joalund

1-2年

Is Rakuten Bank overseen by any financial regulators, and if so, which ones?

As someone who values strict regulatory oversight in forex trading, I pay close attention to a broker’s licensing and compliance status before considering them for my portfolio. In my research and personal scrutiny of Rakuten Bank, I found that it is not regulated by any recognized financial authority in the forex sector. This absence of valid regulatory supervision is a significant red flag for me. Regardless of its long operational history in Japan and its growth in customer accounts, the lack of regulatory oversight means there is no external body ensuring fair practices, secure handling of client funds, or accountability in the event of disputes.

From my perspective, trading with unregulated entities exposes traders to heightened risks—primarily because there is minimal recourse if issues arise. I believe strong regulation is not just a formality—it provides a critical safety net for traders, especially in volatile markets. Therefore, the fact that Rakuten Bank currently operates without valid forex regulation is a deciding factor for me, and it’s the reason why I would proceed with the utmost caution, if at all. My experience has taught me that it’s always safer to prioritize brokers who are fully and transparently regulated by reputable authorities.

Rpy Sundram

1-2年

Does Rakuten Bank offer a swap-free (Islamic) account option for its traders?

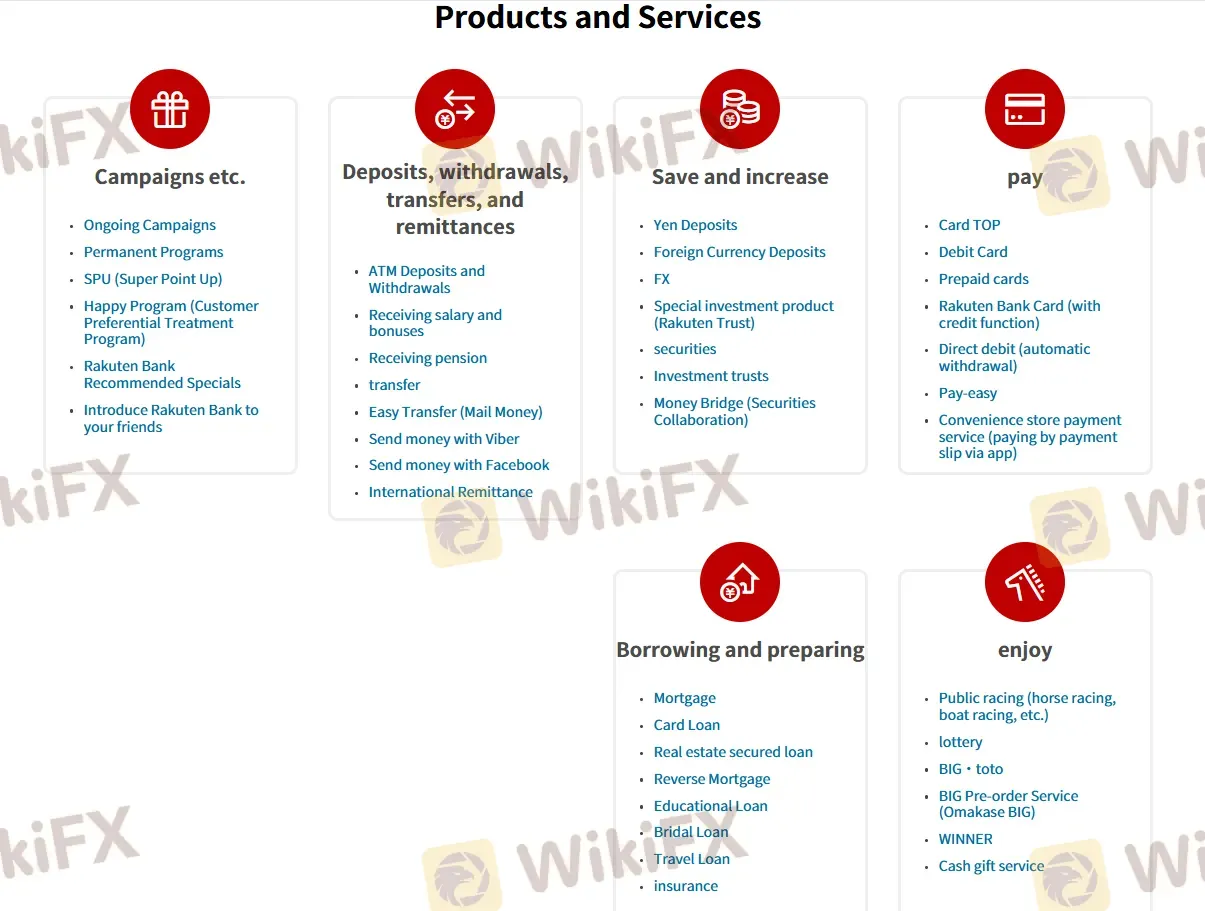

As an experienced forex trader, when evaluating any financial institution for trading—especially banks like Rakuten Bank—it's crucial for me to verify the availability of account types in detail before making assumptions or decisions. Based on my careful review of the available official information, I found no mention or indication that Rakuten Bank offers swap-free or Islamic account options for traders. The bank seems focused on providing banking services such as deposits, withdrawals, transfers, and standard payments through its digital platform, specifically the Rakuten Bank App.

My concern grows stronger because Rakuten Bank is not currently regulated by any recognized financial authority for forex trading activities. This lack of regulatory oversight already raises significant caution for anyone seeking specialized trading services, including Sharia-compliant accounts. In my experience, regulated brokers clearly state their account structures and provide detailed information about options like Islamic accounts, usually to ensure compliance with both legal and religious obligations. The fact that such information is entirely absent here makes me highly doubtful that Rakuten Bank supports swap-free accounts at all.

For me, transparency and robust regulation are non-negotiable, especially for traders who require specific account features for religious compliance. Given the lack of clarity and official regulatory standing, I would be extremely cautious and would not assume that Rakuten Bank offers swap-free (Islamic) accounts. If this feature is essential, I strongly advise seeking a regulated broker with openly documented Islamic account offerings.

Broker Issues

Leverage

Platform

Instruments

Account

schlaepfi

1-2年

What are the primary advantages and disadvantages of trading through Rakuten Bank?

