Resumo da empresa

| OSTOUL Resumo da Revisão | |

| Fundação | 2010 |

| País/Região Registrada | Egito |

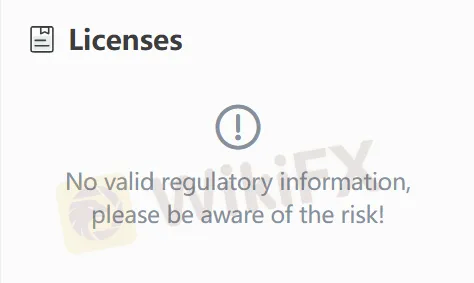

| Regulação | Sem regulação |

| Produtos e Serviços | Corretagem de títulos, títulos, private equity, gestão de portfólio, serviços de custódia, banca de investimento, gestão de fundos, serviços de consultoria |

| Conta Demonstrativa | / |

| Alavancagem | / |

| Spread | / |

| Plataforma de Negociação | Web Trader, Aplicativo Móvel |

| Depósito Mínimo | / |

| Suporte ao Cliente | Formulário de Contato |

| Email: info@ostoulcapital.com | |

| Tel: (+202) 27372560/1 | |

| Redes Sociais: WhatsApp, Facebook, TikTok, YouTube, Instagram | |

| Endereço: 1 Gabalaya St., Zamalek, Cairo, Egito | |

Informações sobre OSTOUL

OSTOUL é uma corretora com sede no Egito fundada em 2010, que não é regulamentada. Oferece uma ampla gama de serviços financeiros, como corretagem de títulos, negociação de títulos, private equity, gestão de portfólio, serviços de custódia, banca de investimento, gestão de fundos e serviços de consultoria.

Prós e Contras

| Prós | Contras |

| Ampla gama de serviços | Não regulamentada |

| Vários canais de contato | Informações limitadas sobre condições de negociação |

| Seis filiais no Oriente Médio |

OSTOUL é Legítimo?

OSTOUL não é regulamentado. Por favor, esteja ciente do risco!

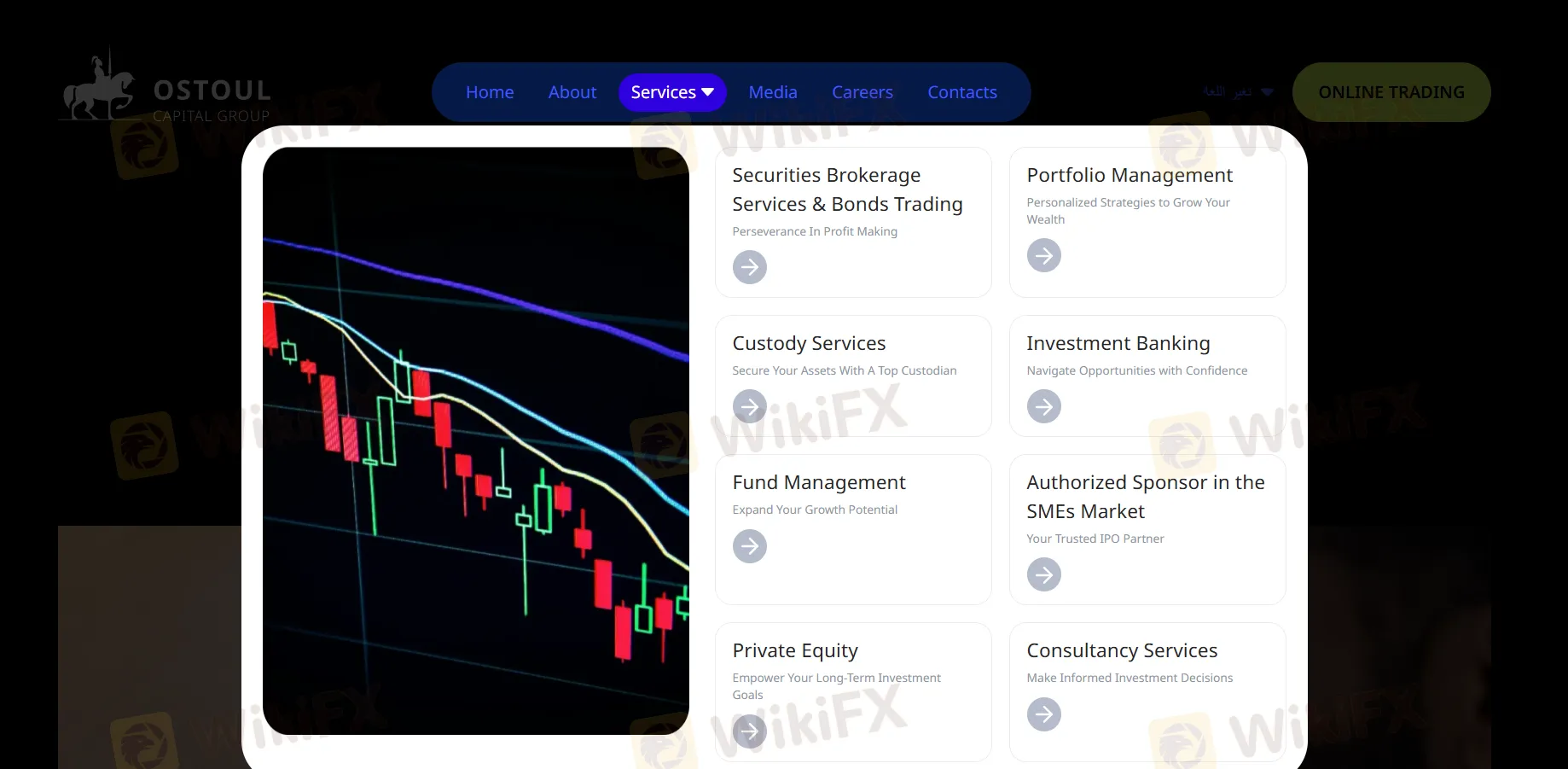

Produtos e Serviços

| Produtos e Serviços | Suportado |

| Corretagem de Valores Mobiliários | ✔ |

| Private Equity | ✔ |

| Negociação de Títulos | ✔ |

| Gestão de Fundos | ✔ |

| Gestão de Carteira | ✔ |

| Banca de Investimento | ✔ |

| Serviços de Custódia | ✔ |

| Serviços de Consultoria | ✔ |

Plataforma de Negociação

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| Trader Web | ✔ | Navegador Web, Windows, MacOs | / |

| Aplicativo Móvel | ✔ | iOS, Android | / |

| MT4 | ❌ | / | Iniciantes |

| MT5 | ❌ | / | Traders experientes |