회사 소개

| OSTOUL 리뷰 요약 | |

| 설립 연도 | 2010 |

| 등록 국가/지역 | 이집트 |

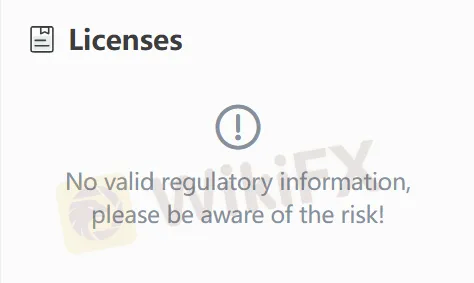

| 규제 | 규제 없음 |

| 제품 및 서비스 | 증권 중개, 채권, 사모 펀드, 포트폴리오 관리, 보관 서비스, 투자은행, 펀드 관리, 컨설팅 서비스 |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | 웹 트레이더, 모바일 앱 |

| 최소 입금액 | / |

| 고객 지원 | 문의 양식 |

| 이메일: info@ostoulcapital.com | |

| 전화: (+202) 27372560/1 | |

| 소셜 미디어: WhatsApp, Facebook, TikTok, YouTube, Instagram | |

| 주소: 이집트 카이로 자말렉 가발라야 거리 1 | |

OSTOUL 정보

OSTOUL은 2010년에 설립된 이집트 기반의 브로커로 규제가 없습니다. 증권 중개, 채권 거래, 사모 펀드, 포트폴리오 관리, 보관 서비스, 투자은행, 펀드 관리 및 컨설팅 서비스와 같은 다양한 금융 서비스를 제공합니다.

장단점

| 장점 | 단점 |

| 다양한 서비스 범위 | 규제 없음 |

| 다양한 연락 채널 | 거래 조건에 대한 정보 부족 |

| 중동에 6개 지점 보유 |

OSTOUL 합법적인가요?

OSTOUL은 비규제입니다. 리스크를 인식해주세요!

