Company Summary

| IMC Review Summary | |

| Founded | 1989 |

| Registered Country/Region | Netherlands |

| Regulation | SFC |

| Products and Services | Quant Research, Trading Technology, Institutional Trading, Crypto Solutions, ETF Market Making |

| Demo Account | / |

| Customer Support | New York: 100 Park Ave, Suite 3215, New York, NY 10017, United States |

| Hong Kong: +852 (3) 658 9888, contact.hongkong@imc.com, Unit 1702, 17/F, 100 Queen's Rd Central, Hong Kong | |

| Seoul: 40F, FKI Tower, 24 Yeoui-daero, Yeongdeungpo-gu, Seoul 07320, Korea | |

IMC Information

Founded in 1989 in the Netherlands, IMC is a well-established, tech-driven proprietary trading and market-making company. Operating worldwide with main headquarters in New York, Hong Kong, and Seoul, it is governed by the SFC in Hong Kong. IMC emphasizes quantitative research, sophisticated trading methods, and liquidity services across more than 90 exchanges.

Pros and Cons

| Pros | Cons |

| Regulated by the SFC (Hong Kong) | Does not offer retail trading or demo accounts |

| Over 35 years of market-making and trading experience | No public trading platform like MT4/MT5 |

| Strong presence across 90+ exchanges and multiple asset classes | Limited information on account features |

Is IMC Legit?

IMC is a Hong Kong Securities and Futures Commission (SFC)-licensed financial company. It has a valid futures trading license (ANR402) since March 12, 2007. This status verifies IMC's Hong Kong financial regulatory compliance.

Products and Services

Technology-driven financial services from IMC include quantitative analysis, complex trading methods, and new technology. Artificial intelligence, machine learning, and high-performance computers help the organization compete in global financial markets.

| Product / Service | Details |

| Quant Research | Creates and optimizes trading strategies using AI and ML |

| Technology & Engineering | Automates trading and builds high-performance infrastructure |

| Trading | Applying unique trading tactics with 35 years of market expertise |

Liquidity Service

After 35 years, IMC is a trusted liquidity provider with steady pricing and deep market access on 90+ exchanges. The company provides fast, cheap quotes and customized financial solutions to equity, crypto, and ETF counterparties. IMC excels in automation-driven pricing, geographic and product coverage, and product reliability in all markets.

| Liquidity Service | Details |

| Institutional Sales | Direct, off-screen trading with IMC for buy-side firms across Europe, US, and Asia-Pacific |

| Options Wholesaling | Advanced connectivity to all OCC venues for U.S. listed options trading |

| Crypto Solutions | Global access to crypto products, including spot, perps, futures, and options |

| ETF Market Making | Lead Market Maker in over 150 U.S.-listed ETFs, supporting liquidity and efficiency |

