公司簡介

| 國聯期貨 評論摘要 | |

| 成立年份 | 2002 |

| 註冊國家/地區 | 中國 |

| 監管 | CFFEX |

| 交易產品 | 商品期貨、金融期貨、期權 |

| 模擬帳戶 | ✅ |

| 交易平台 | CTP主系統、FastQuote v3、FastQuote v2、Boyi Yun、Wuxianyi、國聯期貨 APP 和模擬交易軟件 |

| 最低存款 | / |

| 客戶支援 | 電話:95570 / 400-8888-012 |

| 傳真:0510-82752315 82759156 | |

| 電郵:admin@glqh.com | |

| 地址:江蘇省無錫市財經一街8號6樓 | |

國聯期貨 資訊

國聯期貨有限公司是經中國證券監督管理委員會(CSRC)批准的綜合期貨公司。總部設在江蘇省無錫市,擁有20多家分支機構和1家風險管理子公司,服務網絡覆蓋中國主要城市。其業務涵蓋商品期貨經紀、金融期貨經紀、期貨投資諮詢、資產管理等。適合國內期貨投資者,尤其是新手和機構客戶。

優缺點

| 優點 | 缺點 |

| 提供模擬帳戶 | 部分高級服務收費 |

| 受 CFFEX 監管 | 國際業務有限(僅限國內期貨) |

| 業務全面 | |

| 多種交易平台 | |

| 營運時間長 | |

| 適合新手 |

國聯期貨 是否合法?

國聯期貨是經中國證券監督管理委員會(CSRC)批准的持有期貨經紀、資產管理等合法資格的金融機構,並受中國期貨業協會(CFIA)監管。證券公司由中國金融期貨交易所(CFFEX)監管,牌照號碼為0118。

| 監管機構 | 當前狀態 | 持牌實體 | 監管國家 | 牌照類型 | 牌照號碼 |

| 中國金融期貨交易所(CFFEX) | 監管 | 国联期货股份有限公司 | 中國 | 期貨牌照 | 0118 |

我可以在 國聯期貨 交易什麼?

