회사 소개

| Jarden 리뷰 요약 | |

| 설립 연도 | 1961 |

| 등록 국가/지역 | 뉴질랜드 |

| 규제 | ASIC (호주) 규제 |

| 시장 상품 | 주식, 외환, 상품, 선물, 옵션 |

| 데모 계정 | ❌ |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | Ranos, Commtrade, Market Trader |

| 최소 입금액 | / |

| 고객 지원 | 문의 양식 |

| 전화: +61 2 8077 1300 | |

| 이메일: info@afca.org.au | |

| 주소: Level 54 Governor Phillip Tower 1 Farrer Place Sydney NSW 2000 | |

Jarden 정보

Jarden은 1961년에 설립된 뉴질랜드 기반의 중개업체로, ASIC에 의해 규제를 받고 있습니다. 다양한 시장 상품을 제공하며, 예를 들어 주식, 외환, 상품, 선물 및 옵션 등이 있습니다.

장단점

| 장점 | 단점 |

| ASIC 규제 | 한정된 거래 정보 |

| 다양한 거래 자산 | MT4 및 MT5 지원 없음 |

| 다양한 연락 채널 | 데모 계정 없음 |

| 실무실 증명 | |

| 긴 운영 시간 |

Jarden 합법인가요?

Jarden은 Australia Securities & Investment Commission (ASIC)에 의해 규제되었으며, JARDEN AUSTRALIA PTY LTD의 라이선스 번호 000485351으로 등록되어 있습니다.

| 규제 상태 | 규제 기관 | 라이선스 기관 | 라이선스 유형 | 라이선스 번호 |

| 규제됨 | Australia Securities & Investment Commission (ASIC) | JARDEN AUSTRALIA PTY LTD | 마켓 메이커 (MM) | 000485351 |

WikiFX 현장 조사

WikiFX 현장 조사팀은 Jarden의 사무실이 호주에 위치해 있음을 확인했으며, 현장에서 그 사무실을 발견했습니다. 이는 회사가 실제 사무실을 운영하고 있음을 의미합니다.

Jarden에서 무엇을 거래할 수 있나요?

| 거래 상품 | 지원 |

| 주식 | ✔ |

| 외환 | ✔ |

| 상품 | ✔ |

| 선물 | ✔ |

| 옵션 | ✔ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| ETFs | ❌ |

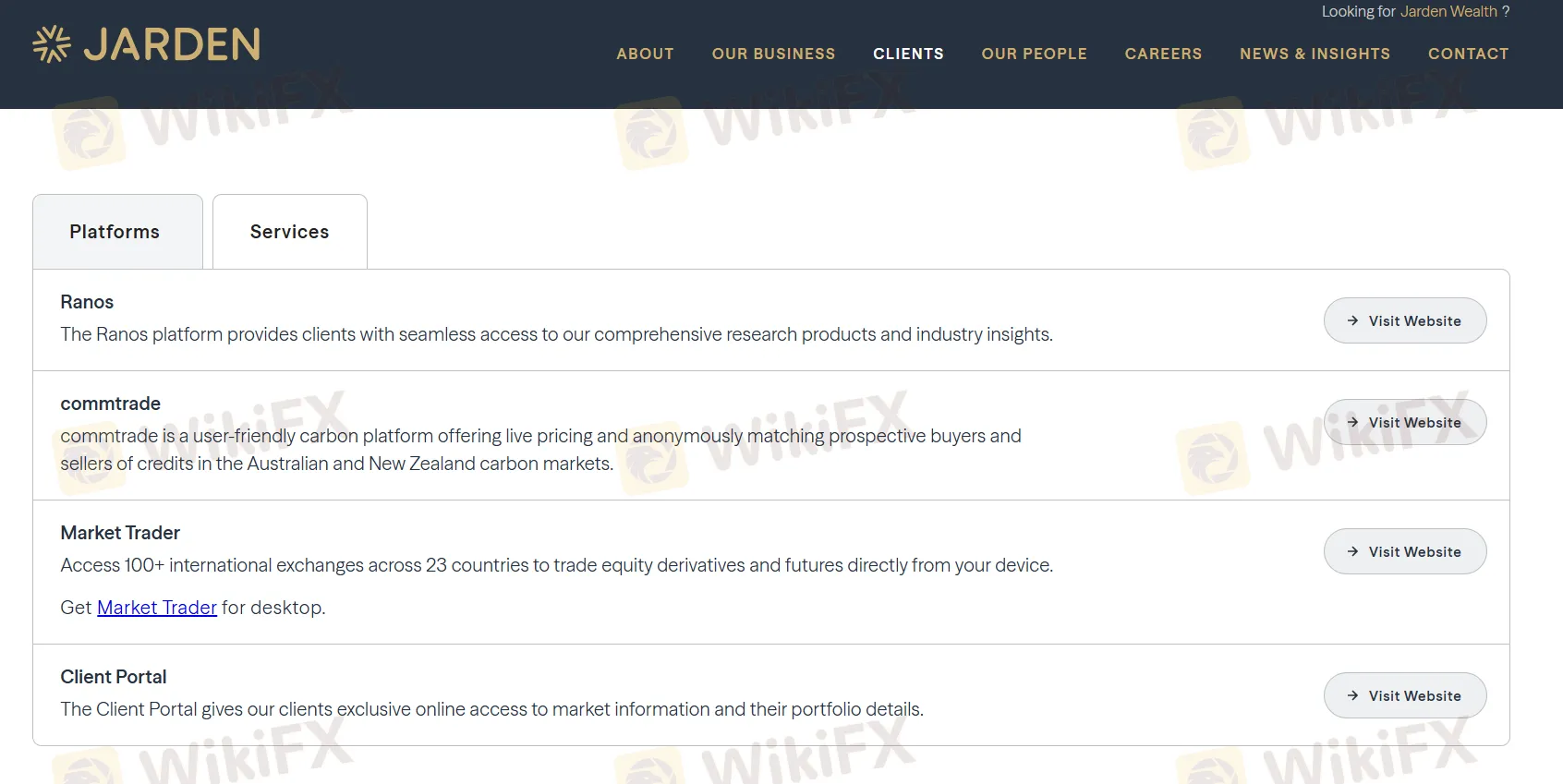

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합 대상 |

| Ranos | ✔ | 웹 (브라우저 기반) | / |

| Commtrade | ✔ | 웹 (브라우저 기반) | / |

| Market Trader | ✔ | Windows | / |

| MT4 | ❌ | / | 초보자 |

| MT5 | ❌ | / | 경험 있는 트레이더 |