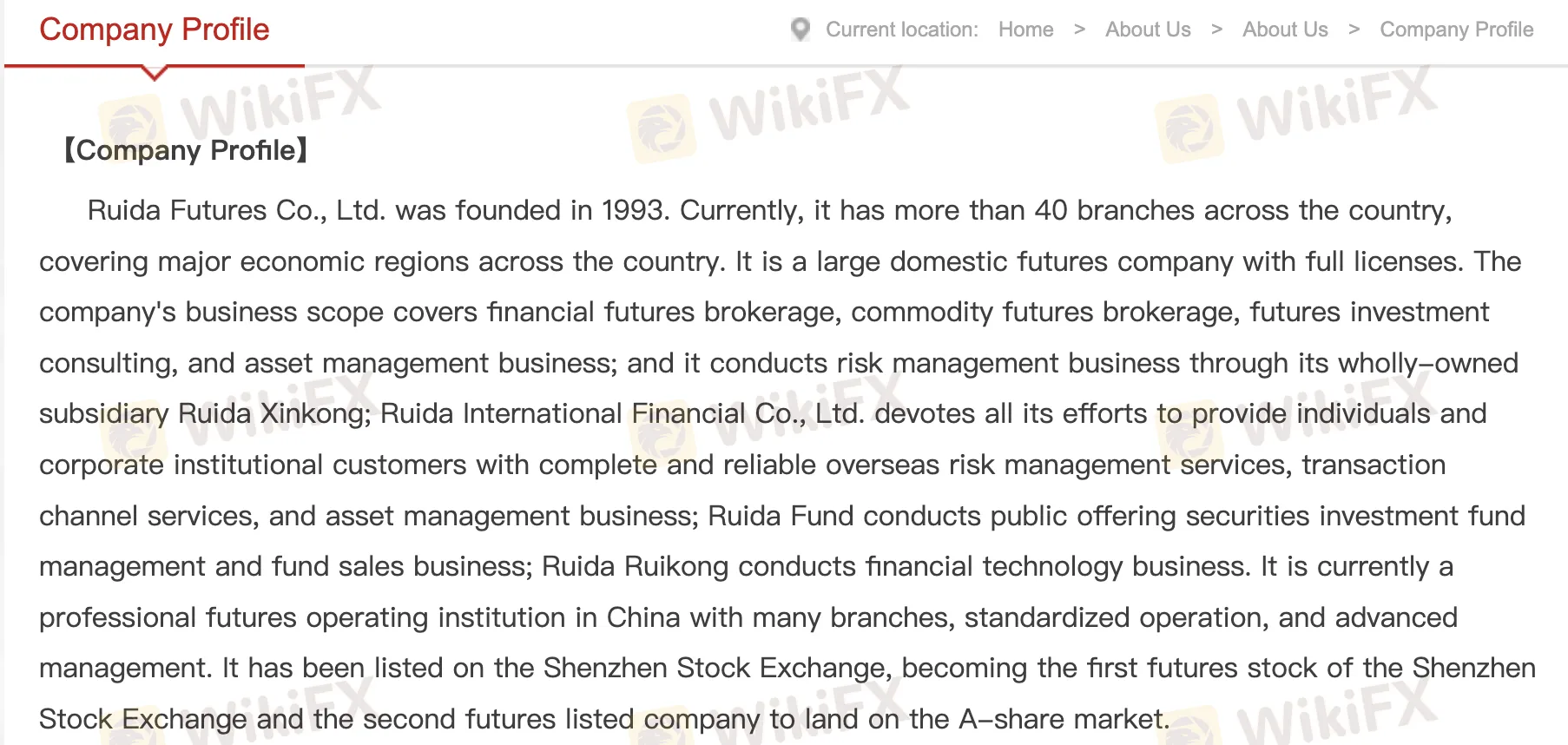

Şirket özeti

| RUIDA FUTURES İnceleme Özeti | |

| Kuruluş Yılı | 1993 |

| Kayıtlı Ülke/Bölge | Çin |

| Düzenleme | CFFEX |

| Ürünler ve Hizmetler | Emtia ve finansal vadeli işlemler aracılığı, yatırım danışmanlığı, varlık ve fon yönetimi, finansal teknoloji ve uluslararası risk hizmetleri |

