公司簡介

| 寶盛證券 檢討摘要 | |

| 成立年份 | 1997 |

| 註冊地區/國家 | 香港 |

| 監管 | SFC |

| 市場工具 | 多市場股票、期貨合約、股票期貨、貨幣期貨、利率期貨、金屬期貨 |

| 模擬帳戶 | ❌ |

| 交易平台 | 網頁、手機 |

| 最低存款 | 0 |

| 客戶支援 | 電話:+852 2255 8888 |

| 電郵:service@boomhq.com | |

寶盛證券 資訊

Boom Securities 是一家成立於1997年的香港線上券商,受香港SFC監管(CE號碼:AEF808)。通過其專有的網頁和手機交易平台,提供全球股票和期貨市場的訪問,而且不收取存款或提款費用。

優缺點

| 優點 | 缺點 |

| 受香港SFC監管 | 沒有提供模擬帳戶 |

| 可訪問12個以上的全球股票和期貨市場 | 閒置帳戶收取不活躍費用 |

| 無存款或提款費用 |

寶盛證券 是否合法?

Boom Securities(香港)有限公司是一家合法且受監管的金融機構。它獲得香港證監會(SFC)授權,該機構是金融行業中一個備受尊重的監管機構。該公司持有期貨合約交易牌照,牌照號碼為AEF808。

我可以在 寶盛證券 交易什麼?

Boom Securities 提供各種交易工具,包括美國股票、香港和全球期貨,涵蓋指數、貨幣、利率、商品、能源和金屬。

| 可交易工具 | 支援 |

| 貨幣 | ✔ |

| 商品 | ✔ |

| 指數 | ✔ |

| 股票 | ✔ |

| ETFs | ✔ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

帳戶類型

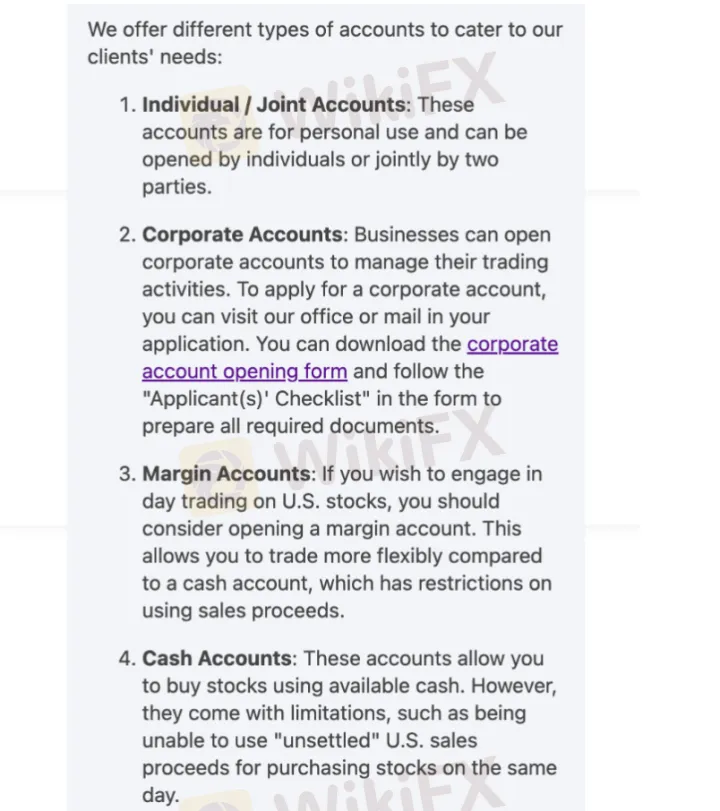

Boom Securities提供總共4種即時交易帳戶:個人/聯名帳戶、企業帳戶、保證金帳戶和現金帳戶。每種帳戶均設計適合不同類型的交易者,從個人投資者和企業實體到活躍的美國日內交易者。

