| Tarifas de Operaciones con Margen | 1.15% - 2.8% |