| Platform/Uygulama | Jinshida, Midas Touch, Flagship App, Boyi Master & APP, Polestar V9.3/V9.5, Express Terminal V2/V3, Infinite Easy (Ez/Pro), Caishun, SP Trader, Trading Pioneer/TBQuant, Wenhua, Tonghuashun |

| Müşteri Desteği | Telefon: 4008-8787-66 |

RUIDA FUTURES Bilgileri

1993 yılında kurulan Ruida Futures Co., Ltd., Çin Finansal Vadeli İşlemler Borsası tarafından düzenlenen lisanslı bir Çin vadeli işlemler şirketidir. Şirket, iştirakleri aracılığıyla emtia ve finansal vadeli işlemler aracılığı, yatırım danışmanlığı, varlık yönetimi ve uluslararası risk yönetimi de dahil olmak üzere geniş bir hizmet yelpazesi sunmaktadır.

Artıları ve Eksileri

| Artılar | Eksiler |

| CFFEX tarafından düzenlenir | Bazı platformlar acemi kullanıcılar için fazla karmaşık olabilir |

| Geniş vadeli işlemler ve varlık yönetimi hizmetleri sunar | Teminat gereksinimi borsa tabanından %5 daha yüksektir |

| Çoklu işlem platformu (masaüstü ve mobil) |

RUIDA FUTURES Güvenilir mi?

Ruida Futures Co., Ltd. (瑞达期货股份有限公司), Çin'de yasal ve düzenlenmiş bir finansal kuruluştur. Çin Finansal Vadeli İşlemler Borsası (CFFEX) tarafından verilen geçerli bir Vadeli İşlemler Lisansı (Lisans No. 0170) bulunmaktadır.

Ürünler ve Hizmetler

Çin'de, Ruida Futures Co., Ltd. emtia ve finansal vadeli işlemler için aracılık, yatırım danışmanlığı ve varlık yönetimi gibi lisanslı finansal hizmetlerin kapsamlı bir yelpazesini sunmaktadır. Ayrıca şirketleri, offshore risk yönetimi, fon yönetimi ve fintech hizmetleri sunmaktadır.

