Giới thiệu doanh nghiệp

| C&S Tóm tắt đánh giá | |

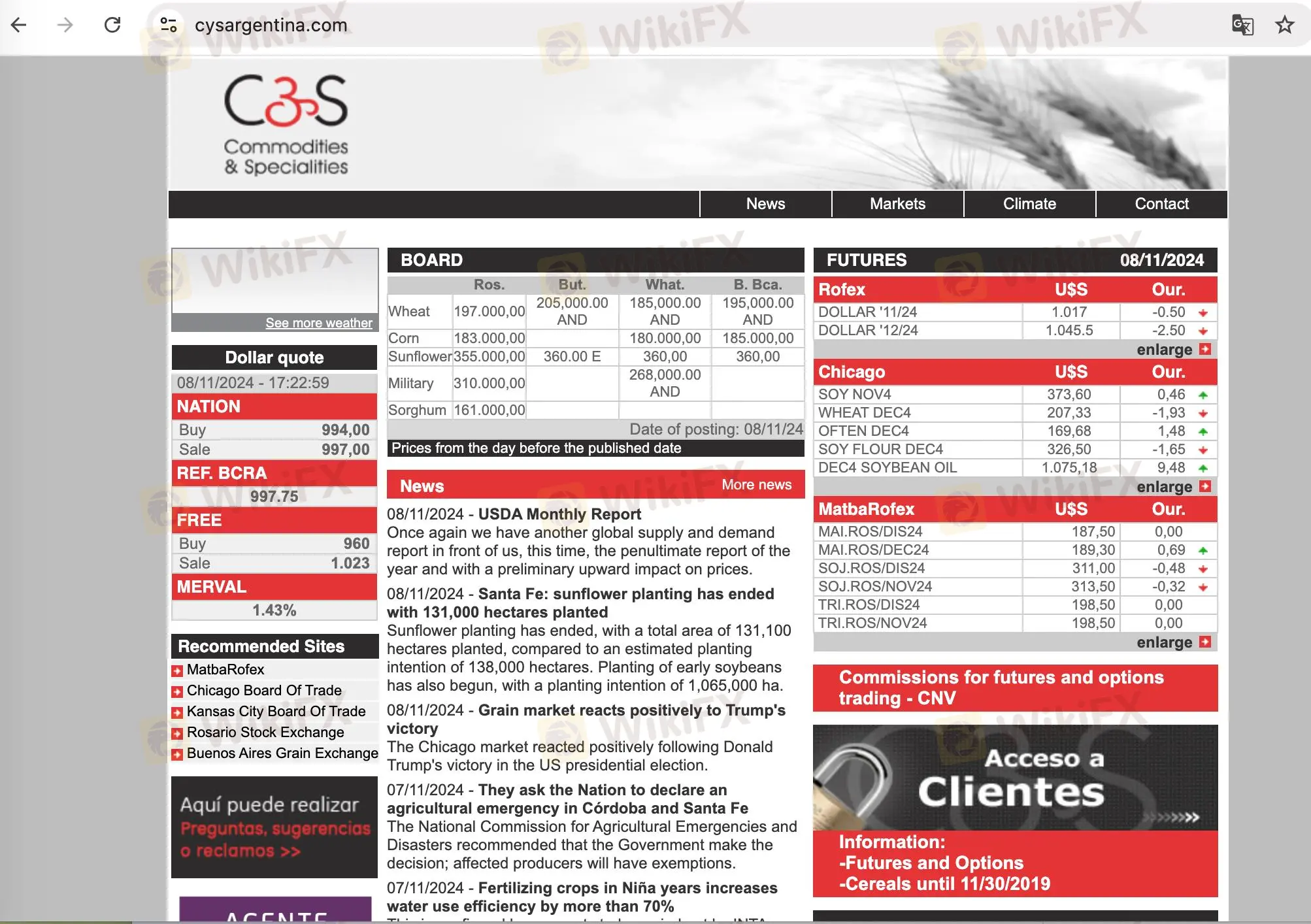

| Thành lập | 2008 |

| Quốc gia/ Vùng đăng ký | Argentina |

| Quy định | Không có quy định |

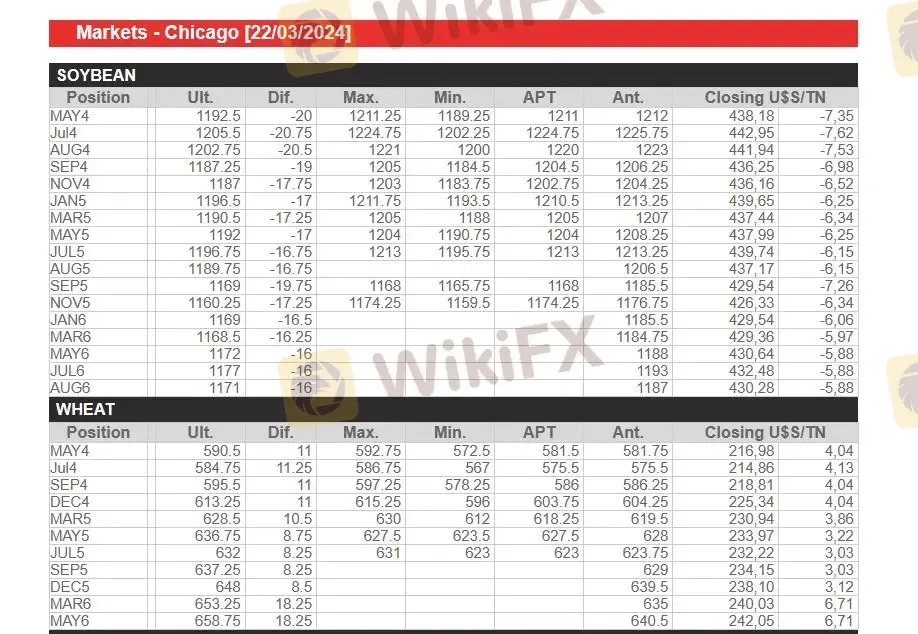

| Công cụ thị trường | Hàng hóa |

| Tài khoản Demo | ❌ |

| Nền tảng giao dịch | / |

| Yêu cầu tiền gửi tối thiểu | / |

| Hỗ trợ khách hàng | Điện thoại: (+54.341) 426-0226 / 426-7201 |

| Email: contacto@cysargentina.com | |

| Địa chỉ: Entre Rios 729 - P.11 - Rosario, Santa Fe, Argentina | |

| Twitter: https://twitter.com/cysargentina | |

| Facebook: https://www.facebook.com/home.php?#!/profile.php?id=100001769530055 | |

Thông tin C&S

Thành lập vào năm 2008, C&S là một nhà cung cấp dịch vụ tài chính không được quy định đăng ký tại Argentina, cung cấp giao dịch hàng hóa.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

| Nhiều kênh liên hệ | Không có quy định |

| Không có tài khoản demo | |

| Sản phẩm giao dịch hạn chế |

C&S có hợp pháp không?

Không. C&S được đăng ký tại Argentina. Hiện tại, nó không có quy định hợp lệ.

Tôi có thể giao dịch gì trên C&S?

| Công cụ giao dịch | Được hỗ trợ |

| Hàng hóa | ✔ |

| Ngoại hối | ❌ |

| Cổ phiếu | ❌ |

| Chỉ số | ❌ |

| Đồng tiền mã hóa | ❌ |