Razzie87

1-2年

Is it possible to trade individual assets such as Gold (XAU/USD) and Crude Oil through UCML?

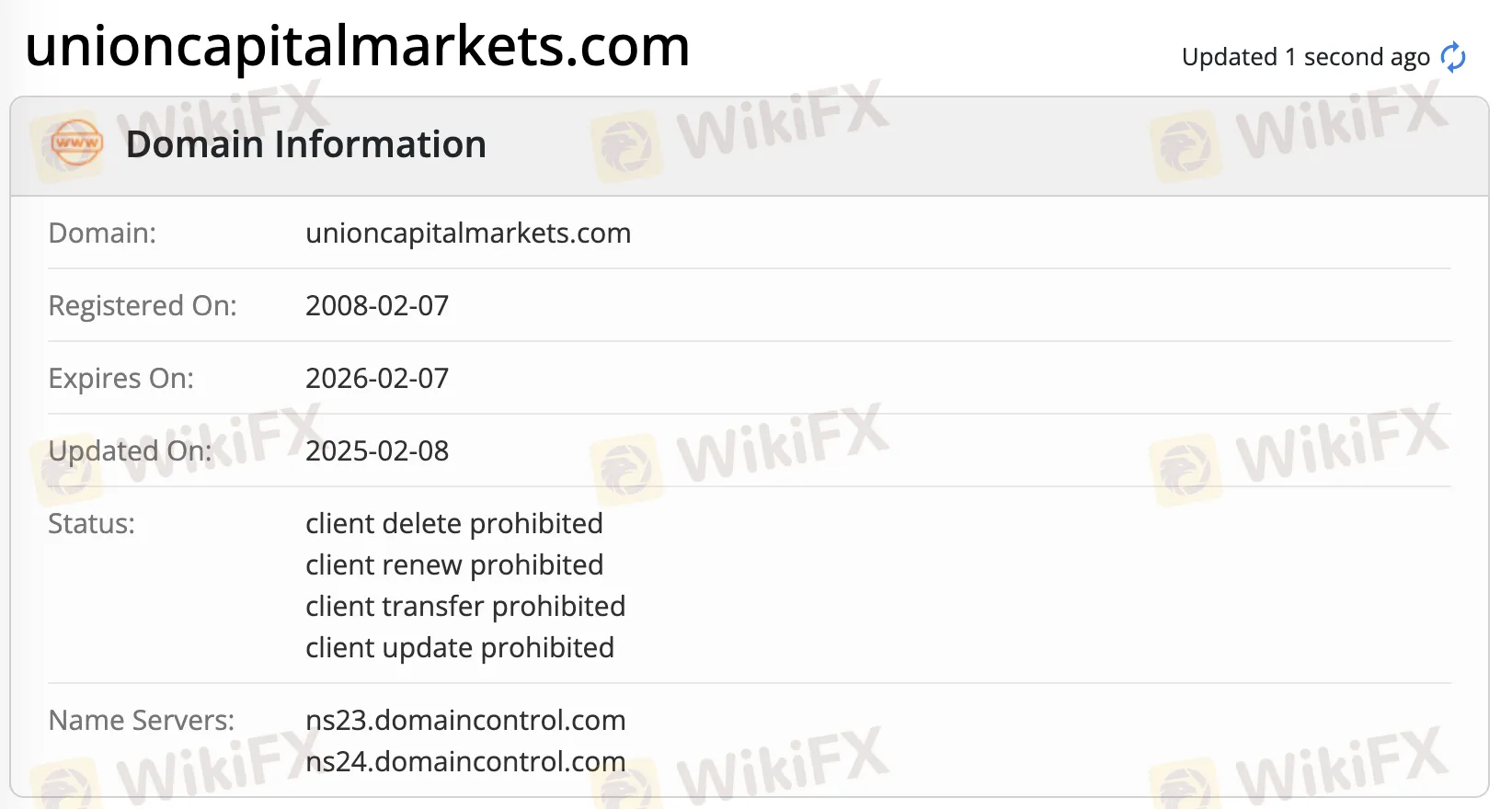

Based on my due diligence and the details available, I would not consider UCML a viable option for trading individual assets like Gold (XAU/USD) or Crude Oil. My first concern is regulatory; UCML operates entirely without valid oversight and is explicitly described as unregulated, which signals substantial risk for client funds and recourse in case of disputes. As someone who has seen the consequences of unregulated trading firsthand, this risk alone is a significant deterrent for me.