| Ürünler & Hizmetler | Desteklenen |

| Emtia Vadeli İşlemleri Aracılığı | ✔ |

| Finansal Vadeli İşlemler Aracılığı | ✔ |

| Vadeli İşlemler Yatırım Danışmanlığı | ✔ |

| Varlık Yönetimi | ✔ |

| Yurtdışı Risk Yönetimi (Ruida Intl. aracılığıyla) | ✔ |

| İşlem Kanalı Hizmetleri (Uluslararası) | ✔ |

| Kamu Fon Yönetimi (Ruida Fon aracılığıyla) | ✔ |

| Fon Satış İşleri | ✔ |

| Fintech Hizmetleri (Ruida Ruikong aracılığıyla) | ✔ |

| Hisse Senedi İşlemleri | ✘ |

| Kripto Para İşlemleri | ✘ |

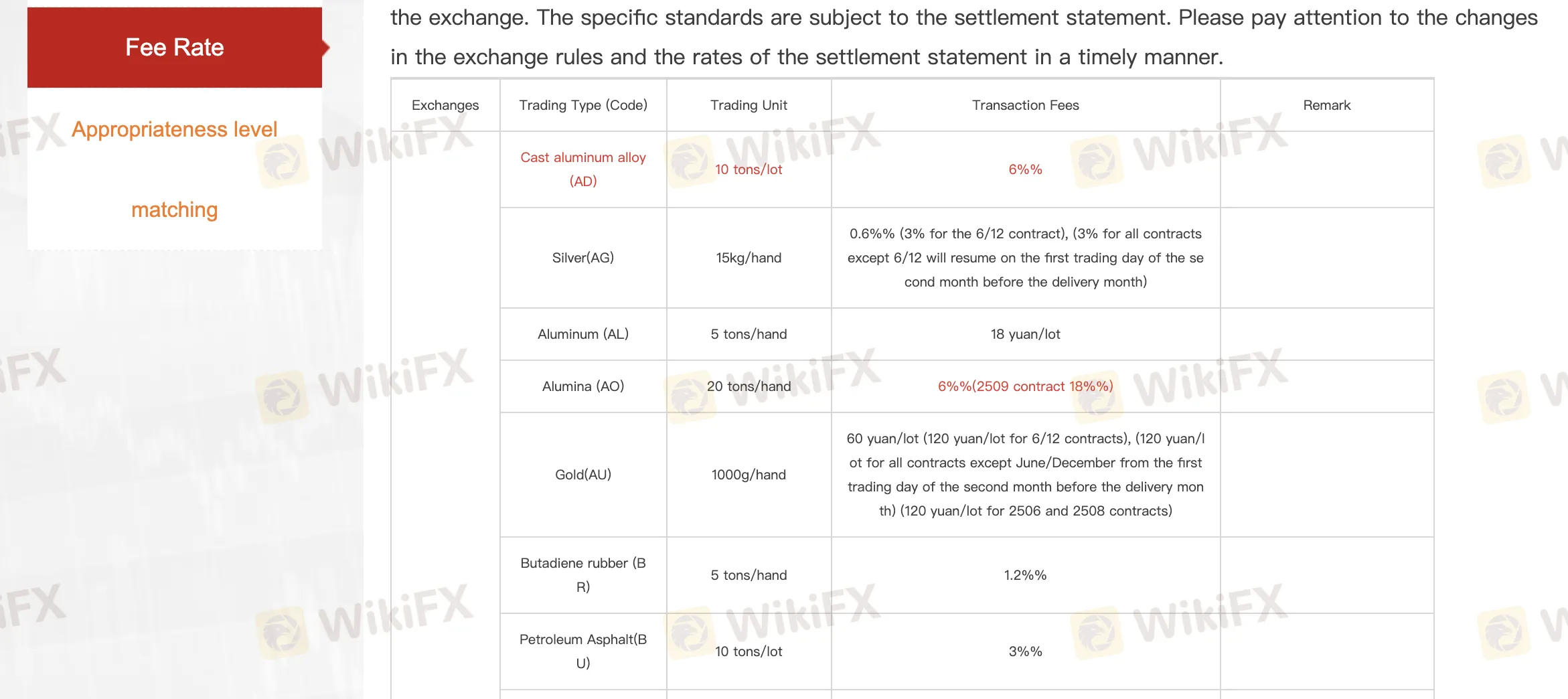

RUIDA FUTURES Ücretler

Ruida Futures ücretleri genellikle endüstri standardına uygundur ve borsa gereksinimlerinin üzerinde %5 marj primi içerir. Ticaret maliyetleri ürüne göre değişir - bazıları lot başına ücretlendirilir (örneğin ¥18/lot), diğerleri yüzde olarak (örneğin %3). Aynı gün işlemler ve opsiyonlar daha yüksek veya ek ücretler gerektirebilir.

| Değişim | Önemli Ürünler | Tpik Ücret (lot başına) | Gün İçi Ek Ücret | Notlar |

| SHFE | Altın, Gümüş, Bakır, Demir Çubuk, Kauçuk | 6–60 RMB veya %0.6–6% | Bazı ürünler 2× | Ücretler sözleşme ayına göre değişir; teslimata yakın marj artabilir |

| DCE | Soya Fasulyesi, Mısır, Demir Cevheri, PE, PP | 6–36 RMB veya %0.6–9% | Demir cevheri, kok kömürü için yaygın | Teslimat ayı fiyat farklılıkları; soya yağı, mısır varyasyonları |

| CZCE | Metanol, PTA, Kanola Yemeği, Cam | 6–180 RMB veya %0.6–12% | Evet, PTA, metanol gibi sözleşmeler için | Bazı ürünler açılış hacmi minimumlarına sahiptir |

| CFFEX | CSI 300, SSE 50, CGB Futures | 18–90 RMB veya %1.38 + 1 RMB/sipariş | Evet (%13.8) | Hisse senedi endeksi ve tahvil vadeli işlemler için geçerlidir; opsiyonları içerir |

| INE | Ham Petrol, Bakır, Yakıt Yağı | 60–120 RMB veya %0.6–3% | Evet (örneğin, EC %72'ye kadar) | EC/SC yüksek teslimat ayı marjlarına sahiptir |

| GFEX | Lityum Karbonat, Silikon | %4.8–6 veya 12–18 RMB | Özel gün içi oranları yok | Daha yeni sözleşmeler; nispeten düşük hacim |

