公司簡介

| Toho Securities 檢討摘要 | |

| 成立年份 | 2015 |

| 註冊國家/地區 | 日本 |

| 監管 | 受金融廳監管 |

| 產品 | 日本國內共同基金、外國股票、國內/外國/結構債券 |

| 客戶支援 | 總公司: 〒960-8633, 福島市大町3-25號(東邦銀行總行3樓)電話: 024-523-3284 |

| 福島分行: 〒960-8633, 福島市大町3-25號(東邦銀行總行3樓)電話: 024-523-5550 | |

| 郡山分行: 〒963-8014, 郡山市虎丸町20-58號(東邦銀行郡山支店3樓)電話: 024-934-8880 | |

| 会津分行: 〒965-0042, 会津若松市大町1-10-28號(東邦銀行会津支店2樓)電話: 0242-28-0050 | |

| いわき支店: 〒970-8026, いわき市平字平沢9-3號(東邦銀行いわき支店3樓)電話: 0246-23-7711 | |

| 原町オフィス: 〒975-0008, 南相馬市原町区本町1-31號, 四葉ビル3樓電話: 0244-26-8333 | |

Toho Securities 資訊

Toho Securities 是一家成立於2015年的日本金融公司,為個人和企業客戶提供包括日本國內共同基金、外國股票、國內/外國/結構債券在內的金融產品。

該公司目前由金融廳(金融庁)監管,顯示一定程度的可信度和合法性。

優缺點

| 優點 | 缺點 |

| 受金融廳監管 | 收取交易費用 |

| 多種客戶支援渠道 |

Toho Securities 是否合法?

Toho Securities 目前受到金融廳(金融庁)監管,牌照號碼為東北財務局長(金商)第36號。

| 監管國家 | 監管機構 | 當前狀態 | 受監管實體 | 牌照類型 | 牌照號碼 |

| 金融廳 | 受監管 | Toho Securities株式会社 | 零售外匯牌照 | 東北財務局長(金商)第36號 |

我可以在Toho Securities上交易什麼?

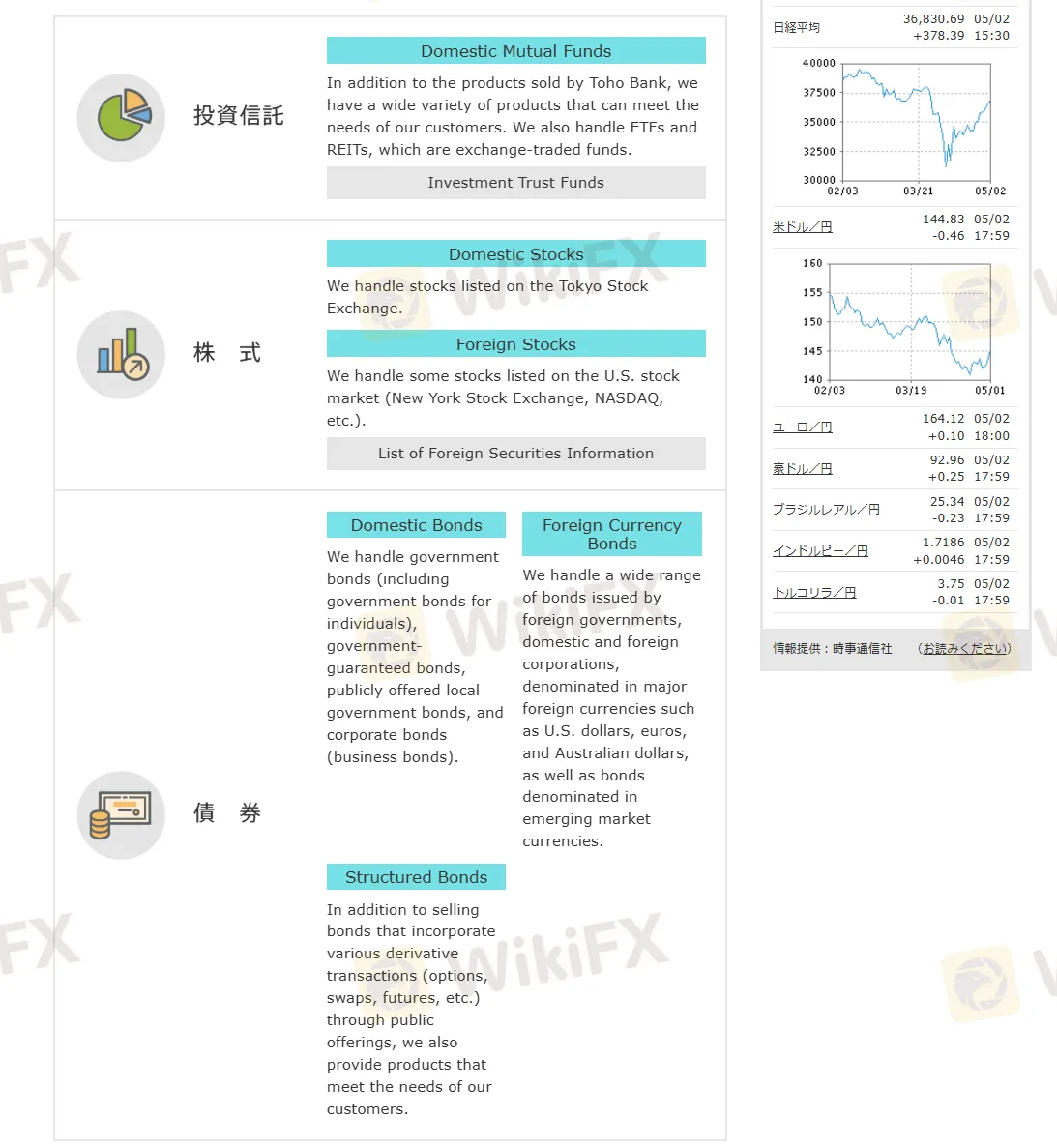

Toho Securities 提供廣泛的投資產品,包括國內和外國共同基金、ETFs,和REITs。

他們還處理東京證券交易所上市的國內股票,以及來自紐約證券交易所和納斯達克等市場的美國股票。

債券包括主要和新興貨幣的日本政府、地方政府、企業和外幣債券。

結構債券還提供了包括期權和掉期在內的衍生品。

存款和提款

Toho Securities 主要接受銀行轉帳付款。

費用

Toho Securities 根據不同產品的交易量收取交易費用,例如,對於國內股票交易佣金,詳情如下(含稅):

| 合約金額 | 基本費用 |

| 最低佣金 | JPY 2,750 |

| 高達JPY 1,000,000 | 1.21% |

| 超過JPY 1M至不足JPY 3M | 0.8800% + JPY 3,300 |

| 超過JPY 3M至不足JPY 5M | 0.7700% + JPY 6,600 |

| 超過JPY 5M至不足JPY 10M | 0.6600% + JPY 12,100 |

| 超過JPY 10M至不足JPY 30M | 0.5500% + JPY 23,100 |

| 超過JPY 30M至不足JPY 50M | 0.2200% + JPY 122,100 |

| 超過JPY 50M | 0.1100% + JPY 177,100 |

| 最高佣金 | JPY 275,000 |

要了解該公司的最新交易費用,您應該訪問 https://toho-sec.co.jp/account/charge.html 或與他們的代表溝通,以確保您充分了解您的交易成本。