Unternehmensprofil

| OSTOUL Überprüfungszusammenfassung | |

| Gegründet | 2010 |

| Registriertes Land/Region | Ägypten |

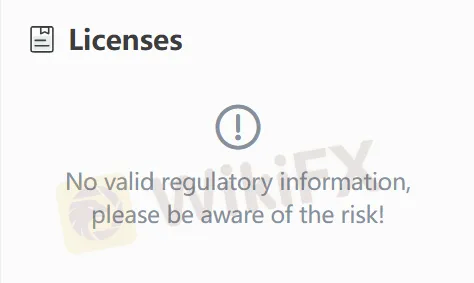

| Regulierung | Keine Regulierung |

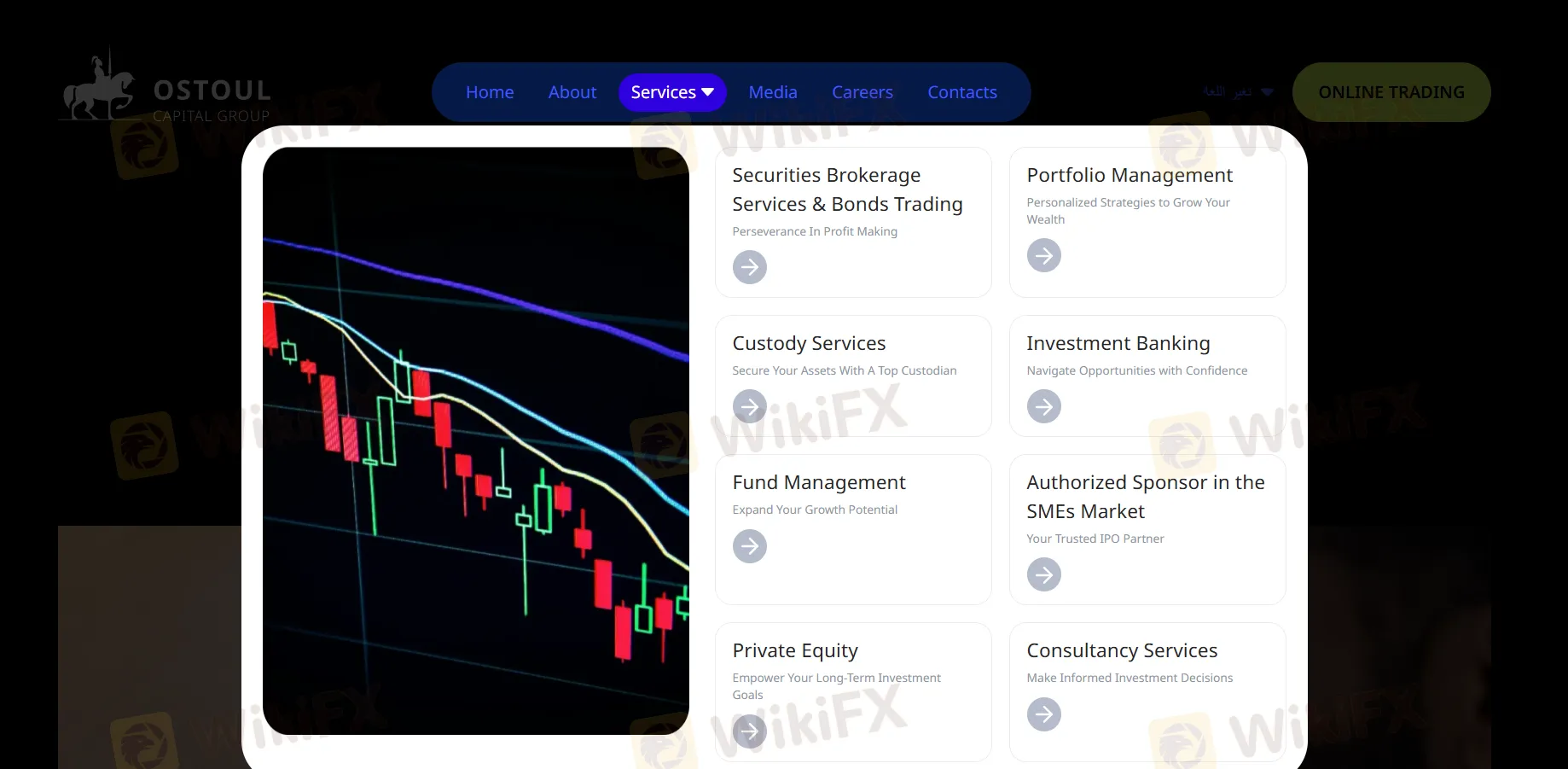

| Produkte & Dienstleistungen | Wertpapiermakler, Anleihen, Private Equity, Portfolioverwaltung, Verwahrungsdienste, Investmentbanking, Fondsmanagement, Beratungsdienste |

| Demokonto | / |

| Hebel | / |

| Spread | / |

| Handelsplattform | Web Trader, Mobile APP |

| Mindesteinzahlung | / |

| Kundensupport | Kontaktformular |

| E-Mail: info@ostoulcapital.com | |

| Tel: (+202) 27372560/1 | |

| Soziale Medien: WhatsApp, Facebook, TikTok, YouTube, Instagram | |

| Adresse: 1 Gabalaya St., Zamalek, Kairo, Ägypten | |

OSTOUL Informationen

OSTOUL ist ein in Ägypten ansässiger Broker, der 2010 gegründet wurde und nicht reguliert ist. Er bietet eine vielfältige Palette von Finanzdienstleistungen wie Wertpapierhandel, Anleihenhandel, Private-Equity, Portfolioverwaltung, Verwahrungsdienste, Investmentbanking, Fondsmanagement und Beratungsdienste an.

Vor- und Nachteile

| Vorteile | Nachteile |

| Vielfältige Dienstleistungen | Nicht reguliert |

| Verschiedene Kontaktmöglichkeiten | Begrenzte Informationen zu Handelsbedingungen |

| Sechs Niederlassungen im Nahen Osten |

Ist OSTOUL legitim?

OSTOUL ist nicht reguliert. Bitte seien Sie sich der Risiken bewusst!

Produkte & Dienstleistungen

| Produkte & Dienstleistungen | Unterstützt |

| Wertpapierhandel | ✔ |

| Private Equity | ✔ |

| Anleihenhandel | ✔ |

| Fondmanagement | ✔ |

| Portfolioverwaltung | ✔ |

| Investmentbanking | ✔ |

| Verwahrungsdienste | ✔ |

| Beratungsdienste | ✔ |

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| Web Trader | ✔ | Webbrowser, Windows, MacOs | / |

| Mobile App | ✔ | iOS, Android | / |

| MT4 | ❌ | / | Anfänger |

| MT5 | ❌ | / | Erfahrene Händler |