Platform/UYGULAMA

| Platform/UYGULAMA | Desteklenen | Mevcut Cihazlar | Uygun |

| Jinshida Ticaret Sistemi | ✔ | Masaüstü | Kapsamlı vadeli işlemler |

| Midas Touch | ✔ | Masaüstü | Hızlı yürütme, panoramik sipariş görünümü |

| Ruida Futures Bayrak Uygulaması | ✔ | Mobil (iOS/Android) | Tek noktadan hesap açma + işlem yapma |

| Boyi Master (5 & 7) | ✔ | Masaüstü | Piyasa analizi, entegre "Lightning Hand" |

| Boyi UYGULAMA | ✔ | Mobil | Mobil vadeli işlemler ve opsiyonlar |

| Polestar V9.3 / V9.5 | ✔ | Masaüstü | Yüksek hızlı işlem, derin piyasa analizi |

| Express Trading Terminal (V2/V3) | ✔ | Masaüstü | Gerçek zamanlı hesap verileri ve hızlı sipariş fonksiyonları |

| Sonsuz Kolay (Ez & Pro) | ✔ | Masaüstü | Opsiyon işlemleri, Excel dışa aktarma, özel stratejiler |

| Caishun | ✔ | Masaüstü | Arbitraj ve uzun vadeli tarihsel analiz |

| SP Trader (Lightning Trading) | ✔ | Masaüstü | Gerçek zamanlı tekliflerle küresel vadeli işlemler |

| Ticaret Öncüsü / TBQuant | ✔ | Masaüstü | Sistemli işlem, çoklu hesap yönetimi |

| Wenhua Yingshun / Wenhua Seyahat | ✔ | Masaüstü / Mobil | Teknik analiz ve akıllı işlem |

| Tonghuashun Futures | ✔ | Masaüstü / Mobil | Vadeli işlem teklifleri ve işlem |

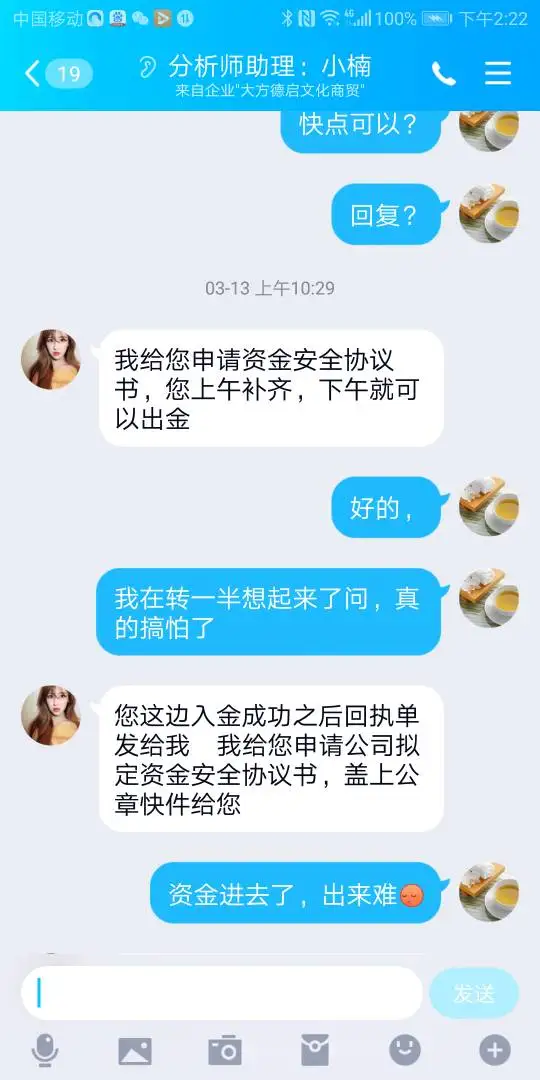

薇11六1四3零2七1

Hong Kong

2019年9月,我被拉入一个股票交流群,群里有金盈老师推荐了几只股票,都是连续拉涨停,还天天开直播介绍炒股技巧和介绍好票。再接下来就说股票行情不好挣钱太慢,做股指期货才能更快赚钱,于是在直播间让大家找经理开护、入金,并且每天在直播间晒图,跟进的群友轻轻松松就赚了几千美金。还有就是在股市里赔的钱,现在的行情是不可能挣回来的,只有通过炒指数分分钟就可以让你回本。 这些蛊惑让我动心了,觉得我也有时间,又有老师指导能在短时间内挣点钱,把股市亏本的钱挣回来就行。于是我开护了。我开护后,观察了几天,也问了群里的其他人出入金都能做,夸老师厉害!跟着老师吃肉之类的!又看到不少人已经开始操作赚钱了。就跟着老师操作。没想到一个星期就亏了42万,才觉得可能是骗局!

