Buod ng kumpanya

| Maven Buod ng Pagsusuri | |

| Itinatag | 2010 |

| Nakarehistrong Bansa/Rehiyon | United Kingdom |

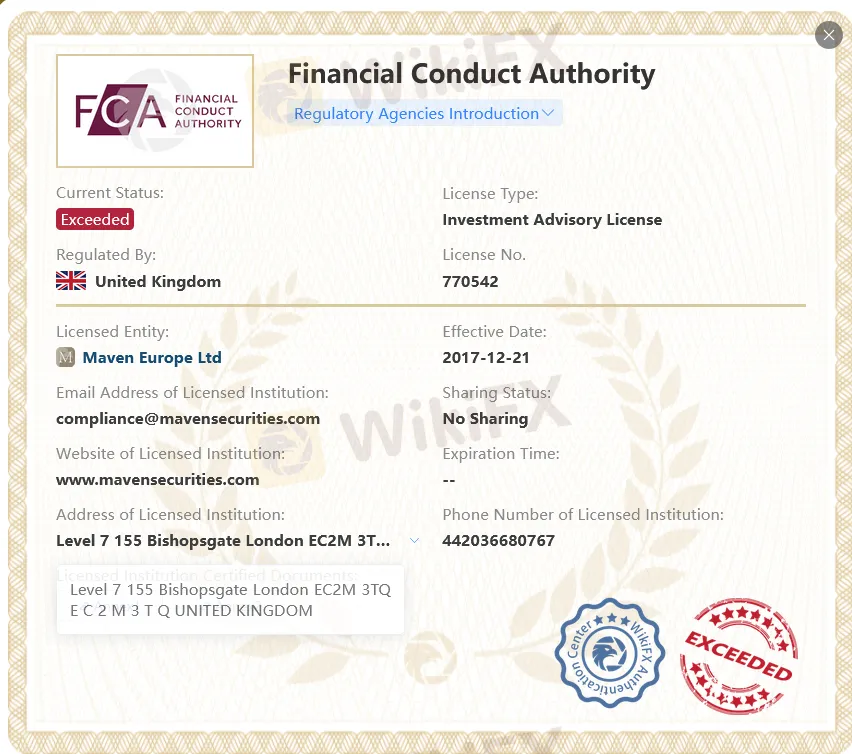

| Regulasyon | FCA (Na-exceed) |

| Suporta sa Customer | Telepono: +44 203 668 0767 |

| Address: Antas 7, 155 Bishopsgate, London, EC2M 3TQ | |

Impormasyon Tungkol sa Maven

Maven ay nagmamalaki na sila ay nangunguna sa merkado bilang isang pribadong kumpanya sa kalakalan na itinatag noong 2010, na nagspecialize sa merkadong pang-seguridad. Ang lisensya nito na ibinigay ng Financial Conduct Authority (FCA) ay na-exceed.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Relatibong mahabang kasaysayan | Na-exceed ang lisensya ng FCA |

| Kawalan ng transparensya |

Tunay ba ang Maven?

Hindi. Sa kasalukuyan, wala nang bisa ang regulasyon ng Maven. Sila lamang ay may na-exceed na lisensya mula sa FCA. Mangyaring maging maingat sa panganib!

| Status ng Regulasyon | Na-exceed |

| Regulado ng | Financial Conduct Authority (FCA) |

| Uri ng Lisensya | Investment Advisory License |

| Numero ng Lisensya | 770542 |