Perfil de la compañía

| Rakuten Bank Resumen de la reseña | |

| Fundado | 2000 |

| País/Región registrado | Japón |

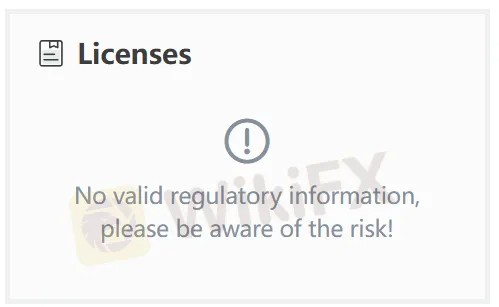

| Regulación | No regulado |

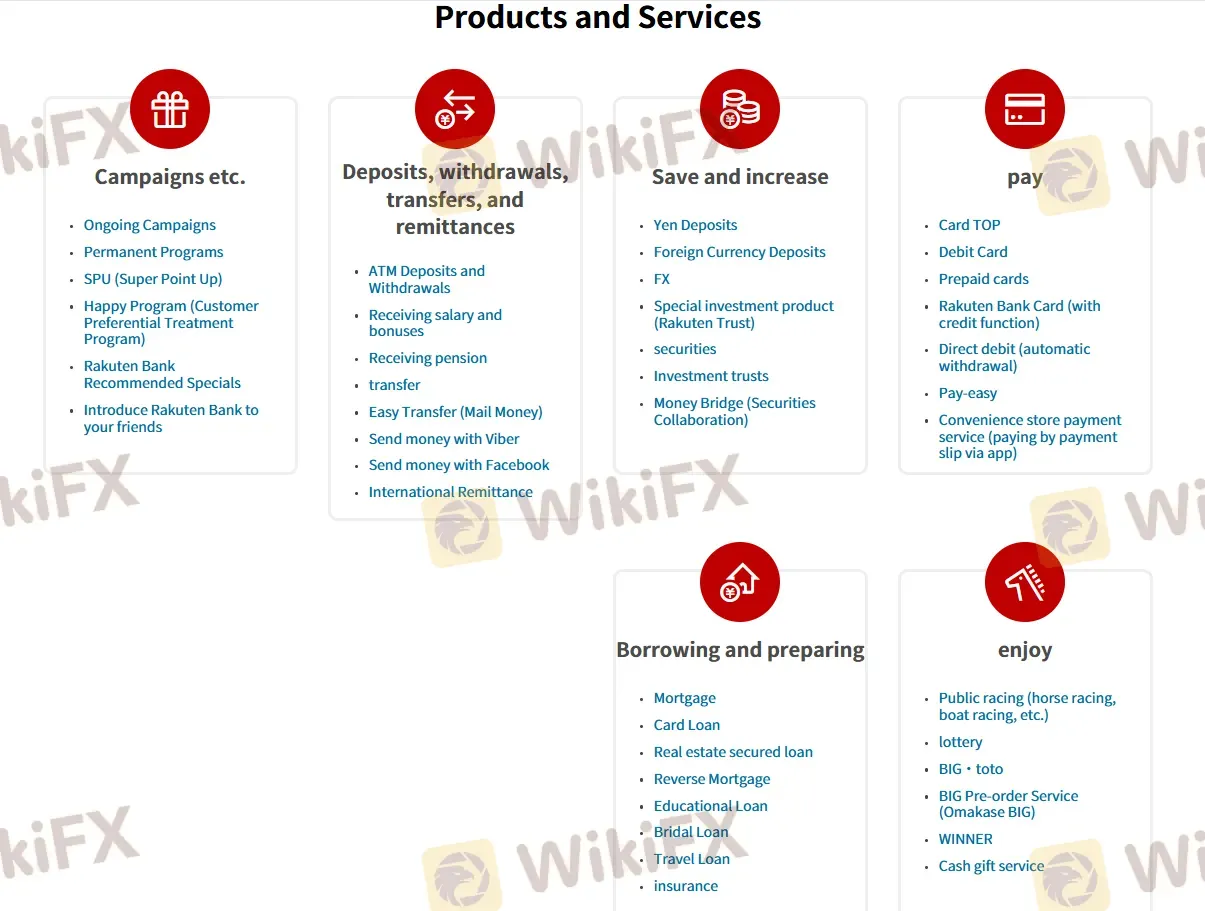

| Servicios | Depósitos y retiros, transferencias y remesas, ahorro e incremento, préstamos, pagos |