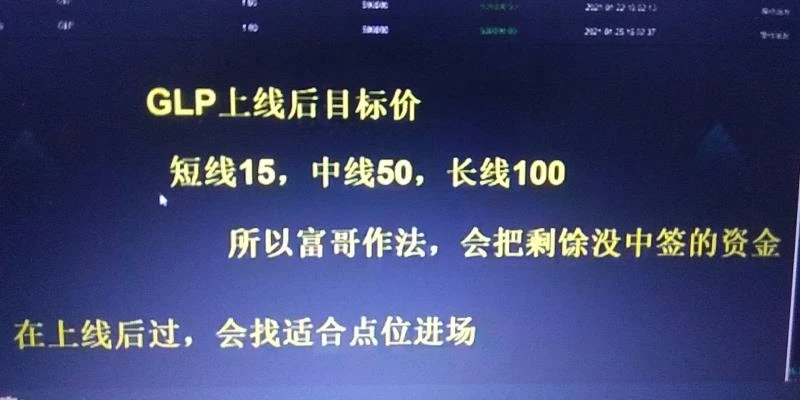

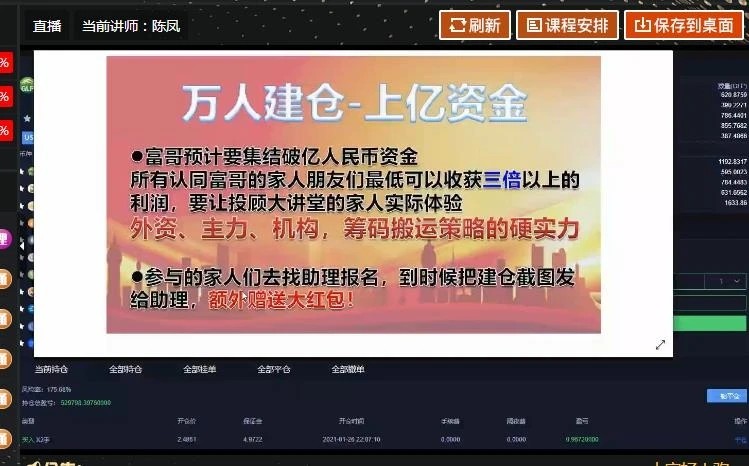

FX6351424842

Hong Kong

Then the platform suddenly went wrong and it has been repairing

Exposure

FX2287070820

Hong Kong

What should we do if you close your platform? You are a fraud

Exposure

jamloveok

Thailand

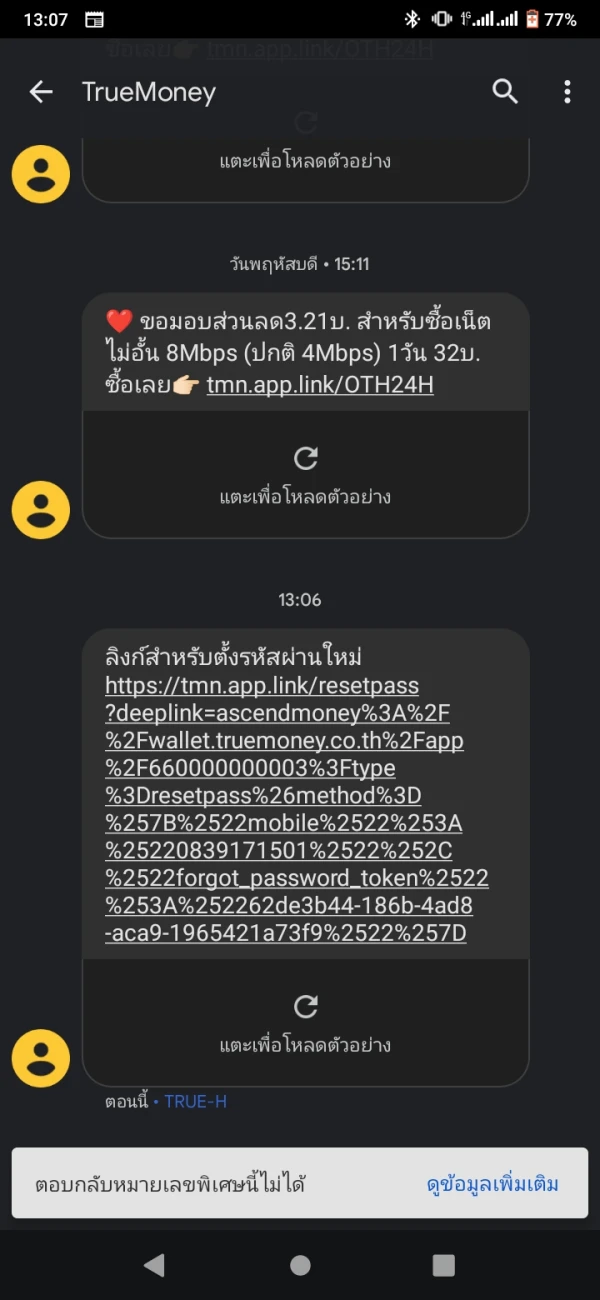

My website truemove company tell your subordinates why then i will call the police he sent link to my mobile phone how does it work truemove why this cheating behavior against AIS against happy from dtac not You see, dtac one-2-call they don't have the same personality as TrueMove h, so their employees' behavior is better than TrueMove h.

Positive

FX1036488142

Ecuador

So far I think the service provided by this company is satisfactory for me! It offers a variety of financial products such as futures. The fly in the ointment is that the customer support they offer is not available 24/7, sometimes I have to wait maybe hours or even a day or two for a response.

Positive