Moreover, UCML does not specifically list forex, commodities, or other popular traded instruments—like gold or oil—among its products. Instead, the broker focuses on services such as investment banking, securities, real estate, private equities, and asset management. The lack of any demo account and minimal transparency regarding trading conditions make it especially hard for me to evaluate what, if any, execution environment or asset coverage UCML would actually provide. In my experience, legitimate brokers are upfront about available assets and trading parameters—a lack of such basics is a major red flag.

Given these points, I see no evidence that UCML offers trading in assets like XAU/USD or crude oil at all. Even if they did, the absence of regulation and transparency would make participation infeasible for me as a responsible trader. For exposure to gold or oil, I would only trust established, strictly regulated brokers with a clear track record and disclosure.

Broker Issues

Account

Platform

Leverage

Instruments

sweetosh

1-2年

What is the usual timeframe for UCML to process withdrawals to either a bank account or an e-wallet?

Based on my review of UCML, I must emphasize that there is insufficient and unclear information regarding their withdrawal processing times, whether to a bank account or an e-wallet. I was unable to find any published or verifiable details on UCML’s website or brokerage resources specifying typical timelines for fund withdrawal. This significant lack of transparency is immediately concerning for me as an experienced trader, particularly since the broker currently operates without any active regulatory oversight. In my professional opinion, the absence of regulation and concrete withdrawal procedures increases potential risk substantially. Without oversight or a clear policy, there is no third-party guarantee that withdrawal requests will be processed promptly or at all. Over the years, I have learned that unreliable withdrawal processes can lead to major issues, especially with unregulated brokers. For me, dealing with a broker that does not clearly disclose withdrawal times or procedures is not an acceptable risk, no matter their operational history or service range. Consequently, I would proceed with extreme caution and advise any trader to require documented, verifiable information before considering deposits or expecting withdrawals from UCML.

Broker Issues

Withdrawal

Deposit

schlaepfi

1-2年

Are there any inactivity fees charged by UCML, and under what circumstances do they apply?

After carefully researching UCML, I have found that the broker does not publicly disclose any information regarding inactivity fees. In my experience, transparency around fee structures—especially concerning inactivity charges—is a fundamental aspect of building trust with a broker. Unfortunately, with UCML, the lack of explicit information about potential fees of this type raises concerns for me. The broker itself already presents a high-risk profile due to lacking regulatory oversight and providing minimal clarity on trading conditions in general.

As a trader, I place great emphasis on knowing exactly what costs I might incur, not just while actively trading, but also during periods when I might need to pause my activities. Without this information from UCML, I cannot confidently say whether they charge inactivity fees or under what terms these might be imposed, which is a significant drawback. In my judgment, this obscurity requires caution—unclear fee schedules can sometimes lead to unexpected charges. For these reasons, I would advise anyone considering UCML to thoroughly question their customer service directly for detailed, written clarification before opening any type of account or funding it. For me, the absence of such details is a major red flag when evaluating any broker.

Broker Issues

Fees and Spreads

J Forex Trader

1-2年

Could you break down the total trading costs involved when trading indices such as the US100 on UCML?

Drawing from my experience as a trader, I must highlight that trading indices like the US100 on UCML is simply not possible. According to my research, UCML does not support trading in indices, including the US100, nor does it provide access to other common asset classes such as forex, commodities, stocks, or cryptocurrencies. Their scope is limited to services in investment banking, securities, real estate, private equities, and asset management, but trading in financial instruments such as indices is not available.

Even beyond the lack of index trading, I find UCML’s setup particularly concerning. The broker is unregulated—there is no oversight from reputable financial authorities. This is a critical red flag for me because regulation is key in providing a minimum layer of protection and recourse to traders. Furthermore, UCML offers little transparency about costs or trading conditions, entirely omits the availability of demo accounts, and there is insufficient public information to estimate spreads, commissions, overnight fees, or any other trading charges.

Given these gaps and the absence of regulated framework or detailed disclosures, I cannot quantify or break down trading costs for indices on UCML, as these products are not available and essential information is lacking. Personally, I steer clear of such unregulated, opaque brokers to protect my capital and ensure transparency in every aspect of my trading.

Broker Issues

Fees and Spreads