Giới thiệu doanh nghiệp

| OSTOUL Tóm tắt Đánh giá | |

| Thành lập | 2010 |

| Quốc gia/Vùng | Ai Cập |

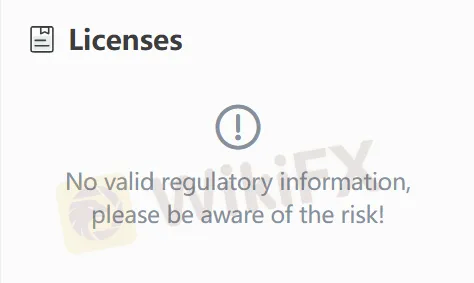

| Quy định | Không có quy định |

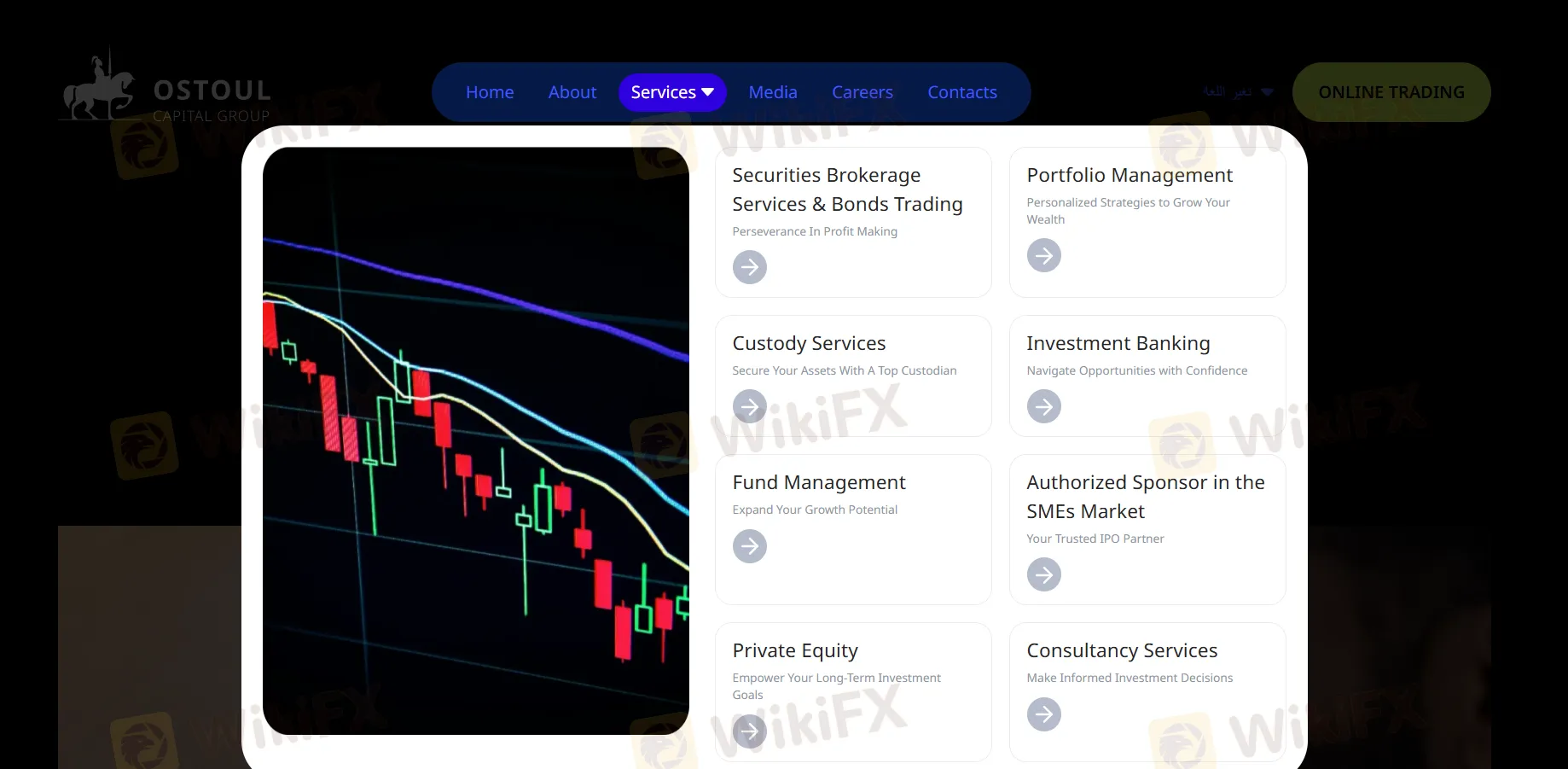

| Sản phẩm & Dịch vụ | Môi giới chứng khoán, trái phiếu, vốn riêng, quản lý danh mục, dịch vụ giữ chứng khoán, ngân hàng đầu tư, quản lý quỹ và dịch vụ tư vấn |

| Tài khoản Demo | / |

| Đòn bẩy | / |

| Chênh lệch | / |

| Nền tảng Giao dịch | Web Trader, Ứng dụng di động |

| Yêu cầu Tiền gửi tối thiểu | / |

| Hỗ trợ Khách hàng | Mẫu Liên hệ |

| Email: info@ostoulcapital.com | |

| Điện thoại: (+202) 27372560/1 | |

| Mạng xã hội: WhatsApp, Facebook, TikTok, YouTube, Instagram | |

| Địa chỉ: 1 Gabalaya St., Zamalek, Cairo, Ai Cập | |

Thông tin về OSTOUL

OSTOUL là một nhà môi giới có trụ sở tại Ai Cập, thành lập vào năm 2010, không được quy định. Cung cấp một loạt các dịch vụ tài chính đa dạng như môi giới chứng khoán, giao dịch trái phiếu, vốn riêng, quản lý danh mục, dịch vụ giữ chứng khoán, ngân hàng đầu tư, quản lý quỹ và dịch vụ tư vấn.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

| Dịch vụ đa dạng | Không được quy định |

| Nhiều kênh liên hệ | Thông tin hạn chế về điều kiện giao dịch |

| Sáu chi nhánh tại Trung Đông |

OSTOUL Có Uy tín không?

OSTOUL không được quản lý. Vui lòng nhớ đến rủi ro!

Sản phẩm & Dịch vụ

| Sản phẩm & Dịch vụ | Hỗ trợ |

| Môi giới Chứng khoán | ✔ |

| Vốn riêng | ✔ |

| Giao dịch Trái phiếu | ✔ |

| Quản lý Quỹ | ✔ |

| Quản lý Danh mục | ✔ |

| Ngân hàng Đầu tư | ✔ |

| Dịch vụ Giữ chỗ | ✔ |

| Dịch vụ Tư vấn | ✔ |

Nền tảng Giao dịch

| Nền tảng Giao dịch | Hỗ trợ | Thiết bị hỗ trợ | Phù hợp với |

| Web Trader | ✔ | Trình duyệt Web, Windows, MacOs | / |

| Ứng dụng Di động | ✔ | iOS, Android | / |

| MT4 | ❌ | / | Người mới bắt đầu |

| MT5 | ❌ | / | Người giao dịch có kinh nghiệm |