제품 및 서비스

| 제품 및 서비스 | 지원 |

| 증권 중개 | ✔ |

| 사모 펀드 | ✔ |

| 채권 거래 | ✔ |

| 자산 관리 | ✔ |

| 포트폴리오 관리 | ✔ |

| 투자은행 | ✔ |

| 보관 서비스 | ✔ |

| 컨설팅 서비스 | ✔ |

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합 대상 |

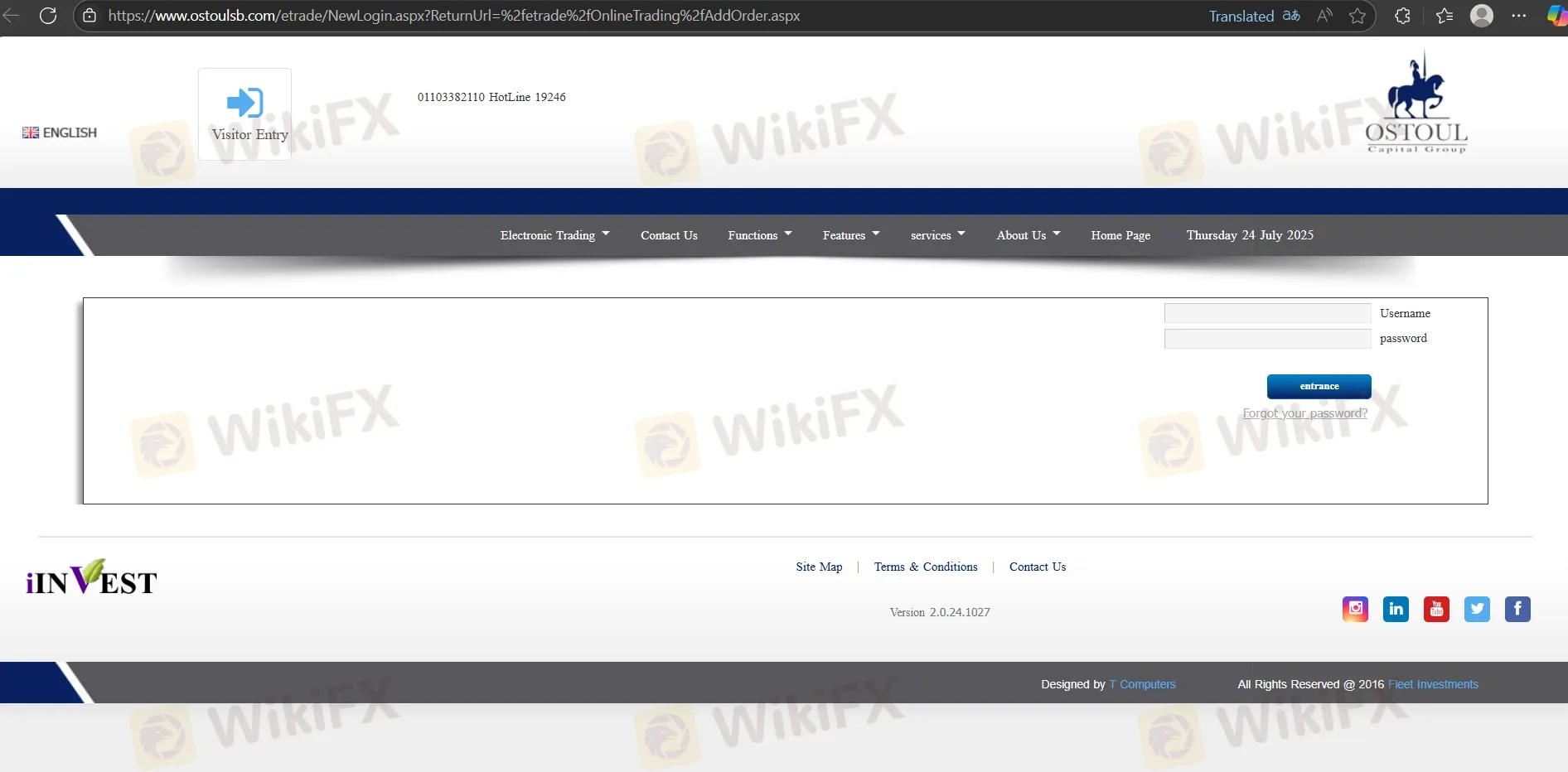

| 웹 트레이더 | ✔ | 웹 브라우저, Windows, MacOs | / |

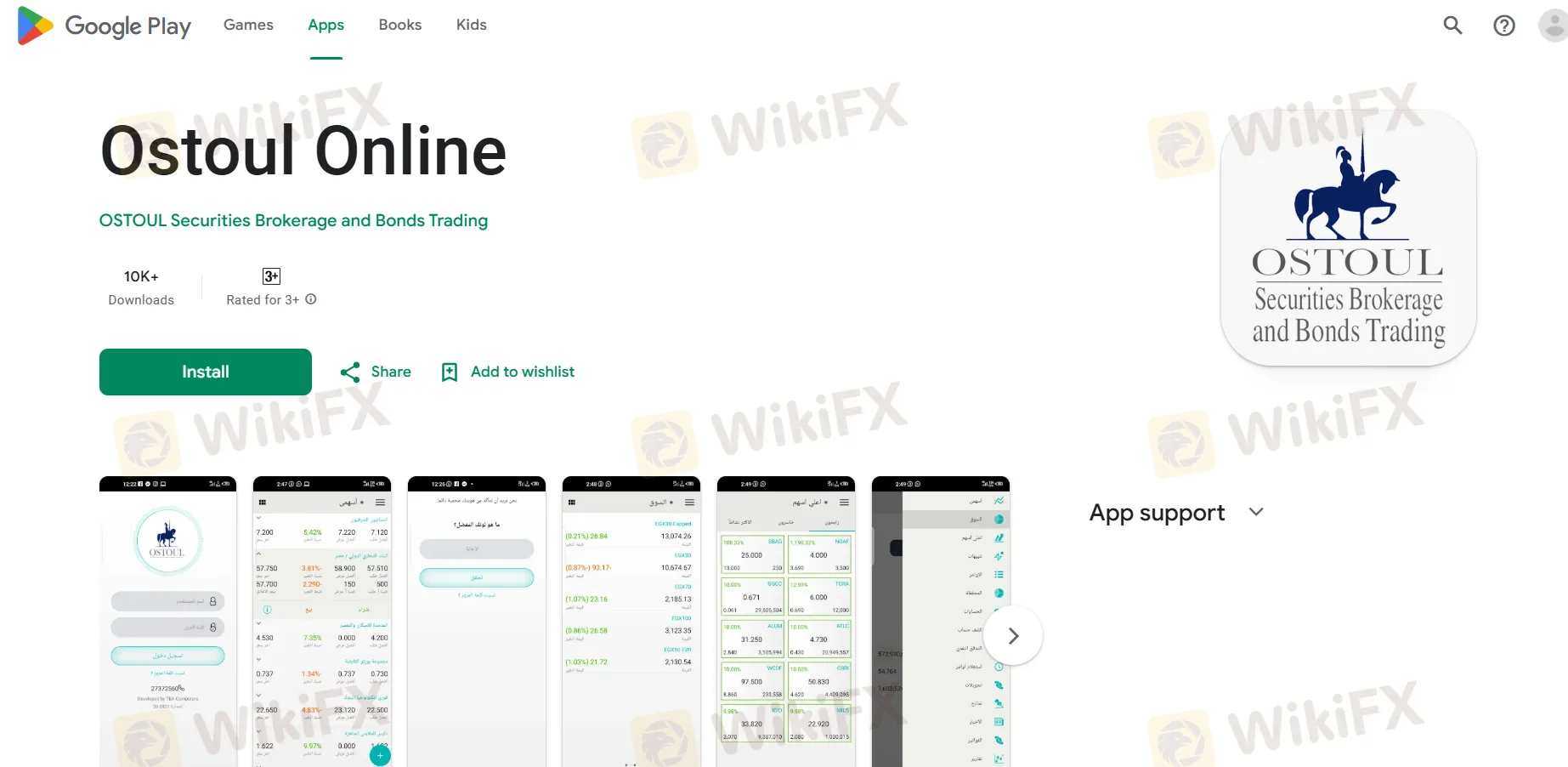

| 모바일 앱 | ✔ | iOS, Android | / |

| MT4 | ❌ | / | 초보자 |

| MT5 | ❌ | / | 경험 있는 트레이더 |