Giới thiệu doanh nghiệp

| IndiaNivesh Tóm tắt Đánh giá | |

| Thành lập | 2006 |

| Quốc gia/Khu vực Đăng ký | Ấn Độ |

| Quy định | Không có quy định |

| Công cụ Thị trường | Cổ phiếu, quỹ hỗn hợp, dẫn xuất, IPO, tiền tệ, bảo hiểm, hàng hóa |

| Tài khoản Demo | ❌ |

| Nền tảng Giao dịch | Ứng dụng IndiaNivesh |

| Hỗ trợ Khách hàng | Điện thoại: 022 – 62406240 |

| Mạng xã hội: Facebook, X, Instagram, LinkedIn, YouTube | |

| Email: customersupport@indianivesh.in | |

Thông tin về IndiaNivesh

IndiaNivesh là một nhà cung cấp dịch vụ không được quy định hàng đầu về môi giới và dịch vụ tài chính tại Sở giao dịch Chứng khoán Ấn Độ. Nó cung cấp các sản phẩm và dịch vụ về cổ phiếu, quỹ hỗn hợp, dẫn xuất, IPO/OFS, tiền tệ, bảo hiểm, hàng hóa, LAS&MTF, các giải pháp tùy chỉnh, dịch vụ quản lý danh mục, vốn riêng, đầu tư chiến lược, nghiên cứu, bán hàng và giao dịch, huy động vốn (vốn cổ phần & nợ), nhập cảnh Ấn Độ, toàn cầu hóa các công ty Ấn Độ, sáp nhập & thâu tóm.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

| Thời gian hoạt động lâu | Thiếu quy định |

| Nhiều kênh liên hệ | Không có tài khoản demo |

| Nhiều sản phẩm & dịch vụ |

IndiaNivesh Có Uy tín không?

Hiện tại không có quy định hợp lệ. Vui lòng lưu ý về rủi ro!

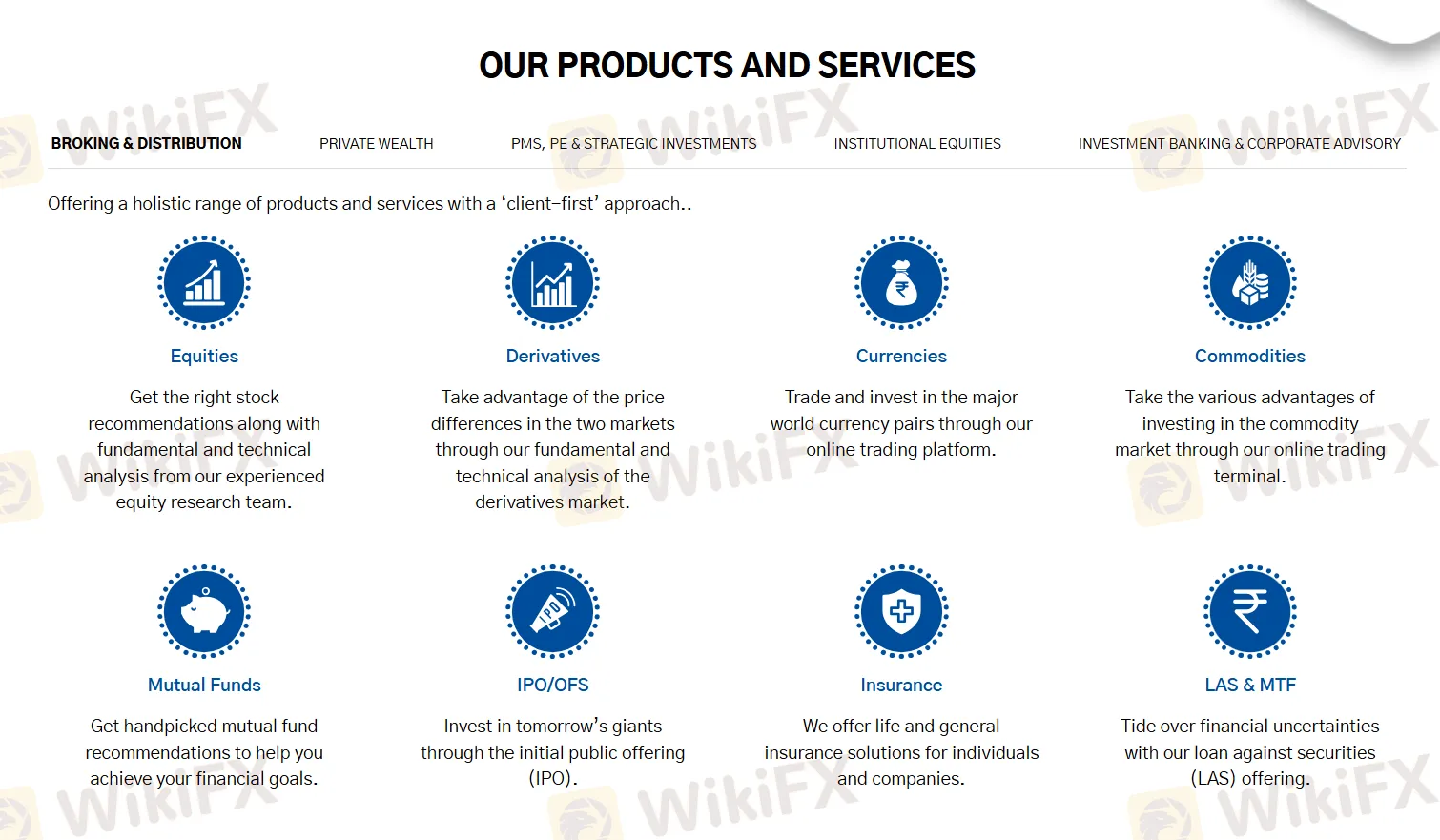

Tôi Có Thể Giao Dịch Gì trên IndiaNivesh?

| Tài Sản Giao Dịch | Hỗ Trợ |

| Cổ Phiếu | ✔ |

| Quỹ Đầu Tư | ✔ |

| Chứng Khoán Phái Sinh | ✔ |

| IPO | ✔ |

| Tiền Tệ | ✔ |

| Bảo Hiểm | ✔ |

| Hàng Hoá | ✔ |

| Chỉ Số | ❌ |

| Tiền Điện Tử | ❌ |

| Trái Phiếu | ❌ |

| Tùy Chọn | ❌ |

| ETFs | ❌ |

Nền Tảng Giao Dịch

| Nền Tảng Giao Dịch | Hỗ Trợ | Thiết Bị Hỗ Trợ | Phù Hợp với |

| IndiaNivesh Ứng Dụng | ✔ | Di Động | / |