公司简介

| IndiaNivesh 评论摘要 | |

| 成立时间 | 2006 |

| 注册国家/地区 | 印度 |

| 监管 | 无监管 |

| 市场工具 | 股票、共同基金、衍生品、IPO、货币、保险、大宗商品 |

| 模拟账户 | ❌ |

| 交易平台 | IndiaNivesh 应用 |

| 客户支持 | 电话:022 – 62406240 |

| 社交媒体:Facebook、X、Instagram、LinkedIn、YouTube | |

| 电子邮件:customersupport@indianivesh.in | |

IndiaNivesh 信息

IndiaNivesh 是印度证券交易所的一家未受监管的高级经纪和金融服务提供商。它提供股票、共同基金、衍生品、IPO/OFS、货币、保险、大宗商品、LAS&MTF、定制解决方案、投资组合管理服务、私募股权、战略投资、研究、销售和交易、资本筹集(股权和债务)、印度进入、印度公司的全球化、并购等产品和服务。

优缺点

| 优点 | 缺点 |

| 运营时间长 | 缺乏监管 |

| 多种联系渠道 | 无演示 账户 |

| 多样化的产品和服务 |

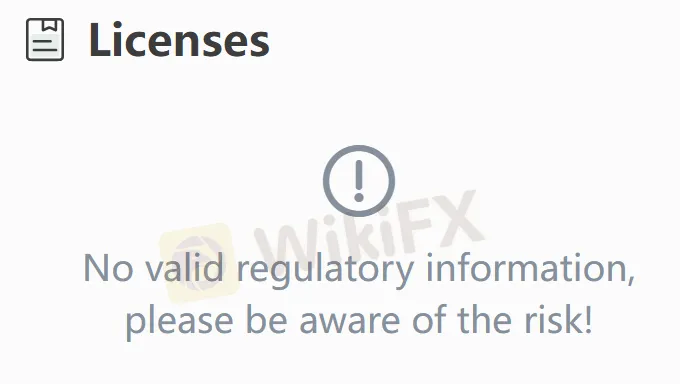

IndiaNivesh 是否合法?

目前没有有效的监管。请注意风险!

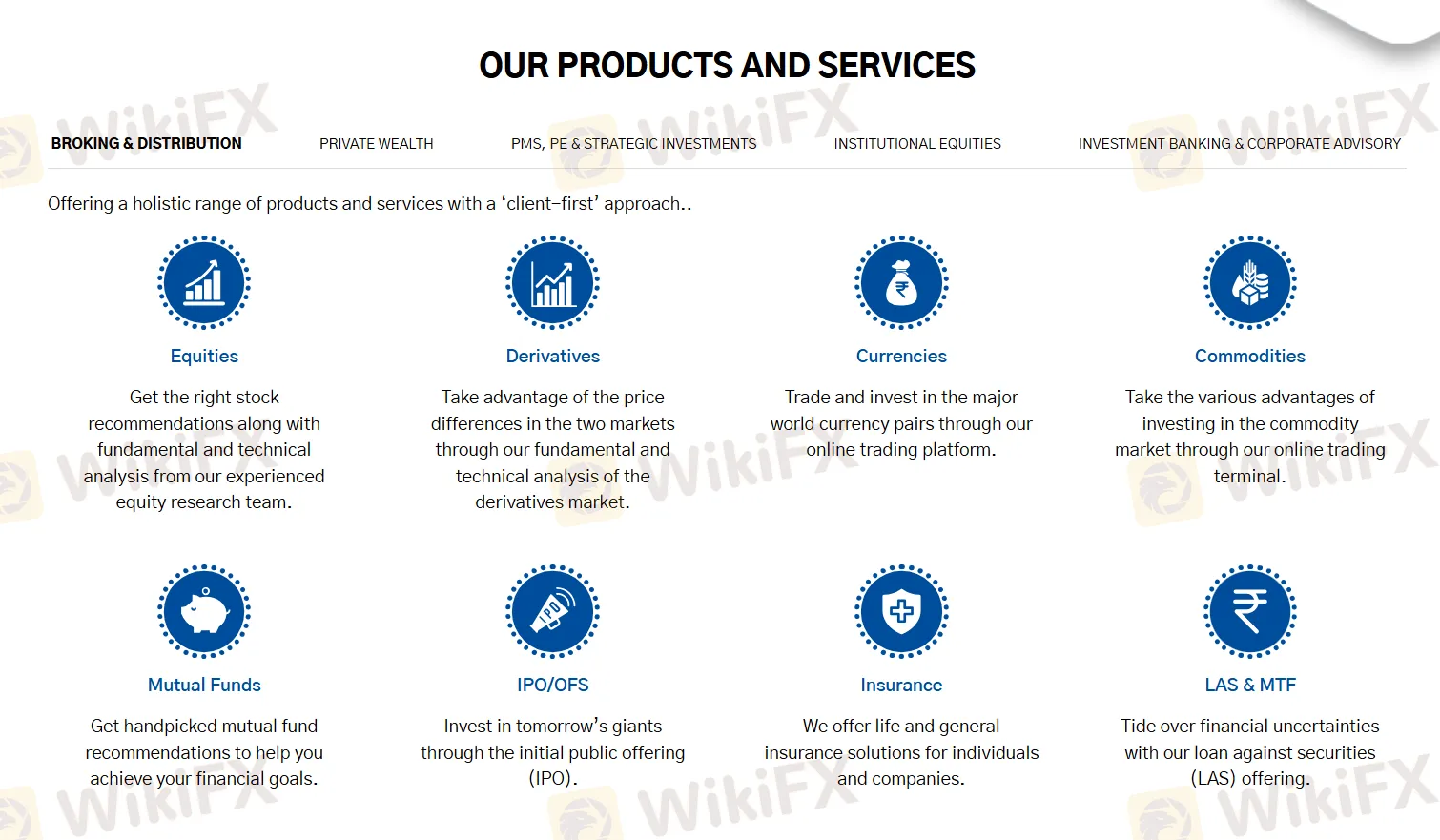

我可以在IndiaNivesh上交易什么?

| 交易资产 | 支持 |

| 股票 | ✔ |

| 互惠基金 | ✔ |

| 衍生品 | ✔ |

| 首次公开募股 | ✔ |

| 货币 | ✔ |

| 保险 | ✔ |

| 大宗商品 | ✔ |

| 指数 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 交易所交易基金 | ❌ |

交易平台

| 交易平台 | 支持 | 可用设备 | 适用于 |

| IndiaNivesh 应用 | ✔ | 移动设备 | / |