Teşhir

FX6775882262

Hong Kong

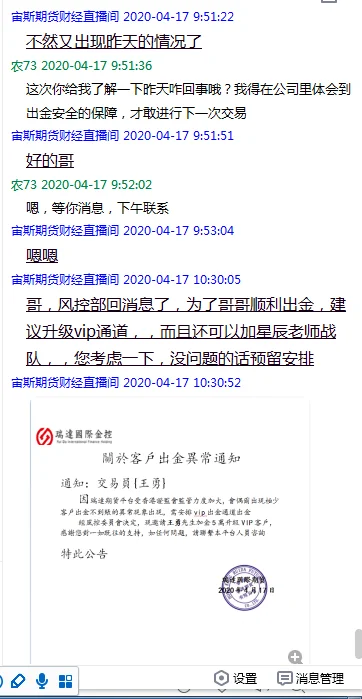

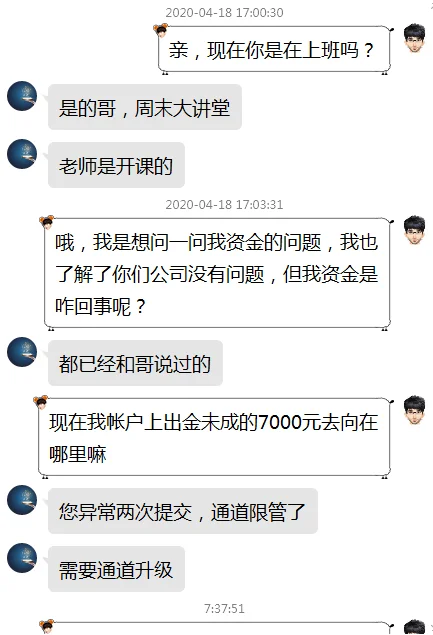

公司利用直播间诱导客户,周末都坚持讲授技术,客户联系助理出金不成后反应未果

Teşhir

卿21224

Hong Kong

多次入金了,现在想出金不给出金,找助理所有的助理都是说要加金结果入金了后都不理,到现在都不给出金

Teşhir

顺遂

Hong Kong

鑫斗财经直播间,利用低手续费,赠金,操盘手翻倍活动诱骗入金。然后找各种理由让再入金才能出金,最后全部无法出金。直播间老师有:罗宾,金珊,佐伊,高明,天涯,东方。一群骗子,过一段时间就更换直播间继续行骗。

Teşhir

李纯涛

Hong Kong

套路太深,环环相扣,诱骗入金; 之后不能出金,诱导/欺诈

Teşhir

FX3688361241

Irak

我在前面看到了昵称“大晚上”的朋友的曝光的帖子。我气愤万分。大晚上朋友的经历跟我是一样的,惊人的相似。平移费用,vip通道费用,转账过去诈骗没收到要重新转账,交易所更正信息费用,交易所风险金,我上述费用缴纳了二十万!结果仍然是一分钱出不了!我希望大家能联合起来想办法。连大晚上朋友提到的几个助理我都联系过。骗人的心肠极其歹毒。他们知道我们血汗钱难以割舍,不断诱骗,胁迫,恐吓我们借钱来交各种费用。甚至劝我们借高利贷缴纳费用。结局都一样,全部打了水漂。请想办法联合起来。