可交易的產品涵蓋主要的國內期貨和期權市場,如商品期貨、金融期貨、期權,以及供投資者通過模擬練習的模擬交易產品。

| 交易產品 | 支持 | 子類別 | 代表性品種 |

| 商品期貨 | ✔ | 農產品 | 大豆、玉米、棉花、豆粕、豆油、棕櫚油、活豬等 |

| 金屬 | 銅、鋁、鋅、鎳、金、銀等 | ||

| 能源與化工 | 原油、燃料油、甲醇、PTA、乙二醇、沥青等 | ||

| 金融期貨 | ✔ | 股指期貨 | 中證500 (IC)、中證1000 (IM) 等 |

| 國債期貨 | 10年期國債 (T)、5年期國債 (TF)、2年期國債 (TS) | ||

| 期權 | ✔ | 商品期權 | 大商所2506系列 (例如豆粕、玉米期權)、郑商所 (糖、棉花期權) 等 |

| 金融期權 | 中證300股指期權 (IO)、中證1000股指期權 (MO) 等 |

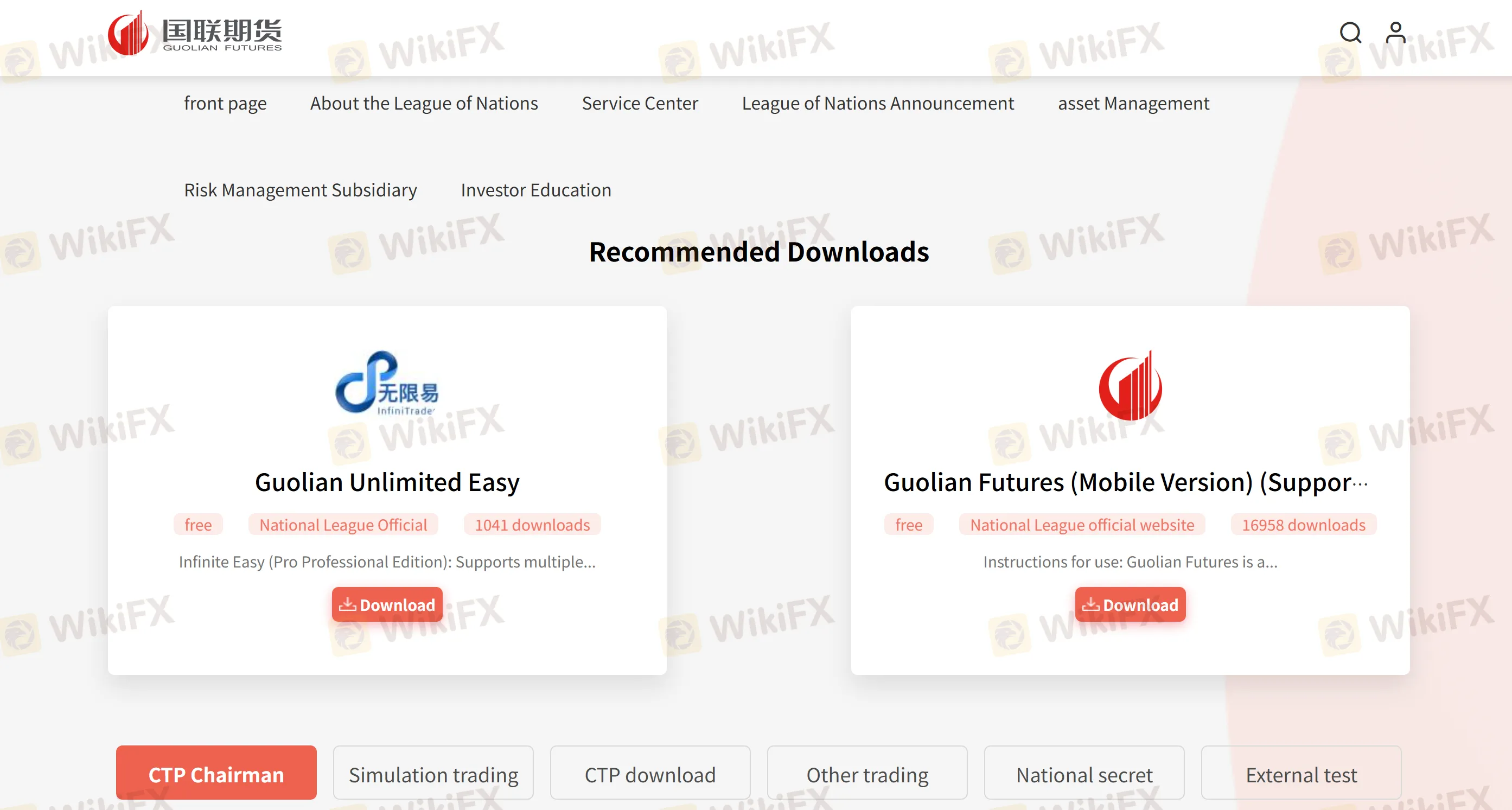

交易平台

國聯期貨 提供桌面軟件、手機軟件和模擬交易平台。具體包括 CTP 主系統、FastQuote v3/v2、博易雲、無限益,以及 國聯期貨 APP 等。

| 類型 | 軟件名稱 | 特點 | 適用對象 |

| 桌面軟件 | CTP 主系統 | 主流交易系統 | 高頻交易者、專業投資者 |

| FastQuote v3 | 多屏分析、完整歷史市場數據和高級圖表工具 | 技術分析交易者 | |

| FastQuote v2 | 快速下單 | 短線交易者、日內交易者 | |