| 帳戶類型 | 特點 | 適合對象 |

| 個人/聯名 | 供個人使用或由兩人共同擁有 | 個人投資者 |

| 企業 | 為公司設計以管理交易操作 | 企業或機構 |

| 保證金 | 提供靈活交易,可使用未結算資金 | 美國股票活躍或日內交易者 |

| 現金 | 僅使用已結算現金進行交易;不能使用保證金或未結算收益 | 保守或長期投資者 |

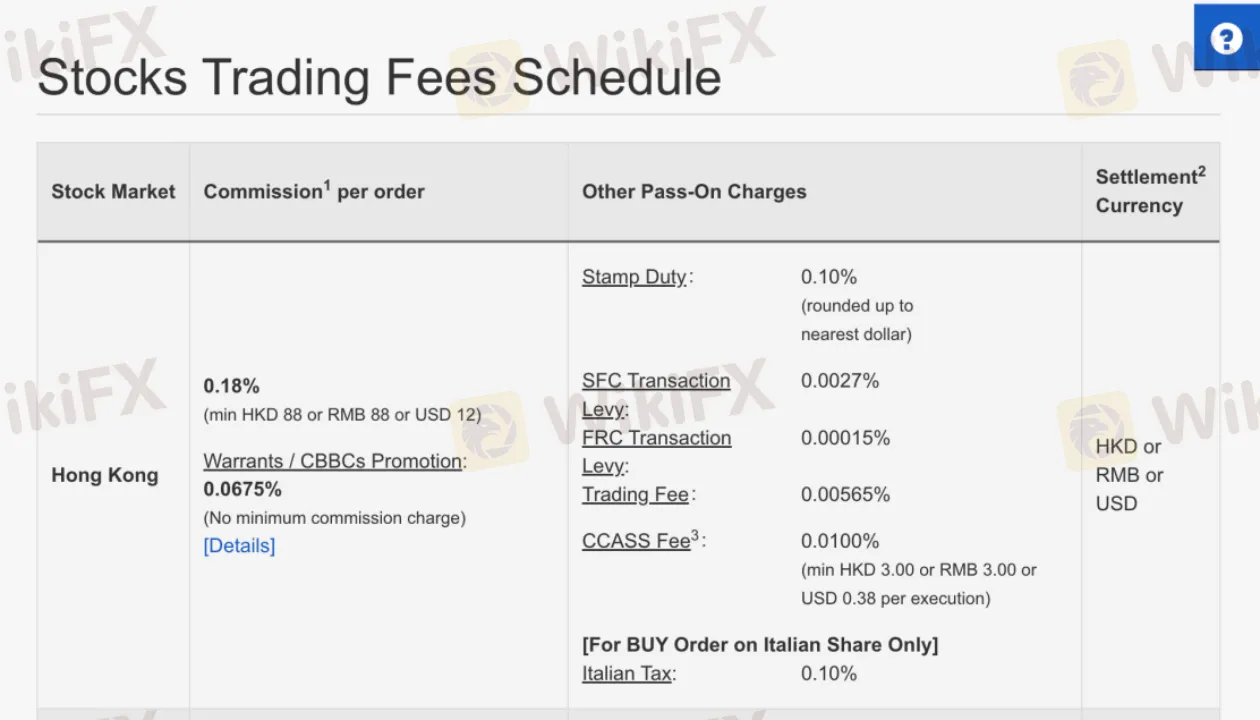

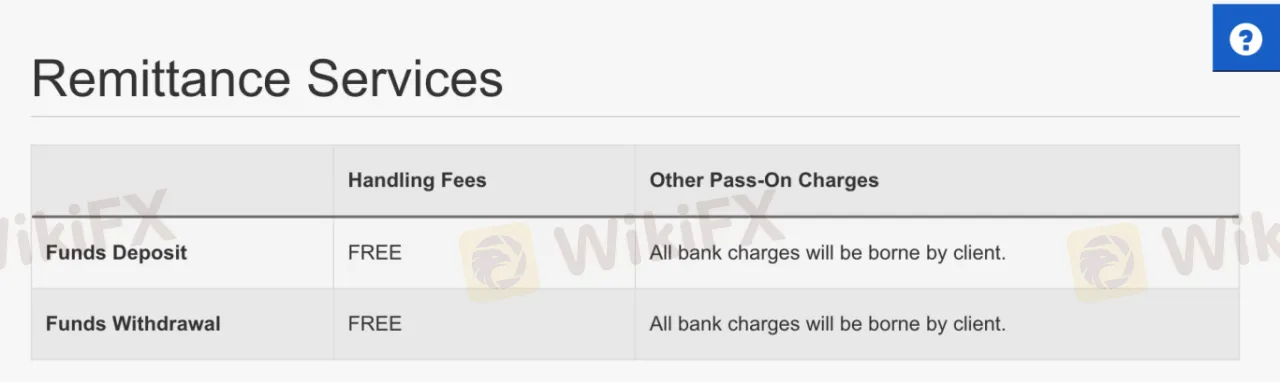

寶盛證券 費用

Boom Securities的費用結構透明,一般競爭力強,與行業標準相比。該經紀商不收取隱藏點差或高平台費用,許多基本服務(如存款、提款和報表)均免費。但是,一些即時數據和企業服務可能會產生適度費用。

