Şirket özeti

| CCB Futures İnceleme Özeti | |

| Kuruluş Yılı | 2013 |

| Kayıtlı Ülke/Bölge | Çin |

| Düzenleme | CFFE (Düzenlenmiş) |

| Piyasa Enstrümanı | Vadeli İşlemler |

| Deneme Hesabı | ✅ |

| İşlem Platformu | Wenhua Winshun Cloud Market Trading Software HD Sürümü (wh6), Hızlı işlem terminali, Sonsuz Kolay (Pro Profesyonel Sürüm), Flush Futures PC Sürümü, Boyi Master, Polestar 9.5 Jianxin Futures Sürümü, Polestar 9.3 Jianxin Futures Sürümü, vb. |

| Müşteri Desteği | Canlı sohbet |

| Tel: 400-90-95533 | |

| E-posta: ptg@ccbfutures.com | |

CCB Futures Bilgileri

CCB Futures, çeşitli işlem platformlarında vadeli işlem yapma imkanı sunan düzenlenmiş bir aracı kurumdur.

Artıları ve Eksileri

| Artılar | Eksiler |

| Çeşitli işlem platformları | Sınırlı işlem ürün çeşitliliği |

| İyi düzenlenmiş | |

| Deneme hesapları mevcut | |

| Canlı sohbet desteği |

CCB Futures Güvenilir mi?

Evet. CCB Futures, hizmet sunmak için CFFEX tarafından lisanslanmıştır.

| Düzenlenmiş Ülke | Düzenleyici | Mevcut Durum | Düzenlenmiş Kuruluş | Lisans Türü | Lisans No. |

| Çin Finansal Vadeli İşlemler Borsası (CFFEX) | Düzenlenmiş | CCB Futures有限责任公司 | Vadeli İşlem Lisansı | 0103 |

CCB Futures Üzerinde Ne İşlem Yapabilirim?

CCB Futures vadeli işlemlerde işlem yapma imkanı sunmaktadır.

| İşlem Yapılabilir Enstrümanlar | Desteklenen |

| Vadeli İşlemler | ✔ |

| Forex | ❌ |

| Emtialar | ❌ |

| Endeksler | ❌ |

| Hisse Senetleri | ❌ |

| Kriptolar | ❌ |

| Bono ve Tahviller | ❌ |

| Opsiyonlar | ❌ |

| ETF'ler | ❌ |

Hesap Türü

CCB Futures sunduğu hesap türlerini net bir şekilde belirtmemiş olsa da müşteriler için demo hesapları sunmaktadır.