Teşhir

FX3688361241

Irak

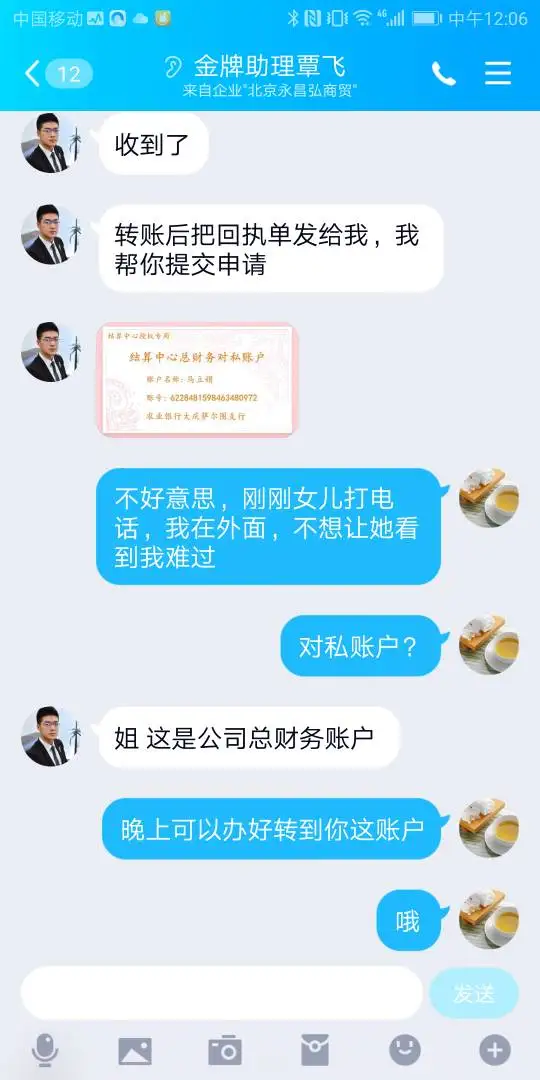

我被骗了数次:第一次交转户费用,居然看到我的电子回单说没有收到。然后不得不再交一次。 然后转户完毕,又通知说缴纳VIP通道费用。又是几万元进去。然后对天发誓没有任何问题了。接着再给我发个通知,说交易所发现我的账户信息输入错误,要缴纳18万的更正费。然后。被这群骗子整的我死去活路。他们是丧心病狂的。如果大家要联合立案,请到贴吧去看看。大家一起联合起来才能更加有效地锁定这群骗子。他们欺负我们没有有力的线索。

Teşhir

FX1926873034

Hong Kong

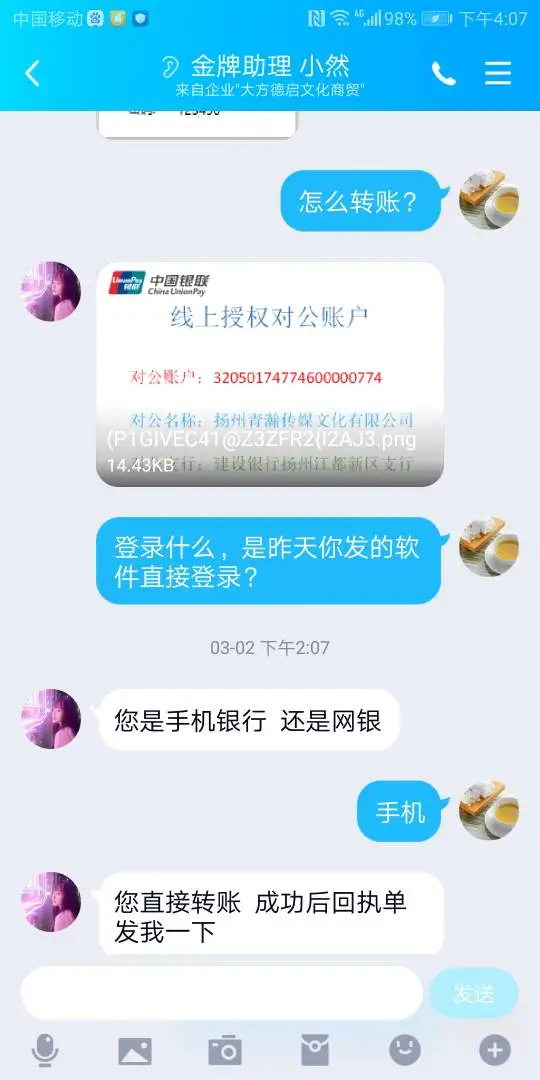

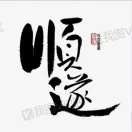

今天是2020.10.23日,刚刚去立案回来。昨天被骗。前期投入10万多,看直播间,加入操盘手计划,直播间http://rdcj.cdjxcg.com/找的菲菲老师,盈利95万,需要付38万佣金,付了20万,让我们出金30万,再付剩余18万,再让我们全部出金。结果昨天付了20万,助理晓冉说付错了,付了我们自己操作的账户去了,给了我们交易密码,可是出金出不来,让我们再付18万。才幡然醒悟上当受骗了,昨天去公安局找了刑警,今天立案了,提供了转账记录信息。

