Giới thiệu doanh nghiệp

| Jarden Tóm tắt Đánh giá | |

| Thành lập | 1961 |

| Quốc gia/Vùng | New Zealand |

| Quy định | Được quản lý bởi ASIC (Australia) |

| Công cụ Thị trường | Cổ phiếu, Ngoại hối, Hàng hóa, Hợp đồng tương lai, Lựa chọn |

| Tài khoản Demo | ❌ |

| Đòn bẩy | / |

| Chênh lệch | / |

| Nền tảng Giao dịch | Ranos, Commtrade, Market Trader |

| Yêu cầu Tiền gửi tối thiểu | / |

| Hỗ trợ Khách hàng | Mẫu Liên hệ |

| Điện thoại: +61 2 8077 1300 | |

| Email: info@afca.org.au | |

| Địa chỉ: Tầng 54, Tháp Thống đốc Phillip, Số 1 Farrer Place, Sydney NSW 2000 | |

Thông tin về Jarden

Jarden là một nhà môi giới có trụ sở tại New Zealand, thành lập vào năm 1961, được quản lý bởi ASIC. Cung cấp một loạt các công cụ thị trường đa dạng như: Cổ phiếu, Ngoại hối, Hàng hóa, Hợp đồng tương lai và Lựa chọn.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

| Được quản lý bởi ASIC | Thông tin giao dịch hạn chế |

| Nhiều tài sản giao dịch | Không hỗ trợ MT4 và MT5 |

| Nhiều kênh liên hệ | Không có tài khoản demo |

| Văn phòng vật lý đã được chứng minh | |

| Thời gian hoạt động lâu dài |

Jarden Có Uy tín không?

Jarden được quản lýbởi Ủy ban Chứng khoán & Đầu tư Úc (ASIC), dưới JARDEN AUSTRALIA PTY LTD, với số giấy phép 000485351.

| Tình trạng Quy định | Được quản lý bởi | Tổ chức Được Cấp phép | Loại Giấy phép | Số Giấy phép |

| Được quản lý | Ủy ban Chứng khoán & Đầu tư Úc (ASIC) | JARDEN AUSTRALIA PTY LTD | Nhà Môi giới Thị trường (MM) | 000485351 |

Khảo sát Thực địa WikiFX

Nhóm khảo sát trường của WikiFX đã thăm địa chỉ của Jarden tại Úc, và chúng tôi đã tìm thấy văn phòng của họ tại địa điểm, điều này có nghĩa là công ty hoạt động với một văn phòng vật lý.

Tôi Có Thể Giao Dịch Gì trên Jarden?

| Công Cụ Giao Dịch | Hỗ Trợ |

| Cổ Phiếu | ✔ |

| Forex | ✔ |

| Hàng Hóa | ✔ |

| Hợp Đồng Tương Lai | ✔ |

| Tùy Chọn | ✔ |

| Chỉ Số | ❌ |

| Cổ Phiếu | ❌ |

| Tiền Điện Tử | ❌ |

| Trái Phiếu | ❌ |

| ETFs | ❌ |

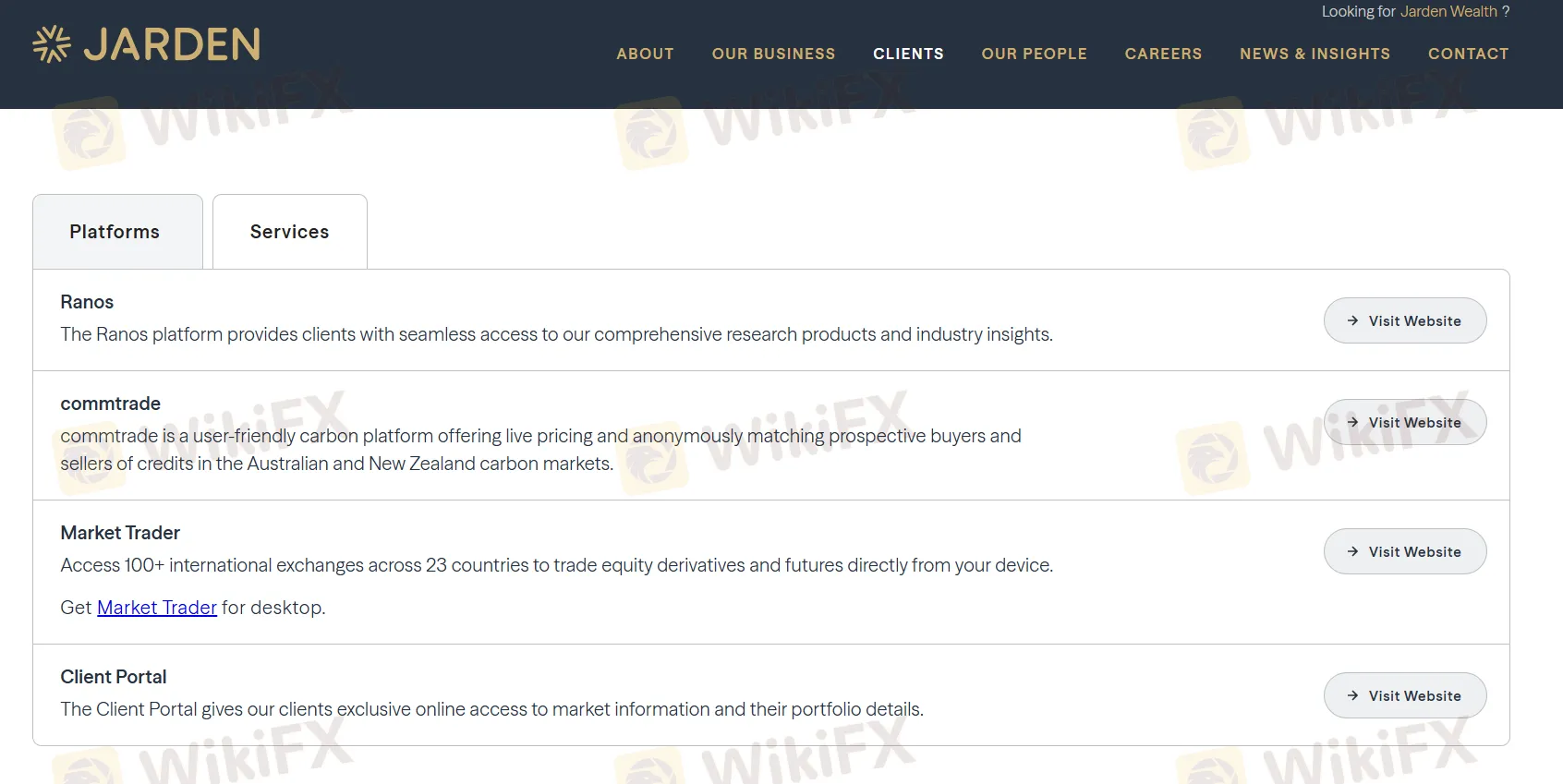

Nền Tảng Giao Dịch

| Nền Tảng Giao Dịch | Hỗ Trợ | Thiết Bị Có Sẵn | Phù Hợp với |

| Ranos | ✔ | Web (dựa trên trình duyệt) | / |

| Commtrade | ✔ | Web (dựa trên trình duyệt) | / |

| Market Trader | ✔ | Windows | / |

| MT4 | ❌ | / | Người mới bắt đầu |

| MT5 | ❌ | / | Người giao dịch có kinh nghiệm |