Buod ng kumpanya

| Jarden Buod ng Pagsusuri | |

| Itinatag | 1961 |

| Rehistradong Bansa/Rehiyon | New Zealand |

| Regulasyon | Regulated by ASIC (Australia) |

| Mga Kasangkapan sa Merkado | Equities, Forex, Commodities, Futures, Options |

| Demo Account | ❌ |

| Levadura | / |

| Spread | / |

| Platform ng Paggawa ng Kalakalan | Ranos, Commtrade, Market Trader |

| Minimum na Deposito | / |

| Suporta sa Customer | Form ng Pakikipag-ugnayan |

| Tel: +61 2 8077 1300 | |

| Email: info@afca.org.au | |

| Address: Antas 54 Governor Phillip Tower 1 Farrer Place Sydney NSW 2000 | |

Impormasyon ng Jarden

Ang Jarden ay isang broker na nakabase sa New Zealand na itinatag noong 1961, na regulado ng ASIC. Nag-aalok ito ng iba't ibang uri ng mga kasangkapan sa merkado, halimbawa: Equities, Forex, Commodities, Futures, at Options.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulated by ASIC | Limitadong impormasyon sa kalakalan |

| Iba't ibang mga asset sa kalakalan | Walang suporta para sa MT4 at MT5 |

| Maraming mga paraan ng pakikipag-ugnayan | Walang demo accounts |

| Napatunayang pisikal na opisina | |

| Mahabang oras ng operasyon |

Tunay ba ang Jarden?

Ang Jarden ay regulado ng Australia Securities & Investment Commission (ASIC), sa ilalim ng JARDEN AUSTRALIA PTY LTD, na may lisensyang numero 000485351.

| Status ng Regulasyon | Regulado ng | Lisensyadong Institusyon | Tipo ng Lisensya | Numero ng Lisensya |

| Regulado | Australia Securities & Investment Commission (ASIC) | JARDEN AUSTRALIA PTY LTD | Market Maker (MM) | 000485351 |

Pagsusuri sa Larangan ng WikiFX

Ang koponan ng pagsasaliksik sa larangan ng WikiFX ay bumisita sa address ng Jarden sa Australia, at natagpuan namin ang kanilang opisina sa lugar, na nangangahulugang ang kumpanya ay may operasyon sa isang pisikal na opisina.

Ano ang Maaari Kong I-trade sa Jarden?

| Mga Kasangkapan sa Paghahalal | Supported |

| Equities | ✔ |

| Forex | ✔ |

| Commodities | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

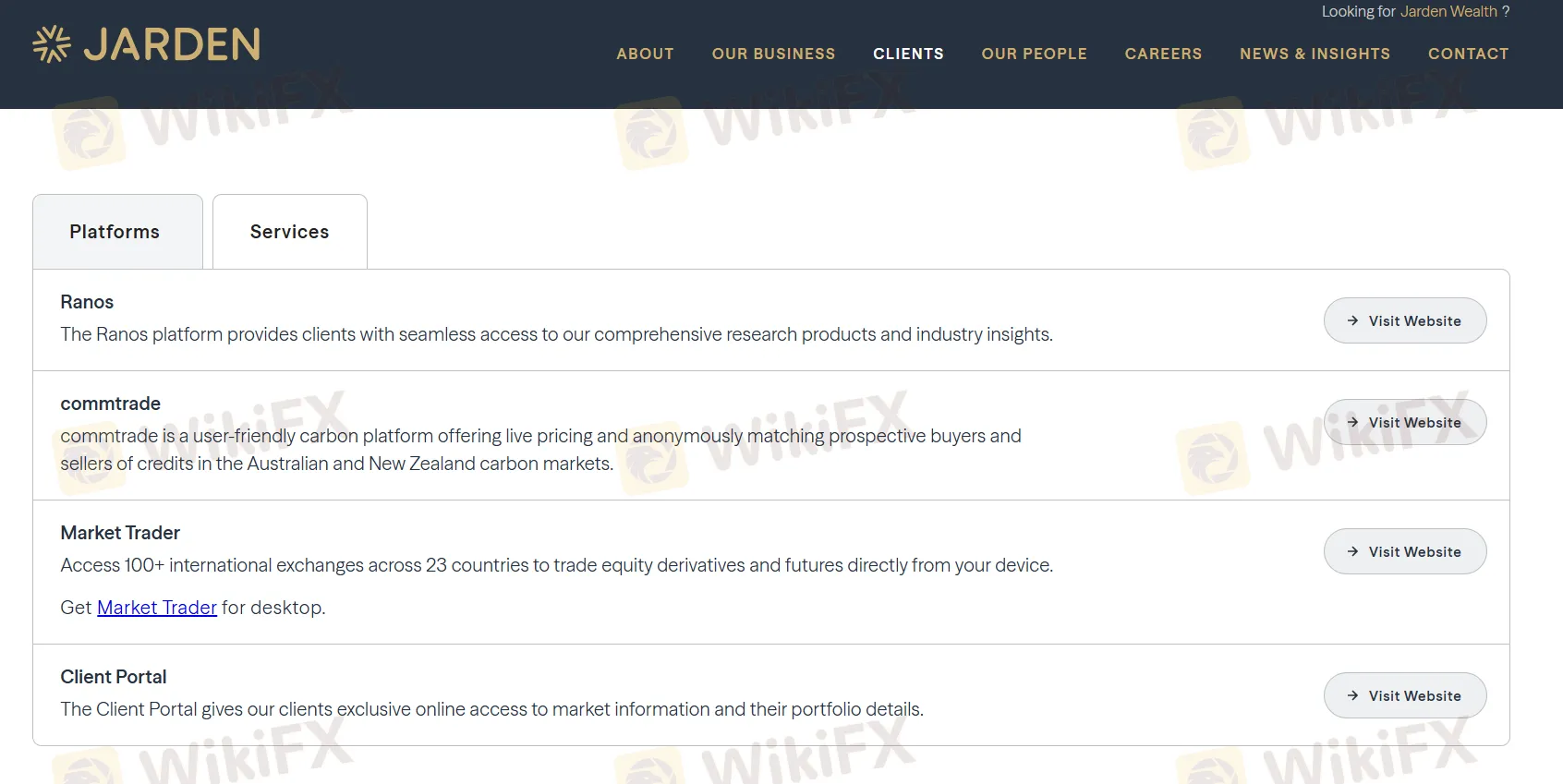

Platform ng Paghahalal

| Platform ng Paghahalal | Supported | Available Devices | Suitable for |

| Ranos | ✔ | Web (browser-based) | / |

| Commtrade | ✔ | Web (browser-based) | / |

| Market Trader | ✔ | Windows | / |

| MT4 | ❌ | / | Mga Baguhan |

| MT5 | ❌ | / | Mga Dalubhasa sa kalakalan |