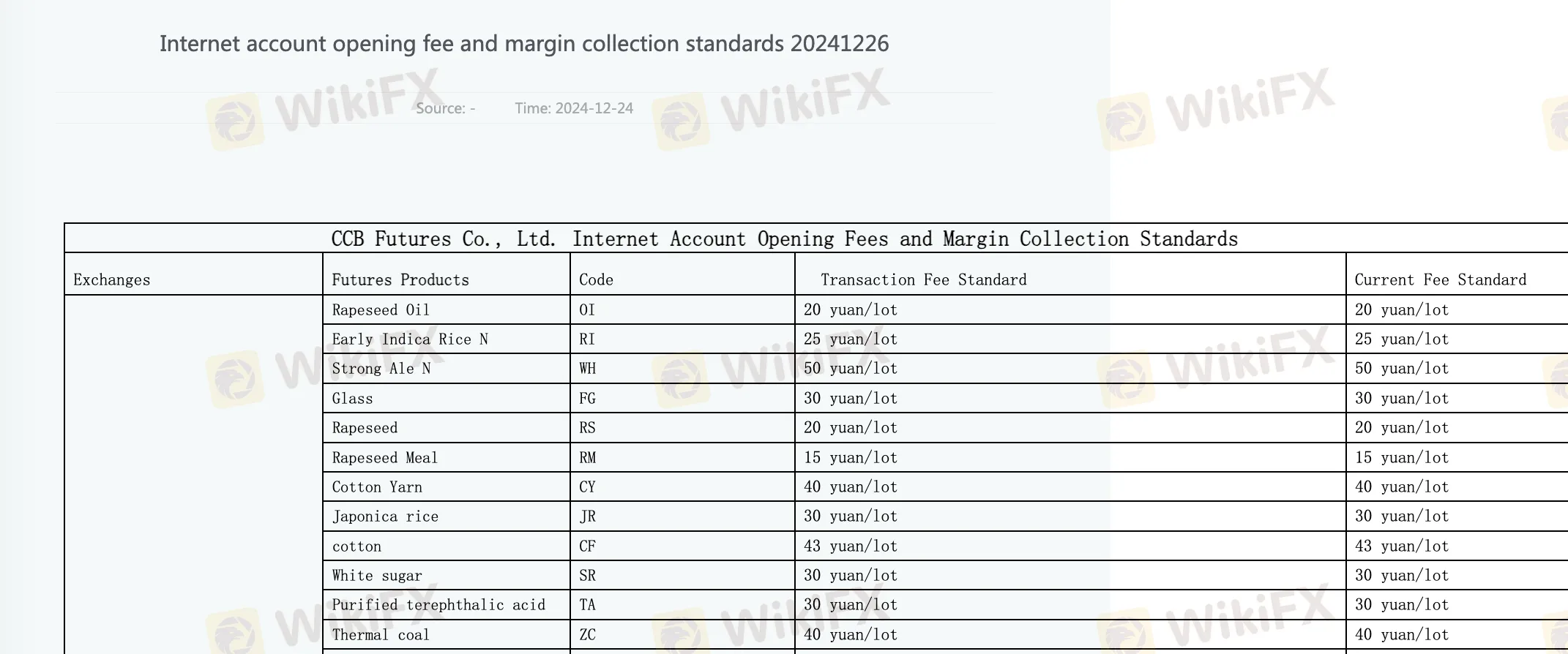

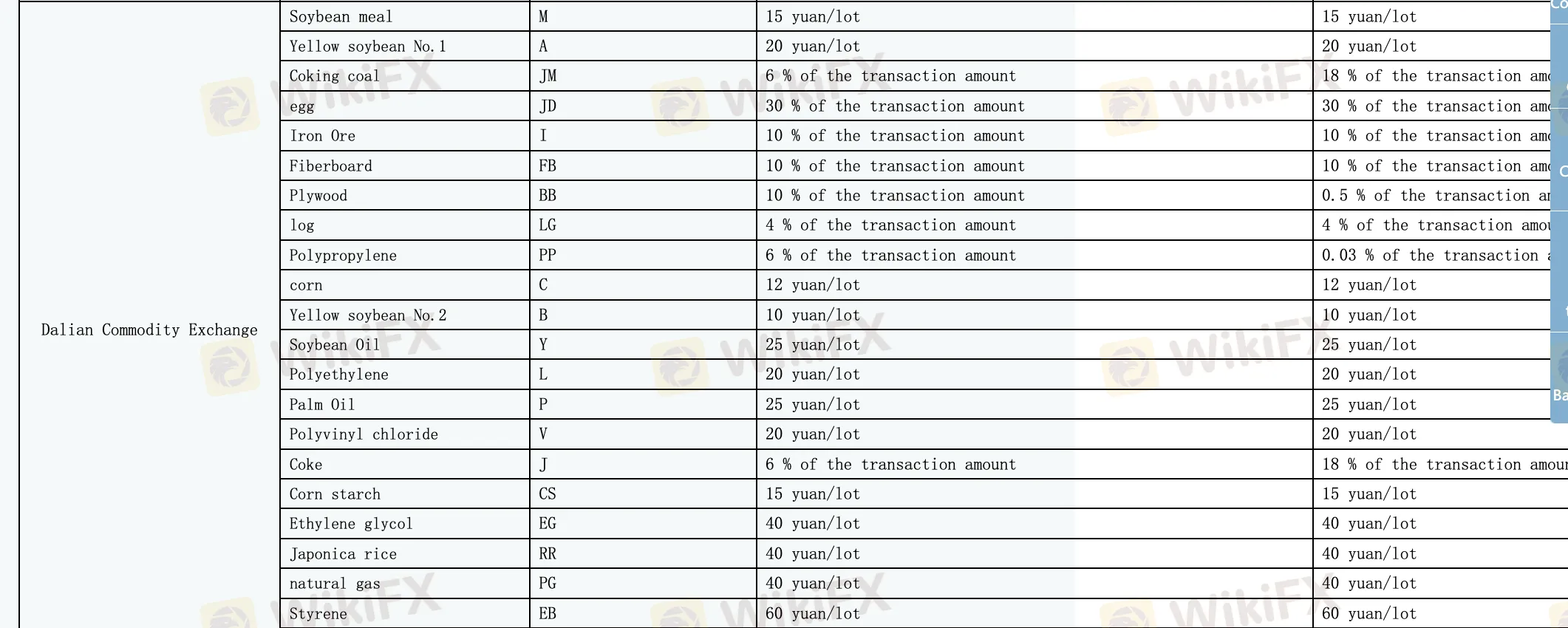

CCB Futures Ücretleri

CCB Futures internet hesap açılış ücreti ve güncel ücret talep etmekte ve teminat toplama standartlarına sahiptir.

| Vadeli Ürünler | Güncel Ücret Standartı |

| Kanola yağı | 20 yuan/lot |

| Pamuk | 43 yuan/lot |

| Palmiye yağı | 25 yuan/lot |

İşlem Platformu

Aracı çeşitli işlem platformları sunmaktadır, bunlar arasında Wenhua Winshun Cloud Market Trading Software HD Sürümü (wh6), Hızlı işlem terminali, Sonsuz Kolay (Pro Profesyonel Sürüm), Flush Futures PC Sürümü, Boyi Master, Polestar 9.5 Jianxin Futures Sürümü, Polestar 9.3 Jianxin Futures Sürümü, Kuaiqi V3 İşlem Terminali, İşlem Öncüsü, Piramit Karar İşlem Sistemi, Hızlı işlem terminali-ulusal gizli sürüm, Jianxin Futures Uygulaması ve Yisheng Yixing Mobil İşlem Yazılımı bulunmaktadır.

Kullanılabilir cihazlar: masaüstü ve mobil.

Para Yatırma ve Çekme

Sürekli işlem saatleri içinde, müşteriler sadece para yatırabilir ancak para çekemezler. Belirlenen minimum para yatırma veya çekme miktarı yoktur ve belirtilen ücret veya masraf bulunmamaktadır.