QM Trader

1-2年

Does T&D impose any charges when you deposit or withdraw funds from your account?

Based on my review of the available details, I did not find any specific information from T&D regarding charges for deposits or withdrawals. As an experienced trader, I always exercise caution when a broker does not clearly disclose its fee structure, especially regarding fund transfers. T&D is regulated by the Financial Services Agency (FSA) in Japan, which suggests a certain level of oversight and reliability. However, the absence of transparent information about deposit or withdrawal costs is, for me, a notable gap. In my own trading practice, undisclosed fees can create unnecessary financial uncertainty. Given these ambiguities, I would consider it prudent to clarify directly with T&D’s support—although it’s worth noting they appear to rely solely on email for customer service, which sometimes slows down communication. Overall, while their regulatory status is reassuring, I personally would not make assumptions about zero fees and would insist on acquiring written confirmation before making any significant account transactions with them. This careful approach aligns with my personal standards for risk management in all YMYL (Your Money or Your Life) decisions.

Broker Issues

Deposit

Withdrawal

Thobani Dlalda

1-2年

Can you use Expert Advisors (EAs) for automated trading on T&D's platforms?

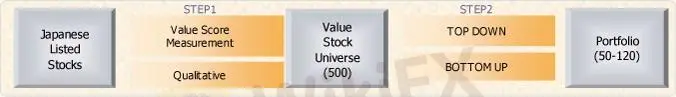

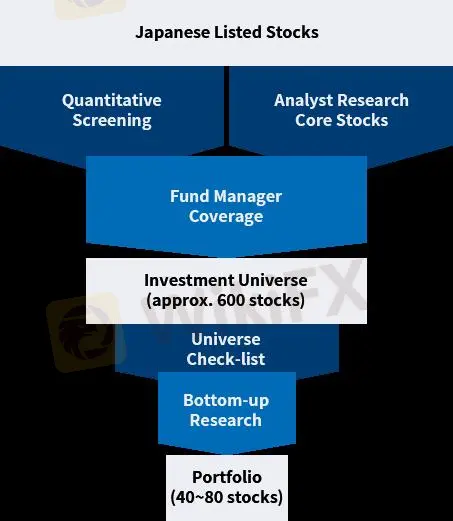

Drawing on my years of forex trading experience and a cautious approach to broker selection, I always evaluate a platform’s transparency and detailed offering before integrating any automation like Expert Advisors (EAs). Reviewing T&D, I found that it is a long-standing Japanese investment management company regulated by the FSA, mainly focused on strategies like AXIA (Value), SOPHIA (Core-Growth), and ESG-oriented investments. The information available points toward T&D providing various investment management services but does not specify direct retail forex or CFD trading access, nor does it clearly mention any standard retail trading platforms such as MT4 or MT5—both essential for running EAs.

From what I could gather, the absence of details about supported trading terminals raises uncertainties for anyone seeking to automate trading via EAs. In my experience, when a broker prioritizes managed investment products or portfolio-focused strategies—rather than individualized trading interfaces—it typically does not cater to self-directed traders who wish to deploy EAs. With T&D, the lack of explicit information about platform compatibility or support for automated strategies means that, for me, I would act conservatively and assume EA usage is not supported unless further, verifiable details are provided by T&D directly. For traders like myself who rely on automation, this represents a significant limitation and calls for direct clarification from the company before proceeding.

Broker Issues

Platform

Account

Instruments

Leverage

Дмитрий

1-2年

Which payment options are available for making deposits and withdrawals with T&D, such as credit cards, PayPal, Skrill, or cryptocurrencies?

From my thorough review and experience as an independent trader examining T&D Asset Management, I noticed that specific details about payment options for deposits and withdrawals—such as credit cards, PayPal, Skrill, or cryptocurrencies—are not explicitly disclosed in their available public information. For me, this lack of clear guidance is significant; as a trader, I depend on transparency regarding funding methods to assess both convenience and risk. I do observe that T&D is a Japan-based, FSA-regulated investment management company with a long track record and a focus on portfolio management strategies rather than retail forex trading platforms where a variety of payment gateways are the norm.

Additionally, my research indicates customer support is handled exclusively via email, without any mention of dedicated payment support or multiple transactional channels. This, combined with the absence of published details about deposit and withdrawal processes, makes it impossible for me to responsibly recommend or assume the availability of standard options like credit cards, PayPal, or crypto. In the current regulatory climate, and given T&D’s conservative profile as an asset management firm rather than a mainstream online broker, I urge potential investors to proceed carefully and contact the company directly for their most up-to-date payment methods. In my view, it’s crucial not to make any funding decisions without complete clarity from official sources.

Broker Issues

Withdrawal

Deposit

Yousef47

1-2年

Could you break down the total trading costs involved for trading indices such as the US100 on the T&D platform?

In my experience as a trader evaluating brokers, I prioritize transparency and reliability—especially when it comes to understanding the true trading costs associated with popular indices like the US100. T&D Asset Management is regulated in Japan by the Financial Services Agency and has been operating for over 15 years, which is generally a positive sign in terms of operational legitimacy and oversight. However, from the data available, T&D appears to focus on investment management strategies such as AXIA (Value), SOPHIA (Core-Growth), and ESG, which center on equity and long-term investment rather than direct retail trading of indices such as the US100.

Based on their official services, I couldn’t find concrete evidence that T&D offers leveraged or CFD products directly tied to global indices, including the US100, in the standard retail trading sense. Without clear information on platform spreads, commissions, or overnight swap rates specifically for indices, it is difficult—if not impossible—for me to break down exact trading costs. Additionally, there is only one direct user review, which raises some concerns about the accessibility and practical experience of trading with T&D for global clients. Given these ambiguities and the limited customer support options (just email), I would urge any trader to proceed with caution, and to directly confirm all cost structures, instrument availability, and withdrawal procedures through official channels before committing significant funds. In summary, I could not verify transparent or competitive trading cost data for the US100—or even direct access to this instrument—on the T&D platform based on the information currently available to me.

Broker Issues

Fees and Spreads