Teşhir

大晚上

Hong Kong

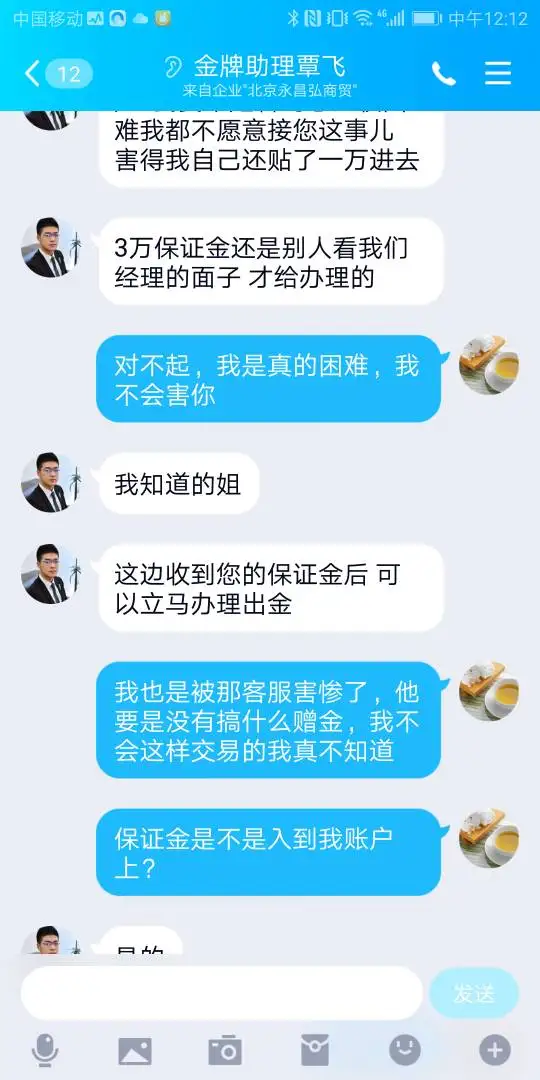

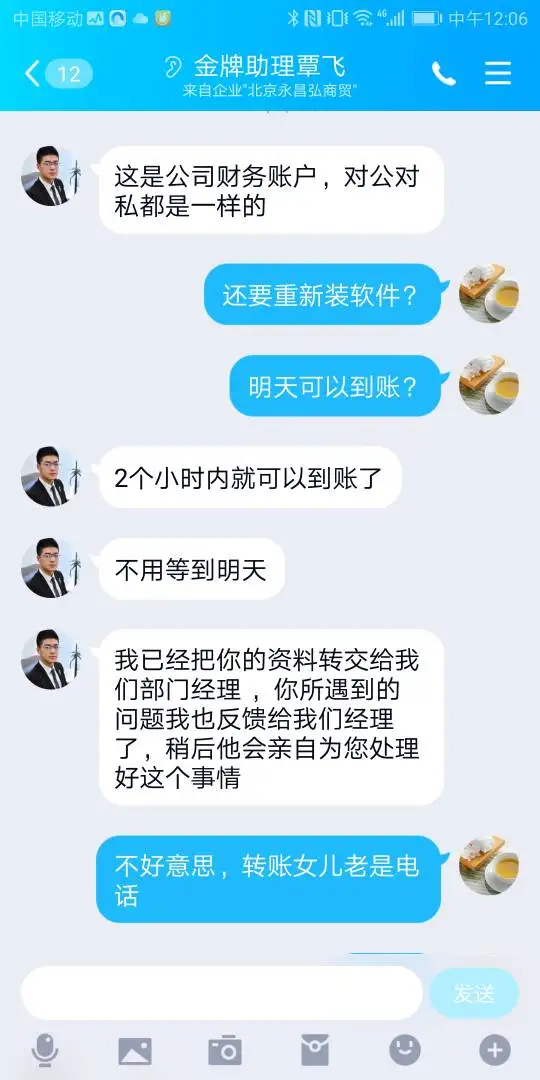

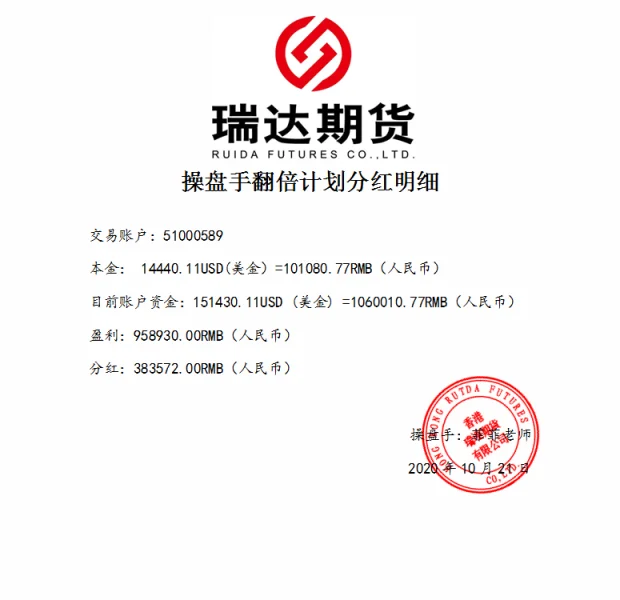

假瑞达,从五月份初做,被上海吉骁兮兮,说是云南韩若兮,开帐户做,亏五万多,中间想出金,被各种理由拒绝,后说升级vip,从最开始入金后面入金加赠金二万,只要再入二万多可出金,当交二万多以后,又说赠二万不算,又补交二万,再申请出金,仍不让出。后换了吉骁公司另一助理叫娜娜,说叫夏莉娜,换帐号,说要资金平移,交平移费二万多,后又说激活帐户费,出金交保证金等又骗交七八万多。其中有一次交了一万,已交过去,骗我这边说没收到,一直不让出金。后又换姓朱的运营总监,他又骗订安全资金协议,协议说交一万,出全部资金十多万。后又换瑞达期货负责人用安全协议说要交七千出金,一直团伙诈骗,后有骗子莉莉,有骗子范海歆,有骗子客诉部朱海通经理,姓朱现在改QQ海纳百川,有骗子冯晓飞,现在QQ名字瑞达期货,用申佳日用品企业QQ,凡是用这申佳企业QQ的,还有北京江拓博鸿科技,山西锋利网络科技,要注意风险。后又遇到客诉部朱的骗说交一万会出金,没出到。后又说是交易所的QQ不羁的。交过资金也没有出金成功。他们用各种方式骗资金却不让出金。

Teşhir

86245

Hong Kong

诱导我入金一直没办法出金先说涉嫌洗钱驳回又说操作不满驳回再问他们也没耐心了

Teşhir

张勇7998

Hong Kong