From my perspective as an independent forex trader, considering Rakuten Bank’s offering for trading demands a very measured approach. On the surface, Rakuten Bank benefits from a long-standing presence in Japan’s digital banking sector and a large customer base with significant deposit holdings. This operational history initially conveyed some confidence to me about the stability and infrastructure behind their services. The platform’s digital focus, mainly through their app, does offer convenience for users managing deposits, transfers, and related financial services.

However, the lack of valid regulatory oversight is, in my experience, a major red flag that outweighs these operational positives for any trader with serious risk management standards. In the forex industry, genuine, transparent regulation isn’t just a legal box to tick—it is fundamental for safeguarding client funds, dispute resolution, and overall market integrity. Without recognized regulation, I cannot comfortably trust that my trading funds would be protected or that fair practice is ensured. Furthermore, the platform seems to lack robust customer support, with assistance apparently limited and mostly in Japanese, which raises accessibility issues for international users.

Given these factors, although Rakuten Bank’s long history and digital infrastructure are appealing, the absence of regulatory protection and inadequate support would prevent me from considering it a prudent or trustworthy choice for forex trading. For me, adherence to regulatory standards remains non-negotiable when selecting a trading venue.

Jezreel2

1-2年

Can you detail the particular advantages Rakuten Bank offers in terms of its available trading instruments and its fee system?

Based on my careful review of Rakuten Bank as a trading venue, I must highlight a few important risks before speaking about its features. In my experience, the broker's lack of regulation is a major red flag—an essential consideration for anyone trading or holding funds with a financial institution. As of now, Rakuten Bank is not regulated by any financial authority for forex or similar trading services, which means there is an inherent risk to both capital safety and dispute resolution in the event of an issue.

Focusing on its offerings, Rakuten Bank is positioned primarily as a comprehensive digital bank rather than a specialized forex or CFD broker. It handles deposits, withdrawals, payments, remittances, and borrowing. In my research and interactions, I have not found robust information to suggest Rakuten Bank provides direct access to traditional forex trading instruments, CFDs, or a detailed, competitive fee system commonly found with globally recognized brokers. Their platform—the Rakuten Bank App—is focused on general banking rather than specialized trading tools.

Given this, while Rakuten Bank seems to serve Japanese banking customers efficiently and boasts a large user base, as a trader, I personally require more specific instrument diversity, clear fee structures, and above all, regulatory security. In the context of trading, especially forex or derivatives, I’m very cautious about engaging with any provider that lacks strict regulatory oversight and detailed, transparent disclosures regarding trading conditions and costs. For me, safety and regulatory compliance are far more compelling than any purported advantage in instruments or fees.