| Plataforma/APP | Aplicación Rakuten Bank |

| Soporte al cliente | / |

Información de Rakuten Bank

Rakuten Bank, Ltd. es un destacado banco digital japonés con sede en Tokio, Japón. Establecido el 14 de enero de 2000, el banco opera principalmente a través de canales electrónicos, ofreciendo una amplia gama de servicios financieros a clientes individuales y comerciales.

Hasta el 10 de junio de 2025, el capital de Rakuten Bank asciende a ¥32,617 millones. El banco ha mostrado un crecimiento significativo, superando los 17 millones de cuentas de clientes y logrando un saldo total de depósitos que supera los ¥12 billones para enero de 2025.

En abril de 2023, Rakuten Bank se enlistó en la Bolsa de Tokio.

Pros y contras

| Pros | Contras |

| Larga historia operativa | No regulado |

| Amplia gama de servicios | La información de contacto solo es compatible con japonés |

| Falta de soporte al cliente |

¿Es Rakuten Bank legítimo?

No. Rakuten Bank no ha sido regulado por ninguna autoridad. ¡Por favor, tenga en cuenta el riesgo!

Servicios

Como banco en Japón, Rakuten Bank ofrece múltiples servicios, que incluyen depósitos y retiros, transferencias y remesas, ahorro e incremento, préstamos y pago.

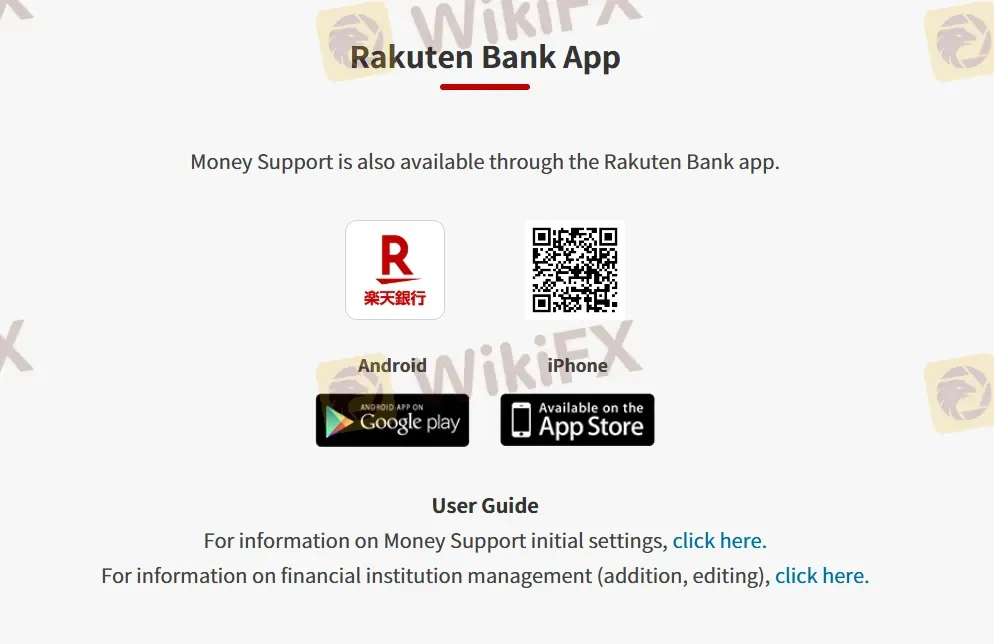

Plataforma/APLICACIÓN

La plataforma de Rakuten Bank es Aplicación Rakuten Bank, que es compatible con traders en iPhone y Android.