无法出金,客服第一次说出金通道故障,再往后就是在查询,黑平台!

Teşhir

FX3327602342

Hong Kong

该平台公司现利用开户赠金活动诱骗客户入金,开户时我再三跟客服确定没有入金门槛条件限制!赠金出金是有条件限制,做满多少手数才能出金,这个可以理解和接受!但客户的本金和盈利部分是可以随意出入的!这个是一般正规平台的通用做法!第二天就不能出金!更奇葩的是我居然不能查看自己的账户?!问客服说是为了资金安全?没有达到入金门槛不能激活账户!交易所检测风险过高!真是胡扯!我满足保证金开仓条件!不用赠金也可开仓交易!后来还要让我再入金5万才能出金!还在玩套路!出金才是王道,任何理由不能出金全是胡扯!只有黑平台才用这中卑劣的技俩!大家小心!

Teşhir

留香

Hong Kong

诱骗开户入金交易,结果不能出金。说什么资金有风险,要求增加资金。

Teşhir

薇11六1四3零2七1

Hong Kong

今年9月份的时候,我于机缘巧合之下被人拉进了直播间,里面有四个老师讲课,老师们开始讲股票还会推荐股票,讲的好推荐的也准,我跟着买了几次都有小赚。就一直去听课,听了一段时间老师推荐的股票亏了之后,老师说现在股票行情不好,收益低,还是做股指、期货赚钱,可以带大家到瑞达期货做股指、期货一起发财,说着还晒出自己盈利的账户。我刚开始的时候打算考虑考虑在做,后来看到群里赚的人越来越多,有点经不住诱惑找到开户专员投了56万,可没想到不到两个星期直接亏光了,当时我都懵了,老师我去问老师老师要就不回我消息要就找各种借口说什么投资本来就有风险,群也把我踢了。

Teşhir