| 博易雲 | 支持期權交易和 CTP 平台 | 綜合期權/期貨交易者 | |

| 無限益 | 多賬戶管理 | 機構投資者、量化團隊 | |

| 手機軟件 | 國聯期貨 APP | 開戶、交易 | 普通投資者、新手用戶 |

| 模擬平台 | 模擬交易軟件 | 模擬股指期貨和期權策略,無實際資本風險 | 新手練習、策略測試 |

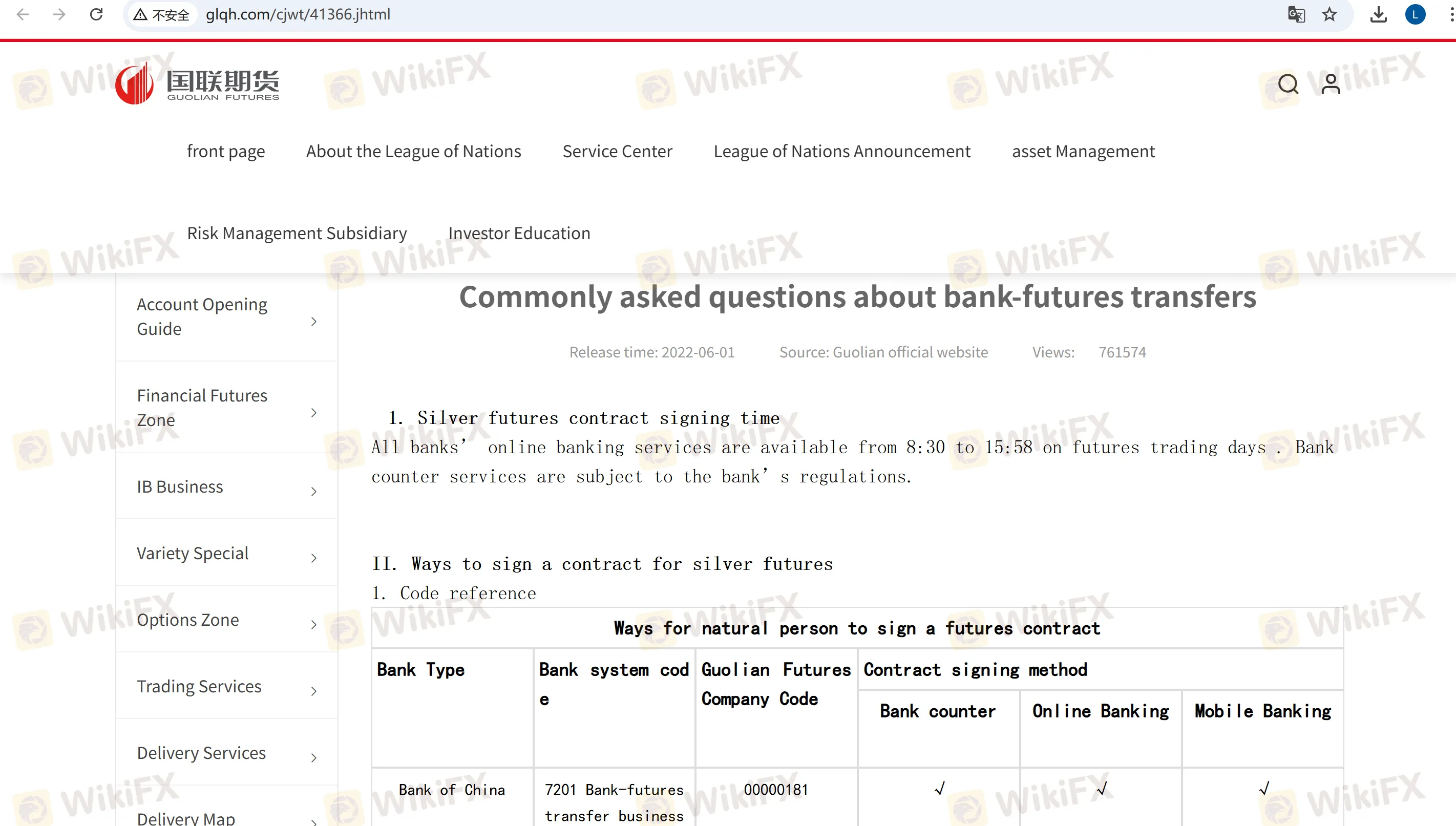

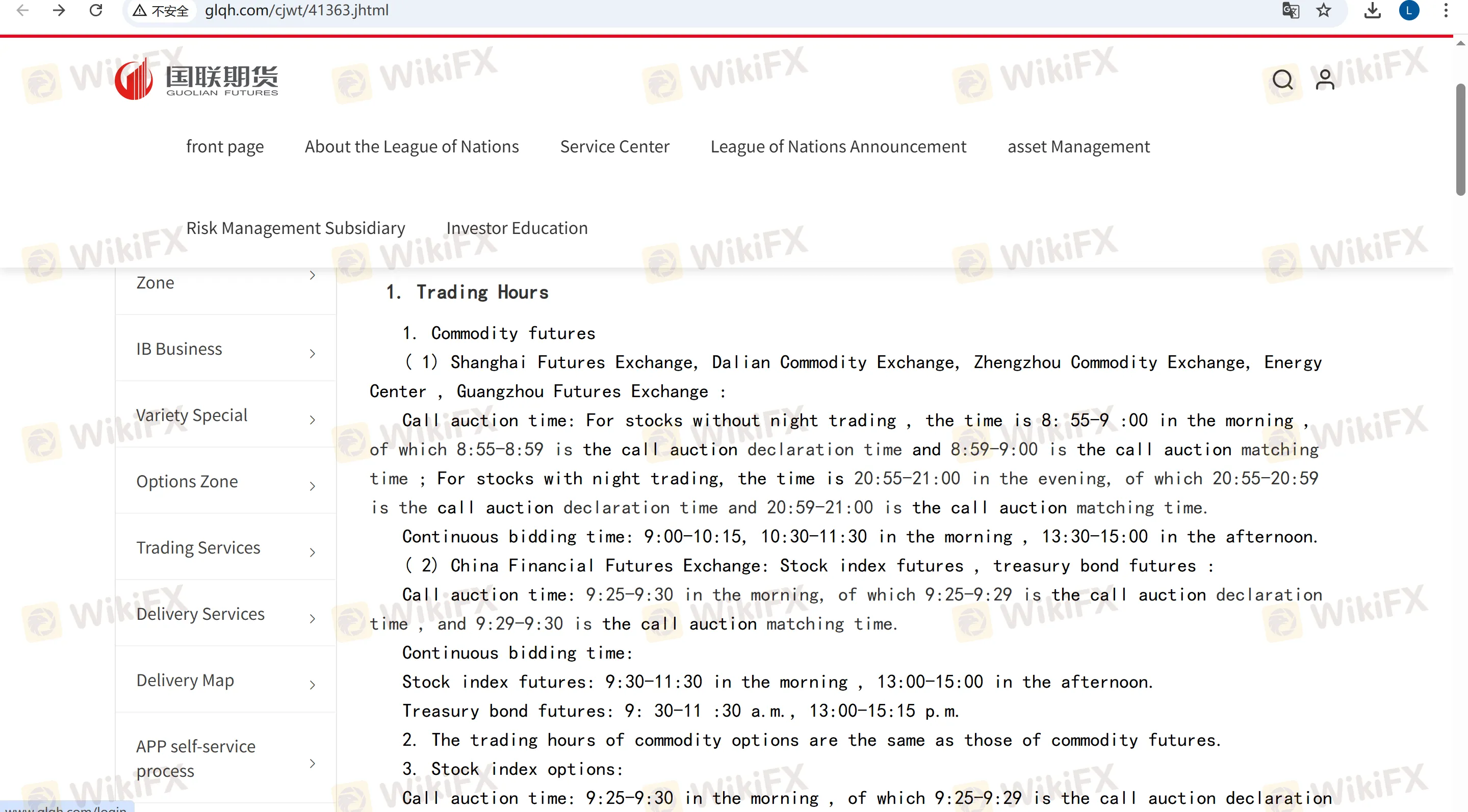

存款與提款

銀行轉帳 用於資金存入,支持主要銀行,實時到賬,並且免費。對於第三方支付(需要事先確認合規性),到賬時間和手續費取決於支付提供商。提款時間為指定交易時間,通常從9:00至15:30,部分產品支持夜間交易提款。