Giới thiệu doanh nghiệp

| Rakuten Bank Tóm tắt Đánh giá | |

| Thành lập | 2000 |

| Quốc gia/Vùng đăng ký | Nhật Bản |

| Quy định | Không được quy định |

| Dịch vụ | Gửi và rút tiền, chuyển khoản và chuyển tiền, tiết kiệm và tăng cường, vay mượn, thanh toán |

| Nền tảng/Ứng dụng | Ứng dụng Rakuten Bank |

| Hỗ trợ Khách hàng | / |

Thông tin về Rakuten Bank

Rakuten Bank, Ltd. là một ngân hàng số hàng đầu của Nhật Bản, trụ sở tại Tokyo, Nhật Bản. Được thành lập vào ngày 14 tháng 1 năm 2000, ngân hàng hoạt động chủ yếu thông qua các kênh điện tử, cung cấp một loạt dịch vụ tài chính đa dạng cho khách hàng cá nhân và doanh nghiệp.

Đến ngày 10 tháng 6 năm 2025, vốn của Rakuten Bank đạt 32.617 triệu ¥. Ngân hàng đã có sự phát triển đáng kể, vượt qua 17 triệu tài khoản khách hàng và đạt tổng số dư tiền gửi vượt quá 12 nghìn tỷ ¥ vào tháng 1 năm 2025.

Vào tháng 4 năm 2023, Rakuten Bank đã được niêm yết trên Sở giao dịch chứng khoán Tokyo.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

| Lịch sử hoạt động lâu dài | Không được quy định |

| Dịch vụ đa dạng | Thông tin liên hệ chỉ hỗ trợ tiếng Nhật |

| Thiếu hỗ trợ khách hàng |

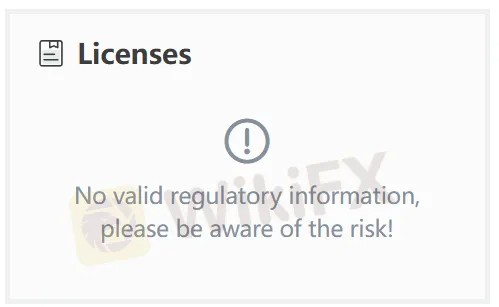

Rakuten Bank Có Uy tín không?

Không. Rakuten Bank chưa được quy định bởi bất kỳ cơ quan nào. Vui lòng lưu ý về rủi ro!

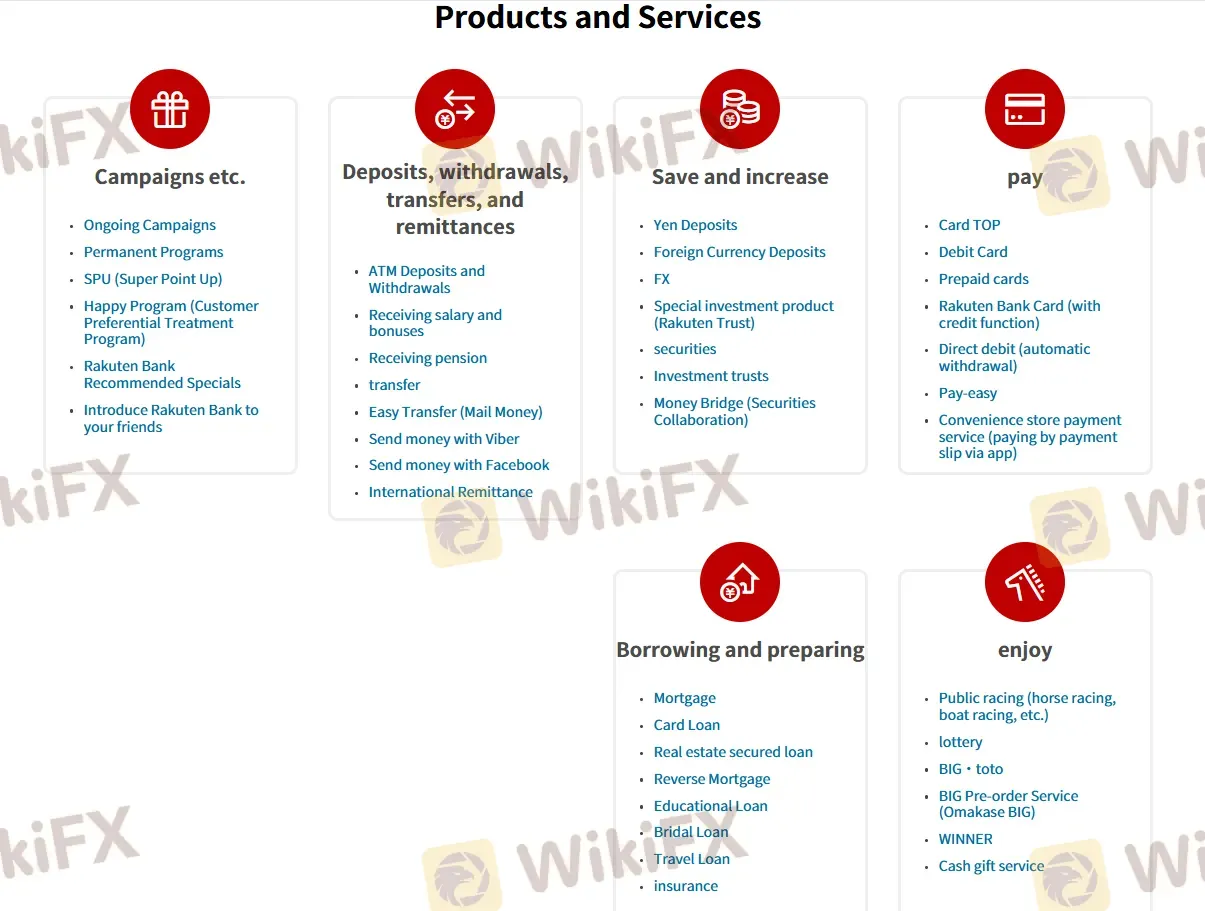

Dịch vụ

Là một ngân hàng tại Nhật Bản, Rakuten Bank cung cấp nhiều dịch vụ, bao gồm gửi và rút tiền, chuyển khoản và chuyển tiền, tiết kiệm và tăng cường, vay mượn, và thanh toán.

Nền tảng/Ứng dụng

Nền tảng của Rakuten Bank là Ứng dụng Rakuten Bank, hỗ trợ các nhà giao dịch trên iPhone và Android.