| 市場 | 佣金費用 |

| 美國股票 | 每筆交易20美元 |

| 香港股票 | 每筆交易0.18% |

| 全球市場 | 每筆交易0.50%或更低 |

非交易費用

| 非交易費用 | 金額 |

| 存款費用 | 0 |

| 提款費用 | 0 |

| 閒置費用 | 港幣200(個人/聯名)港幣1,000(企業) |

交易平台

| 交易平台 | 支援 | 可用設備 |

| 網上交易平台 | ✔ | 桌面/網頁瀏覽器 |

| 手機交易應用程式 | ✔ | iOS和Android設備 |

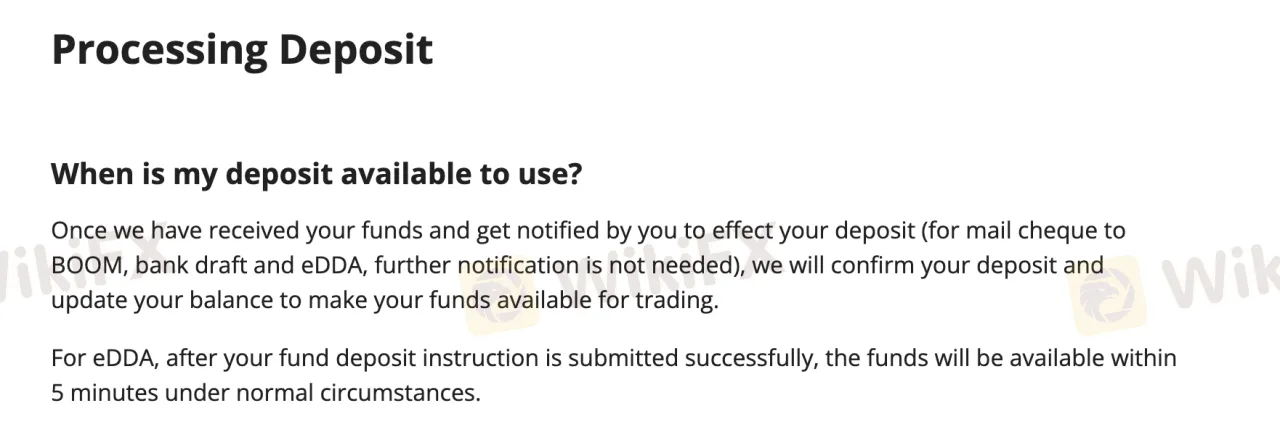

存款和提款

Boom Securities 不收取任何存款或提款費用。除了eDDA存款外,沒有最低存款或提款金額,eDDA存款的最低金額為200港幣。

存款選項

| 存款選項 | 最低存款 | 存款費用 | 存款處理時間 |

| eDDA(電子直接轉帳) | 200港幣 | 0 | 在正常情況下5分鐘內 |

| FPS / 網上 / 電話銀行 / 自動櫃員機 | 0 | 工作時間內當天 | |

| 銀行轉帳 / 電匯 | 各銀行不同 | ||

| 支票 / 銀行本票 | / |

提款選項

| 提款選項 | 最低提款 | 提款費用 | 提款處理時間 |

| 轉至指定銀行戶口 | 0 | 0 | 香港時間中午12:00前當天 |

| 支票提款 | 當天 | ||

| 轉至其他銀行戶口 | 根據指示批准後處理 |

FX6022430072

香港

我是在港工作的内地人,之前都用富途觉得画面不错,但是长期下来手续费太贵,朋友推荐下用的BOOM,它属于老式港风画面,刚开始也不习惯,习惯之后用它做交易还行,最主要是手续费比其他都便宜,有时候炒下日股。听说他们可以炒16个热门市场的股票。

好評

Henry 王超

新西蘭

BOOM 的網站看起來大小很奇怪,我的瀏覽體驗很差。而且他們沒有任何監管牌照,他們是如何經營十五年以上的?

好評

FX1153144384

新加坡

莫名其妙 这个公司网站打不开了已经 我还看到没有任何监管牌照。但是网上又看不到有人说它是诈骗!估计是网站暂时失效了吧?我明天再来看看好了

好評

荒47706

泰國

其实这个公司的是我的朋友推荐给我的,我尝试了几个月之后觉得确实不错。宝盛证券已经成立了快二十年了,不要太靠谱哦!他们的交易平台虽然不是常见的MT4或者MT5,但是绝对值得你尝试一下,很好用。

好評

FX1036206024

阿根廷

我已經在這家公司交易了一段時間,對此很滿意,並將繼續交易。但我在 wikifx 網站上看到它不受監管,我有點害怕。誰能告訴我這到底是一家值得信賴的公司嗎?

好評